Last updated on March 8th, 2022

Are you constantly worrying about finding the right time to buy your stocks?

You can consider a dollar cost averaging strategy instead. This allows you to invest a fixed amount into the same investment over a period of time.

This is why you should consider OCBC’s Blue Chip Investment Plan (BCIP): by using this Regular Savings Plan (RSP), you are able to dollar cost average into a variety of blue chip stocks and exchange traded funds!

Contents

- 1 OCBC BCIP Review

- 2 What is the OCBC BCIP?

- 3 Is the OCBC BCIP different from OCBC RoboInvest?

- 4 What counters can I invest in using the OCBC BCIP?

- 5 Can I receive dividends when I invest with the OCBC BCIP?

- 6 Can I reinvest my dividends from the BCIP?

- 7 What are the returns for the BCIP?

- 8 What are the fees I will incur when using OCBC BCIP?

- 9 Is the BCIP a worthy investment?

- 10 How do I apply for the OCBC BCIP?

- 11 How does the OCBC BCIP work?

- 12 How do I sell the shares I have in OCBC BCIP?

- 13 Do I own my stocks in the OCBC BCIP?

- 14 How can I transfer shares to my name?

- 15 Conclusion

- 16 OCBC BCIP FAQs

OCBC BCIP Review

The OCBC BCIP is a regular savings plan that allows you to invest in a variety of stocks, ETFs and REITs listed on the Singapore Exchange (SGX).

It is an option to consider if you only have a small amount to invest, since the minimum investment amount begins from $100 a month.

Here is the OCBC BCIP reviewed in-depth:

What is the OCBC BCIP?

The OCBC Blue Chip Investment Plan (BCIP) is a regular savings plan by OCBC, which allows you to invest in 20 different counters, including:

- 14 individuals stocks that are part of the Straits Times Index (STI);

- 1 REIT; and

- 5 ETFs listed on the SGX.

The OCBC BCIP plan uses a dollar cost averaging approach to buy a counter. This means that when you invest the same amount of money each month, the number of units you buy will be different.

When the price is high, you will buy less units of the counter. When the price is low, you will buy more units. In the long run, the average price of the counter will be somewhere between the highest and lowest prices you have paid.

This will help to reduce your tendency to time the market, and aid in removing your emotions from investing!

Moreover, you do not need to check your stocks everyday as the price will eventually average out. Known as passive investing, it is ideal for those who prefer ‘passive’ investing to active trading.

Is the OCBC BCIP different from OCBC RoboInvest?

The OCBC BCIP is a regular savings plan while OCBC RoboInvest is a robo-advisor.

Even though they are provided by the same bank, they are 2 very different investment products!

These 2 investment platforms use different strategies to help you achieve your financial goals. They mainly differ in terms of:

- Number of holdings within each portfolio

- Minimum investment amount

- Fees charged

You can find out more about the differences between a robo-advisor and a regular savings plan here.

What counters can I invest in using the OCBC BCIP?

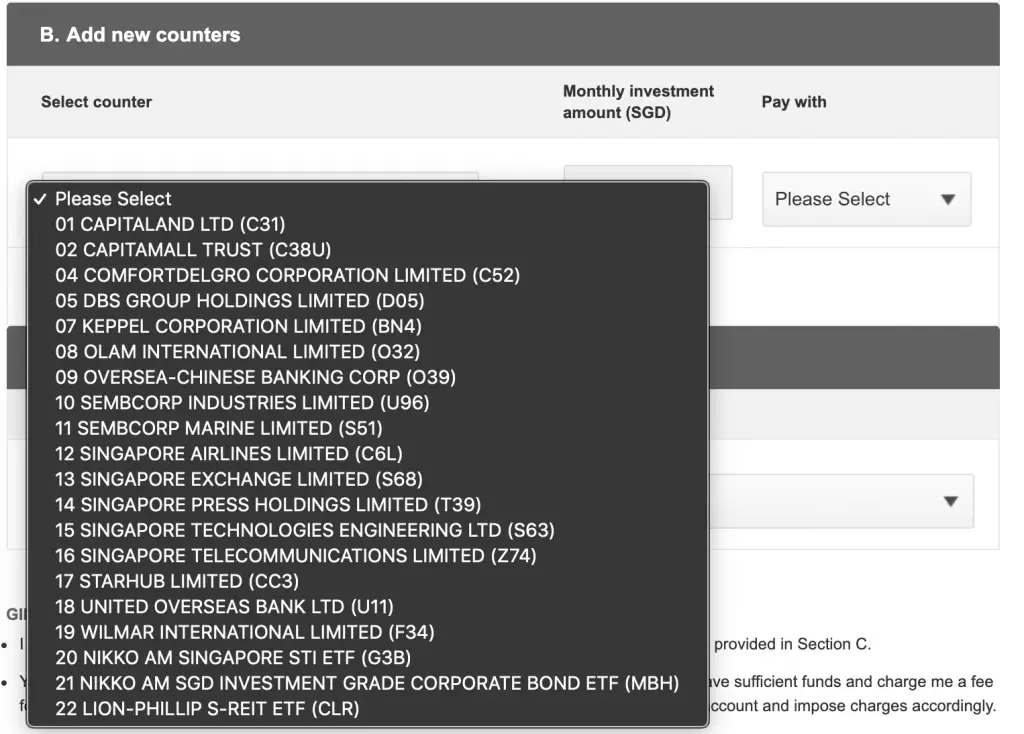

There are 3 major types of counters that you can invest using the OCBC BCIP:

#1 Stocks

There are 14 individual stocks (all found in the STI) that you can choose from.

These stocks are considered the blue chip stocks of Singapore, which mean they usually have a very good reputation with strong financial health.

When you invest in the following blue chip stocks of Singapore, there is usually a lower risk compared to growth stocks, though low risk does not mean no risk!

| Stock Name | SGX Code |

|---|---|

| CapitaLand Limited | C31 |

| ComfortDelGro Corporation Limited | C52 |

| DBS Group Holdings Limited | D05 |

| Keppel Corporation Limited | BN4 |

| Oversea-Chinese Banking Corporation Limited | O39 |

| SembCorp Industries Limited | U96 |

| Singapore Airlines Limited | C6L |

| Singapore Exchange Limited | S68 |

| Singapore Press Holdings Limited | T39 |

| Singapore Technologies Engineering Limited | S63 |

| Singapore Telecommunications Ltd | Z74 |

| StarHub Ltd | CC3 |

| United Overseas Bank Limited | U11 |

| Wilmar International Limited | F34 |

#2 Real Estate Investment Trusts (REITs)

REITs are funds that invest in income-generating real estate assets.

You will mainly earn returns from the dividend yield of the REIT. This dividend is usually based on the rental income that the REIT receives from all of its assets.

Currently you are only able to buy one REIT, which is CapitaLand Integrated Commercial Trust (CICT).

In a recent review, FTSE Russell decided to remove Singapore Press Holdings (SPH) from the STI. SPH was replaced by MapleTree Industrial Trust, another REIT. The STI now has 6 REITs in its index.

OCBC did mention in their FAQs that they may add or remove counters from the BCIP based on the constituents of the STI.

As such, you may be able to invest in more REITs using the BCIP in the future!

#3 Exchange Traded Funds (ETFs)

Exchange traded funds are funds traded in the stock market, and buy different investments, usually based on an index.

When you buy a share in the fund, you are diversifying across the different investments of that fund.

Here are the 4 ETFs that you can buy, with the index that it tracks:

| ETF | Ticker | Asset Class | Index Tracked |

|---|---|---|---|

| Nikko AM Singapore STI ETF | G3B | Stocks | FTSE Straits Times Index |

| Nikko AM SGD Investment Grade Corporate Bond ETF | A35 | Bonds | iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index |

| Lion-Phillip S-REIT ETF | CLR | REITs | Morningstar® Singapore REIT Yield Focus IndexSM |

| Lion-OCBC Securities Hang Seng Tech ETF | HST | Stocks | Hang Seng Tech Index |

A35 is one of the bond ETFs being listed on the SGX. You can view my comparison of how A35 and the other ETF, MBH differ from each other.

ETFs buy into all the investments in the index, which means you purchase a basket of stocks, bonds or REITs. If you wish to invest in some of these ETFs together, you can consider StashAway’s Income Portfolio.

Such diversification lowers the risk involved with investing as you are depending on the performance on different investments, instead of just one.

However, you will have to pay for the expense ratio of the fund. This is on top of the transaction fee that you have to pay when using OCBC BCIP.

Here’s the expense ratios of these 4 ETFs:

| ETF | Expense Ratio |

|---|---|

| Nikko AM Singapore STI ETF | 0.3% |

| Nikko AM SGD Investment Grade Corporate Bond ETF | 0.27% |

| Lion-Phillip S-REIT ETF | 0.58% |

| Lion-OCBC Hang Seng Tech ETF | 0.68% |

The Lion-OCBC Hang Seng Tech ETF has the highest expense ratio at 0.68%.

Even though the expense ratio may seem small, it will eat into your returns in the long run! This is something you’ll need to also consider before investing in ETFs.

HST tracks the Hang Seng Tech Index, and not the Hang Seng Index. You can check out my guide on buying the Hang Seng Index from Singapore for more information.

Can I receive dividends when I invest with the OCBC BCIP?

If the share, REIT or ETF that you buy using OCBC BCIP issues a dividend, it will be credited into your OCBC-linked bank account.

The dividend that you receive varies from counter to counter.

To track all the dividends that you’re receiving, you can consider giving StocksCafe a shot!

Usually, the company will announce the dividend they will issue to their shareholders. There are 3 types of dividends that you may receive:

#1 Cash dividend

This is the most common form of dividend. The company will announce the cash dividend that they will issue for each share you own. The dividend will then be credited into your deposit account.

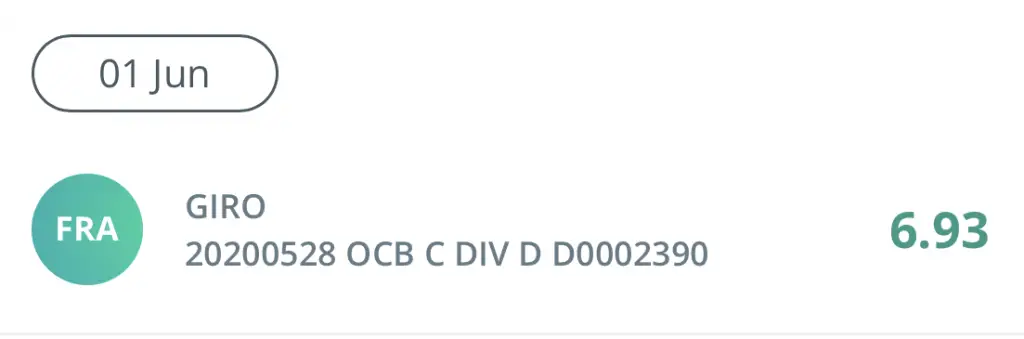

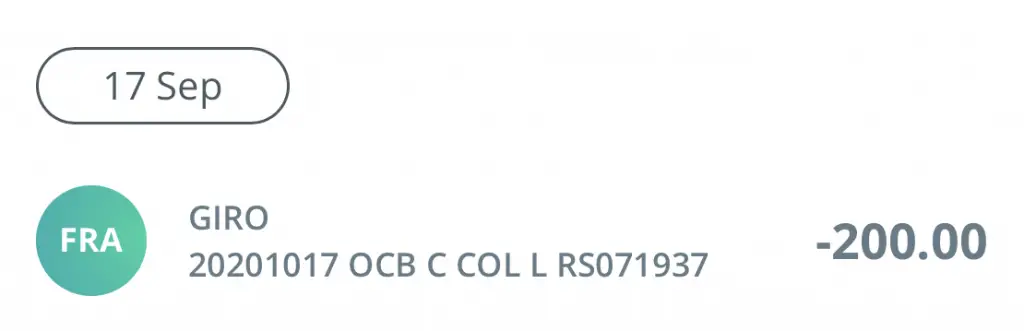

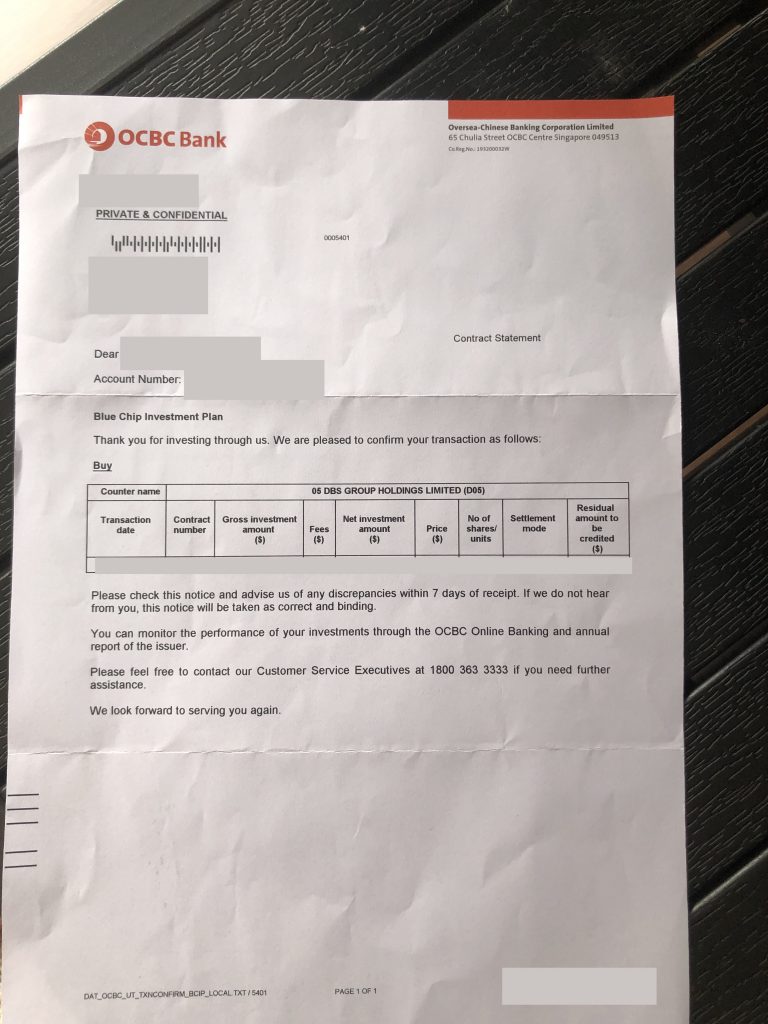

Here’s the dividends that I received from investing in DBS shares in a particular month.

#2 Shares

Companies may offer you a dividend in the form of more shares. If you receive a share dividend, it will be credited to your BCIP account.

#3 Choice

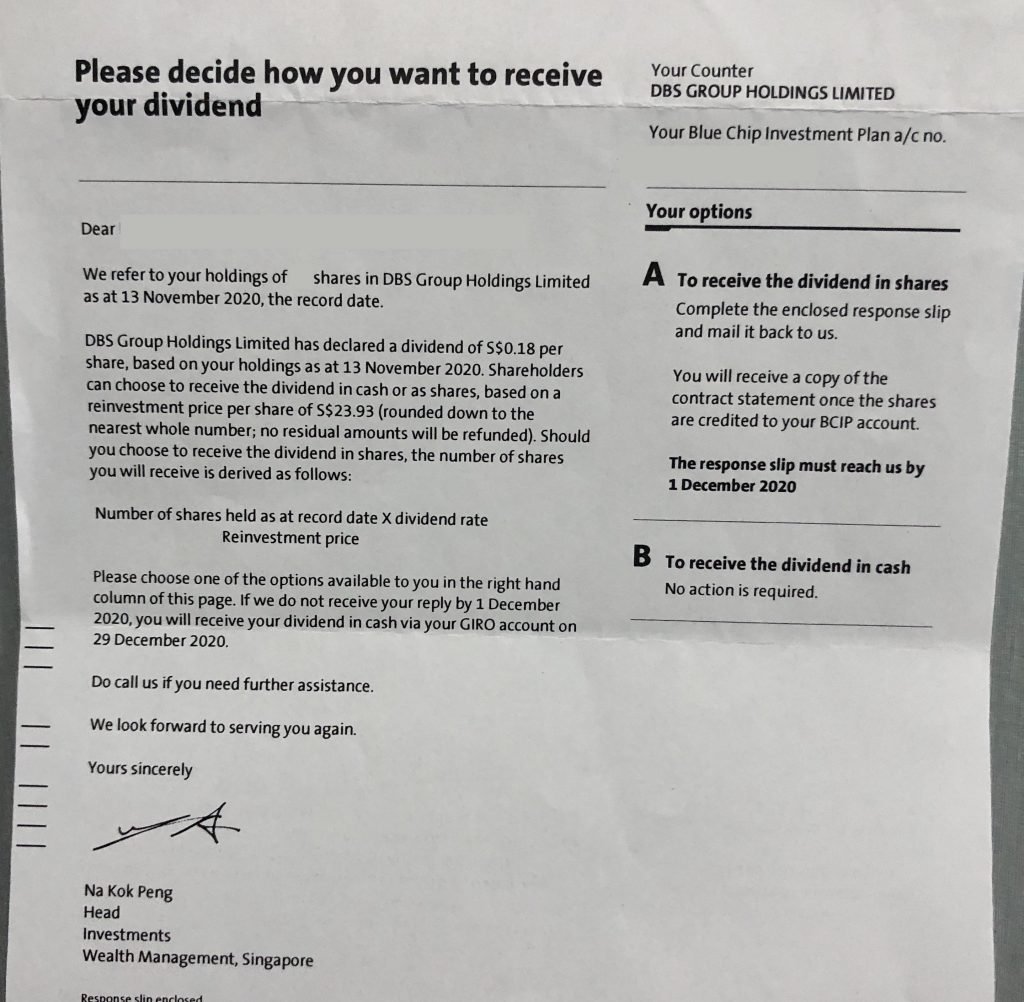

A company may offer you a choice dividend. For example, DBS offered a scrip dividend to be paid out on 29 Dec 2020.

I received a letter from OCBC for me to decide whether to receive the dividend in the form of cash or shares.

If you wish to have your dividends issued as shares, you will have to mail back to them with your signature. Otherwise, your dividend will be issued to you as cash.

Can I reinvest my dividends from the BCIP?

You may have heard of reinvesting your dividends. This will help you to compound your returns even further! However, OCBC BCIP does not explicitly allow you to reinvest your dividends.

Here are 2 possible options that to consider when reinvesting your dividends:

#1 A one-off increase in your contribution to the BCIP

You can choose to increase your contribution into the counter that you’re investing in. However, you can only invest with BCIP in multiples of $100.

As such, you may decide to increase your contribution to the BCIP when your dividends reach $100. This can be a rather tedious process.

Any amendments to your plans will only take effect in the next month. This means that you’ll have to anticipate the dividends that you’ll earn, and amend the plan one month before the dividend issue date.

Afterwards, you will need to amend your plan again to reduce your contribution! This is something I would not recommend as it requires constant monitoring of your account.

If you forget to reduce your contribution to the original amount, you will be paying $100 extra each month!

#2 Reinvest your dividends into a robo-advisor

You can consider placing your dividends in a robo-advisor instead.

Robo-advisors such as StashAway, Syfe and UOBAM invest do not have a minimum sum to invest with them. You’ll be able to invest all of your dividends into these platforms, no matter how little!

I personally prefer this method as this allows you to invest your dividends immediately.

However, note that if you invest too little a sum, your capital may be eaten away by the expenses of the robs-advisor, especially if your returns are insufficient to cover your expenses and gain you a return.

You can view my comparison between Syfe Equity 100 and StashAway to see which portfolio is better for you.

What are the returns for the BCIP?

With the OCBC BCIP, you are buying into a single stock or ETF. As such, the returns you receive depend heavily on the performance of the stock / ETF.

Usually, the counters are rather well established. You most likely wouldn’t go wrong when you invest them. However, this doesn’t mean that you should just invest in any counter!

Do your research on the stock / ETF first before investing! By knowing how the company works, it will help you decide if it is worth investing in them.

What are the fees I will incur when using OCBC BCIP?

There are 2 main fees that you will incur when investing with the BCIP:

#1 Transaction fee

Each time you purchase a counter with the BCIP, you will incur a transaction fee.

This fee is incurred whenever you make a buy or sell order. The fee is calculated based on the total investment amount or the total sale proceeds.

There are 2 fee structures, depending on your age:

1. BCIP customers below 30 years old

The fee structure is slightly more attractive when you’re below 30 years old:

| Transaction Type | Fee |

|---|---|

| Buy | 0.88% of total amount invested |

| Sell | 0.88% of total amount sold |

| SRS Processing Fee | $0.37 |

However, you can only invest up to $500 per counter to receive this preferential rate. It is a great way for young people to start investing due to this cheaper fee.

2. All other BCIP customer

If you are above 30 years old, the fees are much more expensive:

| Transaction Type | Fee |

|---|---|

| Buy | 0.3% of total amount invested (min. $5) |

| Sell | 0.3% of total amount sold (min. $5) |

| SRS Processing Fee | $0.37 |

While the fee looks lower at 0.3%, there is a minimum fee of $5. This means that if the 0.3% fee is less than $5, you will be charged $5.

The only way you incur a 0.3% fee is when you invest at least $1700 monthly!

| Amount Invested | Fee Paid | Percentage of Amount Invested |

|---|---|---|

| $100 | $5.00 | 5.00% |

| $500 | $5.00 | 1.00% |

| $1,000 | $5.00 | 0.50% |

| $1,500 | $5.00 | 0.33% |

| $1,700 | $5.10 | 0.30% |

Based on the table above, you will pay lower fees only if you are able to invest a larger sum each month.

Thus, if you are over 30 years old and can only invest a small sum monthly, the BCIP may be unsuitable for you.

There are more cost-effective ways of investing, such as with a robo-advisor!

#2 Transfer of shares fee

The shares that you buy with OCBC BCIP are under the custody of OCBC. You do not have full control over these shares. If you wish to fully own your shares, you will have to transfer these shares to your Central Depository (CDP) account or another financial institution.

You may also want to transfer these shares to another owner. Here’s the fee breakdown:

| Type of Transfer | Fee |

|---|---|

| Change of beneficial owner | 3bps of settlement value, min $150, per settlement instruction + GST |

| No change in beneficial owner / Transfer to immediate family (per transaction) | $10 + GST |

A change of a beneficial owner means that the shares are transferred to an account that is not in your name. This includes both single and joint accounts.

The fees are pretty costly. As such, you should consider carefully before you wish to transfer your shares out!

Is the BCIP a worthy investment?

The OCBC BCIP allows you to invest in stocks or ETFs via a dollar cost averaging approach. This is a great way to cultivate an investing habit, even with a small sum.

Here are the pros and cons of investing with the OCBC Blue Chip Investment Plan:

| Pros | Cons |

|---|---|

| Able to start investing with $100 a month | Fees can be quite hefty when you reach 30 years old |

| Able to invest in individual blue chip stocks | You will incur both transaction and management fees when you invest in ETFs |

| Able to invest SRS funds | Sell orders are only executed on the next business day |

| GIRO applications are made on your behalf | Investing using SRS funds incur additional processing fees |

| Fees are attractive if you’re below 30 years old | REIT investing options are rather limited |

| Dividends are credited directly to your OCBC debiting account | Unable to reinvest dividends |

| Shares are not under your full custody |

Below are more key pointers:

#1 BCIP allows you to invest in individual stocks

You are able to buy shares of stocks with whatever amount that you can invest with BCIP.

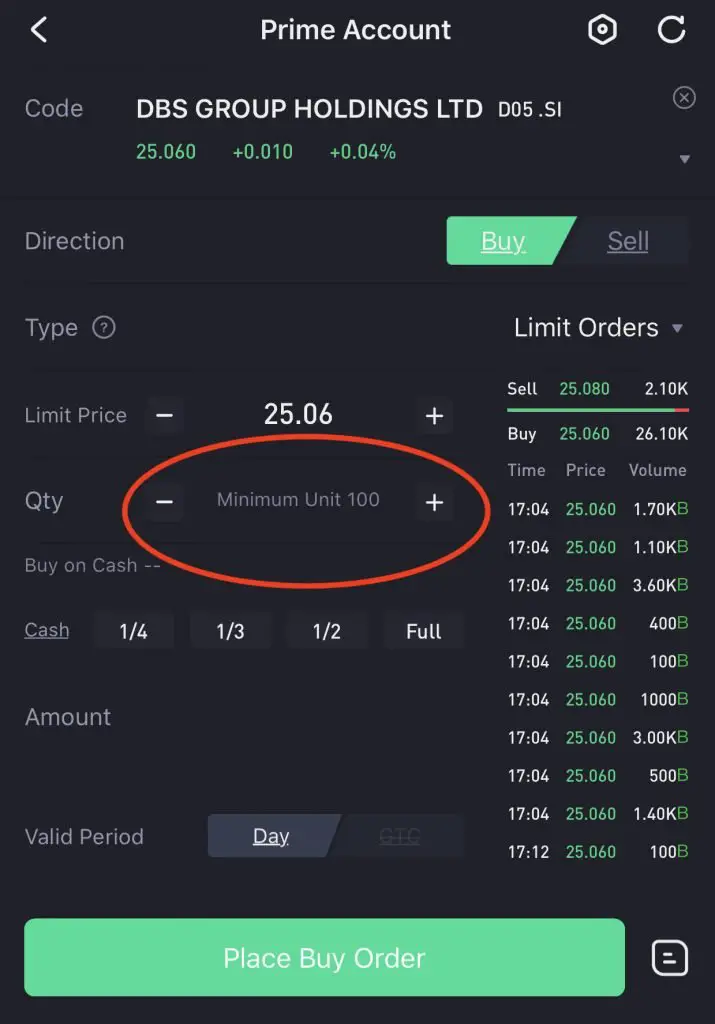

For example, DBS shares cost around $25. If you were to invest using a broker like Tiger Brokers, the minimum units you can buy is 100 on the SGX.

If you wish to invest in DBS stocks via a broker, you’ll need a minimum of around $2500!

As such, the BCIP makes investing in these expensive stocks more accessible. If you invest $100, you will receive around 3 shares (after accounting for fees). Even though the number of shares you receive is quite small, it will add up over time!

#2 BCIP is cheaper than POEMS Share Builders Plan

Apart from the BCIP, the POEMS Share Builders Plan also allows you to invest in individual stocks using a RSP. Although POEMS offers 44 counters, their fees are much more expensive.

Depending on the number of counters you invest in, you will be charged a flat fee of $6 – $10 each month! As such, the OCBC BCIP may be more cost-effective.

If you wish to invest in ETFs, POSB Invest Saver may be a cheaper option for you. It charges you a transaction fee of 0.5% or 0.82% (depending on the ETF you choose).

#3 BCIP may be suitable for a select group of people

I would only recommend investing in the BCIP if:

- You are below 30 years old;

- You only have a small sum to start investing;

- You want to invest using a dollar cost averaging approach; and

- You wish to invest in individual stocks

If you are above 30 years old, investing in BCIP seems worth it only if you have at least $600 to spare monthly. This can be a pretty significant sum to concentrate your portfolio only on 1 stock or ETF.

If the stock or ETF decides to take a nosedive, your portfolio will be severely impacted!

Currently, my plan is to accumulate as much DBS shares as I can before I reach 30 years old. Once I’m 30, I’m planning to cancel the plan as the fees will be too costly.

#4 BCIP’s counters are heavily concentrated in Asia and Singapore

The investment options that you can buy with the BCIP is rather limited to the Singaporean and Asian market. Compared to other countries like US or China, these investments have a much lower growth potential.

If you wish to invest in certain US products such as the S&P 500 and the ARKK ETF, you will have to look elsewhere.

Interested to begin investing with OCBC BCIP? Here is a guide to help you get started:

How do I apply for the OCBC BCIP?

To get started with the OCBC BCIP, there are 3 things you need:

- OCBC deposit account

- OCBC iBanking

- OCBC SRS account (if you wish to invest your SRS funds)

Note: You can only have one SRS account. If you have a SRS account with UOB or DBS, it is possible to switch from either one to OCBC.

Here’s what you need to do to get started:

- Apply for an OCBC Blue Chip Investment Plan account

- Select how much and what counter you wish to invest in

- Amend your plan if needed

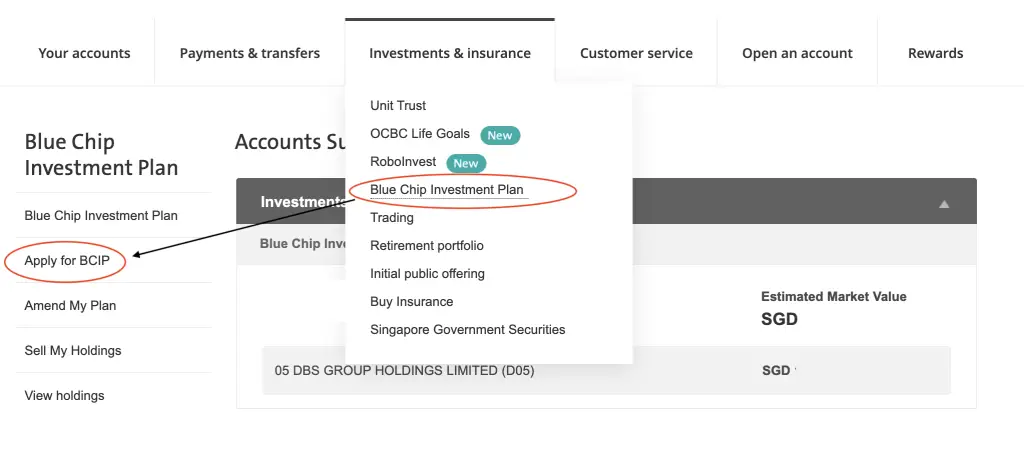

#1 Apply for an OCBC Blue Chip Investment Plan account

After creating your OCBC bank account, you can apply for a BCIP account via OCBC’s iBanking platform.

You can choose to create a normal account or a joint account. A joint account can only be created for an adult parent with a child (under 18 years old).

Your application will take about a week to be processed, and you will be notified via SMS.

#2 Select how much and what counter you wish to invest in

The OCBC BCIP has 20 different counters for you to choose from.

You can choose which stock or ETF that you wish to purchase. After that, you’ll need to select your monthly investment amount.

You can start investing from $100 a month. If you wish to invest more, you can invest in further multiples of $100.

After submitting your application, you will need to select the account that you’re debiting from. This has to be an OCBC account. A GIRO application will then be made to deduct the amount from your account.

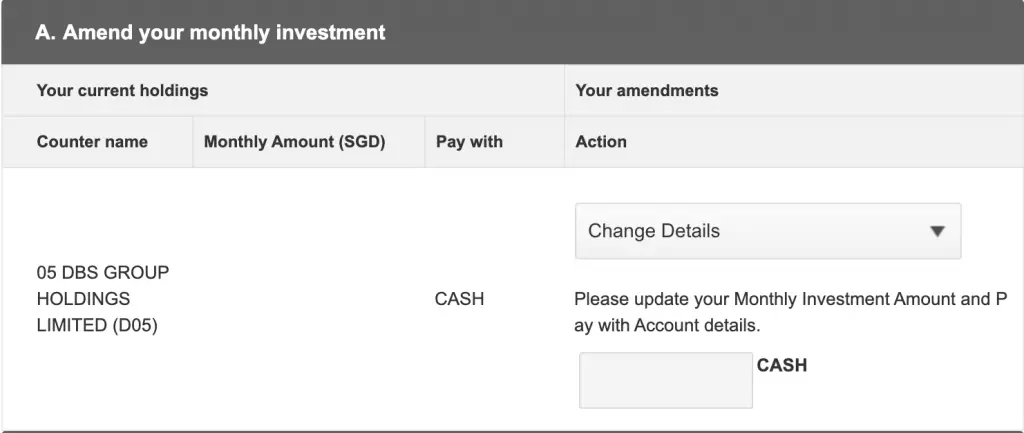

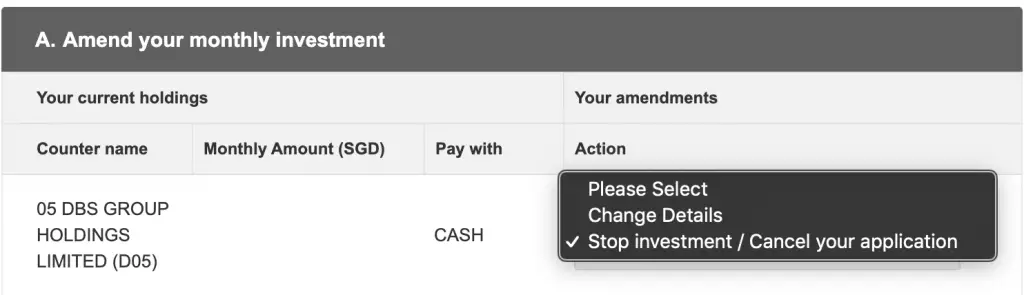

#3 Amend your plan if needed

If you wish to amend your plan, you can do so anytime on the iBanking platform.

Here are the types of amendments you can make:

- Change your investment amount

- Stop investment / cancel application

- Add new counters

- Change your settlement account

1. Change your investment amount

You can choose to change the amount you want to invest each month for each counter.

2. Stop investment / cancel application

To cancel your BCIP plan, you will need to go to ‘Amend My Plan → Stop Investment / Cancel Your Application‘.

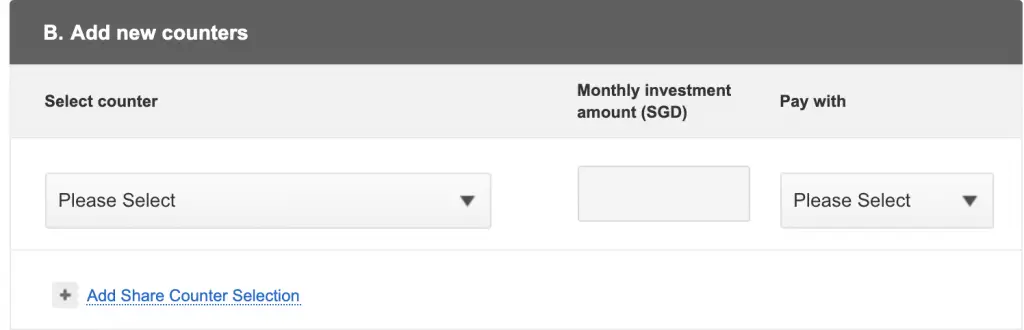

3. Add new counters

You can choose to add a new counter to invest in using the BCIP.

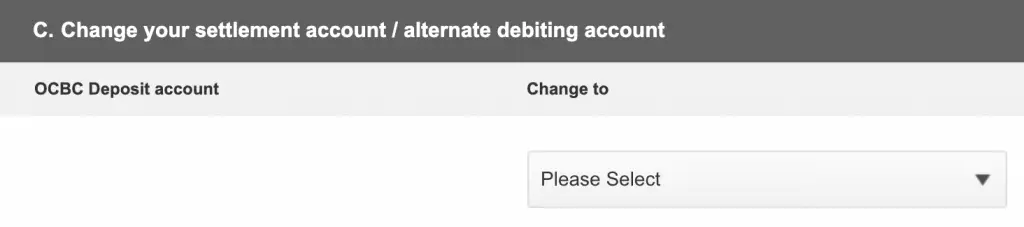

4. Change your settlement account

You can choose to change the account used to fund your investments into the BCIP. This same account will be the one where your dividends are credited as well.

You will be able to change to any account you have with OCBC, such as:

Note: If you make any amendment requests before 12pm on the last business day of the month, it will only be effective by the next month. This is because the GIRO application will take some time to be processed.

How does the OCBC BCIP work?

Here’s a step-by-step process of how the OCBC BCIP works:

#1 Deduction from your bank account

The money will be deducted via GIRO on the 17th day of each month. If the 17th day is not a business day, the deduction will occur on the next business day.

You will have to ensure there are sufficient funds in your chosen deposit account so that the deduction to go through. If there are 3 consecutive failed deductions, your purchase instruction will be terminated!

If you are investing using your SRS account, the deduction will occur 3 business days before the purchase execution date.

If you do not have enough money in your SRS account, the money will be deducted from your deposit account.

#2 Purchase of counter based on your instructions

OCBC will purchase the counter for you based on the instruction that you’ve set. The purchase date will be on the 22nd day of each month. If that falls on a non-business day, the purchase will be executed on the next business day.

The BCIP only allows you to purchase whole shares. Thus, you cannot own fractional shares under the BCIP.

1. Average purchase price

The price you pay for the counter is the average purchase price. OCBC will gather all the purchase orders made by their customers for that counter, and execute these orders in the market.

As these orders may not happen at the same time, the price of the counter may vary. OCBC will charge you the average purchase price for that specific counter.

Average purchase price = total cost of purchasing all counters / quantity of counters purchased

2. Quantity of shares allocated

You will be allocated the number of shares based on this formula:

Quantity of shares allocated = (Your Investment amount – Fees) / Average Purchase Price

The quantity of shares you are allocated will be rounded down to the nearest whole number. Still confused? Here’s an example:

If you invest $200 a month into a counter, where its average purchase price of the counter is $10, and the fees you pay is $5:

You will be allocated 19 shares ($200 – $5) / $10 = 19 shares (rounded down).

So what happens to the $5 that is not invested? It will be refunded back to your deposit account a few days after the purchase date.

You will be refunded the amount a few days after the purchase date.

#3 Receive statements

After your funds have been invested into a counter, you will receive a statement by mail which shows:

- Number of units of the counter purchased

- Price paid for the counter

- Fees paid

Unfortunately, this is the only way for you to check your transaction history. The iBanking platform does not allow you to do so.

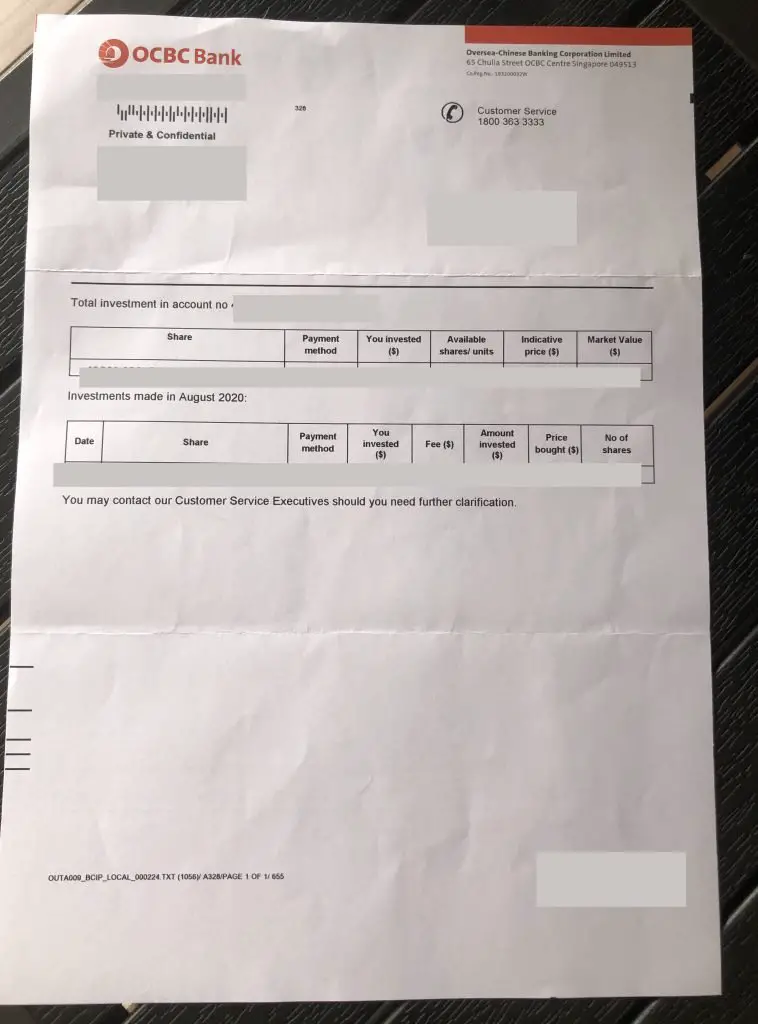

At the end of each month, you will also receive a statement.

This statement includes:

- All transactions made; and

- Total holdings

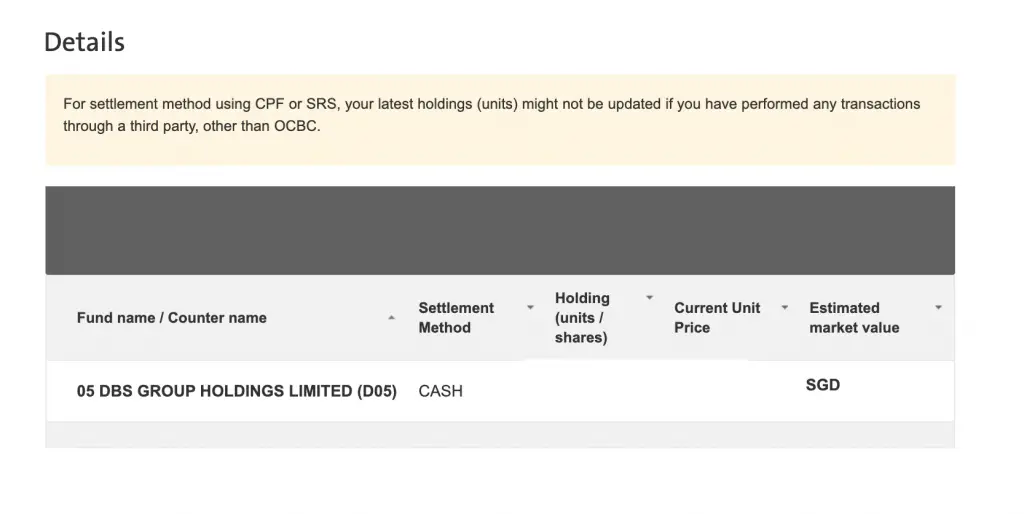

Alternatively, you can check your balance on the iBanking platform as well.

At the homepage, you can scroll down to the investments tab.

When you click on the account, here are the things that you can view:

- Counters purchased;

- Method of settlement (Cash / SRS);

- Number of shares / units held;

- Current unit price; and

- Estimated market value of your holdings.

Unfortunately, you are unable to view the average price that you’ve bought the counter at – a feature that I wish the BCIP would have. It would be more useful to compare your average price with the current market price.

If you want to track your portfolio in greater detail, consider trying out StocksCafe.

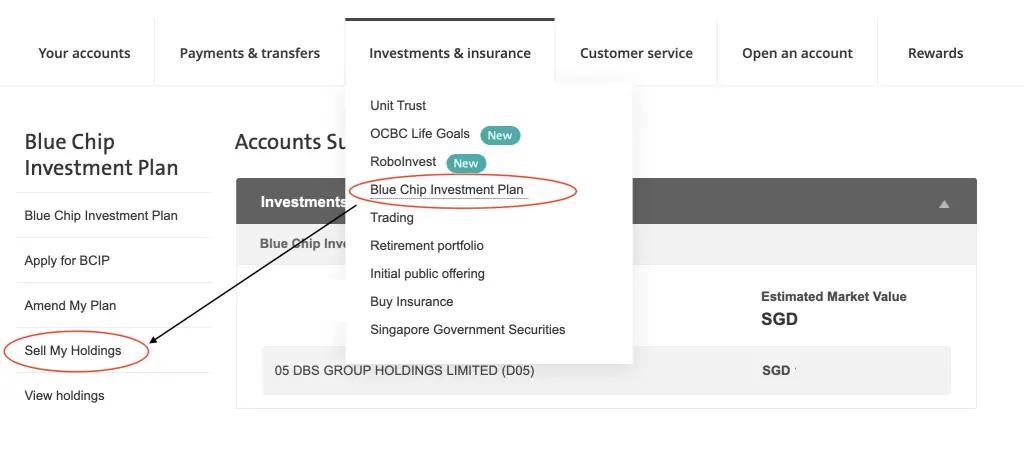

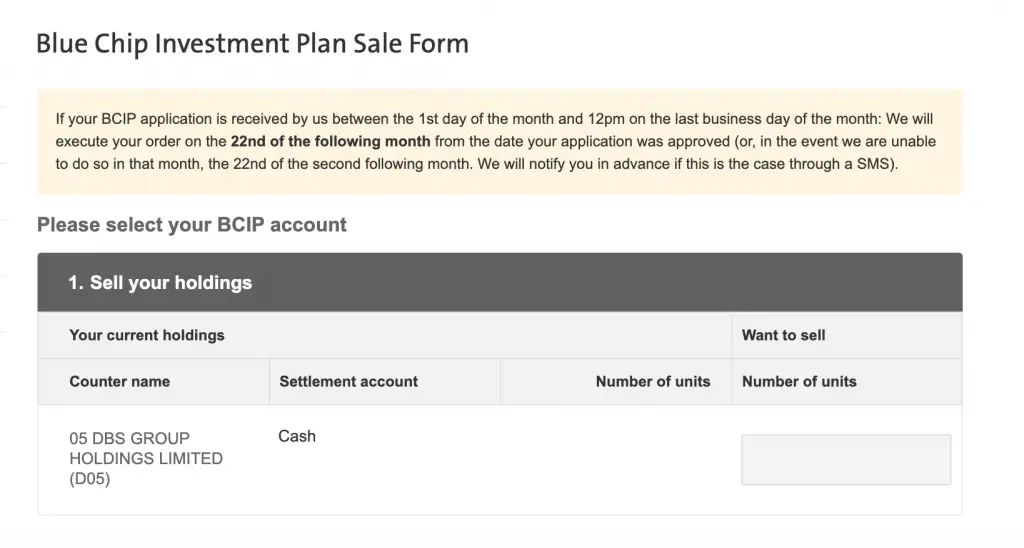

To sell the shares that you own with the BCIP, you will need to go to ‘Blue Chip Investment Plan → Sell My Holdings‘.

You will be asked how many units you wish to sell.

However, your counter will not be sold immediately. If you make the sell order before 2.30pm on any business day, your shares will be sold on the next business day.

You should receive your funds 3 business days after the sell order has been executed.

Since there is a time lag before you can sell the counter, anything can happen to the market during this period.

You may experience something similar to the March 2020 market crash! As such, the BCIP is only for a long term investing strategy. You will be unable to take advantage of short-term price changes due to the time lag between the placing and execution of a sell order.

Do I own my stocks in the OCBC BCIP?

When you invest in the BCIP, you do not need a Central Depository (CDP) Account or a custodian account. Your shares will be under the custody of OCBC.

Your shares are under these 2 places, meaning you do not have full custody of your shares:

| Funds Used | Shares Are Under |

|---|---|

| Cash | OCBC Securities Pte. Ltd |

| SRS | OCBC Nominees Singapore Private Limited |

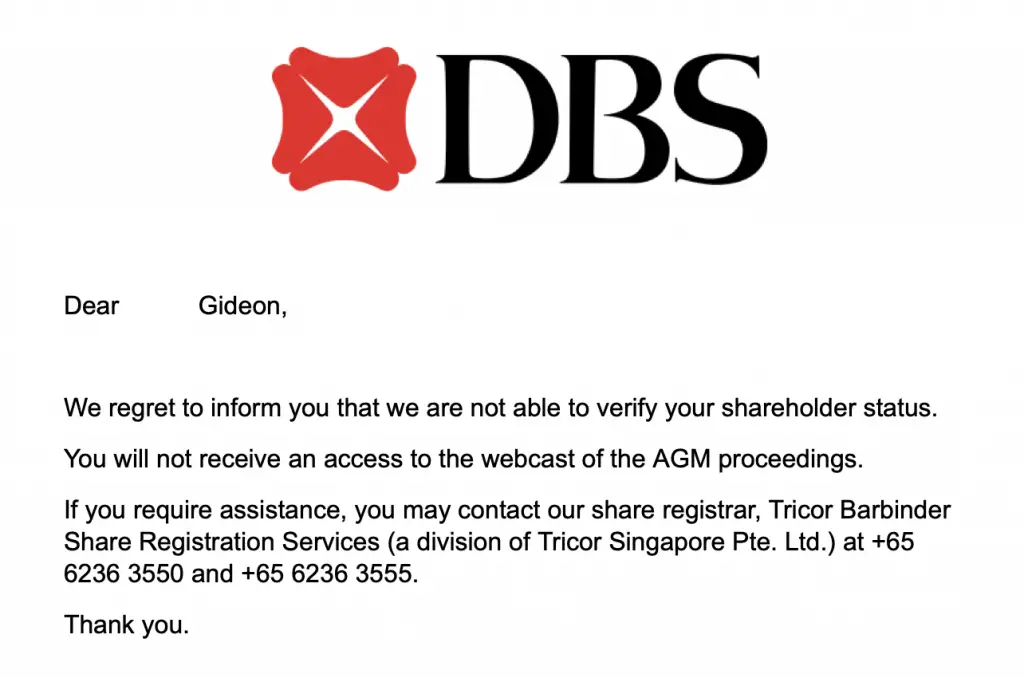

You have no voting rights as a shareholder, and will not receive annual reports from the company. I have been investing in DBS using the BCIP, but when I tried to apply to attend the DBS AGM, I was rejected.

As such, you do not have the same privileges as other classes of shareholders of the company!

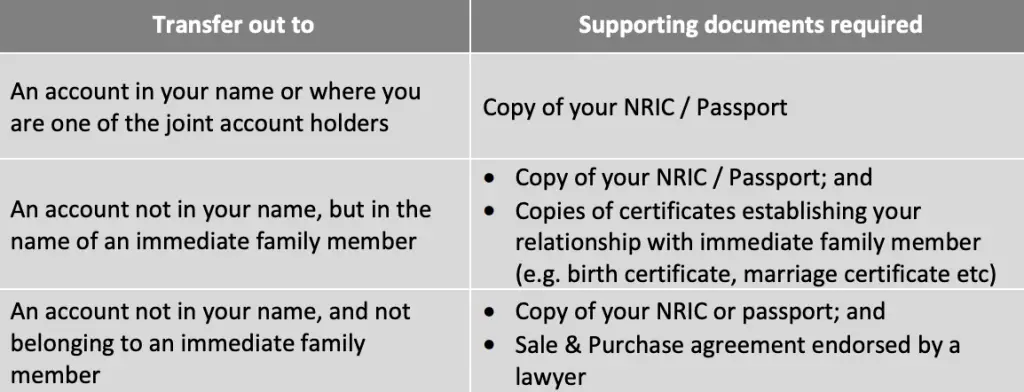

If you wish to have full custody of your shares, you may want to transfer them out to your CDP account or to another financial institution.

You will have to go to an OCBC branch to collect and fill up the transfer form. However, you can only transfer out shares that you’ve paid in cash. If you used SRS to purchase them, you are unable to transfer them out.

You will need to bring along the following documents:

Note: You will incur ‘transfer of shares‘ fees!

Conclusion

The BCIP is a good way to accumulate individual blue chip stocks when you’re at a young age. However, you may want to consider other options once you grow older.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?

OCBC BCIP FAQs

-

How does the OCBC BCIP work?

The BCIP is a regular savings plan (RSP). You will invest the same amount of money each month into a stock or ETF via a dollar cost averaging strategy.

-

What fees does OCBC BCIP charge?

OCBC BCIP charges a transaction fee for every buy or sell order, and a transfer of shares fee if you wish to transfer your shares to a CDP account or another financial institution.

-

Is OCBC BCIP and OCBC RoboInvest the same?

Although they are provided by the same bank, the two of them are very different investment products. OCBC BCIP is a regular savings plan while OCBC RoboInvest is a robo-advisor.

-

What is the deduction date for the OCBC BCIP?

Your fees will be deducted on the 17th day of the month. You will have to make sure that you have the investment amount in your account 2 days before the deduction.

-

Can I receive dividends from the OCBC BCIP?

It is possible to receive dividends from the stock or ETF that you have invested in. The amount that you receive depends on the stock or ETF, and the dividend will be credited to your OCBC account.

-

Will I receive statements when I invest in the BCIP?

You will be mailed a transaction statement as well as a monthly statement.

-

How can I stop my BCIP investment?

In the iBanking platform, you will have to go to ‘Blue Chip Investment Plan → Amend My Plan → Stop Investment’.

-

How can I sell my BCIP holdings?

You can go to ‘Blue Chip Investment Plan → Sell My Holdings’. The sale will take place on the next business day, provided you make the sell order by 2.30pm.

-

Can I reinvest my dividends received from the BCIP?

OCBC BCIP does not provide you the option of reinvesting your dividends. 2 ways that you can do so are by making a one-off increase in your monthly contribution or to transfer your dividend to a robo-advisor.

-

Do I have full ownership of the shares I have with OCBC BCIP?

You do not have full custody of the shares that you have bought with the BCIP. As such, you will not have the full rights of being a shareholder of that company.

-

Can I create a joint account for the BCIP?

You can create a joint account with your legal child who is below 18 years old.

-

What are the returns when I invest in the BCIP?

The returns you receive depend heavily on the performance of the stock or ETF in the market. The BCIP is not a risk-free way of investing. As such, you should always do your research before choosing to invest in one of the counters.

-

What is the purchase date of the BCIP?

The counters will be purchased on the 22nd day of each month.

-

What counters can I invest with BCIP?

You are able to invest in 19 counters. 15 of them are stocks or REITs that are components of the Straits Times Index, while the other 4 are ETFs that are listed on the SGX.

-

Can I invest in the OCBC BCIP using SRS?

You can use your SRS funds to invest with the BCIP. However, you will incur an additional processing fee of $0.37 for each transaction you make.

-

Is the OCBC BCIP good?

The OCBC BCIP is a good way to start investing if you only have a small sum of money to invest each month and are below 30 years old. It uses a dollar cost averaging approach, which helps you to remove emotions when you invest. However, the fees can be pretty hefty once you are above 30 years old. As such, you may want to consider alternative ways to invest instead.