Last updated on January 4th, 2022

You’ve just received your first dividend from the stock you own, perhaps from a platform like Tiger Brokers.

If you want to make your money grow for you, you may have heard that reinvesting your dividends will further compound your growth.

But how do you exactly go about doing that?

Here are some of my suggestions that you can consider.

Contents

- 1 How to reinvest dividends in Singapore

- 2 Manually reinvest via a broker

- 3 Sign up for a dividend reinvestment plan (DRIP)

- 4 Invest in an accumulating mutual fund or ETF

- 5 Invest your dividends into a robo-advisor with no minimum sum

- 6 Invest with a robo-advisor

- 7 Consider investing in crypto

- 8 Conclusion

- 9 👉🏻 Referral Deals

How to reinvest dividends in Singapore

Here are 5 ways you can reinvest your dividends in Singapore:

- Manually reinvest via a broker

- Sign up for a dividend reinvestment plan (DRIP)

- Invest in an accumulating mutual fund or ETF

- Invest your dividends into a robo-advisor with no minimum sum

- Invest with a robo-advisor

- Consider investing in crypto

Manually reinvest via a broker

The most straightforward way for you to reinvest your dividends is by buying the same stock via a broker.

For example, you may receive a dividend from the Apple stocks that you own. You can choose to buy more of Apple stocks with the dividend you receive.

However, this may not be as easy as it seems!

Let’s say that you buy a stock that gives you a $1 dividend.

This means that if you’ve only bought 1 stock, you will only receive $1 worth of dividends!

It can be really hard to reinvest this $1 back into the same stock that you own.

This is because:

- If your stock is in the SGX, the minimum lot size for most stocks is 100

- Most brokers in Singapore do not allow you to buy fractional shares

There are some stocks and REITs listed on the SGX that only cost a few dollars. However, you’ll need to buy a minimum of 100 units each time.

As such, you might not be able to buy the stock you want, due to the minimum lot size.

Meanwhile, trading in the NYSE or LSE only requires you to buy 1 unit.

Don’t forget about transaction fees too

When you use a broker to buy your stock, you will need to pay a trade commission.

The worst part is that most of these brokers charge you a minimum sum.

For example, OCBC Securities charges you a minimum commission of $25 for SGX stocks.

If you are investing a small sum of money, it is really not worth paying such high commissions!

As such, periodically investing small sums will be very costly for you.

You may want to consider low cost brokers like Tiger Brokers or Moomoo. Both of them charge a much lower minimum sum.

This strategy only works if you have a large sum invested

The more money you have invested in the stock, the greater amount of dividends you will receive.

Let’s say for the same stock, you now own 1000 units of the stock.

When they issue a $1 dividend, you will now receive $1000 in dividends!

This makes it much easier for you to manually reinvest your dividends with your broker.

For smaller amounts, you may want to accumulate them instead

If you are receiving small amounts of dividends each month, you may want to accumulate them to a larger sum first.

After you have a larger sum, you can then start to reinvest them in the market.

For example, let’s say here are your dividend payouts between January to June:

| Month | Dividend Received |

|---|---|

| Jan | $10 |

| Feb | $5 |

| Mar | $20 |

| Apr | $30 |

| May | $5 |

| June | $20 |

Once you received the dividend in January, you may be tempted to reinvest it straightaway.

However, there are very limited options that you can invest in with $10. The fees can be very hefty too!

Since you know that you will be receiving more payouts in the coming months, you can choose to wait instead.

After June, you would have accumulated $90 worth of dividends. This gives you slightly more options to buy certain stocks that you wish to!

Verdict

Reinvesting your dividends into the stock that you own can be a good strategy. However, it really depends on how much dividends you receive.

If you have a huge sum of dividends, then reinvesting them is definitely feasible.

However, you may just be starting out in your investment journey. In that case, you will only receive a small dividend payout each time.

For this case, you may want to find an alternative way of reinvesting your dividends.

Sign up for a dividend reinvestment plan (DRIP)

Some REITs in Singapore allow you to sign up for a dividend reinvestment plan (DRIP).

A dividend reinvestment plan (DRIP) is a program that allows investors to reinvest their cash dividends into additional shares or fractional shares of the underlying stock on the dividend payment date.

Investopedia

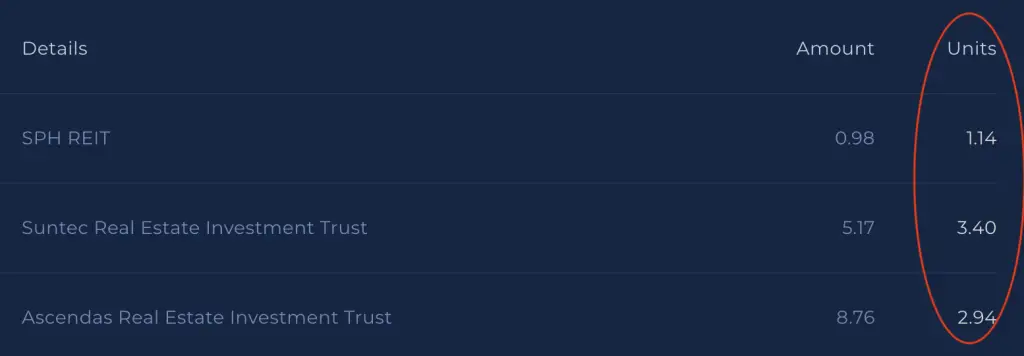

Instead of receiving the dividend payouts from the REIT that you own, this will be reinvested into more units of the REIT.

For example, you may own 100 units of a REIT which costs $1 and gives you a 3% dividend. You will receive a dividend of $3, which means you will receive 3 extra units of the REIT.

This is similar to a scrip dividend being issued by companies like DBS and Singtel.

If you have already intended to reinvest your dividends, then the DRIP will help you to do so at no extra cost!

Here are some REITs that offer you DRIP plans:

| REIT | SGX Ticker | DRIP Period |

|---|---|---|

| Mapletree Commercial | N2IU | 4Q FY2015/16 |

| CapitaLand China Trust | AU8U | 14 Aug 2019 – 31 Dec 2019 |

| Mapletree Logistic Trust | M44U | 4Q FY19/20 |

| ESR REIT | J91U | 1 Oct 2020 – 31 Dec 2020 |

However, there are some disadvantages to these DRIP plans:

#1 These DRIP plans are not ongoing

From the table above, you can see that these DRIP plans only happen once in a while. As such, you can’t rely on this plan to continue reinvesting your dividends in the long term.

#2 DRIP plans will cause you to have odd lots

Owning more units of the same REIT may be very exciting. This is especially if the price of the REIT starts to increase!

However, there is a high chance that you will own odd lots.

Let’s look at the same example above.

If you used the DRIP, you will now have 103 units, instead of 100.

This is a problem if you’re investing in the SGX. Since the minimum lot size is 100, you will be unable to sell the extra 3 units.

Instead, you’ll need to sell your shares on the Unit Share market.

This is available for a few brokers, including:

- POEMS

- OCBC Securities

- DBS Vickers

- FSMOne

- Lim & Tan

- UTRADE

- Standard Chartered

The problem with the Unit Share market is that there is very little liquidity.

If you are trying to sell these 3 units, you need to find someone who wants to buy these 3 units!

If you can’t find a buyer, then you aren’t able to sell off your shares!

Verdict

Overall, DRIPs are not really effective if you are thinking of reinvesting your dividends for the long term.

They only happen periodically. In the end, it depends on when the company decides to conduct a DRIP.

As such, this may not be a viable plan to reinvest your dividends.

Invest in an accumulating mutual fund or ETF

If you are looking to buy an Exchange-Traded Fund (ETF) or mutual fund to hold for the long term, you may want to consider accumulating funds.

Accumulating funds reinvest your dividends for you, instead of distributing the dividends to you.

Accumulating funds own many different companies within their portfolio. These companies may decide to declare a dividend and will distribute it to the fund.

Usually, a distributing fund will distribute the dividends to you. In contrast, an accumulating fund will use those dividends to reinvest in the same companies that they hold.

You can view my comparison between an accumulating and distributing fund to see how they are different.

In this way, you are able to reinvest your dividends automatically, at no extra cost!

Accumulating funds are not found in the US

You may want to buy a S&P 500 ETF from the US exchanges. However, you can only find distributing ETFs!

For ETFs that are domiciled in the US, they will have to distribute a minimum of 90% of its net investment income to its shareholders.

As such, you will most likely be able to find these ETFs on the London Stock Exchange instead.

Here are some examples of accumulating funds that you can buy that track different indices:

You can view my comparison between the S&P 500 and the MSCI World indices to see how they differ.

All of these ETFs are listed on the London Stock Exchange, instead of the US exchanges. However, they are all denominated in USD as well.

The expense ratios of these funds may be slightly higher, but it may be worth it if you intend to reinvest your dividends.

There are accumulating share classes for mutual funds too

Some mutual funds have accumulating share classes too. These are similar to accumulating ETFs, where any dividends you receive will be automatically reinvested for you.

If you are looking at buying these mutual funds, you can go onto certain platforms like FSMOne or DollarDex.

However, the fees that you pay for these funds can be really high!

You can consider using Endowus’ platform, which allows you to buy these funds at a much lower cost.

On their platform, you are able to choose from their Advised Portfolios.

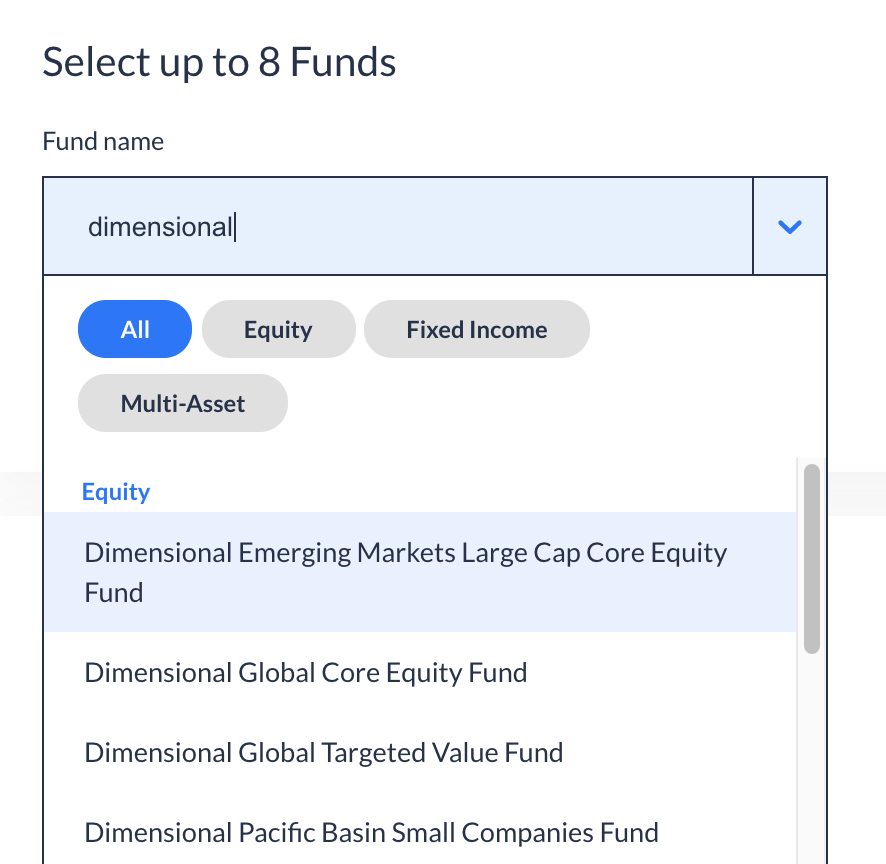

Alternatively, you can use Fund Smart, which allows you to create your own portfolio of funds. You are able to choose up to 8 funds within each portfolio.

You are able to gain access to funds, such as the Dimensional World Equity Fund.

Moreover, you are able to buy these funds at the institutional share class. These charge lower expense ratios compared to the funds you can buy on other platforms.

If you are looking to buy accumulating mutual funds, Endowus can be a platform you can consider using.

Verdict

Accumulating funds are a great option if you already intend to reinvest your dividends. This is because the funds will help you to reinvest them automatically, at no extra costs.

However, these ETFs are not found in the US exchanges. Instead, you’ll have to buy them on the London Stock Exchange, which not many brokers in Singapore give you this access.

There are mutual funds with accumulating share classes too, which also work the same way as the ETFs.

If you are young and are looking to compound your wealth quickly, then you can seriously consider investing in this type of fund!

Invest your dividends into a robo-advisor with no minimum sum

There are 3 main robo-advisors in Singapore that allow you to start investing with no minimum sum:

This means that any dividends that you earn can be invested into either of these platforms, no matter how little your dividend is!

For example, I am earning dividends from my investment in the OCBC BCIP. These dividends are very little, so I can’t really invest them elsewhere.

Instead, I’ve chosen to put that small amount into Syfe REIT+. I feel that Syfe REIT+ is a good option because you are not buying any ETFs.

You are buying the REITs directly, which helps you to save one added layer of costs! This is because you only pay the management fee to Syfe, but not the expense ratio to the fund manager.

I am also placing the interest earned from the funds in my SingLife Account into this portfolio too.

These platforms allow you to invest in fractional shares

The reason why these platforms do not require a minimum sum is because they allow you to invest in fractional shares.

This makes investing really accessible for you. However, there are risks in the event that these platforms close down like Smartly.

If you own any fractional shares with a platform that closes down, there may be a chance that you have to sell them off even if you wanted to keep them.

This is a risk you have to consider you’re willing to take before investing with any of these platforms!

Verdict

Since these robo-advisors allow you to invest with no minimum sum, you are able to put in any dividends that you receive into their portfolios.

All of these platforms charge you an all-inclusive management fee. As such, you do not need to pay any transaction fees.

This makes it very convenient to make multiple small transactions over time.

However, the management fees can be very high once your assets with them increases too!

Invest with a robo-advisor

One of the most fuss-free ways that you can reinvest your dividends is by investing with a robo-advisor.

This is because most of these platforms will automatically reinvest your dividends for you at no extra costs.

Some of these robo-advisors include:

There are some portfolios that give you the option of reinvesting your dividends instead of receiving them. Some examples include:

However, you’ll need at least $20,000 with Syfe to start receiving your dividend payouts.

All of them charge you a management fee based on the amount of assets that you have with them.

This fee includes all the expenses you incur when investing with them, such as your transaction fees.

While the fees may seem very low when you’re first starting out, it can be very significant once you have a large sum managed with them!

At a certain point in time, it may be more cost effective for you to do DIY investing instead.

Verdict

Investing with robo-advisors are one of the most fuss-free ways of investing. This is because you’ll just need to fund your money, and the platform does most of the work for you.

All you need to do is to fund your account, and they will create a portfolio for you!

This may be good when you’re a beginner investor. However, you may develop your own strategy as you improve your knowledge.

Eventually, you may want to invest using your own method, and not follow the robo-advisor’s strategy!

Consider investing in crypto

This may be pretty controversial, but you can consider adding some crypto into your portfolio.

Apart from Bitcoin, there are many different altcoins that you can invest in, such as:

You are now able to buy crypto on the various exchanges with your SGD via Xfers. The best part is that most do not charge you any minimum fees.

As such, you can start building up your crypto portfolio with the small amount of dividends you receive on these platforms:

| Platform | Minimum Amount | Fees |

|---|---|---|

| Coinhako | $45 | 1% |

| Coinut | None | 0.50% |

| Crypto.com | USD $1 | Up to 0.16% |

| Gemini Active Trader | Depends on currency | Up to 0.35% |

| Liquid | None | Up to 0.30% |

| Luno | 0.0005 BTC | Up to 0.10% (Exchange) and 1% (Instant Buy) |

| Tokenize | None | 0.80% – 1%, min $1 |

Most of these platforms have a rather low minimum amount to start investing in these currencies. Apart from Tokenize, most of them do not have a minimum trading fee.

As such, you can start to buy some of these cryptocurrencies even with a small sum!

However, you’ll need to find out if the platform has a SGD trading pair with the currency you wish to buy.

What’s more, you are able to lend out your crypto and receive really attractive interest rates on platforms like:

- Celsius

- BlockFi

- Hodlnaut

- Crypto.com Earn

- YouHodler

- Nexo

However, all of this is extremely risky. There is a possibility that you may lose all your money in crypto as well!

As such, I believe in putting just a portion of your portfolio into crypto. It is a great ‘satellite’ portion if you intend to use a core-satellite investing strategy.

Verdict

The potential upside on investing in crypto is extremely huge. However, it is still a very volatile market, and there are many risks involved.

I do believe that there is some value in investing a small amount of your portfolio into crypto. That way, you still will be able to enjoy great returns if your currencies perform well.

Moreover, you would not be greatly affected if there is a huge crash in the crypto market!

With crypto becoming more mainstream, it is definitely much easier to invest in this new ‘asset class’ than it was before!

Conclusion

If you are keen to compound your returns even further, you should seriously consider reinvesting your dividends.

However when you’re first starting out, the amount of dividends that you receive can be really little. In this scenario, there are not many options for you to reinvest your dividends.

However, you’ll start to build your portfolio as you continue to invest. Over time, you will start to receive more dividends each time.

Eventually, you’ll receive a substantial amount of dividends. This gives you more options on how you can reinvest them.

If you are just starting out, the best way would be to invest in an accumulating fund. That way, you do not need to worry about receiving dividends and then reinvesting them!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 6 months.

You will be able to save up to $75 worth of fees!

You can view more information about this referral program on Syfe’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?