Last updated on September 21st, 2021

[UPDATE: SingLife has put new sign-ups for the SingLife Account on hold from 15 December 2020. You may want to consider consider cash management accounts offered by robo-advisors instead, such as Endowus Cash Smart, Syfe Cash+ or StashAway Simple.]

Are you tired of switching between saving accounts to get the best interest rate on your savings?

Instead of a savings account, why not consider an insurance savings plan like the SingLife Account?

I’ve been using the account since March 2020, and found that it has great benefits, with only a few downsides.

Here’s why I believe everyone should apply for one now.

Contents

- 1 SingLife Account Review

- 2 What is the SingLife Account?

- 3 Why is the SingLife Account Better Than Other Insurance Savings Plans?

- 4 Who Is Eligible for a SingLife Account?

- 5 How Do I Apply for a SingLife Account?

- 6 What Are the Requirements for the SingLife Account?

- 7 How Does the SingLife Debit Card Work?

- 8 How Can I Withdraw Money From the SingLife Account?

- 9 Is SingLife Safe?

- 10 How Do I Terminate My SingLife Account?

- 11 How Does SingLife Compare With Other Alternatives?

- 12 Should I Get The SingLife Account?

- 13 Is the SingLife Account good?

- 14 👉🏻 Referral Deals

- 15 SingLife FAQs

SingLife Account Review

The SingLife Account provides an attractive return rate on your first $10k with flexible deposits and withdrawals. With a low minimum amount, it is a place that you should consider putting your savings into.

Here is the SingLife Account reviewed in-depth:

What is the SingLife Account?

The SingLife Account is a capital guaranteed insurance savings plan offered by SingLife. It offers you an attractive interest rate with flexible withdrawal and a low minimum sum.

Moreover, you are able to receive some insurance benefits too.

How does the SingLife Account work?

You will need to credit your money into the SingLife Account. SingLife will then use this money to invest in certain assets that will generate a return. You will then receive the current crediting rate that SingLife offers.

Although SingLife did not explicitly state how they can generate such high returns, they should be investing in low risk assets.

Is SingLife capital guaranteed?

The SingLife Account is a capital guaranteed insurance savings plan. This means that SingLife will have to return you the capital (aka amount) that you’ve put into the account, no matter what. Unlike other investment products, there is no risk of losing the capital that you have placed into this plan.

As such, they may not want to invest in assets that are too risky!

Here’s the rate of returns offered that you can get with the SingLife Account:

| Amount | Rate of Return |

|---|---|

| First $10k | 1.5% p.a |

| Next $90k | 1% p.a. |

| Any Amount > $100k | 0% p.a. |

Is SingLife’s return rate guaranteed?

The return rate for the SingLife Account is not guaranteed. SingLife may decide to lower the return rate on the account, if the assets which they invest your funds in are not performing as expected.

This happened after 1 November 2020, where the base return rate on your first $10k has decreased from 2.5% to 2%. The base interest rate was reduced further to 1.5% from 28 Jan 2021.

It is still possible to earn 2% p.a. on your first $10k. However, you will need to participate in the Save, Spend and Earn campaign to earn that additional 0.5%.

The campaign requires you to spend $500 each policy month to receive the additional 0.5%.

Even though the return rate has been reduced to 1.5%, it is still a really good deal for your first $10k!

How does the return rate work?

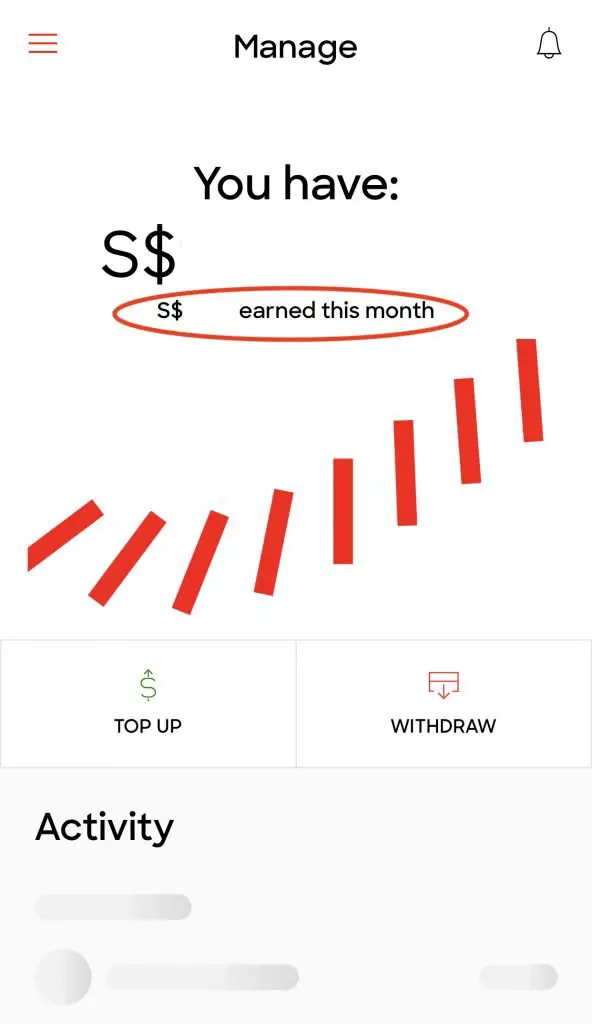

One thing I really like about the app is that it shows you the rate of returns you have earned for each day.

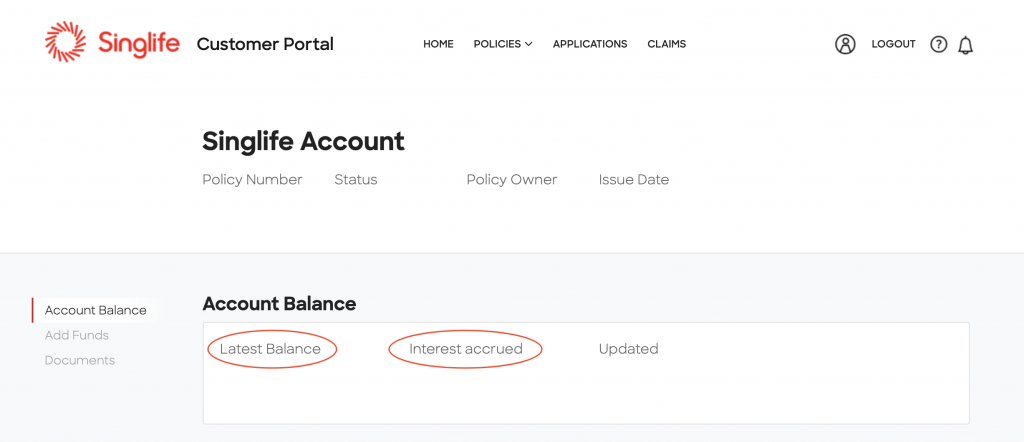

SingLife has an online portal as well for you to check your balance, if you prefer to do so.

When you create your SingLife Account, you will be given a SingLife ID. You can login to the portal using either your mobile number or username.

The rate of return is calculated daily, and will be credited to you at the end of each month.

SingLife considers the start of each month to be the exact date that you applied for the account.

For example, if you created the account on the 13th day of the month, you will receive your return rate on the 13th day of each month.

How is the daily return rate being calculated?

When SingLife mentions that the return rate per annum is 1.5%, it is usually being rounded up to the nearest decimal place.

The actual return rate that you get may be slightly lower than 1.5%.

So to calculate the daily return rate you will receive, you can divide 1.5% by 365. This gives you about a 0.0041% return rate per day.

You would then need to multiply it by the total amount you have in the SingLife Account.

For example, a $10k deposit would give you around 41 cents each day.

Insurance benefits of the SingLife Account

The SingLife Account is an insurance plan as well. As such, it provides you with certain benefits for:

- Death

- Terminal Illness

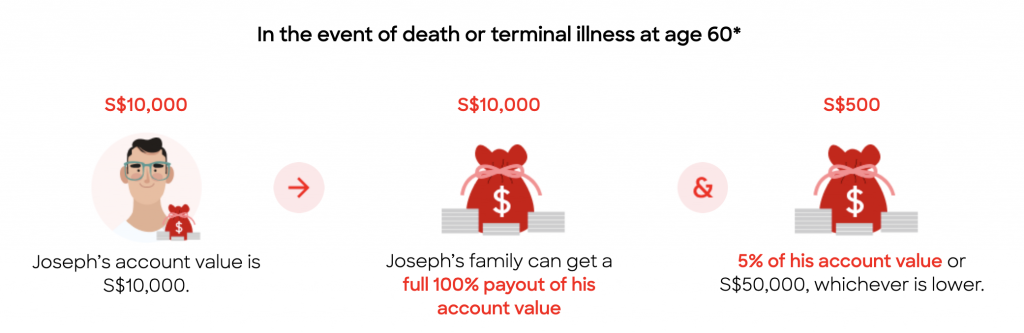

If you pass on with the policy in effect, you will receive a death benefit according to your age.

| Age of Death | Death Benefit |

|---|---|

| Before 61 y/o | Account Value + the LOWER of 5% of Account Value OR $50K |

| After 61 y/o | Account Value + the LOWER of 1% of Account Value OR $50K |

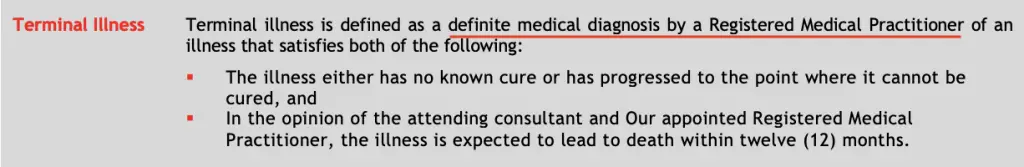

If you are diagnosed with a terminal illness, you will receive the full death benefit, depending on your age.

Here is SingLife’s definition of a terminal illness:

The good thing about this death benefit is that it is a ‘sum assured‘ benefit. This allows you to claim death benefits from multiple insurance policies!

Do I need insurance plans if I already have the SingLife Account?

The insurance benefits provided by the SingLife Account cannot cover you entirely.

For example, let’s say you pass on and you’re below 61 years old.

If you have $10k in the SingLife Account, you will only receive $10.5k when you pass on.

The average expense for a funeral is between $7-10k in 2018. This means you are just able to cover the expenses for a funeral with this payout.

What if you still have loans outstanding, such as your housing loan?

Your family will still need to repay the loan on your behalf!

You will need to have other insurance plans too

As such, it is insufficient to just rely on the payouts provided by the SingLife Account in case of death or total permanent disability.

If you have any dependants or outstanding loans, it would be best to purchase an additional life insurance plan.

These plans give a payout ranging from $100k to more than $1million. This amount will be able to provide for your family.

As such, the insurance benefits provided by the SingLife Account are good to have, but you should not solely rely on them.

Why is the SingLife Account Better Than Other Insurance Savings Plans?

Previously, insurance savings plans used to be very rigid.

There are 2 main ways that you place your funds into a plan:

- Regular Monthly Deposits

- One-Time Lump Sum

Once you have committed to a plan, the money is locked up with the insurance company. You can only withdraw it at the end of the agreed period.

In contrast, there is no lock-in period for SingLife.

You can freely deposit and withdraw funds to and from the account, at any point of time!

No withdrawal fees

Some insurance companies may charge fees for their plans. For example, you may be charged a withdrawal fee.

However, the SingLife Account does not charge any fees. The only catch is that you do not get to enjoy the return rate if your account value is less than $100.

The SingLife Account is an insurance savings plan

It is important to note that the SingLife Account is neither a savings account nor a fixed deposit.

The SingLife Account is just a flexible insurance savings plan that has similar characteristics to a savings account.

It is important to note this difference, especially when it comes to the definitions under SDIC.

Who Is Eligible for a SingLife Account?

Here’s the criteria, as stated on SingLife’s website:

- You have to be a Singaporean Resident who is either a:

- Singapore Citizen

- Singapore PR

- Foreigner holding a valid pass

- Your age has to be between 18-75 years old

The requirements are very flexible, and almost anyone can open an account with SingLife!

How Do I Apply for a SingLife Account?

Here’s how to apply for the SingLife Account:

- Download the app on the App Store or Google Play Store (you can use my referral link to sign up for the account)

- Sign up for a SingLife ID using MyInfo (your ID will be your phone number)

- Apply for the SingLife Account in the app

Although SingLife’s website states that you require a few minutes for the signup process, the app can get a bit laggy and may not load properly.

If you are experiencing such problems, I would recommend that you wait a few hours before trying to apply via the app again.

Once you’ve successfully signed up for the account, you can login to the app either using Touch / Face ID or a 4-digit PIN code.

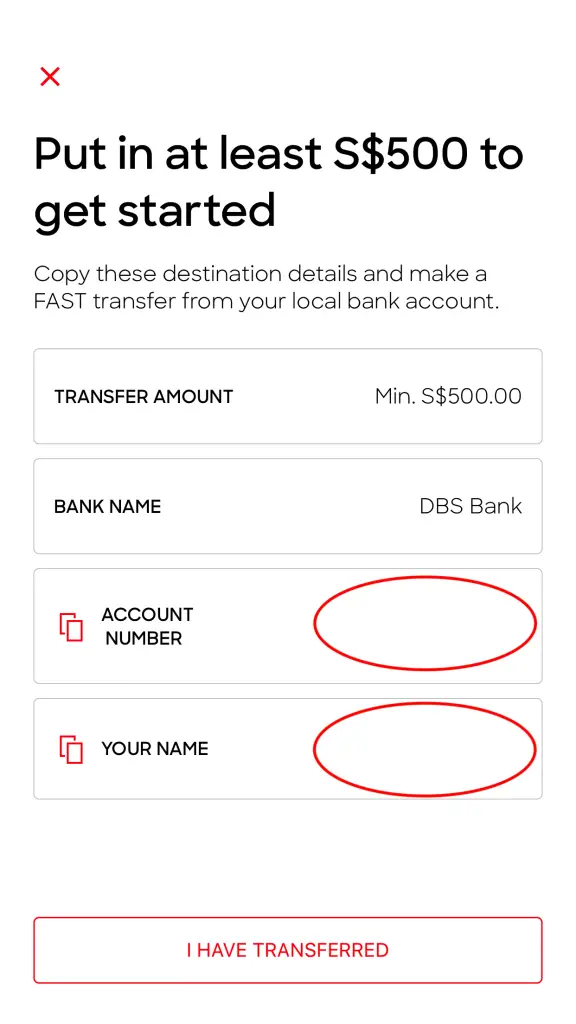

You’ll have to deposit a minimum of $500 first. This allows you to start earning the advertised rate of return.

SingLife is an insurance company, and not a bank. As such, it is not able to issue you a bank account. However, SingLife is a partner with DBS. Your SingLife Account will be tagged to a DBS bank account. You will use this account for any deposits you wish to make.

You’ll need to add the account number assigned to you as a payee in your local bank account, before you can transfer any money.

After you’ve set your SingLife account as a payee, you can freely deposit any amount from your local bank account into SingLife.

The transfer is really fast as well. You should receive a notification below once you’ve transferred money from your bank account to your SingLife Account.

What’s more, SingLife will send you a summary of the transactions you made on the previous day.

Although SingLife does not provide an e-Statement at the end of each month, this summary is a good way for you to check your daily transactions.

What Are the Requirements for the SingLife Account?

There are very few terms that you’ll have to comply to, and there’s no fall below fee as well!

You’ll need a minimum of $100 inside the account to continue the earn the return rate.

If your account value is below $100 for more than 60 days, SingLife reserves the right to terminate your policy.

How Does the SingLife Debit Card Work?

The SingLife Account comes with a Visa debit card as well.

Whenever you use the card, the amount will be debited from your SingLife Account.

The SingLife debit card has 2 main benefits:

#1 No fees (FX or annual)

The card does not have any FX fees or annual fees.

FX fees are foreign transaction fees being charged to your card when you use it for overseas purchases.

Such fees are around 2.5-3.5% of the actual amount that you need to pay.

SingLife states that they offer competitive exchange rates as well. So you can consider using this card for your overseas online purchases!

Besides the SingLife debit card, there are other debit cards that do not charge FX fees as well, including:

You are able to use this card for your day-to-day purchases in Singapore as well.

However, you are unable to use the card to make withdrawals from a local ATM.

You can find out 4 simple ways to withdraw cash, even if you do not have an ATM card.

How does the SingLife debit card compare to YouTrip?

The SingLife debit card is very similar to the YouTrip card, a multicurrency debit card.

Here’s a comparison between the 2 debit cards:

| SingLife | YouTrip | |

|---|---|---|

| Multiple currencies in account? | No (can choose either SGD or foreign currency at point of sale) | Yes |

| Top-up needed? | No (direct from SingLife account) | Yes (min $20) |

| Inactivity Fee | No | $5/mth if inactive for 12 mths |

| FX Fees | No | No |

| FX Rates | Unknown | Very competitive |

| Retrenchment Benefit | Yes | No |

| ATM Withdrawal | No | Overseas only (fee will be charged) |

Depending on your spending patterns, you may choose one card over another.

Since I have the YouTrip card which provides really competitive FX rates, I do not see a need to get the SingLife debit card.

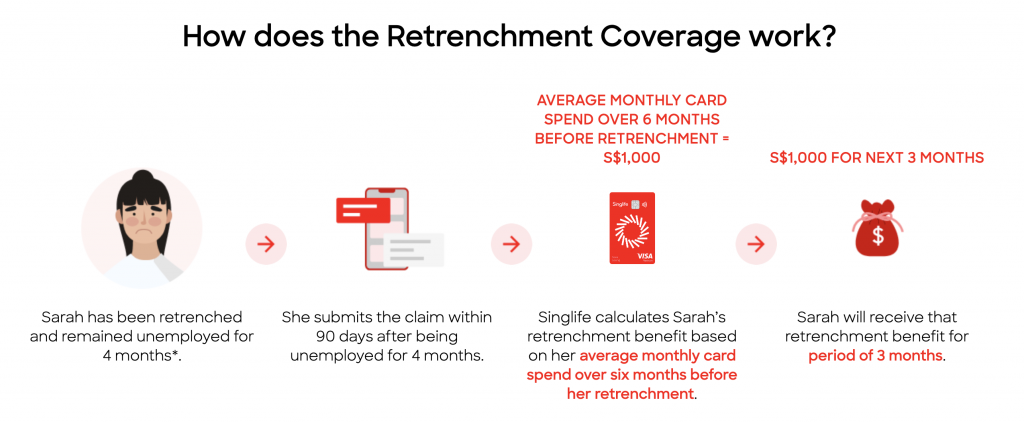

#2 Retrenchment Benefit

Another unique feature of the debit card is its retrenchment benefit.

If you have been retrenched and you remain unemployed for ≥ 4 months, SingLife will pay a retrenchment benefit for a period of 3 months, up to $10k.

This benefit is calculated based on the average card transaction values you have made in the past 6 months before you are retrenched.

It is certainly a unique feature of the SingLife Account.

However, I still prefer to use the Standard Chartered JumpStart debit card.

This is because it gives me a 1% cashback on any eligible Mastercard transaction.

Moreover, I do not have a use for the retrenchment benefit at this point of time.

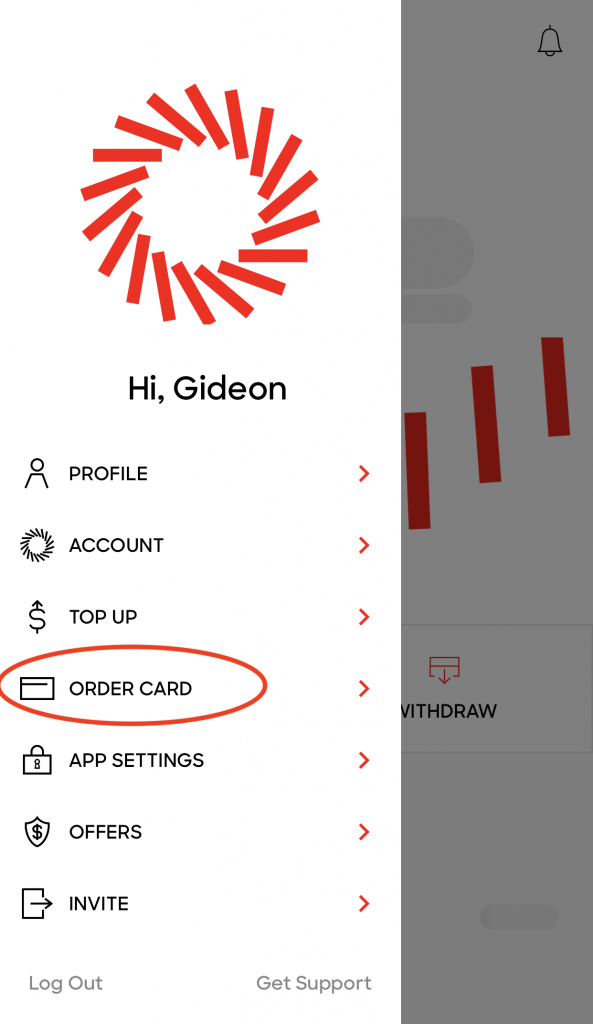

Ordering the SingLife Debit Card

Here’s a step-by-step guide to order the SingLife debit card:

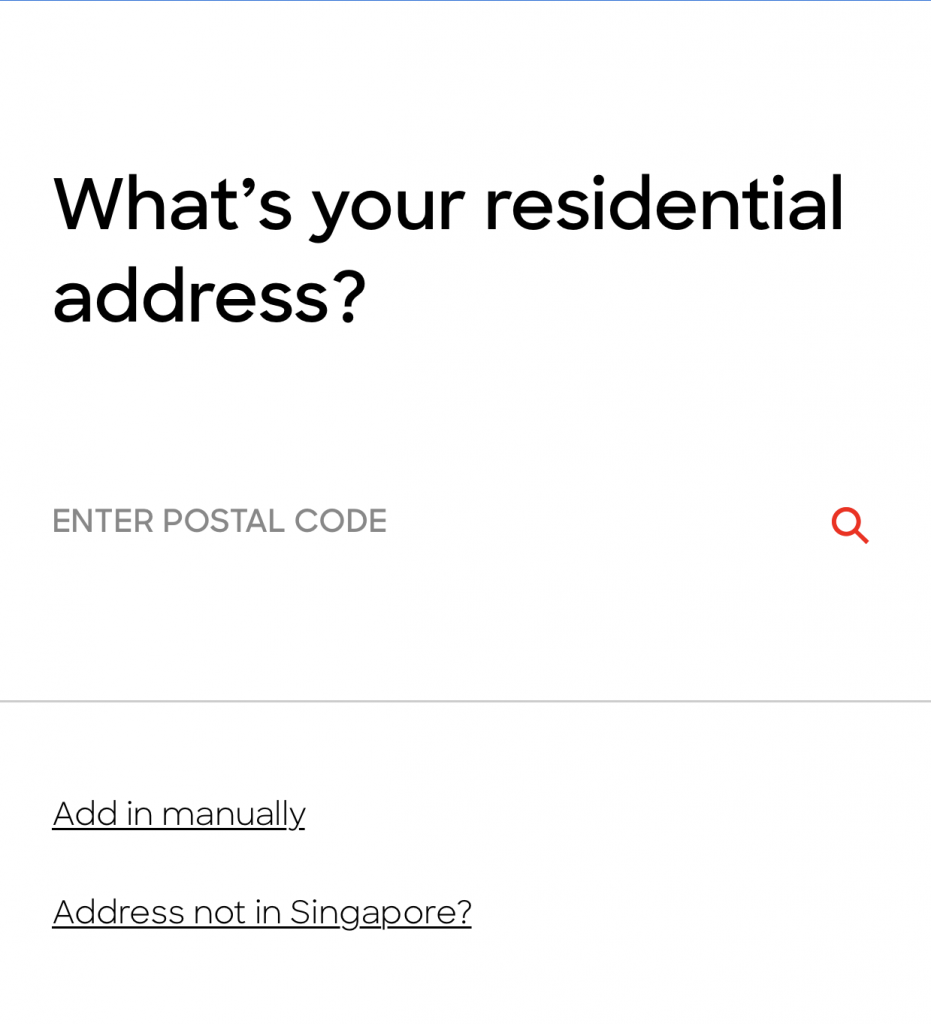

#1 Go to ‘Order Card‘

#2 Enter your address manually or via postal code

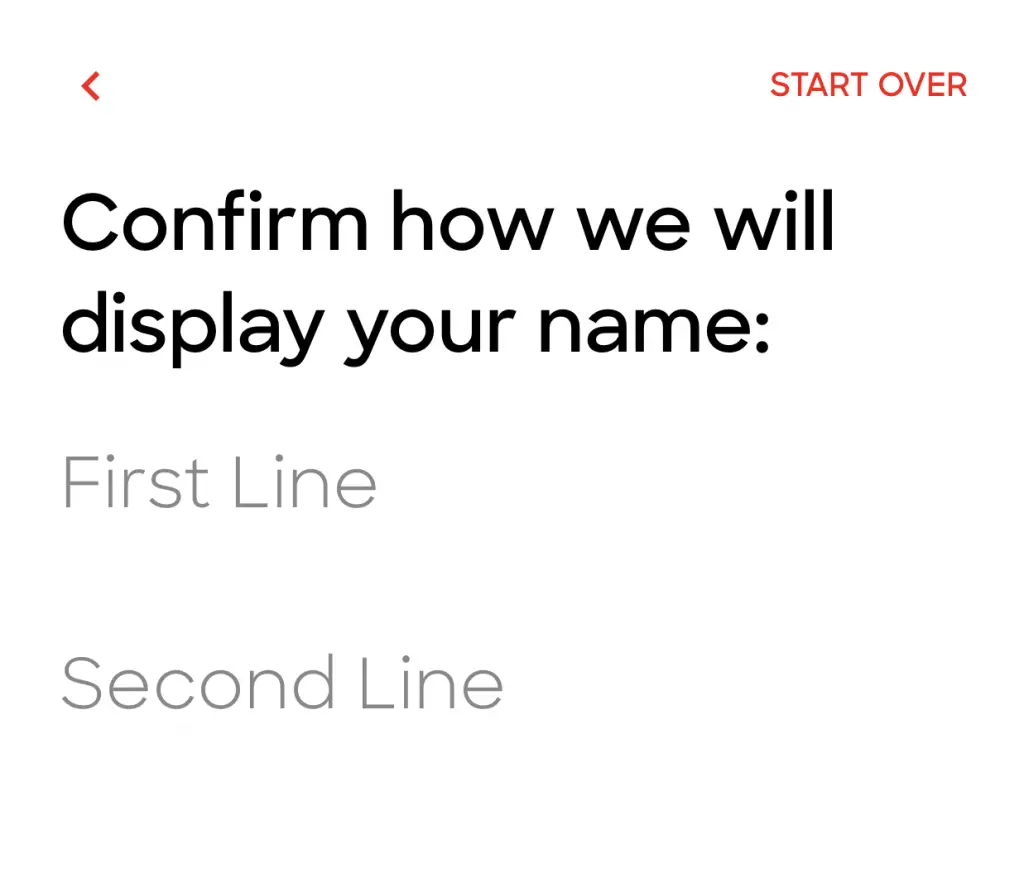

#3 Confirm how your name will be displayed on the card

#4 Place the order

The card should arrive within 9-12 business days.

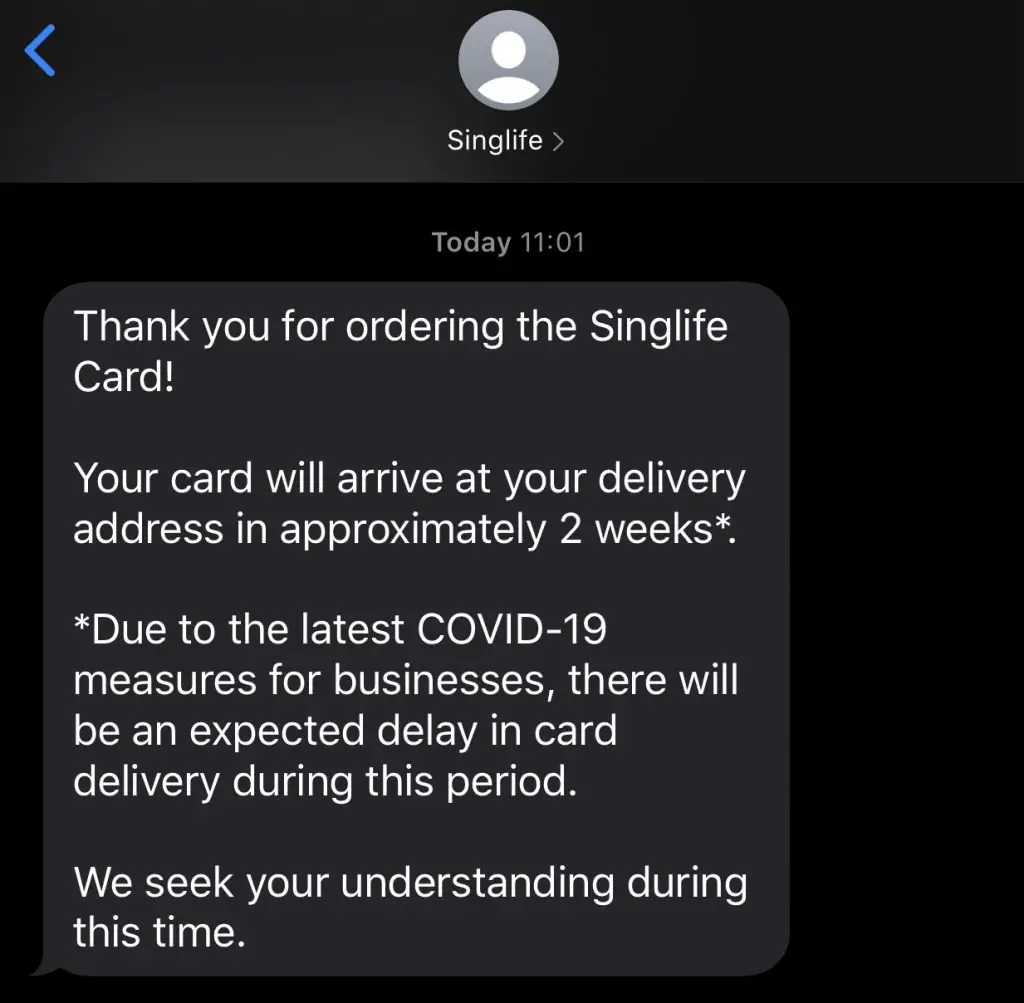

You should receive an SMS confirmation as well.

It took around 2 weeks for my debit card to be delivered.

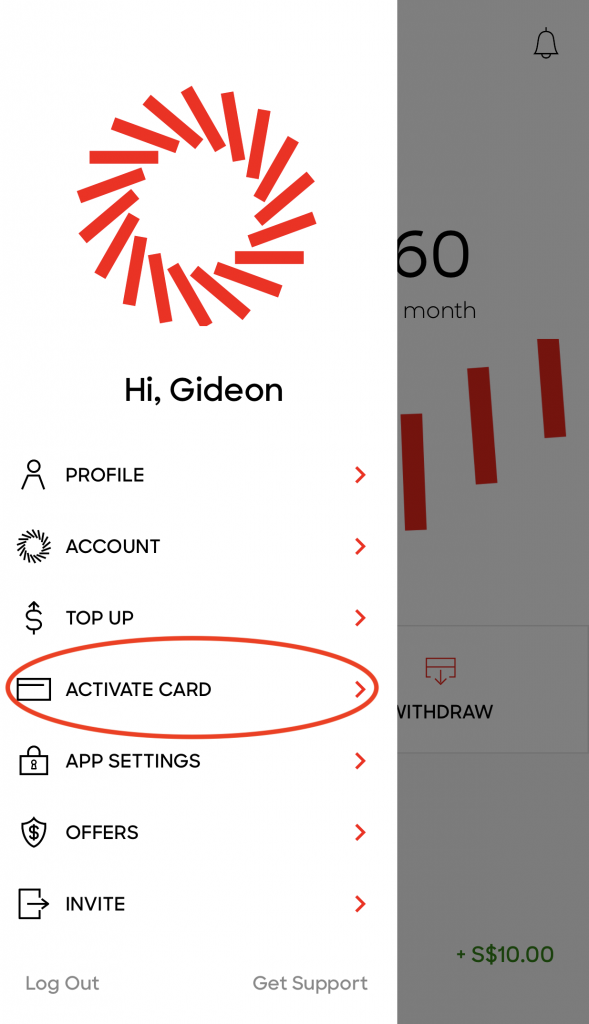

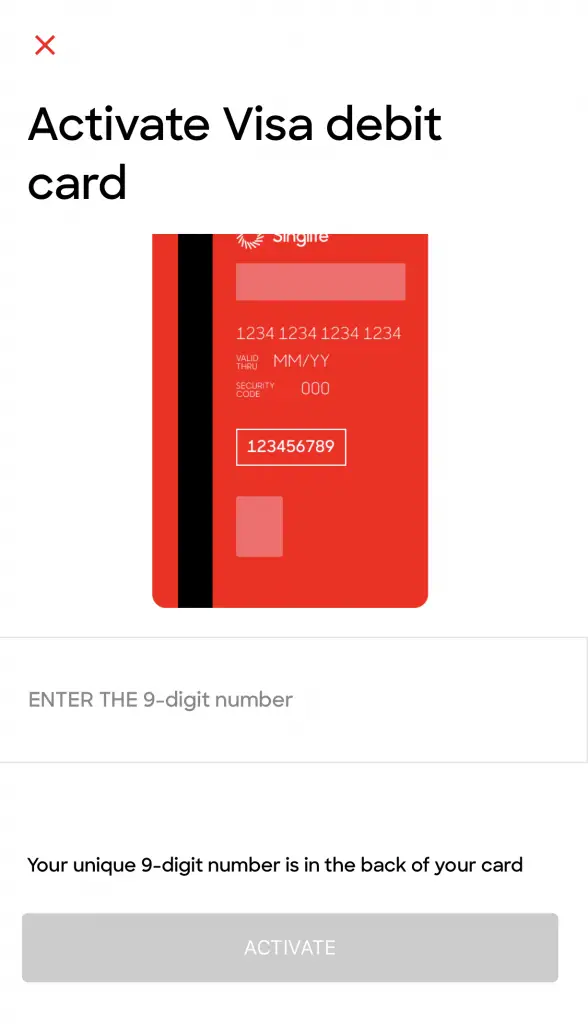

#5 Activate your card

You can follow the instructions in the letter to activate your card.

You will need to select ‘Activate Card’ from the menu.

You will then need to enter a 9-digit code that is found at the back of your card.

Your card will be activated after entering your code.

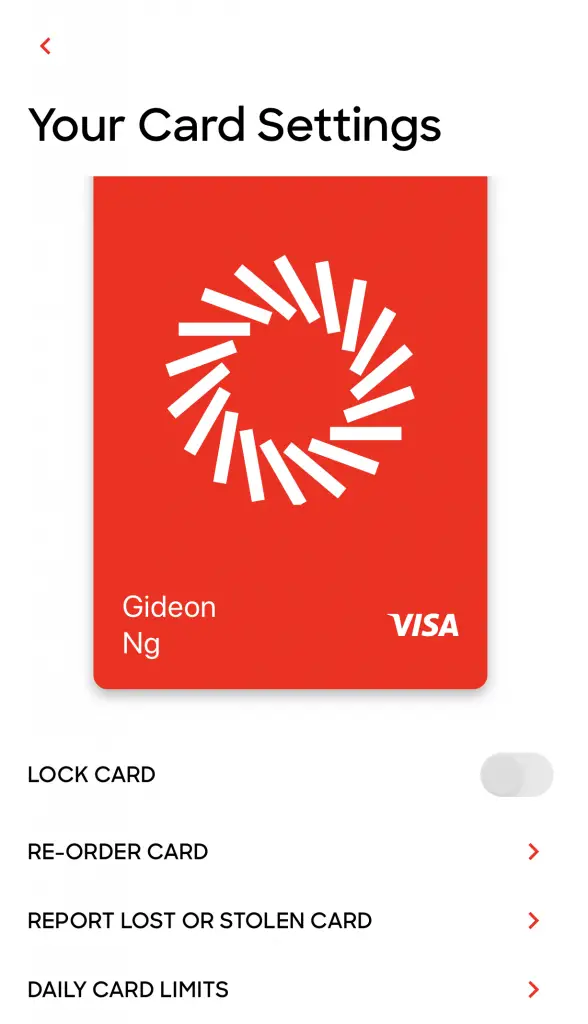

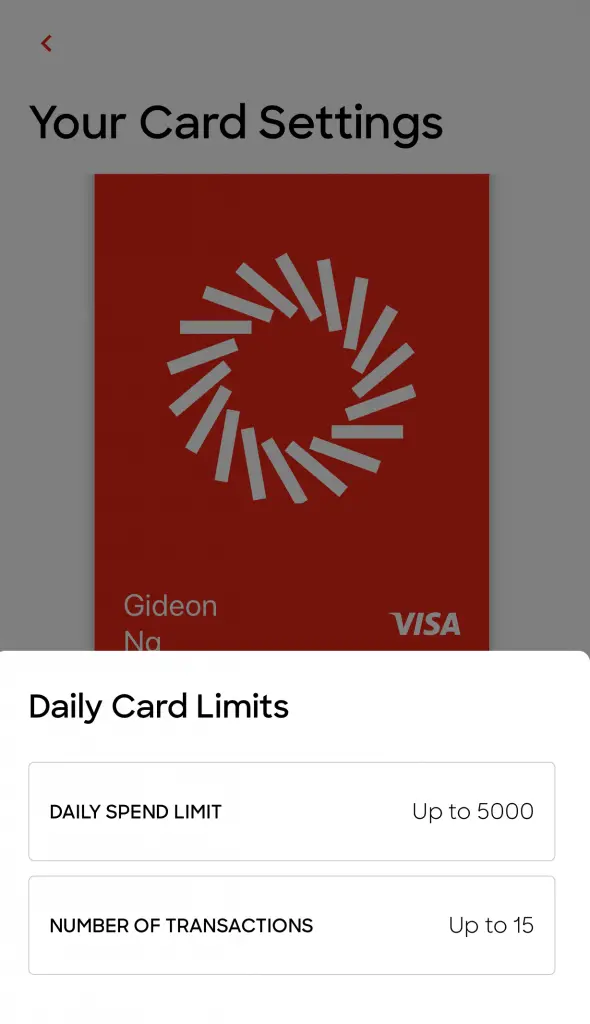

#6 Update your card’s settings

From the app, you are able to update your card’s settings.

Here are 4 things you can do in this menu:

- Lock your card

- Re-order your card (this will cancel your original card)

- Report a lost or stolen card

- Set a daily card limit

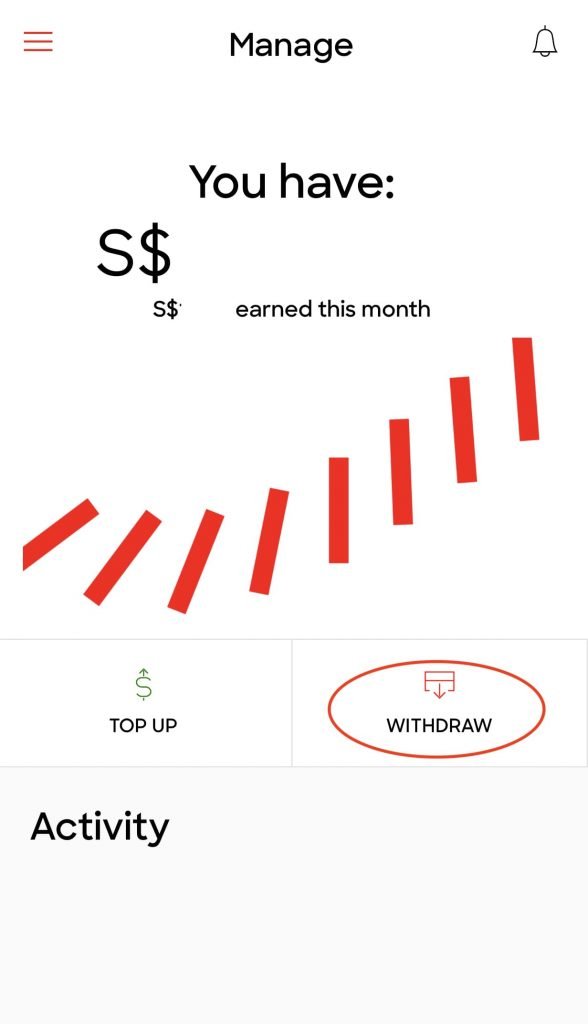

How Can I Withdraw Money From the SingLife Account?

Withdrawing money from SingLife can be done in 4 steps:

- Go to ‘Withdraw‘

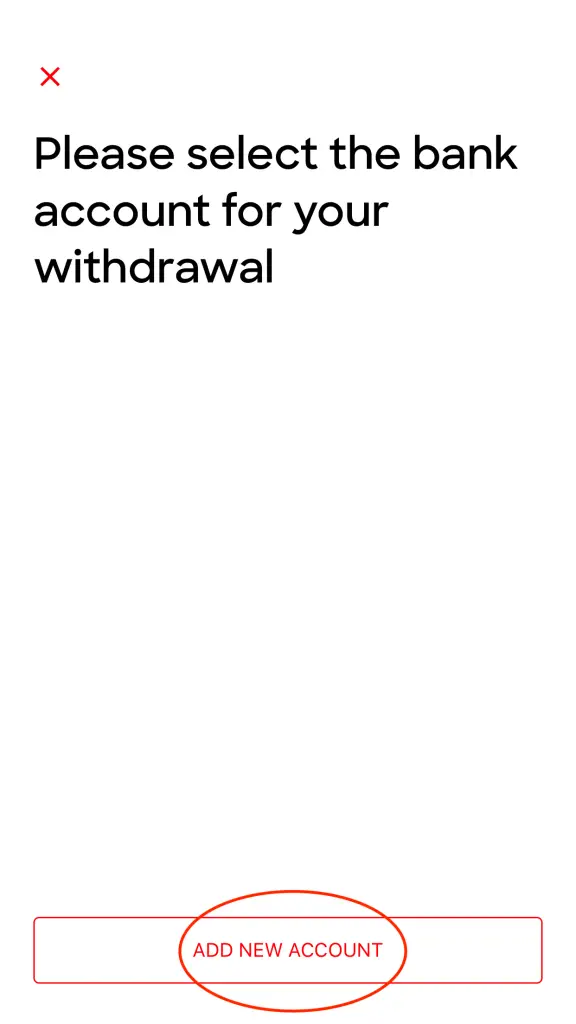

- Tap on ‘Add New Bank Account‘

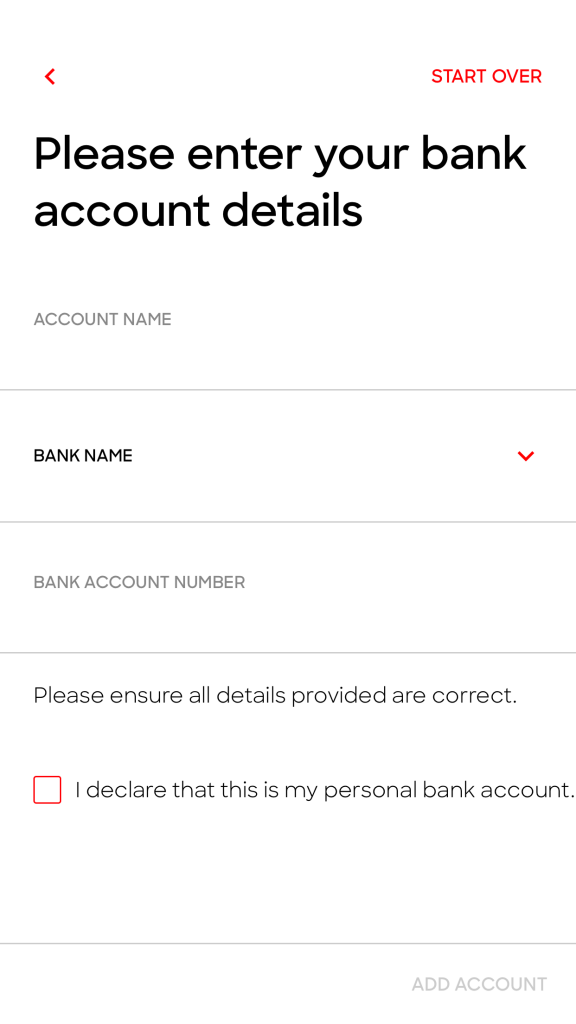

- Enter your bank details (The account has to be under your name!)

- Select the amount you wish to withdraw

#1 Go to ‘Withdraw’

#2 Tap on ‘Add New Bank Account‘

#3 Enter your bank details

The account that you enter has to be under your name!

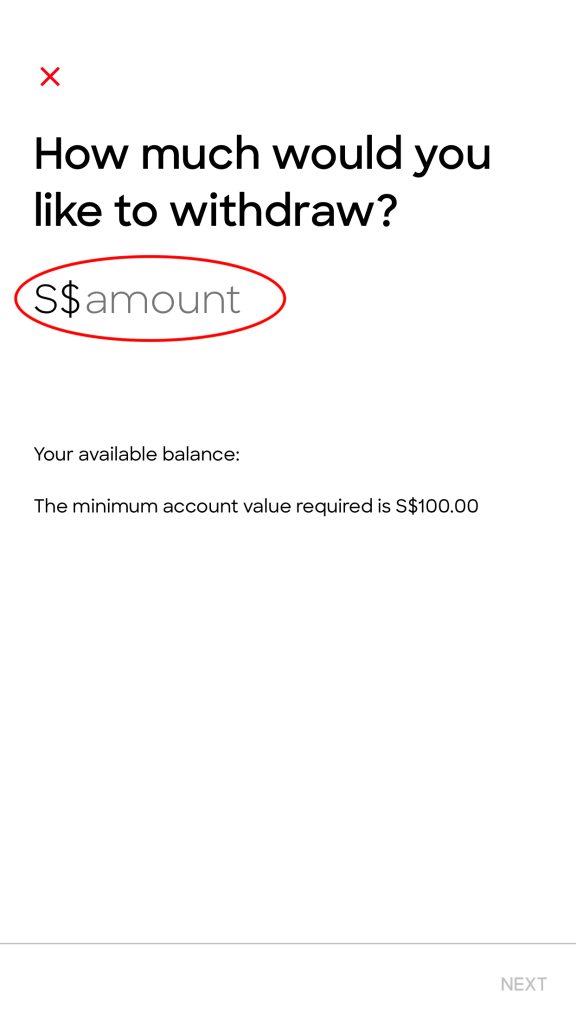

#4 Select the amount you wish to withdraw

There is no withdrawal limit or minimum withdrawal amount. You can even withdraw $10 from the account!

However, if you wish to continue earning the return rate, you will need to maintain a minimum of $100 in the account.

For the bank account that receives the money, it can be any bank account from any bank.

The only condition is that this bank account must be under your name.

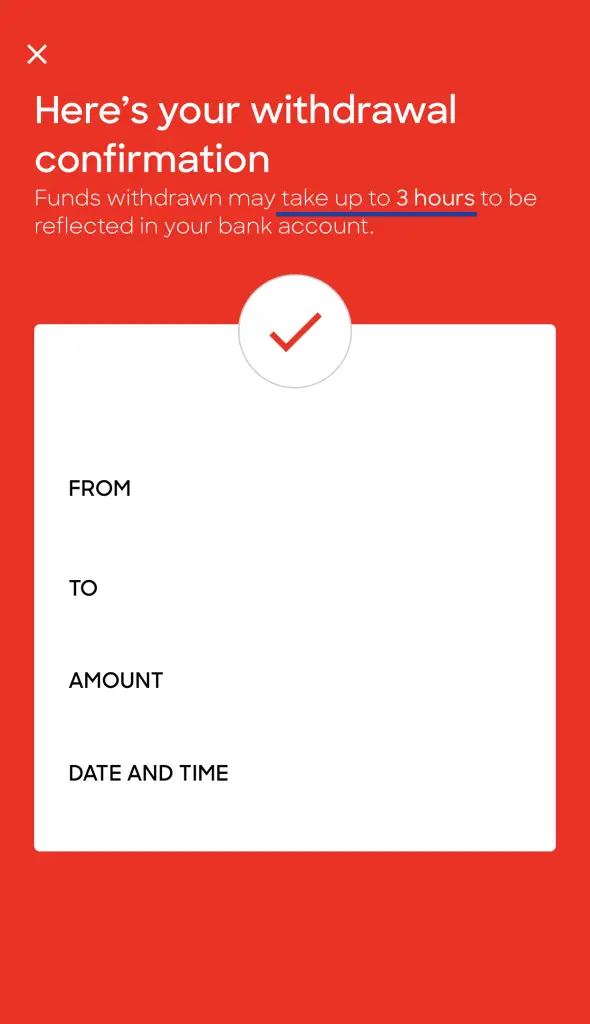

After you make the withdrawal request, it may take up to 3 hours before the money is transferred to your account.

From my experience, it usually takes less than an hour (around 10-15 mins) for it to be transferred.

I think that the 3 hours is just a disclaimer in case anything happens for a transfer. However, I’m not willing to take this risk, especially if I need the money immediately.

This is the main drawback of the SingLife Account, since the transfers take a longer time compared to a normal FAST transfer.

Moreover, the SingLife app can be rather buggy at times. It may take a while for it to show all of your transactions.

Sometimes after logging into the app, I may receive this error message.

This is not ideal if you need to withdraw the money immediately!

As such, I would suggest against leaving all of your emergency funds in the SingLife Account. Having some in a savings account would help to ensure better liquidity.

Even though SingLife has an online portal, you are only able to view your balances. You can’t withdraw money from the portal, and only from the app.

I hope that the online portal will have a withdrawal option in the future!

Is SingLife Safe?

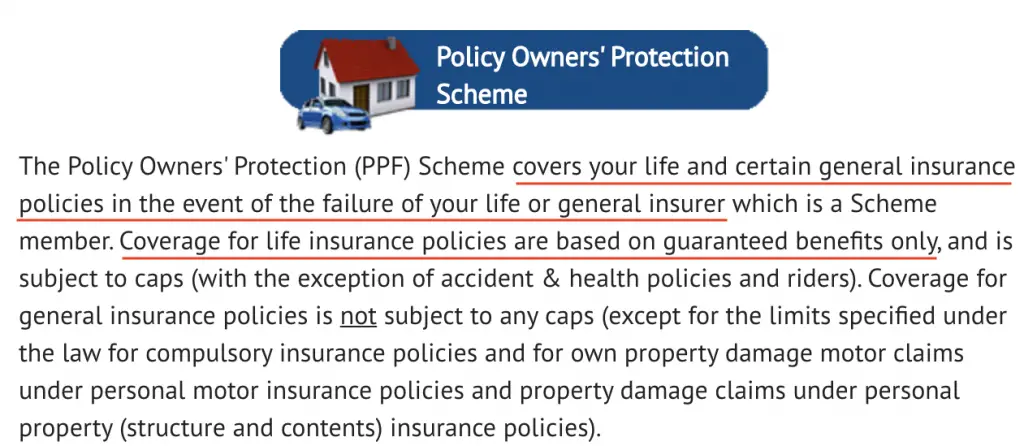

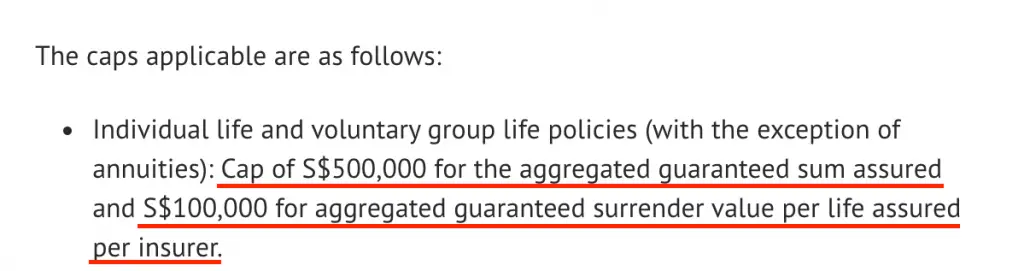

The SingLife Account is an insurance savings plan. Hence, it is protected by the Policy Owner’s Protection Scheme, under the Singapore Deposit Insurance Corporation (SDIC).

This is different from the Deposit Insurance Scheme that bank accounts fall under. The SingLife Account is considered an individual life policy. The sum assured will thus be up to $100k for the surrender value of the policy.

In the unfortunate event that SingLife closes down, the amount that you put in will still be protected by the SDIC.

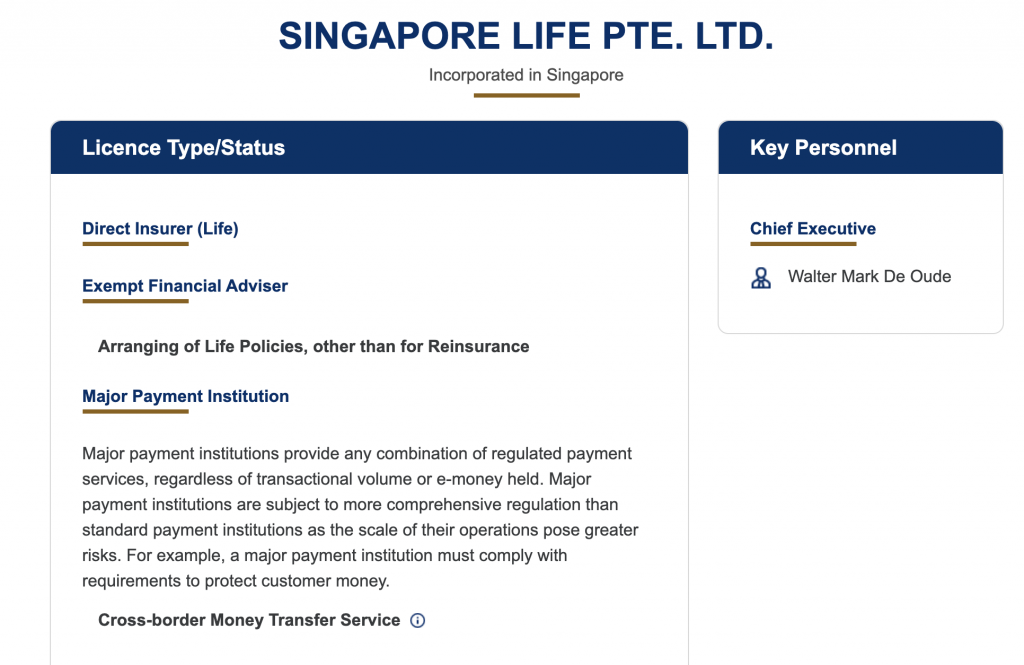

Moreover, SingLife is licensed by the Monetary Authority of Singapore (MAS).

SingLife has also recently merged with Aviva, making it one of the largest insurance firms in South-East Asia.

This should give you some reassurance that SingLife is a credible company, and one that is here to stay.

How Do I Terminate My SingLife Account?

In the event that you wish to terminate your SingLife Account, you can do so via the SingLife app.

Here’s a step-by-step guide to terminating your SingLife Account:

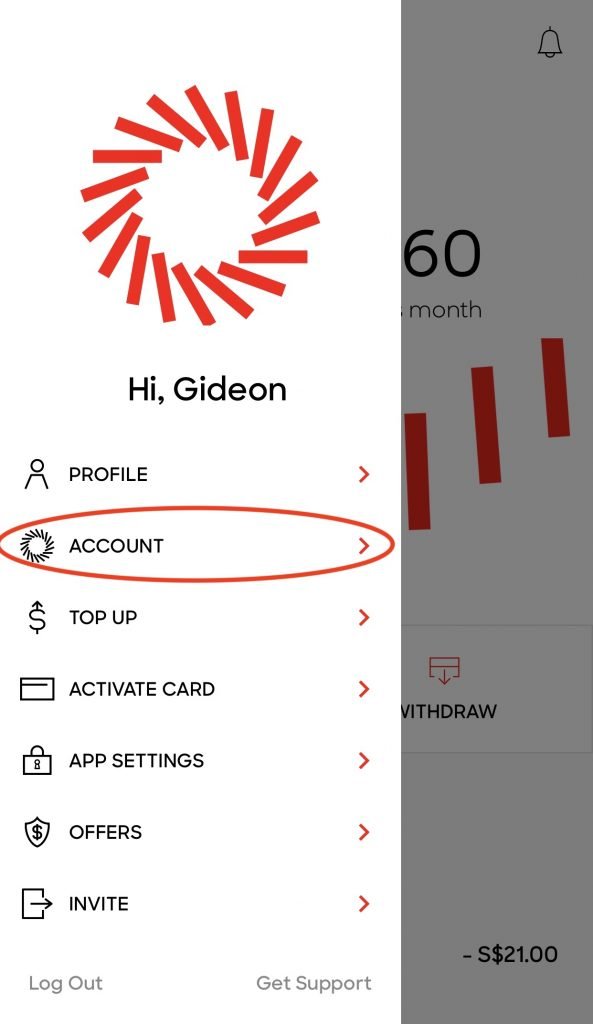

#1 Tap the hamburger icon on the top left of the SingLife App and go to ‘Account’

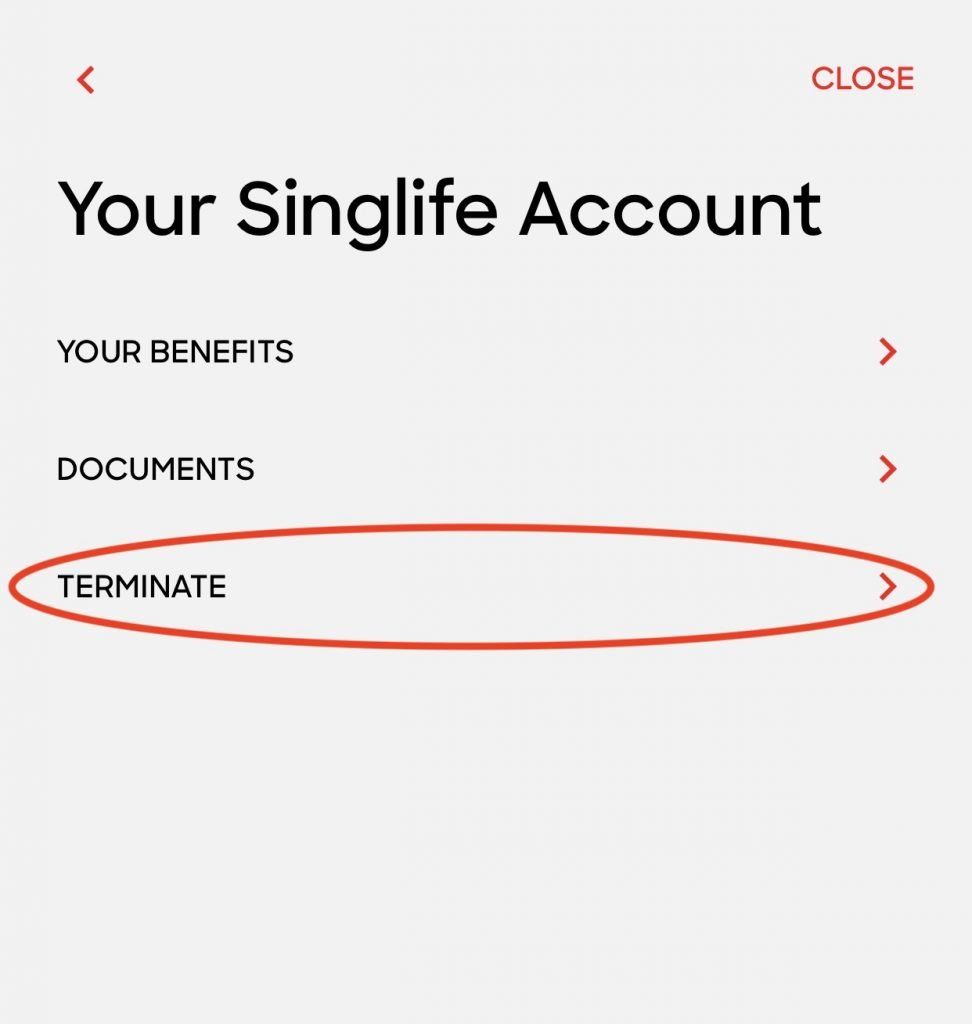

#2 Go to ‘Terminate’

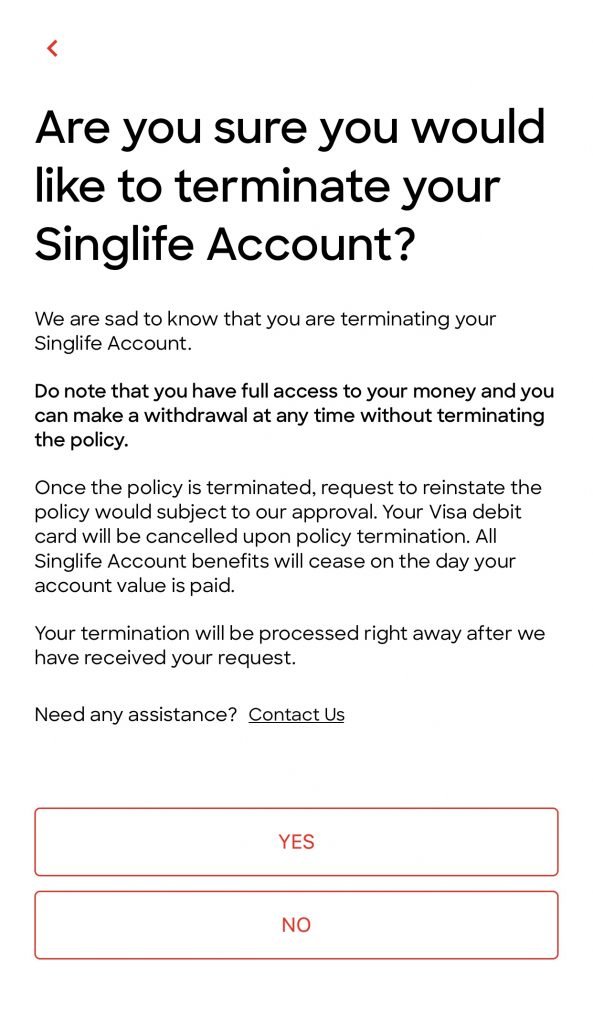

#3 Tap ‘Yes’ to confirm your termination

From the policy document, it states that your benefits will cease on the day that the surrender benefit is paid.

The surrender benefit is equal to the total account value at the full surrender date.

However, the returns you’ve earned will only be credited at the end of each month.

If you decide to terminate your policy halfway into the month, you risk losing half a month’s worth of returns!

No guarantee of when you’ll receive your capital

SingLife also did not explicitly state how and by when would they return the surrender benefit to you. As such, you may have to be prepared to wait a while before the surrender benefit is paid to you.

If you decide to surrender the policy, you have the possibility of reinstating your policy in the future. However, this is up to the discretion of SingLife and they may decide not to reinstate your policy.

There are many limitations if you decide to terminate the policy. I strongly recommend you to think twice before cancelling it!

How Does SingLife Compare With Other Alternatives?

There are a few different alternatives to the SingLife account.

With SingLife’s attractive return rate, especially for the first $10k, it is very hard to find another option that can beat SingLife.

#1 Savings Accounts

Here are some possible savings accounts that you might want to compare with SingLife:

1. Standard Chartered JumpStart

The Standard Chartered JumpStart Account and the SingLife Account are the 2 most popular accounts, especially for students. If you are looking for the better account, I would suggest getting both!

This is because I prefer JumpStart for its liquidity and the 1% cashback, and SingLife for its higher return rate.

If you would like to know more, you can view my complete breakdown of SingLife vs JumpStart.

2. CIMB FastSaver

The CIMB FastSaver used to be everyone’s go to account for emergency funds. However, with a huge drop in their interest rate, it is no longer an attractive option compared to SingLife.

3. DBS Multiplier

The DBS Multiplier is a popular high yield savings account that you can earn up to 3.8% p.a.! However, there are many conditions you’ll need to fulfil before you can earn this high interest rate.

In fact, it is actually quite hard to earn this high interest rate. As such, the SingLife Account may still provide a better return rate with very few requirements.

Other Flexible Insurance Savings Plans (Etiqa Elastiq and Dash EasyEarn)

Besides the SingLife Account, there are three other insurance savings plans that have a degree of flexibility as well.

All of these 3 plans are provided by Etiqa, including:

- Etiqa ELASTIQ

- Etiqa GIGANTIQ

- Dash EasyEarn

Etiqa Elastiq is a unique product with a 1.8% guaranteed yield for 3 years. I recommend you to sign up for it after you’ve maxed out your $10k in SingLife.

Comparing with the other plans, SingLife is the clear winner as well.

| Plan | SingLife | Elastiq | EasyEarn | GIGANTIQ |

|---|---|---|---|---|

| Interest / Return | 1.5% for first $10k, 1% for next $90k | 1.8% for initial premium | 1.5% base + 0.5% (for first year only) | 1% p.a. guaranteed for first year, with additional 0.8% p.a. for first $10k |

| Initial Sum | $500 | $5,000 | $2,000 | $50 |

| Lock-in Period | None | 90 days | None | None |

| Min. Daily Balance | $100 | $5,000 | $2,000 | $50 |

| Fall Below Fee | None | $5 | None | None |

| Min. Withdrawal | None | $500 | $100 | $1 |

| Withdrawal Fee | None | None | $0.70, waived if withdraw to Dash | $0.70 (PayNow) $0.50 (Direct Debit POSB / DBS) |

| Min. Top-up | None | $500 | $100 | $1 |

| Death Benefit | 105% | 106.8% | 105% | 105% |

The SingLife Account has the least requirements and the highest return rate among the 3.

It should be the plan that you aim to get first!

StashAway Simple

StashAway Simple is being advertised as a fuss-free cash management solution.

Previously, StashAway Simple offered a 1.9% return, which was pretty attractive. However, StashAway has since revised the rate to 1.4% p.a. instead.

Here’s a quick comparison of SingLife vs StashAway Simple:

| SingLife | StashAway Simple | |

|---|---|---|

| Return Rate | 1.5% for first $10k, 1% for next $90k | 1.40% |

| SDIC Insured | Yes | No |

| Minimum Balance | $100 | None |

| Withdrawal Time | Up to 3 hours | Up to 3-4 business days |

SingLife trumps StashAway Simple, with its higher return rate and much faster withdrawals.

However, you may want to consider StashAway Simple for your short term goals. This is especially applicable if you have already maxed out your $10k in the SingLife Account.

Should I Get The SingLife Account?

Here’s a recap of its pros and cons:

| Pros | Cons |

|---|---|

| 1.5% returns for first $10k | Laggy app that is rather unresponsive |

| No lock in period | Withdrawals may take longer compared to a normal FAST transfer |

| Very low minimum account balance of $100 | Unable to withdraw money from the online portal |

| No minimum withdrawal or deposit | Return rate is not guaranteed |

| Life insurance policy included | You can’t use SingLife debit card to withdraw money from ATMs |

| Debit card with no FX fees | You can receive an additional 0.5% return on your first $10k, but only if you spend at least $500 on the SingLife debit card each policy month |

| No other fees for using the plan | |

| SDIC insured |

Even with the drop in returns from 2.5% to 1.5%, the SingLife Account still offers one of the best returns in this current market. The only major complaint I have with SingLife is that its app’s design and speed could be improved.

Since the withdrawal requests can only be made on the app, it should definitely be more stable.

Is the SingLife Account good?

The SingLife Account presents a strong case for you to place $10k to earn a decent 1.5% return rate with very little requirements. It has one of the best deals in this current market as its competitors are unable to provide such a high rate of returns.

It also offers a gateway to SingLife Grow, which is an investment-linked policy that you might want to consider.

As such, I strongly encourage you to create the account!

For more information, you can check out their site and policy form.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

SingLife Account and Grow Referral (Up to $35 credited)

If you are interested in signing up for a SingLife Account or buying a SingLife Grow plan, you can use my referral link or the referral code: ‘K8KXV6cv‘.

Here’s what you need to do:

- Sign up for a SingLife Account with my referral link or use the code ‘K8KXV6cv’

- Order and activate your SingLife Visa Debit Card (Earn $5)

- Sign up for a SingLife Grow policy with the code ‘K8KXV6cv’

- Fund your policy with a minimum of $1,000 (Earn $30)

You can read more about this referral program on SingLife’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?

SingLife FAQs

-

What is the SingLife Account?

The SingLife Account is an insurance savings plan offered by SingLife. It is neither a bank account nor a deposit account.

-

How does the SingLife Account work?

You can credit your money into the SingLife Account to earn you the return rate. You are able to receive insurance benefits such as death or total permanent disability benefits.

-

Can SingLife be trusted?

SingLife is an insurance company that is licensed by MAS. The SingLife Account is protected under the SDIC’s Policy Protection Scheme.

-

What is the return rate for the SingLife Account?

The SingLife Account offers 2% on your first $10k and 1% on the next $90k. You are able to earn an additional 0.5% if you participate in the Save, Spend and Earn campaign

-

What’s the catch with the SingLife Account?

The return rate offered by the SingLife Account is not guaranteed and may be revised at any time. You would need to have a minimum of $100 to enjoy this return rate.

-

When will the return rate be credited to my SingLife Account?

You will be credited with the returns every month on your policy start date. You can verify this date in the policy schedule provided.

-

Which bank is the SingLife Account under?

Your SingLife Account is linked to a DBS account, which is created by SingLife.

-

How do I withdraw my money from the SingLife Account?

You can make a withdrawal via the SingLife mobile app. You can withdraw your money to any account from any bank, but it has to be under your name.

-

How long does it take to withdraw the money out of the SingLife Account?

It usually takes around 5-10 minutes for the money to be credited into your account. However, SingLife states that it may take up to 3 hours before the money gets credited.

-

Does the SingLife Account have a withdrawal limit?

The SingLife Account does not have a withdrawal limit.

-

Does the SingLife Account have a withdrawal fee?

There are no withdrawal fees associated with the SingLife Account.

-

How old do I need to be to create a SingLife Account?

You can create the SingLife Account if you are between 18 to 75 years old.

-

Is there a lock-in period for the SingLife Account?

There is no lock-in period for the SingLife Account.

-

Does the SingLife Account have a referral program?

You will receive $10 credited into your SingLife Account if you download the app using a referral link, activate your policy, and order and activate your SingLife Visa Debit Card.

Carl

July 11, 2020 at 6:58 pmOnce the initial on-boarding has been done through the app, you may prefer the website to the app for a slightly (better/faster) user experience : https://online.singlife.com/

Gideon

July 11, 2020 at 8:13 pmThanks for pointing that out! The sad thing is that you can’t withdraw funds from the website and can only do so via the app, which is quite frustrating at times.

Carl

July 12, 2020 at 6:40 pmMaybe that’s a feature(making it hard to withdraw) … to let the money compound inside and do its magic over time… the 1% after 10K is also a decent rate now

Zhang Min

August 10, 2020 at 1:58 pmMust I get the SingLife Visa Debit Card if I want to get the $10? >_<

Gideon

August 10, 2020 at 2:11 pmYes you’ll need to sign up for the Debit Card and activate it to get the referral bonus.