Last updated on October 31st, 2021

You’ve decided to purchase some Irish-domiciled ETFs from the London Stock Exchange in UK.

However, there are not many brokers in Singapore that allow you to do so!

Which brokers offer the LSE, and which one should you choose?

Here’s what you need to know:

Contents

How to buy LSE stocks in Singapore

There are 4 ways you can buy LSE stocks and ETFs in Singapore:

- Saxo

- Interactive Brokers

- Standard Chartered Trading

- Singaporean Retail Brokers

Here is each broker reviewed in-depth:

Saxo

Saxo is one of the brokers that provides you with access to the London Stock Exchange. Here are some of the fees that you may incur when trading with this broker:

Trading commissions

Here are the trading commissions that you’ll incur when you make a trade with Saxo:

| Exchange | Commission | Minimum |

|---|---|---|

| LSE | 0.10% | 8 GBP |

| LSE International Order Book (IOB) | 0.10% | 20 USD |

The International Order Book is only applicable to stocks that want to have a secondary listing on the LSE!

When you trade on the LSE, there may be some ETFs that are denominated in USD instead of GBP. Some of these ETFs include CSPX and IWDA.

So how does this affect the minimum commission?

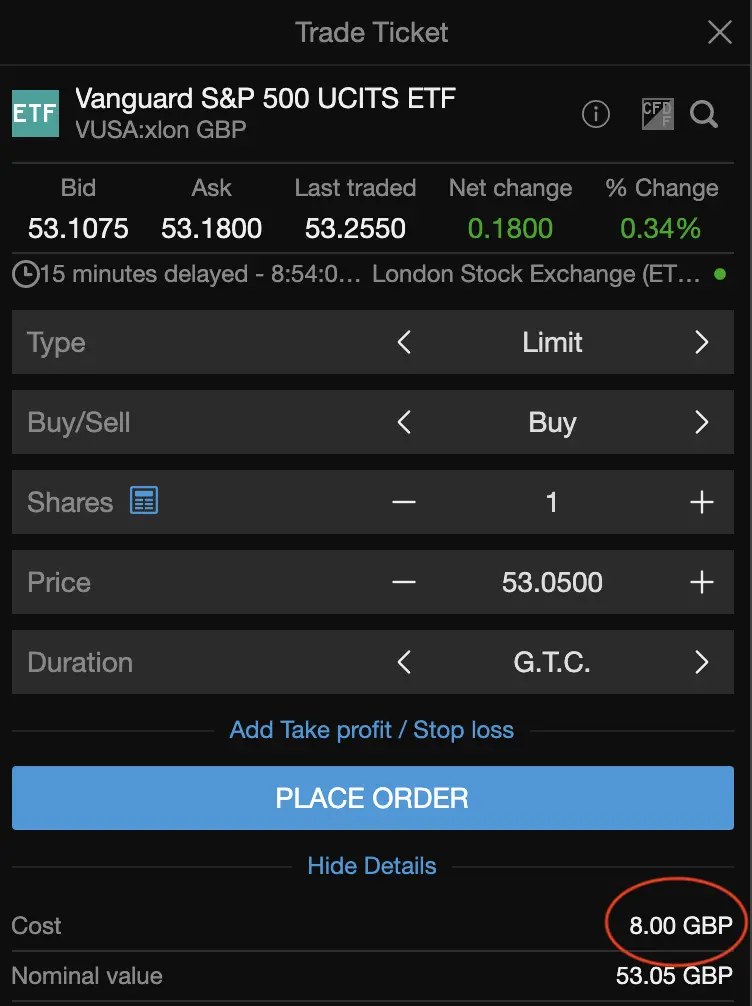

Here is what I found from the Saxo demo platform:

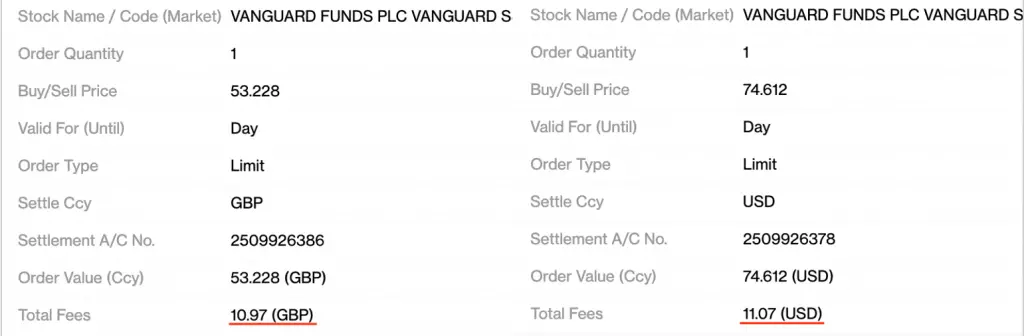

When you trade a GBP-denominated ETF such as VUSA, the minimum commission is 8 GBP.

However when you want to buy a USD-denominated ETF like VUSD, the minimum commission is now 11 USD!

8 GBP costs around 11 USD, based on the current exchange rate. This means that you’ll be paying an equivalent of 8 GBP in USD for USD-denominated stocks!

Custody fee

Saxo charges a 0.12% custody fee per year that you use their platform.

This fee is calculated daily based on the value of your stocks at the end of the day. You are then charged this fee on a monthly basis.

This is similar to the management fees that robo-advisors charge!

Essentially, this fee will eat into your returns by 0.12% each year.

Foreign exchange (FX) fees

You will most likely be transferring SGD into your Saxo account to make a trade.

However when you want to make a trade in another currency like USD or GBP, you will need to exchange your SGD to that currency.

Saxo charges you with a currency conversion fee of 0.75%, which can be really hefty.

Moreover, Saxo has a spread of 0.3%, which will eat into your returns.

Moreover, you are able to open sub-accounts for different currencies. Essentially, you have a multi-currency account within Saxo!

If there are other platforms that provide more attractive exchange rates, you can use those and deposit into your sub-accounts too.

However, the currency that you deposit must match the denomination of the account you deposit into.

If it doesn’t match, Saxo will exchange your currency using the prevailing exchange rate.

No inactivity fee

Saxo does not charge an inactivity fee for Singaporean accounts. While they charge this fee for US accounts, you will not incur this fee if you are using Saxo Markets.

No withdrawal fees

Saxo does not charge any withdrawal fees when you use their online module to make the request.

This is similar to other brokers like Tiger Brokers!

Verdict

Overall, Saxo does provide affordable commissions for trading on the LSE. The main issue with Saxo is the 0.12% custodian fee.

This can really eat into your returns in the long run!

Interactive Brokers

Interactive Brokers is another online broker that gives you access to the LSE. Here are some of the things you need to know when you want to use this broker:

Trading Commissions

There are 2 pricing structures that you can use with Interactive Brokers:

| Account Type | Definition |

|---|---|

| Tiered | Commission charged is based on your investment amount Clearing and exchange fees are separate from the commission |

| Fixed | A fixed commission is charged for all trades Clearing and exchange fees are included |

The commissions that you are charged are dependent on the type of account you choose:

| Account Type | Commission | Minimum |

|---|---|---|

| Tiered | 0.05% (if trade value is < 40,000,000 GBP per month) | GBP 1 |

| Fixed | None | GBP 6 or USD $5 |

Both of these commissions are lower than Saxo!

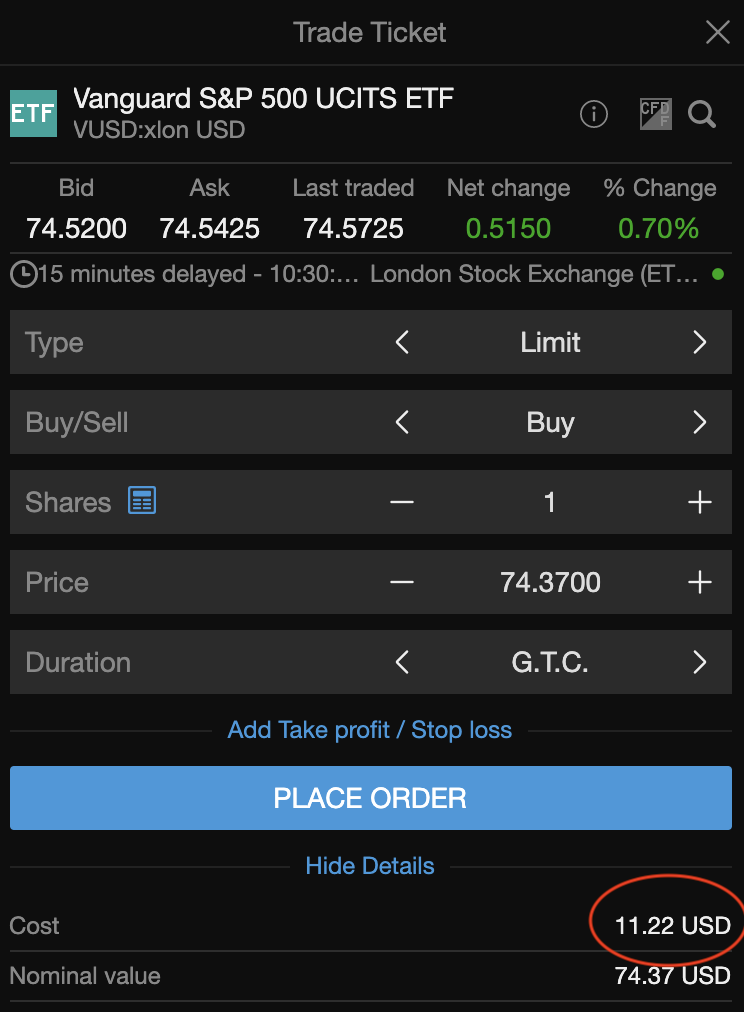

Here is how the fees will look like when you’re buying GBP and USD-denominated ETFs on the fixed structure:

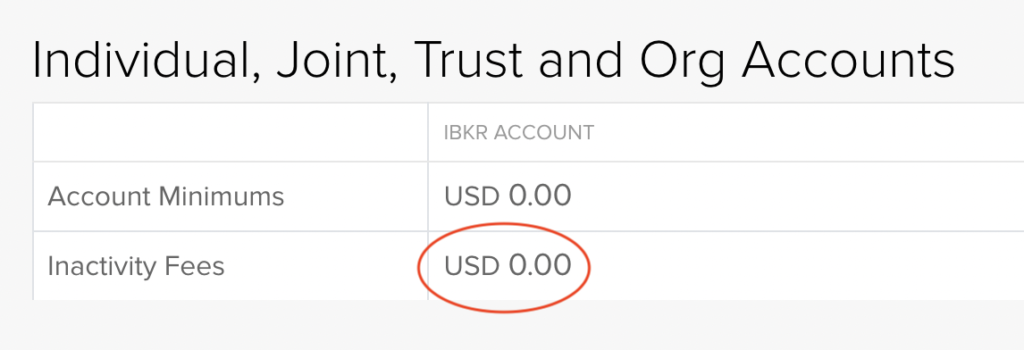

Interactive Brokers no longer has an inactivity fee

Previously, Interactive Brokers charged an inactivity fee if you did not pay USD$10 in commissions a month. However, this has now been abolished!

Since you do not pay this fee, it makes trading with Interactive Brokers really cheap. If you intend to dollar-cost average and only make one trade per month, this greatly reduces the costs you’ll incur!

Currency conversion

Interactive Brokers also allows you to convert your currency on their platform.

The pricing is slightly different from Saxo:

0.2 basis points (0.002%) * trade value, minimum of USD2 per order

Depending on the amount that you choose to invest, it could be slightly cheaper compared to Saxo.

No custody fee

Unlike Saxo, you do not have a custody fee. Instead you are charged the monthly fee of USD $10 if you have less than USD $100k!

Since this can be offset by your commissions, you may not have to pay much in terms of ‘custody fees’!

Deposit and withdrawals

You are able to deposit your money via a variety of methods. This includes:

- Wire transfer

- US ACH

- Check

The most common way would be to transfer your funds via wire transfer.

You are able to make withdrawals from your account too. However, you can only make one free withdrawal request each month!

After that, you will be charged SGD $15 for a wire transfer.

Verdict

Interactive Brokers does provide a very decent trading platform. This is mainly due to its lower commissions.

The main problem is that the platform can be rather confusing if you are a beginner investor.

If you are willing to go through all of the hassle, you can consider trying out Interactive Brokers.

Standard Chartered Trading

Standard Chartered has a trading platform that allows you to purchase stocks and ETFs listed on the LSE, such as IWDA.

Here’s what you need to know about this platform:

Trading commissions

Here are the commissions that Standard Chartered charges you for each trade. This depends on whether you have Priority Banking or not.

| Account Type | Commission | Minimum |

|---|---|---|

| Personal Banking | 0.25% | 10 USD or GBP |

| Priority Banking | 0.20% | None |

You will be charged 7% GST on every commission that you make. For example, you will be charged a minimum of GBP $10.70 if you are just a personal banking client!

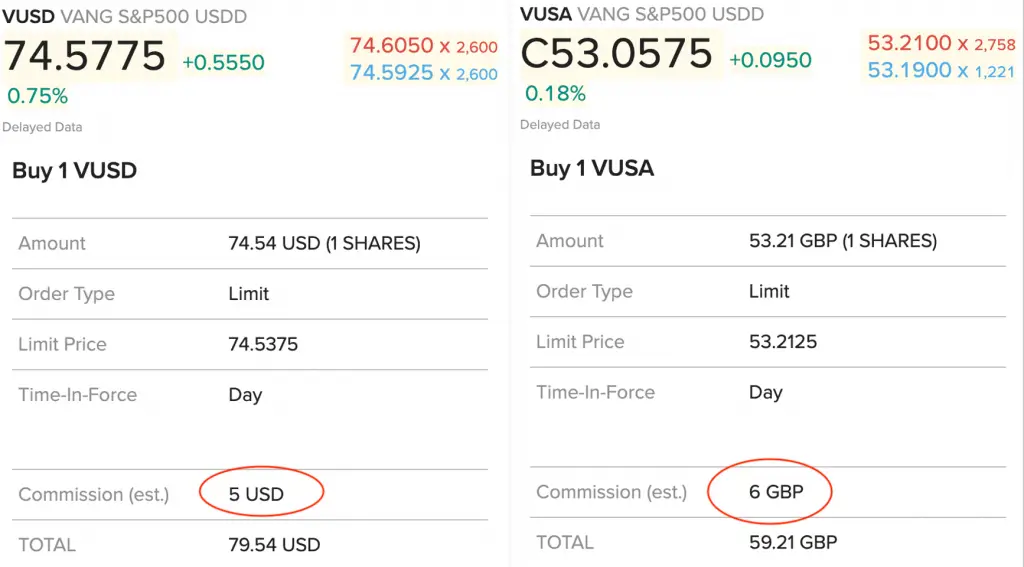

Here are the charges when you buy either VUSA or VUSD on Standard Chartered.

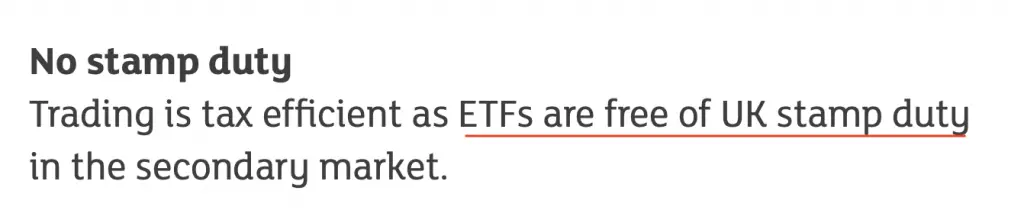

The fees that you pay in the commissions include the 1% stamp duty fees. However, you will not be charged this fee when you actually pay for the trade!

This is because the LSE does not charge a stamp duty for any ETFs that you buy.

Even though Standard Chartered’s fees includes the stamp duties, you will not be charged that amount when your fees are deducted!

The commissions that Standard Chartered charges are much higher compared to Saxo or Interactive Brokers. However, this broker still has some other advantages.

Foreign exchange fees

Standard Chartered does not charge any foreign exchange fees.

There are 2 ways that you can exchange your SGD to USD or GBP on their platform:

- LiveFX

- Direct transfer to Securities Settlement Account

You will be charged around 0.4% for exchanging your currency on Standard Chartered, based on other reports.

The exchange rates are pretty competitive, although Interactive Brokers offers better rates.

No custody fees

Standard Chartered does not charge any custody fees, unlike Saxo. It also does not have any activity fees like Interactive Brokers.

As such, the main fees you’ll be paying are your trade commissions. If you are a buy and hold investor, this may be a cheaper alternative compared to Saxo or Interactive Brokers.

However, you’ll need to consider the amount that you wish to invest first!

This will help you to decide which platform is the most worth it for you.

Withdrawal and deposits

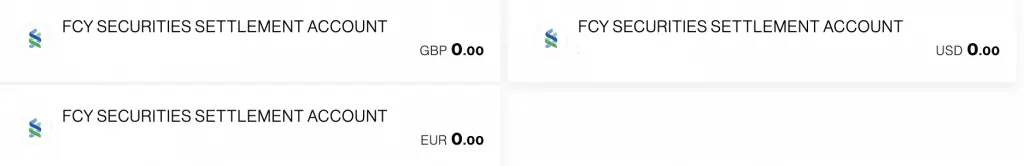

When you open your trading account with Standard Chartered, you will be asked to open multiple Securities Settlement Accounts. These accounts are in different currencies that you can trade in.

If you have any Standard Chartered accounts like the JumpStart account, you can easily transfer between your accounts!

These accounts are also pre-funded accounts. This means that you’ll need to have money inside your account first, before you can make a trade.

This is similar to DBS Vickers’ Cash Upfront account.

As such, Standard Chartered is the easiest to move your money around.

Verdict

Standard Chartered is a pretty attractive option to trade LSE stocks. However, the interface is pretty outdated, and the commissions are slightly higher.

What you do get instead is an easy method of transferring money to and from your bank account!

Singapore Retail Brokers

The final option you can buy LSE stocks from are Singapore Brokers.

However, the costs involved are just too high to consider trading with any of them!

You will be better off using the first 3 platforms, especially if you are a frequent trader!

6 Singaporean brokers offer access to the LSE

There are 6 Singaporean brokers that allow you to trade in the LSE. This includes:

Their commissions are extremely pricey

Here are the commissions that you’re charged for each broker:

| Broker | Commission | Minimum |

|---|---|---|

| OCBC Securities | 0.70% | GBP 55 / EUR 70 / USD 95 |

| POEMS | 0.4% | GBP 25 |

| Maybank Kim Eng | 0.30% | GBP 20 |

| KGI Securities | 0.50% | GBP 50 |

| DBS Vickers | 0.25% (Cash Upfront) 0.35% (Cash) | GBP 20 / EUR 26 / USD 28 (Cash Upfront) GBP 25 / EUR 33 / USD 36 (Cash) |

| UOB Kay Hian | 0.35% | GBP 35 / EUR 33 / USD 36 |

The commissions are extremely hefty! Based on this alone, it is definitely not worth trading with any of these brokers.

What’s more, some of these brokers may charge GST on your commissions, making it even more costly!

Custodian fee

When you trade with these brokers in foreign stocks, you may need to pay a custodian charge.

All of these brokers have the same charge of $2 per counter per month (max of $150).

However, the custodian charge can be waived if you make a certain number of trades, either:

- 2 trades in the same calendar month

- 6 trades in the same calendar quarter

This may be equivalent to an inactivity fee charged by these brokers.

Verdict

I do not think it is worth even considering any of these brokers, unless you intend to trade large sums each time.

The fees that you incur are just too high, and there are cheaper options out there!

Things you need to know when trading on the LSE

Apart from choosing a broker, here are some things you may want to know when trading on the LSE:

Market fees

The LSE has some market fees as well. This is similar to the 0.04% fees that are charged on the SGX.

Here are some of the fees that you’ll incur:

| Fee | Amount |

|---|---|

| Stamp Duty (UK-domiciled) | 0.5% |

| Stamp Duty (Irish-domiciled) | 1% |

| Transaction levy (if trade is > 10,000 GBP) | 1 GBP |

The stamp duties only apply to buy trades, and only to stocks (not ETFs).

Minimum unit

You are able to buy just a single unit of each stock or ETF on the LSE. This is different from the SGX, which has a minimum lot size of 5-100!

This makes the stock or ETF more accessible for you. However, you’ll need to consider the commissions that you incur for each trade too.

Due to the minimum commissions, it may not be worth investing in such small amounts!

Trading hours

Here are the trading hours in the LSE in Singapore time (GMT +8).

| Type | Time |

|---|---|

| Normal | 1600-1230 |

| Daylight Savings Time | 1500-1130 |

Verdict

Which broker should you be choosing to purchase stocks on the LSE? Ultimately, it comes down to a few decisions you need to make:

- The commissions you want to pay for each trade

- The costs you incur when exchanging your SGD to USD or GBP

- The custodial or inactivity fees you incur

- The ease of withdrawing and depositing your funds

I believe it boils down to the 3 main brokers:

- Saxo

- Interactive Brokers

- Standard Chartered

These brokers have very different pricing structures. As such, it is hard to give a true comparison between them.

However, here are the pros and cons of each broker:

| Broker | Pros | Cons |

|---|---|---|

| Saxo | Low commissions | 0.12% custody fee 0.75% FX conversion fee |

| Interactive Brokers | Low commission Low FX rates No inactivity fee | Transferring and exchanging money may be a hassle |

| Standard Chartered | No custody fees Easiest to deposit and withdraw money | FX spread may be high Commissions are the highest among the 3 |

With Saxo’s high exchange fees, it may not be that worth it after all.

In my opinion, here’s what I think is the best:

Standard Chartered is good for lump sum investments

Standard Chartered is good if you intend to do a lump sum investment. This is because:

- There are no custody fees charged

- The only fees you incur are the trading commissions

As such, you’ll essentially pay the commission when you make the trade. There are no other fees that you’ll need to pay!

However, it can get pretty expensive if you intend to do a dollar-cost averaging method instead!

Interactive Brokers is good if you want to do dollar cost averaging

If you intend to invest into an ETF or stock monthly, Interactive Brokers may be the better option.

This is because:

- They have the lowest trading commissions

- Their currency exchange rate is the best

You may be worried about the USD $10 monthly fee. However, this can be offset by both your trading and currency exchange commissions!

If you make frequent trades in the market, this broker may be more suitable for you!

The choice of broker depends on your investment amount

In the end, the choice of broker will heavily depend on the amount and frequency that you want to invest.

The performance of the stock or ETF will be the same, no matter how you invest in it.

The only thing that affects your net returns will be the costs!

As such, you’ll need to decide which is the best broker for your situation.

Conclusion

Stocks and ETFs on the LSE are not as widely available in Singapore compared to US stocks.

However, they are still more accessible compared to Korean or Taiwanese stocks!

Nevertheless, you should choose a broker that is best suited to kickstart your investment journey!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

POEMS Referral (Free US trades for 1 month)

If you are interested in signing up for a POEMS account, you can use my referral link. You will be able to receive free US trades for one month after you deposit SGD $3,000 into POEMS!

Here’s what you need to do:

- Sign up for a POEMS Cash Plus Account

- Deposit ≥ SGD $3,000 into your Cash Plus Account within 1 week of opening your account

- Enjoy 1 month worth of free US trades

Saxo Referral (Earn $100-$250 in cash)

If you are interested in creating a Saxo trading account, you can take part in the referral program.

Here’s are the rewards that you can receive from this program:

| Action | Reward |

|---|---|

| Fund ≥ SGD $3,000 and make ≥ 3 qualifying trades | SGD $100 |

| Fund ≥ SGD $100,000 and make ≥ 3 qualifying trades | SGD $250 |

The 3 qualifying trades that you need to make have to be on margin products, such as:

- CFDs

- FX

- Futures / Forwards

- Options

The process is quite different from other referral programmes, so you can contact me for the next steps for the referral!

You can find out more about the referral program on Saxo’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?