Last updated on June 14th, 2021

If you’ve delved into the world of UCITS ETF investing, you may have come across funds that end with ‘DIST‘, and those that end with ‘ACC‘.

What is an accumulating ETF and how is it different from a distributing ETF?

Here’s everything that you need to know about these 2 types of ETFs:

Contents

- 1 Accumulating vs Distributing ETFs

- 2 Definition

- 3 Accumulating ETFs reinvest your dividends

- 4 Cost per unit of ETF

- 5 Returns

- 6 Net Asset Value

- 7 Dividend withholding taxes

- 8 Transaction fees

- 9 Estate tax

- 10 Expense Ratio

- 11 Availability of funds

- 12 Liquidity

- 13 Can I switch from distributing to accumulating or vice versa?

- 14 Which type of ETF should I choose?

- 15 Conclusion

Accumulating vs Distributing ETFs

As a general rule, these two types of ETFs differ in how they handle the dividends they receive. Accumulating ETFs automatically reinvest the dividends into the fund. Meanwhile, distributing ETFs will distribute these dividends to you.

Both ETFs will incur the same dividend withholding taxes. However, one type of ETF may be more tax efficient in certain countries compared to the other.

Here is a detailed comparison between these 2 types of ETFs:

Definition

Here are the two definitions of these 2 different types of ETFs:

Distributing ETFs distribute your dividends to you

Distributing ETFs are the most common type of ETFs that you’ll encounter with. When an ETF invests in different stocks, some of them may distribute dividends.

The dividends are then collected by the fund manager. Depending on their distribution date, they will distribute the dividends periodically to you.

For example, here is the dividend distribution dates for the Vanguard Total World Stock ETF (VT).

Based on this frequency, you will receive your dividends every quarter. Different companies may distribute dividends on different months. However, VT will only distribute it to you each quarter.

Accumulating ETFs reinvest your dividends

An accumulating ETF is an exchange traded fund that automatically invests your dividends for you. Instead of issuing you the dividends, the fund manager reinvests your dividends into the fund.

They will buy more of the assets that are found in the fund.

As such, you will not receive any dividends when you invest in an accumulating ETF.

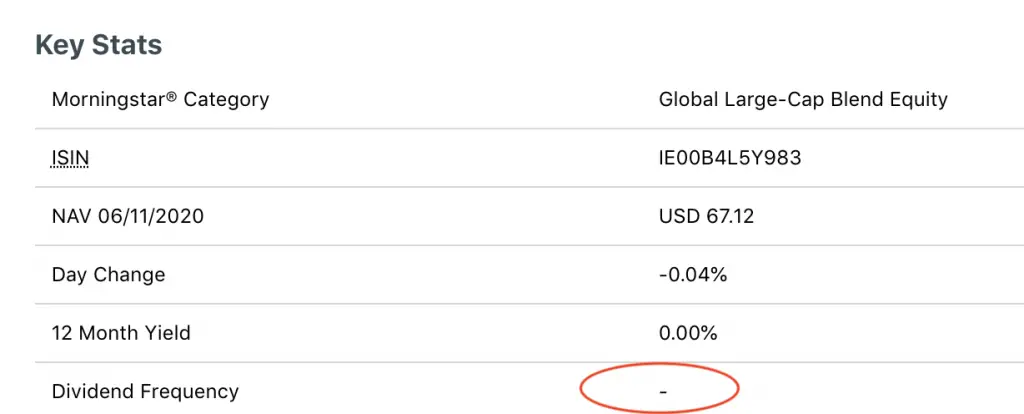

How do you know that an ETF is accumulating?

As a general rule, accumulating ETFs will have ‘ACC‘ behind the fund’s name. Alternatively, you can check the fund’s dividend distribution, as accumulating ETFs would not distribute any dividends to you.

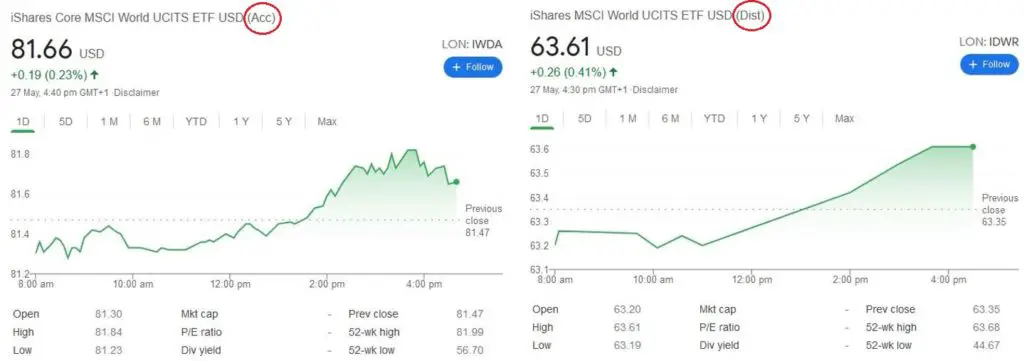

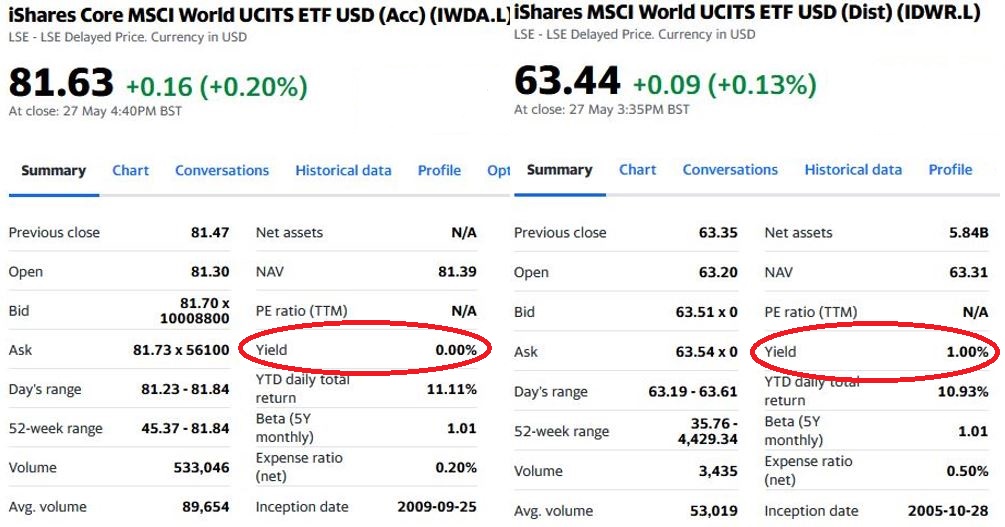

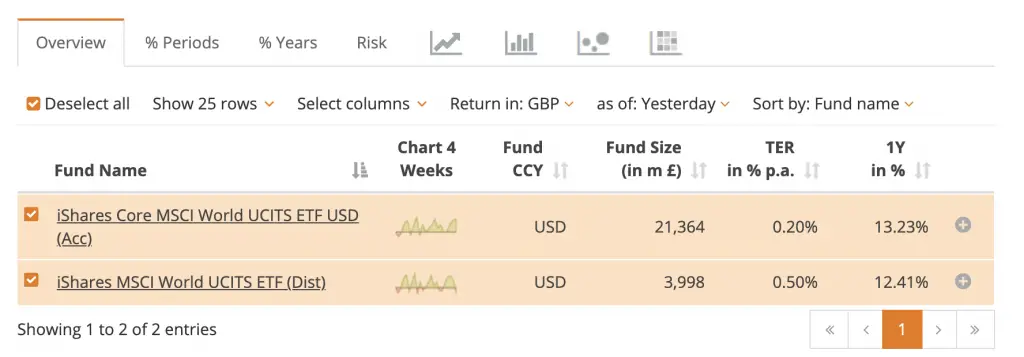

For example, here is a comparison between IWDA and IDWR.

Both ETFs are provided by the same fund manager and track the same MSCI World Index. However, IWDA is an accumulating ETF while IDWR is distributing.

Some ETFs do not explicitly mention if they are accumulating or distributing in their names. For example, VUSA, an S&P500 UCITS ETF offered by Vanguard, does not mention that it is an accumulating ETF.

In this case, a good way to check if an ETF is accumulating or distributing is to see if the ETF pays a dividend yield.

Using IWDA and IDWR as comparisons again, we will examine their yields on Yahoo Finance:

From observing the yield column for both ETFs, the yield for the accumulating ETF (IWDA) is zero as it does not pay any dividend! On the other hand, the distributing ETF (IDWR) has a dividend yield.

As such, I would recommend you to double check if the ETF is accumulating or distributing before investing in it!

Accumulating ETFs are not found in US

You may wonder, why are accumulating ETFs not found in the US exchanges? For ETFs that are domiciled in the US, they will have to distribute a minimum of 90% of its net investment income to its shareholders.

As such, they are unable to accumulate the dividends they received from the stocks they own in their basket. These US-domiciled ETFs will have no choice but to distribute the dividends to you.

Some of these ETFs include the ARKK ETF.

For non-US domiciled ETFs, they may not have such a requirement. Those that are Irish-domiciled do not need to distribute their income to you. As such, they are able to reinvest your dividends for you.

Cost per unit of ETF

When you want to invest in an ETF, one of the factors you may need to consider is the cost per unit of the ETF. Interestingly, the difference between an accumulating and distributing ETF can be quite big.

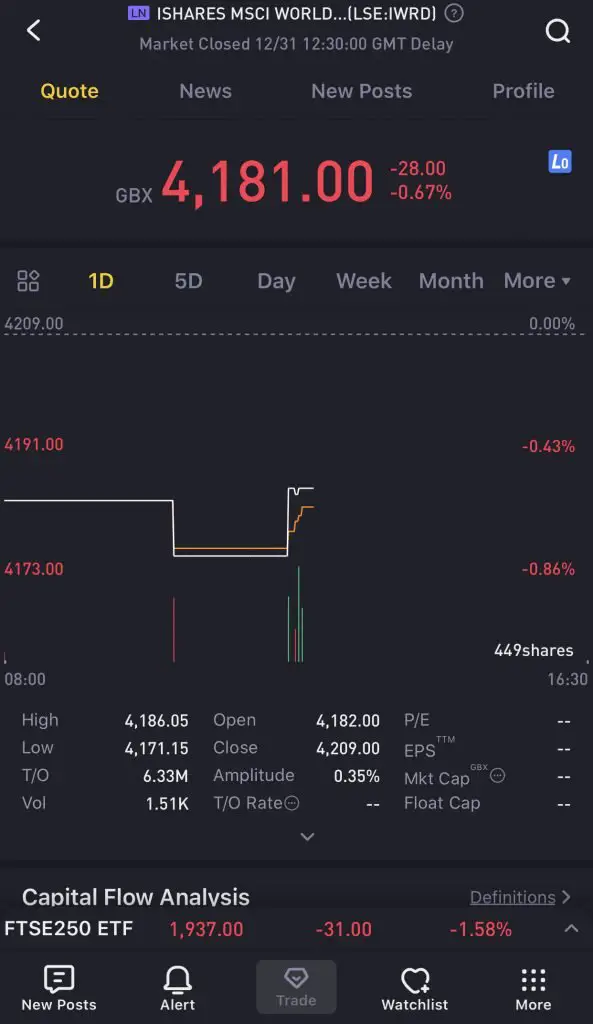

For example, here is the IWDA information page on Tiger Brokers.

1 unit of IWDA costs around $70 USD.

However, IWRD costs around 42 pounds, which is equivalent to about $59.32 USD (as of 28 May 2021).

GBX is the symbol for pence. 1 pound (GBP) is equal to 100 pennies.

Accumulating and distributing ETFs can differ in terms of:

- Currencies they are denominated in

- The unit price of each ETF

The London Stock Exchange (LSE) has a minimum order size of 1 unit. As such, the number of units that you can purchase depends on your initial investment amount.

If you only have a small amount to invest, you may want to consider the ETF with a lower unit price.

Returns

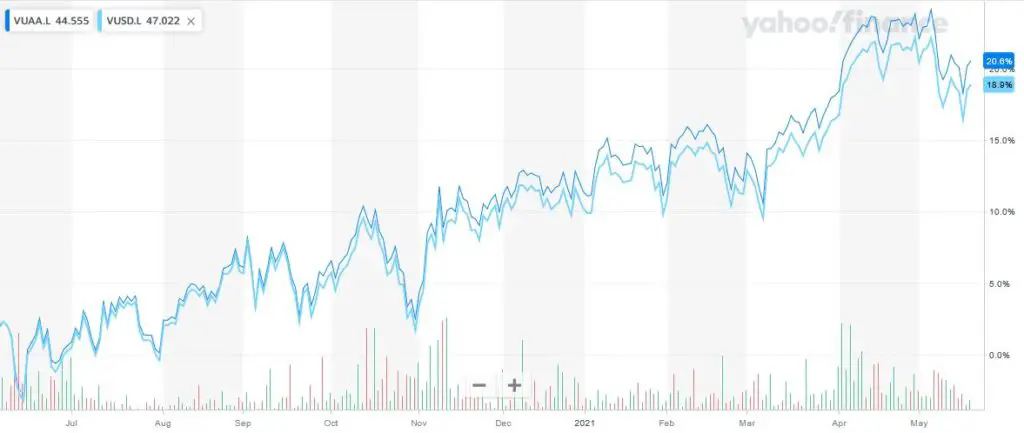

Are there any differences in returns? For example, let’s compare between VUAA (Acc) and VUSD (Dist) (Vanguard’s S&P 500 UCITS ETFs).

Both of them are tracking the S&P 500 index. As such, there should not be any differences in the returns.

This assumption is only based on the index’s return. Other factors such as fees and taxes are not considered in this assumption.

This can be seen by their 1 year performance.

After factoring in VUSD’s annual yield (of 1.13% as of chart reproduction), both ETFs have very similar performances! As such, you should not have any advantages when investing in one over the other.

Net Asset Value

The net asset value (NAV) of a fund is calculated by this formula:

(Value of Assets – Value of Liabilities) / Total Shares Outstanding

Bogleheads did a very thorough analysis on the NAV of an accumulating and distributing ETF. You may think that investing in a distributing ETF will increase your returns if you reinvest your dividends. In actual fact, both accumulating and distributing ETFs will ultimately have the same returns!

The NAV of a distributing ETF will decrease whenever a dividend is distributed. However, the NAV of an accumulating ETF will not change since no dividend is distributed.

Therefore, if you reinvest your dividends that you receive from the distributing ETF, you should get almost the same returns as the accumulating one, as your increase in shares is nullified by the reduction in NAV.

However, this scenario assumes that the ETFs started on the same day and there are no transaction fees for reinvesting your dividends.

The bottom line: both ETFs will have the same performance

In a real-world scenario, it is much harder to compare between a distributing and accumulating ETF. However, it is safe to say that both ETFs should give you the same pre-tax performance.

This is because both ETFs hold the same assets.

As such, the performance of the ETF should not be something that you would need to consider when deciding between the 2!

Dividend withholding taxes

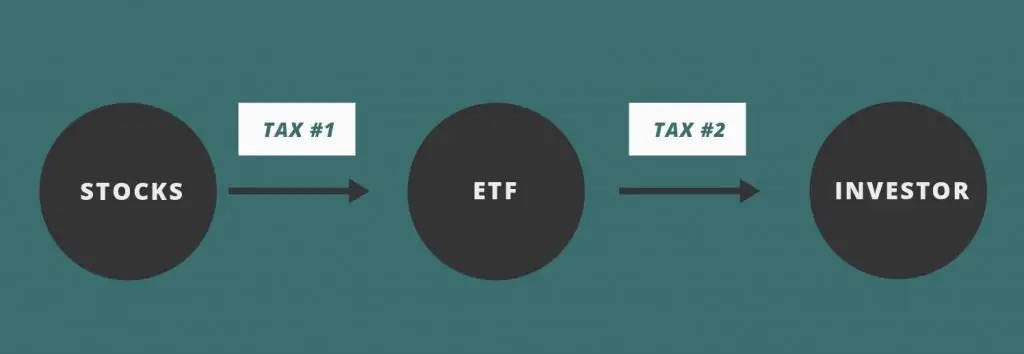

The 15% dividend withholding tax that you incur will be the same. It does not matter whether you invest in an accumulating or distributing ETF.

This is because the withholding tax is incurred at the first layer. This is where the dividends are being distributed from the stocks to the Irish-domiciled ETF.

When you invest in an ETF, you may encounter some taxes on your returns. The dividend withholding tax is the most common of these taxes.

A dividend withholding tax is a tax on the dividends that you receive.

The most common case of a dividend withholding tax is when you invest in US stocks and US domiciled ETFs. If you are a non resident alien of the US, you will incur a 30% withholding tax!

This is a pretty hefty tax, especially if you’re investing in a dividend ETF.

When it comes to an ETF, things get slightly more complicated. There are 2 layers which you can incur this tax:

- From stock to ETF

- From ETF to you as an individual investor

Dividend withholding taxes are incurred on the first layer

For both UCITS accumulating and distributing ETFs, they are usually domiciled in Ireland. As such, the dividend withholding tax is incurred at the first layer.

When the dividends are issued from a US stock to an Irish-domiciled ETF, a 15% dividend withholding tax will be incurred. As such, you will not incur a lower dividend withholding tax if you invest in an accumulating fund!

Taxes at the second layer depend on your country

You may incur additional taxes when you receive the dividends from the Irish-domiciled ETF. However, this depends on what country you are from.

Singaporeans will not incur additional dividend taxes

If you are residing in Singapore, you will not incur extra dividend taxes when you receive these dividends.

From IRAS’ website, it states that foreign dividends received by Singaporean residents after 2004 are non-taxable dividends.

This means that you will not be charged additional taxes on the dividends that you receive from these Irish domiciled ETFs.

As such, you will only incur 15% worth of dividend taxes.

European countries may have different tax laws on dividends

Other countries may have certain tax advantages when you invest in a certain type of ETF. Belgium has a 30% taxation on dividends that you receive. If you invest in an accumulating fund, you will not incur this tax.

It is very important to take note of the taxes you incur when you invest. If you face an additional dividend tax like in Belgium, it may be more tax efficient to invest in an accumulating ETF instead!

Transaction fees

Transaction fees are something that are very important to consider when you invest. These fees will be incurred whenever you make a buy and sell order.

If you are not careful, the fees may add up and it can eat into your returns! As such, it is always important to find a brokerage that charges the lowest fees.

Accumulating ETFs help you to save on transaction fees

If you intend to reinvest your dividends into the same fund, accumulating ETFs will be a better choice. This is because the accumulating ETF automatically reinvests your dividends for you.

With this automatic reinvestment, you do not have to manually reinvest your dividends into the ETF. As such, you save on the transaction fees for this buy order.

You will incur additional fees when reinvesting your dividends received by distributing ETFs

If you wish to reinvest the dividends you received from a distributing ETF, you will need to make an additional buy order.

This will incur additional transaction fees for this order that you make.

Investing in an accumulating ETF is the more cost effective method if you wish to reinvest your dividends!

Estate tax

Both of these funds are domiciled in Ireland. You do not incur any estate or inheritance taxes so long as:

- You and your beneficiary are not Irish citizens

- You do not own any property in Ireland

Expense Ratio

Another way that you will incur fees will be via the expense ratio of an ETF. This is a management fee that you’ll need to pay the ETF’s manager each year.

The expense ratio is usually different for an accumulating and distributing ETF. This is because they are 2 different funds that are issued by the same fund manager.

Fund managers may charge a higher expense ratio for funds with a smaller fund size. This is usually because the costs are spread over a smaller number of investors.

Here is a comparison between iShares’ accumulating and distributing ETFs that track the MSCI World Index:

The distributing ETF has a smaller fund size, and charges a higher expense ratio.

The expense ratio is something you’ll need to consider when you choose the ETF to invest in. Having too high an expense ratio will hurt you in the long run!

Availability of funds

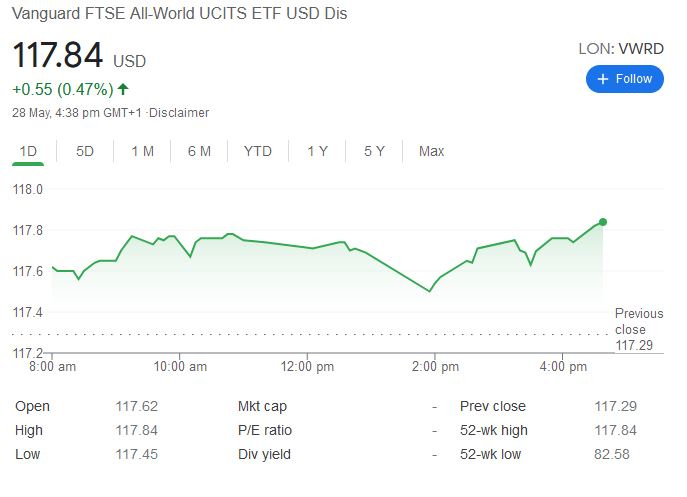

There are some fund managers that do not offer a certain type of ETF. For example, Vanguard offers VWRD, a distributing ETF that tracks the FTSE All-World index in USD.

However, Vanguard does not offer an accumulating ETF that tracks the same index in USD!

As such, you will need to research on the index that you wish to track. After that, you will need to see if any fund manager offers the type of ETF you wish to invest in.

One way you can do so is by looking at the ETF screener on JustETF.com. This allows you to see all the ETFs that tracks the same index.

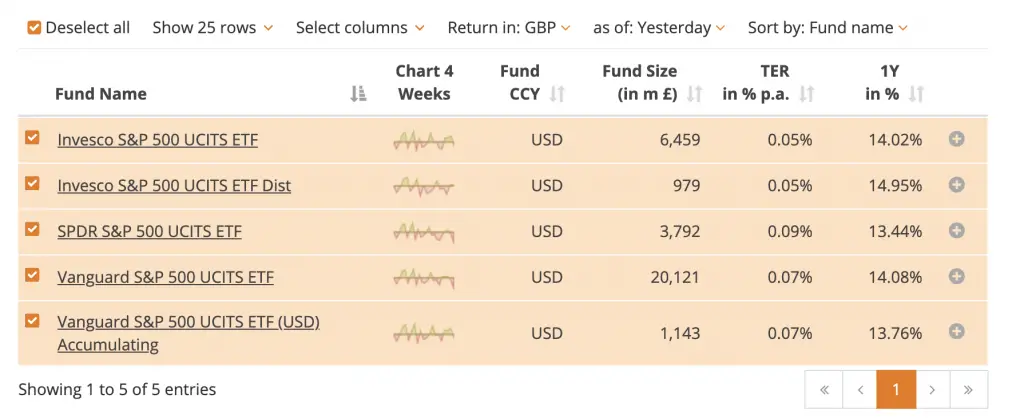

For the ETFs that track the S&P 500, SPDR only has a distributing ETF and not an accumulating one.

If you want to invest in a S&P 500 accumulating ETF, you can consider the funds offered by Vanguard or Invesco.

You can read my guide on how to invest in the S&P 500 from Singapore to find out more!

Liquidity

Another factor you may want to consider is the liquidity of both ETFs. One measure of liquidity is by determining the average trading volume of each ETF.

You can find out the average trading volume of each ETF on Yahoo Finance. For example, here is a comparison between IWDA (ACC) and IWRD (DIST) which both track the MSCI World Index.

| IWDA | IWRD | |

|---|---|---|

| Average Trading Volume | 89,654 | 60,479 |

The liquidity of the ETFs may affect you more if you are a frequent trader. If you trade in an ETF with low liquidity, you may not get buy or sell the ETF at the price you initially intended to.

Can I switch from distributing to accumulating or vice versa?

Unlike unit trusts which allow you to switch your funds, you can’t switch between distributing and accumulating ETFs.

This is because unlike unit trusts, both types of ETFs are traded on the stock market.

If you wish to switch between a distributing and accumulating ETF, you will need to sell your ETF first, and then buy the other type of ETF.

Through this trade, you may have lost some of the value of the ETF.

As such, I would recommend choosing one type of ETF and sticking to it!

Which type of ETF should I choose?

So which type of ETF should you be choosing?

This is assuming that the taxes you incur are the same.

Choose an accumulating ETF if you have a longer time horizon

If you intend to reinvest your dividends into the same ETF, then an accumulating ETF will make more sense. This is because the fund manager automatically reinvests your funds for you, saving you on transaction costs.

Accumulating ETFs are more suitable if you are young and have a long time horizon. You should be in the wealth accumulation phase at this stage.

As such, reinvesting your dividends will help to compound your growth even further!

However, it is still fine to be investing in a distributing ETF even if you have a long time horizon. Accumulating ETFs make the most sense if you originally intended to reinvest your dividends.

Choose a distributing ETF if you want to receive a regular income

If you intend to receive dividends as an additional source of income, then distributing ETFs are the way to go.

These ETFs will usually have a quarterly distribution for all the dividends that they have received.

As such, distributing ETFs are more suitable if you are at the later stage of your life. You can receive quarterly payouts even when you’re retired!

However, you will need to invest a significant amount of money into the ETF for the dividends to sustain you in the long run!

Conclusion

The main difference between accumulating and distributing ETFs are the way that they handle the dividends they receive.

You may incur different amounts of taxes, depending on the type of ETF you invest in. However, this depends on the tax laws of the country you are residing in.

As such, one of the major considerations that you should have is the stage of life that you are in. If you have a longer time horizon, then accumulating ETFs may make the most sense!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?