Last updated on March 5th, 2022

You’ve become tired of the poor returns that you’ve received from the Straits Times Index (STI). Most of your friends have been telling you to invest in the S&P 500 which provides much better returns!

The S&P 500 is an index that tracks the performance of the largest 500 companies in the United States.

However, how do you go about buying the S&P 500 in Singapore? Here’s a guide to get you started.

Contents

- 1 How to invest in the S&P 500 in Singapore

- 2 #1 Decide whether you want to invest in an ETF or mutual fund that tracks the S&P 500

- 3 #2 Choose which ETF or mutual fund you want to invest in

- 4 #3 Select a platform (either a brokerage or robo-advisor) that allows you to invest in the ETF or mutual fund of your choice

- 5 How do I dollar-cost average (DCA) into the S&P 500?

- 6 Should I just invest in the S&P 500?

- 7 Conclusion

- 8 👉🏻 Referral Deals

How to invest in the S&P 500 in Singapore

Here are 3 steps you’ll need to start investing in the S&P 500 in Singapore:

- Decide whether you want to invest in an ETF or mutual fund that tracks the S&P 500

- Choose which ETF or mutual fund you want to invest in

- Select a platform (either a brokerage or robo-advisor) that allows you to invest in the ETF or mutual fund of your choice

#1 Decide whether you want to invest in an ETF or mutual fund that tracks the S&P 500

When you want to buy into the S&P 500, you are unable to buy the index itself!

Instead, you will need to buy into a fund that tracks the S&P 500 index. These funds will buy into the stocks that make up the index.

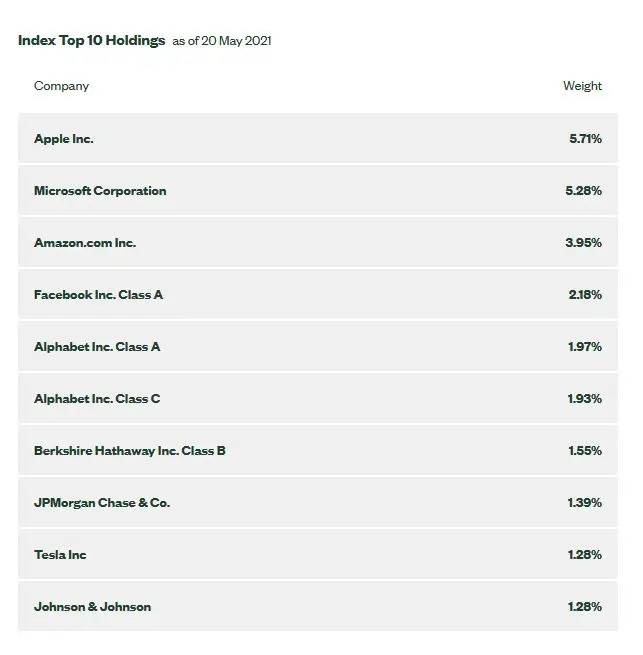

Here are the top 10 holdings in the S&P 500.

This means that the fund that you invest in will buy all of these stocks according to their weightage.

In fact, the S&P 500 actually has 505 stocks. This is because some of the companies in the index have multiple share classes!

You can see how the S&P 500 differs from other indices, such as:

Here are the 2 kinds of funds that you can invest in the S&P 500:

1. ETFs

Exchange-traded funds (ETFs) are the more popular option to invest in the S&P 500 in Singapore. This is because they are seen to be lower-cost options compared to mutual funds.

Moreover, they are available on stock exchanges. This makes it more accessible for you as an investor.

2. Mutual funds

Another type of fund that tracks the S&P 500 are mutual funds. These mutual funds were made popular by John Bogle in 1975. He was the pioneer of the S&P 500 Index Fund that allowed retail investors to buy into the S&P 500 Index.

However, it is hard to gain access to an S&P 500 mutual fund in Singapore. Popular funds like FXAIX, SWPPX and VFINX are unavailable to Singaporean investors. The only way to buy them could be via Interactive Brokers’ Mutual Fund Marketplace.

It may be possible to buy these funds via your financial advisor, but it may be pretty hefty.

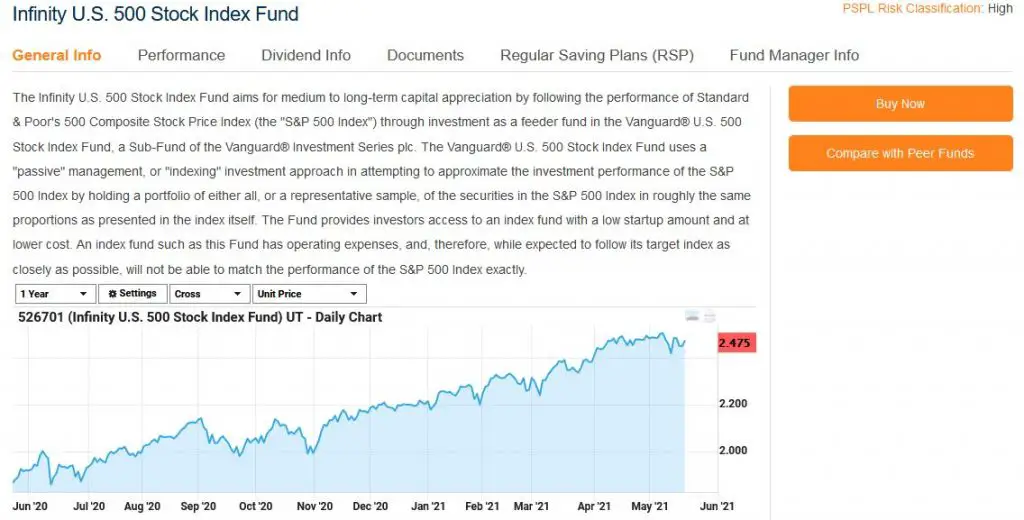

Infinity U.S. 500 Stock Index Fund (Lion Global)

The main mutual fund that is available to Singaporeans is the Infinity U.S. 500 Stock Index Fund. This fund is managed by Lion Global Investors.

There are 2 different classes to this mutual fund: SGD and USD. It may be better to invest in the SGD class since it helps to reduce your currency exchange risk.

Mutual funds are usually more costly in Singapore

Moreover, there are many additional costs when you invest in a mutual fund. These include (in May 2021):

- Initial charge (up to 2%)

- Expense ratio (0.68%)

It is usually more costly to invest in a mutual fund. In contrast, Vanguard’s S&P 500 ETF only has an expense ratio of 0.03%! As such, it may be more cost effective to invest in an ETF instead.

However, Endowus recently launched their Fund Smart portfolio. This allows you to buy into the Infinity U.S. 500 Stock Index Fund at a lower fee.

#2 Choose which ETF or mutual fund you want to invest in

If you’ve decided to invest in an ETF, you now have another headache. There are many different S&P 500 ETFs to choose from!

You can skip this step if you’ve decided to invest in a mutual fund.

Types of ETFs

Here are some of the S&P 500 ETFs that you can purchase in different exchanges:

1. SGX

In the SGX, there is only one S&P 500 ETF being listed. This is the SPDR S&P 500 ETF (S27) that is managed by SSGA.

There used to be a SGX-listed S&P 500 ETF (I17) by BlackRock as well. However, this fund has already been delisted on the SGX.

When you want to invest in S27, you may want to take note that the minimum units you need to invest is 10.

2. New York Stock Exchange (NYSE)

There are 4 different S&P 500 ETFs that are listed on the NYSE.

The reason why there are many ETFs is because they are managed by different fund managers.

You may want to note that all of these ETFs are distributing, which means they pay out periodic dividends.

| Ticker | ETF Fund Manager | Dividend Yield |

|---|---|---|

| VOO | Vanguard | 1.41% |

| IVV | BlackRock | 1.36% |

| SPY | SSGA | 1.33% |

| SPLG | SSGA | 1.37% |

Other S&P 500 ETFs that only track part of the S&P 500 Index

There are many variants of the S&P 500 ETFs available that track a subset of the S&P 500 Index. Here are some examples:

Since the indexes that these ETFs are tracking have their own focus, you will not be investing in all 500 companies in the S&P 500! Therefore, if you are interested in tracking only a specific area of the American market, you may consider investing in these ETFs.

You can view my guide on the best methods you can use to by US ETFs from Singapore.

Can I buy VOO in Singapore?

You are able to buy the VOO ETF in Singapore from a stock broker or robo-advisor that offers you access to the New York Stock Exchange (NYSE).

3. Irish-domiciled S&P500 ETFs listed on the London Stock Exchange (LSE)

The ETFs that I’ve previously mentioned are all domiciled in the US. However, there are other S&P 500 ETFs which are domiciled in Ireland. These are usually referred to as UCITS ETFs which are able to be listed on the European Stock Exchanges.

One huge advantage of UCITS ETFs is that they are able to own funds from US stocks, yet they do not incur the hefty US estate tax.

Here are some examples of the S&P 500 UCITS ETFs listed on the London Stock Exchange (LSE):

| LSE Ticker | Fund Manager | Currency | Type of ETF |

|---|---|---|---|

| VUSA | Vanguard | GBP | Distributing |

| VUSD | Vanguard | USD | Distributing |

| VUAA | Vanguard | USD | Accumulating |

| SPX5 | SSGA | GBP | Distributing |

| CSPX | BlackRock | USD | Accumulating |

| IUSA | BlackRock | GBP | Distributing |

| IDUS | BlackRock | USD | Distributing |

You can read my comparison between accumulating and distributing ETFs to see how they are different.

The 3 main differences among these ETFs include:

- Fund manager

- Currency

- Type of ETF (Accumulating or Distributing)

If you are interested in investing in the LSE from Singapore, you can check out my guide.

Which ETF should I choose?

There are so many different ETFs, so which one should you choose? Here are 3 things you may want to consider:

1. Expense Ratio

The expense ratio is the fee that you will need to pay the fund managers when you invest in the ETFs. Here are the expense ratios of the ETFs that I’ve previously mentioned:

| Ticker | Exchange | Fund Manager | Expense Ratio |

|---|---|---|---|

| S27 | SGX | SSGA | 0.09% |

| VOO | NYSE | Vanguard | 0.03% |

| IVV | NYSE | BlackRock | 0.03% |

| SPY | NYSE | SSGA | 0.09% |

| SPLG | NYSE | SSGA | 0.03% |

| VUSA | LSE | Vanguard | 0.07% |

| VUSD | LSE | Vanguard | 0.07% |

| VUAA | LSE | Vanguard | 0.07% |

| SPX5 | LSE | SSGA | 0.09% |

| CSPX | LSE | BlackRock | 0.07% |

| IUSA | LSE | BlackRock | 0.07% |

| IDUS | LSE | BlackRock | 0.07% |

All of the expense ratios are below 0.1%, which is really low! The UCITS ETFs tend to have a higher expense ratio than the NYSE counterparts.

Even though the costs seem really low, the extra fees that you pay for UCITS ETFs may eventually add up!

2. Dividend Withholding Tax

The dividend withholding tax is something that you may want to consider as well. These S&P 500 ETFs will issue a dividend to you. Your dividends will be taxed before they are distributed to you.

Due to the different tax treaties, you will incur different taxes based on the fund’s domicile. Here are the dividend withholding taxes that you will incur:

| Fund Domicile | Dividend Withholding Tax |

|---|---|

| USA | 30% |

| Ireland | 15% |

If you invest in an Ireland-domiciled ETF, you will incur a lower dividend withholding tax!

S27 and the NYSE S&P 500 ETFs are domiciled in the USA. As such, you will incur the higher withholding tax (30%). You will not be able to avoid this tax if you invest in the SGX-listed ETF.

It may be more cost efficient to invest in an Ireland-domiciled ETF as you will incur a lower tax.

3. Liquidity

If you are a frequent trader, an ETF’s liquidity may be something that is important for you. One way that an ETF’s liquidity is measured is by the average trading volume. Here are the 3 month average trading volumes for these ETFs (from Yahoo Finance):

| Ticker | Exchange | Fund Manager | Average Trading Volume |

|---|---|---|---|

| S27 | SGX | SSGA | 291 |

| VOO | NYSE | Vanguard | 4,605,149 |

| IVV | NYSE | BlackRock | 4,759,557 |

| SPY | NYSE | SSGA | 88,929,077 |

| SPLG | NYSE | SSGA | 3,272,774 |

| VUSA | LSE | Vanguard | 289,813 |

| VUSD | LSE | Vanguard | 412,666 |

| VUAA | LSE | Vanguard | 12,457 |

| SPX5 | LSE | SSGA | 2,996 |

| CSPX | LSE | BlackRock | 104,724 |

| IUSA | LSE | BlackRock | 258,570 |

| IDUS | LSE | BlackRock | 258,687 |

The NYSE listed ETFs have a much higher liquidity compared to the LSE listed ones. And let’s not even talk about S27 which has such a poor liquidity!

With a poorer liquidity, it may be hard for you to buy or sell at your intended price.

Should you choose a NYSE or LSE listed ETF?

Here are the 3 factors side-by-side for these 2 types of ETFs:

| NYSE | LSE | |

|---|---|---|

| Expense Ratio | Lower | Higher |

| Dividend Withholding Tax | Higher | Lower |

| Liquidity | Higher | Lower |

You can invest in a UCITS ETF to reduce the dividend withholding tax you incur. However, the tradeoff you will incur is a lower liquidity and a higher expense ratio.

As such, you really need to consider which ETF you prefer to invest in!

If you’d like to know more about the taxations and returns of these ETFs, you can read this article by the New Academy of Finance.

Comparison between individual ETFs

Still undecided between which ETF you should be choosing? Here are some comparisons between some individual ETFs:

- S27 vs SPY

- S27 vs VOO

- S27 vs CSPX

- CSPX vs VUSD

- VOO vs VUSD

- CSPX vs VOO

- VUSD vs SPY

- VUSA vs VUSD

- CSPX vs SPY

- CSPX vs IVV

#3 Select a platform (either a brokerage or robo-advisor) that allows you to invest in the ETF or mutual fund of your choice

So you’ve decided which ETF or mutual fund you should choose. Now, you’ll need to find a brokerage or robo-advisor that allows you to purchase it.

1. Brokerage

Brokerages allow you to trade ETFs on the different exchanges. Here is a list of some of the brokerages you can use in Singapore:

| Brokerage | NYSE | LSE |

|---|---|---|

| FSMOne | ✓ | ✕ |

| POEMS | ✓ | ✓ |

| CGS CIMB | ✓ | ✕ |

| Saxo | ✓ | ✓ |

| Tiger Brokers | ✓ | ✕ |

| DBS Vickers | ✓ | ✓ |

| OCBC Securities | ✓ | ✓ |

| Interactive Brokers | ✓ | ✓ |

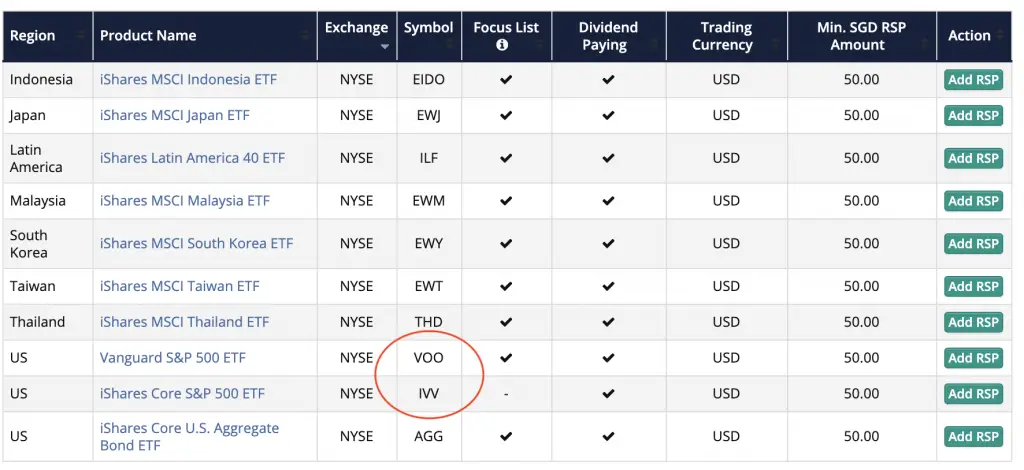

FSMOne offers regular savings plans in the US stock exchanges

FSMOne also allows you to invest in either VOO or IVV via a regular savings plan.

This is something that other regular savings plans like OCBC BCIP, Invest Saver or POEMS Share Builders Plan do not offer. As such, only FSMOne provides you with the option to dollar cost average into the S&P 500.

Some brokerages offer mutual funds

If you do wish to invest in a S&P 500 mutual fund, there are some options you can consider as well:

1. Interactive Brokers for international mutual funds

Interactive Brokers is an online brokerage that spans across multiple countries. As such, it is able to offer you access to certain mutual funds. One such example is the VFIAX mutual fund.

2. Local brokers for Lion Global Infinity 500 Mutual Fund

Some local brokers do offer you access to the Lion Global S&P500 mutual fund too. This includes:

However, there may be a lot of hidden fees when you invest in this S&P 500 mutual fund. You may want to consider other low-cost methods of investing in the S&P 500 instead!

Other factors to consider

There are other factors you may want to consider when selecting which brokerage to invest in. This includes:

- Trading commissions

- Exchange rate

- Other miscellaneous fees

- Ease of depositing and withdrawing funds

As such, do try to take the time to see which is the best brokerage for you!

2. Robo-advisors

Here are 3 robo-advisors that allow you to invest in the S&P 500:

#1 Endowus

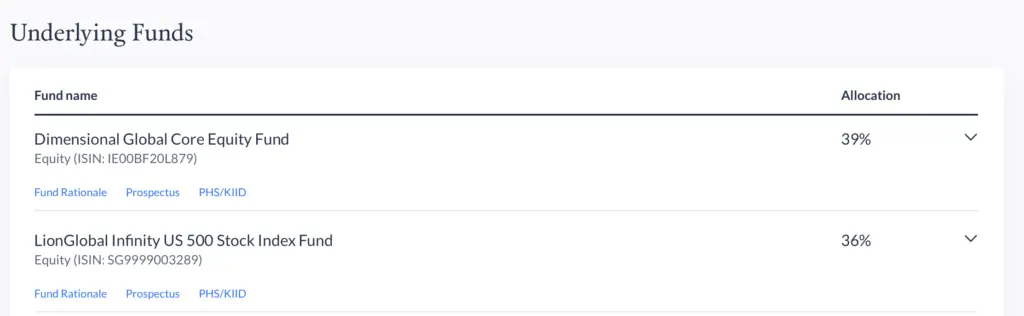

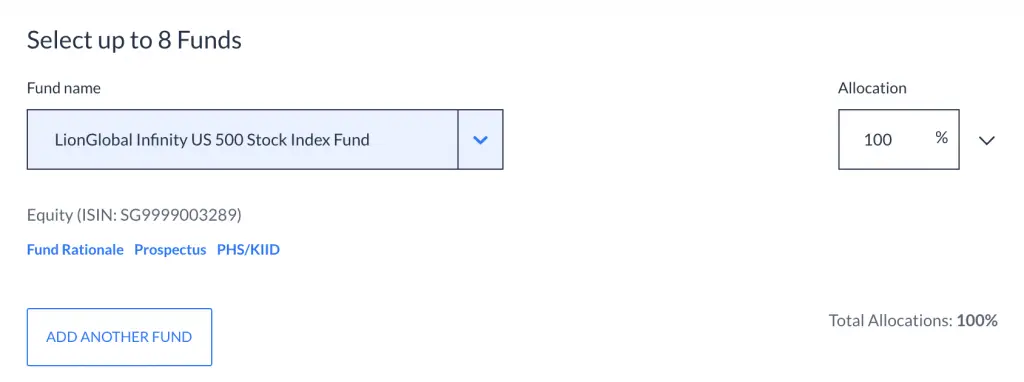

Endowus provides you with access to the S&P 500 via the Lion Global Infinity US 500 Stock Index Fund. You will be able to invest in this fund either through the Advised Portfolios, or by creating your customised portfolio via Fund Smart.

If you choose to invest in one of Endowus’ Advised portfolios, you are able to gain exposure to the S&P 500. A part of your funds will be invested into the Lion Global Infinity US 500 Stock Index Fund.

Around 36% of your funds will be invested into this index if you choose a 100% equity portfolio.

If you want to create a portfolio that is 100% invested in the S&P 500, you can do so via Fund Smart.

Fund Smart allows you to create your customised portfolio by selecting up to 8 different funds.

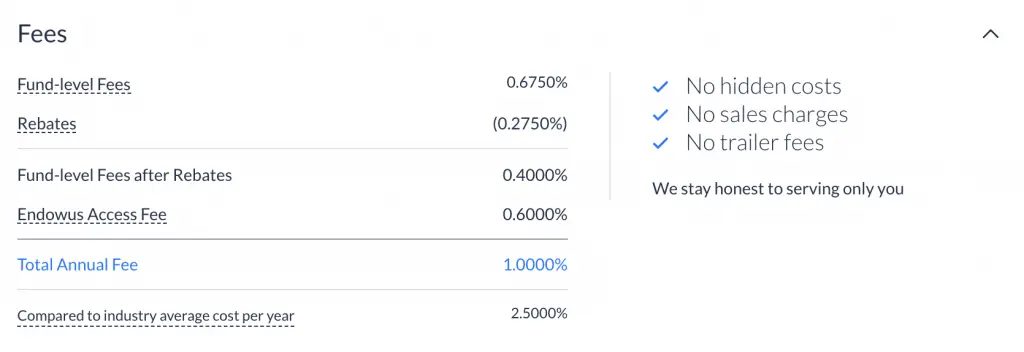

Endowus also has lower fees compared to normal brokers. You will incur a total of 1% in fees from both Endowus and the fund manager.

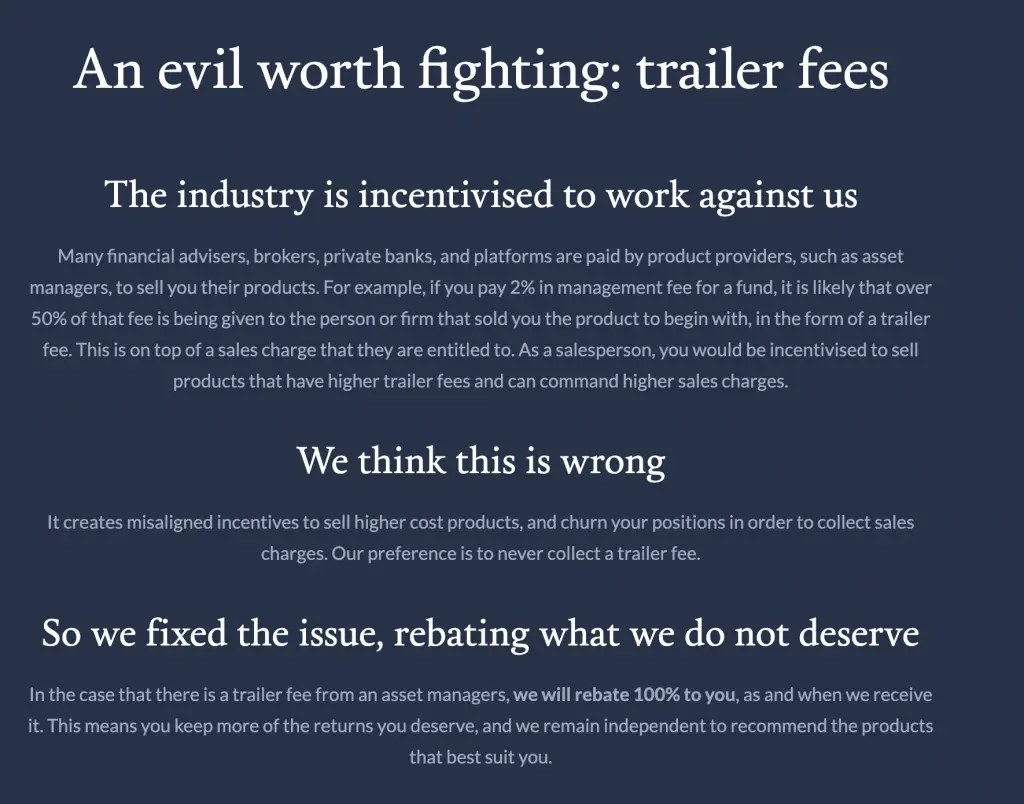

This is because Endowus rebates the trailer fees that they receive from the fund manager to you.

This will further help to reduce your cost of investing!

To access this low-cost robo-advisor, you required to invest an initial amount of at least $1k. For every subsequent investment, you will need to invest at least $100 per transaction,

This may be a good way for you to buy into the S&P 500, especially if you only have a small sum to invest.

The best part is that you are able to use both your SRS and CPF funds to gain exposure to the S&P 500 by buying this fund!

#2 Syfe Select (Custom)

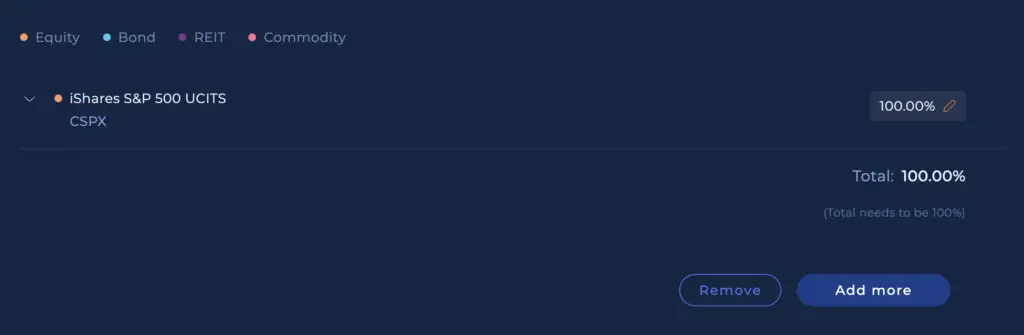

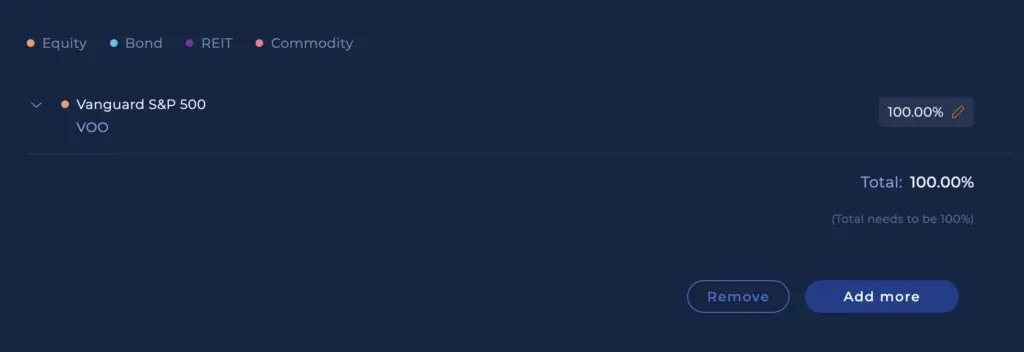

If you decide to make a custom Select portfolio on Syfe, it is possible for you to invest solely in the S&P 500. You can do this by choosing a 100% allocation into CSPX or VOO, which are ETFs that track the S&P 500.

To do so, you will need to create a Syfe Select ‘Custom‘ portfolio, and select a 100% allocation to either ETF.

This can be done with CSPX,

as well as VOO.

The good news is that you can start investing in the S&P 500 with no minimum amount. You are able to just put in $1 a day while you use Syfe!

However, Syfe will invest your money in fractional shares. This may have some implications in the unfortunate event that Syfe closes down.

Another drawback is that you will be paying an additional 0.65% in annual fees to Syfe. Let’s say that you receive a 10% return in one year.

Due to the fees that you pay Syfe, you will only receive a 9.35% return, instead of a 10% return.

It may be good to start off with Syfe, since it has no minimum sum. However as your portfolio grows, you may want to consider alternative methods of investing into the S&P 500.

This is because the management fees can be very costly once you have a large investment amount with Syfe!

#3 Kristal.AI

Kristal.AI is an attractive option you may want to consider. They do not charge you any management fees if your total investment amount is less than $10k!

Within Kristal.AI, you can choose between the SPY and IVV ETFs.

S&P 500 index subsets are also available, such as the State Street S&P500 Growth ETF (SPYG) and the Invesco S&P500 Technology ETF (RYT).

However, there are some drawbacks when investing with Kristal AI:

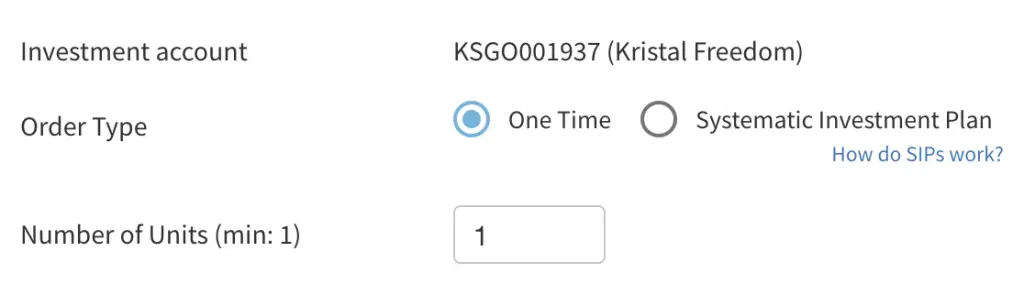

1. You cannot invest in fractional shares

You are unable to invest in fractional shares using Kristal AI. The minimum number of units that you can purchase the SPY is 1.

As such, this is similar to buying this ETF via a broker with access to the US markets.

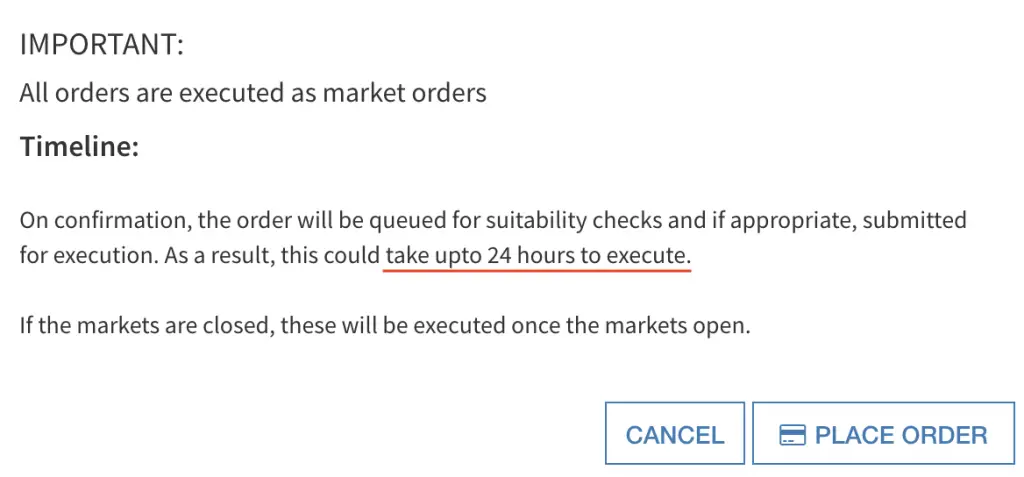

2. There is a time lag between initiating and executing the order

When you invest with Kristal.AI, you may experience a time lag. Your order may take up to 24 hours to be processed.

The NAV that you see on the ETF’s page is based on the last market close price. As such, you will need to pay an extra 2% of the NAV as a buffer.

This may be an added cost as you may be buying the ETF at a price higher than you intended to!

Kristal.AI may not be the best way to invest in the S&P 500 ETF

Kristal.AI provides an interesting method to invest into the S&P 500 ETF with its variety of products. Furthermore, you do not incur any transaction fees or management fees if your total invested amount is less than US$10k.

However, the time lag and lack of fractional shares may make Kristal AI unattractive.

Kristal AI does keep your assets under your own name in custodian accounts under Saxo Markets. This is a drawback as it prevents you from investing in fractional shares. However, you will be given more control of your assets in the unlikely event that Kristal AI closes down.

How do I dollar-cost average (DCA) into the S&P 500?

To dollar-cost average into the S&P 500, you will need to select the stock broker that has the lowest trade commissions and monthly fees to keep your costs low. Alternatively, you can choose to invest using a robo-advisor, as most of them do not charge transaction fees.

The good thing about using robo-advisors is that you can set up recurring transfers to their platform. Once you set up a monthly investment, the platform will help to invest into the ETF or fund that tracks the S&P 500 immediately for you.

However, robo-advisors charge management fees instead of transaction fees. While they are good for beginners, the amount of fees you pay can be quite high if your invested amount reaches a sizeable amount.

Brokers are a good choice to DCA into the S&P 500 too. You will need to find one that has the cheapest trading commissions, so that you can save for each trade that you make!

Should I just invest in the S&P 500?

While the S&P 500 is diversified across 500 companies, it is still heavily concentrated in the USA. If you solely invest in the S&P 500, you are putting your faith in the US economy to do well, which may not always be the case.

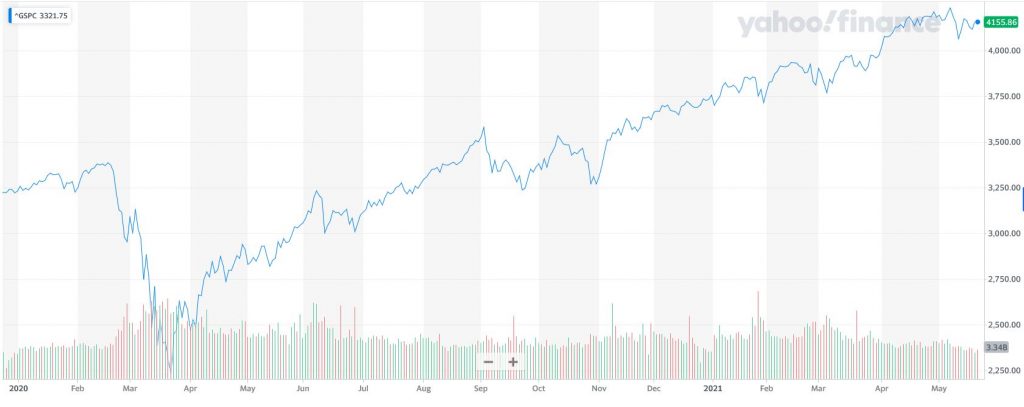

The S&P 500 has continued to perform throughout the years, which makes it one of the more popular indices to invest in.

However, if you intend to be a passive index investor, the S&P 500 may still be too concentrated for you. If the US economy fails in the future, your investments will plunge too!

In this case, you may want to consider buying indices which tracks companies from across the world, such as the MSCI World Index.

Conclusion

There are so many ways for you to invest in the S&P 500. It can be really overwhelming at first when you are looking at all the options. However, the raw returns of all of these instruments should be the same!

This is because all of them should have the same allocation since they all track the same index.

As such, the major things you’ll need to consider are:

- The fees you incur

- The taxes you incur

- The liquidity and ease of withdrawal

There are also other things you can invest in, such as the ARKK ETF. You can try to explore the different products out there to decide which is the best for you!

If you’re looking for a way to track the markets and your portfolio, you can consider using TradingView, which allows you to monitor more than 50 stock exchanges.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 6 months.

You will be able to save up to $75 worth of fees!

You can view more information about this referral program on Syfe’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?