Last updated on June 6th, 2021

Everyone says it is better to invest in the US market as there are higher returns. However, there are many risks involved that you may not be willing to take.

As such, you may want to consider investing in a SGD-denominated portfolio instead.

Here’s how StashAway’s Income Portfolio may help you to build such a portfolio:

Contents

What is the Income Portfolio?

StashAway’s Income Portfolio is a diversified portfolio denominated in SGD. Your invested funds will be diversified across 4 different asset classes:

- Government bonds

- Corporate bonds

- REITs

- Stocks

The Income Portfolio also aims to provide you with a steady income throughout the year. This is in the form of dividends that are issued by the funds.

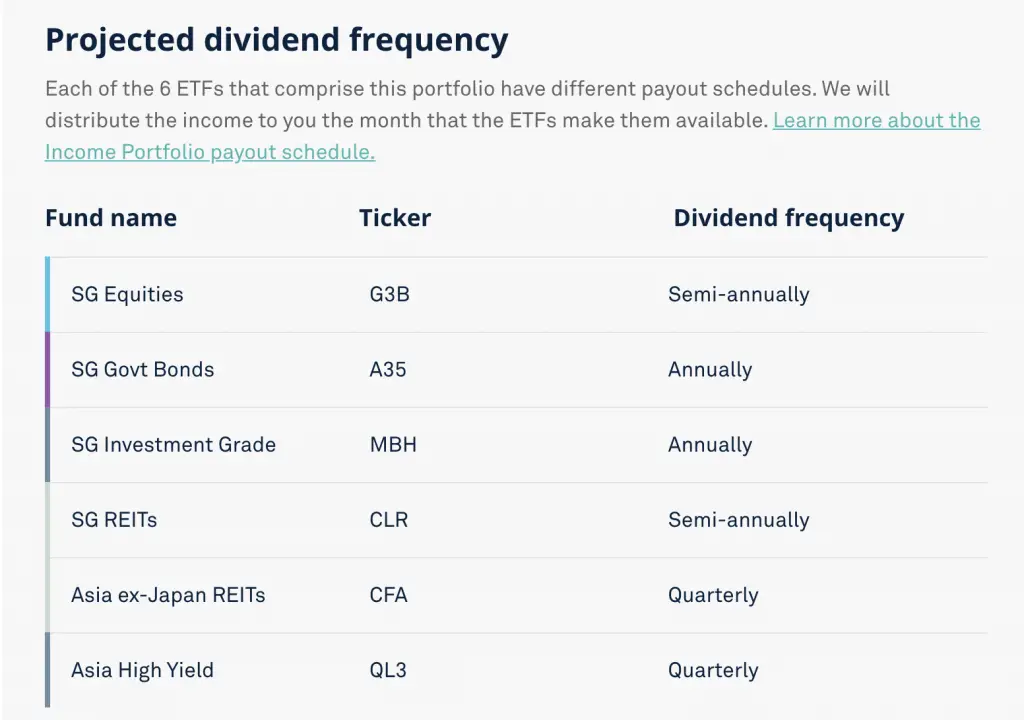

Here are the projected dividend frequencies for each month:

If you prefer staying invested in the Singapore market, then this portfolio may be the one for you!

What are some characteristics of the Income Portfolio?

Here are 3 characteristics of this portfolio:

#1 The Income Portfolio has a StashAway Risk Index of 12%

The Income Portfolio has a StashAway Risk Index of 12%.

This means that there is a 99% probability that you will not lose more than 12% of your portfolio in a year.

For example, you may have $10,000 in the Income Portfolio.

There is a 99% probability that you will not lose more than $1,200 in a year.

Here is a comparison of the StashAway Risk Index for their other products:

| Portfolio | StashAway Risk Index |

|---|---|

| General Investing | 6.5 – 36% |

| StashAway Simple | 1.7% |

| Income Portfolio | 12% |

As seen, the risk of the Income Portfolio is rather manageable. Nonetheless, if you are afraid of losing that percentage of money, you may want to consider StashAway Simple or a lower risk portfolio.

You can read my comparison of how StashAway’s higher risk portfolio compares with Syfe’s Equity 100 portfolio.

#2 Rebalancing is done using the ERAA framework

One of StashAway’s main features is their robo-advisory algorithm. The ERAA framework is a special algorithm that decides your asset allocation. This usually depends on the current economic conditions that we are in.

For example in a recession, the ERAA framework may suggest to reduce your stocks allocation so as to reduce your risk.

By selling a portion of your stocks, the money will then be used to buy more bonds.

This helps to reduce your risk. In contrast, an all-stocks portfolio is likely to result in huge losses during a recession!

If you’d like your portfolio to be algorithmically rebalanced, the Income Portfolio is something you can consider.

#3 Minimum account balance

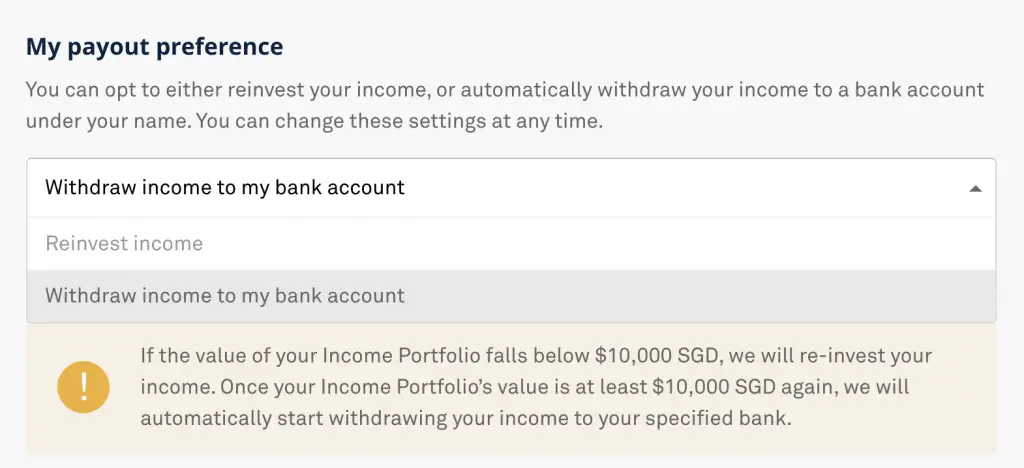

Contrary to StashAway’s other portfolios, you will need a minimum account balance of $10,000.

The aim of the Income Portfolio is to provide a steady income via dividends. To earn a substantial income from dividends, you will need to have a large sum invested.

This is why I believe that StashAway requires such a high minimum account balance.

You are still able to start investing in the Income Portfolio if you have less than $10k. However, you will not be allowed to withdraw your dividend payouts to your bank account.

Instead, the dividends will be reinvested into your portfolio.

How do I create this portfolio?

Here’s a step-by-step guide to create your Income Portfolio:

#1 Select ‘Get Started’ on the website or app

When you are on the StashAway website or app, you can scroll down until you find the Income Portfolio option.

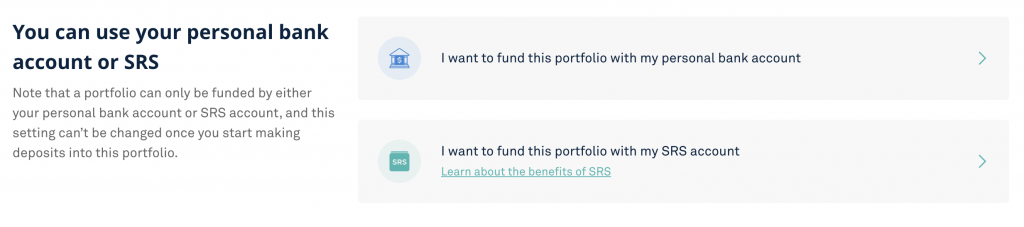

#2 Select your funding source

You can choose to use either cash from your bank account or your SRS funds.

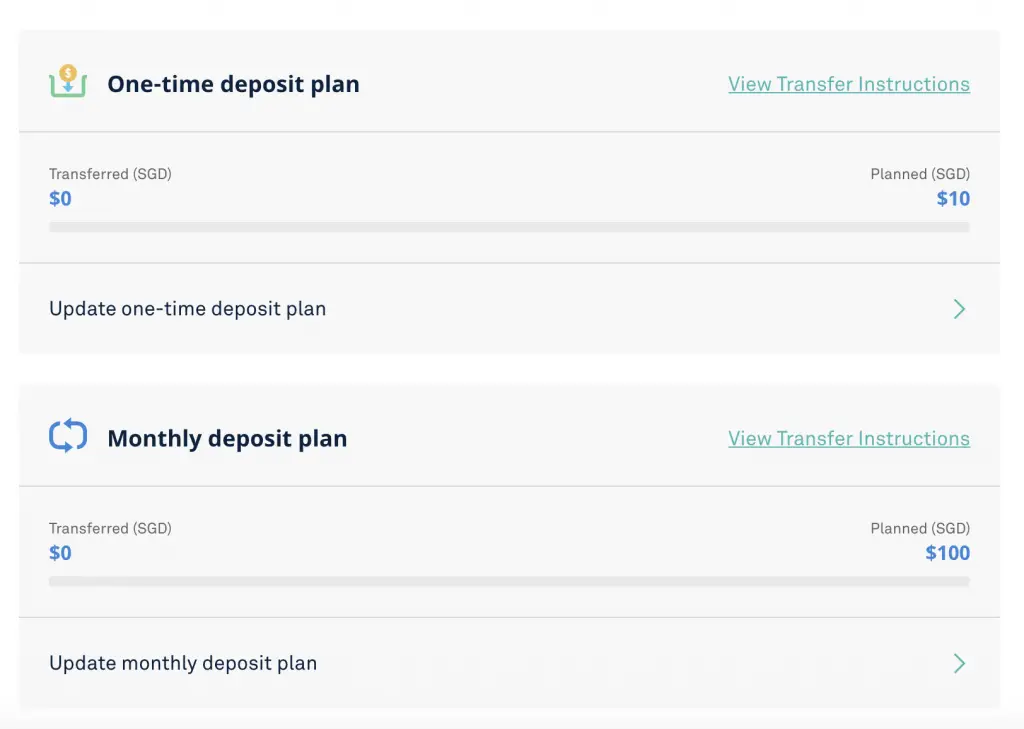

#3 Deposit funds to your Income Portfolio

You can choose to make a monthly deposit or a lump sum deposit.

Here are some things that you need to take note of when depositing your funds:

- The account you deposit from has to be in your own name (joint accounts are fine too!)

- You can only deposit your funds via bank transfer

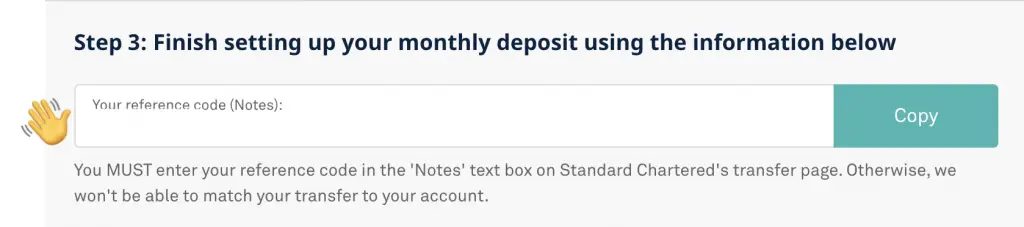

When you transfer the money, don’t forget to add in your reference code!

Once your funds are received, StashAway will invest them based on their ERAA framework.

StashAway also gives you an option to schedule a recurring transfer from StashAway Simple.

What holdings are in the Income Portfolio?

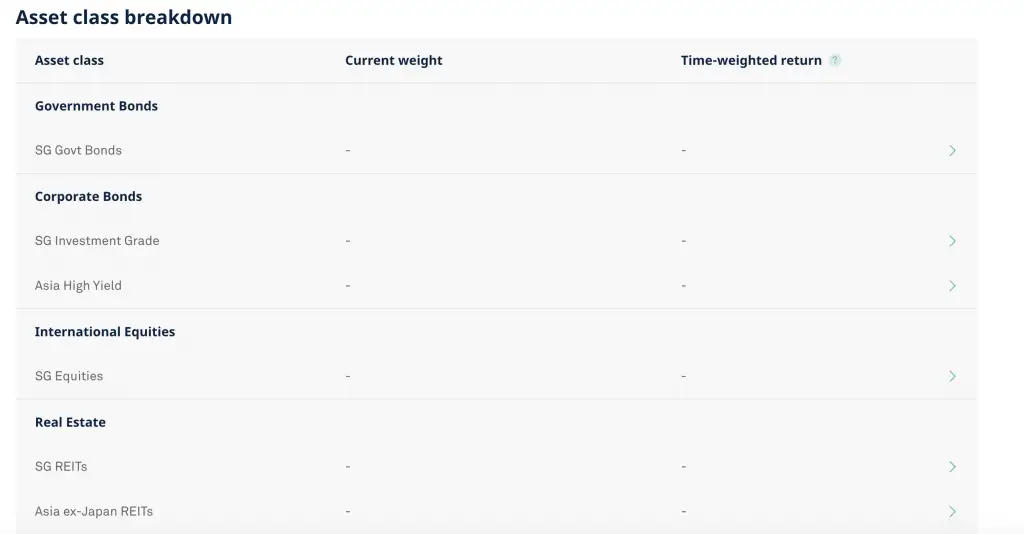

One rather annoying thing is that the web platform does not show exactly which ETFs you’re investing in.

Instead, you will need to select each individual fund to see exactly what you’re investing in!

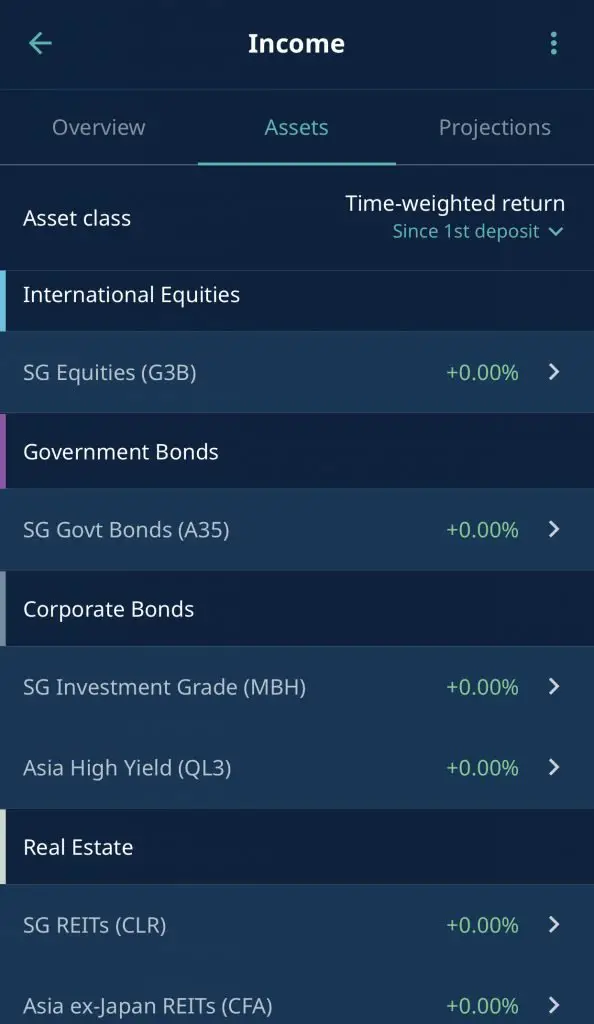

Thankfully, the app allows you to view all the holdings at a glance.

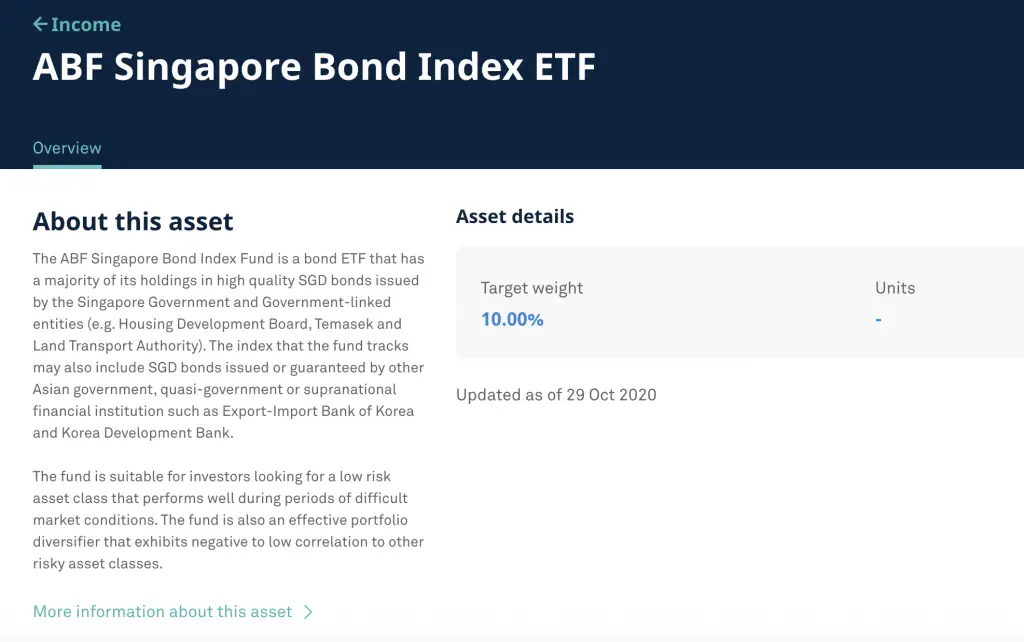

Here are the holdings that StashAway will invest in for you:

| Asset Class | Fund Name | SGX Ticker |

|---|---|---|

| Equities | Nikko AM STI ETF | G3B |

| Government Bonds | ABF Singapore Bond Index Fund | A35 |

| Corporate Bonds | Nikko AM SGD Investment Grade Corporate Bond Fund | MBH |

| Corporate Bonds | iShares Barclays Capital USD Asia High Yield Bond Index ETF | QL3 |

| Real Estate | Lion-Phillip S-REIT ETF | CLR |

| Real Estate | NikkoAM-STC Asia REIT | CFA |

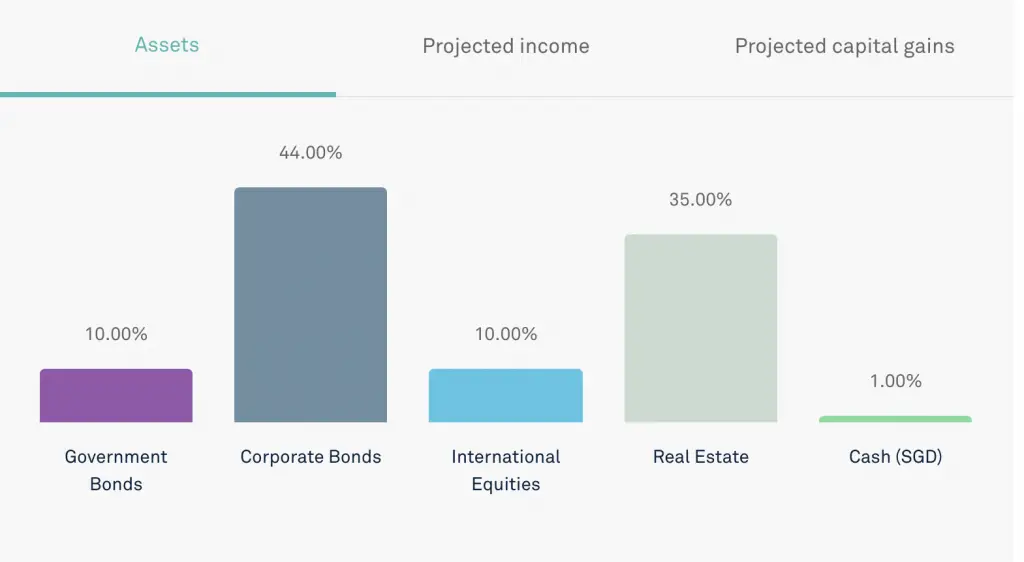

And here is the asset allocation for your funds:

Your funds will be heavily allocated into corporate bonds. While this produces a steady income, you may not get high returns in terms of capital appreciation.

This could possibly be why the projected net return is only at 4.4%.

What are the fees?

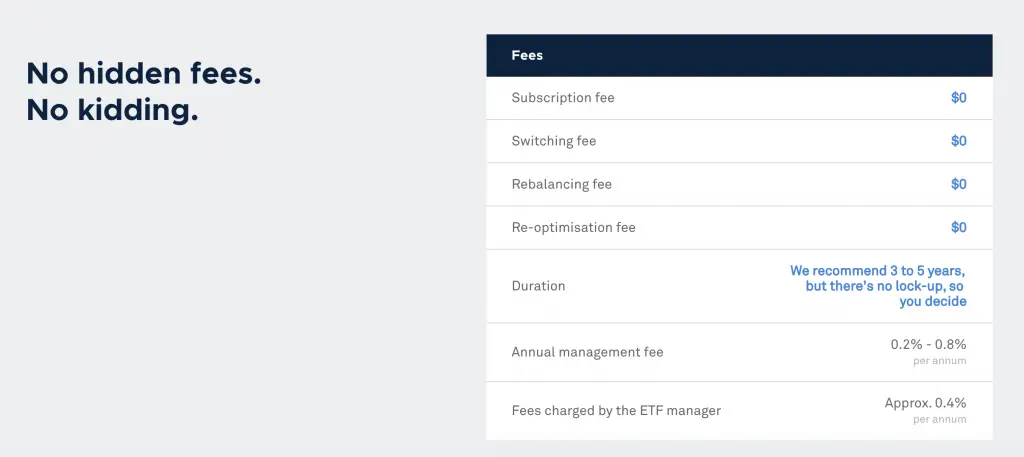

StashAway does not charge any hidden fees.

However, there are 2 main fees that you’ll incur when investing with the Income Portfolio:

#1 Management fee

StashAway charges you with an annual management fee. Instead of charging you for transactions, they will charge you based on the amount that you have invested with them.

This is great as you are able to make multiple deposits without having to incur any transaction fees.

Here are the management fees that StashAway charges:

| Amount Invested | Management Fee |

|---|---|

| First $25k | 0.8% |

| > $25k and ≤ $50k | 0.7% |

| > $50k and ≤ $100k | 0.6% |

| > $100k and ≤ $250k | 0.5% |

| > $250k and ≤ $500k | 0.4% |

| > $500k and ≤ $1 million | 0.3% |

| > $1 million | 0.2% |

One thing you may want to note is that you’ll need to pay these fees, regardless of your portfolio’s performance. This means even if you are losing money, you will still have to pay the management fee to StashAway!

#2 Expense ratio

On top of the management fees, you will have to pay the expense ratio to the fund managers as well.

The expense ratio is the annual fee that all funds or exchange-traded funds charge their shareholders.

Here are the expense ratios of the 6 funds, based on Yahoo Finance:

| Fund Name | Expense Ratio |

|---|---|

| Nikko AM STI ETF (G3B) | 0.30% |

| ABF Singapore Bond Index Fund (A35) | 0.26% |

| Nikko AM SGD Investment Grade Corporate Bond Fund (MBH) | 0.25% |

| iShares Barclays Capital USD Asia High Yield Bond Index ETF (QL3) | 0.50% |

| Lion-Phillip S-REIT ETF (CLR) | 0.60% |

| NikkoAM-STC Asia REIT (CFA) | 0.60% |

The expense ratios for G3B, A35 and MBH are all still pretty reasonable. However, QL3, CLR and CFA have a relatively high expense ratio.

In contrast, US ETFs can have expense ratios as low as 0.1%!

Due to the asset allocation, StashAway predicts that you’ll only be paying 0.4% p.a. to the ETF fund managers.

If you only have $10k invested in the Income Portfolio, you’ll be paying around 1.2% each year in fees!

When you add up both the management fee and the expense ratio, the fees can be pretty hefty. As such, you’ll want to consider the fees carefully before investing in this portfolio!

You will not incur an estate tax with the Income Portfolio

All the ETFs that you invest with the Income Portfolio are domiciled in Singapore. As such, you will not incur an estate tax which is imposed on US-related assets.

How do I withdraw money from my Income Portfolio?

Here’s how you can withdraw funds from your Income Portfolio:

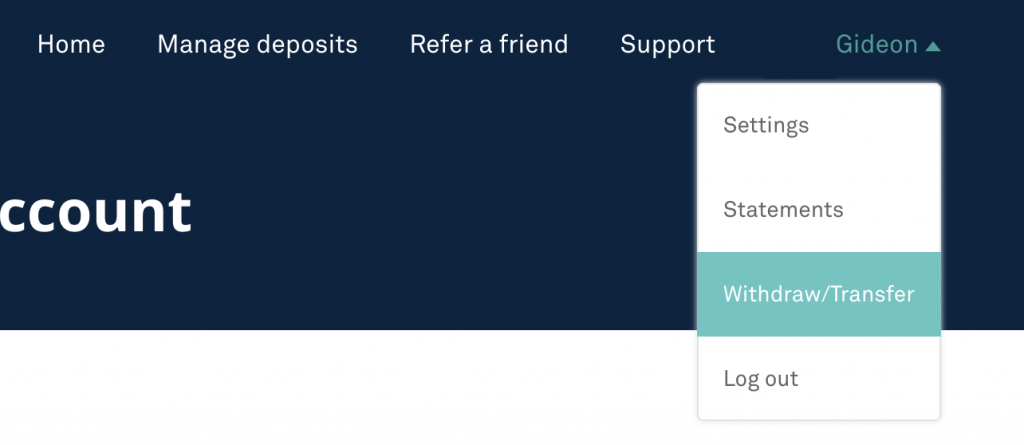

#1 Go to ‘Your Name → Withdraw/Transfer’

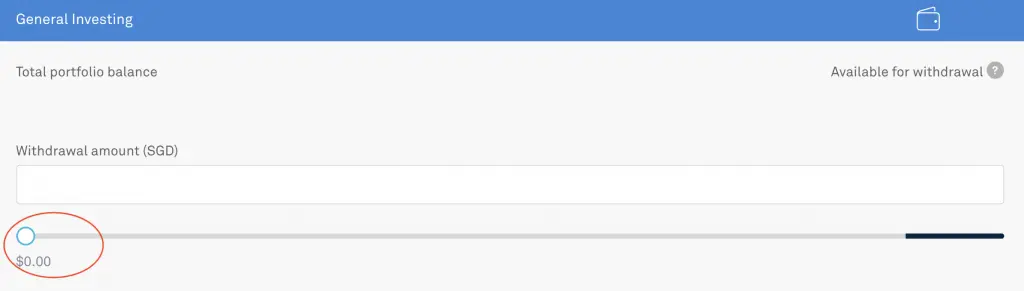

#2 Select the amount you wish to withdraw

You can choose the slider to select the amount you wish to withdraw. If you withdraw more than 90% of your funds, you will be asked to withdraw your total portfolio.

You will need to confirm your withdrawal amount and bank account details. The funds will then take 2-3 business days before it reaches your bank account.

Do remember that you’ll want to keep a minimum of $10k inside your portfolio!

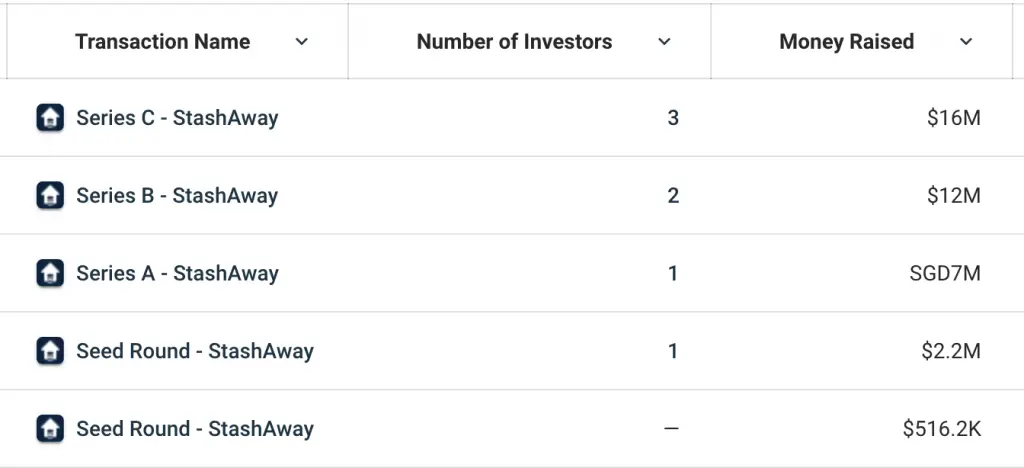

Is StashAway safe?

StashAway is one of the earliest robo-advisors in Singapore and they have established themselves well. They even managed to raise USD$16 million in their Series C funding!

Given this strong backing by their investors, I believe that they would not close down like Smartly.

Verdict

Here are 5 key points that I want to summarise about the Income Portfolio:

#1 It is rather restrictive in asset allocation

I believe that the Income Portfolio is rather restrictive. You are unable to decide on the best allocation that suits you. Instead, you will have to follow the allocation set out by the ERAA framework.

If you have a long time horizon, you may want to have a higher allocation to stocks and REITs. As such, investing in the Income Portfolio may not be the best choice for you.

#2 Expense ratios are rather high

The expense ratios of the funds selected are much higher than the US ETFs. Moreover, the returns of these ETFs may be much lower than the US ETFs!

As a result, you may actually be paying more for lower returns. You should consider whether the fees that you are paying are worth the returns that you are receiving.

#3 Minimum balance is really high

StashAway prides itself as being accessible to beginner investors. This is because they allow you to start investing in their portfolios with no minimum sum required.

However, the Income Portfolio requires you to have a minimum of $10k!

This requirement is slightly higher than other robo-advisors with minimum sums, such as Endowus.

I do hope that the Income Portfolio’s minimum balance can be reduced in the future. That way, it will be more accessible for beginner investors.

#4 The portfolio can be manually replicated

It is possible to buy this portfolio on your own. You do not have to start with $10k, and you will pay transaction fees instead of management fees. Therefore, it is possible for you to create your own DIY portfolio!

Here are 2 ways that you can purchase this portfolio by yourself:

Regular Savings Plans

The regular savings plans that are provided by OCBC and DBS / POSB do allow you to purchase some of these ETFs.

| ETF | OCBC BCIP | DBS / POSB Invest-Saver | POEMS SBP |

|---|---|---|---|

| G3B | ✓ | ✓ | ✕ |

| MBH | ✓ | ✓ | ✓ |

| CLR | ✓ | ✓ | ✓ |

| A35 | ✕ | ✓ | ✓ |

I would prefer investing using the Invest-Saver. You have more options and will incur lower transaction fees too!

You can view my comparison between regular savings plans and robo-advisors to see which is better for you.

Online Brokerages

You are able to purchase these ETFs via any online brokerage that supports SGX trading.

Some of these include Tiger Brokers and Moomoo.

The fees that you’ll need to pay include the transaction fee and the expense ratio. The transaction fee is a one-time payment.

Adding them together, it may cost less than the management fee!

The only difference is that StashAway allows you to purchase fractional shares. However, when you invest in the SGX yourself, most of these ETFs have a minimum lot size of 10.

Investing with StashAway makes sure that all of your money will be invested. Since you can only buy these ETFs in multiples of 10 on the SGX, you may have some excess cash lying around!

#5 This is a safe option to invest in a SGD-denominated portfolio

The Income Portfolio invests in SGD-denominated ETFs. This greatly reduces your foreign currency risks.

Moreover, the companies that you invest in should be familiar to you. Majority of them are based in Singapore.

The Income Portfolio gives you a decent exposure to the Singapore market. Moreover, your portfolio is automatically managed by StashAway. If you want a fuss-free method of investing with lower risks, the Income Portfolio may just be for you.

Conclusion

StashAway’s Income Portfolio is an interesting product. However, I feel that the high expense ratios as well as the large minimum balance are its downfall.

Here’s who I believe the Income Portfolio is best suited for:

- You are a beginner investor, and you are not sure where to start

- You do not want to take too much risk, and prefer to invest in the Singapore markets

- You do not want to constantly rebalance your portfolio

If you meet these criteria, the Income Portfolio may be something that you should consider!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

StashAway Referral (Up to $40,000 SGD managed for free for 6 months)

If you are interested in signing up for StashAway, you can use my referral link to sign up.

Here’s what you’ll need to do:

- Sign up for a StashAway account

- Make a deposit of ≥ $10k within 4 weeks of signing up

- Receive a fee waiver for 6 months (up to $40k)

You can find out more about this program on SingSaver.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?