Last updated on June 6th, 2021

You’ve decided to start your investment journey in the London Stock Exchange (LSE). However, you may be unsure of how much you are required to invest in any of the stocks listed.

Furthermore, there is some conflicting information available as well. Some websites say that the minimum is 1 lot, while others say that it is 100!

So which is the accurate version?

Contents

What is the minimum lot size for the LSE?

The minimum lot size for the LSE is 1 unit. The LSE has removed the initial minimum order size of 50 units since 20 September 2010.

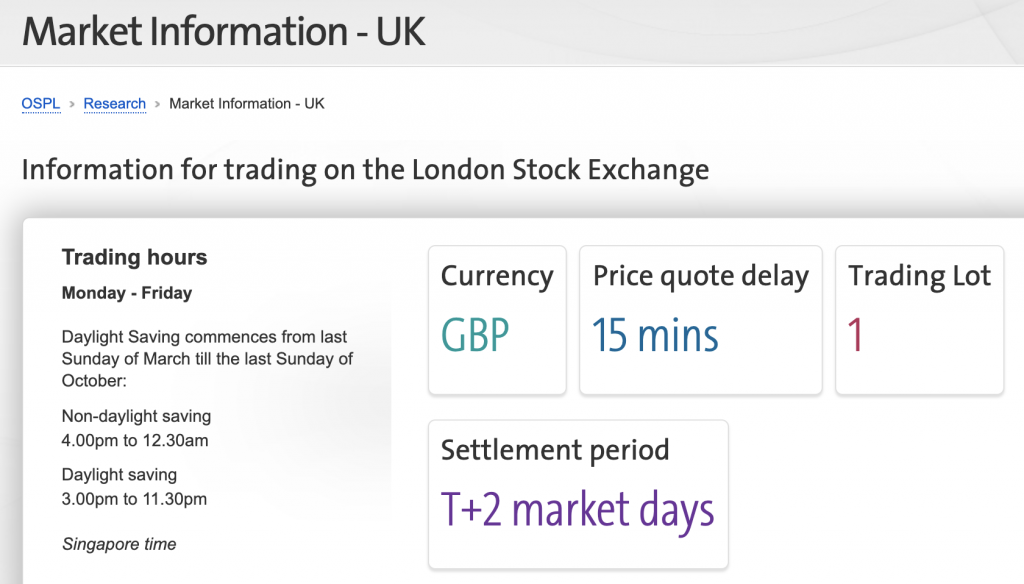

Unfortunately, the LSE does not have this information readily available on their website.

However, here are some clues we can use to determine the LSE’s minimum lot size:

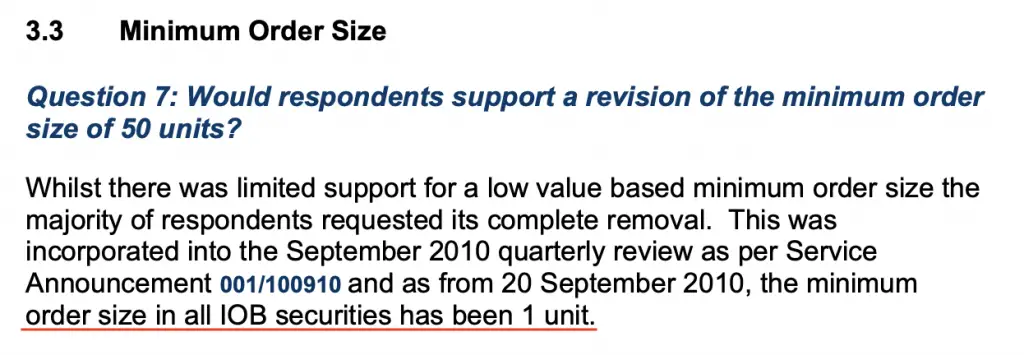

LSE has removed the minimum order of 50 units

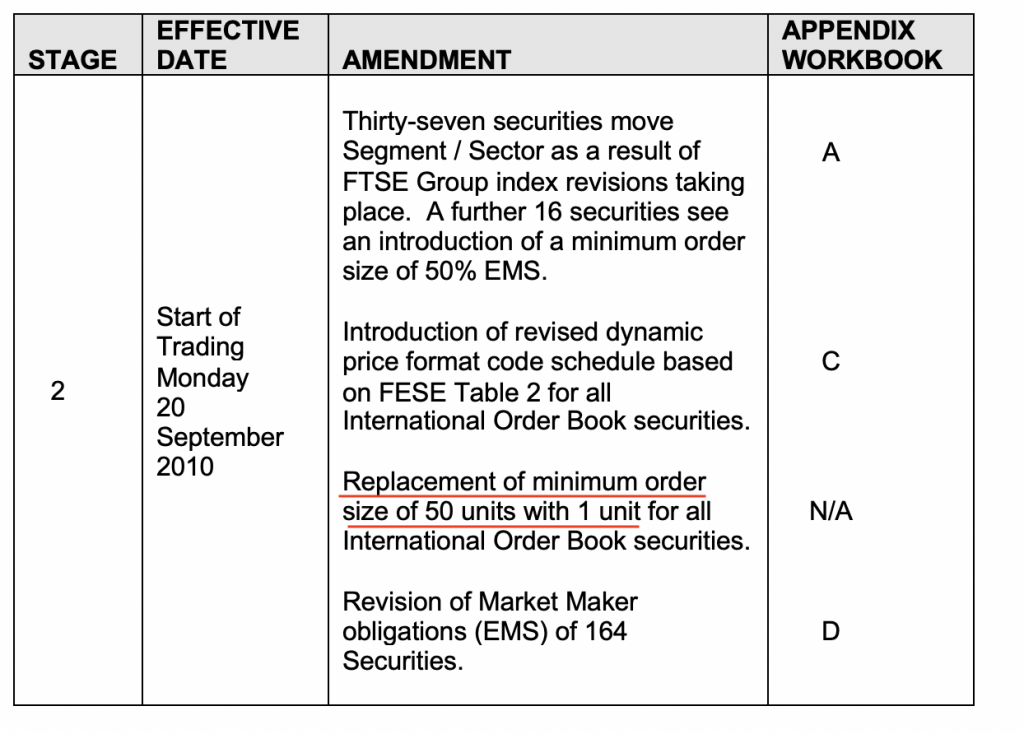

Before September 2010, the minimum lot size of the LSE used to be 50 units. This meant that you could only buy stocks listed on the LSE in multiples of 50.

This can be pretty expensive.

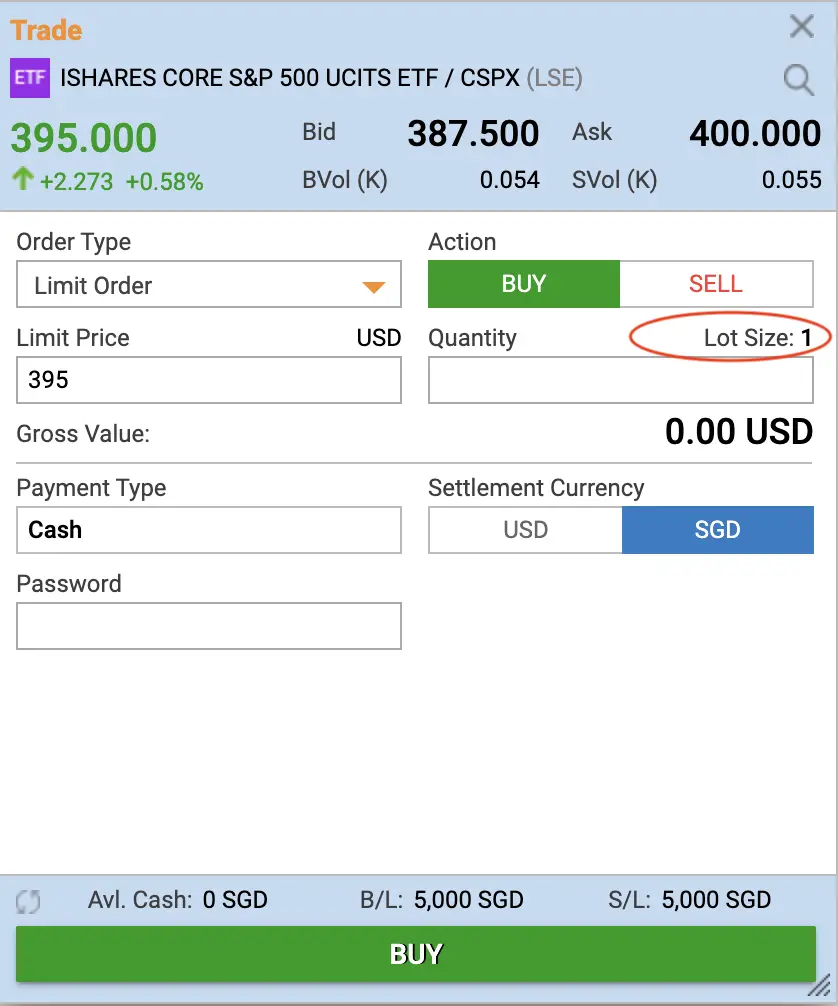

For example, CSPX is an S&P 500 ETF that is listed on the LSE. It costs around $370 USD for one unit.

If you wanted to purchase the CSPX ETF, you would have to purchase it in multiples of 50. This meant that you had to purchase it in multiples of $18,500 USD!

However during a Quarterly Review, the LSE decided to reduce the order size to 1 unit from 20 September 2010.

This was done as this change was heavily requested.

From 20 September 2010, the minimum lot size is now 1 unit on the LSE!

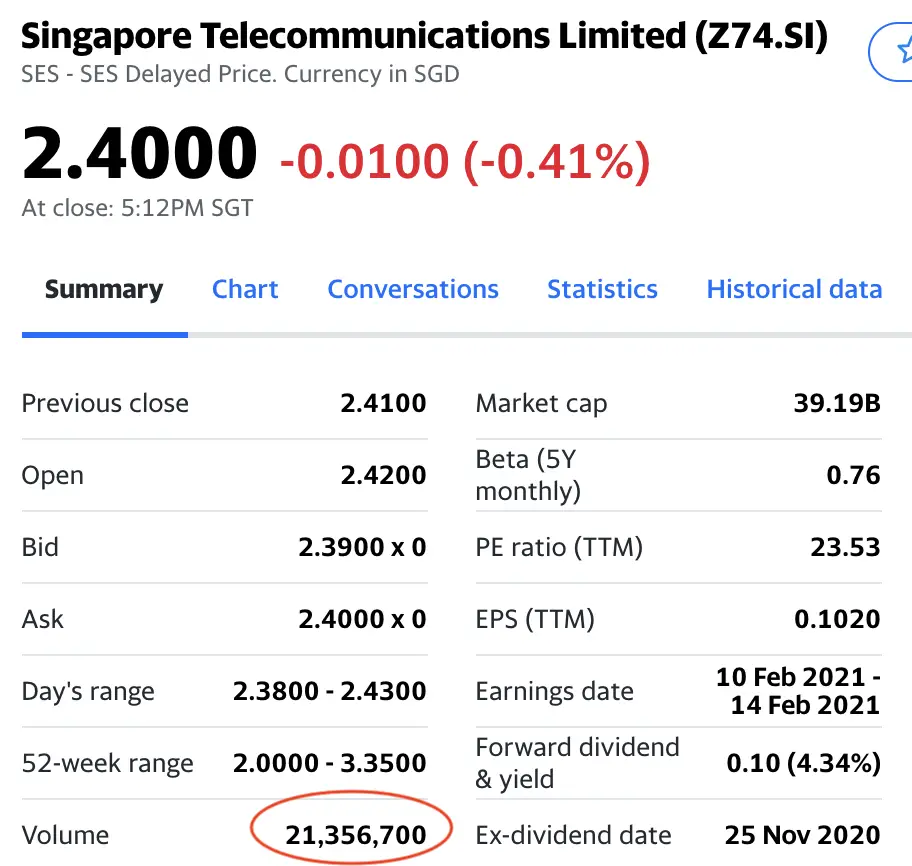

The trading volume is not in fixed multiples

You can also view the trading volume for the stocks to see the amounts that they are traded in.

For example, most of the stocks listed on the SGX are only traded in multiples of 100.

This is because the minimum lot size on the SGX for stocks is 100.

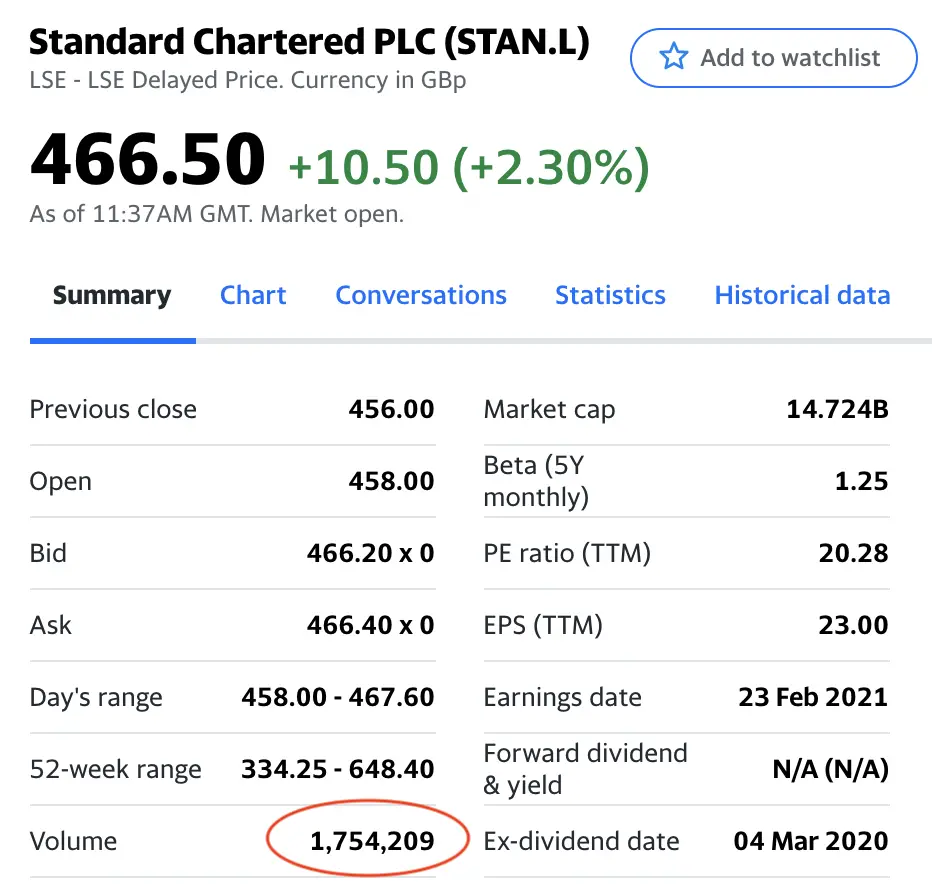

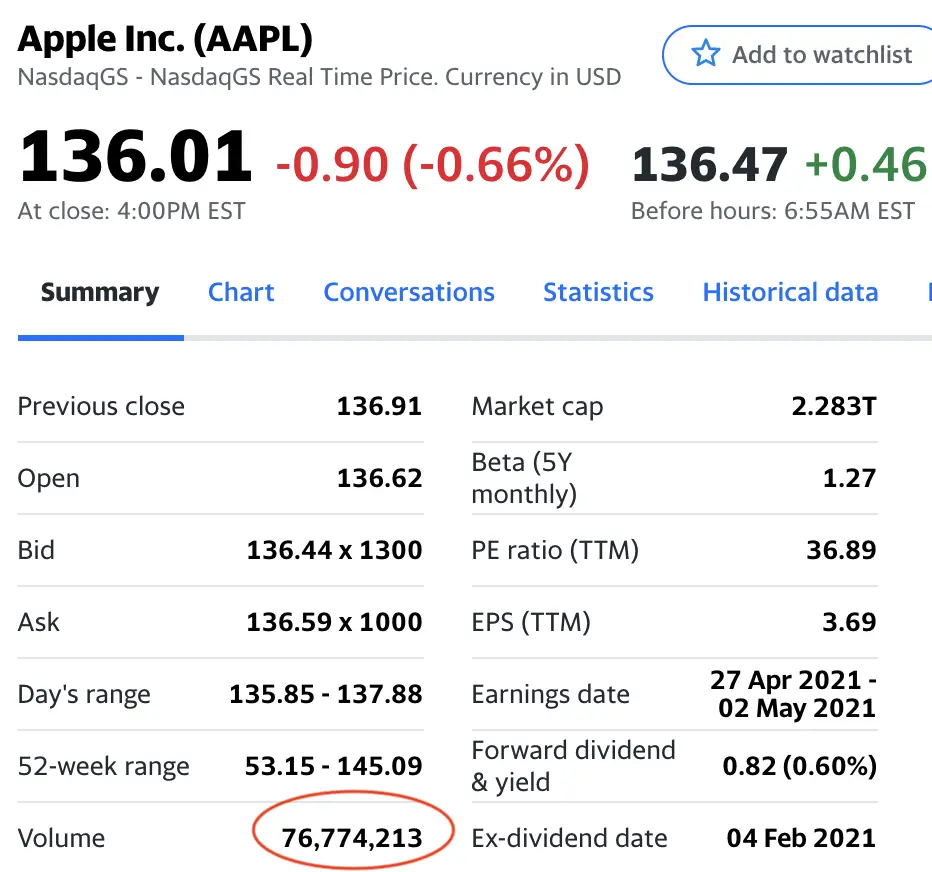

However, you can see that the stocks that are traded on the LSE does not have fixed multiples.

If there was a minimum lot size, you would not be able to trade odd units like 9.

This is similar to stocks traded in the Nasdaq, where the minimum unit size is 1 as well.

As such, you should be able to trade in lots of 1 share in the LSE!

You can view the volume chart to find the specific trading volume for each day for a stock.

Brokers allow you to trade in lots of 1 unit

There are a few brokers which allow you to trade on the LSE. This includes:

- Saxo

- Interactive Brokers

- OCBC Securities

- POEMS

- Standard Chartered

- Maybank Kim Eng

- KGI Securities

- DBS Vickers

- UOB Kay Hian

OCBC Securities mentioned that you can trade in lots of 1 unit,

as well as POEMS.

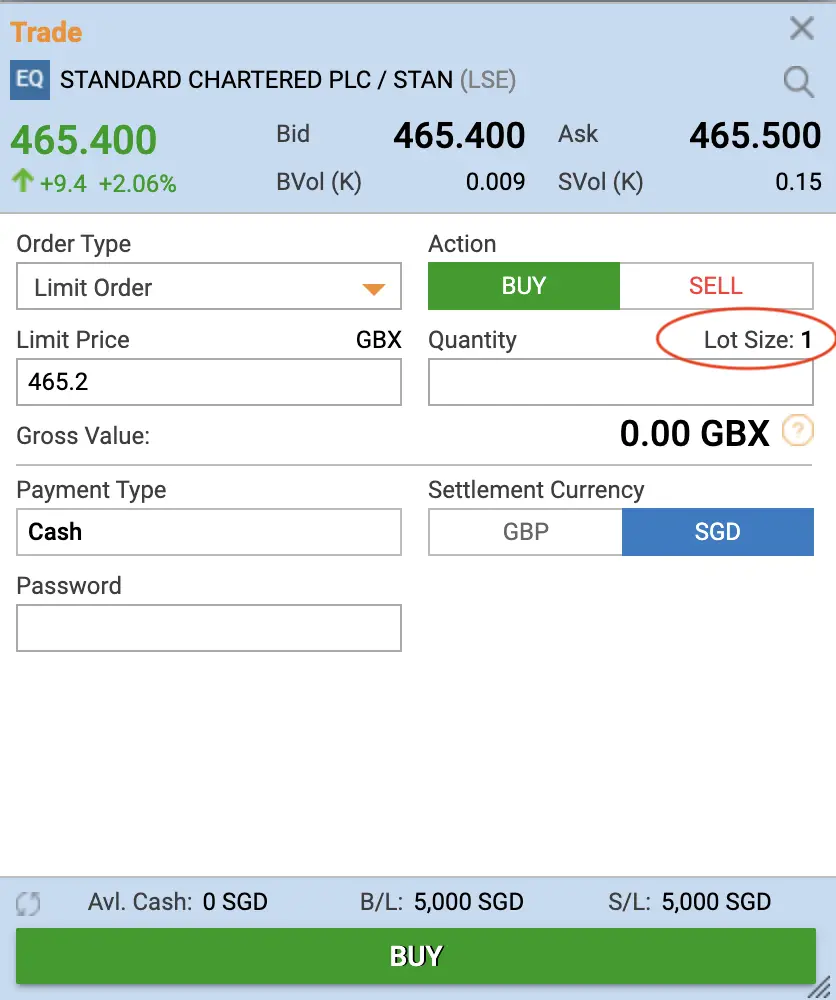

You can see that POEMS’ platform allows you to trade in lot sizes of 1 too.

This includes ETFs as well.

As such, most brokers should allow you to trade in lots of 1 unit on their platforms!

You’ll need to consider the trading commissions of the broker you choose

Some stocks like Standard Chartered only cost around 400 GBX, which is equivalent to GBP 4. This makes the stock really accessible for you!

Even though you can purchase just 1 unit of stocks listed on the LSE, you’ll need to consider the costs you’ll incur.

Most brokers will charge a commission for each trade you make. They will also have a minimum commission that you’ll need to pay:

| Broker | Commission | Minimum |

|---|---|---|

| Saxo | 0.1% | GBP 8 |

| Interactive Brokers | 0.45% | GBP 0.1 (ETFs) and GBP 0.11 (Stocks) |

| OCBC Securities | 0.70% | GBP 55 / EUR 70 / USD 95 |

| POEMS | 0.4% | GBP 25 |

| Standard Chartered | 0.25% | GBP 10 / EUR 10 / USD 10 |

| Maybank Kim Eng | 0.30% | GBP 20 |

| KGI Securities | 0.50% | GBP 50 |

| DBS Vickers | 0.25% (Cash Upfront) or 0.35% (Cash) | GBP 20 / EUR 26 / USD 28 (Cash Upfront) or GBP 25 / EUR 33 / USD 36 (Cash) |

| UOB Kay Hian | 0.35% | GBP 35 / EUR 33 / USD 36 |

For brokers that are found in Singapore, the minimum commissions can be really hefty!

You’ll need to consider how the minimum commission affects your fees when purchasing from the LSE!

Conclusion

For all stocks or ETFs listed on the LSE, the minimum units you are required to purchase is 1.

This makes it more accessible compared to other exchanges which have a minimum lot size, such as the SGX or HKEX.

However, you’ll need to consider the fees you incur as well. Some brokers charge quite a high minimum commission for each trade you make.

As such, the fees that you pay may be greater than your actual investment value!

Standard Chartered Referral (No fees for the first 2 months)

From now till 30 June 2021, you are able to enjoy zero trading fees for your first 2 months of trading.

You will need to use my referral link to sign up. However, I am only entitled to 3 referrals during this period.

Please contact me if you’re interested in receiving this promotion!

You can find out more about this promotion on Standard Chartered’s website.

Saxo Referral (Earn $100-$250 in cash)

If you are interested in creating a Saxo trading account, you can take part in the referral program.

Here’s are the rewards that you can receive from this program:

| Action | Reward |

|---|---|

| Fund ≥ SGD $3,000 and make ≥ 3 qualifying trades | SGD $100 |

| Fund ≥ SGD $100,000 and make ≥ 3 qualifying trades | SGD $250 |

The 3 qualifying trades that you need to make have to be on margin products, such as:

- CFDs

- FX

- Futures / Forwards

- Options

The process is quite different from other referral programmes, so you can contact me for the next steps for the referral!

You can find out more about the referral program on Saxo’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?