Last updated on June 6th, 2021

You may decide to invest in a FTSE All-World ETF managed by Vanguard. However, you see that Vanguard offers both VWRD and VWRL!

So how exactly are these 2 ETFs different?

Contents

The difference between VWRD and VWRL

VWRD and VWRL are exactly the same ETF. However, VWRD is denominated in USD while VWRL is denominated in GBP. You should have a very similar performance between either ETF when you compare them in the same currency.

Here is an in-depth comparison between these 2 ETFs:

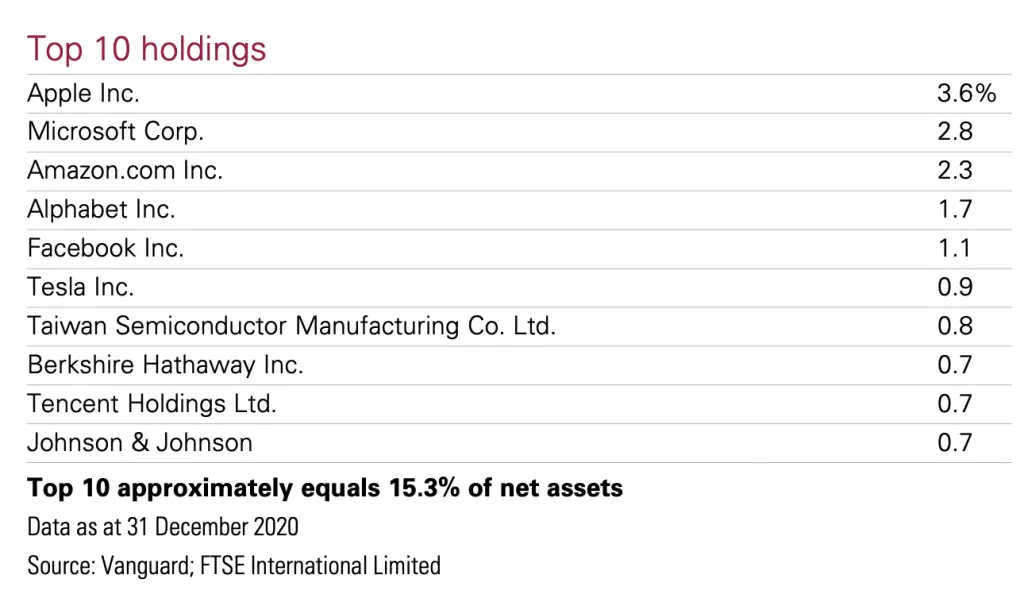

Same index tracked

VWRD and VWRL both track the FTSE All World Index.

The FTSE All World Index tracks large and mid-sized company stocks in both developed and emerging markets

Vanguard

This means that both ETFs will hold the same stocks in the same proportion.

Different currency denomination

VWRD is denominated in USD, while VWRL is denominated in GBP on the London Stock Exchange (LSE).

Since both ETFs are listed on the LSE, you can purchase them with a minimum unit of 1.

This is how both ETFs look like on Tiger Brokers.

VWRL can be denominated in other currencies when it is listed on other exchanges!

Besides the LSE, VWRL is listed in 3 other exchanges:

- SIX Swiss Exchange

- NYSE Euronext

- Borsa Italiana S.p.A.

Here are the different currencies, based on the exchange this ETF is listed on:

| Stock Exchange | Ticker | Currency |

|---|---|---|

| London Stock Exchange | VWRL | GBP |

| SIX Swiss Exchange | VWRL | CHF |

| NYSE Euronext | VWRL | EUR |

| Borsa Italiana S.p.A. | VWRL | EUR |

VWRD is also listed on the Bolsa Mexicana De Valores! As such, VWRD is listed on 2 exchanges:

| Stock Exchange | Ticker | Currency |

|---|---|---|

| London Stock Exchange | VWRD | USD |

| Bolsa Mexicana De Valores | VWRD | USD |

You can view all of these information on Vanguard’s factsheet.

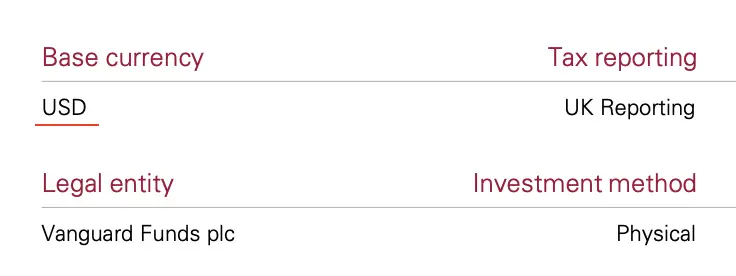

One thing that you may want to note is that all these ETFs have their base currency in USD. However, the currency in which they are denominated in depends on the exchange this ETF is listed on.

You can view my guide to see what are the best ways to buy LSE ETFs from Singapore.

Their performance should be very similar

If you want to compare the performance between VWRD and VWRL, it may be slightly different based on the currency denomination.

However to make a fair comparison, you will need to compare the net asset value of both ETFs instead.

This is because both ETFs have the same holdings in the same proportion. This means that their net asset value should be very similar.

As such, you should not be too worried about comparing the performance of these ETFs against one another.

Both are distributing ETFs

VWRD and VWRL are both distributing ETFs. They will pay you a dividend every quarter.

This is different from accumulating ETFs which reinvest your dividends instead.

This is great if you wish to receive some dividend income every 3 months!

Dividends are paid in USD

Even though the ETF may be denominated in another currency, the base currency of this fund is in USD.

As such, your dividends will still be distributed in USD, even though the ETF is listed in another currency.

Fund domicile

Since they are the same UCITS ETF, both VWRD and VWRL are Irish domiciled.

This has some implications on the taxes you’ll incur:

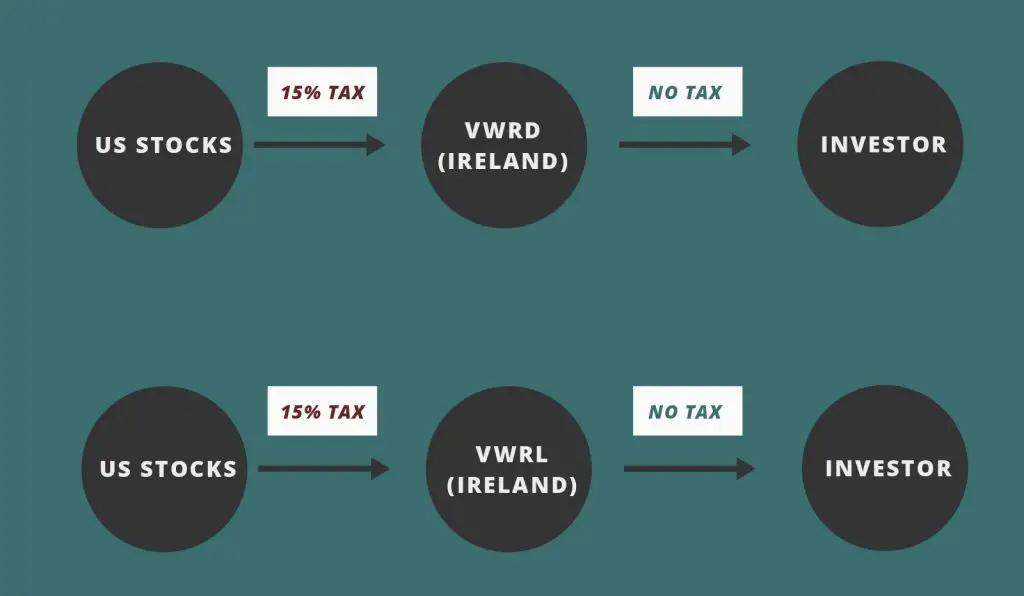

15% dividend withholding tax for non-resident aliens of USA

If you are a non-resident alien to the US, you will normally incur a 30% dividend withholding tax on your US assets.

However there is a tax treaty between Ireland and US. Any dividends you receive from an Irish-domiciled ETF will only incur a 15% withholding tax!

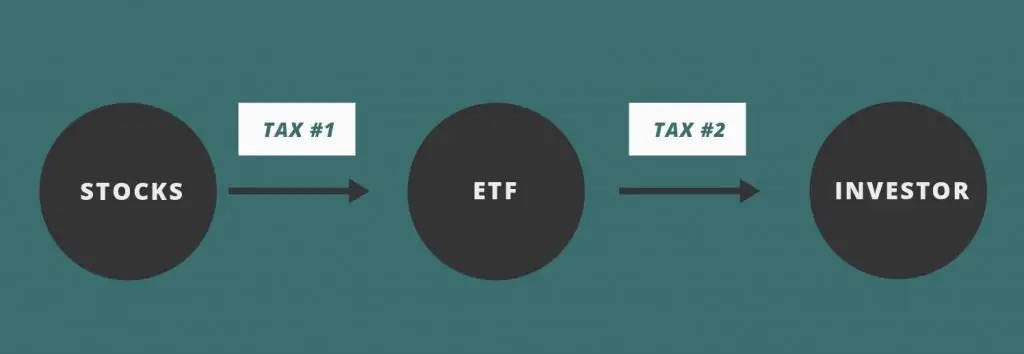

2 layers of taxes

For any ETF, the fund manager buys the stocks based on the index they are tracking. The dividends that they distribute are collected from the stocks in their fund.

As such, there are 2 layers where you may incur some taxes:

- From stock to ETF

- From ETF to you, the investor

Both ETFs incur the tax on the first layer

For both ETFs, the dividends from the US stocks are distributed to an Irish-domiciled ETF. As such, the 15% withholding tax applies on the first layer.

Irish-domiciled ETFs are only advantageous for US stocks

You may want to incur a lower dividend withholding tax via Irish-domiciled funds. However, this only applies to US stocks.

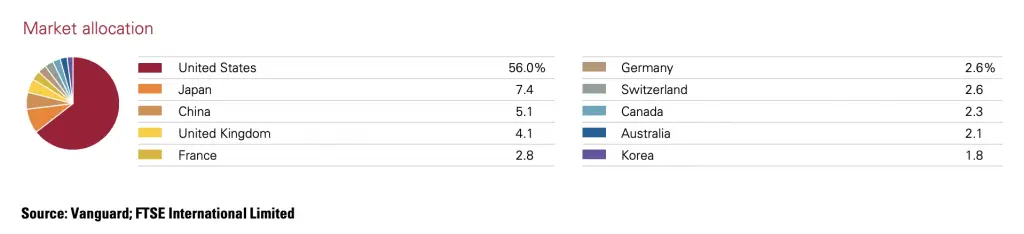

When you invest in these ETFs that track the FTSE-All World Index, not all of the stocks come from the US.

Here are some of the withholding taxes that you’ll incur when these stocks distribute their dividends:

The main advantage of investing in an Irish-domiciled ETF is that you’ll reduce the withholding taxes from US stocks.

This is rather significant since more than 50% of the index’s holdings come from the US!

However, the withholding taxes still remain the same for stocks that come from other countries.

If you wish to track your dividends with the taxes accounted for, you can consider trying out StocksCafe’s platform.

No estate tax for non-Irish citizens

Even though both ETFs own stocks that are from the US, both ETFs are domiciled in Ireland.

With this fund structure, you will not incur the dreaded US estate tax if you invest with these UCITS ETFs!

This will give you significant tax savings, as none of your assets will be taxed.

However, you may still be taxed under the Irish laws if:

- Either you or your beneficiary is an Irish citizen

- You own a property in Ireland

Expense ratio

Since VWRD and VWRL are essentially the same ETF, they will have the same expense ratio as well.

The expense ratio helps to cover some of the expenses that the fund manager incurred while managing the fund.

Both ETFs have the same expense ratio of 0.22%.

As such, the cost of investing is the same even if you invest in either ETF.

Liquidity

If you are looking to actively trade using these ETFs, you may want to look at their liquidity. One of the indicators you may want to look at is the ETF’s trading volume.

Here are the average trading volume for both ETFs listed on the LSE:

| VWRD | VWRL | |

|---|---|---|

| Average Trading Volume | 49,000 | 27,000 |

VWRL has a slightly lower trading volume compared to VWRD. However, this difference in trading volume may not really make much of a difference in the end!

Verdict

There are so many similarities between these 2 ETFs. So which one should you invest in?

VWRL is suitable if you live in the UK

Your base currency is in GBP if you live in the UK. As such, it may be better if you invest in VWRL instead.

This is because you do not need to exchange your GBP to another currency to start investing in this ETF!

By investing in VWRL, you will save on any currency conversion fees you may incur. Moreover, you are not subject to any fluctuations in the exchange rate!

VWRD is suitable if you live in the US

If you live in the US or other countries that have the USD as your base currency, VWRD may be the more suitable choice.

Again, you do not need to change your currency to another one. This means that:

- You do not incur any currency exchange fees

- You are not subjected to any currency fluctuations

Either ETF is suitable if your base currency is neither GBP or USD

If you live in other countries, your base currency will not be in USD or GBP. As such, you’ll still need to convert your base currency to either USD or GBP to invest in this FTSE All-World Index ETF.

It does not really matter which currency you choose. Ultimately, both ETFs will give you very similar returns!

Conclusion

VWRD and VWRL are 2 different names for exactly the same ETF. In the end, the only thing you’ll need to consider between these 2 ETFs is the currency you wish to invest in!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?