Last updated on March 5th, 2022

You may have seen ETFs that track these different indices: the S&P 500 and MSCI World Index.

Most people may tell you that the MSCI World Index is more globally diversified.

How are these 2 indices different and which should you invest in?

Here’s what you need to know:

Contents

The difference between MSCI World Index and S&P 500

The MSCI World Index includes more than 1,500 large and mid cap companies from 23 developed countries. Meanwhile, the S&P 500 contains the top 500 large cap companies from the USA. As such, the MSCI World Index provides greater diversification.

Here is an in-depth comparison between these 2 indices:

Country diversification

The countries that are available in both indexes are quite different.

The MSCI World Index has a more diversified portfolio

The MSCI World Index includes both large and mid cap stocks from 23 developed countries.

The top 5 countries that carry the highest weightage in this index are:

- United States

- Japan

- United Kingdom

- France

- Canada

The index also includes both large and mid cap stocks.

A large cap company is one that has a market capitalisation of more than $10 billion.

Meanwhile, a mid cap company has a market capitalisation between $2 to $10 billion.

Investopedia

The market cap of a company can be determined by multiplying the stock price by the number of outstanding shares.

S&P 500 solely focuses on companies found in USA

In contrast, the S&P 500 only tracks large cap US equities that are listed on the US exchanges.

The criteria to be included in the S&P 500 is much stricter, because the company needs to fall under one of the 500 largest companies from the US.

Number of holdings

The MSCI World Index has 1,562 different constituents. Meanwhile the S&P 500 only has 505 holdings!

You may wonder why the S&P 500 has 505 stocks. This is because there are 5 companies that have multiple share classes!

The MSCI World Index has stocks from different countries that are listed on different exchanges:

| Stock | Stock Ticker | Exchange |

|---|---|---|

| Nestle | NESN | SIX Swiss Exchange |

| ASML | ASML | Euronext Exchange |

| LVMH | MC | Euronext Paris |

| Toyota | 7203 | Tokyo Stock Exchange |

| AIA | 1299 | Hong Kong Stock Exchange |

Meanwhile, the S&P 500 only includes stocks from the USA. Same of these stocks are included in the MSCI World Index too!

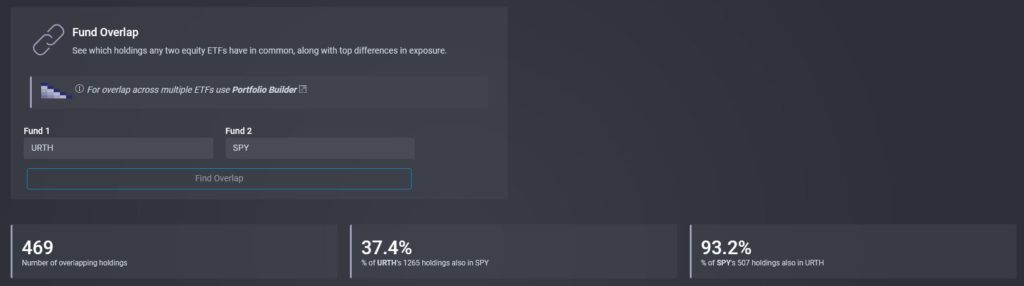

You can see the stock overlap between S&P 500 and MSCI World Index on ETF Research Center’s Fund Overlap tool.

Here is a comparison between the ETFs URTH and SPY, which track the MSCI World Index and S&P 500 respectively:

Most of the holdings in the S&P 500 (> 90%) are found in the MSCI World Index as well!

The MSCI World Index is far more diversified. As such, the MSCI World Index will have a lower weightage of US stocks as compared to the S&P 500.

Top sectors

Here is a comparison between the top sectors that are found in the S&P 500 and S&P 500 Growth Indices as of 8th June 2021:

| MSCI World Index | S&P 500 |

|---|---|

| IT | IT |

| Financials | Healthcare |

| Healthcare | Financials |

| Consumer Discretionary | Consumer Discretionary |

| Industrials | Communication Services |

Both indices have the highest weightage in information technology. Moreover, they have a similar weightage towards it (~20% vs ~25%).

This is much lower compared to the S&P 500 Growth Index which has around 40% weighted in IT!

Though the top 5 sectors in the both indexes are rather similar, the MSCI World Index is more weighted towards stocks in the industrials sector, while the S&P 500 is more weighted to communication services.

Top holdings

Here are the top 10 holdings of each index as of 9th June 2021:

| MSCI World | S&P 500 |

|---|---|

| Apple | Apple |

| Microsoft | Microsoft |

| Amazon | Amazon |

| Facebook Inc A | Facebook Inc A |

| Alphabet Inc C (Google) | Alphabet Inc A (Google) |

| Alphabet Inc A (Google) | Alphabet Inc C (Google) |

| JP Morgan Chase & Co | Berkshire Hathaway B |

| Tesla | JP Morgan Chase & Co |

| Johnson & Johnson | Tesla |

| NVIDIA Corp | NVIDIA Corp |

The top holdings for both indices are very similar! This is because all of them are American companies.

However, the weightage for each stock is slightly different. For example, Apple makes up ~4% of the MSCI World Index, while it makes up around 6% of the S&P 500.

The MSCI World has a lower weightage in Apple as it is much more diversified!

Most of the top companies in the world come from the US. This is why these companies dominate both indices’ top holdings.

Performance

If you compare the performances between both indices, it seems that the S&P 500 does perform better than the MSCI World Index.

Here is a comparison of the 5 year performance of two ETFs (SPY and URTH) which track both indices:

Over the past 5 years, you would have received a higher return if you placed money into a S&P 500 ETF, compared to an ETF that tracks the MSCI World Index!

However, past performance does not indicate future returns, so it’s important to do more extensive research before investing in an ETF!

Availability of ETFs

You are unable to buy directly into either of these indices. Instead, you will need to buy into a fund that tracks this index!

2 types of funds that can track an index include exchange-traded funds (ETFs) and mutual funds.

The S&P 500 index is such a prominent index, so ETFs that track it are listed all over the world!

You are able to find an S&P 500 ETF listed on exchanges from many different countries:

- New York Stock Exchange (NYSE)

- London Stock Exchange (LSE)

- Australia Stock Exchange (ASX)

- Tokyo Stock Exchange (TSE)

- Singapore Exchange (SGX)

- Korea Stock Exchange (KRX)

Here are some of the ETFs that track the S&P 500:

There are many S&P 500 ETFs listed on the LSE as there are both accumulating and distributing ETFs!

MSCI World has less investing options

There are fewer exchanges where you can purchase an ETF that tracks the MSCI World Index. Here are some of the more popular ones:

There are limited options when it comes to investing in the MSCI World Index. Most of the ETFs mainly come from the NYSE or LSE!

Verdict

Here is a comparison between the MSCI World and the S&P 500:

| MSCI World | S&P 500 | |

|---|---|---|

| Type of stocks | Large and mid cap equities from developed countries | Large cap US equities |

| Number of holdings | 1,562 | 505 |

| Top sectors | IT Financials Healthcare Consumer Discretionary Industrials | IT Healthcare Financials Consumer Discretionary Communication Services |

| Past performance | Weaker | Stronger |

| Availability of ETF | Limited | Wider |

So which index should you choose to invest in?

Choose the MSCI World if you prefer a more diversified portfolio

The MSCI World Index is a more globally diversified index. It contains stocks from different countries, and not just one.

Even if one economy does poorly, it may not affect the index as a whole!

However, the US economy has been performing better than other economies. This is why the S&P 500 has been doing better than the MSCI World.

However, it is too concentrated into the US economy. If the US economy eventually fails, your investments may perform poorly!

As such, the MSCI World is ‘safer’ as it does not solely rely on just one economy!

MSCI World has a large weightage in the US economy

The MSCI World has around 70% of its holdings in the USA. If you are comfortable with a 70-30 composition (US stocks vs global stocks), the MSCI World Index is something you can go for.

If you wish to have more flexibility with your US-Global allocation, you may want to invest in an ETF that tracks the MSCI World Ex USA Index instead.

The MSCI World Ex USA Index tracks global stocks excluding those from the USA.

You can combine it with a S&P 500 ETF to achieve your preferred allocation!

Choose the S&P 500 if you are confident in the US economy

Warren Buffett famously said that you should ‘never bet against America‘.

If you believe in this statement too, you can invest solely in the S&P 500!

This index has been performing well in the long run, provided you buy and hold.

I would suggest that you do not check your ETF everyday. Instead, you should try to continue to dollar cost average into the index and hold for the long run!

Conclusion

Both indices give you a diversified portfolio of stocks to invest in.

The main considerations you should have include:

- What kind of diversification you want to have

- The exchange which you want to trade in

- How confident you are in the US economy

If you’re looking for a way to track the markets and your portfolio, you can consider using TradingView, which allows you to monitor more than 50 stock exchanges.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?