Last updated on June 6th, 2021

There are so many different robo-advisors out there that offer you a wide range of portfolios.

You may be torn between investing with Syfe’s REIT+ and StashAway’s Highest Risk (36%) portfolio. Both of them are really accessible for beginner investors, so which one should you choose?

Here’s a comparison on these 2 robo-advisory portfolios.

Contents

Syfe REIT+ vs StashAway

Syfe REIT+ is 100% concentrated in REITs, while StashAway offers you a diversified portfolio across different asset classes. REIT+ provides high dividend yields while StashAway is more aggressive. The portfolio that you should choose depends on the investment goal you wish to achieve.

Here is a in-depth comparison of these 2 portfolios:

Investing Strategy

The 2 robo-advisors use very different investment strategies:

StashAway uses their ERAA framework

StashAway uses an Economic Regime-based Asset Allocation (ERAA) framework. This framework focuses on asset allocation instead of securities selection.

This means that StashAway focuses on your allocation into each asset class, rather than choosing which specific stock or bond they would invest in.

Essentially, StashAway’s ERRA framework follows the Modern Portfolio Theory.

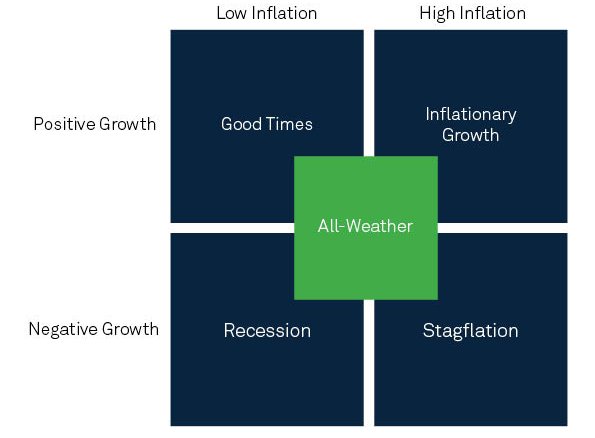

StashAway decides on your allocation based on the current economic conditions. Here are the 4 economic regimes that are defined by StashAway:

The ERAA has a certain allocation for each regime. For example, you will be weighted more towards equities in periods of strong growth. Meanwhile during poor economic times, you may be allocated more towards bonds.

The ERAA will re-optimise your for you when it detects a change in the economic regime. A recent re-optimisation was done in May to account for the effects of COVID-19.

StashAway Risk Index

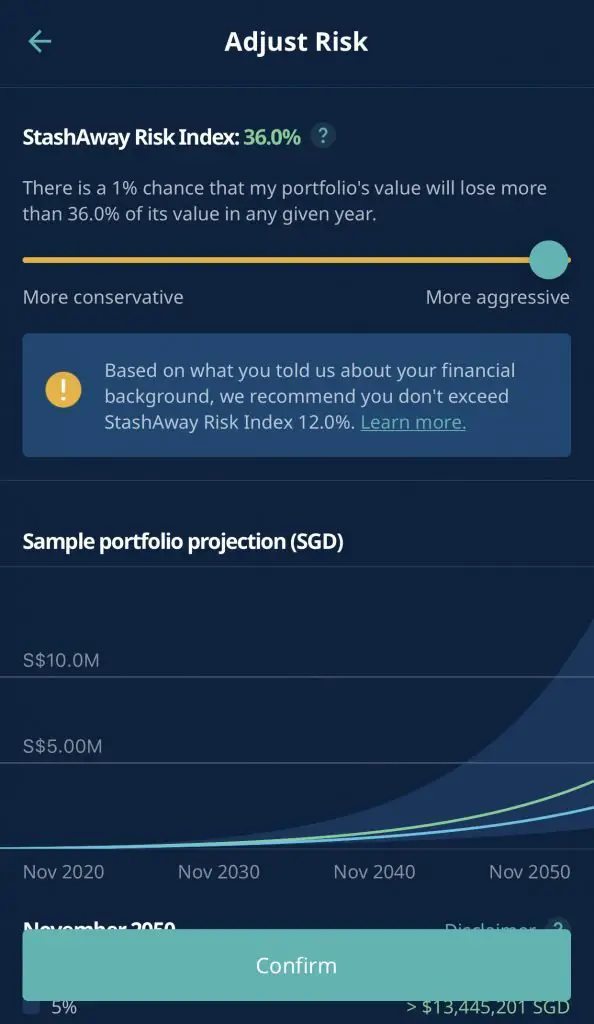

StashAway also has a risk index that determines the ‘riskiness‘ of your portfolio.

The Risk Index means that there is a 99% probability that you will not lose more than x% of your portfolio in a year.

The x% is the amount of risk you are willing to take.

The more risk you’re willing to take, the higher the Risk Index. The highest risk profile that you can create is 36%.

You can consider investing in StashAway’s Income Portfolio as well.

Syfe REIT+ uses the ARI strategy (optional)

You are able to use Syfe’s Automated Risk-managed Investment (ARI) strategy in your REIT+ portfolio.

This strategy is a combination of 2 different approaches:

Essentially, your allocation to the REITs index is balanced with bonds. When the market is extremely volatile, a part of your REITs portfolio will be sold and bonds will be bought.

An example of a volatile time in the market is the COVID-19 pandemic.

Here’s how Syfe’s ARI strategy fared against the other 2 portfolios.

ARI dynamically allocates the amount of bonds it thinks you should have in your portfolio. This is based on the current economic conditions too.

This ARI algorithm was first found in Syfe’s very first portfolio: Global ARI.

However, the maximum allocation your portfolio can have towards bonds is 50%. This means the amount of your funds being allocated into REITs will be 50% or more.

ARI helps to reduce your short-term volatility

From the diagram above, Syfe’s ARI algorithm helps to reduce the impact when prices start to fall.

When the prices start to rise, ARI’s performance is much better too.

In the long run, the ARI’s performance is much better compared to both approaches!

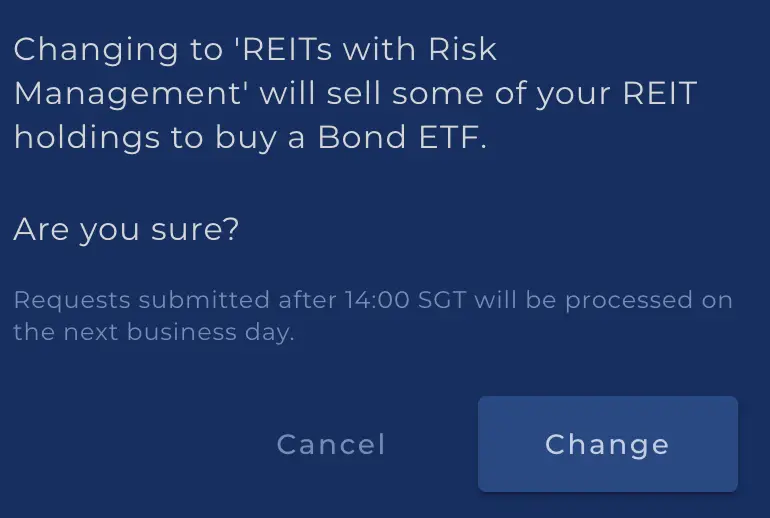

The ARI strategy is optional

When you first create your REIT+ portfolio, you are given 2 choices:

- 100% REITs

- REITs with risk management

You will only use the ARI strategy if you choose ‘REITs with risk management‘.

If you choose 100% REITs, you will just be following the iEdge S-REIT Leaders Index.

Type of Assets

Both of these portfolios invest in different types of assets.

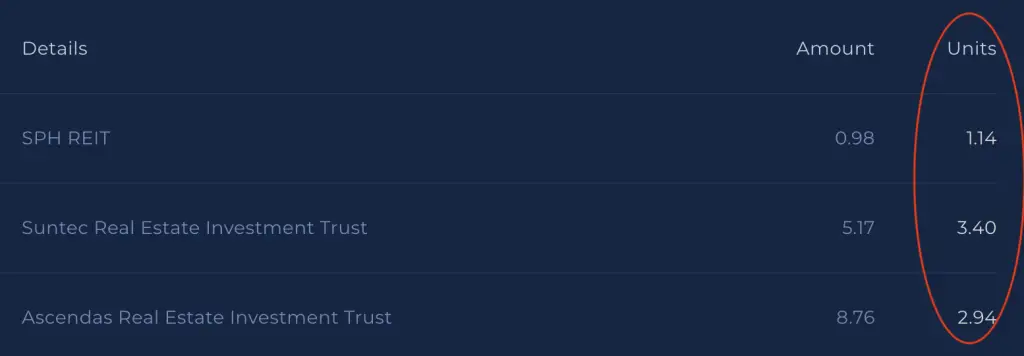

Syfe REIT+ invests in Singapore REITs

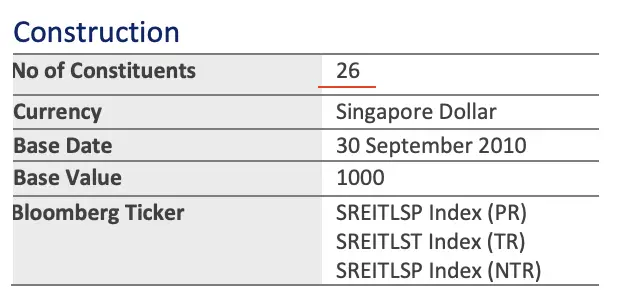

REIT+ tracks the iEdge S-REIT Leaders Index. This index measures the performance of the largest and most tradable REITs in Singapore.

This was previously called the iEdge S-REIT 20 Index. However, SGX changed it to the Leaders Index which now has 26 holdings instead.

Despite this change in the index, Syfe REIT+ still tracks the top 20 holdings out of the 26 holdings in the Leaders Index.

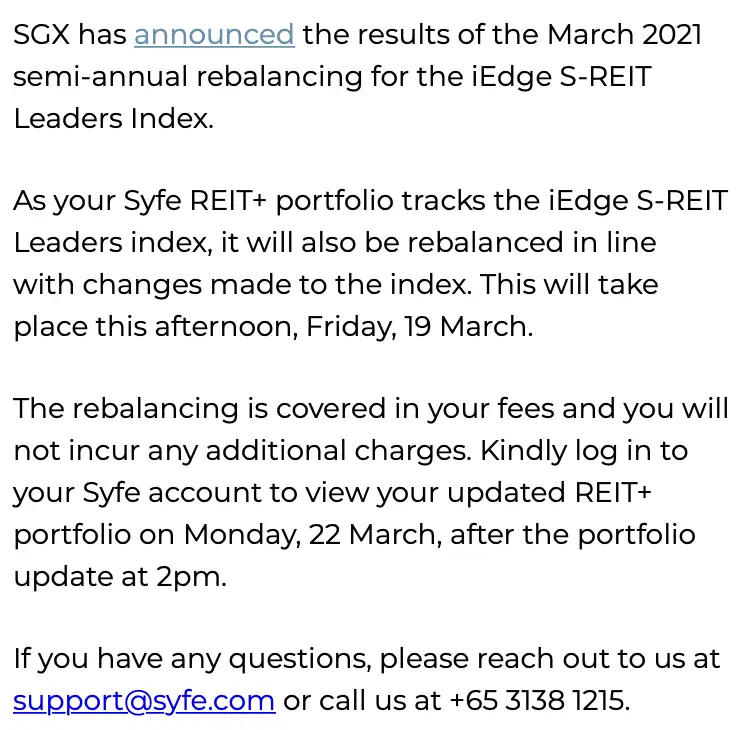

Your portfolio may rebalance based on the index

SGX does a semi-annual rebalancing of their iEdge S-REIT Leaders Index. Whenever there are changes to the index, Syfe will rebalance your portfolio based on the index.

In the most recent change, 2 new REITs were added, while one was removed.

An additional REIT was added as there was a merger of CapitaLand Mall Trust and CapitaLand Commercial Trust.

REITs provide you with a stable income

REITs are extremely popular among Singaporeans as they provide you with regular and attractive dividend yields.

So long as these properties are able to collect steady rental income, you will be able to receive regular dividends from them.

As such, you should not be too worried about capital appreciation when it comes to REITs. Instead, you should be looking for one that is able to provide stable dividend yields.

If you would like to track the dividends that you are earning, you can use a platform like StocksCafe to do so.

You will have a bond component if you opt for the ARI strategy

If you have opted for the ARI strategy, a part of your REIT+ portfolio will be in bonds.

Syfe has chosen the ABF Singapore Bond Index Fund (A35) to be used as the bond component.

If you are wondering about the different types of bond ETFs, you can view my comparison of A35 against MBH.

The percentage of the bond component depends on the ARI algorithm. The algorithm manages your REIT+ portfolio to maintain a downside risk of 15%.

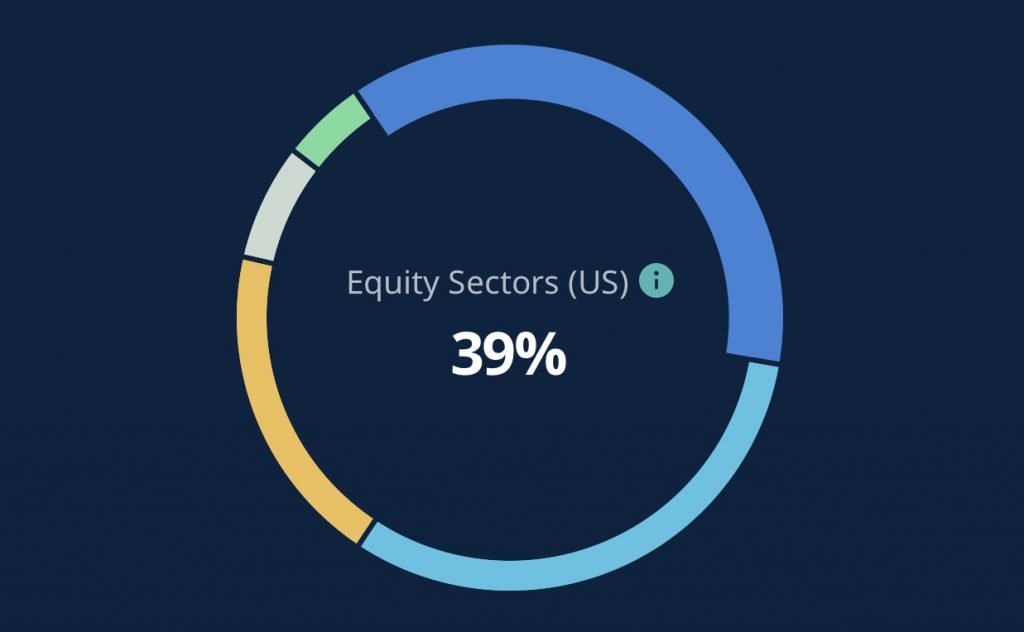

StashAway has a broad allocation among the asset classes

In StashAway’s 36% risk portfolio, you will be allocated to these 4 main asset classes:

- International Equities

- Equity Sectors (US)

- Real Estate

- Commodities

You will be most heavily weighted in US Equities.

You’ll incur different amount of taxes

The types of taxes that you’ll pay for each portfolio will be different:

You do not incur any taxes when investing in REIT+

The REITs that you invest using REIT+ are all domiciled in Singapore. This means that you do not incur any dividend withholding or estate taxes!

REIT+ is the more tax efficient portfolio compared to StashAway.

You will incur a dividend withholding tax with StashAway

For StashAway’s general investing portfolios, they will invest your funds into US-domiciled ETFs. As such, you will incur a 30% dividend withholding tax on all of your dividends.

However, StashAway believes that the higher tax you incur is a trade-off. StashAway still chooses US-domiciled ETFs as they:

- Are cost-efficient

- Are simple to invest in

- Have a low tracking error

Another tax that you may incur when investing in US-listed ETFs is the estate tax.

An estate tax is a tax on your right to transfer your estate at your death.

IRS

Depending on the total amount of all of your US assets, you can a tax of between 18-40%!

StashAway claims that you should not be subject to this tax. However, they are not 100% confident about this issue!

The portfolios are denominated in different currencies

Here are the currencies that each portfolio is denominated in:

Syfe REIT+ is denominated in SGD

The REITs found in REIT+ are all listed on the SGX. As such, they are all denominated in SGD.

You will not be exposed to any currency risk when you invest with REIT+.

StashAway’s portfolio is denominated in USD

Since StashAway invests your money into US-listed ETFs, they are all denominated in USD. If you deposit SGD into your StashAway portfolio, StashAway will convert it into USD for you.

However, you will incur an additional currency conversion fee of 0.08% which is charged by the broker.

As such, you will be exposed to currency risks in 2 ways:

- Fluctuations between the USD-SGD exchange rate

- Currency conversion fee of 0.08%

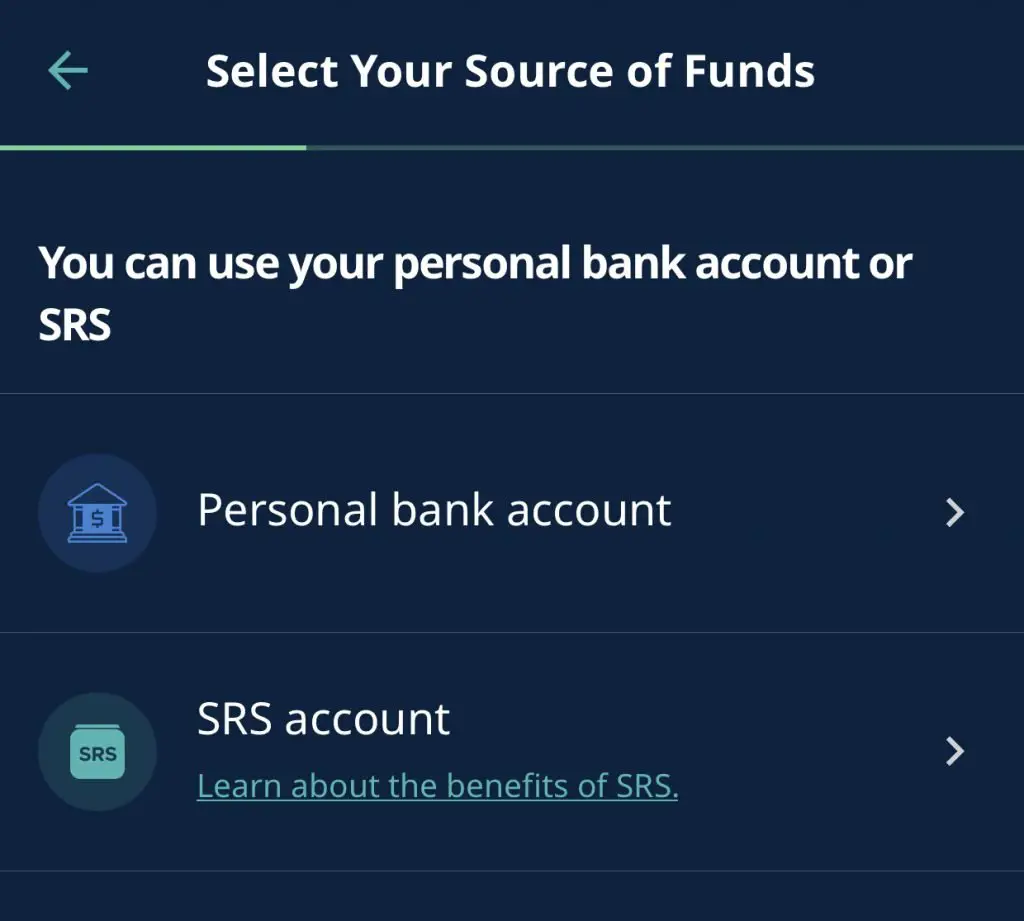

Funds you can use to invest in their portfolios

You are able to invest in StashAway’s portfolios using both your cash and SRS funds.

However, you are unable to invest your SRS funds into Syfe. As such, StashAway may be a better choice if you wish to use your SRS funds for investing.

Performance

It is hard to compare the performances between these 2 robo-advisors since the portfolios are so different.

Moreover, the past returns can never be a good indicator of future returns. One portfolio that performs well now may not do so in the future.

Rather than looking at performance, you should be considering the investment strategy of these robo-advisors instead!

You may be investing just a part of your portfolio into these robo-advisors. If you would like to track it together with your other investment portfolio, you can consider using the StocksCafe platform.

Minimum Sum

Both portfolios do not have a minimum sum for you to begin investing with them. This makes it very accessible even if you just have a small sum to start investing!

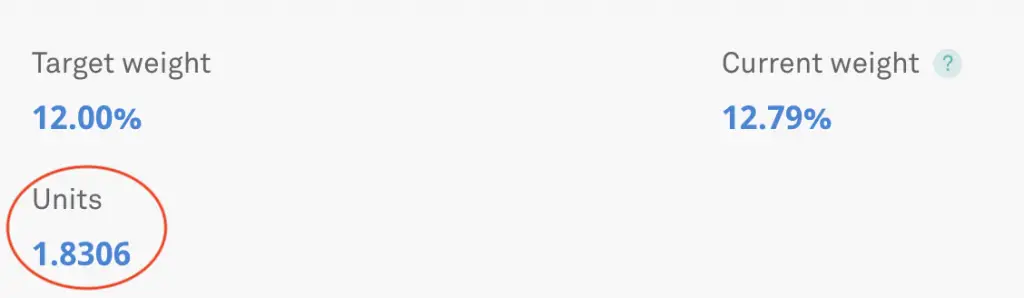

Both Syfe and StashAway invest your money into fractional shares.

For example, a single unit of the ETF may cost $100. If you can only invest $10, you will receive 0.1 units of that ETF.

Both robo-advisors are able to do this as they co-mingle your assets with other investors in one custodian account.

While this makes investing very accessible, there will be issues if either robo-advisor closes down like Smartly. You are not given full control of your assets since they are not under your own name!

However, both Syfe and StashAway have received considerable funding from investors. This shows the investors’ confidence in these 2 firms, and I believe that both firms will be here for the long run.

Fees

Here are the fees that you will need to pay when using these robo-advisors:

StashAway charges you 0.8% a year for your first $25k

You will need to pay 0.8% each year in fees for your first $25k invested with StashAway.

| Amount Invested | Management Fee |

|---|---|

| First $25k | 0.8% |

| > $25k and ≤ $50k | 0.7% |

| > $50k and ≤ $100k | 0.6% |

| > $100k and ≤ $250k | 0.5% |

| > $250k and ≤ $500k | 0.4% |

| > $500k and ≤ $1 million | 0.3% |

| > $1 million | 0.2% |

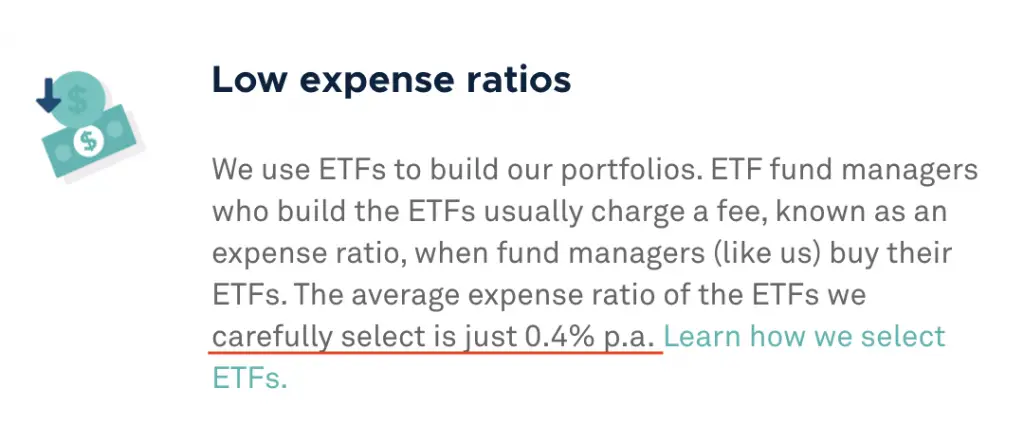

Moreover, you will need to pay the expense ratios of the ETFs as well. This will further add to your costs. StashAway claims that the average expense ratio you will need to pay is around 0.4%.

This means that you will have to pay around 1.2% in fees each year!

Syfe charges you 0.65% for your first $20k

Syfe’s management fees are slightly lower than StashAway. Here is Syfe’s pricing structure:

| Total Amount Invested | Management Fee |

|---|---|

| < $20k | 0.65% |

| ≥ $20k and < $100k | 0.50% |

| ≥ $100k | 0.40% |

Unlike other fee structures, Syfe does not have a stacked fee structure. For example if you have $30k invested with Syfe, you will incur a 0.5% fee on your entire investment amount.

Syfe REIT+ does not have an expense ratio

REIT+ tracks the iEdge S-REIT Leaders Index directly. You do not need to buy an ETF to track this index.

As such, you will not have an added layer of fees that you will need to pay. This helps you to reduce the amount of fees that you need to pay when investing with REIT+!

As such, you will only need to pay the 0.65% management fee for your first $20k with Syfe.

If you choose the REIT+ portfolio with risk management, you will still incur A35’s expense ratio of 0.25%. However, this depends on the amount of your funds being allocated towards bonds.

You will not incur any trading commissions which are the main fees charged by online brokerages like Tiger Brokers.

Verdict

Here is a comparison between the 2 portfolios:

| Syfe REIT+ | StashAway (36%) | |

|---|---|---|

| Investment Strategy | ARI (Optional) | ERAA Framework |

| Asset Class | 100% in REITs | Equities (Global and US) Real Estate Commodities |

| Fund Domicile | NA | US |

| Dividend Withholding Tax | NA | 30% |

| Currency Denomination | SGD | USD |

| Source of Funds | Only Cash | Cash and SRS |

| Minimum Investment Sum | None | None |

| Fees | Lower (no expense ratio) | Higher |

| Useful For | Dividend investing | Balanced portfolio |

Which portfolio is better for you?

Choose StashAway if you prefer a balanced portfolio

StashAway’s 36% Risk Index Portfolio is the riskiest portfolio that StashAway offers you. However, your risk is still diversified across different asset classes.

StashAway also offers periodic rebalancing as well. As such, you can be assured that you will continue to receive steady returns, no matter the economic outlook.

Moreover, you are able to invest in StashAway using your SRS funds. This is an added advantage if you are looking for a portfolio to invest your SRS funds with.

Choose REIT+ if you want a stable income

If you prefer to invest in a portfolio that provides you with dividends, REIT+ is something you should consider.

Moreover, the costs are really low as you do not need to pay an expense ratio of an ETF!

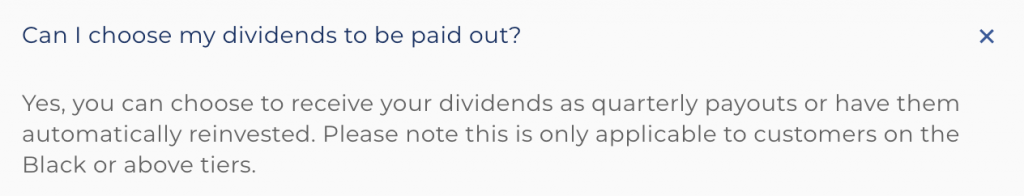

One thing you may wish to note is that you can only receive dividend payouts when you are a Black tier customer.

This means that you’ll need to invest a minimum of $20k with Syfe to start receiving your payouts.

Conclusion

Both portfolios offer a unique way to invest your money. The portfolio that you should choose depends on:

- Your time horizon

- The fees you’re willing to pay

- The investment strategy that you agree with

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 6 months.

You will be able to save up to $75 worth of fees!

You can view more information about this referral program on Syfe’s website.

StashAway Referral (Up to $40,000 SGD managed for free for 6 months)

If you are interested in signing up for StashAway, you can use my referral link to sign up.

Here’s what you’ll need to do:

- Sign up for a StashAway account

- Make a deposit of ≥ $10k within 4 weeks of signing up

- Receive a fee waiver for 6 months (up to $40k)

You can find out more about this program on SingSaver.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?