Last updated on June 6th, 2021

You may be looking for a globally diversified fund to form the base of your core-satellite portfolio.

One of the funds you may come across is the Dimensional World Equity Fund.

However, unit trusts can be pretty expensive right? So is it even worth investing in this fund?

Here’s what you need to know:

Contents

Dimensional World Equity Fund review

The Dimensional World Equity Fund diversifies your investment into a wide range of companies from both developed and emerging markets. This fund charges a higher expense ratio (0.40%) compared to other ETFs. However, the number of holdings in the fund is much higher, giving you a broader diversification.

Here is this fund reviewed in-depth:

Index tracked

Dimensional World Equity Fund does not track an index, like the MSCI World or S&P 500.

Instead, it aims to have an extremely broad exposure to the equity markets in the entire world.

It may include exposure to both:

- Developed markets

- Emerging markets

This allocation is rather similar to the MSCI All Country World Index (ACWI).

Dimensional uses their own strategy for picking stocks

Instead of following an index, Dimensional uses their own strategy to pick theirs stocks.

There is not much information available on their investing strategy.

However, the fund may have a greater allocation towards:

- Small companies (based on market cap)

- Value companies (high book value to market cap)

Moreover, the fund generally has a lower allocation towards large growth companies. This may be slightly different compared to other indices, which uses a market cap weightage.

For these indices, a company with a higher market cap will have a larger allocation.

In this way, you’ll have to trust Dimensional’s investing strategy if you want to invest in this fund.

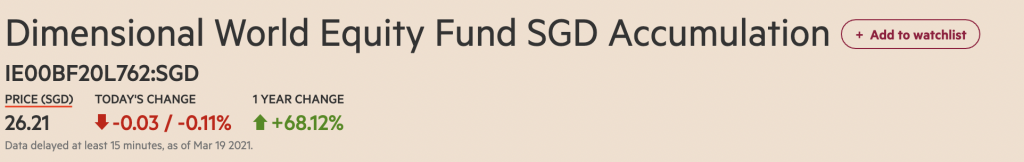

Date of inception

The Dimensional World Equity Fund only started its SGD Institutional Class Accumulation Shares on 19 March 2018, which is rather recent.

An institutional share class is only available for institutional investors. This share class offers the lowest expense ratio compared to retail investor share classes!

Even though you’re not an institutional investor, you are able to invest in this fund using Endowus Fund Smart.

As such, you are given access to this lower cost fund even though you do not have a large net worth!

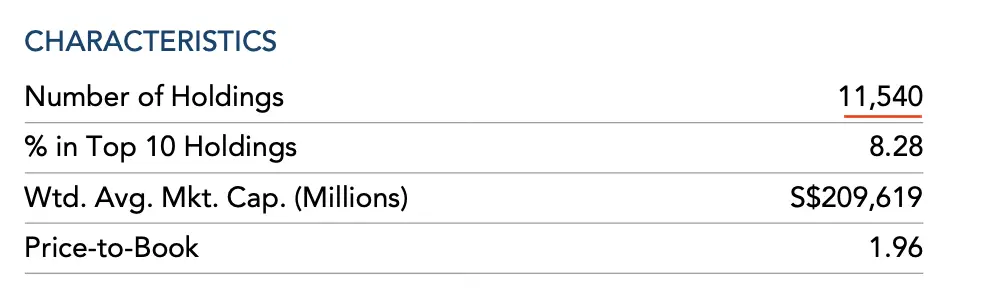

Number of holdings

Dimensional World Equity Fund has 11,540 holdings in their fund.

You may think that the MSCI ACWI is very diversified with 2,964 stocks. However, the Dimensional World Equity Fund has more than 7 times the number of stocks in their fund!

When you invest in the Dimensional World Equity Fund, you will technically own all of these 11,540 stocks.

This makes your investment extremely diversified across many different companies.

Top holdings

Here are the top holdings in this fund:

| Company | Country |

|---|---|

| Apple | US |

| Microsoft | US |

| Amazon | US |

| Alphabet Inc. | US |

| Samsung | Japan |

| Johnson & Johnson | US |

| UnitedHealth Group | US |

| Verizon | US |

| Comcast Corp | US |

| JPMorgan | US |

From the top 10 holdings alone, you can see that it is a very different allocation from other indices.

For example, Samsung is one of the top holdings in this fund. However, they are not found in the top 10 companies for the MSCI ACWI or the FTSE All-World Indices.

If you are interested in just buying the Samsung stock, you can view my guide on purchasing Korean stocks from Singapore.

Moreover, there are other US companies that do not appear in the top 10 holdings of the S&P 500, such as:

- UnitedHealth Group

- Comcast

- Verizon

In this way, your investment holdings are quite different compared to some indices!

The allocation towards each stock is lower

Since the Dimensional World Equity Fund is very diversified, the allocation towards each stock is lower.

For example, here is its allocation towards Apple, compared to other indices:

| Index / Fund | Apple’s Allocation |

|---|---|

| Dimensional World Equity Fund | 2.22% |

| MSCI AWCI | 3.48% |

| FTSE All-World | 3.25% |

| S&P 500 | 5.8% |

This shows how broadly diversified the Dimensional World Equity Fund is. Apple is the largest stock that is found in each of these indices.

For the Dimensional World Equity Fund, it only constitutes 2%. Meanwhile, other indices allocate at least 3% towards Apple.

Since your funds are spread out over more companies, this will increase your diversification!

Currency denomination

The Dimensional World Equity Fund is denominated in SGD.

You can buy and sell this fund in SGD. This reduces the currency conversion fees and risks that you’ll incur.

This is because most index ETFs are normally denominated in USD or GBP.

However, you may want to note that the underlying assets are denominated in GBP.

Dividend withholding tax

If you are purchasing the Dimensional World Equity Fund from Singapore, you are most likely a non-resident alien to the US.

If you purchased a US ETF, you will incur the 30% dividend withholding tax.

However, the Dimensional World Equity Fund is domiciled in Ireland.

There is a tax treaty between Ireland and US. Any dividends issued from US stocks will only incur a 15% withholding tax.

This will help to reduce the amount of taxes that you’re paying!

Moreover, you do not incur the hefty US estate tax when you pass on.

One thing you may want to note is that the Dimensional World Equity Fund is an accumulating fund.

This means that you will not receive any dividend payouts when you invest in this fund. Instead, the fund manager will automatically reinvest your dividends back into the fund.

You can view my comparison between an accumulating and distributing fund to understand this further.

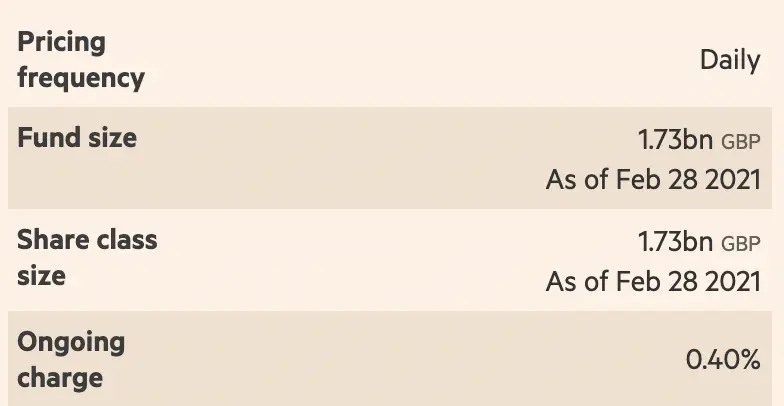

Expense ratio

On top of the trading commissions you’ll need to pay the broker, you will have to pay an expense ratio to the fund manager as well.

Dimensional World Equity Fund charges you a 0.40% expense ratio.

This is much higher compared to other ETFs which track globally diversified indices like the MSCI AWCI or FTSE All-World Index:

The costs of investing with Dimensional World Equity Fund is much higher. However, you are also getting a lot more diversification as you ‘own’ many more companies with the fund!

As such, you will need to consider of you are willing to pay the extra costs for greater diversification.

Ways to invest

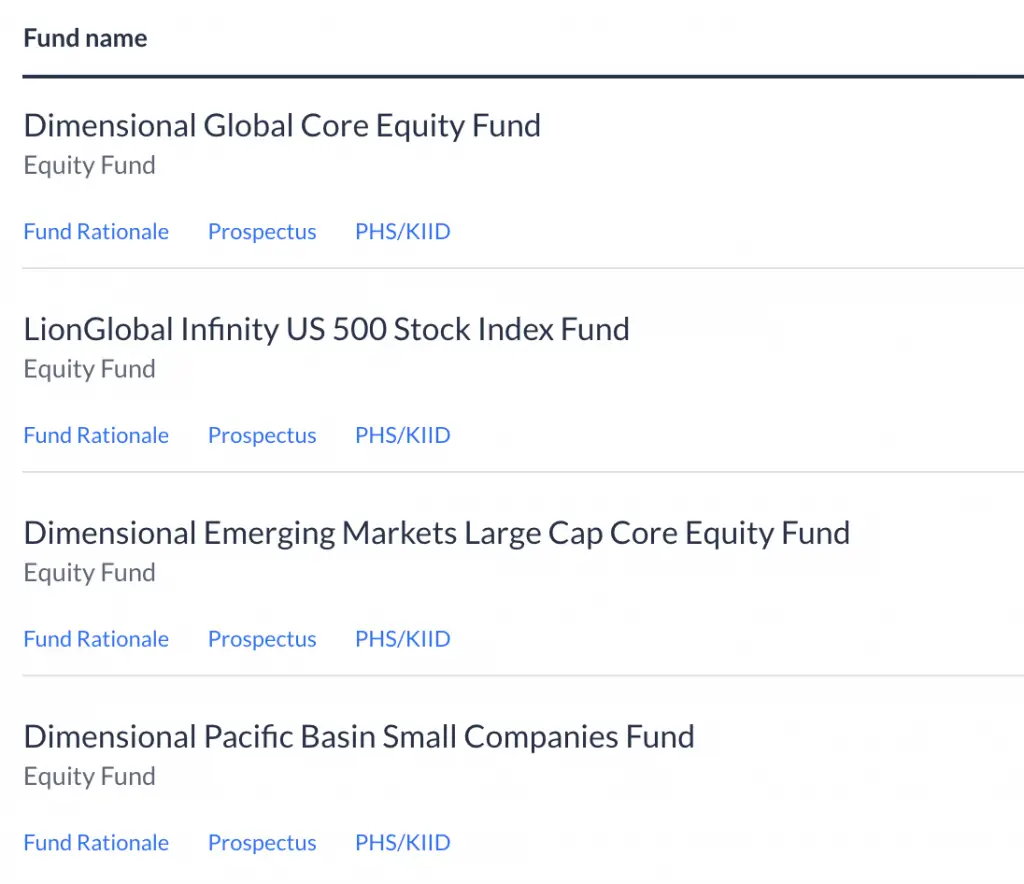

In Singapore, it is very hard for you to get access to Dimensional Funds.

The 3 main ways that you can buy Dimensional Funds are through:

MoneyOwl does not offer the Dimensional World Equity Fund with their portfolios. Meanwhile, it can be rather expensive to invest in Dimensional funds with a financial advisor too.

The most cost effective way to buy the Dimensional World Equity Fund would be through Endowus.

If you invest in their advised portfolios, the Dimensional World Equity Fund will not be found inside.

As such, the only way for you to invest in the Dimensional World Equity Fund is via Fund Smart.

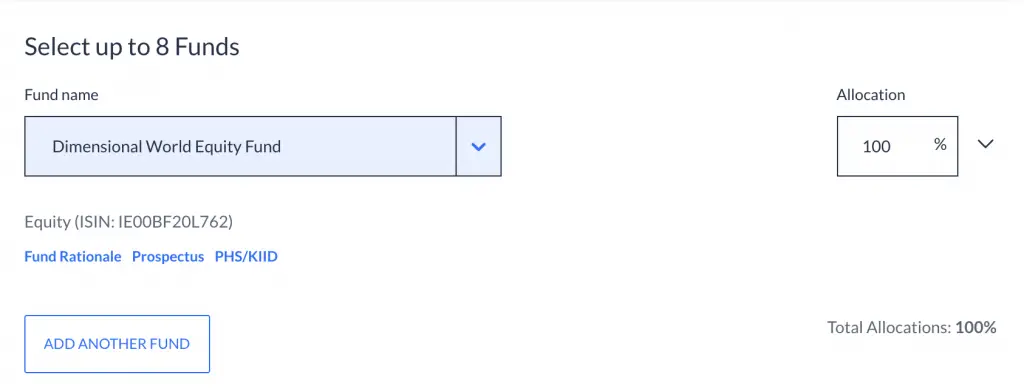

Fund Smart allows you to create your own customised portfolio. You can select the funds and % allocation you wish to have for each fund.

You can choose to have a 100% allocation of your money into the Dimensional World Equity Fund.

You can also add up to 7 more funds into your own customised portfolio.

If you want to invest in the Dimensional World Equity Fund, you are able to use both your Cash and SRS funds.

At this time, you are unable to use your CPF funds.

Here are some key features of Endowus:

| Type | Amount |

|---|---|

| Minimum Initial Investment | $10,000 ($888 until end of March 2021) |

| Minimum Investment Thereafter | $100 |

| Management Fee | 0.4% (SRS) and 0.6% (Cash) |

If you want to invest in this fund by yourself, the minimum investment amount is 107,582 GBP. With Endowus, the minimum sum you’ll need to pay is much lower!

The management fee that you are paying Endowus is on top of the 0.40% expense ratio you are paying Dimensional. As such, this will be your total cost when you invest in this fund:

| Fund Source | Fee |

|---|---|

| Cash | 1% |

| SRS | 0.80% |

For a cost of 1%, you are able to get a really diversified portfolio!

Verdict

Here are the main features of the Dimensional World Equity Fund:

| Inception Date | March 2018 |

| Number of Holdings | 11,540 |

| Currency Denomination | SGD |

| Dividend Withholding Tax | 15% |

| Type of Fund | Accumulating |

| Expense Ratio | 0.40% |

| Ways to Invest | Financial Advisor Endowus |

So should you invest in this fund?

There are 3 main advantages of doing so:

- Extremely diversified

- SGD denominated

- Low expense ratio (in comparison with other mutual funds)

If you are looking for a broad and diverse fund to invest in, the Dimensional World Equity Fund is a strong option for you to consider.

Conclusion

The Dimensional World Equity Fund provides a very strong case to be your core investment in your core-satellite portfolio.

With its high diversification, your investment risk is spread over a large number of companies!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?