Last updated on June 6th, 2021

You’ve decided that you want to invest in the IWDA ETF. However, when you go to iShare’s website, you only see that it only shows SWDA!

Are IWDA and SWDA the same? Here’s a deep dive into what these 2 tickers actually mean.

Contents

- 1 IWDA vs SWDA

- 2 Different ticker names for the same ETF

- 3 Liquidity may be different

- 4 You will not receive any dividends from either ETF

- 5 Both ETFs are domiciled in Ireland

- 6 Both ETFs will have the same expense ratio

- 7 EUNL is another ticker for the same ETF

- 8 Different tickers used in different exchanges

- 9 Which ETF should I choose?

- 10 Conclusion

IWDA vs SWDA

IWDA and SWDA are different ticker names for the iShares Core MSCI World UCITS ETF. They are the same fund managed by iShares, as they both track the MSCI World Index. The main difference is that the exchange they are listed on may choose to list this same ETF under different ticker names.

Different ticker names for the same ETF

Both IWDA and SWDA are listed on the London Stock Exchange. As such, you can just buy 1 unit of each ETF!

Here is how they look like on the Tiger Broker’s app.

IWDA is denominated in USD,

while SWDA is denominated in GBP.

GBX refers to pence sterling while GBP refers to pound sterling. 100 GBX is equal to 1 GBP.

Both IWDA and SWDA track exactly the same index. Their performances will be similar just that they are denominated in different currencies.

You can view my guide to see what are the best ways to buy LSE ETFs from Singapore.

Liquidity may be different

The funds may differ in terms of the ETF’s liquidity. One of the indicators of an ETF’s liquidity is the trading volume.

Here is the average volume of the IWDA and SWDA on the LSE:

The IWDA is more liquid than the SWDA on the LSE due to a larger average volume.

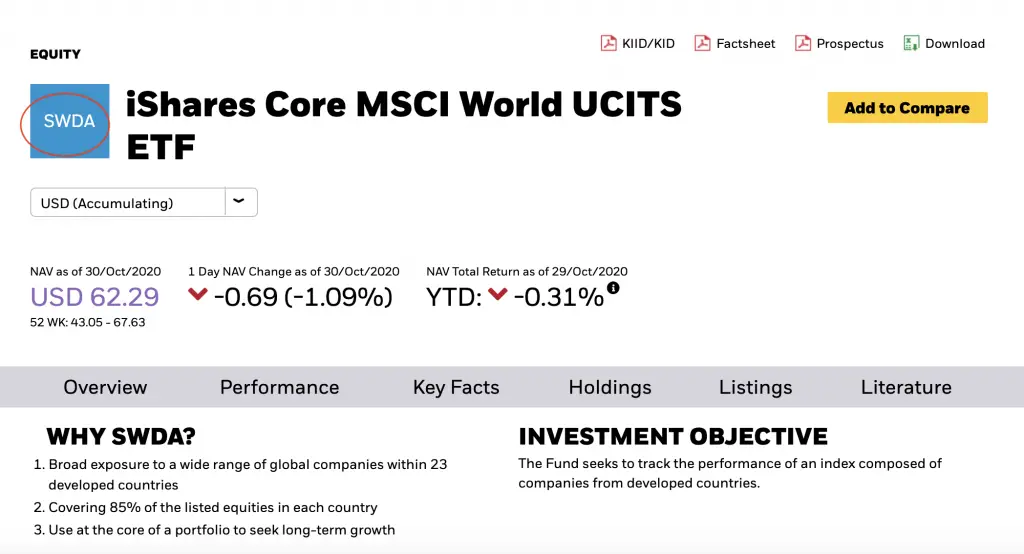

You will not receive any dividends from either ETF

Both of these ETFs are accumulating ETFs. Instead of distributing the dividends to you, they will reinvest the dividends back into the index they are tracking.

This is great if you are a long term investor. If you already have the intention of reinvesting your dividends, an accumulating ETF helps you to save on transaction fees.

If you are looking to receive dividends, you may want to consider a distributing ETF instead. You can read my comparison between accumulating and distributing ETFs to see how they are different.

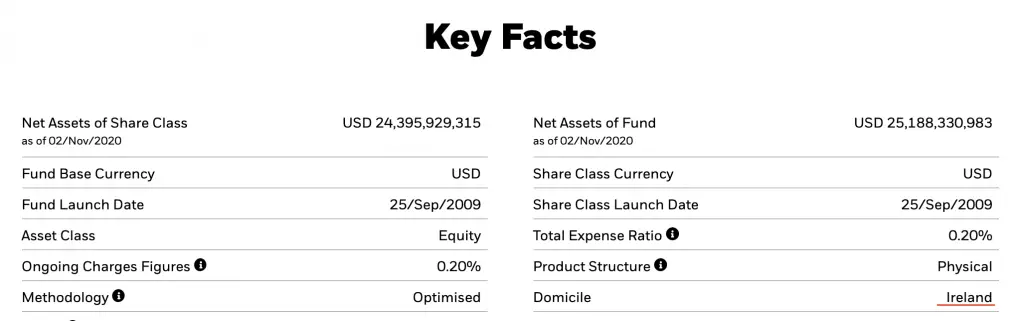

Both ETFs are domiciled in Ireland

Even though they are different tickers, the fund itself is domiciled in Ireland.

This will have implications on any dividend withholding taxes that you may incur.

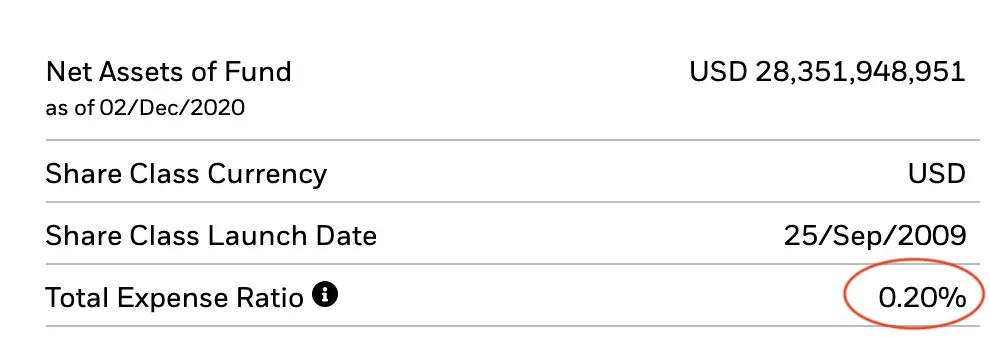

Both ETFs will have the same expense ratio

Since you are essentially investing in the same fund, you will have to pay the same expense ratio either way.

There will not be any cost savings if you invest in one ETF over the other.

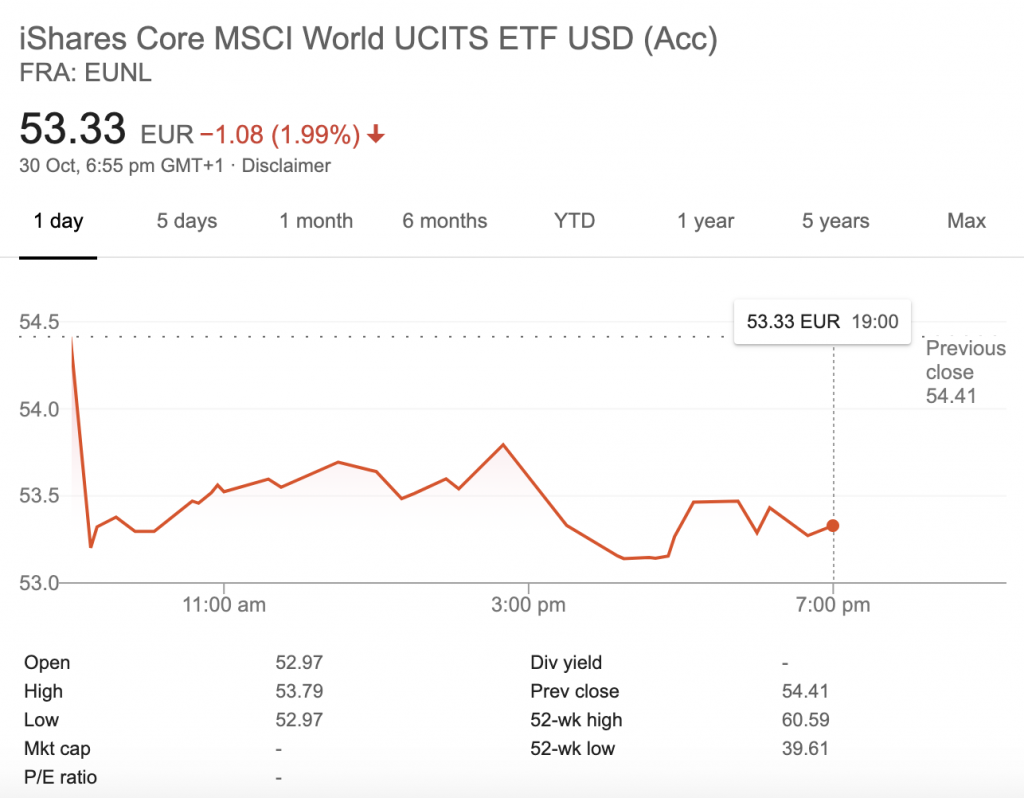

EUNL is another ticker for the same ETF

The iShares Core MSCI World UCITS ETF is also listed on the German exchange (Deutsche Boerse Xetra). However, its ticker name is now EUNL!

This time, the ETF is denominated in EUR.

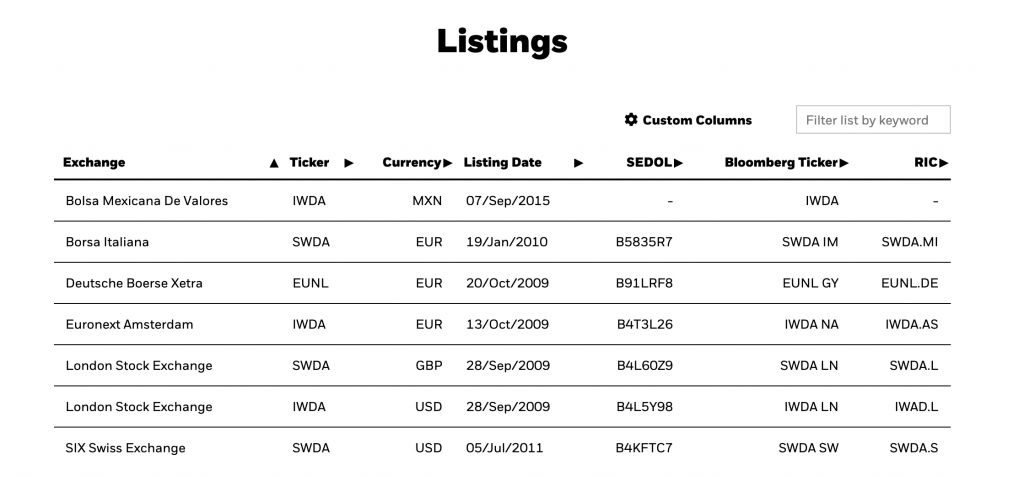

Different tickers used in different exchanges

Here’s how the same ETF is listed on different exchanges.

| Stock Exchange | Ticker Symbol | Currency |

|---|---|---|

| Mexican Stock Exchange | IWDA | MXN |

| Italian Stock Exchange | SWDA | EUR |

| German Stock Exchange | EUNL | EUR |

| Euronext Amsterdam | IWDA | EUR |

| London Stock Exchange | SWDA | GBP |

| London Stock Exchange | IWDA | USD |

| SIX Swiss Exchange | SWDA | USD |

Pretty confusing right? If you are in doubt, you can always go to iShares’ website and scroll down to the listings section.

That way, you wouldn’t be confused anymore!

Which ETF should I choose?

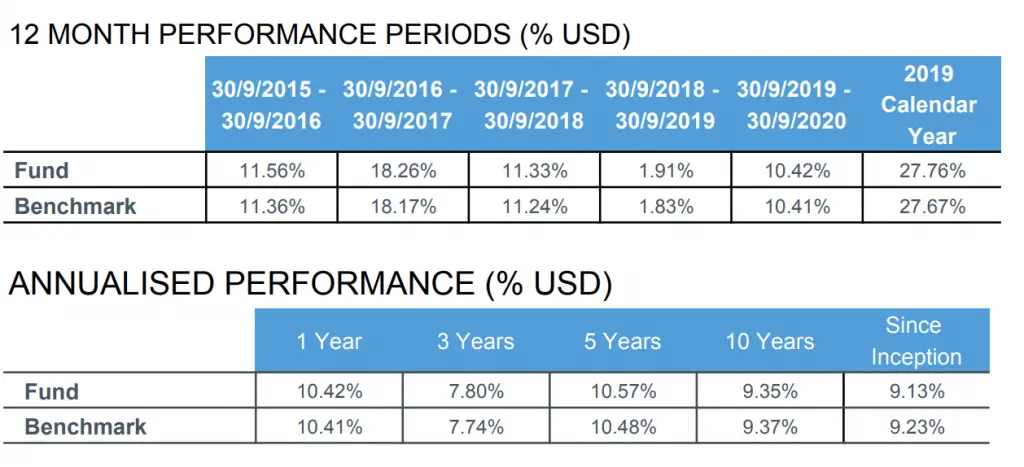

Since both ETFs are so similar, you may be wondering which ETF is better. Since they both track the same index, their performances are essentially the same.

As such, it really depends on which currency you would like to invest in. The price that you purchase the ETF may be slightly different. However, the net asset value of both funds will be the same.

Ultimately, it would not really matter whether you invest in IWDA or SWDA.

Conclusion

IWDA, SWDA and EUNL are all different tickers for the same ETF. They are all different versions of the same iShares Core MSCI World UCITS ETF. All of them track the same index (MSCI World Index). However, they may be denominated in different currencies.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?