Last updated on October 19th, 2021

Robo-advisors are the talk of the town now. You may have come across both Endowus and StashAway, which are 2 of the popular ones.

How are they different and which one should you choose?

Contents

- 1 The difference between StashAway and Endowus

- 2 Type of products they invest in

- 3 Investment strategies used

- 4 Investment portfolios offered

- 5 Cash management portfolios offered

- 6 Performance

- 7 Dividend distribution

- 8 Funds you can invest with

- 9 Minimum sum to invest

- 10 Fees

- 11 Type of account used to handle your assets

- 12 Web platform

- 13 Mobile app

- 14 Verdict

- 15 Conclusion

- 16 👉🏻 Referral Deals

The difference between StashAway and Endowus

StashAway invests in ETFs, while Endowus offers access to mutual funds. Both robo-advisors mainly differ in terms of fees, the minimum amount to invest, and the type of funds (Cash, SRS and CPF) you can use.

Here’s an in-depth comparison between these 2 robo-advisors:

Type of products they invest in

Here are the different products that these 2 robo-advisors invest in:

StashAway invests mainly in ETFs

StashAway invests your money into Exchange Traded Funds (ETFs). These funds are available to trade on exchanges, and contain a basket of stocks.

StashAway chooses US-domiciled ETFs as they:

- Are cost-efficient

- Are simple to invest in

- Have a low tracking error

These US-listed ETFs are used for StashAway’s General Investing portfolios.

For StashAway’s Income Portfolio, your money will be invested in ETFs that are listed on the SGX.

Endowus invests in mutual funds

Endowus mainly invests in mutual funds. These funds are managed by many well-known firms, such as:

- Pimco

- Dimensional

- Eastspring Investments

- First Sentier Investors

- Vanguard

- Schroders

If you were to invest in these funds by yourself, they are usually very costly. Endowus provides access to these funds at a lower cost.

These funds that you can purchase are institutional share classes. This means that you’ll be charged the lowest expense ratio among the different share classes.

These share classes would normally require you to have a minimum investment of around $200k!

Moreover, all of these funds are denominated in SGD! This means that you will reduce the amount of currency risk that you’re exposed to.

These funds are UCITS funds that help to reduce your tax

Another advantage of the funds that Endowus offers is that they are all UCITS funds.

This means that these funds are domiciled in Ireland, rather than the US. For StashAway, majority of the ETFs will be domiciled in the US.

This has significant implications on the taxes you’ll incur as a Singaporean investor. When you invest in a UCITS fund, you will reduce your taxes in 2 ways:

- Lower dividend withholding tax for US stocks (15% vs 30%)

- No estate tax for US assets

While StashAway claims that you should not incur any estate taxes, they are not 100% certain on this matter.

Investment strategies used

These 2 robo-advisors also use very different investing strategies:

StashAway uses their ERAA framework

StashAway uses an Economic Regime-based Asset Allocation (ERAA) framework. This framework focuses on asset allocation instead of securities selection.

This means that StashAway focuses on your allocation into each asset class, rather than choosing which specific stock or bond they would invest in.

Essentially, StashAway’s ERRA framework follows the Modern Portfolio Theory.

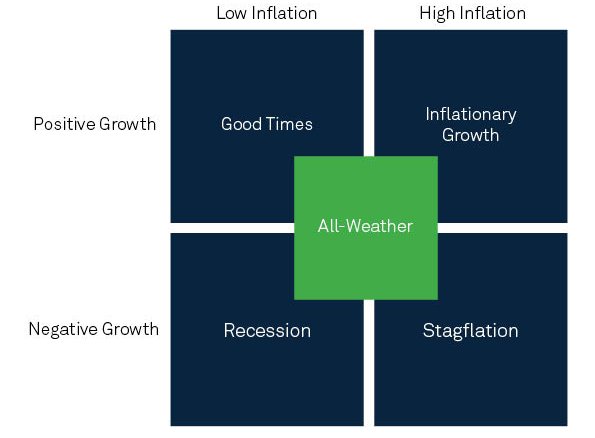

StashAway decides on your allocation based on the current economic conditions. Here are the 4 economic regimes that are defined by StashAway:

The ERAA has a certain allocation for each regime. For example, you will be weighted more towards equities in periods of strong growth. Meanwhile during poor economic times, you may be allocated more towards bonds.

The ERAA will re-optimise your for you when it detects a change in the economic regime. A recent re-optimisation was done in May to account for the effects of COVID-19.

StashAway Risk Index

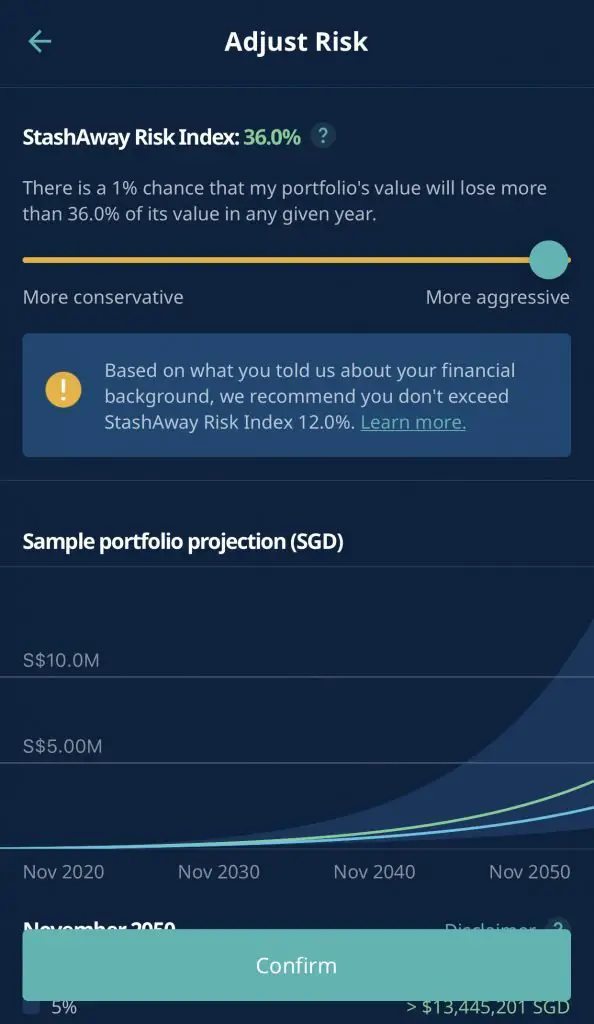

StashAway also has a risk index that determines the ‘riskiness‘ of your portfolio.

The Risk Index means that there is a 99% probability that you will not lose more than x% of your portfolio in a year.

The x% is the amount of risk you are willing to take.

The more risk you’re willing to take, the higher the Risk Index. The highest risk profile that you can create is 36%.

Endowus wants to make low cost investing accessible for everyone

Endowus believes in providing evidence-based investing at the lowest cost possible.

The funds that they have chosen are backed by scientific research, rather than speculation.

Moreover, they believe that fees are something that eat into an investor’s returns. They have a 100% trailer fee rebate policy which greatly reduces your costs!

Investment portfolios offered

Here are the types of portfolios that both robo-advisors offer you:

StashAway offers 2 portfolios

Here are StashAway’s 2 portfolios that they offer:

#1 General Investing

StashAway’s main offering are their General Investment portfolios.

They also offer Goal-Based Investing portfolios which are similar, but are more personalised.

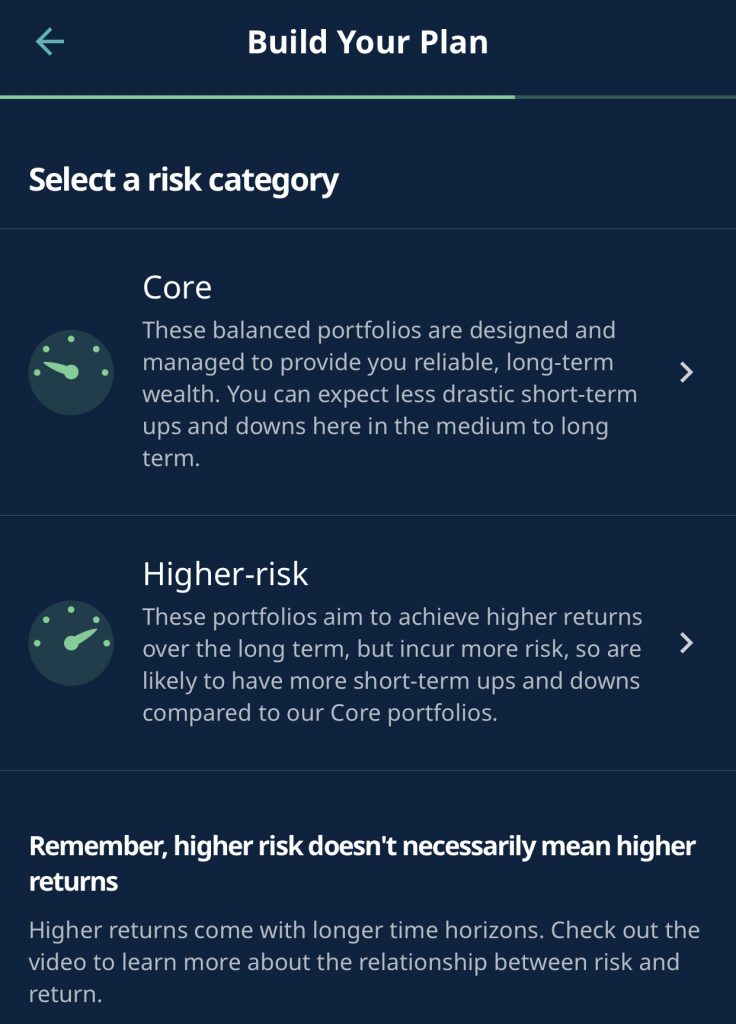

When you are creating your portfolio, you will need to choose between a Core or a Higher-Risk portfolio.

The type of portfolio you choose depends on the amount of risk you want to take:

| Portfolio | StashAway Risk Index |

|---|---|

| Core | 6.5% – 22% |

| Higher-Risk | 26% – 36% |

If you want to take more risks, the Higher-Risk portfolios are more suitable. If not, you may just want to stick to the Core portfolios if you’re risk averse.

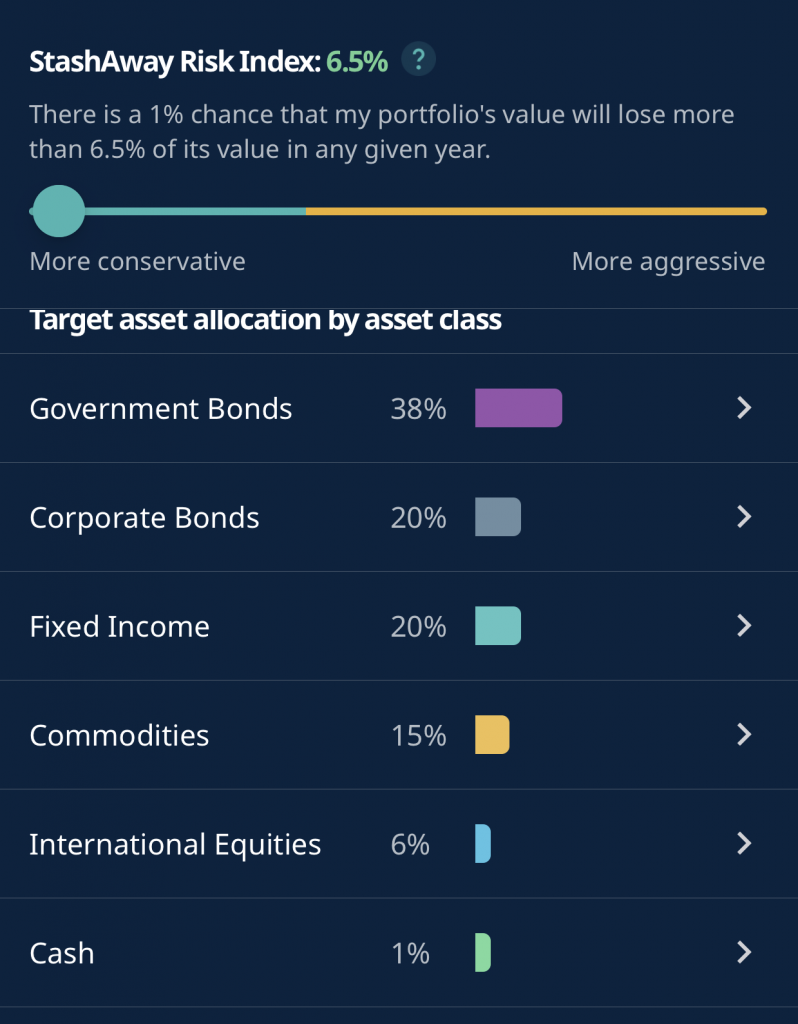

Based on their ERAA framework, they will choose the best asset allocation that fits your Risk Index.

For example, the riskiest portfolio (36%) will have a high weightage in equities.

Meanwhile, the lowest risk portfolio (6.5%) is highly allocated towards bonds.

As such, you should choose the portfolio that best suits your risk profile!

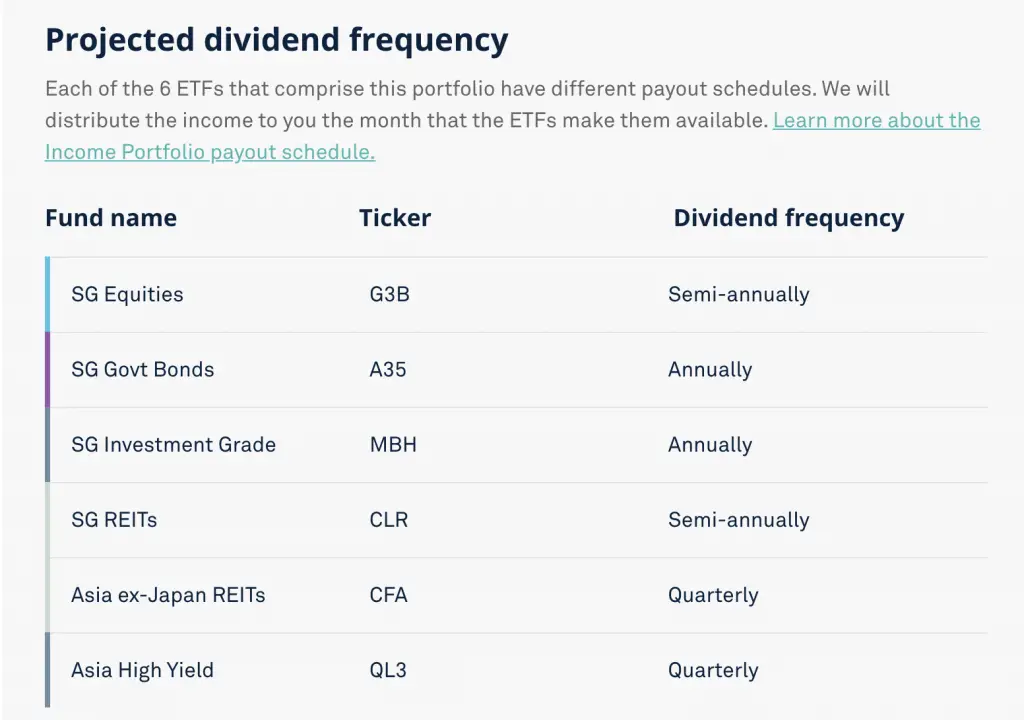

#2 Income Portfolio

StashAway also offers their Income Portfolio which is aimed at helping you to earn through dividends. Your funds will be diversified across 4 different asset classes:

- Government bonds

- Corporate bonds

- REITs

- Stocks

The Income Portfolio aims to provide you with a steady income throughout the year. This is in the form of dividends that are issued by the funds.

Here are the projected dividend frequencies for each month:

If you prefer staying invested in the Singapore market, then this portfolio may be for you!

You can read my review on the Income Portfolio to see if it’s suitable for you.

Endowus offers you different portfolios based on your risk profile

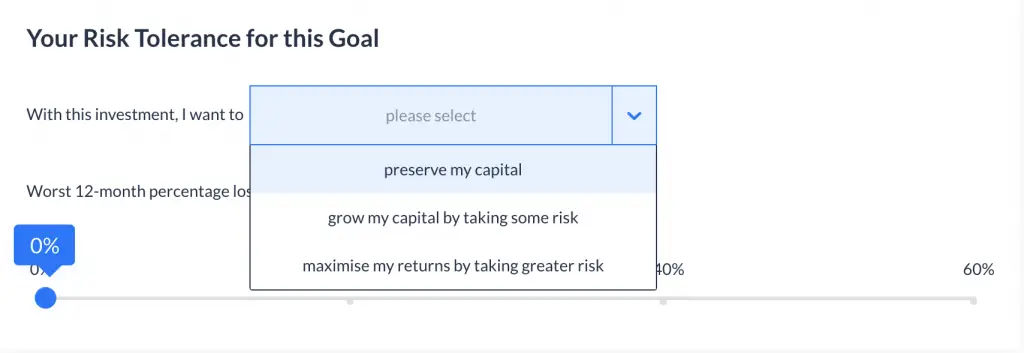

When you create a portfolio with Endowus, you’ll be asked about your risk tolerance.

Endowus will then suggest a portfolio for you based on your risk tolerance and time horizon. These portfolios will allocate your money into 2 different asset classes:

- Equities

- Fixed Income

| Portfolio | Equities | Fixed Income |

|---|---|---|

| Very Aggressive | 100% | 0% |

| Aggressive | 80% | 20% |

| Balanced | 60% | 40% |

| Measured | 40% | 60% |

| Conservative | 20% | 80% |

| Very Conservative | 0% | 100% |

The higher your risk tolerance, the greater the allocation towards equities and vice versa.

There are 2 types of advised portfolios that you can create with Endowus: Core and ESG portfolios. You can view my comparison between these portfolios to see which one is more suitable for you.

Different funds are available for you

The funds that are being used to invest both your Cash and SRS funds are the same. However, the CPFIS Scheme limits the number of funds that you can invest your CPF in.

Another difference is that the Endowus currently does not offer an ESG portfolio for your CPF funds.

Endowus also offers a Fund Smart portfolio

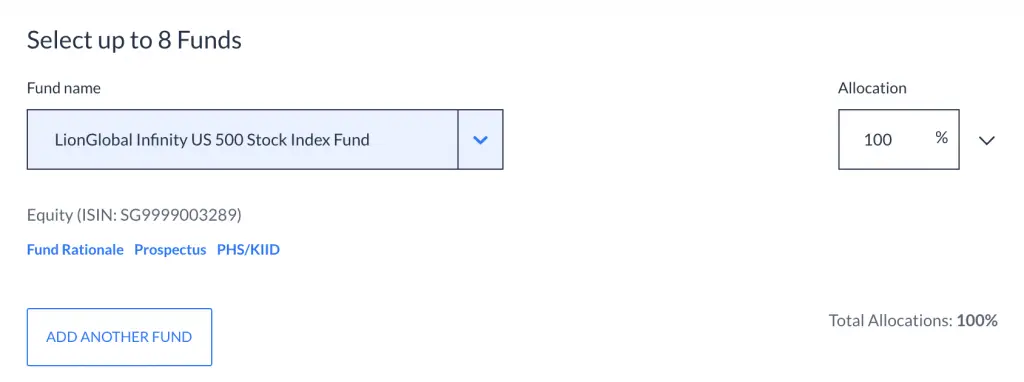

Endowus also has a Fund Smart portfolio. This allows you to customise your portfolio to just the way that you like!

You get to decide:

- Which funds you want to invest in

- The allocation you wish to have in each fund

If you want to just invest in the S&P 500, you can create a portfolio that is 100% allocated into the Infinity US 500 Stock Index Fund.

The main advantage of using Fund Smart is that you get access to these mutual funds at the lowest cost possible!

Cash management portfolios offered

Both robo-advisors also offer a cash management portfolio as well. These portfolios are meant to provide you with a higher returns compared to leaving it in your bank account.

Moreover, these portfolios are also rather liquid for you to easily deposit and withdraw money at any time.

Here are the cash management portfolios that both robo-advisors offer:

StashAway Simple

StashAway Simple was the first cash management portfolio offered by a robo-advisor.

It had a very simple allocation into 2 different funds managed by LionGlobal:

- LionGlobal Money Market Fund (50%)

- LionGlobal Enhanced Liquidity Fund (50%)

With these 2 funds, you are expected to receive a 1.4% yield on your cash.

Endowus Cash Smart

Endowus Cash Smart has 3 different portfolios:

- Cash Smart Core

- Cash Smart Enhanced

- Cash Smart Ultra

Depending on the portfolio that you choose, your money will be invested into different funds:

| Portfolio | Funds |

|---|---|

| Core | Fullerton SGD Cash Fund (50%) LionGlobal SGD Enhanced Liquidity (50%) |

| Enhanced | UOB United SGD Fund (50%) LionGlobal SGD Enhanced Liquidity (50%) |

| Ultra | LionGlobal SGD Enhanced Liquidity Fund (27.5%) Fullerton Short Term Interest Rate Fund (25%) LionGlobal Short Duration Fund (25%) Nikko Shenton Income Fund (12.5%) PIMCO Low Duration Income Fund (10%) |

You can read my full review on Endowus Cash Smart to see if it’s suitable for you.

You can customise your Cash Smart portfolio using Fund Smart

Apart from the Cash Smart portfolios that are being offered by Endowus, you can choose to create your own Cash Smart portfolio as well!

Similar to the Fund Smart portfolio, you can:

- Choose the funds you wish to invest in

- Choose your allocation into each fund

This may help you to earn a higher return compared to Endowus’ recommended portfolios!

Performance

It is hard to compare the performances between these 2 robo-advisors since the portfolios are so different.

Essentially, both robo-advisors use the same asset allocation framework. However, StashAway includes commodities like gold, which Endowus does not.

As such, it may be hard to compare between their portfolios.

Moreover, the past returns can never be a good indicator of future returns. One portfolio that performs well now may not do so in the future.

Rather than looking at performance, you should be considering the investment strategy of these robo-advisors instead!

Dividend distribution

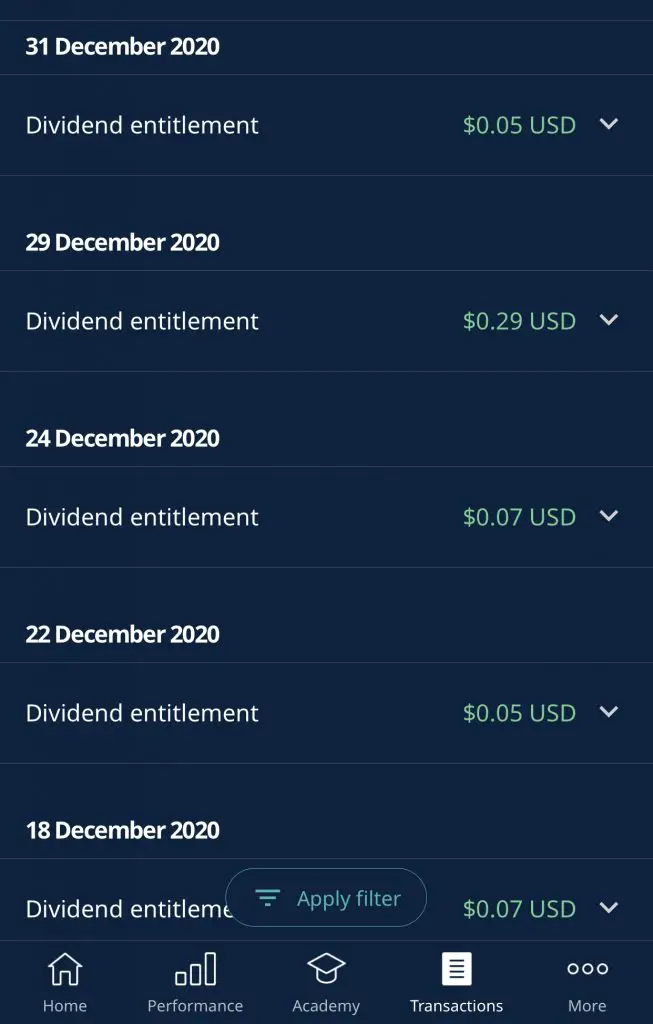

StashAway invests in US-listed ETFs in their general investing portfolios. When any dividends are issued, they will incur a 30% dividend withholding tax.

The dividends that you receive is after this 30% deduction.

You can view the dividends that you’ve received under the Transactions tab.

If you invest in the Income Portfolio, your dividends are not subject to any withholding taxes.

However for Endowus, most of the funds that they invest in are accumulating funds. This means that any dividends you receive will be automatically reinvested for you.

Even if Endowus invests in distributing share class funds, they will still automatically reinvest the dividends for you.

These are similar to accumulating and distributing ETFs that are domiciled in Ireland.

As such, you should not expect to receive any dividends when you invest with Endowus!

Even though you do not receive the dividends, you are still subject to the 15% withholding tax on UCITS funds.

Funds you can invest with

Here are the types of funds you can use to invest in these 2 robo-advisors:

StashAway allows you to use both Cash and SRS

You are able to use either your cash or SRS funds to invest with StashAway.

This is something that other robo-advisors like Syfe do not allow you to do.

Endowus allows you to invest using Cash, SRS and CPF

The main selling point of Endowus is that you are able to invest your CPF funds! So far, they are the only robo-advisor that allows you to do so.

Moreover, they also offer portfolios for your Cash and SRS funds. This makes Endowus an all-in-one platform to invest all of your different funds!

Minimum sum to invest

Here are the minimum sums required to start investing with either robo-advisor:

StashAway has no minimum investment

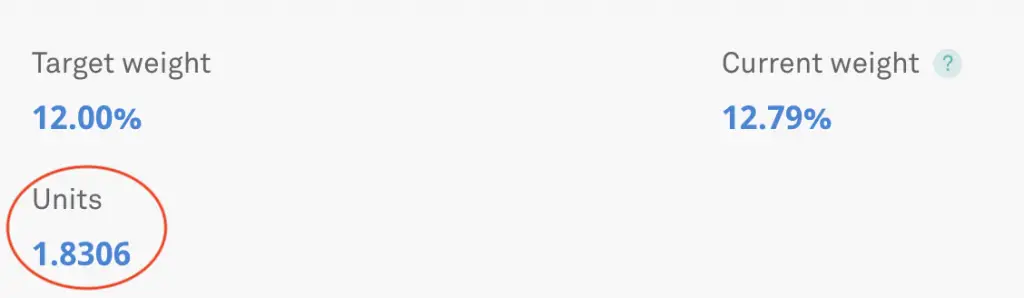

StashAway stores your funds in a co-mingled account with their other customers. This allows you to invest in fractional shares of the various ETFs that StashAway offers.

As such, StashAway does not have a minimum investment amount required to start investing.

This makes investing extremely accessible, especially if you only have a small sum to invest!

The Income Portfolio has a minimum of $10,000

If you want to use StashAway’s Income Portfolio, you will need to invest a minimum of $10,000.

However, it is still possible for you to use this portfolio even if you have less than $10k.

You will just not be able to receive any dividends from your portfolio until you’ve reached the $10k mark.

Endowus has a minimum investment of $1,000

To use the Endowus platform for investing, you will need an initial investment of $1k. This can come from 3 different sources:

- Cash

- SRS

- CPF

You are able to combine funds from your Cash, SRS and CPF to reach the $1k total. Moreover, you can use these funds to invest in any of Endowus’ portfolios.

You do not need to just invest all of your $1k into one portfolio!

Moreover, the minimum sum for each subsequent investment is $100. You aren’t able to invest anything less than a $100!

This may be a larger initial amount if you are just starting to invest. As such, this is something you should consider first before you start to use Endowus.

Fees

Here are the fees that both robo-advisors will charge you:

StashAway charges you 0.8% a year for your first $25k

You will need to pay 0.8% each year in fees for your first $25k invested with StashAway.

| Amount Invested | Management Fee |

|---|---|

| First $25k | 0.8% |

| > $25k and ≤ $50k | 0.7% |

| > $50k and ≤ $100k | 0.6% |

| > $100k and ≤ $250k | 0.5% |

| > $250k and ≤ $500k | 0.4% |

| > $500k and ≤ $1 million | 0.3% |

| > $1 million | 0.2% |

The higher the amount you have with StashAway, the lower your fees will be.

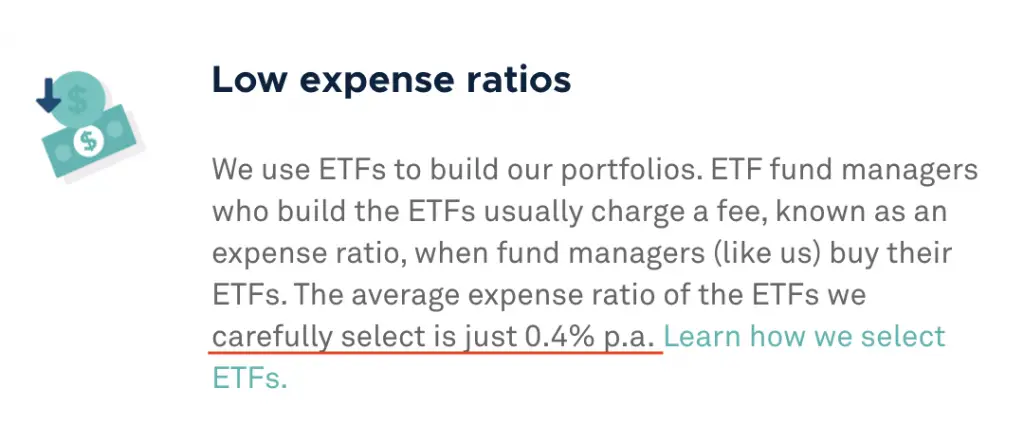

Moreover, you will need to pay the expense ratios of the ETFs as well. This will further add to your costs. StashAway claims that the average expense ratio you will need to pay is around 0.4%.

This means that you will have to pay around 1.2% in fees each year.

StashAway Simple does not charge you any fees

You do not incur any fees for your StashAway Simple portfolio. As such, the amount of funds in your Simple portfolio will not be included in the total amount chargeable.

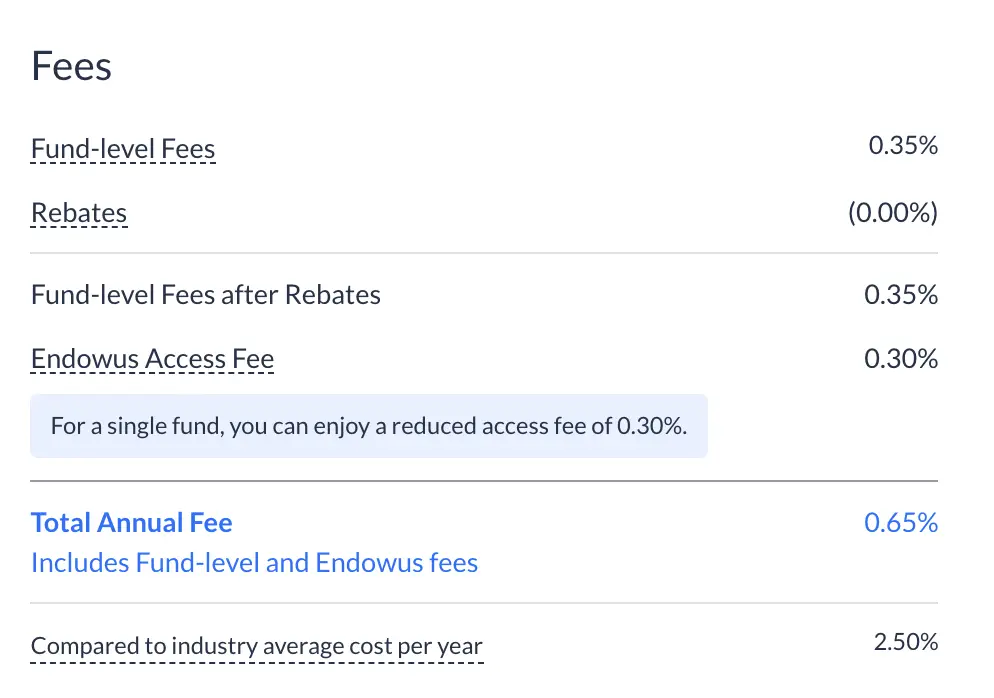

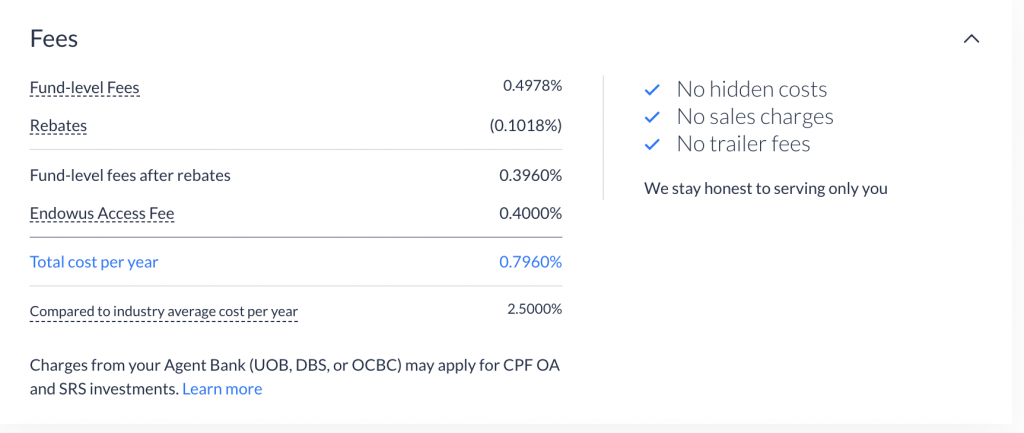

Endowus charges you lower fees

Endowus charges you lower fees on the amount that you have invested with them:

Flat 0.3% for single fund portfolios with Fund Smart

If you have a Fund Smart portfolio that only has a single fund inside (i.e. 100% allocation), you will only be charged 0.3%. This is irregardless of whether you’re using your Cash, SRS or CPF to invest.

This makes it one of the cheapest fees that are being provided by a robo-advisor!

You can consider investing in a broadly diversified fund, such as:

- Infinity US 500 Stock Index Fund

- Dimensional World Equity Fund

Flat 0.4% for CPF and SRS

Endowus charges a flat 0.4% fee for any amount of your CPF or SRS funds that you have invested.

This makes it one of the lowest costs being offered by a robo-advisor!

However, the reason why they are able to charge such low fees is due to the limitations that your CPF and SRS funds have.

Tiered pricing for Cash

Endowus has a tiered pricing for your cash investments:

| Amount | Fee |

|---|---|

| Up to S$200k | 0.6% |

| S$200,001 to S$1,000,000 | 0.5% |

| S$1,000,001 to S$5,000,000 | 0.35% |

| S$5,000,001 and above | 0.25% |

Endowus offers a tiered and not stacked pricing. This means that if you invest $200,001 into Endowus, you will be charged 0.5% for your entire $200,001.

Compared to other robo-advisors, Endowus’ fees are still pretty affordable.

0.05% flat fee for Cash Smart

You will still need to pay an access fee to use Cash Smart. However, this is very low at 0.05% for any amount.

It also does not matter whether you invest in Cash Smart with your Cash or SRS.

Apart from the low management fees charged, Endowus also gives you a full trailer fee rebate.

Full trailer fee rebate

Trailer fees are fees that a fund manager pays a platform. This is similar to a commission that the platform receives for introducing the investor to the fund.

With these trailer fee rebates, this will help to lower your cost of investing!

Pricing can be seen when you invest in any of their portfolios

What I really like about Endowus is the full transparency when it comes to the fees.

This is because you do not just need to pay management fees to the robo-advisor. You’ll need to pay an expense ratio to the funds managers too!

StashAway does not take this cost into account when it advertises its fees.

However, Endowus gives you the full breakdown of the fees that you’ll be charged, including fund-level fees.

This helps you to clearly see your true cost of investing with Endowus!

Type of account used to handle your assets

Both robo-advisors use different types of accounts to manage your assets:

StashAway uses a co-mingled account

StashAway co-mingles your assets with all of its other customers under one account.

This allows StashAway to purchase fractional shares for your portfolio. While this makes investing very accessible, there may be problems when StashAway closes down.

Your fractional shares may not be able to be sold off in the NYSE and SGX! This is because you can only sell off whole shares and not fractional ones on these exchanges.

As such, you do not have control over the fate of your assets, especially for your fractional shares.

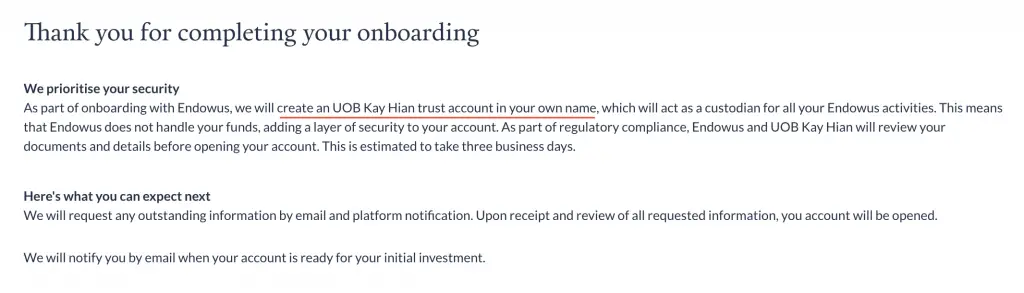

Endowus creates an account under your own name

Endowus creates an account under your own name with UOB Kay Hian.

This gives you complete control over your assets, even in the unfortunate event that Endowus closes down!

You can see how different types of custodian accounts will affect your funds in my analysis of why Smartly closed down.

Web platform

Both robo-advisors have a solid web platform. Here is how StashAway’s platform looks like,

as well as Endowus.

Mobile app

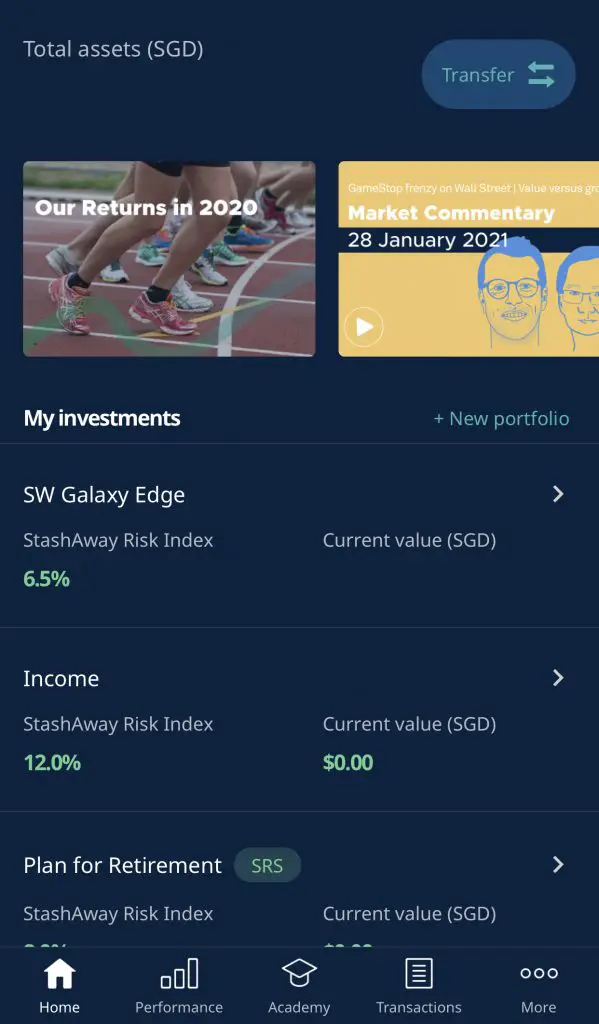

Both robo-advisors also have a mobile app too. Here’s how StashAway’s app looks like,

as well as Endowus’.

Both of them have very sleek apps that can give you quick updates on your portfolios’ performance.

Verdict

Here’s a breakdown between these 2 robo-advisors:

| Endowus | StashAway | |

|---|---|---|

| Type of Product | Mutual Funds | ETFs |

| Investment Strategy | Low cost investing | ERAA Framework |

| Investment Portfolios | Core ESG Fund Smart | General Investing Income Portfolio |

| Cash Management Portfolios | Cash Smart (Core / Enhanced / Ultra) | StashAway Simple |

| Dividend Distribution | None 15% tax (all funds) | Yes 30% (General Investing) 0% (Income) |

| Funds to Invest | Cash SRS CPF | Cash SRS |

| Minimum Sum to Invest | $1,000 (Initial) $100 (Subsequent transactions) | None |

| Fees (Investment) | 0.25-0.6% (Cash) 0.4% (SRS and CPF) 0.3% (Single Fund Portfolio) | 0.8% (first $25k) 0.2%-0.7% (depending on your investment amount) |

| Fees (Cash Management) | 0.05% | 0% |

| Type of Account to Handle Assets | Account under your own name | Co-mingled |

So which robo-advisor should you choose?

Choose StashAway if you have a lower investment amount

StashAway is great if you’re just starting out and do not have a large sum to invest. With its pretty affordable fees, it is a great way for you to start your investment journey.

The only drawback is that StashAway’s fees are rather high. The 0.8% that they charge is rather costly, especially since they are just using US-listed ETFs.

Nevertheless, its low investment amount provides you with an easy way to start being invested. The returns that you receive will still be better than leaving your money in your bank account!

Choose Endowus if you want a lower cost to investing

The greatest barrier to start investing with Endowus is the $1k minimum sum. However if you are able to commit this sum, Endowus is one of the cheapest platforms you could possibly use!

Moreover, it allows you to invest your SRS and CPF funds apart from your cash. It is possible for you to use Endowus for all of your investing needs!

Endowus also provides you with Irish-domicled funds, which help to lower your dividend withholding tax. You do not need to worry about incurring the hefty US estate tax too!

If you are able to set aside at least $1k, Endowus is a strong contender for you to invest your funds.

Conclusion

Both robo-advisors have their strengths, and are able to cater to your different needs.

However, the main considerations that you should have when choosing between these 2 platforms are:

- The amount of money you are able to invest

- The investment strategy you agree with

- The fees you are willing to pay

- Whether you wish to invest your CPF

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

StashAway Referral (Up to $40,000 SGD managed for free for 6 months)

If you are interested in signing up for StashAway, you can use my referral link to sign up.

Here’s what you’ll need to do:

- Sign up for a StashAway account

- Make a deposit of ≥ $10k within 4 weeks of signing up

- Receive a fee waiver for 6 months (up to $40k)

You can find out more about this program on SingSaver.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?