Last updated on June 6th, 2021

Syfe offers 2 unique portfolios: Equity 100 and REIT+. Both of these portfolios are really unique but they cater to different needs that you may have.

So which portfolio should you be choosing?

Contents

Syfe Equity 100 vs REITs

Syfe Equity 100 invests in ETFs that are 100% concentrated in stocks. These ETFs are all listed on the US market, except for CSPX which is domiciled in Ireland. Meanwhile, Syfe REITs+ tracks the iEdge S-REIT Leaders Index. This focuses more on REITs listed on the SGX.

Both portfolios allow you to invest for different goals. You should invest in Equity 100 if you have a long term horizon and are aiming for capital appreciation. If you wish to receive a stable income, then REIT+ may be the better choice for you.

Here is a head-to-head comparison of these 2 portfolios:

Investing Strategy

Both of Syfe’s portfolios use different strategies to invest your funds:

Syfe Equity 100 uses a Smart Beta strategy

Syfe’s Equity 100 focuses on building a smart beta portfolio for you. This is sometimes referred to as factor-based investing.

Syfe aims to provide high returns by concentrating on a few factors. These factors are chosen to ensure that your portfolio will outperform a certain index. Currently, Syfe has selected these 3 factors:

- Growth

- Large-cap

- Low-volatility

Syfe will then select the best ETFs that are weighted towards these factors.

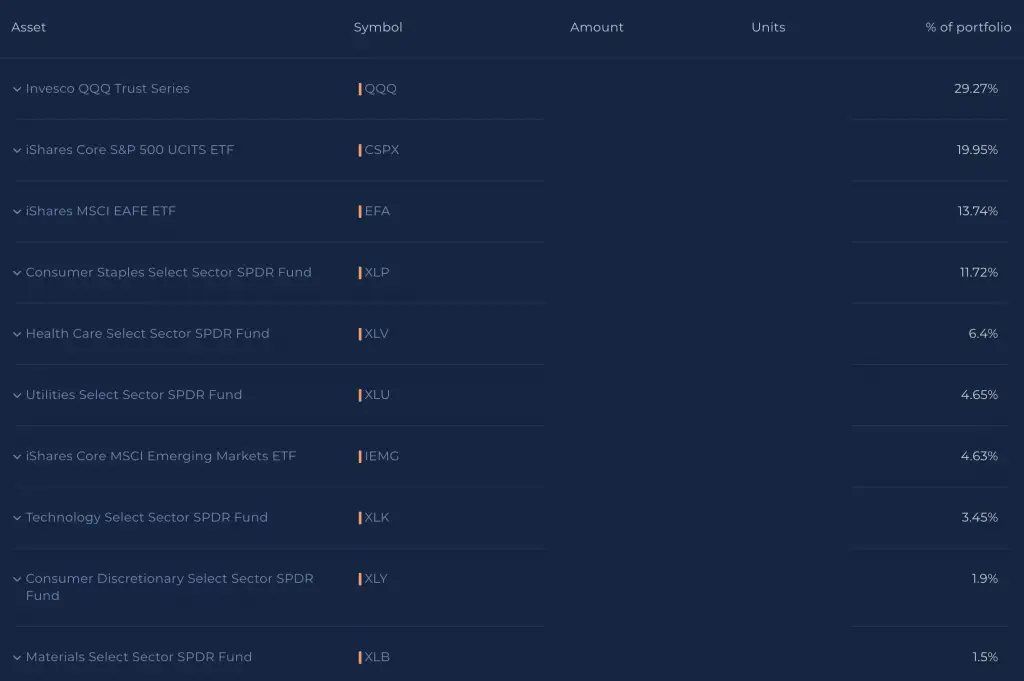

For example, the current portfolio is heavily weighted in the QQQ ETF. This will help to tilt the portfolio towards the growth and large cap factors. Meanwhile, the low-volatility factor is achieved by investing in multiple sector ETFs.

This is different from the original Fama-French 3-factor model, which focused on:

- Size of firms

- Book-to-market values

- Excess return on the market

Syfe will dynamically select the best factors for you

In the long run, the factors that give the best returns in the future may no longer be these 3 factors. As such, Syfe has a dynamic factor selection to choose the best factors in the current economic climate. Your portfolio will be over or under-weighted in certain factors to produce the highest risk-adjusted returns.

This helps to ensure that your portfolio will perform in any market condition!

Syfe REIT+ uses the ARI strategy (optional)

You are able to use Syfe’s Automated Risk-managed Investment (ARI) strategy in your REIT+ portfolio.

This strategy is a combination of 2 different approaches:

Essentially, your allocation to the REITs index is balanced with bonds. When the market is extremely volatile, a part of your REITs portfolio will be sold and bonds will be bought.

An example of a volatile time in the market is the COVID-19 pandemic.

Here’s how Syfe’s ARI strategy fared against the other 2 portfolios.

ARI dynamically allocates the amount of bonds it thinks you should have in your portfolio. This is based on the current economic regime we are in.

This ARI algorithm was first found in Syfe’s very first portfolio: Global ARI.

However, the maximum allocation your portfolio can have towards bonds is 50%. This means the amount of your funds being allocated into REITs will be 50% or more.

ARI helps to reduce your short-term volatility

From the diagram above, Syfe’s ARI algorithm helps to reduce the impact when prices start to fall.

When the prices start to rise, ARI’s performance is much better too.

In the long run, the ARI’s performance is much better compared to both approaches!

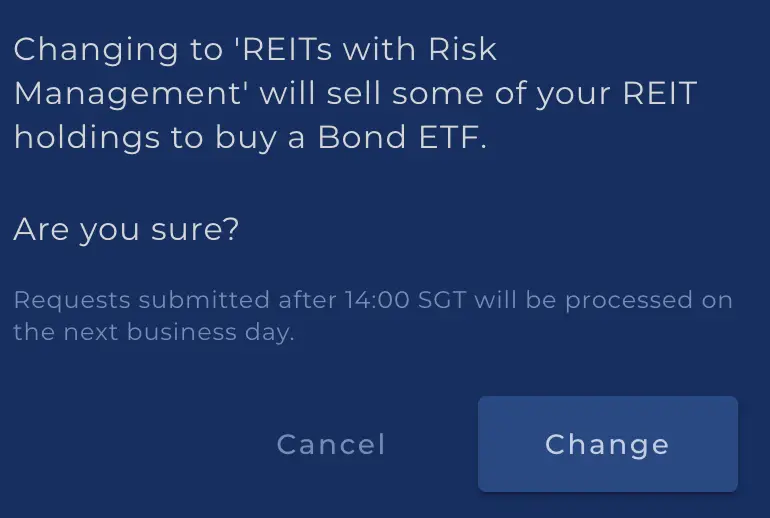

The ARI strategy is optional

When you first create your REIT+ portfolio, you are given 2 choices:

- 100% REITs

- REITs with risk management

You will only use the ARI strategy if you choose ‘REITs with risk management‘.

If you choose 100% REITs, you will just be following the iEdge S-REIT Leaders Index.

Type of Assets

Both of these portfolios invest in very different types of assets.

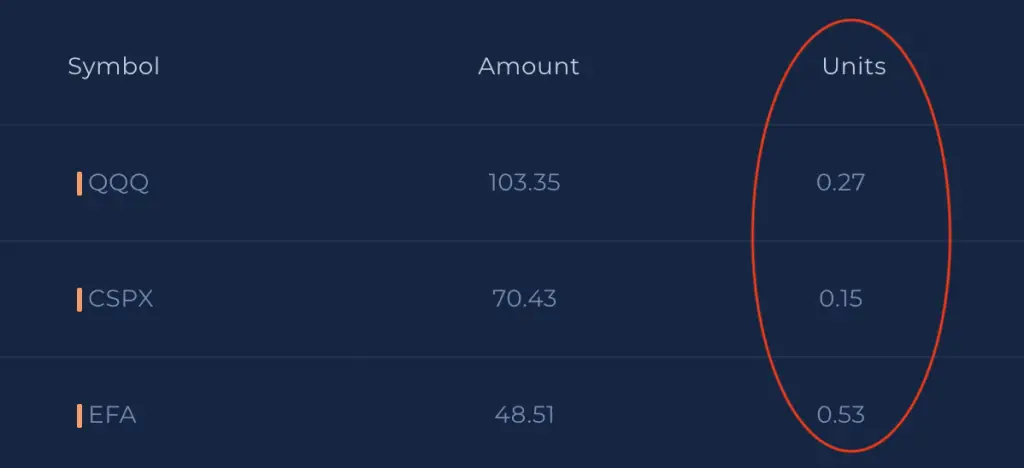

Equity 100 invests in 100% equities

In your Equity 100 portfolio, you will invest in a portfolio of equity ETFs. Here are some of the equity ETFs that Syfe will invest in:

Currently, Equity 100 is very heavily concentrated towards tech stocks (QQQ).

Since you are fully concentrated in stocks, you have the highest potential for returns. However, investing in stocks also come with extreme volatility!

It is only recommended that you invest in a 100% stock portfolio if you have a long time horizon. Usually, this will mean at least 40 years before your retirement.

This allows you to ride the short term volatility to have high returns in the long run!

Syfe REIT+ invests in Singapore REITs

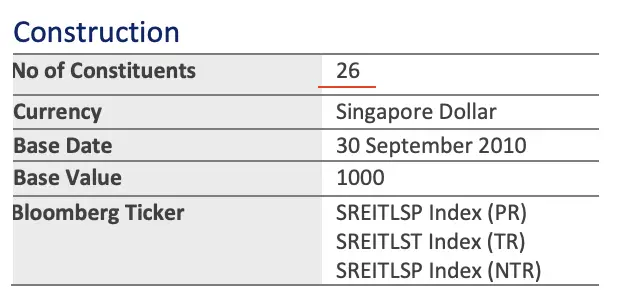

REIT+ tracks the iEdge S-REIT Leaders Index. This index measures the performance of the largest and most tradable REITs in Singapore.

This was previously called the iEdge S-REIT 20 Index. However, SGX changed it to the Leaders Index which now has 26 holdings instead.

Despite this change in the index, Syfe REIT+ still tracks the top 20 holdings out of the 26 holdings in the Leaders Index.

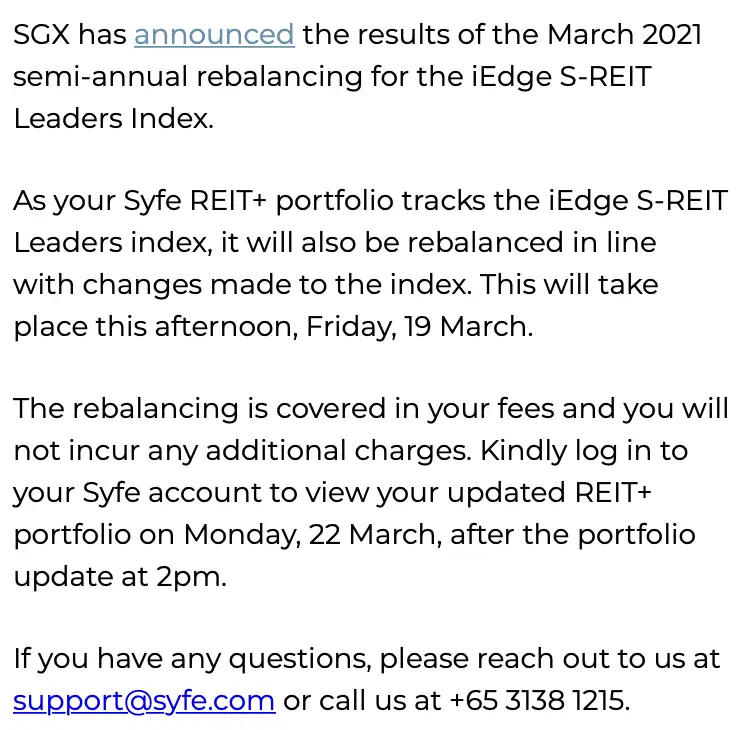

Your portfolio may rebalance based on the index

SGX does a semi-annual rebalancing of their iEdge S-REIT Leaders Index. Whenever there are changes to the index, Syfe will rebalance your portfolio based on the index.

In the most recent change, 2 new REITs were added, while one was removed.

An additional REIT was added as there was a merger of CapitaLand Mall Trust and CapitaLand Commercial Trust.

REITs provide you with a stable income

REITs are extremely popular among Singaporeans as they provide you with regular and attractive dividend yields.

So long as these properties are able to collect steady rental income, you will be able to receive regular dividends from them.

As such, you should not be too worried about capital appreciation when it comes to REITs. Instead, you should be looking for one that is able to provide stable dividend yields.

If you would like to track the dividends that you are earning, you can use a platform like StocksCafe to do so.

You will have a bond component if you opt for the ARI strategy

If you have opted for the ARI strategy, a part of your REIT+ portfolio will be in bonds.

Syfe has chosen the ABF Singapore Bond Index Fund (A35) to be used as the bond component.

If you are wondering about the different types of bond ETFs, you can view my comparison of A35 against MBH.

The percentage of the bond component depends on the ARI algorithm. The algorithm manages your REIT+ portfolio to maintain a downside risk of 15%.

Syfe manages your assets by co-mingling them with the assets of their other customers. This means that all assets are held in a single custodian account.

As such, you will be able to invest in fractional shares for both portfolios.

When you are able to invest in fractional shares, you are able to fully invest your funds. You do not need to worry about the price of each ETF!

However, there comes a risk if Syfe closes down like Smartly did in early 2020. Since your assets are co-mingled, you may not be able to sell off your fractional shares.

As such, you do not have full control over the fate of your assets!

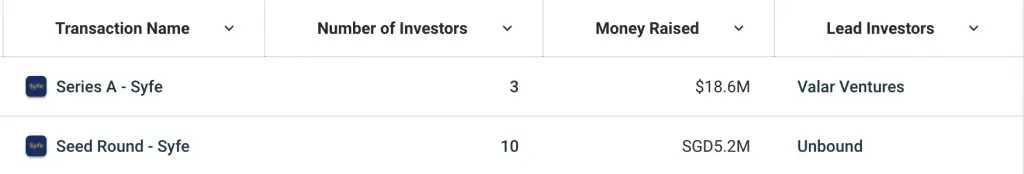

Syfe has received substantial funding

However, you may not need to worry so much about Syfe closing down. Syfe managed to secure USD$18.6 million in their Series A funding.

They received SGD$5.2 million in their seed funding too.

This alone doesn’t mean that Syfe is truly profitable. However, it is a good indicator that investors are confident in this company.

As such, this should give you some confidence that Syfe is here to stay!

Performance

There is no direct comparison between the returns of these 2 portfolios. However, here is how Syfe has reported on the performance of both portfolios.

Equity 100 had a 13.2% annualised return for the last 10 years

When Syfe backtested their Equity 100 portfolio, it gave an average annual return of 13.2% for the last 10 years.

This is pretty comparable to the S&P 500 and MSCI World indexes.

If you would like to backtest your investment strategy, PyInvesting is something you may want to consider.

Overall, Equity 100 gives a very decent return as stocks have a very high potential for good returns.

However, you will need to stay invested in the long term to be able to reap these rewards!

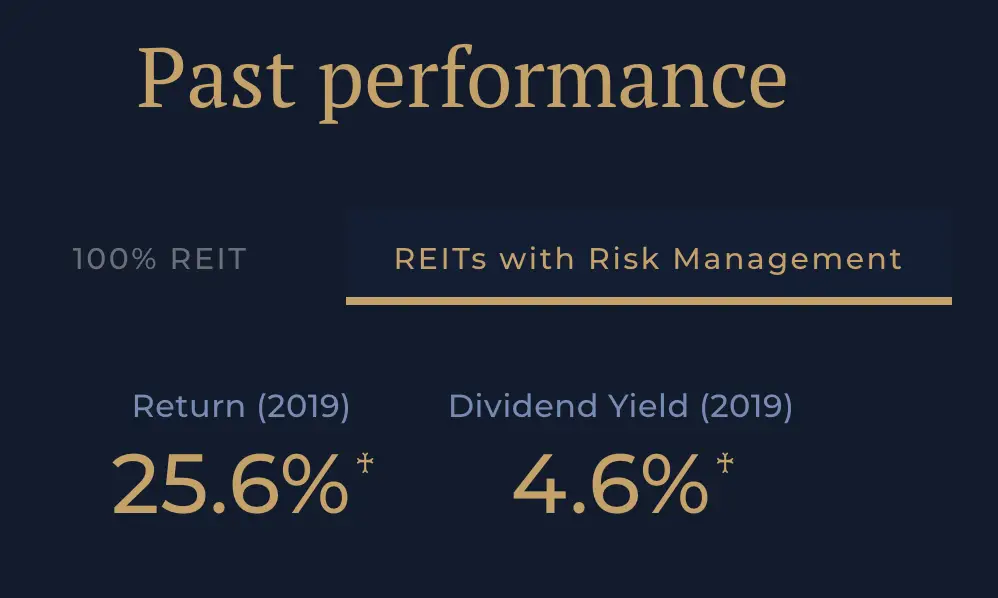

REIT+ had a 27.1% return in 2019

Here are the backtested returns of the REIT+ portfolio.

The portfolio provided a very decent 27.1% return in 2019. However, this was because REITs had an extremely good year!

It would be best that you do not expect this kind of returns every year.

REIT+ had a dividend yield of 5.1% in 2019

Syfe also provided a very decent dividend yield of 5.1% in 2019. If you are looking for a portfolio to receive a stable income, the REIT+ portfolio is something you should consider.

Returns are slightly lower if you included ARI in your portfolio

If you selected REITs with Risk Management, your returns would have been slightly lower.

This will be expected as a portion of your portfolio is in bonds. As such, the returns that you’ll receive will be slightly lower.

However, having bonds in your portfolio will help to reduce the short term volatility!

Minimum Sum

Both portfolios do not require you to have a minimum sum to start investing. This makes the portfolios very accessible even if you have a small sum!

You are able to invest with even $1 as Syfe invests in fractional shares.

Fees

Here are the fees that you’ll need to pay when you invest in either portfolio.

Both portfolios have the same pricing structure under Syfe

Both portfolios are managed by Syfe. As such, they will have the same management fees being charged:

| Total Amount Invested | Management Fee |

|---|---|

| < $20k | 0.65% |

| ≥ $20k and < $100k | 0.50% |

| ≥ $100k | 0.40% |

The management fees are pretty reasonable for a robo-advisor. It is slightly lower compared to StashAway’s fee of 0.8% for the first $25k invested with them.

You can read my comparison between Syfe Equity 100 and StashAway’s 36% portfolio to see which one is more suited for you.

You will need to pay an expense ratio for the ETFs in Equity 100

On top of the management fees, you will need to pay for the expense ratios of the ETFs in Equity 100.

Here are the expense ratios for the ETFs in Equity 100:

| ETF | Expense Ratio |

|---|---|

| QQQ | 0.20% |

| CSPX | 0.07% |

| EFA | 0.32% |

| XLP | 0.13% |

| XLV | 0.13% |

| XLU | 0.13% |

| IEMG | 0.13% |

| XLK | 0.13% |

| XLY | 0.08% |

| XLB | 0.13% |

| IJH | 0.05% |

| IJR | 0.06% |

Adding both the management fees and the expense ratio, your total fees with Equity 100 may reach around 1%!

No expense ratio for REIT+

REIT+ tracks the iEdge S-REIT Leaders Index directly. You do not need to buy an ETF to track this index.

As such, you will not have an added layer of fees that you will need to pay. This helps you to reduce the amount of fees that you need to pay when investing with REIT+!

As such, you will only need to pay the 0.65% management fee for your first $20k with Syfe.

If you choose the REIT+ portfolio with risk management, you will still incur A35’s expense ratio of 0.25%. However, this depends on the amount of your funds being allocated towards bonds.

You will not incur any trading commissions which are the main fees charged by online brokerages like Tiger Brokers.

You will incur withholding taxes with Equity 100

Equity 100 invests in ETFs that are domiciled in either the US or Ireland. As such, you will incur a dividend withholding tax from these ETFs.

Here are the amount of taxes you will incur:

| CSPX | All other US ETFs | |

|---|---|---|

| Dividend Withholding Tax | 30% | 15% |

CSPX is the only ETF in Equity 100 that is domiciled in Ireland. All the other ETFs in Equity 100 are domiciled in the US.

You can read my comparison between CSPX and S27 to see how an Irish-domiciled ETF may be more cost effective.

No dividend withholding tax for REIT+

The REITs that you invest using REIT+ are all listed on the SGX. As such, you will not incur any dividend withholding taxes on the REITs’ dividends!

If you are investing in REIT+, the amount of fees you pay is much lower than Equity 100.

You may be subject to estate tax with Equity 100

Syfe’s Equity 100 mainly invests in US-domiciled ETFs. As such, you may be subject to an estate tax when you pass on.

An estate tax is a tax on the right to transfer your estate to someone else.

The only exception is CSPX, which is an Irish-domiciled ETF. Ireland does not have an estate tax, unless:

- You or the beneficiary are Irish citizens

- You own property in Ireland

Syfe claims that you should not be subject to any estate tax. This is because your assets are held in a co-mingled account. Since you are not investing as an individual, you should not be subject to this tax.

However, they have added a disclaimer, which shows that they are unable to give a definite answer!

No estate tax for your funds in REIT+

The REITs that you invest in REIT+ are all domiciled in Singapore. As such, you will not be subject to any estate tax at all!

Currency conversion for Equity 100

Equity 100 invests in ETFs which are denominated in USD. As such, you will incur another cost which is the currency conversion fee.

This occurs when you convert your SGD to USD to invest in these ETFs.

When you decide to withdraw your funds from Equity 100, the exchange rate may eat slightly into your returns.

No currency conversion required for REIT+

The REITs in REIT+ are all listed in the SGX. As such, they are all denominated in SGD!

Again, you incur very few costs when investing in REIT+.

Verdict

Here’s a breakdown of these 2 portfolios:

| Equity 100 | REIT+ | |

|---|---|---|

| Investing Strategy | Smart Beta | ARI (optional) |

| Assets | 100% stocks | 100% REITs OR REITs + bonds |

| Fractional Shares | Yes | Yes |

| Minimum Sum | None | None |

| Dividend Withholding Tax | 15% for CSPX 30% for rest | None |

| Estate Tax | Maybe | No |

| Fees | Management fee Expense ratio Currency exchange risk | Only management fee |

Which portfolio should you be choosing?

Choose Equity 100 if you have a long time horizon

Equity 100 has a very high potential to give you good returns in the long run. However, stocks are extremely risky assets.

In the short term, the price changes may be very volatile due to the market sentiments. However, the stocks will perform much better in the long run!

As such, you are recommended to invest in this portfolio if you have a long time horizon. This will allow you to ride through the short term volatilities and receive good returns in the end.

If you have a short time horizon, you are not recommended to invest in Equity 100. The markets are very volatile in the short term.

As such, you may withdraw your portfolio at a loss if the markets start to crash!

Equity 100 is a good option to form the growth portion of your entire portfolio. The amount that you should put into Equity 100 really depends on your risk profile!

Choose REIT+ if you want a stable income

If you prefer to invest in something that provides you with dividends, REIT+ is something that you should consider.

Moreover, the costs are really low as you do not need to pay an expense ratio of an ETF!

One thing you may wish to note is that you can only receive dividend payouts when you are a Black tier customer.

This means that you’ll need to invest a minimum of $20k with Syfe to start receiving your payouts.

Syfe REIT+ can be used as your dividend portion of your investing portfolio. It is more of a defensive position that can help you to earn stable dividends over time.

Conclusion

Syfe has 2 very unique portfolios in Equity 100 and REIT+. In fact, it is even possible to use both portfolios together!

This is because the assets that they invest in are very different from each other.

The portfolio that you ultimately choose to invest in may depend on these factors:

- Your time horizon

- Whether you want to have capital appreciation or fixed income via dividends

- The fees you are willing to pay

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 6 months.

You will be able to save up to $75 worth of fees!

You can view more information about this referral program on Syfe’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?