Last updated on February 5th, 2022

There are many S&P 500 ETFs out there, so it may be really confusing for you.

Two of these ETFs are IUSA and VUSA.

Since they are rather similar, which one should you choose?

Contents

The difference between IUSA and VUSA

IUSA is managed by BlackRock while, VUSA is managed by Vanguard. Both of them track the same index (S&P 500). The main difference between these ETFs lie in their unit price and average trading volume.

Index tracked

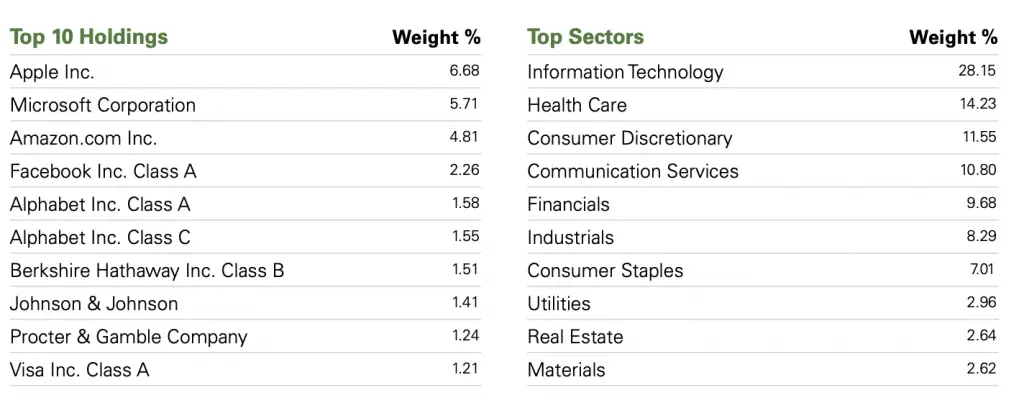

Both ETFs track the S&P 500 index. As such, they should have very similar performances.

This is because both funds will have the same holdings in the same proportion.

If you are looking to invest in the S&P 500, here’s a guide to get you started.

Fund manager

IUSA is managed by BlackRock under the iShares family of ETFs. Meanwhile, VUSA is managed by Vanguard.

IUSA was the ETF that started earlier in 2002. VUSA was only created 10 years later, in 2012. However, VUSA actually has the larger assets under management!

| IUSA | VUSA | |

|---|---|---|

| AUM | 12.1 billion | 26.6 billion |

They are listed on the same exchange

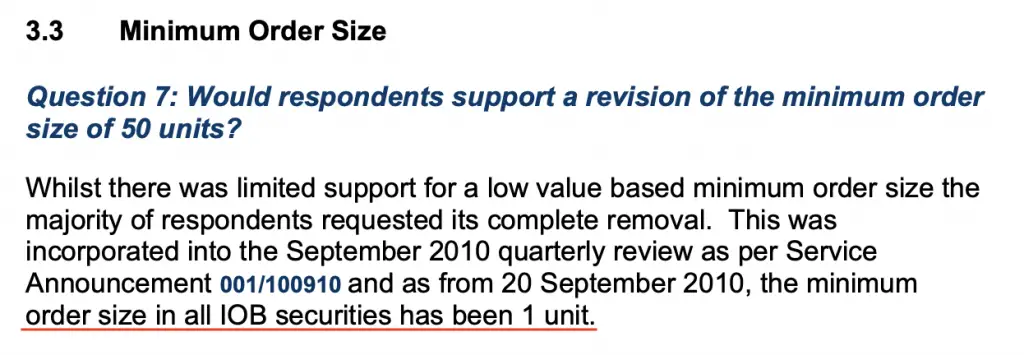

Both IUSA and VUSA are listed on the London Stock Exchange (LSE). This means that you are able to purchase a minimum unit of 1 for either ETF.

This is similar to the US exchanges.

The brokers that allow you to trade on the LSE are pretty limited. One example is Tiger Brokers which does not offer LSE as one of their exchanges.

You can view my guide to see what are the best ways to buy LSE ETFs from Singapore.

Their unit price is different

Both IUSA and VUSA have a different unit price. This becomes significant when you only have a small amount to invest into these ETFs each time.

| IUSA | VUSA | |

|---|---|---|

| Estimated Unit Price | 28 GBP | 50 GBP |

IUSA has a slightly cheaper unit price compared to VUSA. This gives you slightly more flexibility when investing with IUSA.

You are able to buy in multiples of around 28 GBP, instead of 50 GBP!

However, one thing you may want to note is that both ETFs’ assets are denominated in USD. The fund managers will still need to convert your GBP to purchase the assets in USD.

This should still be done at a more favourable rate compared to you!

Dividend withholding tax

Both ETFs are domiciled in Ireland. As such, you will incur a 15% dividend withholding tax if you are a non-resident alien to the US.

This is due to a tax treaty between Ireland and US. As such, both of these ETFs do not incur the US estate tax too.

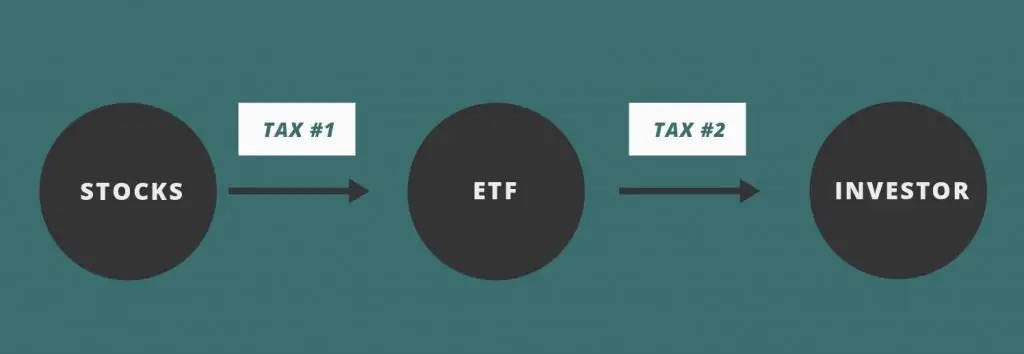

2 layers of taxes

For any ETF, the fund manager buys the stocks based on the index they are tracking. The dividends that they distribute are collected from the stocks in their fund.

As such, there are 2 layers where you may incur some taxes:

- From stock to ETF

- From ETF to you, the investor

Both ETFs incur the tax on the first layer

For both IUSA and VUSA, the dividends from the US stocks are distributed to an Irish-domiciled ETF. As such, the 15% withholding tax applies on the first layer.

If you wish to track your dividends with the taxes accounted for, you can consider trying out StocksCafe’s platform.

Dividend distribution

IUSA and VUSA will distribute your dividend every 3 months. They will gather all of the dividends that they receive and pay it to you each quarter.

This is great if you intend to receive some passive income via dividends.

However, you need to invest a large amount into either ETF to receive a substantial quarterly payout!

Expense ratio

On top of the trading commissions, you’ll need to pay an expense ratio to the fund manager of the ETFs.

Here are the 2 expense ratios that the ETFs will charge you:

| IUSA | VUSA | |

|---|---|---|

| Expense Ratio | 0.07% | 0.07% |

Both of them have exactly the same expense ratio! As such, this cost should not be a huge factor in deciding which ETF to invest in.

Liquidity

If you are looking to actively trade using these ETFs, you may want to look at their liquidity. One of the indicators you may want to look at is the ETF’s trading volume.

| IUSA | VUSA | |

|---|---|---|

| Liquidity | 162,000 | 243,000 |

VUSA has a slightly higher trading volume! However, both ETFs still have a much lower trading volume compared to the NYSE-listed ETFs.

Verdict

Here is a breakdown of IUSA and VUSA:

| IUSA | VUSA | |

|---|---|---|

| Fund Manager | BlackRock | Vanguard |

| AUM | 12.1 billion | 26.6 billion |

| Exchange | LSE | LSE |

| Estimated Unit Price | 28 GBP | 50 GBP |

| Dividend Withholding Tax | 15% | 15% |

| Dividend Distribution | Distributing | Distributing |

| Expense Ratio | 0.07% | 0.07% |

| Liquidity | 162,000 | 243,000 |

Both of them are really similar, so it does not really make a difference which ETF you choose!

If you want slightly more flexibility in your investment amount, then IUSA may make more sense due to the slightly lower unit price.

Conclusion

Both ETFs track the same index, so their performances should be very similar.

The only 3 main differences between these 2 ETFs are:

- Fund manager

- Unit price

- Trading volume

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?