Last updated on June 6th, 2021

Do you want to invest with a robo-advisor, but are scared of the risks?

Maybe you are afraid that the robo-advisor you use might shut down like Smartly in March 2020.

So, is it really safe to invest in a robo-advisor?

Here’s a breakdown of what happened to Smartly, and what you can do to make sure you invest with the right robo-advisor.

Contents

Why did Smartly shut down?

The decision to close Smartly was made by VinaCapital, who bought over Smartly back in 2019. It was after VinaCapital realised that the competition in the robo-advisory industry was too intense.

Moreover, the operating costs were increasing.

They were no longer willing to invest money into Smartly just to compete with the other robo-advisors. As such, they decided to shut Smartly down.

This decision was made just 9 months after they acquired Smartly!

Here are the 3 main reasons why I think Smartly shut down:

#1 Intense competition from other robo-advisors

The robo-advisory scene is extremely competitive. Every firm now wants to have their own robo-advisory platform.

With millennials being more tech-savvy, these firms want to capture their attention with low-cost investing services.

Banks and brokers have entered the market too, making the already saturated market even worse.

In Singapore alone, we have 12 different robo-advisors, excluding Smartly!

Do we really need that many robo-advisors?

Statista believes that a consolidation of robo-advisors may occur in the future. This means that robo-advisors would either merge together, or shut down like Smartly.

With so many robo-advisors available, you will likely want to choose the most attractive option.

#2 Higher fees charged vs other robo-advisors

Smartly charged these fees to use their platform:

| Amount Invested With Smartly | Fee Charged |

|---|---|

| Up to $10k | 1% |

| Over $10k and below $100k | 0.70% |

These are considered the highest fees being charged among the robo-advisors, especially for amounts below $10k.

The maximum amount that other robo-advisors charge is only up to 0.88%.

Most of you would have heard that keeping costs low is one of the most important things in investing.

Although fees alone should not be the deciding factor when choosing a robo-advisor, it still plays a role in your decision.

Would you want to pay that extra fees, even though the returns you earn may be similar?

As such, Smartly may not have been as attractive as their competitors.

#3 Smartly may have too small of a customer base to become profitable

Robo-advisors mainly earn their revenue by charging you management fees.

The fees they charged are based on an asset under management (AUM) model.

This means the more assets you have with the robo-advisor, the higher the fees you’ll have to pay.

Don’t forget, they are in an extremely competitive industry. As such, they will try to lower their management fees to entice you.

This greatly lowers the barriers to entry. You are then able to start investing with very low costs incurred!

However, this comes as a catch.

A MorningStar report estimated that for a robo-advisor in the US to be profitable, they will need to manage somewhere between $16-40 billion worth of assets!

Although the companies studied were from the US, the idea still holds true.

If a robo-advisor firm is unable to manage a large amount of assets, their low fee structure will not be sustainable.

We do not know the size of Smartly’s customer base. However, Statista estimates that robo-advisors in Singapore will manage US$1.062 billion worth of assets by 2020.

VinaCapital must have decided that it is not worth fighting over this market share with their competitors.

The costs of advertising can be really high, especially with so many robo-advisors in Singapore.

As such, VinaCapital decided to shut Smartly down, as they no longer saw them as a profitable service.

What happened after Smartly shut down?

VinaCapital made the decision to shut Smartly down, even before the COVID-19 pandemic. If you were a customer of Smartly, you would have been forced to liquidate your assets.

This means that you had to sell your assets under Smartly. As Smartly was winding down during the COVID-19 pandemics, the prices of assets were plunging.

As such, you would have most likely sold your assets at a loss!

Once the you’ve sold your assets, you were given 2 options:

#1 Withdraw your funds

If you had chosen this option, your funds would have been transferred to your bank account.

The amount that you received may have been lower than your initial capital, as your assets were sold at a bad time.

#2 Transfer your holdings to StashAway

Smartly also gave the option of transferring your holdings to StashAway, another robo-advisor.

By then, you could continue to receive wealth management advice using StashAway’s platform.

However, your holdings could not be transferred directly to StashAway.

Instead, you had to take the following steps:

- Sell your holdings that you have with Smartly

- Transfer your funds to StashAway

- Reinvest your holdings with the StashAway platform

Here’s how this process was carried out, as explained by StashAway’s CEO, Michele Ferrario:

This process seemed pretty inconvenient. It may have caused you a lot of stress as well.

As such, the way that Smartly shut down was less than ideal.

How safe are my assets with a robo-advisor?

You may be worried that you will lose all your money when the robo-advisory firm closes.

However, rest assured as the funds that you invest with the robo-advisor are separate from the firm’s accounts.

To be specific, your funds are usually stored in a custodian account with one of the brokerage firms.

Even if the robo-advisor shuts down, they are not able to touch the money that you have invested with them.

This is a requirement by the Monetary Authority of Singapore (MAS). Your assets will have to be in a custodian account, before the robo-advisor can be licensed.

The MAS issues 2 types of licences to robo-advisory firms:

#1 Capital Markets Services (CMS) Licence

The CMS licence has very strict requirements to be adhered to before MAS can issue it to you.

Here are the 4 robo-advisors that have this licence:

So what does the CMS licence actually mean for these firms? Here’s an explanation by Syfe’s CEO, Dhruv Arora.

The key takeaway: If you invest in a robo-advisory firm that has a CMS licence, you can be assured that the firm has a good financial standing.

#2 Licensed Financial Adviser

Among the robo-advisory firms that do not have a CMS licence, 2 of them have a financial adviser licence instead:

These 2 companies have their own custodian accounts as well. As such, you can be sure that your assets are safe with these companies too.

What types of custodian accounts are there?

Even though custodian accounts means that your assets are safe, the way they work may be different.

There are 2 main types of custodian accounts that firms will use, and this will affect the fate of your assets:

#1 Co-mingled custodian account

A co-mingled account means that your funds are mixed with the funds of other users of the platform.

As a result, the robo-advisor will only have one custodian account. Examples of robo-advisors that use this structure include:

- StashAway

- Syfe

You can view my comparison of Syfe’s Equity 100 portfolio against StashAway to see which one is better for you.

Benefit of a co-mingled custodian account

The benefit of having a single custodian account is that you are able to own fractional shares.

A fractional share means that you own a fraction of a whole share.

For example, if a share costs $100, and if you only invested $10, you will own 0.1 of that share.

This is because the robo-advisor uses the funds in that single custodian account to purchase the different assets.

After that, they will split it up to different customers. The number of units you receive depends on the amount that you had invested.

This is great for beginner investors as you are able to invest with any amount!

Even if you can’t afford to buy a full share, you are able to own a fractional share.

This makes investing really accessible for you!

Problems when the robo-advisor shuts down

However, things get tricky when the robo-advisor shuts down.

Since the assets of all the firm’s customers are under the same custodian account, your assets will be mixed with the assets of other customers.

Moreover, both Syfe and StashAway invest in the US and Singapore stock markets. For comparison, here are the minimum number of units you can purchase in each market.

| Stock Market | Minimum Unit Size |

|---|---|

| SGX | 100 |

| US | 1 |

This means that you will no longer be able to own your fractional shares!

You also do not have full control over the fate of your assets.

What happens if StashAway closes down?

If StashAway closes down, your assets will be kept in a custodian account held under Saxo Capital. However, the exit route for your funds is unclear, and you may have to liquidate your assets.

StashAway only mentioned that they will be unable to touch your funds in the event that they close down. They did not mention that what would happen to your funds after that.

I asked StashAway’s support, and this was their response:

You may be forced to liquidate your assets, which may cause you to sell them at a loss!

However, StashAway reassured me that they have a different structure compared to Smartly, so it is unlikely that they will close down.

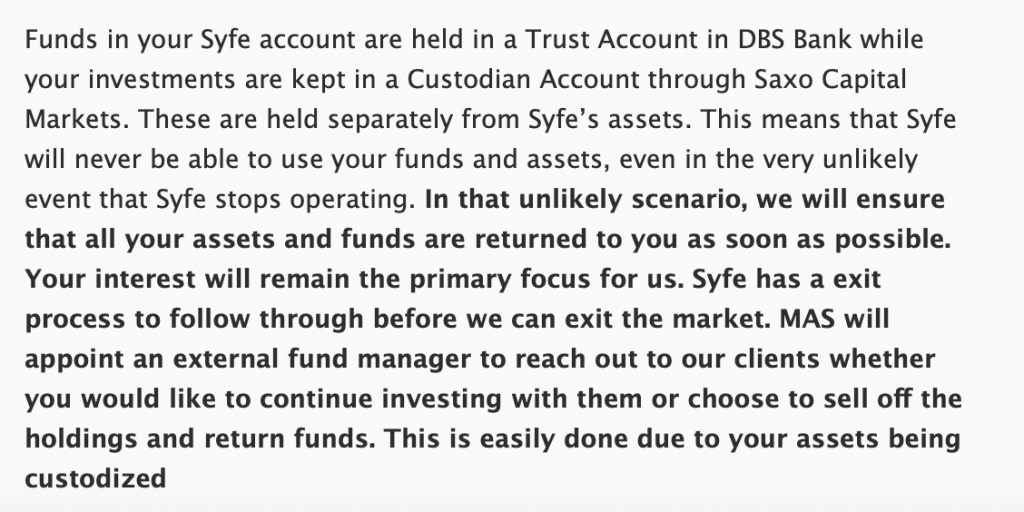

What happens if Syfe closes?

In the event that Syfe closes down, your assets will be kept separate from Syfe’s funds. Your assets will be transferred to an external fund manager, where you can either sell off your funds, or to continue investing with that fund manager.

Here’s the clarification given by Syfe when I asked them about this issue:

Like what happened to Smartly, you will be given 2 choices:

- You can sell off your assets and receive the cash value or

- You can transfer your assets to a fund manager that Syfe has partnered with

From this explanation, you are not given full control of what happens to your assets as:

- You are forced to sell your assets even if you wish to hold onto them

- You can only transfer your assets to Syfe’s partner fund manager, and not the fund manager of your choice

To help you make a better decision, here is the main pro and con of investing in a platform with a co-mingled account.

| Pro | Con |

|---|---|

| Able to invest using fractional shares, so you can invest with any amount | You will have lesser control over the fate of your assets if the robo-advisor closes |

Custodian account under your own name

Some robo-advisors will help you to create a custodian account under your own name.

There are 4 robo-advisors that provides this service:

| Robo-Advisor | Custodian Account |

|---|---|

| AutoWealth | Saxo |

| Endowus | UOB Kay Hian |

| Kristal.AI | Saxo or Interactive Broker |

| MoneyOwl | iFAST |

Having your assets under your name gives you greater control.

Even if the company you invest with shuts down, your assets are still under your name. Your assets are not co-mingled with the assets of the firm’s other customers.

As such, you get to decide what you’d like to do with them.

You can choose to either:

- Hold onto your assets and sell them off later or

- Sell your assets and receive its current value

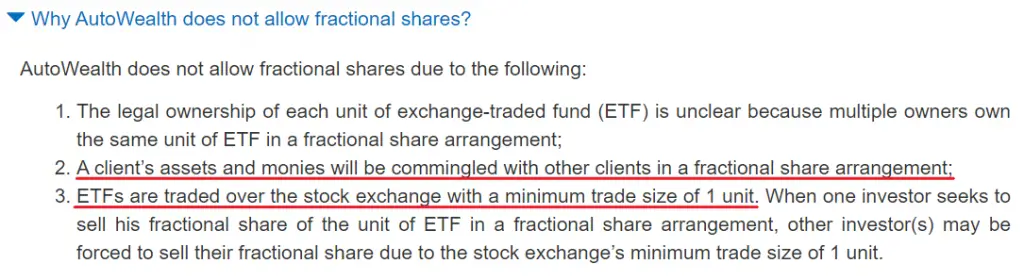

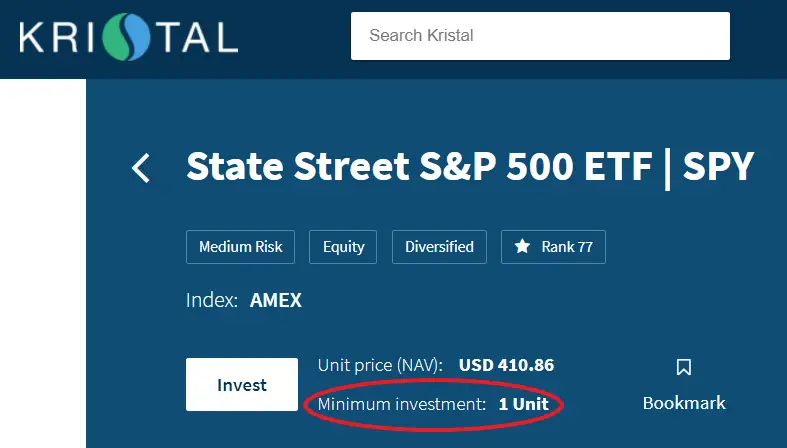

No fractional shares for Kristal.AI or AutoWealth

While you are unable to purchase fractional shares, you may purchase Exchange-Traded Funds (ETFs) using Kristal.AI or AutoWealth. The minimum number of units you can invest is 1.

This can be seen in AutoWealth’s FAQs under “INVESTING THROUGH AUTOWEALTH“,

as well as Kristal.AI’s platform:

As seen, the minimum investment is the value of one unit of that ETF.

If you have a smaller capital, you will not be able to invest in an ETF that has a larger value than your capital.

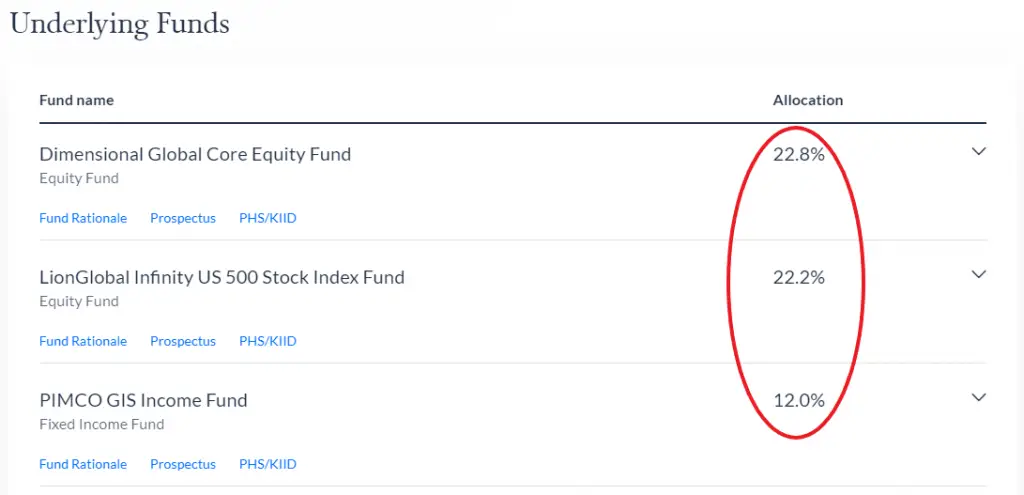

Fractional units are possible for Endowus and MoneyOwl

However, both Endowus and MoneyOwl do not have this problem.

These platforms invest your money into unit trusts, and not exchange traded funds (ETFs).

From there, they will allocate a percentage into each fund and still allow you to purchase fractional units for each funds.

Here’s the pro and con of having the custodian account under your own name:

| Pro | Con |

|---|---|

| You have greater control over your assets | If you invest in ETFs, you are unable to purchase fractional shares |

What can we do to ensure that our assets are safe?

There are many risks involved when investing with a robo-advisor.

To mitigate them, here are 3 things that you can research on to determine if the company is safe to invest with:

#1 Look at the company itself

There are 2 main types of robo-advisory companies out there:

1. Fintech startups

Investing with these companies usually comes with the most risk.

These companies mainly rely on their robo-advisory services to provide them with revenue.

This means that if they do not have enough assets under their management, they may be operating at a loss.

One notable exception is MoneyOwl.

Besides their investment service, they provide other services such as:

- Financial planning

- Insurance

- Will writing

As MoneyOwl’s services are rather diversified, they do not need to rely solely on their investment services for revenue.

2. Banks and Brokers

I’ve combined these 2 together as both of them have relatively lower risks.

Since these banks and brokers are already well-established, the robo-advisory services are just one of the many services these companies provide.

That said, there are some cons when you use a bank or broker robo-advisor:

- They usually charge higher fees

- Their user interface may not be as sleek as the FinTech startups

- They may require you to have a larger initial amount to invest in their platform

Because of these potential drawbacks, you’ll need to consider the trade-offs if you wish to have better security.

#2 Look at the funding of the company

Robo-advisor firms may not solely rely on the revenue they earn from customers.

Instead, they may try to raise more capital through external funding.

These firms will have to pitch their ideas to potential investors. If these investors like the prospects of the firm, they will invest an amount of money into the firm.

In exchange for the funding, these investors will receive a stake in the company.

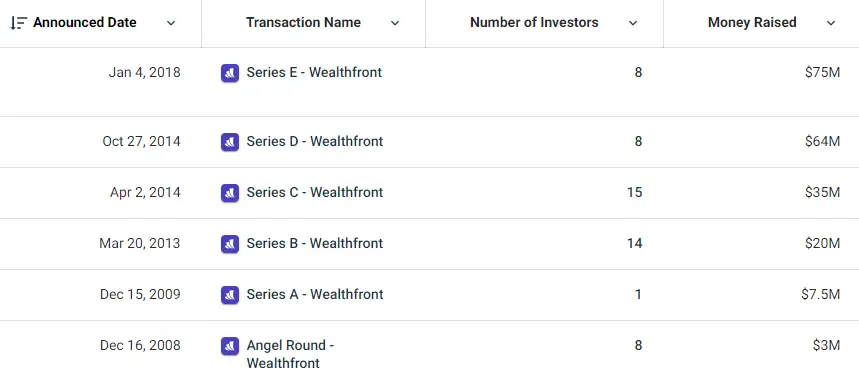

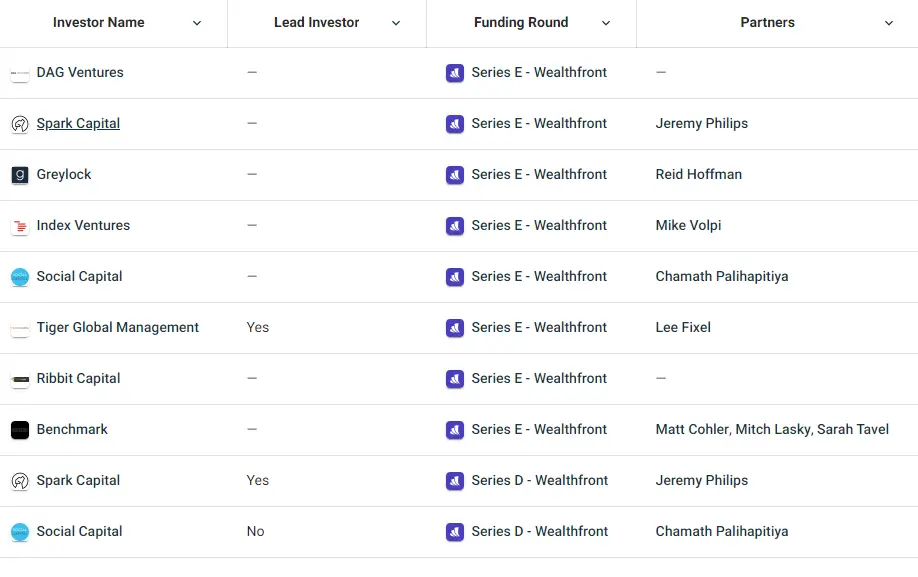

To find out more about the funding of the company, you can refer to Crunchbase.

This platform provides you with financial information about these companies.

However, not all the robo-advisors are listed on Crunchbase.

Finding financial information on Crunchbase

You are able to see how much a robo-advisor firm has raised in each funding round.

To maintain neutrality, I will be using Wealthfront as an example.

Here is a brief description of the meaning of each round:

| Funding Round | Description |

|---|---|

| Seed Funding (Angel Round) | Funding a startup to implement their idea |

| Series A | Companies should have a business model that can generate long-term profits |

| Series B | Companies are trying to expand their market reach |

| Series C | Companies are trying to scale and grow even more |

Most companies usually stop their funding at Series C. They will have Series D and E funding if they want to stay private for longer.

You can also look at the investors who have invested in the firm.

It really says something if reputable investors decide to invest in the firm!

However, even if companies do not receive funding, it doesn’t mean that they will not be successful.

For example, AutoWealth does not have any financials published on TechCrunch. Nevertheless, their CEO, Tai Zhi, mentioned that they will become profitable by 2020.

Therefore, the information on Crunchbase should not influence your decision entirely. It is just meant to be a reference to get a glimpse of the firm’s financials.

Alternatively, you can also look out for press releases on the robo-advisory firm. If they are successful in their funding round, there will be news circulating.

These methods mentioned will help you to understand the health of the firm’s financials. This also allows you to choose firms that have strong backing from their investors.

#3 Look at the exit route of the company

If you are worried about the risks of investing with one of these companies, you may want to look at their exit strategy.

Their strategy depends heavily on what type of custodian account they use.

To get better clarity, you can always drop an email to the customer service team of the company. They will be more than happy to answer your queries.

This will help to give you the reassurance of how your assets are managed, in the unfortunate event that the company you invest with shuts down.

With that said, I would suggest that you invest in a company that has an exit strategy that you’re comfortable with.

Conclusion

In summary, Smartly shut down as the robo-advisory scene in Singapore is extremely competitive. VinaCapital decided that it was no longer profitable and decided to stop funding this venture.

In the ultra-competitive robo-advisor scene, there is a risk that smaller firms may fail.

However, I believe that what happened with Smartly will be a one-off. Most of the other robo-advisors seem well equipped to become profitable in the long term.

Moreover, there are some benefits of investing with robo-advisors. Convenience is one huge benefit that you’ll receive.

If you are afraid of investing with a robo-advisor, I would suggest to research a bit more on the company first. This will give you more confidence that your funds will be safe when you invest them.

To be on the safe side, you may want to invest in a robo-advisory platform that is offered by banks or brokers. These platforms are generally safer as robo-advisory is not their sole source of revenue.

As such, the chances of banks and brokers closing are extremely low. However, this comes with a price as the fees that they charge are usually higher.

In the end, you will have to find the balance between risk and reward to see which robo-advisor is right for you!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 6 months.

You will be able to save up to $75 worth of fees!

You can view more information about this referral program on Syfe’s website.

StashAway Referral (Up to $40,000 SGD managed for free for 6 months)

If you are interested in signing up for StashAway, you can use my referral link to sign up.

Here’s what you’ll need to do:

- Sign up for a StashAway account

- Make a deposit of ≥ $10k within 4 weeks of signing up

- Receive a fee waiver for 6 months (up to $40k)

You can find out more about this program on SingSaver.

MoneyOwl Referral (Up to $65 GrabFood credits)

If you are interested in signing up for a MoneyOwl account, you can use my referral link to sign up. This will allow you to earn up to $65 GrabFood credits.

Here’s what you need to do:

- Sign up for a MoneyOwl account with my referral link

- Apply for MoneyOwl’s services

- Receive your GrabFood credits (up to 4 weeks later)

Here are the services you’ll need to sign up for to earn your GrabFood credits:

| Service | Condition | GrabFood Credit |

|---|---|---|

| Insurance | An insurance plan purchased and issued by MoneyOwl | $20 |

| Investment | An investment portfolio created and funded | $20 |

| Comprehensive Financial Planning | Financial plan is paid for and completed | $20 |

| Will Writing | Will successfully completed | $20 |

You can find out more about this referral program on MoneyOwl’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?