Last updated on June 7th, 2021

Robo-advisors are taking the investing world by storm.

With sleek apps, low fees and fancy algorithms, they seem to be the perfect way to invest. However, should you put all of your money into a robo-advisor?

After using 4 different robo-advisors, I have learnt a thing or two about how they work.

Here are my answers to 13 questions you may have about robo-advisors.

Contents

- 1 What is a Robo-Advisor?

- 2 How does a Robo-Advisor work?

- 3 How many Robo-Advisors are there in Singapore?

- 4 What do Robo-Advisors invest in?

- 5 What funds can I use to invest in a Robo-Advisor?

- 6 What is the minimum amount I need to invest in a Robo-Advisor?

- 7 How can I sell my assets that I have with a Robo-Advisor?

- 8 What Are the returns of a Robo-Advisor?

- 9 How much does a Robo-Advisor cost?

- 10 Can you trust a Robo-Advisor?

- 11 Can a Robo-Advisor close down?

- 12 What are the Pros and Cons of a Robo-Advisor?

- 13 Are Robo-Advisors a good idea?

What is a Robo-Advisor?

Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services. These services usually have little to no human supervision.

Investopedia

After the 2008 Global Financial Crisis, many people lost faith in the financial system.

People no longer trusted financial advisors with their money. Instead, they wanted a cheap and efficient way to invest their money.

This is where robo-advisors come into play.

Companies took advantage of the FinTech Revolution to provide digital advisory services. This means that humans are not involved in advising you on the best assets to invest in. Rather, robo-advisors use an algorithm to decide the best portfolio for you.

However, this doesn’t mean that robo-advisors are entirely automated!

Robo-advisors still have people working on the platform. This ranges from monitoring the algorithm’s performance, to providing customer support.

In fact, most robo-advisory platforms don’t like the term ‘robo-advisors’. They prefer to be called ‘digital wealth planners‘.

However, that term has not caught on and most people still refer to them as robo-advisors or ‘robos’ for short.

How does a Robo-Advisor work?

Most robo-advisors follow this 5-step process:

- Account creation

- Answering a questionnaire

- Algorithm decides the best portfolio for you

- Deposit your money

- Portfolio rebalancing

Account creation

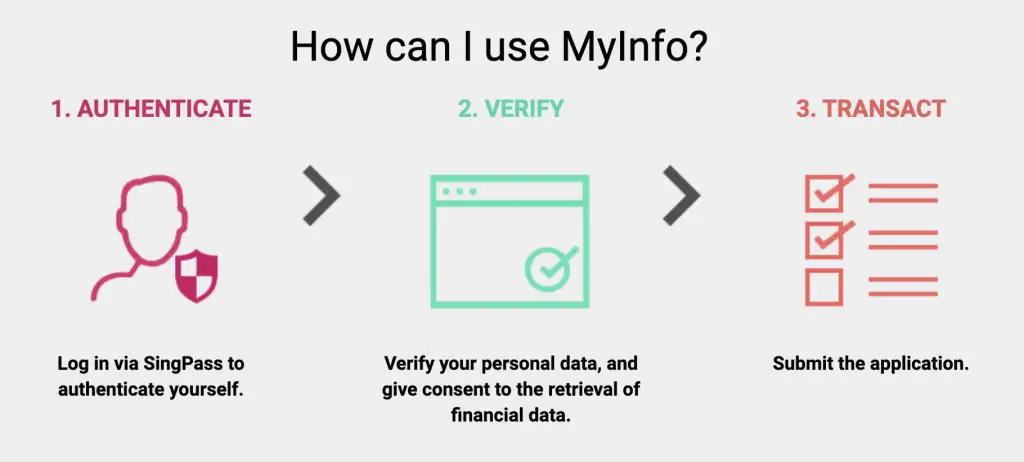

Most robo-advisors would allow you to create an account using MyInfo. You will be able to create an account with the platform within minutes.

This reduces the amount of time you’ll need to fill up any signup forms!

At this point of time, you are only allowed to create an account for yourself. None of the platforms allow you to create a joint account with someone else.

Answering a questionnaire

After creating your account, you will be required to answer a questionnaire. This questionnaire will help to determine the best investment portfolio for you.

One of the questions that almost every questionnaire would have is your risk profile.

This is a very important consideration when deciding the best portfolio for you.

Risk profiles are broadly divided into 3 categories:

- Conservative

- Balanced

- Aggressive

Usually, the more risk you are willing to take, the greater your potential returns. However, you may experience greater losses as well!

There are no ‘checks and balances’ to ensure you select the right risk profile. As such, I urge you to consider this question very carefully.

On paper, you may think that you are able to take a lot of risk.

However, if the value of your assets starts to drop, you may be tempted to sell. This will result in you realising your paper loss.

The robo-advisor does not know you personally. As such, they can only rely on your answers to determine the best portfolio for you.

It is important for you to know how much risk you’re actually willing to take, before you invest in a robo-advisor.

Some platforms offer portfolios based on goal-based investing. The robo-advisor will design a portfolio that helps you to reach your intended financial goal.

You may be required to answer additional questions to better determine your portfolio. These include:

- How long do you have before you wish to achieve your goal?

- How much have you already saved for your goal?

Most robo-advisors normally recommend you to leave your money for at least 3-5 years. If you sell your assets too early, you may not maximise the amount of returns you are receiving.

If you want to achieve a financial goal that is less than 3 years away, I would suggest not to invest in a robo-advisor.

By knowing how much you have already saved, the platform can suggest how much you should be investing each month to achieve your goal.

However, this is only based on projected returns. There is always a chance that you may not accumulate enough money at the end.

Algorithm decides the best portfolio for you

Based on the answers from the questionnaire, the robo-advisor uses an algorithm to determine the best portfolio for you.

These algorithms are usually created and maintained by financial experts. Most of these experts have many years of investing experience.

Based on the performance of your assets, these experts may modify the algorithm to further optimise your portfolio.

Some of the robo-advisors have a name for their algorithms, and these include:

- Economic Regime-Based Asset Allocation (StashAway)

- Automated Risk-Managed Investment Strategy (Syfe)

- Asset Preservation (Kristal.AI)

Most of these algorithms focus on asset allocation. Rather than deciding on a specific stock or bond to invest in, they focus on the asset classes.

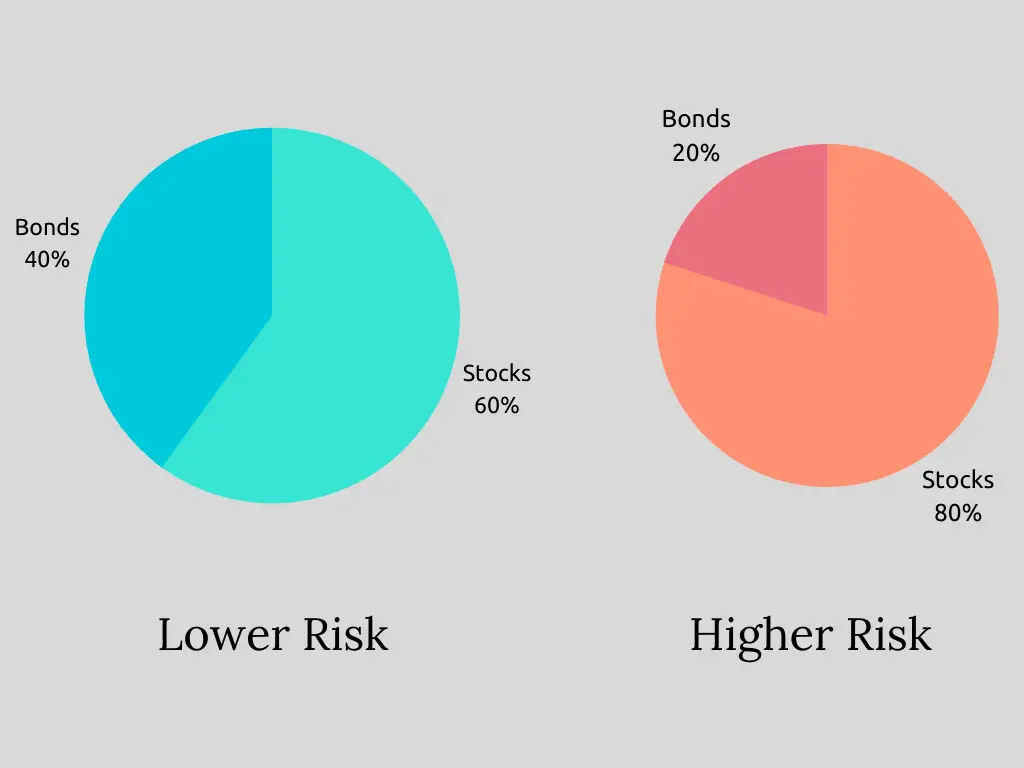

The classic asset allocation that most platforms use is stocks and bonds. A percentage of your money will be allocated into these 2 assets.

The more risk you want to take, the higher the allocation in stocks, and vice versa.

However, most robo-advisors will usually leave part of your portfolio (~ 1%) as cash. This allows them to deduct their fees and facilitate the rebalancing of your portfolio.

Due to the focus on asset allocation, robo-advisors usually adopt a passive investing strategy. As such, they do not aim to earn returns by conducting day trading.

Rebalancing

Most robo-advisors focus on asset allocation. They will constantly monitor the performance of the different assets. This helps to ensure that the value of each asset continues to be near the pre-determined allocation.

If the allocation is too skewed towards one asset class, the robo-advisor might rebalance your portfolio.

For example, let’s say you’re investing in a portfolio that has 60% in stocks and 40% in bonds.

If stocks are doing better than bonds, the value of your stock component may rise faster than that of bonds.

However, based on your risk profile, you’ve indicated that you are only willing to take a certain amount of risk. The robo-advisor will bring the risk level down to one that you’re comfortable with. This is usually done by selling your stocks position and buying bonds with the money.

This results in your allocation shifting back to the original 60% in stocks and 40% in bonds.

How often do robo-advisors rebalance their portfolios? It really depends.

Most robo-advisors would not want to continuously rebalance your portfolio. This usually involves a large number of transactions for them, and can be pretty costly. As such, most of them would only do it if absolutely necessary.

If the market is more volatile, there is a higher chance that your portfolio may be rebalanced.

Here’s a summary of what we’ve discussed earlier.

How many Robo-Advisors are there in Singapore?

With the rising popularity of robo-advisors, every company wants to have their own platform!

There are 12 robo-advisory platforms in Singapore for you to choose from.

These are split into 3 main categories:

FinTech Companies

These firms were started with the main aim of becoming digital wealth management companies. There are 5 companies that fall within this category:

Some of these companies offer different portfolios on their platform.

| Robo-Advisor | Portfolios Offered |

|---|---|

| Endowus | General Investing Cash Smart Fund Smart |

| MoneyOwl | General Investing WiseSaver |

| StashAway | General Investing Income Portfolio StashAway Simple |

| Syfe | Global ARI Equity100 REIT+ |

One notable example is MoneyOwl. Aside from providing an investment service, it has since expanded into other aspects of financial planning. These include:

- Comprehensive financial planning

- Insurance

- Will writing

By integrating technology into their platforms, these FinTech companies are able to keep costs low. As such, they can offer one of the lowest fees in the market.

Seedly recently hosted a webinar with 5 of the 6 companies above (excluding MoneyOwl). You can watch the entire episode below.

Banks

Not wanting to miss out on this opportunity, the big 3 banks in Singapore do have their own platforms too!

UOB was the latest to release their robo-advisory platform, UOBAM Invest, in July 2020.

Banks would be slower to adopt new technology. This is because they have much older systems in place, and may have problems integrating them into newer ones. As such, banks tend to charge a higher fee compared to the FinTech companies.

Brokers

Brokers have started to offer their version of a robo-advisory platform too. Instead of choosing to invest by yourself, you can opt for their digital advisory services instead.

3 brokers in Singapore offer such wealth planning services:

What do Robo-Advisors invest in?

Many robo-advisors invest in funds. However, there are 2 that offer you the option to invest in individual stocks.

Funds

Most platforms will invest in 2 types of funds:

- Mutual funds

- Exchange traded funds (ETF)

When you invest in a fund, you are contributing your money to the fund manager. The fund manager then takes all of the money contributed, and invests in different stocks or bonds.

This makes your investment portfolio very diversified. You are not depending on the performance of just one stock or bond, but the performance of the fund as a whole.

Moreover, most robo-advisors will invest in a few funds for each type of asset. As such, your portfolio is really diversified!

Based on your preference to invest in a mutual fund or ETF, there will be an advisory platform for you.

| Mutual Funds | ETFs |

|---|---|

| DBS DigiPortfolio | AutoWealth |

| MoneyOwl | FSM MAPS |

| Endowus | StashAway |

| Syfe | |

| UOBAM Invest | |

| UOB Utrade Robo |

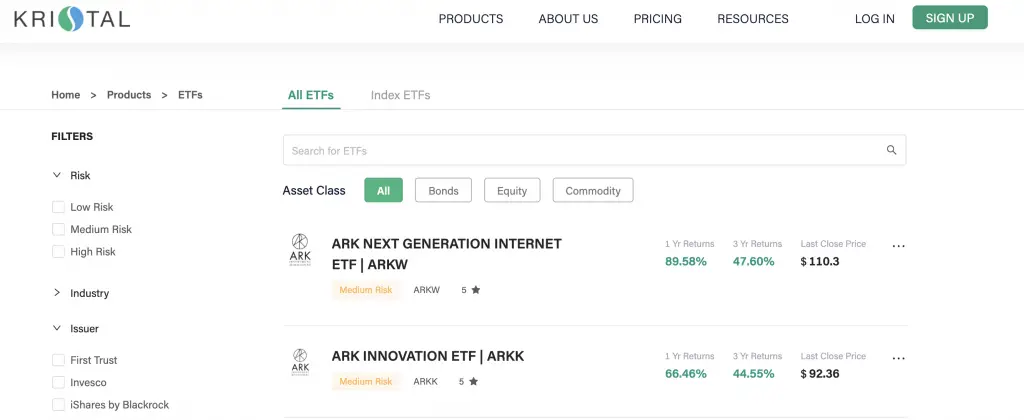

Kristal.AI is a unique platform as it allows you to invest in individual ETFs as well.

Individual stocks

If you wish to invest in individual stocks, there are 2 robo-advisors that provide such an option:

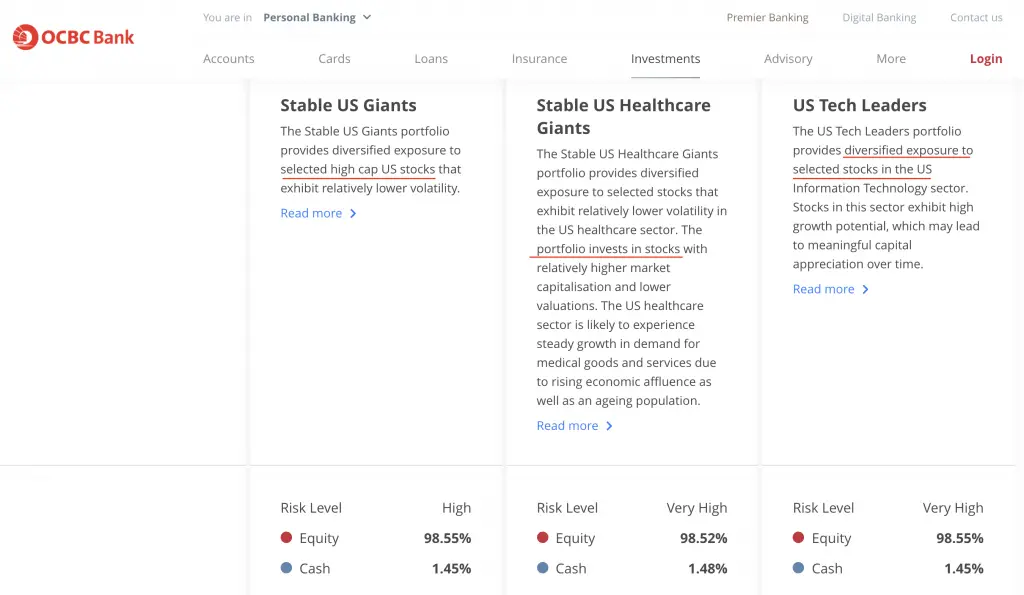

OCBC RoboInvest

Of the 33 portfolios that OCBC RoboInvest offers, 21 of them allow you to invest in individual stocks.

However, the stocks that you invest in are based on a theme.

3 such examples are as:

- Stable US Giants

- Stable US Healthcare Giants

- US Tech Leaders

However, the minimum investment amount differs for each portfolio. It can range anywhere from SGD$1000 to USD$4000.

Investing in these individual stocks are extremely risky. As such, you should be prepared to experience some losses along the way.

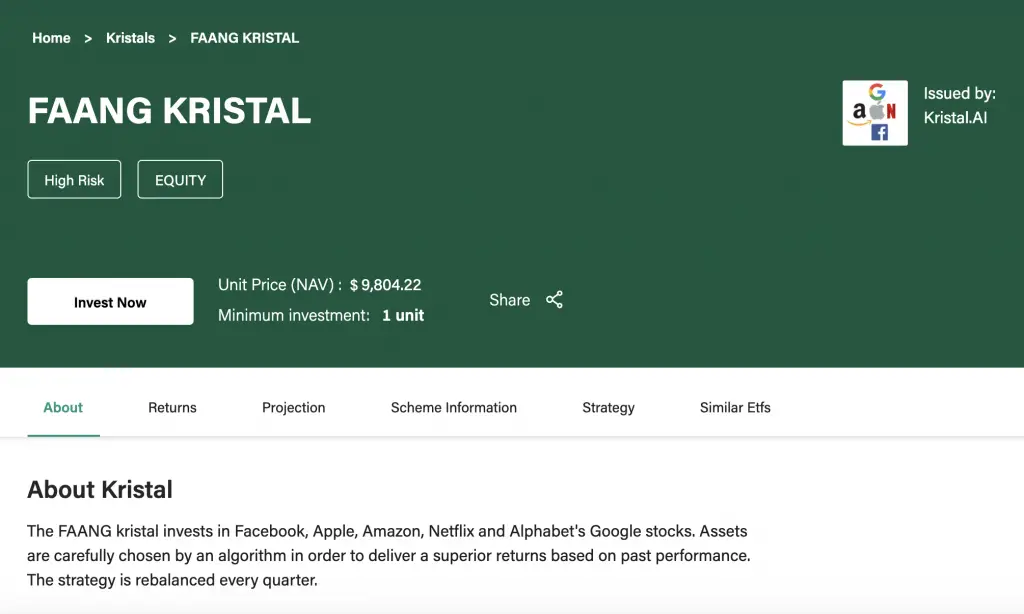

Kristal.AI

Kristal.AI allows you to invest in managed portfolios and individual ETFs. On top of that, they allow you to purchase individual stocks too.

Similar to OCBC RoboInvest, you can only invest in thematic stocks. One such portfolio is the FAANG Kristal.

This portfolio allows you to invest in the 5 big tech stocks in the US:

- Amazon

- Apple

- Netflix

However, you would need to have a Kristal Private Wealth Account before you can invest in this portfolio.

To create a Private Wealth Account, you would need to be an accredited investor.

According to the Monetary Authority of Singapore’s (MAS), you can be an accredited investor only if you meet either of the criteria:

- Your income in the past 12 months is ≥ SGD300,000

- Your net personal assets is ≥ SGD2million (or the equivalent in foreign currency), and the value your primary place of residence can only contribute up to SGD1million

Most of us would not be able to fit these 2 criteria. As such, the only way you can invest in individual stocks would be through OCBC RoboInvest.

How about cryptocurrencies?

Currently, there are no robo-advisors that invest in cryptocurrencies.

Cryptocurrency is still a very new asset to invest in. There is so much risk and volatility involved.

It will be extremely hard for robo-advisors to give a projected return to their customers. As such, most of them would prefer not to offer such a service at this point in time.

What funds can I use to invest in a Robo-Advisor?

There are 3 different types of funds that you can invest in robo-advisors:

Cash

This is the most common way of investing in a robo-advisor.

Some platforms may allow you to invest in another currency besides SGD, such as USD. These platforms may require a minimum amount of USD before you can invest your funds with them.

SRS

Instead of leaving your funds in your Supplementary Retirement Scheme (SRS) account, why not invest it?

The SRS account only offers you 0.05% p.a.

As such, you’ll definitely get a much better return if you invest your SRS funds!

There are 3 robo-advisors which allow you to invest your SRS funds:

- Endowus

- MoneyOwl

- StashAway

CPF

Currently, Endowus is the only robo-advisory platform that allows you to invest your CPF funds.

This is a huge advantage as many working adults would have substantial funds in their CPF.

If you no longer need the money in your Ordinary Account (OA), you can consider investing it instead.

By investing the money in your OA, it is very possible to earn a higher return compared to the 2.5% that the OA offers you.

What is the minimum amount I need to invest in a Robo-Advisor?

Each robo-advisor has its own requirements. Most of them have a minimum amount that you need to invest before you can use their platform.

| Robo-Advisor | Minimum Initial Investment |

|---|---|

| StashAway | None |

| Syfe | None |

| UOBAM | None |

| Kristal.AI | $100 |

| MoneyOwl | $100 initial lump sum OR $50/month |

| FSMOne MAPS | $1,000 OR $500/month |

| DBS DigiPortfolio | $1,000 (USD / SGD) |

| AutoWealth | $3,000 |

| OCBC RoboInvest | $3,500 |

| Phillip SMART Portfolio | $5,000 |

| UOB Utrade ROBO | $5,000 |

| Endowus | $10,000 |

There are 3 robo-advisors with no minimum initial investment:

- StashAway

- Syfe

- UOBAM

This makes it very accessible for people with little capital to start investing!

You may ask, how can these robo-advisors allow you to invest with such a small amount?

These robo-advisors usually allow you to own fractional shares. Instead of owning a whole stock, you will own a small fraction of a stock.

As such, even with a small capital, you are able to invest into different assets and enjoy their returns.

Can I invest a monthly sum into a Robo-Advisor?

Most robo-advisors provide the option for you to invest a monthly sum into your portfolio.

By doing so, you are making use of the dollar cost averaging strategy.

This is similar to regular savings plans like the OCBC Blue Chip Investment Plan and Invest Saver that invest a monthly sum into a stock or an ETF.

In fact, investing a monthly sum is really easy!

Banks allow you to set up standing instructions (also known as recurring transfers). This tells the bank to transfer a fixed amount of money to the bank account of your choice.

When you create a portfolio with a robo-advisor, they usually have a reference code for it.

Here’s what you need to do to set up a monthly investment for most robo-advisors:

- Add the platform’s bank account as a payee

- Set up a standing transfer to the bank account

- Select the amount that you wish to transfer

- Select how many times and how frequent you wish to transfer the money

- Input your reference code

After that, you can sit back and relax while the robo-advisor automates your investments!

How can I sell my assets that I have with a Robo-Advisor?

Most robo-advisors allow you to make a withdrawal request. You are able to withdraw either:

- The total balance in your portfolio

- A certain amount below your total balance

When you make this request, the robo-advisor will sell your assets so you can withdraw that sum of money.

They will still want to maintain the optimal asset allocation for your portfolio. As such, they will sell a portion from each of your asset classes.

What Are the returns of a Robo-Advisor?

For every portfolio that the robo-advisor offers, they will usually come with a projected return.

Most robo-advisors usually show how their portfolios have performed against a benchmark.

Historical returns of a Robo-Advisor

Most platforms will base their projected rate of return on their historical returns.

However, it is extremely important to note that:

Past performance is no guarantee of future results.

No one knows what the future will hold. The assets may perform worse than the historical return. Alternatively, they may perform better than expected!

With things being so unpredictable, it’s best to take the projected returns with a pinch of salt.

They can be useful as a guide, but you should not expect to receive the exact returns that was promised.

Can you lose money with Robo-Advisors?

Just like any other investment, there is always a risk that you’ll lose money when investing in robo-advisors.

However, most robo-advisors try to diversify your investments as much as possible. This ensures that your portfolio’s performance is not reliant on specific stocks or bonds.

Even with this diversification, the risk of losing money is still there. This is especially so if the whole market goes down, as seen in March 2020.

Can Robo-Advisors survive a bear market?

Skeptics of robo-advisors claimed that they would not be able to survive a bear market.

As such, the March-May period in 2020 was a huge test for these platforms. Due to the COVID-19 pandemic, the markets plunged. Many people lost a lot of money as the value of their assets continued to drop.

However, according to the Business Times, most robo-advisors managed to weather this storm.

This is good news as it shows that the algorithms work!

Most robo-advisors are still very new, and there will be many tests in the future. However, it is promising to see that most of them have performed well in one of the worst market crashes in history.

Do Robo-Advisors beat the market?

Whether the robo-advisor is able to beat the market or not heavily depends on their investing strategy.

Since most of them are focused on asset allocation, they are adopting a passive approach to investing.

As such, they are not actively trying to beat the markets’ returns.

However, it is possible that the robo-advisor may outperform the market for certain periods of time. There will also be times when the robo-advisor underperforms.

Over time, the returns may average out and you may be receiving returns that are similar to that of the market.

It is never the intention of a robo-advisor to outperform the market. Rather, they are trying to provide diversified investing at low costs to retail investors like you and I.

What happens to the dividends that I receive when investing with Robo-Advisors?

When you invest in robo-advisor, some of the assets may issue dividends. However when you’re just starting out, each dividend you receive may only be a few cents.

The dividends that you receive will go into the cash component of your portfolio. When you have accumulated enough dividends, they will reinvest them into your portfolio.

Some robo-advisors do provide the option for you to withdraw your dividends.

However, most would require you to have a larger sum of money invested, before you can use this option.

How can I track the performance of my robo-advisory portfolio?

Most robo-advisors will give you a transaction summary at the end of each month.

This will give you an overview of:

- Any buy or sell orders that you’ve made

- Any dividends received

You are able to track your investments’ performance using the app / website of the robo-advisor. If you wish to add it to your entire investment portfolio, you can consider using portfolio trackers like StocksCafe.

How much does a Robo-Advisor cost?

Robo-advisors normally use “low fees” as their unique selling point.

But just how low are their fees?

The fees come in 4 main categories:

Management fees

Robo-advisors usually have an all-inclusive management fee.

This management fee usually encompasses:

- Transactional fees for buy and sell orders

- Account closure

- Rebalancing

- Withdrawal from the account

Most platforms charge you a percentage fee per annum. They will calculate the total value of your assets on a daily basis, and charge you a monthly fee.

The management fees differ for each robo-advisor. Some may charge lower fees if you have invested a larger sum of money with them.

| Robo-Advisor | Fee |

|---|---|

| AutoWealth | 0.5% p.a. Advisory Fee + USD$18 Platform Fee |

| Endowus | 0.25% – 0.6% |

| Kristal.AI | 0% – 0.3% |

| MoneyOwl | 0% – 0.6% |

| StashAway | 0.2% – 0.8% |

| Syfe | 0.4% – 0.65% |

| DBS DigiPortfolio | 0.75% – 0.8% |

| OCBC RoboInvest | 0.88% |

| UOBAM Invest | 0.6% – 0.8% |

| FSMOne MAPS | 0.35% – 0.5% |

| Phillip SMART Portfolio | 0.50% |

| UOB UTrade Robo | 0.5% – 0.88% |

You may have noticed that 2 robo-advisors charge no fees! Does this mean that they are free to use?

Here’s what you need to know before jumping in to invest with them:

Kristal.AI

If the value in your Kristal.AI portfolio is less than $50k, you do not need to pay any management fees.

Any amount that is above $50k will incur you a 0.3% management fee.

You can refer to Kristal.AI’s website for a full breakdown of the fee structure.

MoneyOwl

MoneyOwl is offering a promotional rate until 31 December 2021.

For the first $10k that you invest with MoneyOwl, you do not need to pay any advisory fees!

In general, robo-advisory platforms offer very competitive fees. All of them charge fees that are below 1% p.a.

However, are their fees really that affordable?

These management fees charge you based on the value of your assets under their management. The higher the amount that you’ve invested in the platform, the larger your fees will be.

For example, let’s assume that a robo-advisor charges a flat fee of 0.6% p.a. Based on the amount that you invested, here are the fees that you need to pay.

| Amount Invested | Fees per annum |

|---|---|

| $1,000 | $6 |

| $10,000 | $60 |

| $100,000 | $600 |

| $1,000,000 | $6000 |

If you invest $1 million with the platform, you’re paying $6k worth of fees each year!

The low fees are great when you are just starting out.

However, as your investment portfolio starts to grow, it may be more worth it to do DIY investing instead.

For DIY investing, you pay a transactional fee for each buy or sell order. When you want to invest a small sum, the transaction fee may not be worth it. This is because most brokers charge a minimum fee for each transaction. As such, the fee takes up a larger proportion of the total amount that you’ve invested.

However, if you are investing a larger sum each time, the fee takes up a lower proportion. It may be more cost effective to use a broker instead of a robo-advisor when you’re able to invest larger sums of money.

Expense ratio of funds

You may be so focused on the management fees that you have to pay the robo-advisor. However, the funds they invest in have management fees too!

The management fees of a fund are usually termed as an expense ratio.

The expense ratio is the annual fee that all funds or exchange-traded funds charge their shareholders.

Morningstar

Expense ratios are similar to the management fees of robo-advisors. They charge a percentage of the total assets under their management as well.

Most robo-advisors will use funds that have very low costs. However, these costs will still be present!

As such, the total fees you’ll be paying is actually both:

- Management fees by the robo-advisor

- Expense ratio by the fund managers

Both the fund manager and robo-advisor charge you based on your total assets under management. As such, the costs may really add up if you have a large amount with them!

Currency conversion

Most robo-advisors will invest in the US stock market. When converting from SGD to USD, there may be some conversion fees incurred.

Since robo-advisors are investing larger amounts of money, they tend to get better conversion rates. However, these costs can still add up in the end!

If you wish to avoid these extra costs, you’ll need to check if the robo-advisor you use invests in SGD-denominated or USD-denominated assets.

Dividend withholding tax

If the robo-advisor invests in the US markets, they will incur a dividend withholding tax as well.

For every dividend you receive, you will be taxed 30%. The amount that you receive in your account will be the dividends after tax.

In the long run, this tax can certainly eat into your returns!

As such, you may choose to invest in robo-advisors that offer portfolios which are based in Singapore. When you invest in the Singapore Exchange (SGX), you will not incur any dividend withholding taxes.

Can you trust a Robo-Advisor?

The Monetary Authority of Singapore (MAS) issued the “Guidelines on Provision of Digital Advisory Services” on 8 October 2018.

For companies to provide digital advisory services, they have to be licensed under the Securities and Futures Act.

This license gives the company some credibility, as the MAS does very stringent checks before they issue this license.

As such, you should only choose to invest in a robo-advisor that is licensed by the MAS.

Can a Robo-Advisor close down?

In March 2020, the robo-advisor Smartly shut down.

They cited stiff competition from other firms, such that it was no longer sustainable to run the company.

Customers who used Smartly were forced to sell off their assets, or transfer them to StashAway.

For those customers who sold their assets, they most likely sold it at a loss. This was because the markets were plunging in March 2020!

Many people were concerned about the profitability of robo-advisors after this incident.

Do Robo-Advisors make money?

According to a report by Morningstar, most robo-advisory platforms struggle to make money. This is because of the high costs required to acquire new clients.

These platforms rely on low fees to attract new clients. However, they would need to manage a large amount of assets to sustain their low fees. If not, they face the risk of closing down.

Many of the remaining robo-advisors have reassured their clients that they are here for the long run.

In fact, AutoWealth recently announced in a video that they expect to turn ‘profitable and sustainable in 2020‘!

This is great news for AutoWealth’s clients.

Other companies have not rested on their laurels either. Some have sought to obtain funding to ensure that they remain sustainable.

This is reassuring that the firms are taking steps to ensure they do not close down.

What are the Pros and Cons of a Robo-Advisor?

After understanding how robo-advisors work, here are the pros and cons of investing with a robo-advisor.

Advantages

There are 7 main advantages when you invest in a robo-advisor:

- Lower fees

- More accessible

- Easy to use

- No transactional fees

- Able to ‘set and forget’

- Able to build a diversified portfolio

- Removes emotions from investing

Lower fees

Robo-advisors are able to integrate the latest technology into their platforms. They are able to reduce costs greatly, and thus charge much lower fees.

The fees charged are usually lower compared to a financial advisor or a brokerage.

However, these fees may add up when you have large amount of assets with them!

More accessible

In the past, these advisory platforms would only be available to people with a larger amount to invest.

However, most robo-advisors have very low requirements to start investing in their portfolios.

Thanks to technology, even beginner investors can use these platforms to grow their wealth!

Easy to use

Most robo-advisors have platforms that are user friendly.

Whether it is a website or an app, they are very easy to navigate.

Furthermore, transferring money to a robo-advisor is extremely easy. You can use different methods such as bank transfers or PayNow to transfer money to them.

They will notify you once they’ve received your funds, usually between 1-2 days.

Robo-advisors have certainly made it easier for us start investing.

No transactional fees

Transactional fees are part of the management fees that robo-advisors charge. As such, you can make multiple transactions into your portfolio, without incurring additional costs.

This allows you to make contributions into your portfolio, no matter how small.

A such, you can do a monthly dollar cost averaging strategy with any amount, without having to worry about the transactional fees.

Able to ‘set and forget’

When you set up a recurring transfer, your investments will be automated.

Technically, you don’t need to worry about the investments as everything will be done for you!

However, I encourage you to regularly check your investment’s performance. This helps you see if you are on track to achieving your financial goal.

Able to build a diversified portfolio

Robo-advisors invest in many different funds. Hence, your risk is diversified over many assets.

This is great for beginner investors who do not know much about investing. We would tend to be swayed by market sentiments and choose to invest in popular stocks.

With a diversified portfolio, you don’t have to worry about stock picking. In fact, you don’t need to do any research at all as the algorithm has already decided the best assets that you should invest in!

However, you should still read up and understand the different funds you’re invested in. This helps you to understand the rationale behind investing in them.

Removes emotions from investing

By leaving everything to an algorithm, you are not investing with your emotions. This is great as emotions tend to lead us towards making poor decisions.

When you use the robo-advisor’s algorithm, you are relying on facts rather than emotions to influence your investing decisions.

Disadvantages

However, robo-advisors are not all that perfect. Here are some disadvantages when you invest in robo-advisors:

No flexibility

You are at the ‘mercy’ of the algorithm.

No matter how well you think a certain fund will perform, the algorithm might think otherwise. They may even sell your holdings in that fund!

This gives you very little flexibility when investing in a robo-advisor. You are unable to choose the different funds that you want to invest in. Rather, you can only rely on what the algorithm thinks is best for you.

No human touch

Can a simple questionnaire help a platform to understand their clients well?

I personally do not think so. There are many factors that influence how you make financial decisions!

Robo-advisors usually have a set of fixed profiles that they foresee a customer will have. Based on your answers to the questionnaire, they will choose the profile that best fits you.

As such, the portfolio that they suggest may not suit your needs.

If you wish to receive more personalised advice, a financial advisor may be more suitable for you. They will be with you at every step to ensure that your portfolio is optimised for your current situation.

Fees will add up

As the assets you have with the robo-advisor increases in value, so does your fees.

At a certain point in time, it may no longer be cost effective for you to invest in a robo-advisor. The management fees that you incur can be really substantial!

As you invest more money into the markets, I would suggest to read up on investing. This gives you some investment know-how to do DIY investing, instead of relying on a robo-advisor to invest.

Emotions still can affect you

Robo-advisors aim to remove emotions from investing. However, emotions may still influence your decisions.

Since they do not have transaction fees, you may not feel the pinch when making a withdrawal request.

As such, you may be tempted to sell your assets, especially if they drop in value.

The projected returns may be misleading sometimes. If you see that your portfolio is not performing as expected, you may want to withdraw your assets too.

It is important to note that the projected returns are only possible in the long run. There will be some days that your portfolio will lose money. However, if you continue to stay invested, your assets will increase in value over time.

Moreover, some robo-advisors allow you to adjust your risk profile.

However, I believe that you should know your risk profile first before you invest. As such, you should stick to the risk profile that you originally set.

When the markets start to plunge, you may want to switch to a ‘lower risk’ profile. However, this is not how adjusting your risk works!

In a bear market, people will generally shift their assets from stocks to bonds. This is because bonds are seen as an instrument that provides a steady income.

When you lower your risk, you are essentially doing the same thing. However, you are selling your stocks at a loss, and are buying bonds when they are higher in value.

Ultimately, you may experience greater losses by switching your risk profile!

Robo-advisors have helped to remove emotions from investing. However, you still need to make the right decisions to ensure your portfolio continues to perform.

Are Robo-Advisors a good idea?

So should you invest in a robo-advisor? Here a summary of the pros and cons that we discussed previously.

| Pros | Cons |

|---|---|

| Lower fees | No flexibility |

| More accessible | No human touch |

| Easy to use | Fees will add up |

| No transactional fees | Emotions still can affect you |

| Able to ‘set and forget’ | |

| Able to build a diversified portfolio | |

| Removes emotions from investing |

As a beginner investor, robo-advisors are a great way for you to start investing. You do not need any prior investment knowledge beforehand, and can start straight away. All you need to do is to transfer money to the robo-advisor, and they will invest in the best portfolio for you.

However, as you begin to learn more about investing, you may not totally agree with the investing strategies of the robo-advisor. You may want to move towards DIY investing eventually. This allows you to have greater control over which assets you wish to invest in.

Choosing the best robo-advisor

So, how do you choose the best robo-advisor for yourself?

Here’s some criteria for you to consider:

- You understand and agree with the investing strategy of the robo-advisor

- You are comfortable with the assets that they are investing in

- You are able to commit to the initial investment, and the subsequent monthly contributions

- The fees are acceptable for you

Most of the fees that robo-advisors charge are comparable with each other. As such, you should not choose one robo-advisor over another, solely because it charges lower fees.

What’s more important is choosing an investing strategy that is suited to your needs.

As a millennial and a student, I am thankful that these services are available to us. Robo-advisors have made investing more accessible, especially for the those of us with a small capital. They are great way to start investing, and it is possible to use them for the rest of your life.

However, the fees are the main thing that are holding me back. While they are cheap at the start, they can be pretty substantial once your portfolio grows.

As such, you can consider using robo-advisors as a ‘stepping stone‘ instead. After using their investing strategies, find out what worked and what didn’t for you. This allows you to come up with your strategy that suits your needs. Once you have larger sums to invest with, you can start investing by yourself!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 6 months.

You will be able to save up to $75 worth of fees!

You can view more information about this referral program on Syfe’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?

Pak

September 21, 2020 at 4:33 pmWow! Thanks for the comprehensive guide to robo-advisor. I’ve just started investing with Syfe and planning to add a small monthly sum to grow it. After reading your post, I understand better what I am getting into. =p Cheers.

Gideon

September 21, 2020 at 4:54 pmNo problem! I intend to do a review on Syfe in the future, so you can stay tuned for that! 🙂