Last updated on January 19th, 2022

Lending out your crypto to earn a high yield is the new trend to grow your crypto portfolio.

This is different from staking your crypto, as your funds are usually lent out to trusted borrowers to receive a high interest rate.

There are quite a few ways that you can lend out your crypto, and here’s what you need to know.

Contents

How to earn interest on your crypto in Singapore

Here are 14 ways you can earn interest on your crypto in Singapore:

- Gemini Earn

- Celsius

- BlockFi

- Cake DeFi

- Crypto.com Earn

- Luno Savings Wallet

- Nexo

- Hodlnaut

- YouHodler

- Binance

- Vauld

- Liquid Earn

- Zipmex Earn

- Tokenize Earn

And here is each method explained in-depth:

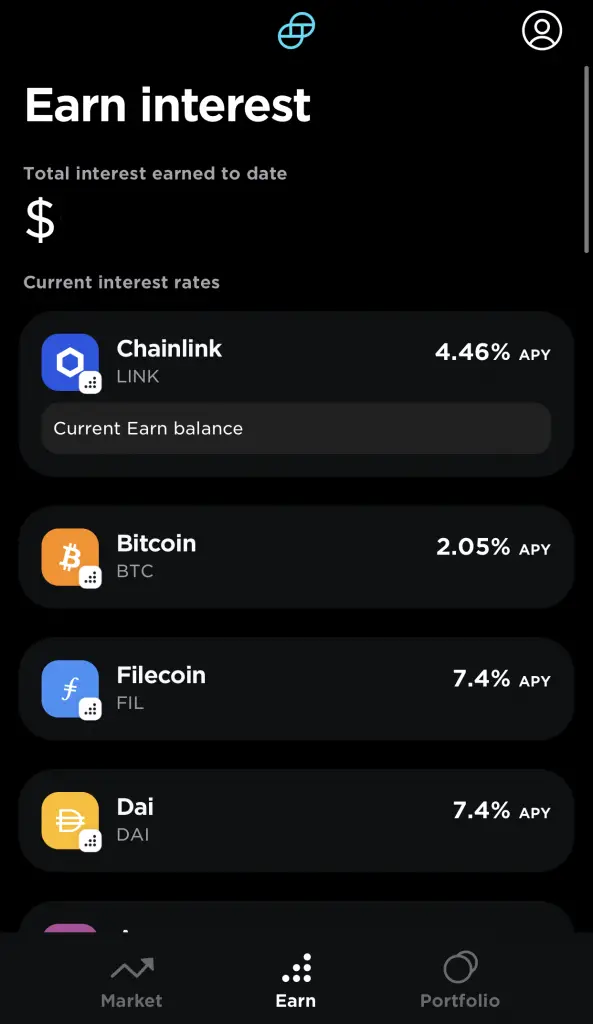

Gemini Earn

Gemini was founded in New York in 2014. They were created by the Winklevoss twins, who have seen major success with their crypto exchange.

Gemini also offers the Earn feature that lends out your crypto to give you a high rate of return.

Here is a summary of Gemini Earn’s features:

| Number of cryptocurrencies | 32 |

| How interest is earned | In-kind |

| Distribution of rewards | Monthly |

| Borrowers of platform | Genesis (may be unsecured) |

| Minimum amount | None |

| Lock-in period | None |

| Withdrawal fees | None to Gemini’s trading platform None for first 10 withdrawals from Gemini’s platform per month |

| Security | Hot wallet + offline storage |

| Extra features | Trading platform (Exchange and Active Trader) |

| Verdict | Loans may be riskier, but you can earn interest on many currencies |

Number of cryptocurrencies

Gemini Earn allows you to earn interest on 32 different currencies.

Some of them include:

Gemini Earn offers a rather unique variety of cryptocurrencies on their platform. They are one of the first that allows you to earn interest on DOGE!

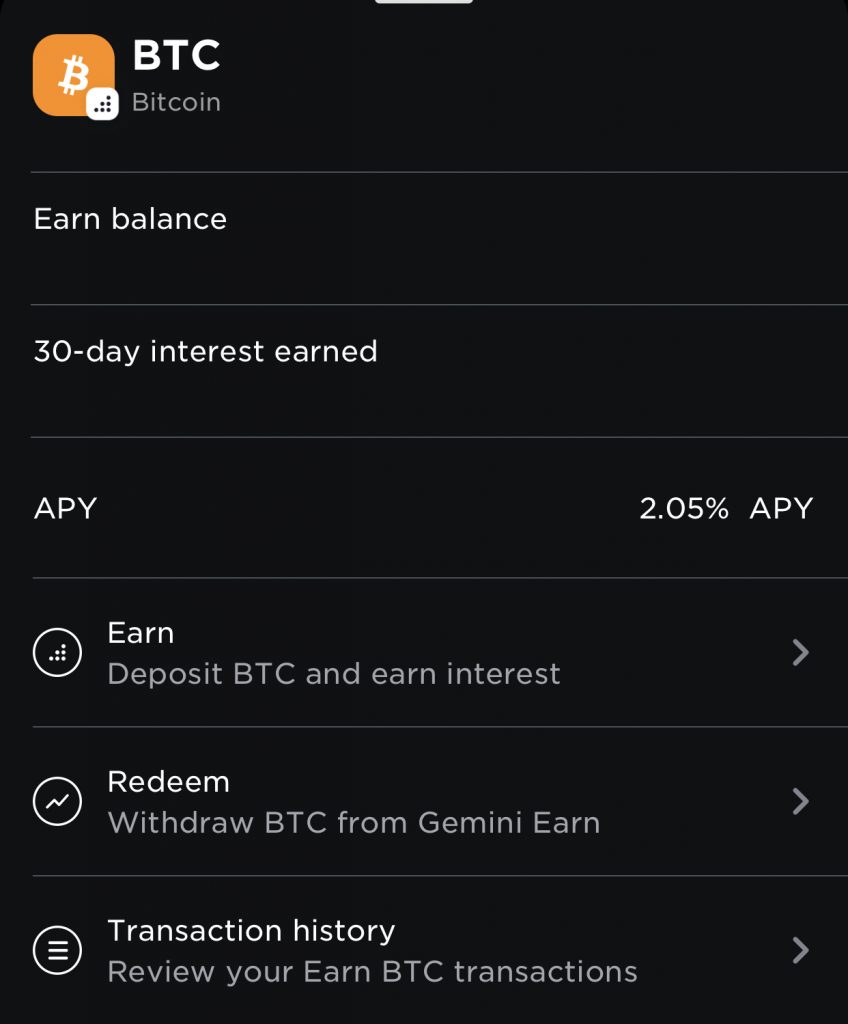

How interest is earned

You will earn interest on your crypto in-kind.

For example, if you lend Bitcoin with Gemini Earn, your interest will be paid in Bitcoin too.

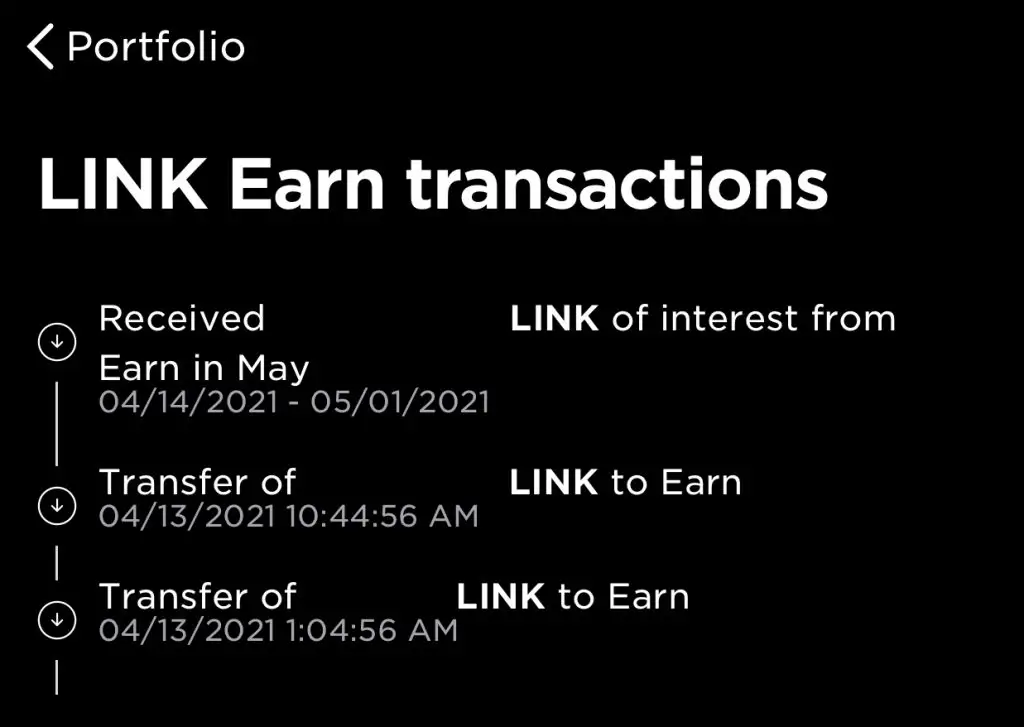

Distribution of rewards

The interest you earn will be calculated and compounded daily by Gemini.

However, the interest will only be credited to you at the start of each month.

Borrowers of platform

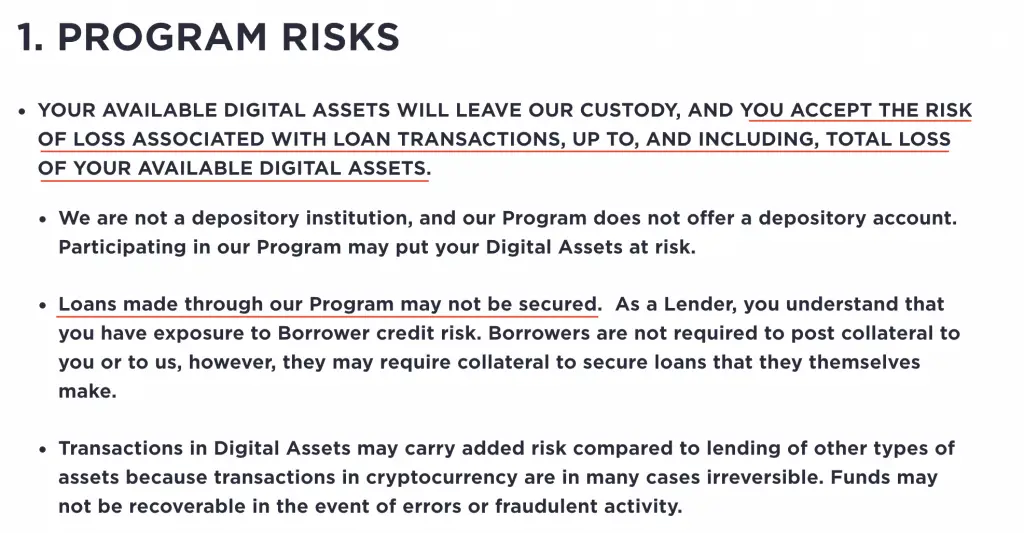

Gemini loans out your cryptocurrencies to their approved borrowers. However, according to Gemini’s Terms of Service, the crypto that you lend out may be via an unsecured loan. This may add extra risks to your loans.

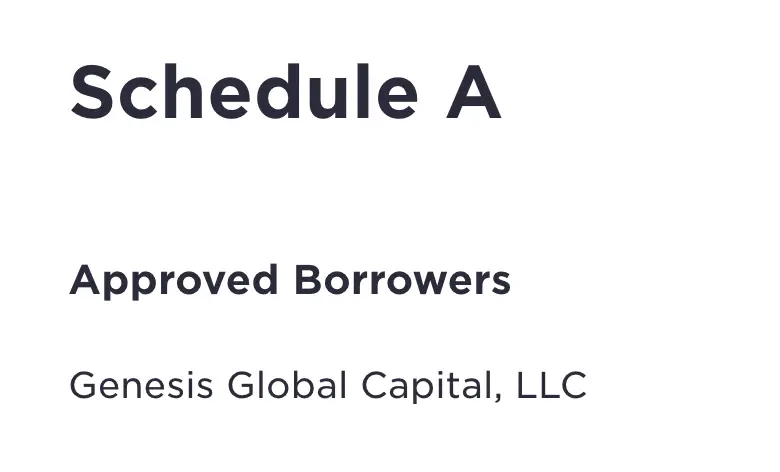

Gemini loans out your funds to their approved borrowers. So far, Gemini’s only approved borrower is Genesis Global Capital.

You may want to take extra caution when placing your funds with Gemini Earn. This is because of this clause in their Terms of Service.

In the event that a borrower defaults with your cryptocurrency, you may not be able to get back your funds!

Moreover, Gemini does not require borrowers to post collateral when they take a loan.

This may mean that your loans may be much riskier, compared to lending out your crypto with BlockFi or Celsius. The borrower does not have much penalties if they decide to default on the loan.

As such, you’ll need to consider if it’s worth taking this risk when lending out your crypto with Gemini Earn!

Minimum amount

Gemini Earn does not have any minimum amount required to start earning interest on your crypto.

You are able to start earning interest with any amount that you currently own!

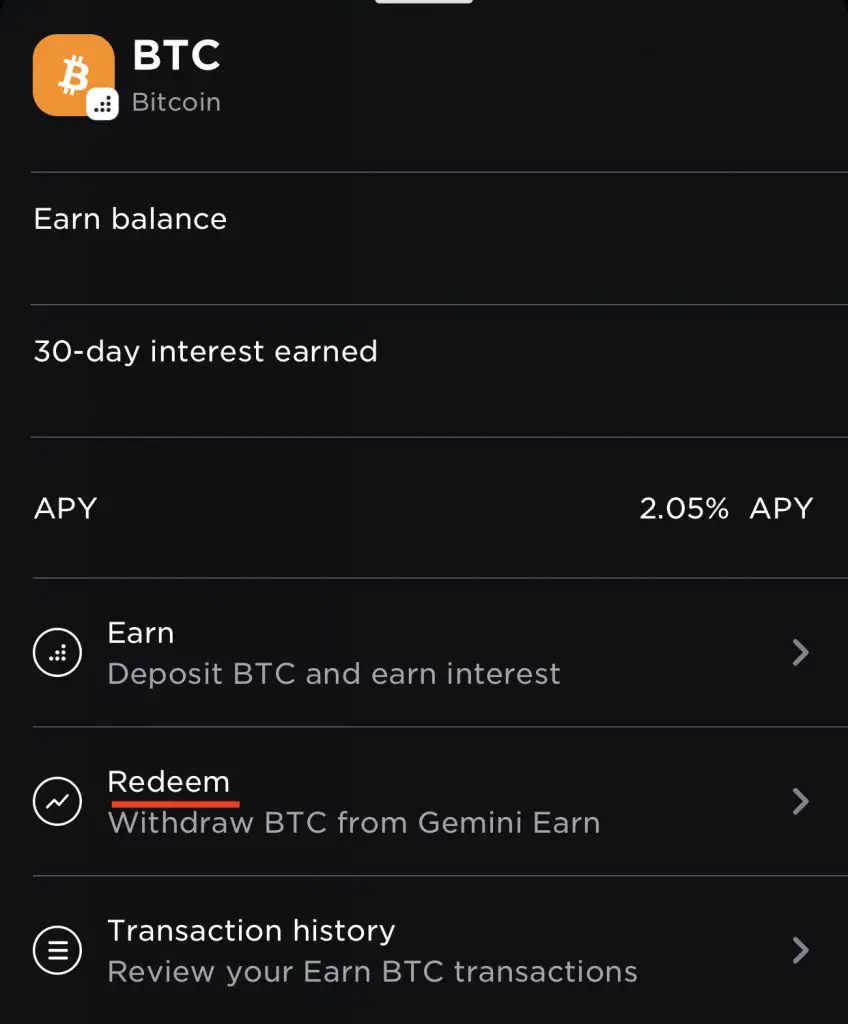

Lock-in period

Gemini Earn does not have any lock-in periods. You are able to freely redeem your crypto at any time!

Your crypto should appear in your account once the transaction has been processed.

If Gemini’s partners experience a large volume of withdrawal requests at the same time, it may take a longer time before your funds reach your account.

Gemini has given their partners a 5 business day limit to transfer your funds.

Withdrawal fees

Gemini does not charge any withdrawal fees when you make a redemption order from Gemini Earn.

Furthermore, you will not be charged any withdrawal fees if you make less than 10 withdrawals a month from Gemini’s platform!

Security

Gemini claims it is one of the most secure crypto exchanges.

Majority of the assets on the exchange are stored in an offline cold wallet.

Moreover, the remaining funds in the hot wallet is insured.

Our policy insures against the theft of Digital Assets from our Hot Wallet that results from a security breach or hack, a fraudulent transfer, or employee theft.

Gemini

It seems that Gemini’s owners are quite confident about the security of their platform!

Extra features

Apart from lending crypto out, Gemini is more well known for being a cryptocurrency exchange.

You will be able to buy cryptocurrency on their platform via 2 ways:

- Gemini Exchange

- Gemini Active Trader

While Gemini Exchange is a more convenient way of buying crypto, the fees that they charge are very high. You may be charged more than 1.49%, depending on your trade amount!

If you want to buy crypto, you can consider Gemini’s Active Trader which only charges up to 0.35%. However, the options are rather limited, as you can only buy BTC or ETH directly from SGD.

Verdict

Gemini Earn provides you a convenient way of earning interest on your crypto, especially if you’ve already bought your crypto on Gemini.

However, it does have some disadvantages:

- Your loans may be unsecured which may add extra risks to your funds

- The interest rates being offered may be slightly lower compared to other platforms

The good thing about Gemini’s platform is that it does not charge any withdrawal fees for your first 10 withdrawals. As such, you can consider sending your crypto to another platform if you want to do so!

Celsius

Celsius was founded in 2017 and is headquartered in New York.

Here is a summary of Celsius’ features:

| Number of cryptocurrencies | 41 |

| How interest is earned | In-kind CEL Tokens |

| Distribution of rewards | Weekly |

| Borrowers of platform | Approved borrowers (secured with collateral) |

| Minimum amount | None |

| Lock-in period | None |

| Withdrawal fees | None |

| Security | Insured by Fireblocks and PrimeTrust |

| Extra features | Buy crypto Take loans |

| Verdict | No withdrawal fees make it very attractive, and you can earn interest on many currencies |

Number of cryptocurrencies

Celsius allows you to earn interest on 41 different currencies.

There is a huge variety of currencies available, such as:

Celsius probably allows you to earn interest on the most number of currencies! You can even earn interest on BNB, which you can transfer from Binance to Celsius via the BSC network.

How interest is earned

Celsius allows you to earn interest in 2 ways:

- In-kind reward (same currency that you own)

- Interest in CEL token

Celsius allows you to earn a higher interest rate, if you choose to earn it in CEL tokens.

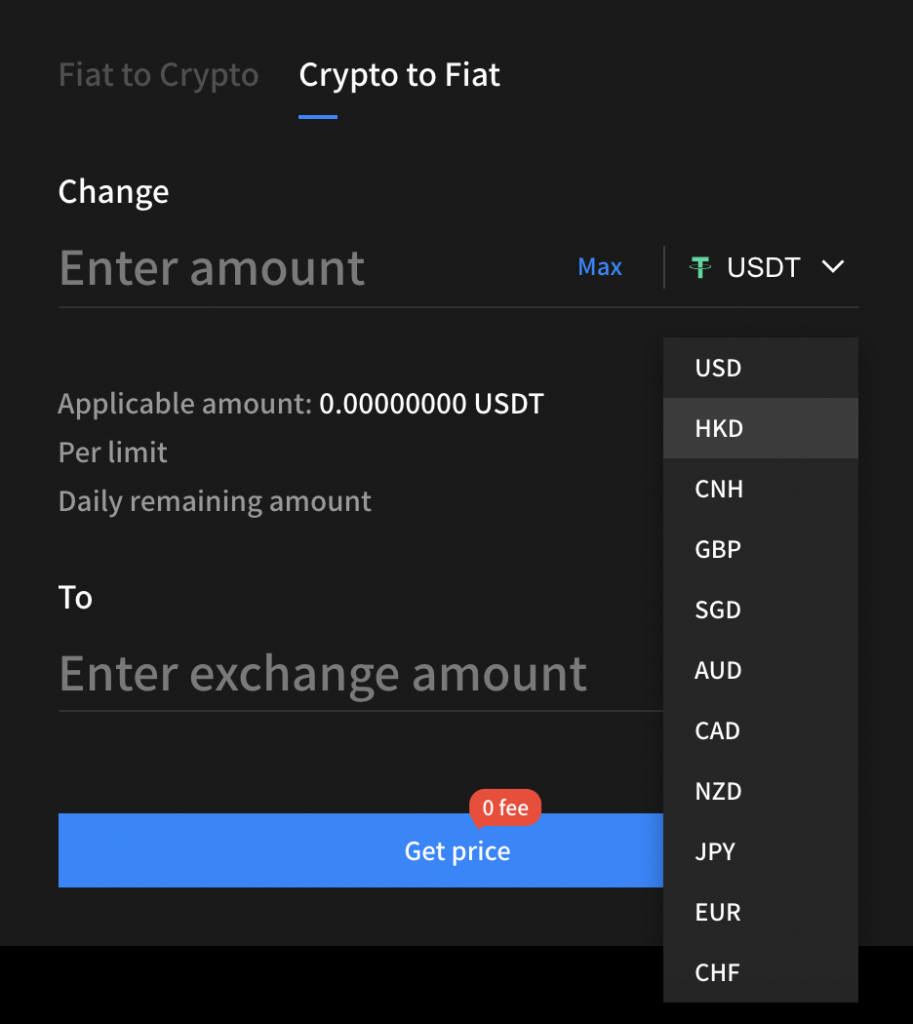

If you are interested in transferring your CEL tokens to sell them, AAX may be an exchange that you can consider.

You will need to sell your CEL tokens for USDT first, before exchanging USDT for SGD.

Distribution of rewards

Celsius calculates your rewards for each week, between Friday to the next Friday.

Your interest is calculated and then paid on the following Monday.

The weekly compounding is less frequent compared to Gemini Earn. However, you will still compound your returns faster compared to a monthly compounding!

Borrowers of platform

Celsius lends your crypto to their approved borrowers. Your crypto is also secured with collateral too.

Celsius also claims to return up to 80% of the interest that they earn from lending your coins. This allows them to offer such high interest rates to you.

Minimum amount

Celsius does not have any minimum amount required to earn interest on your crypto.

This makes it very convenient for you to earn interest, even on small amounts!

Lock-in period

Celsius does not have any lock-in periods. You are able to freely withdraw your crypto whenever you decide to.

Withdrawal fees

Celsius does not charge you any fees when withdrawing from your account.

This will help you to save on the hefty network fees you may incur when withdrawing from other platforms!

Security

Celsius does not disclose the security measures that they have.

However, the assets under their custody are insured by Fireblocks and PrimeTrust.

Your assets are only insured when they are under the custody of Celsius. Once they are loaned out to borrowers, your assets are no longer insured!

However, Celsius is a pretty well-established company. Its services are available in more than 100 countries around the world.

As such, I believe that your assets should be rather secure with this platform!

Extra features

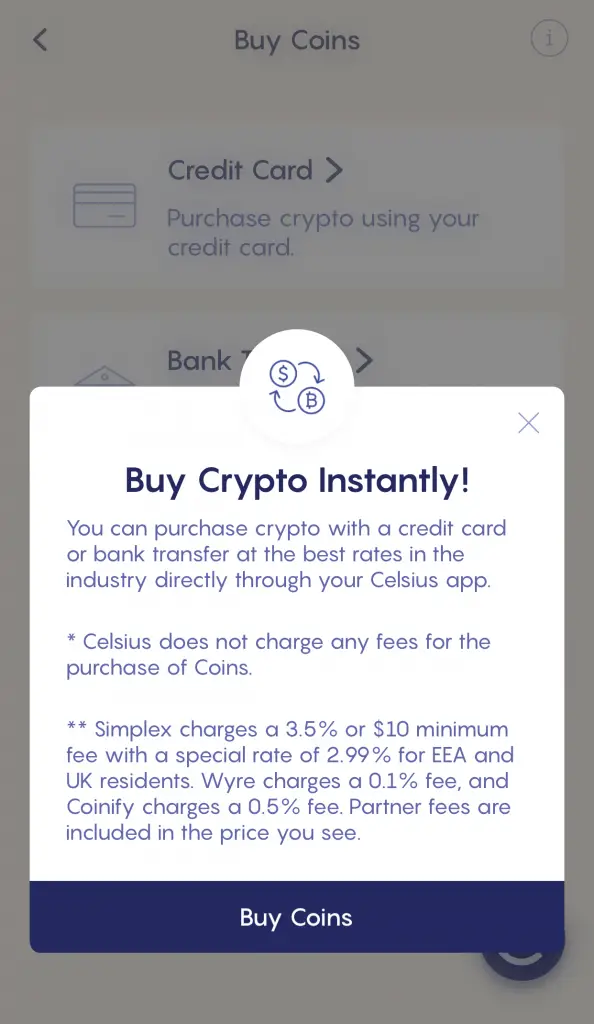

Apart from lending out your crypto, Celsius also allows you to buy crypto on their platform,

as well as take loans.

If you’re in the US, you will incur lower fees when purchasing crypto on Celsius. If you are from Singapore, it may be better to buy your crypto elsewhere, before sending it over!

Verdict

Celsius allows you to earn interest on a wide variety of currencies. Some of them may not be offered by other platforms too!

I really like that Celsius does not charge any withdrawal fees. This helps to reduce your fees when transferring your crypto from one platform to another!

Overall, Celsius provides a very solid platform to help your crypto grow faster!

BlockFi

Meanwhile, BlockFi was founded in 2017, and they are headquartered in New York.

Here is a summary of BlockFi’s features:

| Number of cryptocurrencies | 10 |

| How interest is earned | In-kind |

| Distribution of rewards | Monthly |

| Borrowers of platform | Trusted institutional and corporate borrowers (secured with collateral) |

| Minimum amount | None (if below a certain amount, you may not be able to withdraw it) |

| Lock-in period | None |

| Withdrawal fees | Free for first crypto and stablecoin withdrawal each month |

| Security | Gemini as main custodian |

| Extra features | Buy crypto from USD Take loans |

| Verdict | High interest rates for BTC / ETH 1st free withdrawal each month is attractive |

Number of cryptocurrencies

BlockFi allows you to deposit 10 cryptocurrencies into your account.

Most of these currencies can be found either in Gemini Earn or Celsius too.

How interest is earned

Your interest is earned in-kind as well.

If you loan out LINK using BlockFi, you will receive LINK as interest.

Distribution of rewards

For BlockFi, your interest is paid on the first business day of each month.

This is similar to how a bank works, where your interest is also paid monthly.

Compared to other platforms, your returns may compound slower on BlockFi compared to Gemini Earn or Celsius.

Borrowers of platform

BlockFi lends your crypto to “trusted institutional and corporate borrowers“. They also lend your crypto “on over-collateralized terms“.

Over-collateralization (OC) is the provision of collateral that is worth more than enough to cover potential losses in cases of default.

Investopedia

This means that your crypto is lent to rather reputable sources who are able to pay in case of a default.

This is less risky compared to the potential unsecured loans issued by Gemini Earn.

However, the assets that you own in BlockFi are not insured by the FDIC!

Minimum amount

BlockFi does not have any minimum deposit. However, you may not be able to withdraw small balances if you decide to only deposit a small amount.

As such, you should try to deposit the more than this minimum amount. If not, your crypto may be locked in with BlockFi!

Lock-in period

BlockFi do not have any lock-in periods. This means that you are able to freely withdraw your crypto any time you wish!

However, you have certain withdrawal limits over a 7-day period:

| Currency | Withdrawal Limit (Over 7-Day Period) |

|---|---|

| BTC | 100 |

| ETH | 5,000 |

| LTC | 10,000 |

| Stablecoins | 1,000,000 |

| PAXG | 500 |

Withdrawal fees

Meanwhile, BlockFi allows you free withdrawals for each month:

- 1 free crypto withdrawal per month

- 1 free stablecoin withdrawal per month

This free withdrawal can only be applied to one currency only.

After that, you’ll be charged withdrawal fees. The fee you incur depends on the currency you withdraw:

| Crypto | Withdrawal Fee |

|---|---|

| BTC | 0.00075 BTC |

| ETH | 0.02 ETH |

| LTC | 0.0025 LTC |

| Stablecoins | $10.00 USD |

| PAXG | 0.015 PAXG |

BlockFi also has a minimum withdrawal amount for BTC (0.003 BTC) and ETH (0.056 ETH).

If you choose to withdraw an amount that is smaller than this, it may take up to 30 days for your funds to reach your account!

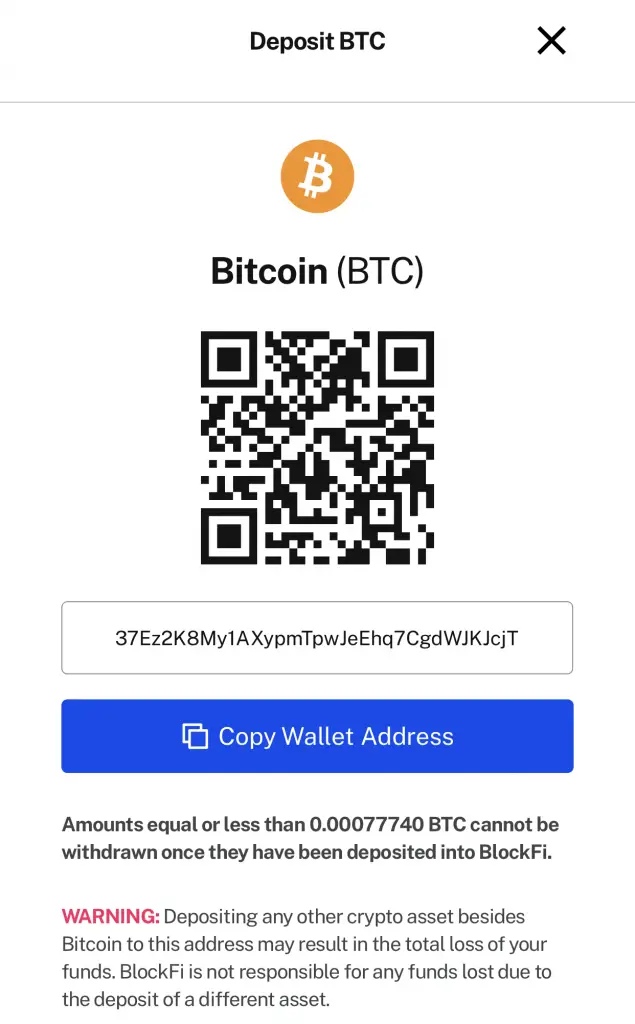

Security

To ensure that some of your assets are available to be withdrawn quickly, BlockFi leaves your assets under the custody of 3 institutions:

Gemini is BlockFi’s main custodian of your assets.

Majority of your assets on the exchange are stored in an offline cold wallet.

Moreover, the remaining funds in the hot wallet is insured.

As such, you can be reassured that your assets are rather safe with BlockFi.

Extra features

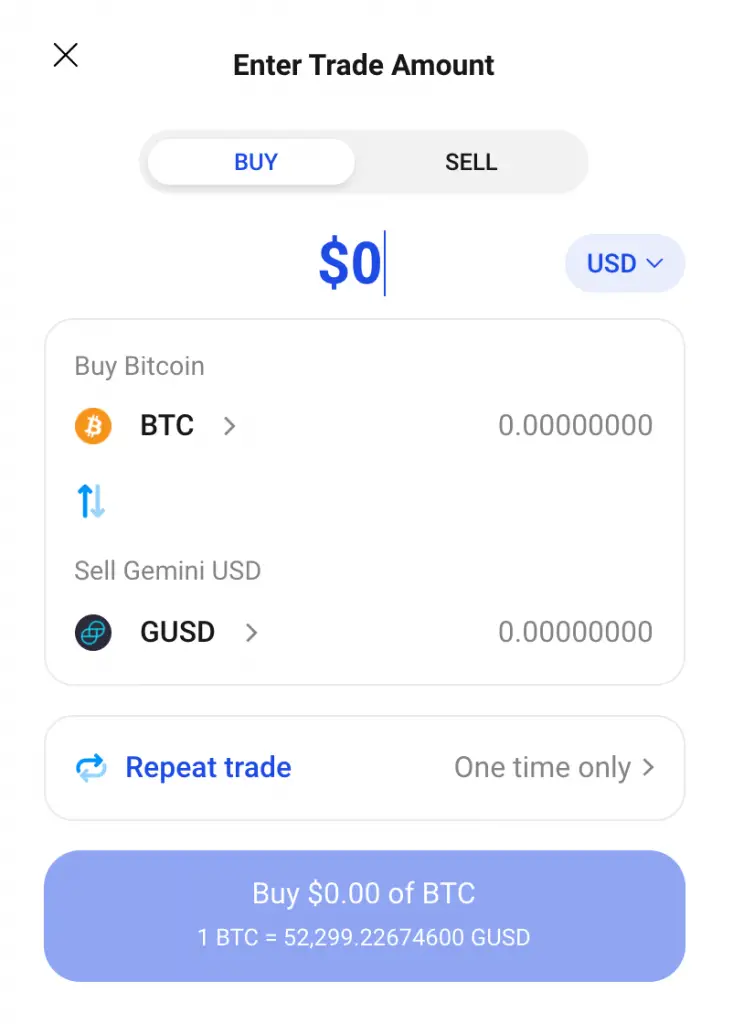

Apart from lending out your crypto, you are able to exchange between crypto on BlockFi.

After depositing your USD, you can trade to other cryptocurrencies from your GUSD.

You can choose to deposit USD into BlockFi, which will be converted into GUSD.

However, you may want to take note of the international transfer fees that you may incur!

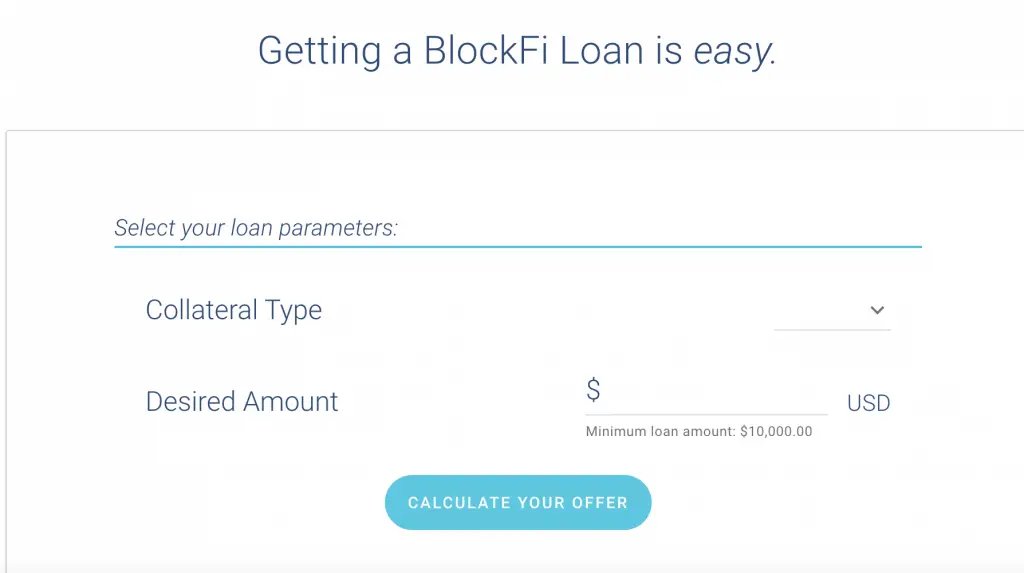

If you are looking to take a loan, you can also do so on BlockFi.

Verdict

BlockFi is one of the first platforms that allow you to earn interest on your crypto.

It does offer quite high interest rates for your BTC and ETH, compared to other platforms.

However, it has some limitations like minimum deposits and withdrawals, as well as withdrawal fees.

Cake DeFi

Cake DeFi was founded in 2019 by Dr. Julian Hosp and U-Zyn Chua. They are currently based in Singapore.

Here is a summary of Cake DeFi’s features:

| Number of cryptocurrencies | 3 |

| How interest is earned | In-kind |

| Distribution of rewards | Every 4 weeks |

| Borrowers of platform | Unknown |

| Minimum amount | None |

| Lock-in period | 4 weeks (until end of batch) |

| Withdrawal fees | Depends on currency |

| Security | Hot wallet + cold storage |

| Extra features | Staking Liquidity mining |

| Verdict | Not many currencies available, but you can consider using it for staking and liquidity mining |

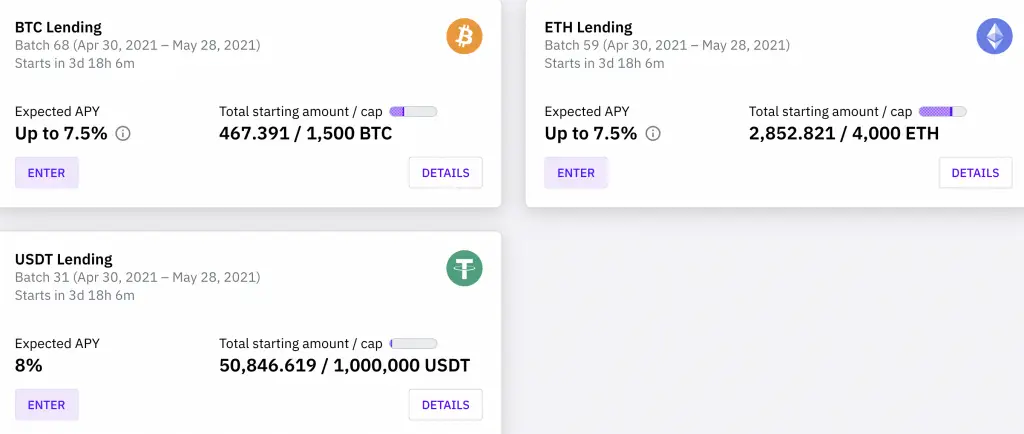

Number of cryptocurrencies

Cake DeFi only allows you to earn interest on 3 currencies:

- BTC

- ETH

- USDT

The lending rates are not as attractive compared to other platforms.

How interest is earned

The interest you earn on Cake DeFi is in-kind as well.

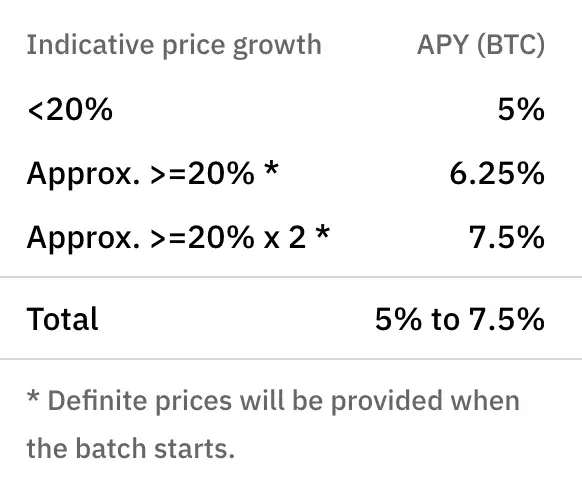

For both BTC and ETH, there is a base reward rate that you will receive.

However, if the price of BTC or ETH increases more than 20%, you will be able to receive the higher rate!

The interest that you can earn when BTC or ETH does well is slightly higher compared to BlockFi.

Even if the price of BTC or ETH goes down, you still will be guaranteed the base reward rate.

Distribution of rewards

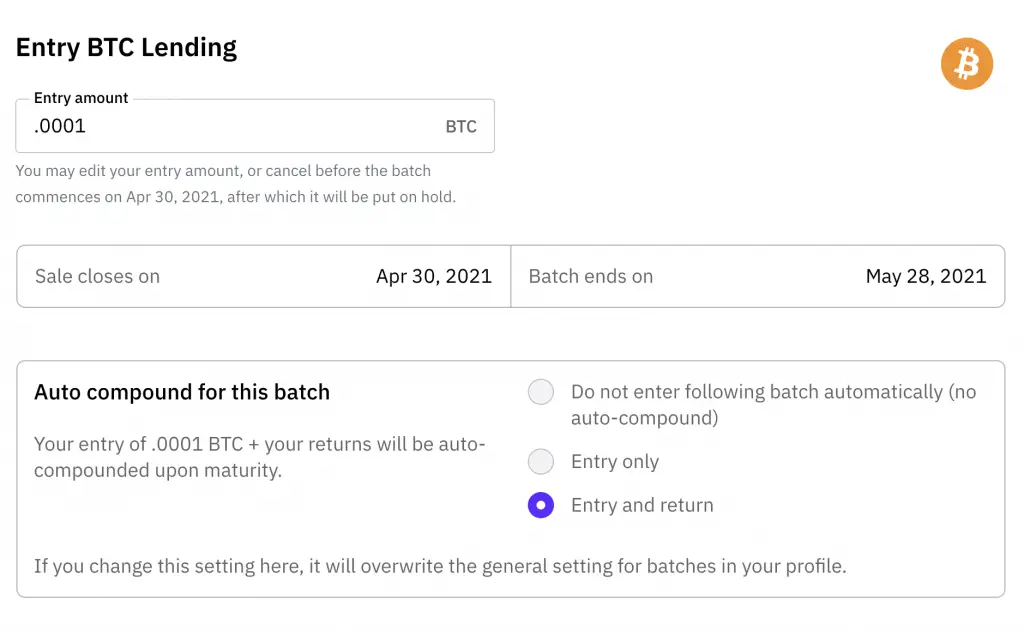

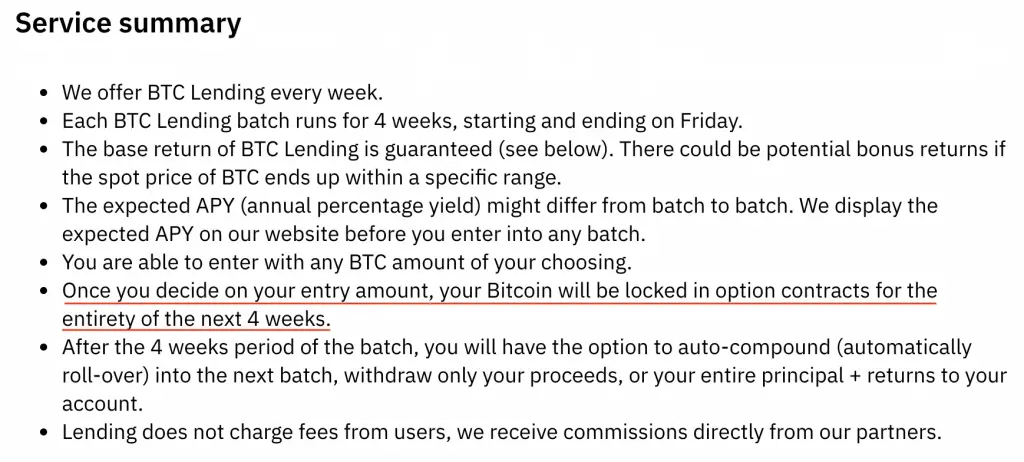

Cake DeFi offers their lending services in batches, which starts every week. The interest rates may change for each new batch that they offer.

Your rewards are paid out to you within 24 hours after the end of your batch. Each batch runs for 4 weeks, so you are only paid your interest around every month.

Borrowers of platform

Cake DeFi is a decentralised finance platform. As such, the borrowers that Cake DeFi lends out your funds to are not really disclosed.

Due to the decentralised nature of Cake DeFi, it is possible that your crypto may be loaned out via P2P lending too.

Minimum amount

When you want to lend your BTC, you are able to lend as small as 0.0001 BTC!

This allows you to earn rewards on your crypto, no matter how small the amount.

Lock-in period

Cake DeFi has a lock-in period of 4 weeks for every batch that you choose to deposit your crypto into.

You aren’t able to withdraw the crypto from the batch after it’s been locked up.

This is slightly less flexible compared to other platforms like BlockFi.

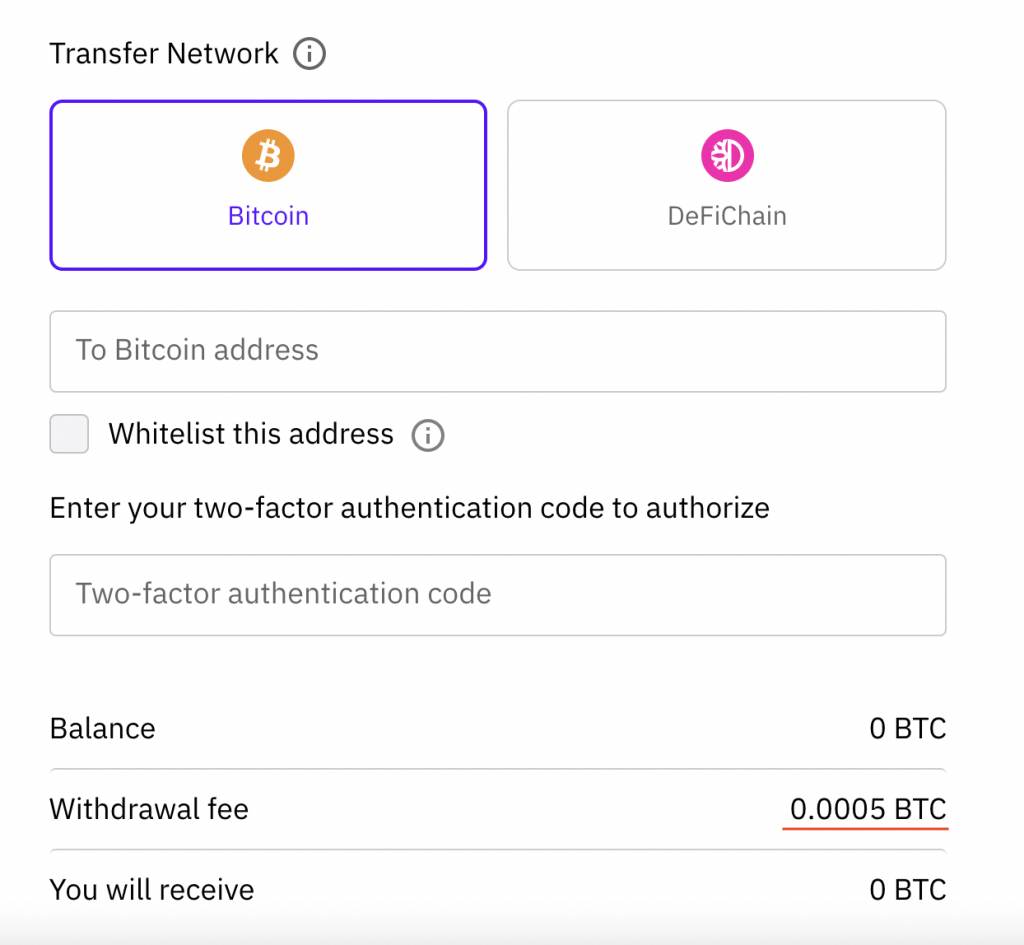

Withdrawal fees

Since your crypto is locked in for 4 weeks, you can’t withdraw your crypto from Cake DeFi during that period.

Once the batch has finished, you can choose to withdraw it.

If you want to withdraw your currency from Cake DeFi, the fees you incur depends on the currency.

However, the good thing is that you’re able to see the fees you’ll incur before making a withdrawal.

Security

Cake DeFi aims to be very transparent with each transaction on their platform. They publish quarterly reports on their YouTube channel. Furthermore, the blockchain addresses of their masternode pools are public. This allows anyone to track all of the transactions on Cake DeFi.

By being very transparent with all of the transactions on their platform, you can be reassured that your assets are rather safe with Cake DeFi!

Furthermore, Cake DeFi stores majority of your funds in an offline ‘cold storage’.

If hackers gain access to Cake DeFi, they are only able to steal the funds from the hot wallet, which only contains a small percentage Cake DeFi’s holdings.

However, just like any other DeFi platform, you would have to trust in Cake DeFi’s technology. Anyone can use their platform, which makes it extremely accessible.

However, this also means that if you lose your money on Cake DeFi, no one will be able to help you!

This is in contrast to centralised finance (CeFi), where you are trusting the company to be a custodian for your assets. If anything goes wrong, you still can rely on the platform to help recover some of your funds.

DeFi certainly has higher risks compared to CeFi. However, these risks come with higher rewards.

You’ll need to decide if it’s worth the risk to earn these higher rewards!

Extra features

Apart from lending your crypto, Cake DeFi also offers staking and liquidity mining services.

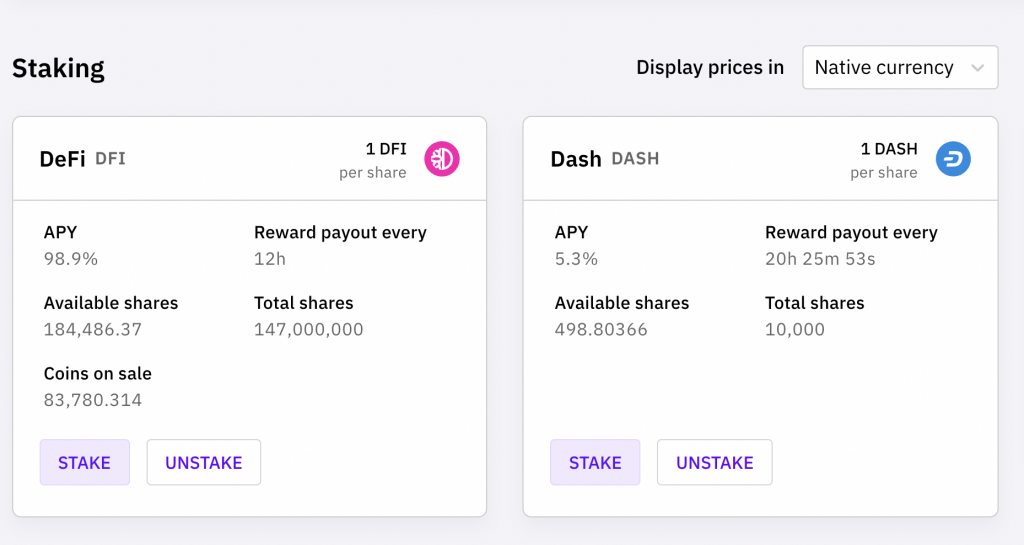

You are able to stake DFI or DASH on Cake DeFi.

You are able to earn a really high yield on your DFI tokens!

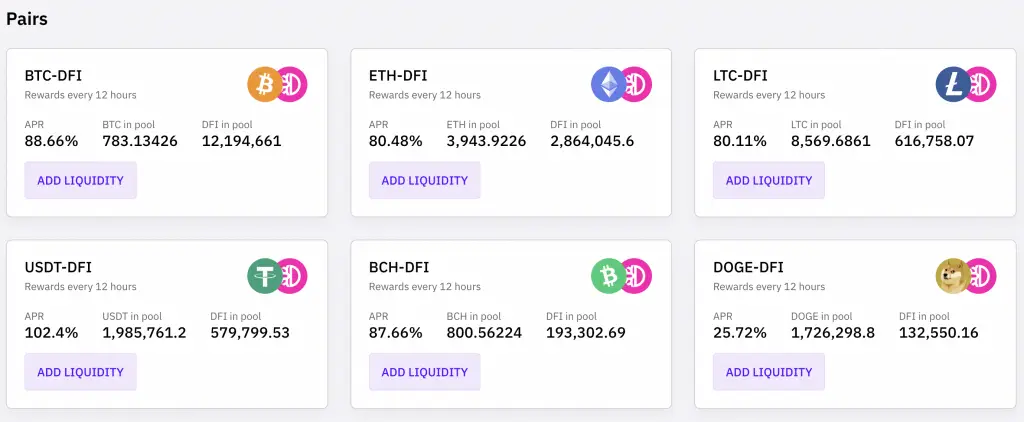

Cake DeFi also allows you to perform liquidity mining. You will need to deposit a token pair into a liquidity mining pool to mine rewards.

This is somewhat similar to Crypto.com’s Supercharger.

Most of these token pairs usually include DFI being paired with another token:

- BTC-DFI

- ETH-DFI

- LTC-DFI

- USDT-DFI

- BCH-DFI

- DOGE-DFI

Verdict

In terms of the interest rates being provided by Cake DeFi, they are much less attractive compared to other options.

Furthermore, you will need to lock in your crypto for at least 4 weeks!

I would prefer using Cake DeFi for their staking and liquidity mining. This is because both services provide much more flexibility and higher rewards.

Crypto.com Earn

Crypto.com was founded in June 2016. They are based in Hong Kong, and serves over 10 million customers.

Here’s a summary of their Earn program:

| Number of cryptocurrencies | 36 |

| How interest is earned | In-kind |

| Distribution of rewards | Every week (simple interest) |

| Borrowers of platform | Unknown |

| Minimum amount | Depends on currency |

| Lock-in period | Flexible, 1 month or 3 months |

| Withdrawal fees | None when withdrawing to Crypto.com App |

| Security | Hot wallet + cold storage |

| Extra features | Exchange platform Buying crypto |

| Verdict | Lock-in period can be quite restrictive |

Number of cryptocurrencies

You are able to earn interest on 36 different cryptocurrencies on Crypto.com’s Earn.

However, the number of currencies that you can actually deposit depends on your country / region:

| Available Cryptocurrency | Supported Locations |

|---|---|

| BTC, CRO, ETH, LTC, XRP, BNB, BAT, LINK, MKR, DAI, PAX, ATOM, BCH, VET, ICX, ADA, ENJ, ALGO, KNC, eGLD, COMP, MANA | All |

| PAXG, TUSD, TAUD, TCAD, TGBP, USDC | All except Singapore |

| EOS, XLM, XTZ, CELR, DOT | All except for the US states of Alabama, Connecticut, Georgia, Hawaii, Idaho, Louisiana, New Mexico, North Carolina, Oregon, Vermont and Washington. |

| USDT, OMG, UNI | All except the US. |

If you are in Singapore like me, you aren’t able to earn interest on most of the stablecoins, except for USDT.

How interest is earned

The interest will be credited in the same currency (in-kind) that you’ve loaned out.

Distribution of rewards

Crypto.com will issue your rewards every week. However, the crypto will only be credited into your Crypto wallet.

This means that you aren’t able to earn interest on your payouts! As such, Crypto.com’s Earn only pays out a simple interest to you each time.

Borrowers of platform

Crypto.com does not state who they lend out your crypto to.

This may be slightly risky, as there is not much transparency here!

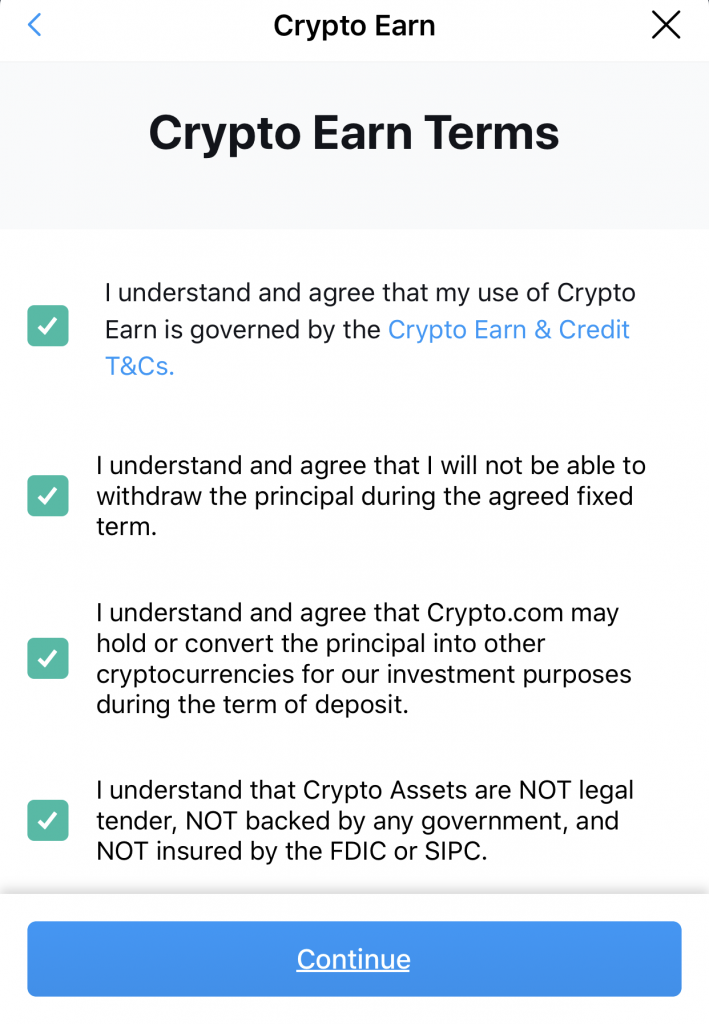

There are certain Terms and Conditions that you’ll need to accept when using Crypto.com’s Earn.

By accepting the Earn and Credit T&Cs, you are accepting the risks involved with lending your crypto. There could be a risk that you will lose all of your cryptocurrency if Crypto.com closes down as well!

However, Crypto.com is a rather reputable company. I believe that the institutions they loan out your crypto to should be rather trustworthy.

Minimum amount

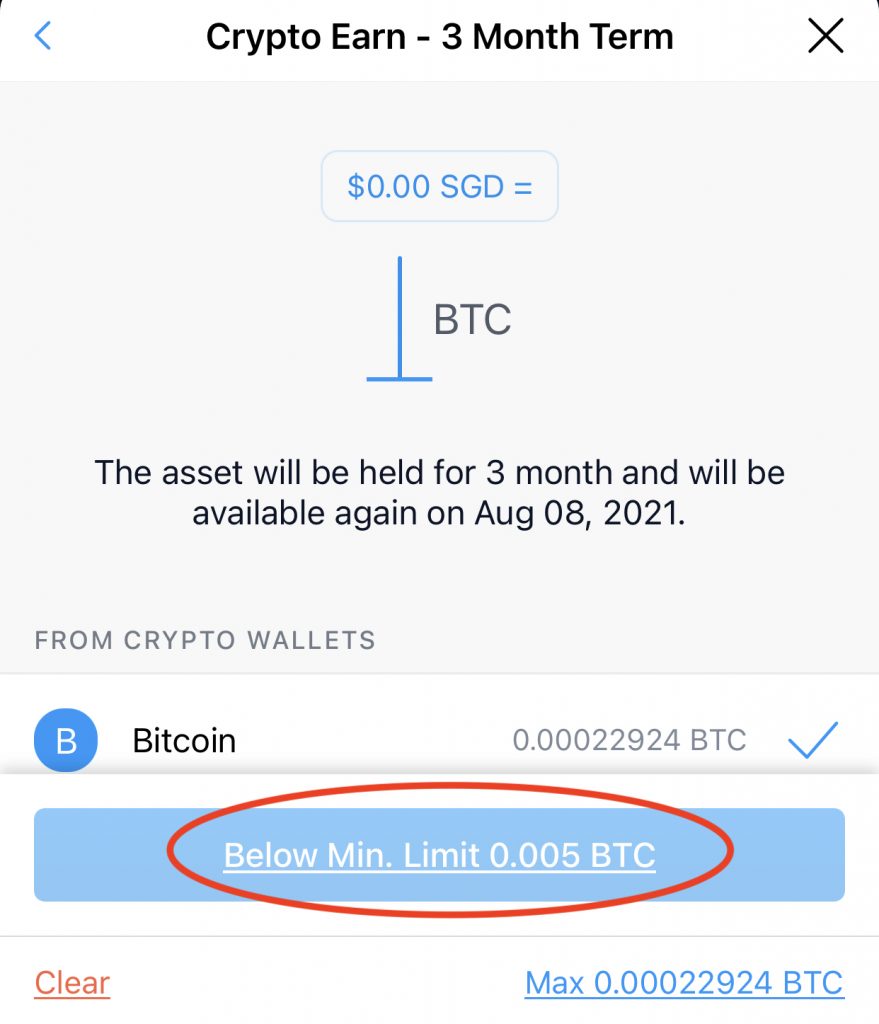

To start using Crypto.com’s Earn, there is a minimum amount you’ll need to have for each currency.

Most of these minimum amounts are at least a few hundred SGD.

If you only have a small amount of crypto, you will not be able to use Crypto Earn!

Lock-in period

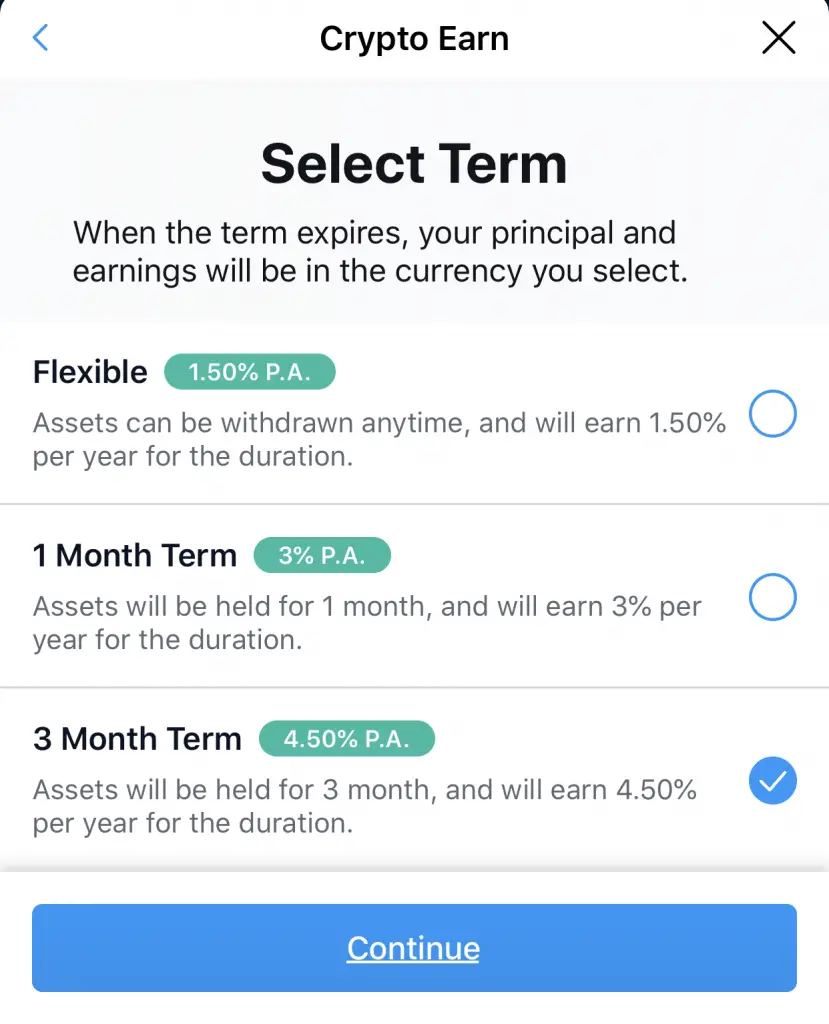

For Crypto.com Earn, you are able to choose between 3 different types of lock-in periods:

- Flexible

- 1 month

- 3 months

The longer you lock up your crypto with Crypto.com, the higher the interest rate you’ll receive.

As such, this may make your funds very inflexible. You should not put in any funds that you intend to sell in the short term!

Withdrawal fees

If you’ve chosen the flexible term, you are able to withdraw your crypto at any time without incurring withdrawal fees.

For the fixed term, you’ll need to wait until the the term has expired before your crypto is credited back into your wallet.

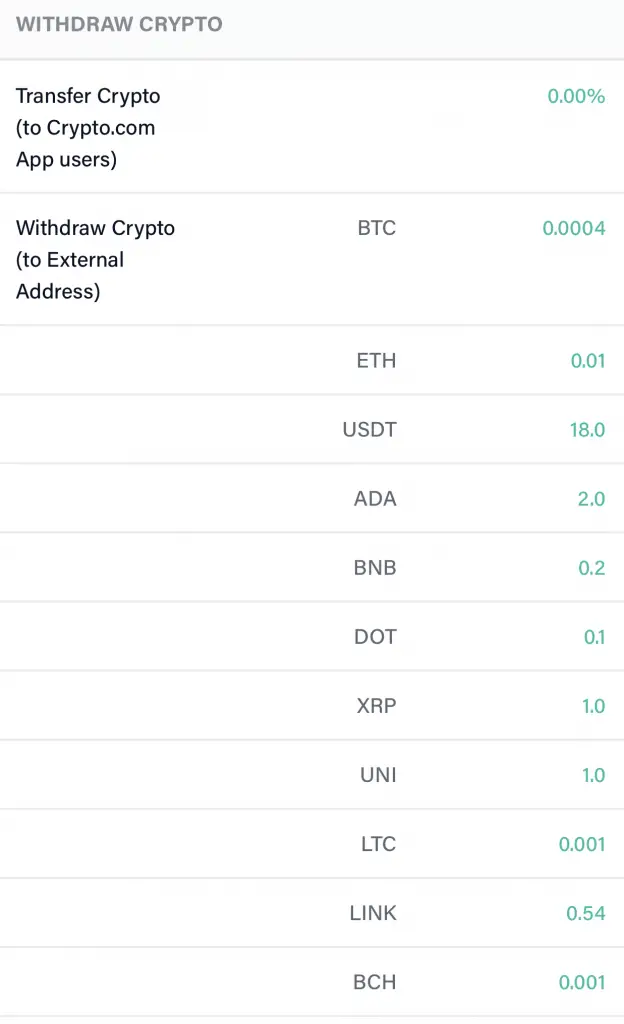

If you want to withdraw your crypto from the Crypto.com App, you may need to pay some withdrawal fees.

The amount you pay depends on the currency you intend to withdraw.

Security

Crypto.com uses Ledger Vault Technology to manage your assets. This allows Crypto.com to securely and efficiently manage your funds.

Crypto.com also holds your assets in cold storage. This means that your assets are stored offline, so that hackers can’t get access to them.

Moreover, the funds that you have with Crypto.com are insured up to USD $360 million!

With such measures in place, Crypto.com is making sure that all of your assets stored with them are secure.

Extra features

The Earn feature is just one of the many functions of the entire Crypto.com ecosystem. Here are some other things you can do on their App and Exchange:

- Visa card with CRO cashback

- Supercharger (Liquidity mining)

- Soft staking

- CRO staking

- Trading and Instant Buying of crypto

There are lots of different features that are available. If you intend to use any of these functions, you can consider buying using the Crypto.com ecosystem.

Verdict

Crypto.com’s Earn is quite inflexible due to the lock-in periods. Furthermore, the interest rates being offered on Crypto.com are lower compared to Celsius or BlockFi.

I would only use Crypto.com Earn if you intend to use the other features on Crypto.com!

Luno Savings Wallet

Luno is based in London and was founded in 2012.

They have expanded to a few countries like UK, Australia and Singapore.

Here is a summary of Luno’s features:

| Number of cryptocurrencies | 3 |

| How interest is earned | In-kind |

| Distribution of rewards | Every month |

| Borrowers of platform | Genesis |

| Minimum amount | None |

| Lock-in period | None |

| Withdrawal fees | None when withdrawing to Luno platform |

| Security | Hot wallet + cold storage |

| Extra features | Exchange platform Instant Buy |

| Verdict | Good if you want to buy and hold BTC from SGD |

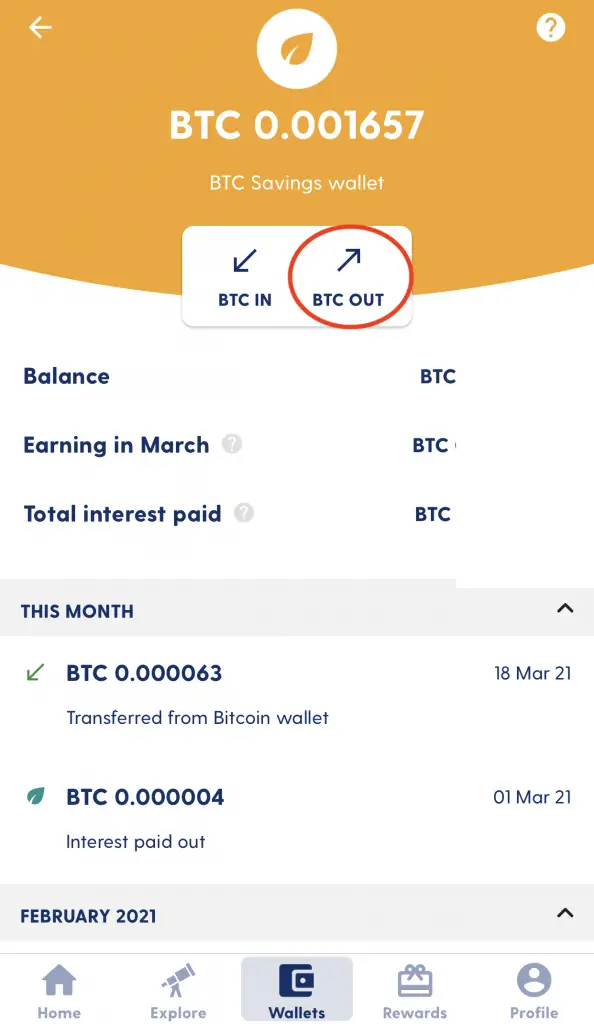

Number of cryptocurrencies

Luno only allows you to earn interest on 3 different currencies:

- BTC

- ETH

- USDC

This is somewhat similar to Cake DeFi’s offering.

How interest is earned

The interest is paid to you in-kind.

If you place BTC in the wallet, you will earn BTC as interest.

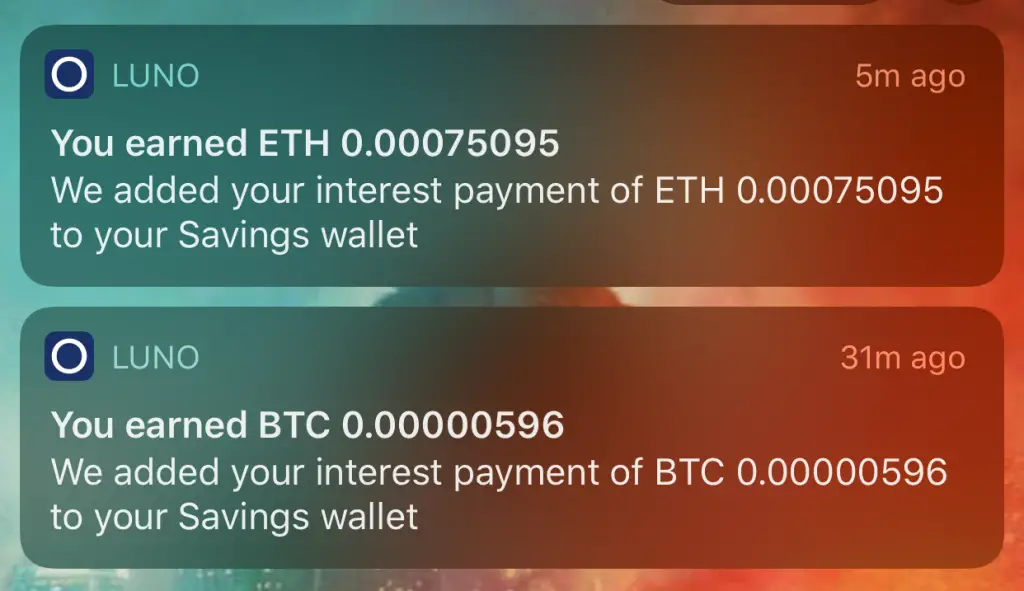

Distribution of rewards

The interest will be accrued daily, but will only be credited into your account at the start of each month.

Borrowers of platform

Luno lends your crypto to Genesis to earn interest on it.

This is similar to Gemini Earn.

Genesis collateralises their loans. This means that a lender on Genesis would need to secure their loan with something of value.

In case the lender defaults, Genesis will take possession of the collateral.

As such, this should discourage the lender from defaulting!

Minimum amount

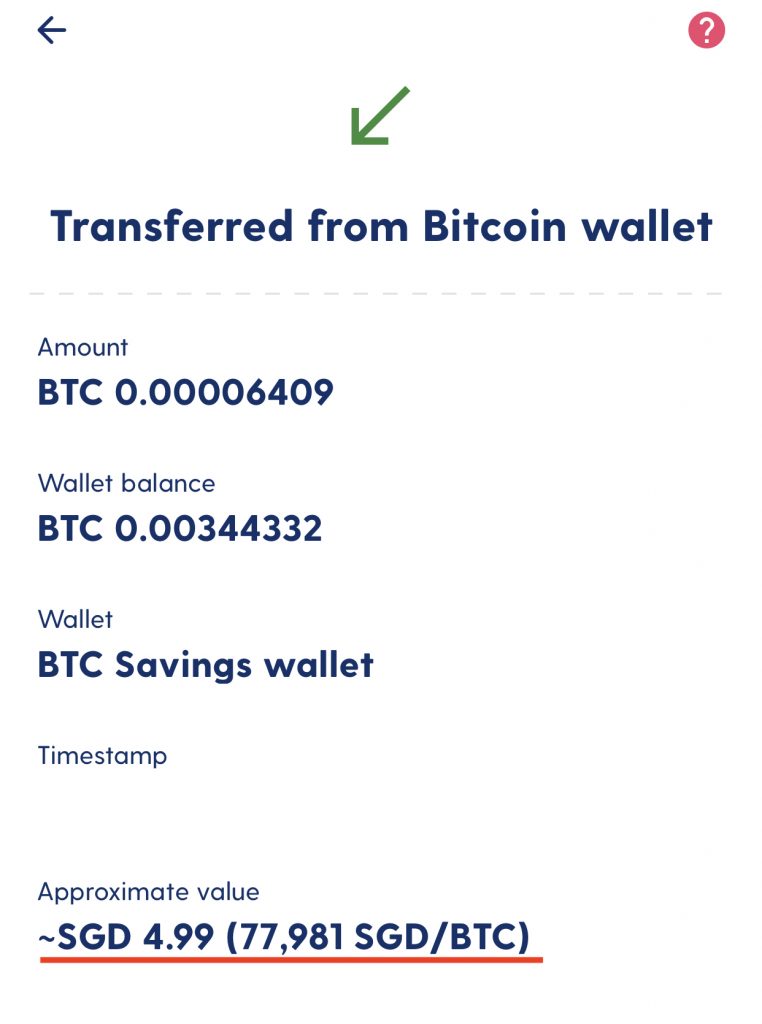

There is no minimum amount for you to start earning an interest on your crypto.

You can transfer amounts as small as $5 SGD worth of BTC into the account!

Lock-in period

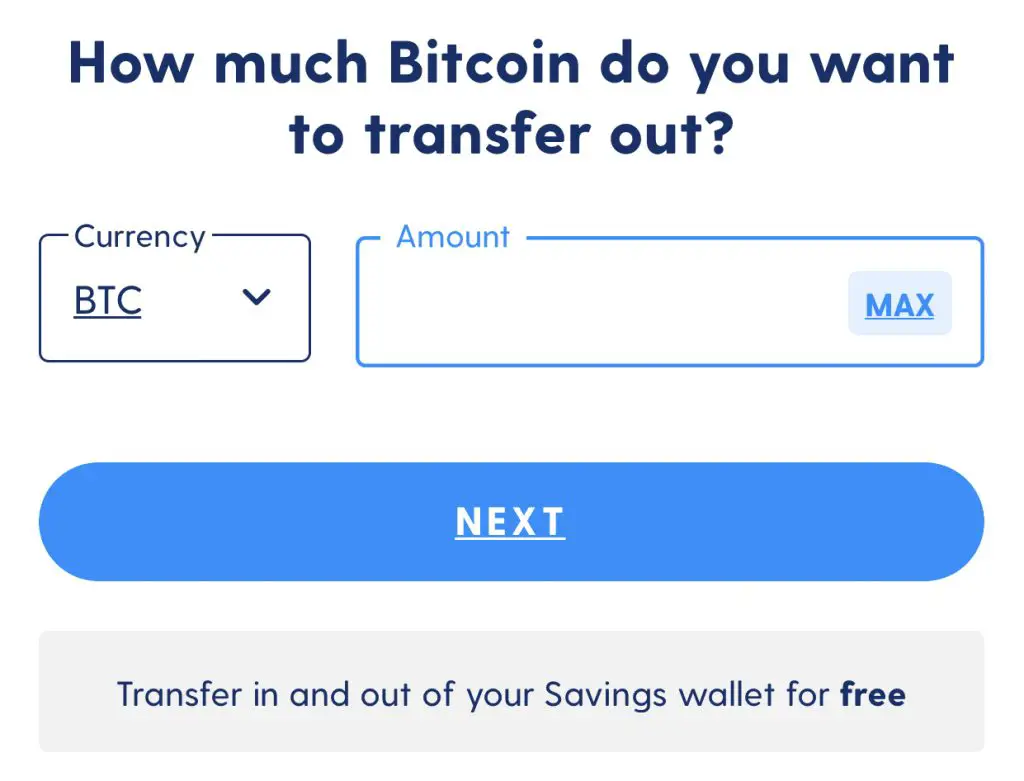

There is no lock-in period, and you are able to freely withdraw your crypto!

All you need to do is to got to ‘BTC Out‘ on the wallet page.

After that, you can select the amount that you wish to withdraw.

Luno claims that your withdrawal should be done in less than a day. However depending on the network, it may take up to 7 days before your funds appear in your crypto wallet.

One good thing is that you’ll be able to continue to earn interest on your crypto while it is being withdrawn!

Withdrawal fees

There are no withdrawal fees being charged whenever you withdraw your crypto from the savings wallet.

If you want to withdraw you crypto from Luno’s platform, you will incur a withdrawal fee.

This fee is dynamic, and depends on the current congestion in the blockchain network.

Security

Luno also uses 2 places to store your crypto:

- Deep freeze storage

- Hot wallet

This approach is quite similar to what Coinhako does. Most of your funds are stored in the cold wallet.

However, some of your funds are in their hot wallet, in case you want to quickly withdraw them.

In the hot wallet, another set of keys are held with BitGo. They are considered to be a secure custodian of your crypto.

Once again, your crypto stored with Luno should be rather secure.

Luno provides 2FA to either your email or mobile phone whenever you login to your account.

Extra features

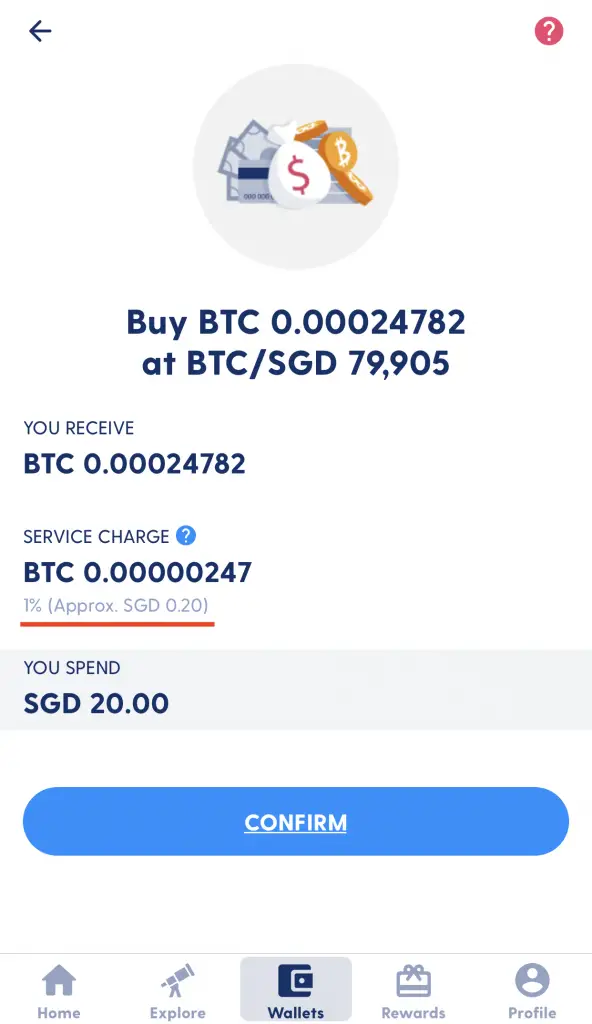

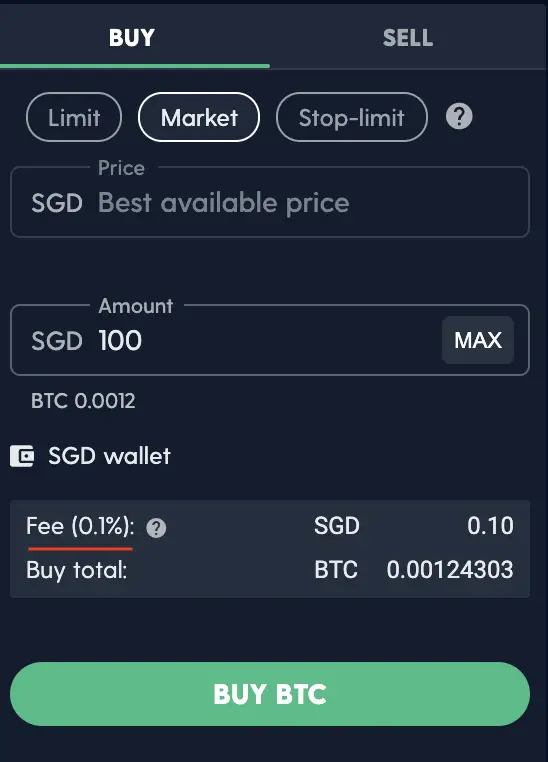

Apart from the savings wallet, you can buy crypto on Luno’s platform.

There are 2 ways you can do so:

- Instant Buy

- Luno Exchange

For the Instant Buy, you will be charged a 1% fee which is rather high!

Luno’s Exchange charges a much lower fee of up to 0.1%.

However, the currencies available on Luno is rather limited. You can only buy 6 currencies, compared to the 30+ in Coinhako or Gemini!

Verdict

Luno provides a very flexible way of earning interest on your crypto.

If you just intend to buy and hold Bitcoin, the you can consider buying from Luno.

This is because you are only charged up to 0.1%, which is much lower compared to other crypto exchanges with SGD support!

If you intend to earn interest on other cryptocurrencies, then Luno may not be that suitable for you.

Nexo

Nexo was founded in 2018 and their headquarters is in London.

Here is a summary of Nexo’s features:

| Number of cryptocurrencies | 17 (crypto) + 3 (fiat) |

| How interest is earned | In-kind NEXO token |

| Distribution of rewards | Daily |

| Borrowers of platform | Institutions (over-collateralised) |

| Minimum amount | Depends on currency |

| Lock-in period | None |

| Withdrawal fees | Depends on currency (no free withdrawals for Base and Silver tiers) |

| Security | Bitgo and Ledger Vault |

| Extra features | Taking loans Exchange to swap tokens |

| Verdict | Secure platform, but withdrawal fees may eat returns |

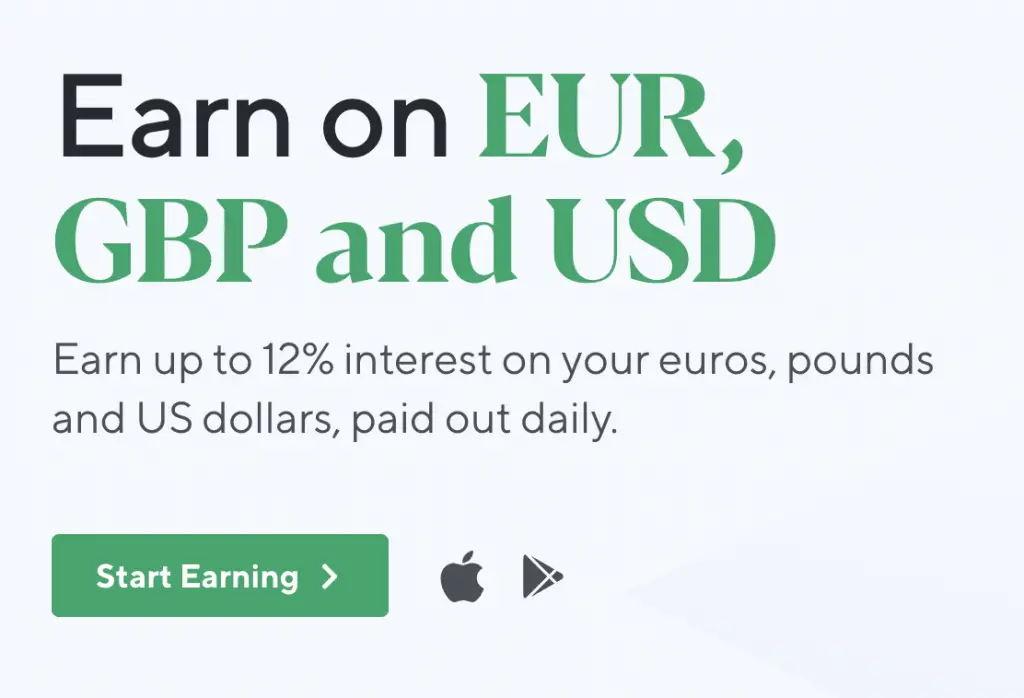

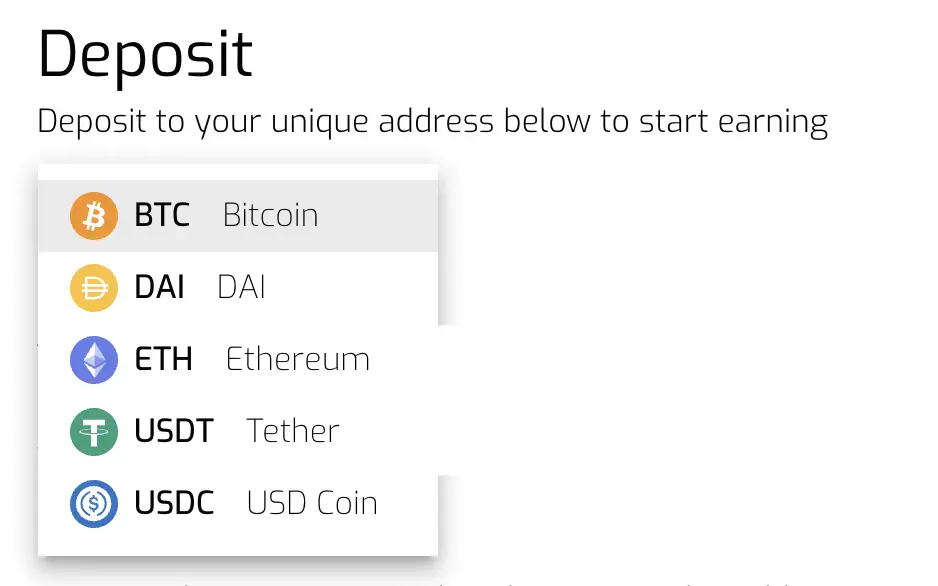

Number of cryptocurrencies

You can earn interest on Nexo with 17 different currencies:

You are able to earn interest on TRX, which may not be found in other platforms.

Apart from crypto, Nexo also allows you to earn interest on your fiat currencies.

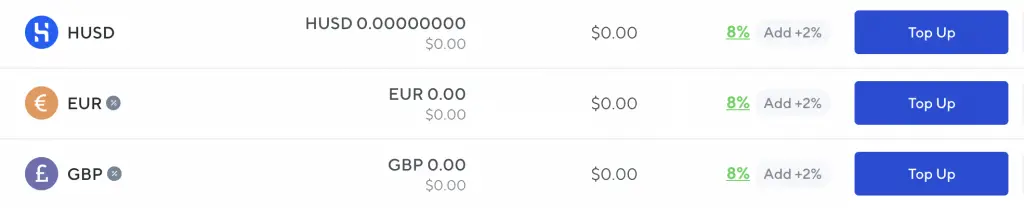

You are able to earn up to 12% APY! However, you would have to earn your interest in the form of NEXO to receive this high interest rate.

If you wish to earn in-kind, you will still get a 10% interest rate. This is still really high!

There are 3 currencies that you can earn from:

- USD

- GBP

- EUR

However, I can’t find the USD option in my account. I only have the option to deposit either GBP or EUR.

How interest is earned

Nexo allow you to earn interest in 2 ways:

- In-Kind (i.e. the token that you’ve deposited)

- Earning in Nexo’s native token (NEXO)

You are able to earn a higher interest rate (additional 2%), if you choose to earn it in NEXO tokens.

Distribution of rewards

For Nexo, your interest is paid out daily. With this daily compounding effect, you are able to receive even higher returns!

However, you will need to hold your assets for at least 24 hours first, before the payout will be issued to you.

Borrowers of platform

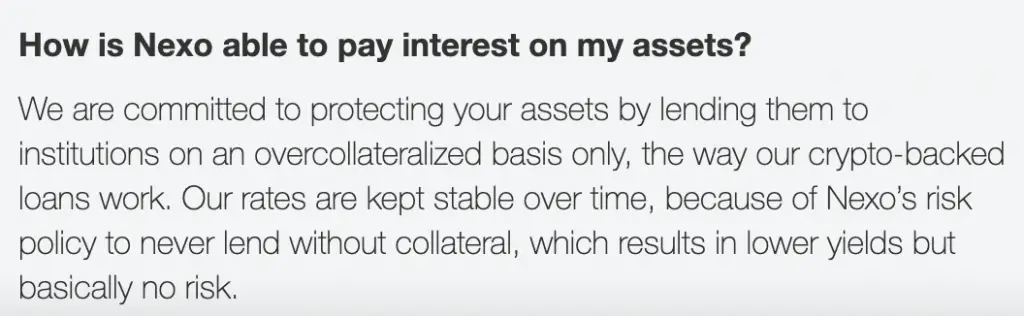

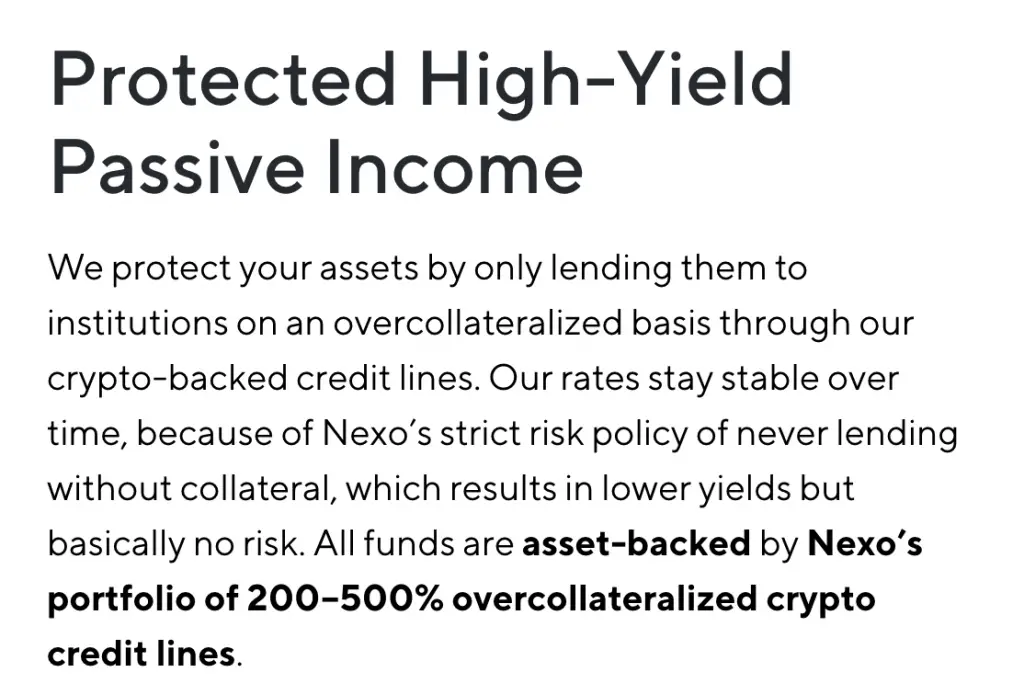

Nexo loans out your crypto to institutions on an over-collaterised basis.

With this over-collaterisation, it helps to lower the risk of the borrower defaulting. As such, your loans may be more secure.

Minimum amount

However, for Nexo, you are required to have a minimum deposit to start earning the high interest rates:

| Currency | Minimum Deposit |

|---|---|

| BTC | 0.001 |

| ETH | 0.01 |

| XRP | 5.00 |

| BCH, LTC | 0.01 |

| EOS | 0.50 |

| XLM | 20 |

| LINK | 0.3 |

| TRX | 150 |

| PAXG | 0.001 |

| BNB | 0.05 |

| Stablecoins | 1 |

The minimum amounts are not too high, but it may affect how much you need to transfer to your account!

Lock-in period

Nexo does not have any lock-in periods. This means that you are able to freely withdraw your crypto any time you wish!

Withdrawal fees

Nexo charges fees for withdrawals that you make. The number of free withdrawals each month depends on your loyalty tier.

| Tier | Number of Free Withdrawals |

|---|---|

| Base and Silver | No free withdrawals |

| Gold | 1 free withdrawal |

| Platinum | 3 free withdrawals |

The withdrawal fee that you are charged depends on the gas fees that are being charged by the network!

If you make a fiat withdrawal to your bank account, this will be free of charge!

You can use Nexo’s Exchange to convert your crypto to a fiat currency.

Security

Nexo has partnered with BitGo and Ledger Vault as their security partners.

BitGo is the main custodian of your crypto assets, and has a pretty strong track record.

Nexo also has $375 million worth of assets being insured by both partners!

Moreover, Nexo only loans your assets to credit lines that are overcollateralised between 200-500%.

This should help to reduce the risk of the institution defaulting from the loan!

Extra features

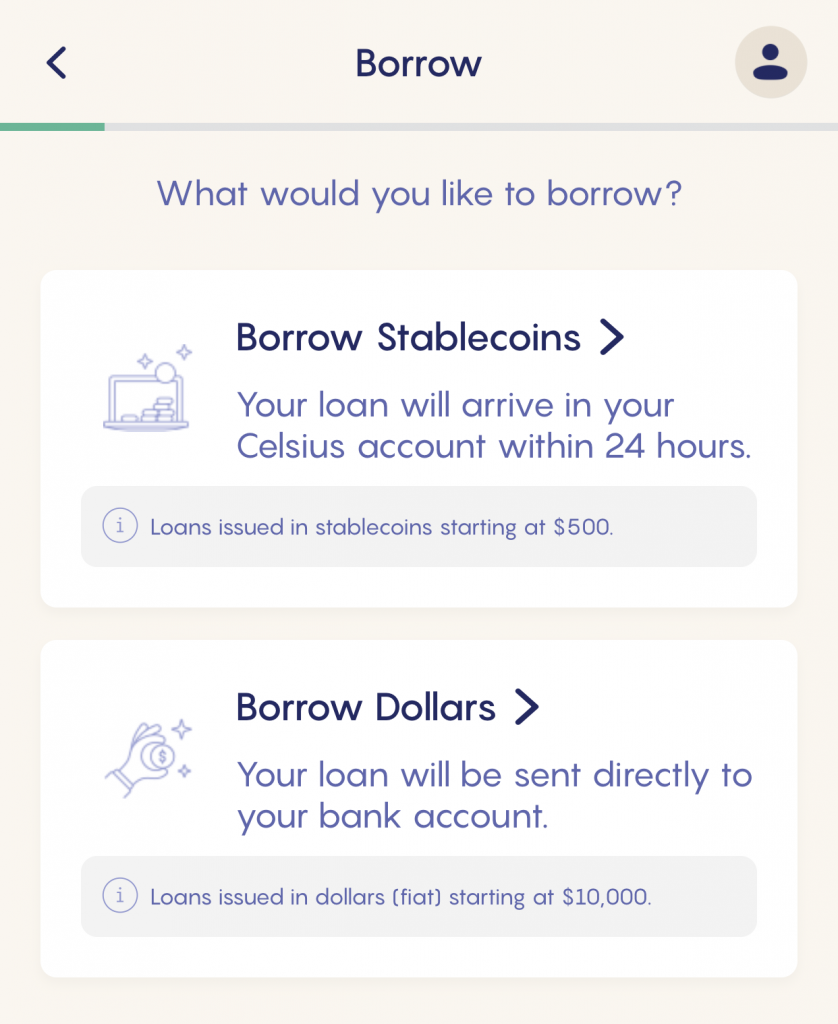

Nexo allows you to take loans while using your crypto as collateral.

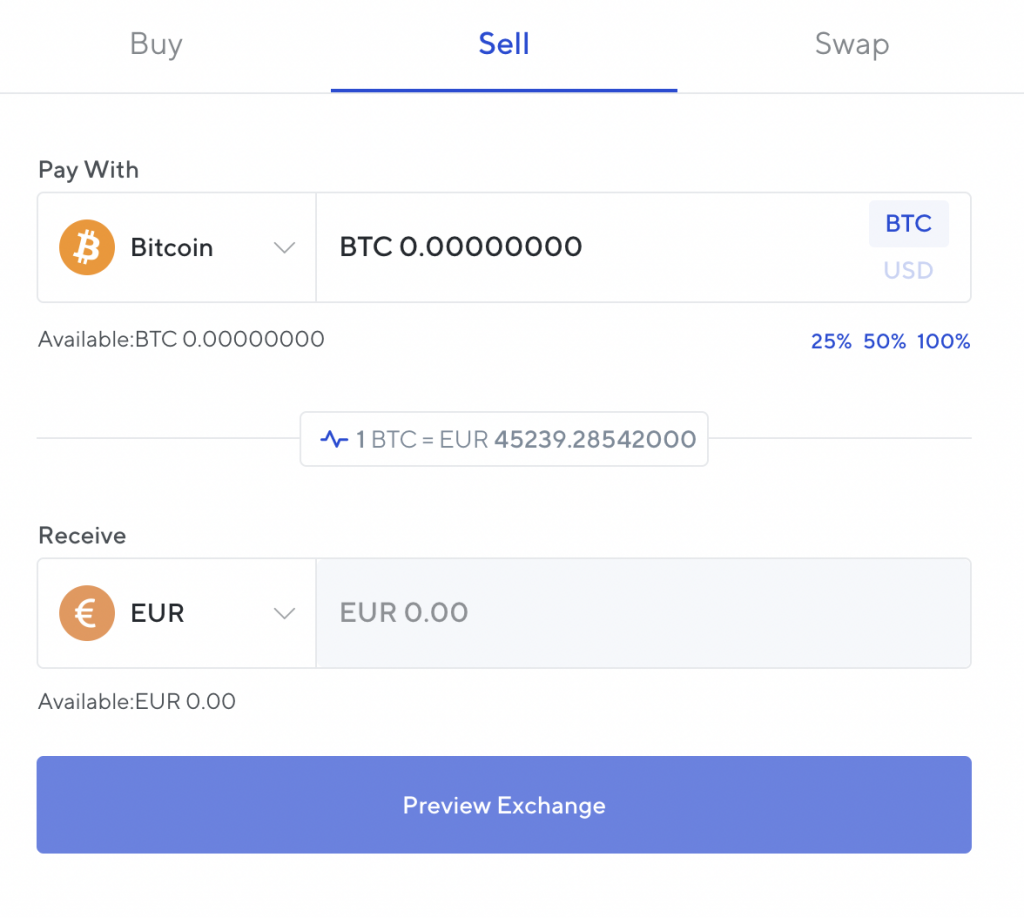

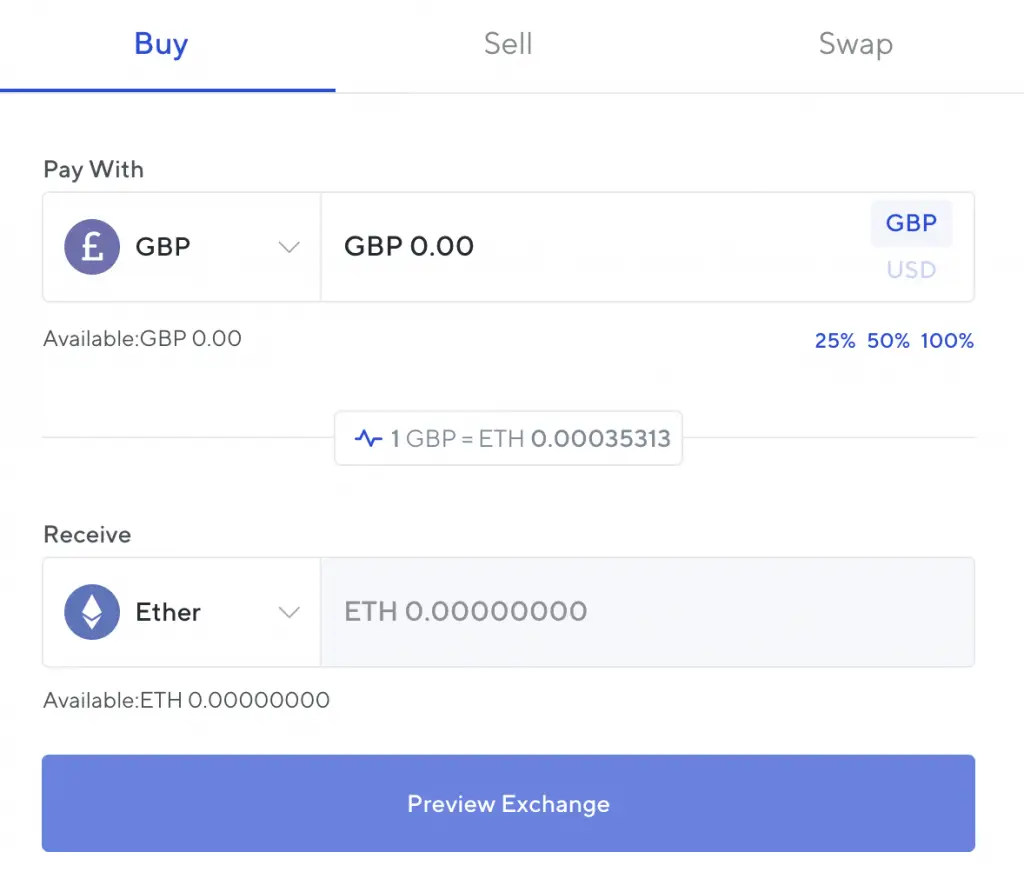

Furthermore, you can use the Nexo Exchange to buy, sell or swap your funds.

You can buy or sell your crypto with fiat, or swap between different cryptocurrencies.

Verdict

Nexo provides a rather stable platform to earn interest on your crypto.

Their security looks top-notch, and they seem to be a very credible company.

However, Nexo charges a withdrawal fee when you want to withdraw crypto out of their platform.

You can try swapping your crypto for a fiat currency to reduce the fees. However, you won’t be able to swap your crypto for SGD!

Hodlnaut

Hodlnaut was started by 2 entrepreneurs from Singapore in 2019 to allow investors to earn interest on their crypto.

Here is a summary of Hodlnaut’s features:

| Number of cryptocurrencies | 5 |

| How interest is earned | In-kind |

| Distribution of rewards | Weekly |

| Borrowers of platform | Institutions |

| Minimum amount | None |

| Lock-in period | None |

| Withdrawal fees | Depends on currency |

| Security | Bitgo |

| Extra features | Swap |

| Verdict | Secure platform, but limited number of currencies |

Number of cryptocurrencies

Hodlnaut’s offerings are quite limited as you can only deposit 5 coins into the platform.

These are the 5 currencies you can use:

How interest is earned

You interest will be provided in the same currency that you’ve loaned out.

Distribution of rewards

For Hodlnaut, the interest is accrued at the end of every day. However, it will only be credited into your account every Monday.

As such, your interest will be accrued weekly.

Borrowers of platform

Hodlnaut lends your crypto to “established and vetted financial institutions” that are willing to pay a high interest rate.

Minimum amount

Hodlnaut does not have any minimum deposits required.

I was able to start earning interest on the small amounts that I have with Hodlnaut!

Lock-in period

Hodlnaut does not have any lock-in periods. This means that you are able to freely withdraw your crypto any time you wish!

Withdrawal fees

Hodlnaut charges you withdrawal fees, based on the crypto that you wish to withdraw:

| Currency | Fee |

|---|---|

| BTC | 0.0005 BTC |

| DAI | 3 DAI |

| ETH | 0.005 ETH |

| USDT | 3 USDT |

| USDC | 3 USDC |

The BTC withdrawal fee is quite high! This is something you may want to consider when you are swapping exchanges.

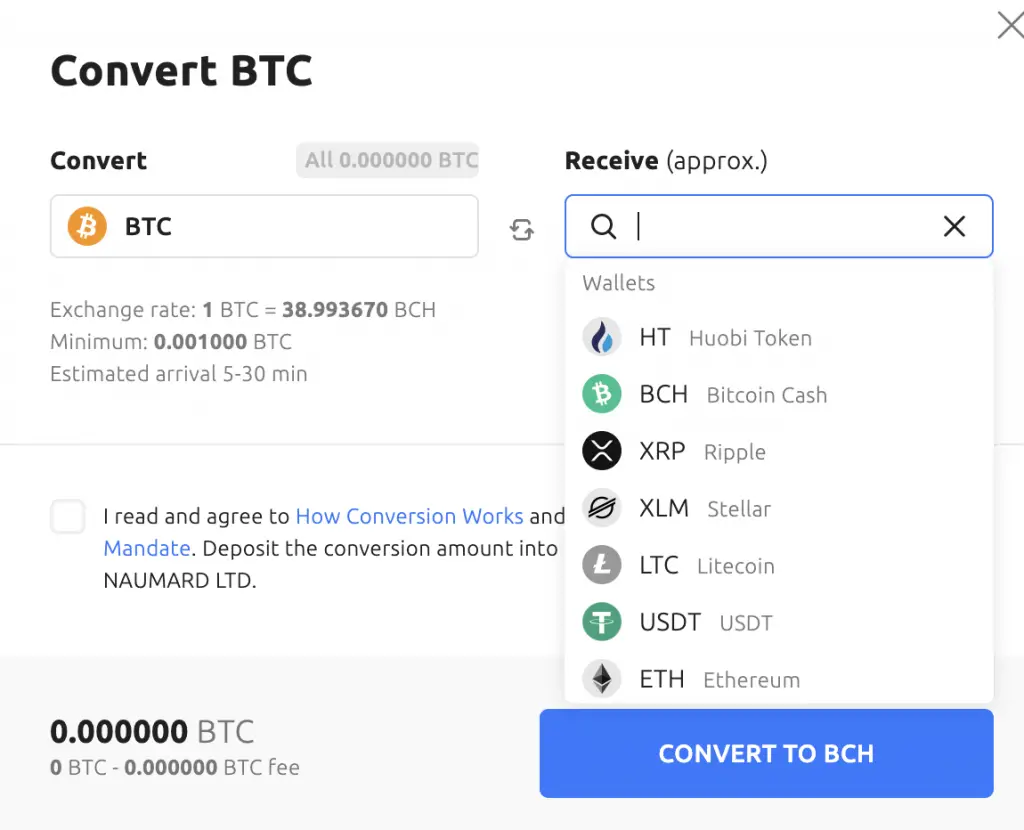

You may want to consider swapping your BTC to one of the stablecoins (USDT, DAI or USDC) to lower your withdrawal fees.

Security

Hodlnaut stores your assets in a BitGo wallet when you deposit your funds to them.

Moreover, Hodlnaut does not have any hot wallets. This means that their crypto wallets are not connected to the internet.

This reduces the chances of your accounts being hacked!

Hodlnaut does not have any third-part insurance to cover for any losses. However, they stated that they have set aside some of their profits to cover any losses due to hacks.

Extra features

In contrast, Hodlnaut does not offer loans if you’re an individual investor.

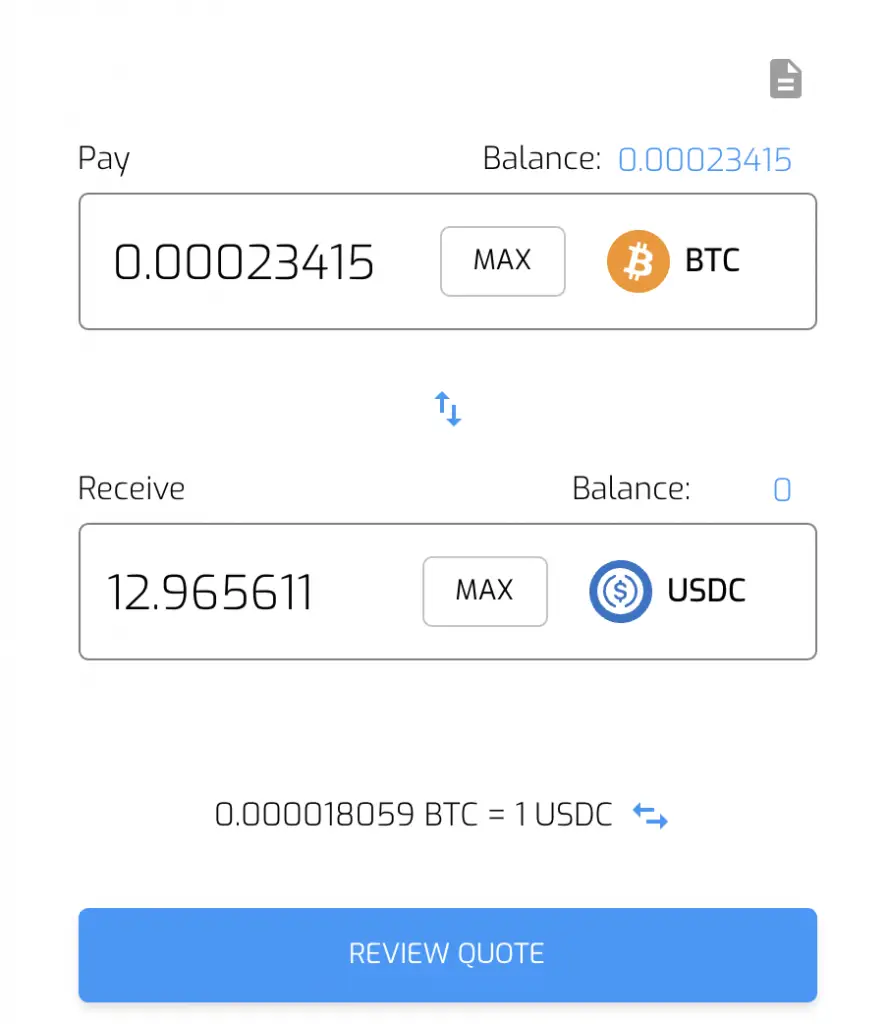

However, they offer a swap feature that lets you convert your crypto to any of the other 4 currencies.

This can be quite convenient if you want to swap your BTC / ETH to a stablecoin and earn a higher yield!

Verdict

Hodlnaut offers a fuss-free way to earn interest on your crypto. However, the number of currencies on their platform are rather limited.

The withdrawal fee is rather high for BTC and ETH too!

Nevertheless, it is still a solid platform that you can consider.

YouHodler

YouHodler is a Swiss company that has headquarters in both Switzerland and Cyprus.

Here is a summary of their services:

| Number of cryptocurrencies | 18 (crypto) + 7 (stablecoin) |

| How interest is earned | In-kind |

| Distribution of rewards | Weekly |

| Borrowers of platform | Undisclosed |

| Lock-in period | None |

| Withdrawal fees | Depends on currency (fixed for some e.g. XRP and LINK) |

| Security | Ledger Vault |

| Extra features | Crypto exchange Multi HODL Loans Turbocharge |

| Verdict | High interest rates for stablecoins |

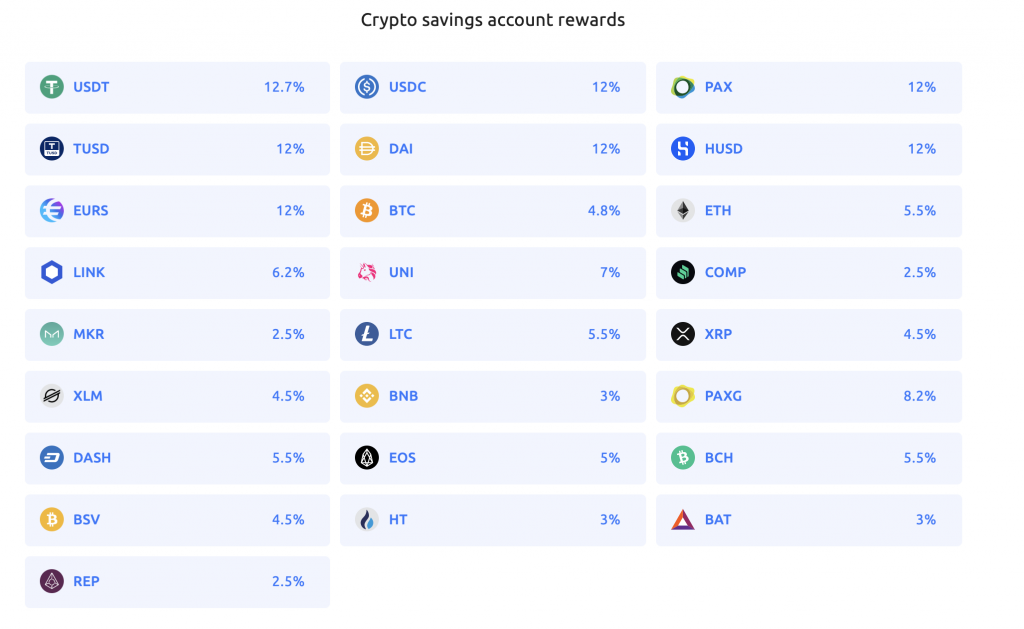

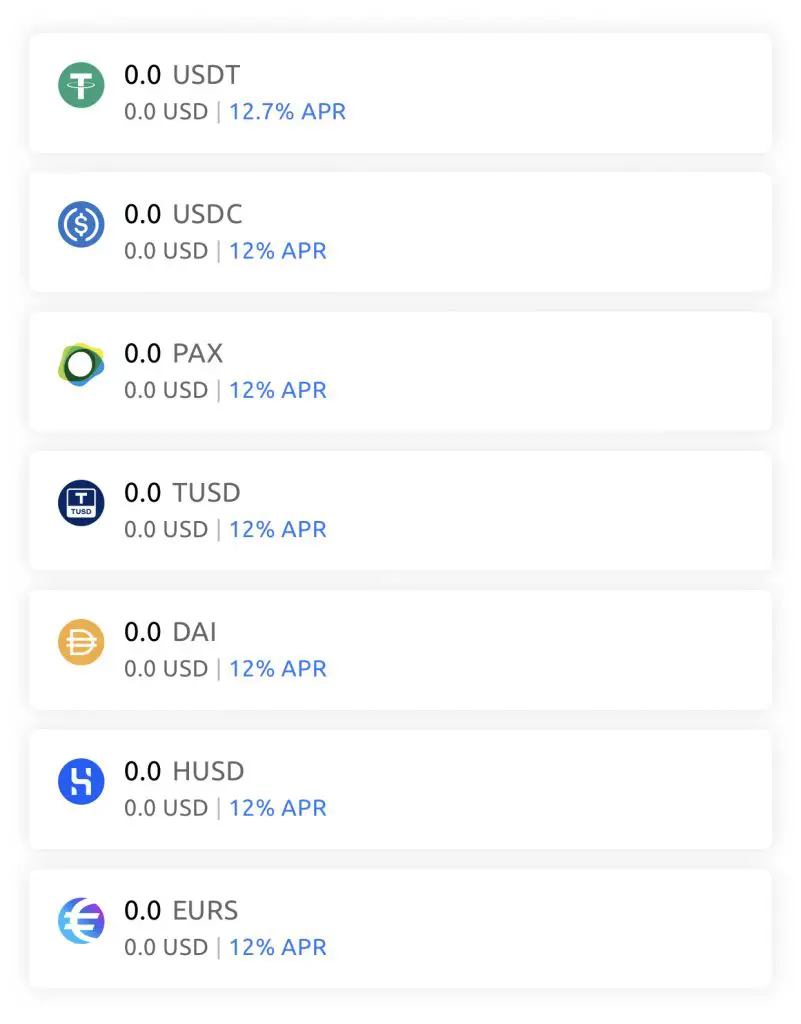

Number of cryptocurrencies

YouHodler allows you to earn interest on 18 different cryptocurrencies.

Some of these currencies include:

- COMP

- EOS

- BAT

You are also able to earn interest on 7 different stablecoins, including:

- USDT

- USDC

- DAI

- HUSD

- EURS

How interest is earned

Your interest will be earned in-kind, which is the same as the currency that you’ve loan out.

Distribution of rewards

The interest that you earn will be paid to you weekly.

This is similar to Celsius and it will help to compound your returns faster!

Borrowers of platform

YouHodler does not disclose who they are lending your funds to.

However, they did state on their website that they are legally obligated to return your crypto assets.

This is in accordance with EU laws.

Even if your borrowers may default, YouHodler would still need to return your crypto assets to you.

This may give you some reassurance, but I would be wary with depositing large sums into this platform.

Lock-in period

YouHodler does not lock in your crypto, and you are able to withdraw them at any time.

This makes it rather flexible, which is similar to the other lending platforms.

Withdrawal fees

You will be charged a withdrawal fee if you decide to withdraw your crypto.

Some of the currencies like XRP or LINK have a fixed withdrawal fee.

For the remaining currencies, you will be charged based on the prevailing network fee. This may be quite high, if there is strong demand for that network!

Due to these fees, you may not want to withdraw only small amounts each time.

Security

YouHodler uses Ledger Vault’s technology to provide custody to your funds with them.

Ledger’s technology is rather secure and helps to ensure that your funds will be kept safe!

With this technology being implemented, you should be reassured that your funds will not be easily stolen.

Extra features

YouHodler also offers different services, such as:

- Exchanging crypto

- Multi HODL

- Loans

- Turbocharge

You can use YouHodler to exchange your crypto for another currency.

You may be charged an exchange fee for this conversion too!

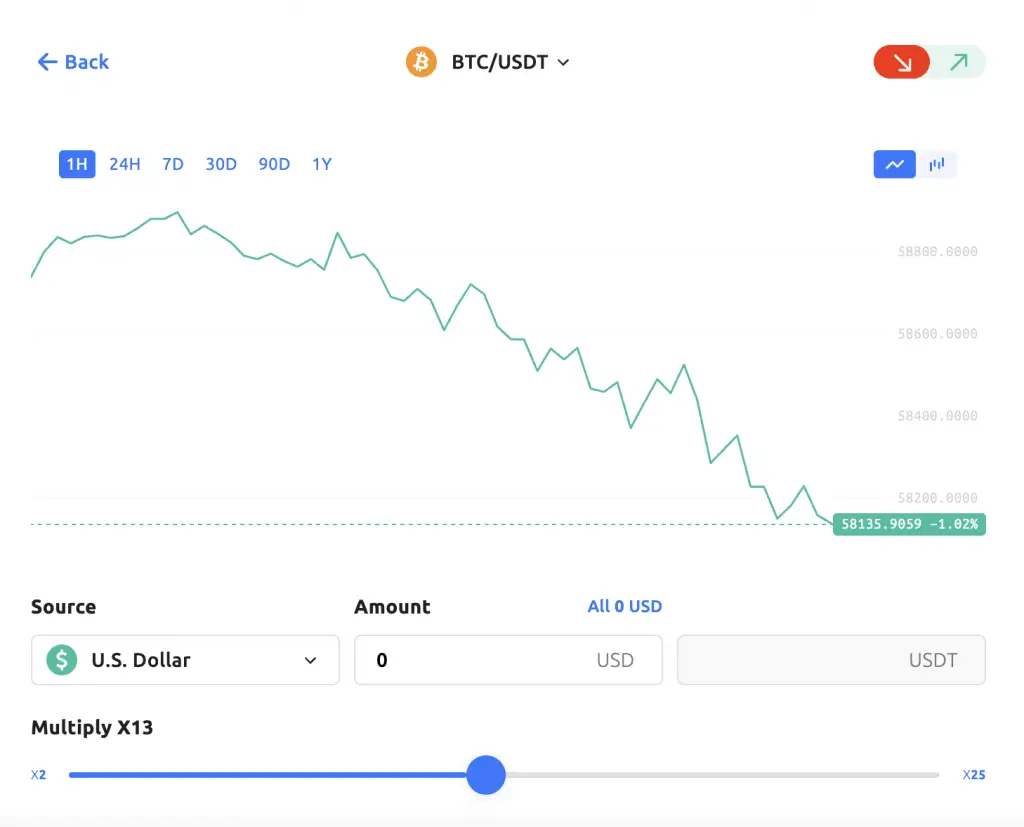

Multi HODL allows you to trade contract-for-differences (CFDs) on the crypto that you choose.

The main aim for Multi HODL is to take advantage of market volatility to increase your returns.

However, I am still unsure how this exactly works!

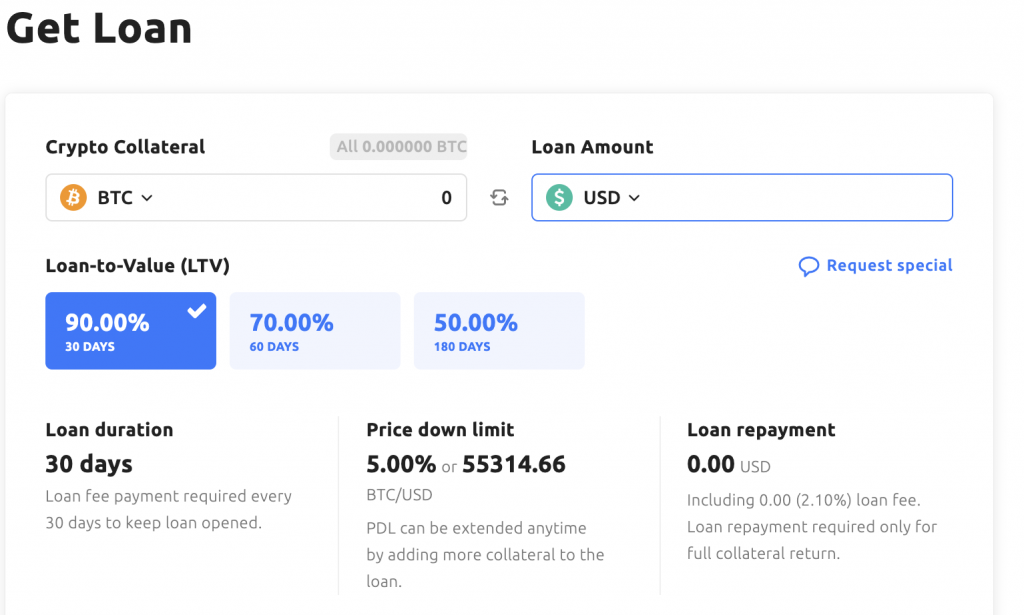

You are also able to loan USD / EUR with your crypto as collateral,

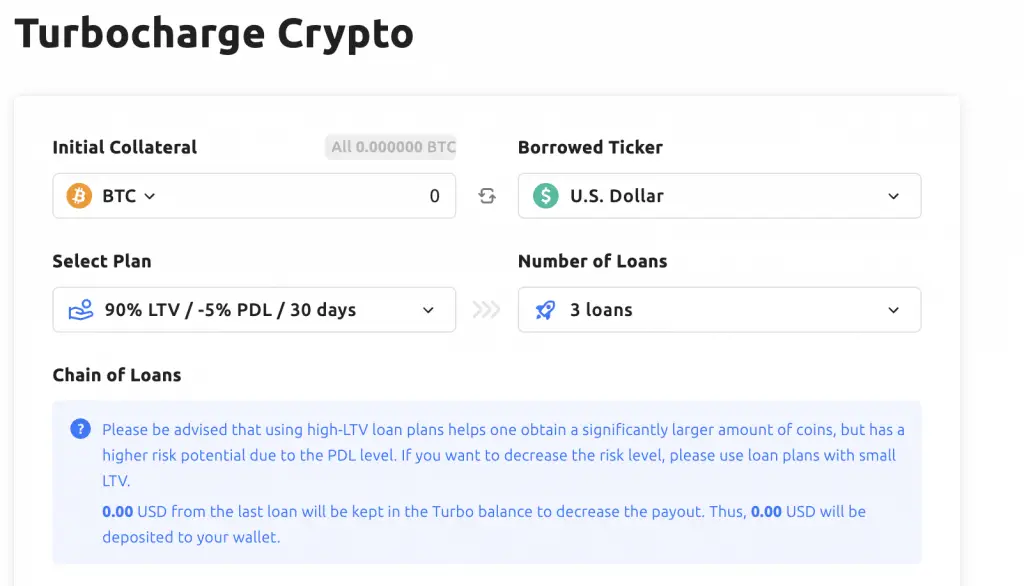

and even use the Turbocharge function to buy crypto with borrowed funds.

These features can be really complicated, and you should only use it if you can understand how they work!

Verdict

YouHodler allows you to earn interest on currencies like REP, DASH and COMP.

The interest rates on stablecoins is one of the highest compared to the other platforms (currently at 12.7%).

However, YouHodler charges you withdrawal fees, which may eat into your returns!

Binance

Binance is one of the largest crypto trading platforms in the world.

They provide an extensive number of services on their platform, and lending out your crypto is one of them.

Here is a summary of Binance’s Savings Wallet:

| Number of cryptocurrencies | Up to 58 |

| How interest is earned | In-kind |

| Distribution of rewards | Daily |

| Borrowers of platform | Margin traders on Binance |

| Lock-in period | None |

| Withdrawal fees | None |

| Security | AI-based measures |

| Extra features | Staking P2P Trading Trading Derivatives Liquid Swap |

| Verdict | Good for earning some interest on your idle funds while waiting for trades |

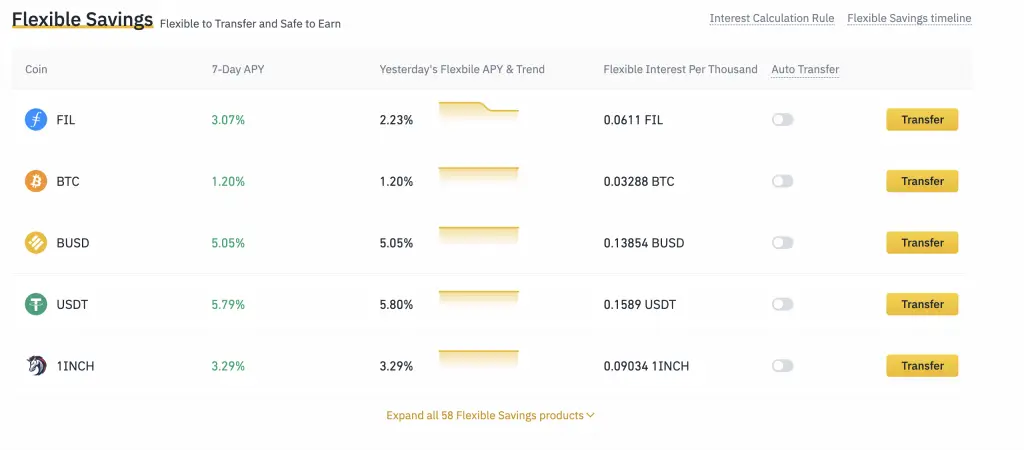

Number of cryptocurrencies

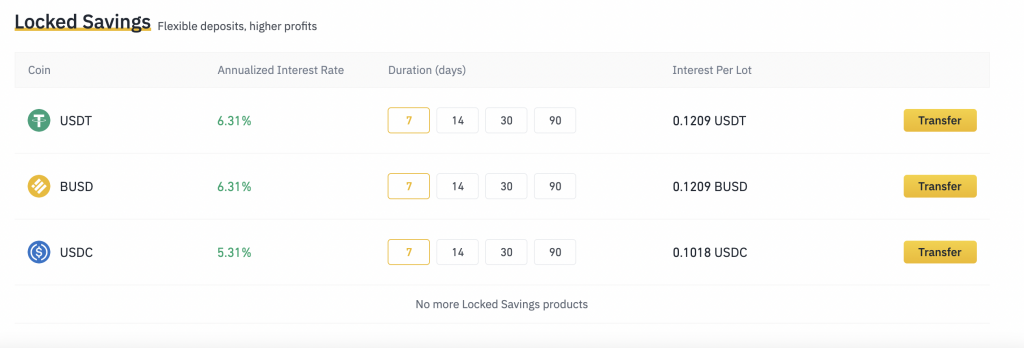

Binance has 2 different types of savings programmes:

- Flexible savings

- Locked savings

There are more currencies available in the flexible savings, compared to locked savings.

You can earn interest on up to 58 different currencies with the flexible savings,

while there are limited options if you want to use the locked savings.

The interest rates will be higher for the locked savings compared to the flexible ones.

How interest is earned

The interest will be earned in the same currency as the one that you’ve placed into the Binance Savings wallet.

Distribution of rewards

The interest will be credited to your account daily. However, you’ll need to redeem your funds from Binance Earn before you can receive both your initial capital and the interest.

The rates that you see on Binance Earn are the average interest rates for the past 7 days. This will help you to give a gauge of the interest rates you’ll receive.

However, the interest rates may change everyday. You may receive a higher or lower interest rate than the one currently being advertised!

Borrowers of platform

When you lend your funds with Binance Savings, you are actually lending it out to margin traders on the platform.

As such, your funds would be quite safe as they are still within the Binance platform.

There is quite a low risk that your funds will be lost!

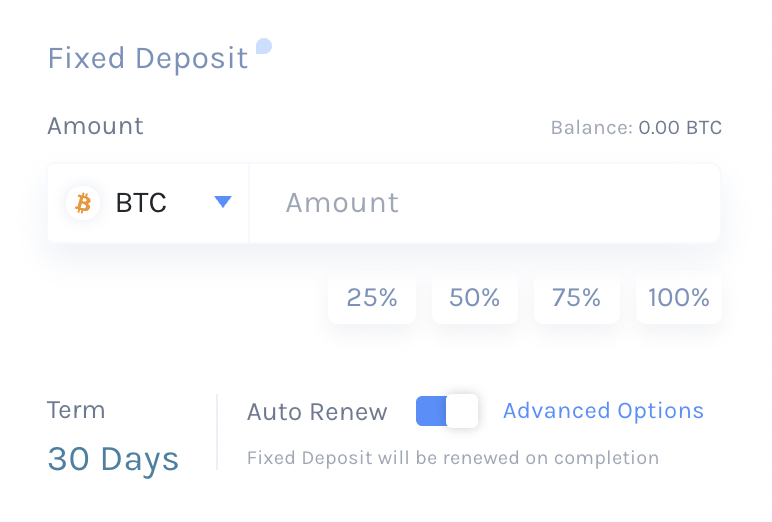

Lock-in period

Binance Flexible Savings does not have any lock-in period, and you can withdraw your funds at any time.

If you choose Locked Savings instead, then your funds will be locked up for a certain period of time (between 7-90 days).

Withdrawal fees

Binance does not charge you any withdrawal fees when you decide to withdraw your funds out of the Savings Wallet.

Security

Binance listed down some security measures that they have, most which involve artificial intelligence.

Due to the sheer number of transactions that they have on their platform, the AI will help to monitor for any unusual activity.

However, Binance has been hacked before in 2019. Over $40 million worth of assets were stolen from the exchange!

Although the security measures have definitely been ramped up, there is still a risk that the platform can be hacked again.

As such, you may want to consider only placing a small amount in Binance, instead of your entire crypto portfolio!

Extra features

Apart from lending out your crypto, there are many things that you can do on Binance’s platform:

- Staking

- P2P trading

- Trading

- Derivatives

- Liquid Swap

These features are really useful if you want to earn more with your crypto.

Moreover, you can place your funds in the Savings Wallet when you transfer between these services!

Verdict

The main aim of Binance Earn is to help you to earn interest on your idle funds while waiting to trade them.

As such, the interest rates that you can earn are much lower compared to the other lending platforms.

Binance Earn would only be suitable for you if you are a frequent trader on Binance’s platform.

While you are waiting to make your trades, you still can earn some interest on your idle funds!

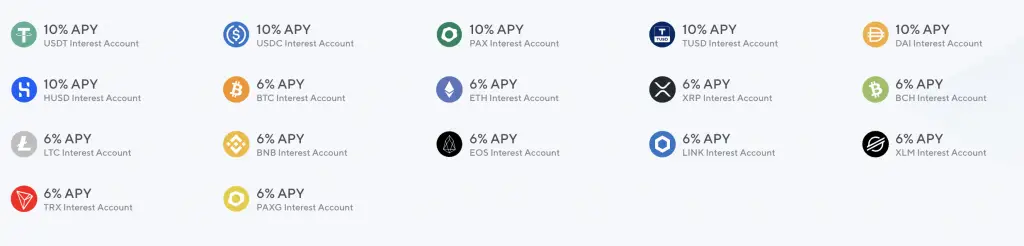

Vauld

Vauld was founded in 2018 and it has its headquarters in Singapore.

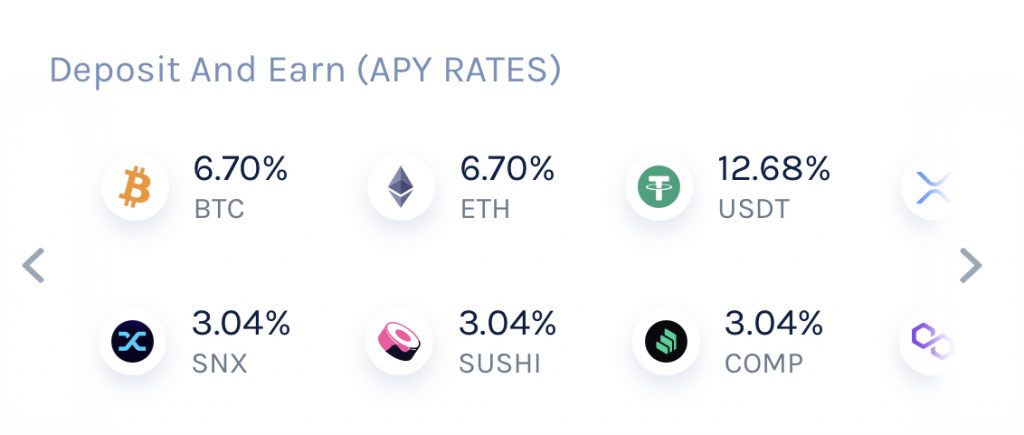

Here is a summary of Vauld’s features:

| Number of cryptocurrencies | 30 |

| How interest is earned | In-kind |

| Distribution of rewards | Every 30 days |

| Borrowers of platform | Approved borrowers (over-collateralised) |

| Minimum amount | None |

| Lock-in period | None |

| Withdrawal fees | Dynamic |

| Security | BitGo as custody partner |

| Extra features | Instant Swap Trading Platform |

| Verdict | High number of currencies, but withdrawal fees are dynamic |

Number of cryptocurrencies

Vauld allows you to earn interest on 30 different currencies.

You are able to earn interest on currencies like:

- SUSHI

- COMP

- ENJ

- MANA

- 1INCH

There are quite a few currencies that you can earn interest only on Vauld!

How interest is earned

The interest you earn will be credited to you in-kind, depending on the currency that you choose.

Distribution of rewards

When you are borrowing crypto with Vauld, they will be locked up in a fixed deposit for 30 days.

When the 30 day term expires, you will be able to earn the interest that you have accrued.

The process will be the same for any currency that you choose to loan out.

Borrowers of platform

When you deposit your funds into Vauld, it will be transferred into a centralised pool.

Your funds will be lent out to borrowers that have been previously approved by Vauld.

While Vauld does not disclose who their partners are, they state that they will over-collaterise your loan by at least 150%.

This will help to lower the risk of your borrowers from defaulting.

Minimum amount

There is no minimum amount required to start loaning out your crypto on Vauld.

As such, you are able to start earning interest with whatever funds that you have!

Lock-in period

Vauld loans out your funds to their borrowers, and expects them to pay them back within 30 days.

However, there are no fees or penalties that you’ll need to pay if you decide to opt out of a fixed deposit before the end of 30 days.

You’ll still be able to receive interest based on the duration that you’ve had the fixed deposit!

As such, Vauld is still quite a flexible option that you can choose.

Withdrawal fees

The withdrawal fees for Vauld are dynamic. This depends on how congested the network is when you decide to withdraw your funds.

As such, there is a risk that the fees you pay can be quite high when you decide to withdraw your funds!

Security

Vauld uses BitGo as their custody partner. BitGo is one of the leading custodians for digital assets.

As such, your funds should be rather safe with Vauld!

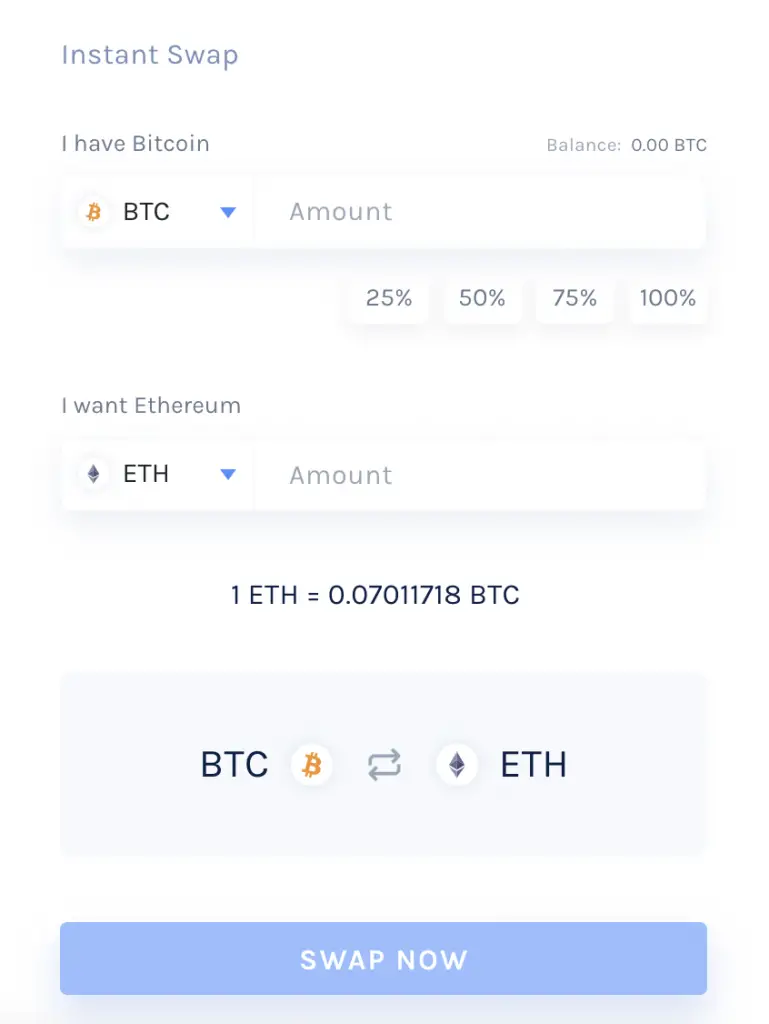

Extra features

Apart from lending out your crypto, you are able to swap your crypto to another currency,

as well as trade them on Vauld’s Exchange.

Vauld charges you very competitive fees of 0.05%!

Verdict

Vauld provides a worthy option for you to lend your crypto with them.

The main issue I have with Vauld is the dynamic withdrawal fees. This may eat up quite a bit of your returns, especially if you’re withdrawing a small sum each time!

Liquid Earn

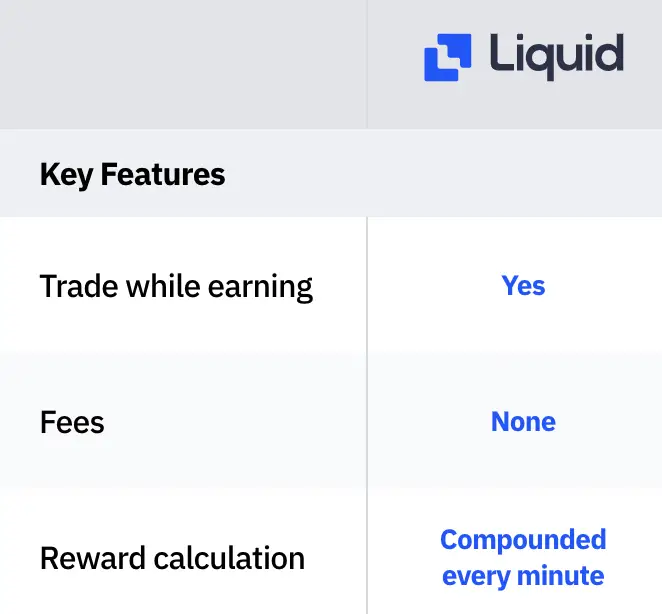

Liquid is a crypto exchange that is based in Japan. It was founded in 2014, and has offices in Japan, Singapore and Vietnam.

They recently launched their Earn program, which is similar to other platforms.

Here is a summary of Liquid’s features:

| Number of cryptocurrencies | 13 |

| How interest is earned | In-kind |

| Distribution of rewards | Compounded every minute |

| Borrowers of platform | Uses Celsius’ partners |

| Minimum amount | None |

| Lock-in period | None |

| Withdrawal fees | None when withdrawing to Liquid Withdrawal out of Liquid depends on currency |

| Security | Hot wallet + cold storage |

| Extra features | Trading Platform Buy/Swap |

| Verdict | Currencies are limited and interest rates aren’t that attractive |

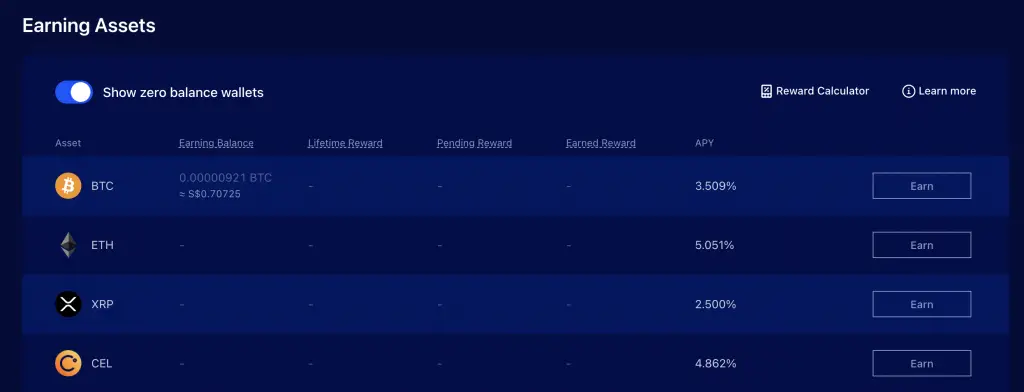

Number of cryptocurrencies

Liquid allows you to earn interest on 13 different cryptocurrencies.

This includes:

- SNX

- UNI

- XLM

- CEL

- XRP

How interest is earned

The interest is earned in-kind on your crypto. This is similar to most platforms apart from Celsius or Nexo.

Distribution of rewards

What is unique about Liquid is that your returns are compounded every minute!

This definitely helps to ensure that you maximise the returns that you are receiving.

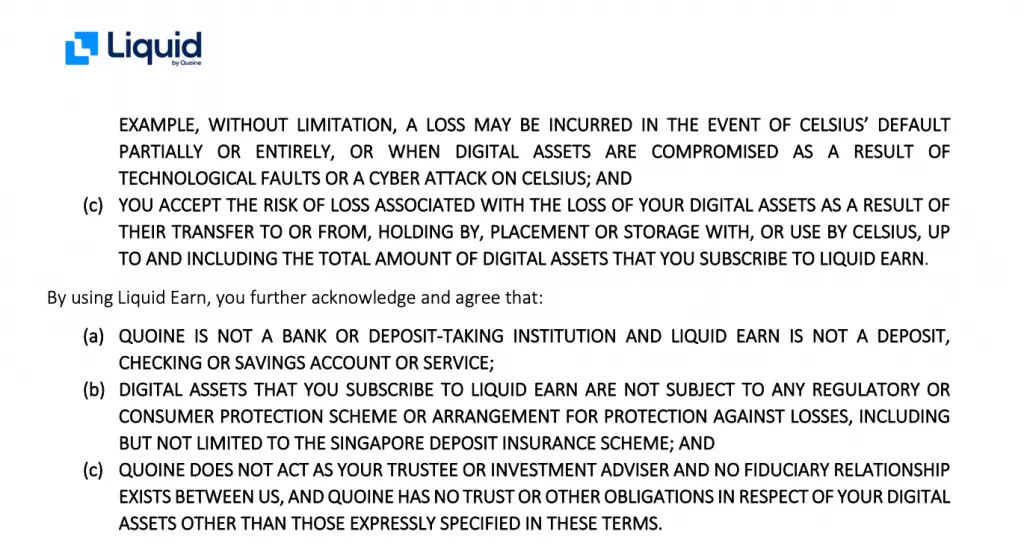

Borrowers of platform

Liquid actually uses the lending services that are being provided by Celsius.

However, if your funds are lost, Liquid will not take any responsibility.

This can be seen in Liquid’s Terms of Service.

You’ll need to fully understand these risks before you start lending out your crypto!

Minimum amount

Liquid Earn does not have any minimum amount to start earning on their platform.

I was even able to deposit $0.70 worth of BTC!

This makes Liquid Earn accessible, even if you only have a small amount of crypto.

Lock-in period

Liquid Earn does not have any lock-in periods.

You can even continue to earn rewards on your funds while you are trading them!

This makes your funds in Liquid Earn very flexible.

Withdrawal fees

Liquid does not charge any fees when you’re transferring your funds to and from your Earning balance.

If you wish to transfer your funds out of Liquid, you may incur a withdrawal fee that depends on the currency you withdraw.

Since these fees are a fixed amount, you may not want to withdraw small amounts!

Liquid also charges quite a high fee if you intend to withdraw SGD from their platform (min $15 SGD).

It would be better to transfer your crypto to another exchange that supports SGD and sell it there instead.

Security

Liquid stores around 98% of all of their assets in cold storage.

Meanwhile, the remaining 2% of crypto is stored in warm wallets, which is powered by Unbound Tech.

Liquid was previously hacked on 13 Nov 2020, where the hackers tried to gain access to login and 2FA data.

However, no assets were stolen from their platform.

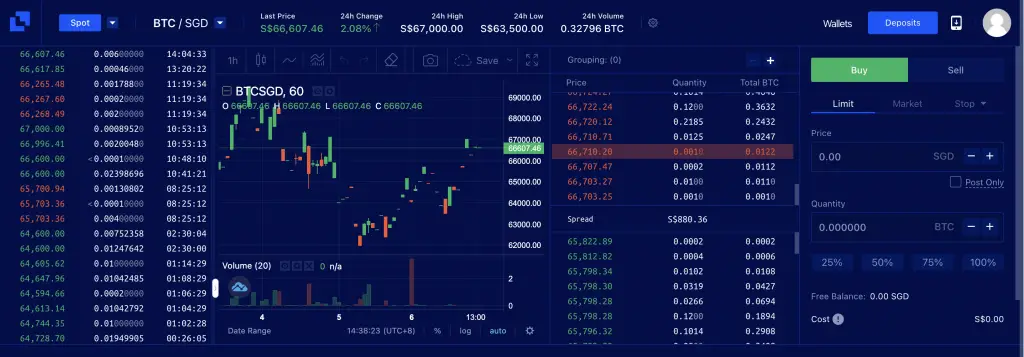

Extra features

Apart from the Earn feature, you can trade on Liquid’s platform,

or choose to Buy/Swap crypto instantly.

Verdict

Liquid Earn is extremely flexible, and it gives you the convenience of trading while still being able to earn interest on your crypto.

However, the interest rates and number of currencies are rather limited compared to other platforms!

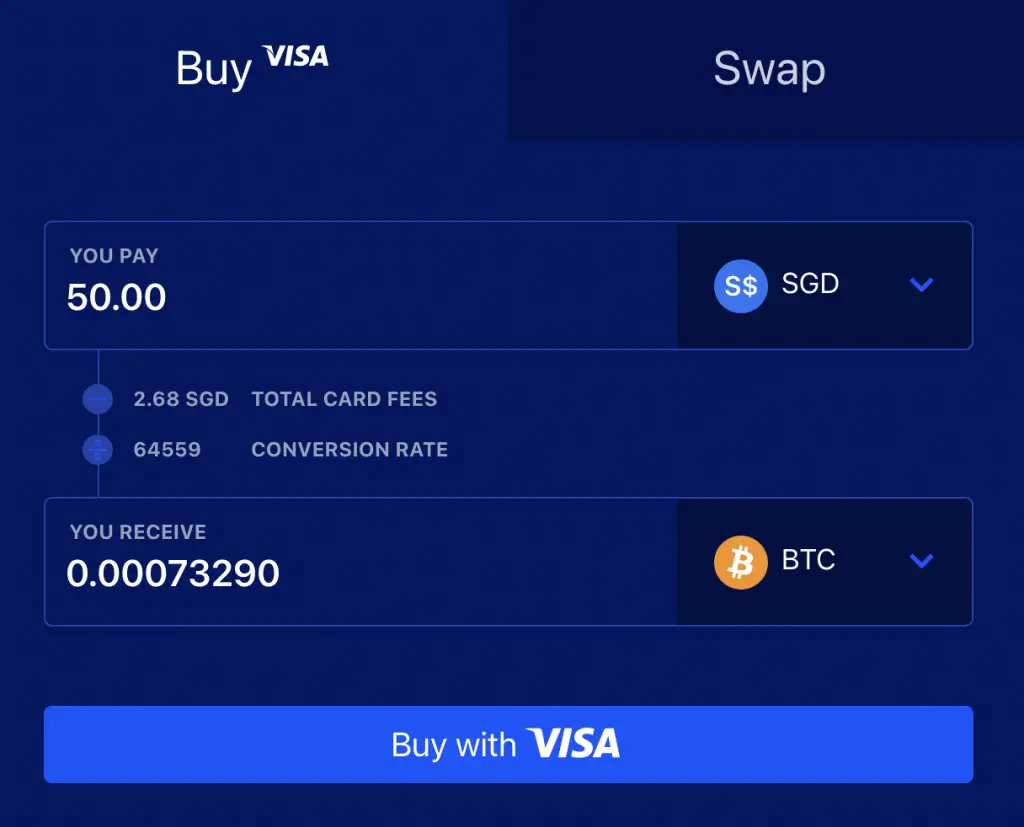

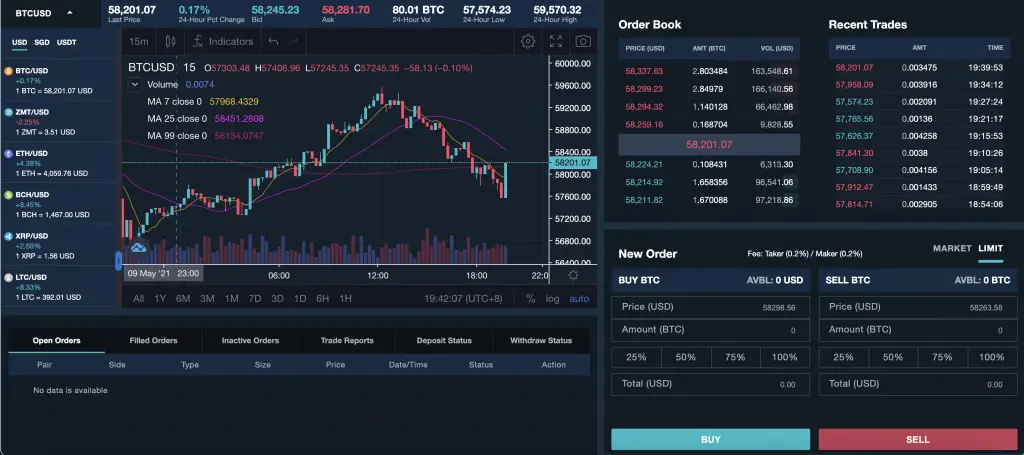

Zipmex Earn

Zipmex is an exchange that was founded in Thailand.

They are another exchange that offers SGD support and an Earn feature, which is similar to Liquid.

Here is a summary of their features:

| Number of cryptocurrencies | 7 |

| How interest is earned | In-kind |

| Distribution of rewards | Daily |

| Borrowers of platform | Undisclosed |

| Minimum amount | None |

| Lock-in period | None |

| Withdrawal fees | None when withdrawing to Zipmex Withdrawal out of Zipmex depends on currency |

| Security | Uses BitGo wallet |

| Extra features | Trading platform |

| Verdict | Good if you want to buy and hold crypto that you’ve bought on Zipmex |

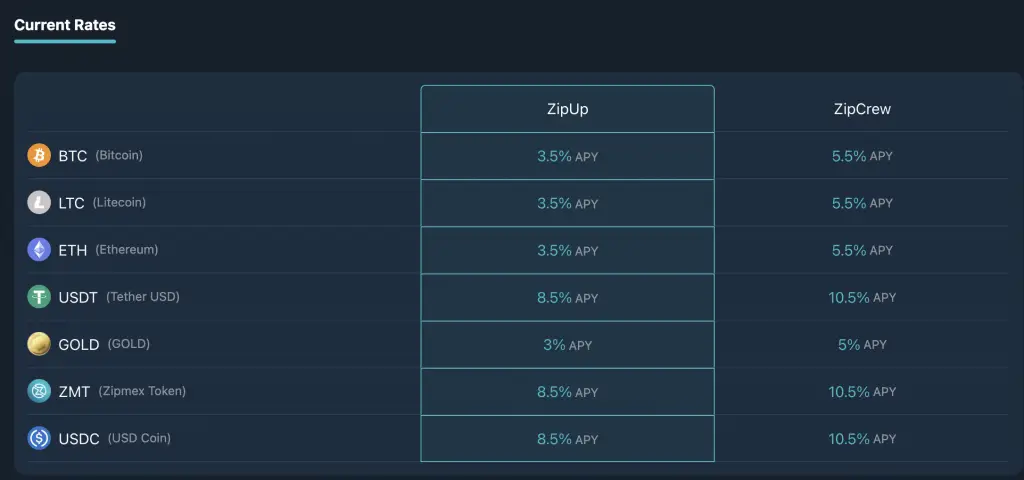

Number of cryptocurrencies

Zipmex only allows you to earn interest on 7 currencies:

- BTC

- LTC

- ETH

- USDT

- GOLD

- ZMT

- USDC

ZMT is Zipmex’s native token.

How interest is earned

Your interest will be earned in-kind, based on the currency that you’re lending out.

Distribution of rewards

Zipmex calculates and pays your interest daily.

With a daily compounding, your returns will be able to grow faster!

Borrowers of platform

Zipmex did not disclose who they will be lending your crypto to.

However, Zipmex uses BitGo as their custodian, and they have set up an insurance policy worth $100 million.

This should give you some reassurance that your funds are rather secure.

Minimum amount

There are no minimum amounts required for you to start earning with Zipmex.

You can start earning interest with whatever small amounts you have!

Lock-in period

Zipmex does not have any lock-in period, and you can withdraw your funds whenever you like.

Withdrawal fees

Zipmex does not charge you any withdrawal fees when you withdraw your funds from Zipmex Earn back to the trading platform.

If you decide to withdraw your fees from Zipmex’s platform, the fee will depend on the currency you’re withdrawing.

Security

Zipmex uses BitGo’s infrastructure to secure their platform.

Most of your funds will be stored in a wallet that is offline, so hackers won’t be able to access them.

Zipmex did talk about what would happen if they cease operations. However, they mentioned about the laws in Thailand, and did not mention anything in Singapore.

You may want to be a bit cautious and not put all of your funds into Zipmex!

Extra features

Apart from lending out your crypto, Zipmex functions as a trading platform too.

The trading fees are rather low at 0.2% as well!

You can consider this exchange if you want to buy some of these currencies at low costs.

Verdict

Zipmex is a decent platform to earn interest on your crypto. However, the number of currencies that you can earn interest on are quite limited compared to other platforms!

Nevertheless, it is still one of the platforms that allow you to buy crypto directly from SGD.

As such, you can buy your crypto and then lend it out. This will help you to save on the high withdrawal fees of some platforms!

Tokenize Earn

Tokenize is another exchange from Singapore that was launched in early 2018.

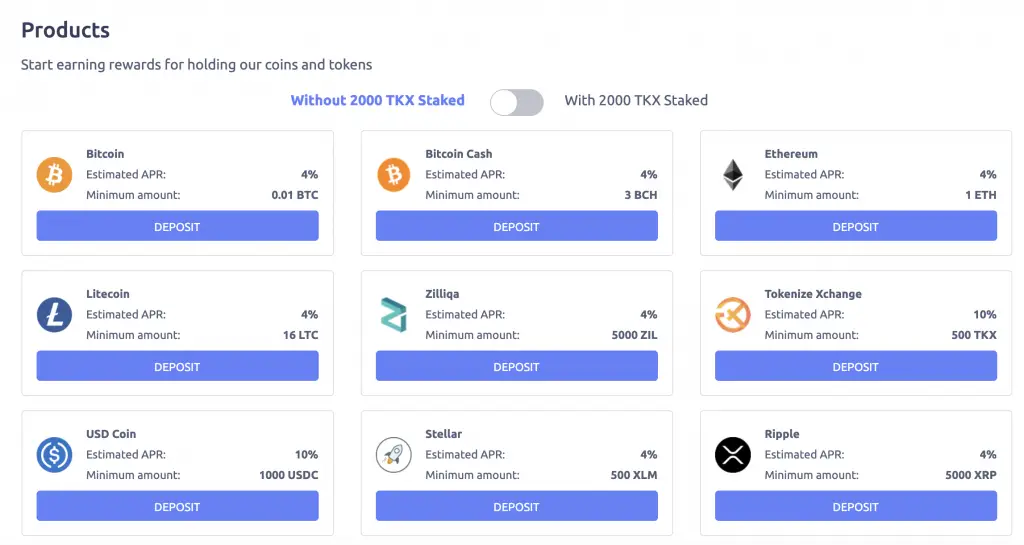

Here is a summary of its features:

| Number of cryptocurrencies | 18 |

| How interest is earned | In-kind |

| Distribution of rewards | Beginning of every month |

| Borrowers of platform | Institutional and corporate borrowers |

| Minimum amount | Depends on currency |

| Lock-in period | Minimum 30 days |

| Withdrawal fees | None when withdrawing to Tokenize Withdrawal out of Tokenize depends on currency |

| Security | Undisclosed |

| Extra features | Trading platform Dual Earn |

| Verdict | Minimum amounts can make Tokenize Earn quite inaccessible |

Number of cryptocurrencies

Tokenize allows you to earn interest on 18 different currencies.

Some of them include:

Tokenize offers quite a wide variety of tokens you can earn interest on.

Moreover, you are able to buy these tokens directly from Tokenize’s trading platform!

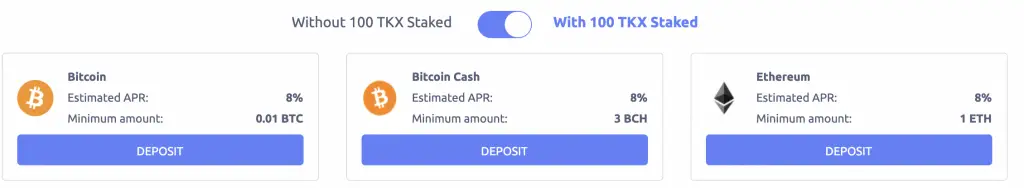

How interest is earned

The interest will be credited into your account, in the same currency that you’ve loaned out.

You will be able to earn a higher interest rate if you’ve staked 100 TKX on their platform.

TKX is Tokenize’s native token.

Distribution of rewards

The interest that you’ve earned will be paid out at the beginning of every month.

This is slightly less favourable compared to other platforms which compound your returns every week.

Borrowers of platform

Tokenize lends out your crypto to trusted institutional and corporate borrowers.

Your funds will usually be over-collaterised, but that may not be the case for all loans.

Tokenize has implemented some risk management measures to ensure that your loans are secure and safe.

However, you should not view Tokenize Earn as a savings account!

Minimum amount

For each token that you want to loan out, there is a minimum amount you’ll need to meet.

The requirements can be quite high for some currencies:

| Currency | Minimum Amount |

|---|---|

| LTC | 16 LTC |

| USDC | 1000 USDC |

| UNI | 100 UNI |

| AAVE | 1 AAVE |

The amount you’ll need to put in may cost a few hundred SGD!

As such, Tokenize Earn may not be that accessible if you don’t have a large sum of crypto!

Lock-in period

Your crypto has a minimum lock-in period of 30 days. You will only be able to withdraw your crypto after this period.

Tokenize also reserves the right to take up to 7 days to process your withdrawal.

With these restrictions, Tokenize Earn is less flexible compared to other platforms!

Withdrawal fees

Tokenize does not charge you any fees when you are withdrawing your crypto from Tokenize Earn into the trading platform.

If you choose to withdraw your funds from Tokenize’s platform, you will incur some withdrawal fees.

This depends on the currency that you’re withdrawing.

Security

Tokenize is less transparent regarding their security protocols.

On their website, they mentioned their security measures rather briefly.

This may be slightly worrying if you are very concerned about the security of the platform!

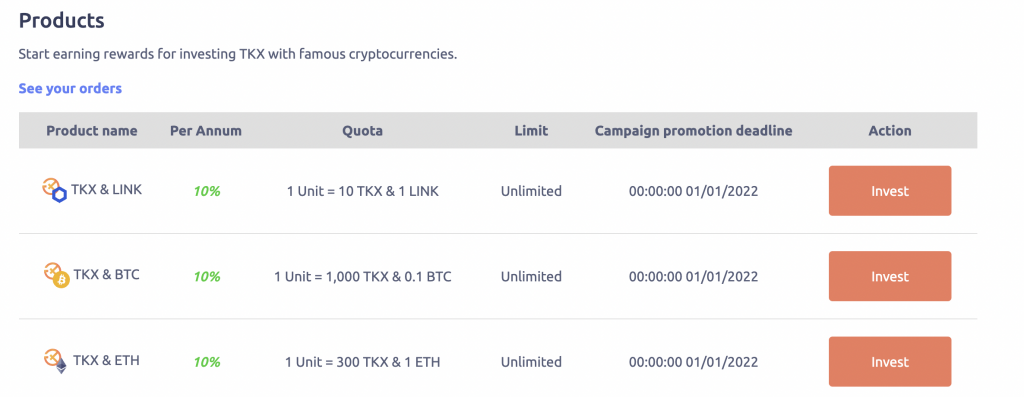

Extra features

Apart from the Earn feature, you are able to buy crypto from SGD on Tokenize’s trading platform .

The trading fees for Tokenize range from 0.8% – 1%, with a minimum of SGD$1. This is rather similar to Coinhako.

You are also able to use Tokenize’s Dual Earn, where you can earn interest on a crypto pair with TKX.

The minimums for each pair are quite high too, which means you’ll need quite a large sum of crypto to take part!

Verdict

Tokenize Earn will be useful if you use the trading platform to buy your crypto from SGD.

However, the minimum amount you need to start earning interest is quite high for certain currencies. Your crypto will be locked up for at least 30 days too!

You’ll need to decide if you’re ok with having your crypto locked up for that period of time.

Conclusion

There are many platforms that allow you to earn interest on your crypto.

While the interest rates are very high, the risks that come with these platforms are quite high too.

You should never treat any of these platforms like a savings account!

If you have a large sum of crypto, I would suggest spreading it across different platforms. In this way, your risk is spread out, instead of being concentrated in one place!

Here are some things you may want to consider when choosing between these platforms:

- The currency you wish to earn interest on

- Whether the platform supports SGD or not

- Whether you’ll incur withdrawal fees

- The lock-in period for lending out your crypto

- The minimum amounts required to start using the Earn feature

- How safe your loan and the platform is

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

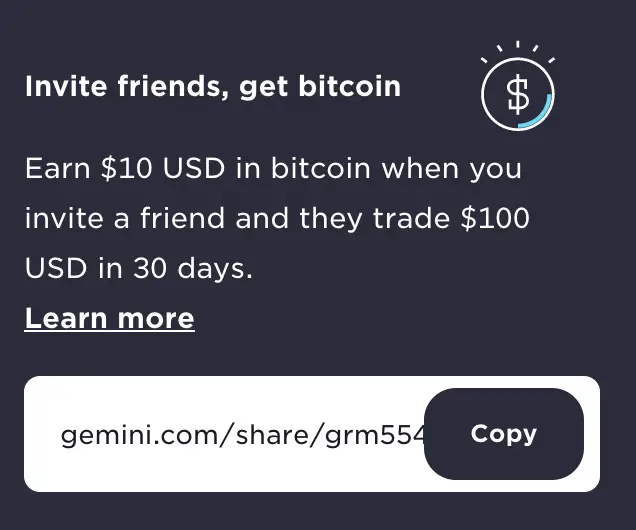

Gemini Referral (Earn $10 USD in BTC)

If you are interested in signing up for a Gemini account, you can use my referral link.

You will be able to receive $10 USD in BTC!

Here’s what you need to do:

- Register for a Gemini account

- Trade ≥ USD $100 or equivalent on Gemini’s platform

- Receive USD $10 worth of BTC in your account

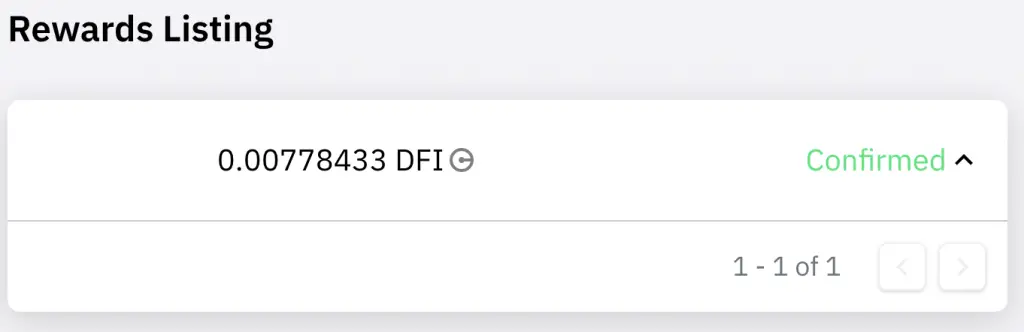

Cake DeFi Referral (Receive $30 USD worth of DFI tokens)

If you are interested in signing up for a Cake DeFi account, you can use my referral link.

After making your first deposit of ≥ $50 USD worth of crypto, you will be able to earn $30 USD worth of DFI tokens!

Here’s what you’ll need to do:

- Sign up for a Cake DeFi account

- Make a deposit of ≥ $50 USD worth of crypto into your Cake DeFi wallet

- Receive $30 USD worth of DFI tokens ($20 base + $10 referral bonus)

Your DFI tokens should be credited to you on the following Monday.

The DFI tokens that you earn will be locked up for 180 days in the Confectionery program. You will be able to earn the base APY for staking DFI tokens.

Even though your DFI is being locked up, you are still able to earn rewards on it!

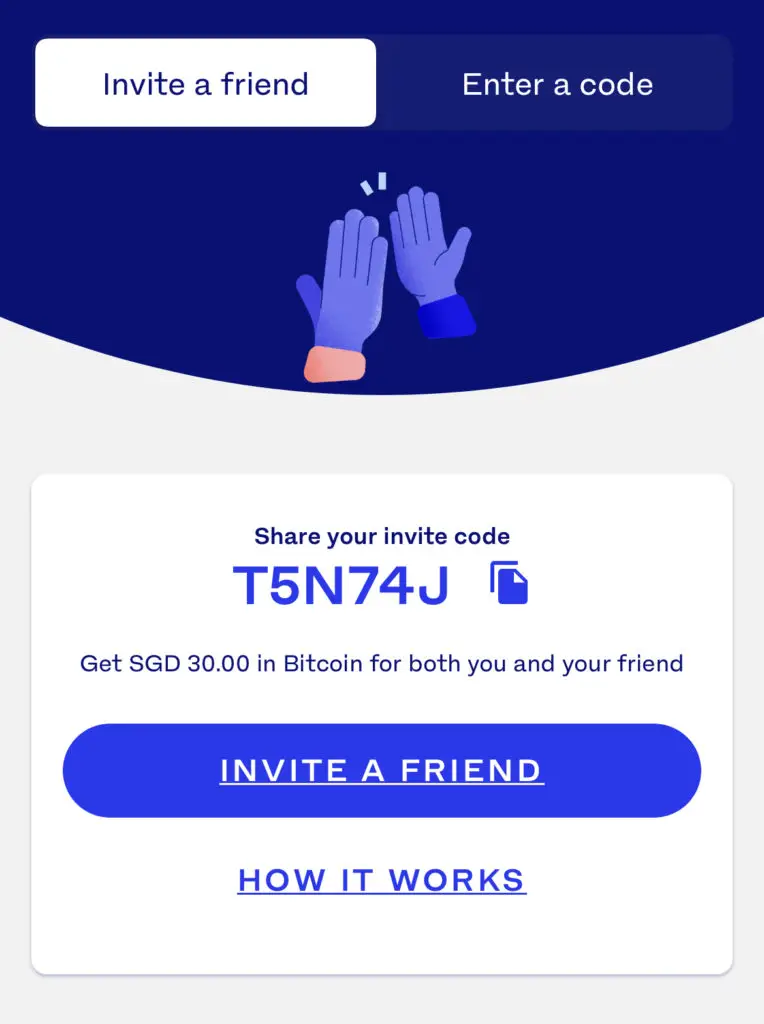

Luno Referral (Earn SGD $30 in Bitcoin)

If you are interested in signing up for a Luno account, you can use the referral code ‘T5N74J‘ or my referral link to sign up for an account.

You’ll be able to earn SGD $30 worth in Bitcoin!

Here’s what you need to do:

- Sign up for a Luno Account

- Deposit and buy ≥ SGD $200 of BTC via Instant Buy

- Receive SGD $30 in Bitcoin

You will need to purchase BTC using the Instant Buy function. The fees that you incur will be 0.75%.

It would be best to buy only $200 SGD worth of BTC, which only incurs you a $1.50 fee. The $30 SGD bonus will be able to offset the fee!

Binance Referral (Receive 5% off your trading fees)

If you are interested in signing up for a Binance account, you can use my referral link.

You will be able to receive 5% off all of your trading fees on Binance!

Tokenize Referral (Get 5 TKX worth ~ $25 SGD)

If you are interested in signing up for a Tokenize account, you can use my referral link.

You will be able to receive 5 TKX in your account (worth ~$25 SGD)!

Here’s what you need to do:

- Sign up for a Tokenize account

- Trade at least $1000 USD worth of crypto

- Receive 5 TKX in your Tokenize wallet

You can view details of this referral program on Tokenize’s website.

Receive a further SGD $50 worth of TKX when you upgrade to Premium

You are able to receive another SGD $50 worth of TKX if you upgrade to the Premium or Platinum membership of Tokenize.

You will need to pay 160 TKX to upgrade your membership to the Premium tier.

Once you have upgraded your membership tier, you will receive the TKX bonus!

You can view more information about this promotion on Tokenize’s website as well.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?