Last updated on January 2nd, 2022

Tiger Brokers took the stock trading scene in Singapore by storm after announcing their cheap commission rates in 2020.

However, they are not the only one as Moomoo (powered by FUTU) has a similar platform that allows you to trade at low costs too!

So how do these low fee platforms compare with each other?

Contents

- 1 The difference between Tiger Brokers and Moomoo (powered by Futu)

- 2 Company

- 3 Type of Products Available

- 4 Types of Exchanges Available

- 5 Fees

- 6 Exchange Rates

- 7 Pre and aftermarket trading

- 8 App and Platform Experience

- 9 Ease of Opening Account

- 10 Deposits and Withdrawal

- 11 Type of Custodian Account

- 12 Verdict

- 13 Conclusion

- 14 👉🏻 Referral Deals

The difference between Tiger Brokers and Moomoo (powered by Futu)

Both Tiger Brokers and Moomoo (powered by Futu) offer really cheap commissions when you are trading in the SGX, HKEX or US markets. Tiger Brokers offers access into 2 more markets (ASX and China), while Moomoo offers cheaper minimum commissions for SGX trades.

Here is an in-depth comparison between these 2 platforms:

Company

Tiger Brokers was founded in 2014 as UP Fintech. They initially started out in China, but they have expanded into Singapore, Australia and New York.

They were also listed on the NASDAQ in 2019 (TIGR).

Tiger Brokers has a huge backing from different companies, such as:

- Interactive Brokers

- Xiaomi

Moomoo trading is under Futu Singapore

Meanwhile, Moomoo is a trading platform that is powered by Futu. In Singapore, the products and services in Moomoo are offered by Futu Singapore.

Futu Singapore’s parent company is Futu Holdings.

Futu Holdings was founded in Hong Kong in 2011, and has now expanded their presence in China, US and Singapore.

They were also listed on the NASDAQ in 2019 (FUTU) too.

Futu’s strategic investors include Tencent Holdings, Matrix Partners and Sequoia Capital.

Type of Products Available

Both brokerages offer different kinds of products:

Tiger Brokers has a rather standard offering of products

You are able to buy the standard products from the different exchanges using Tiger Broker’s platform. This includes:

- Stocks

- ETFs

- Mutual funds

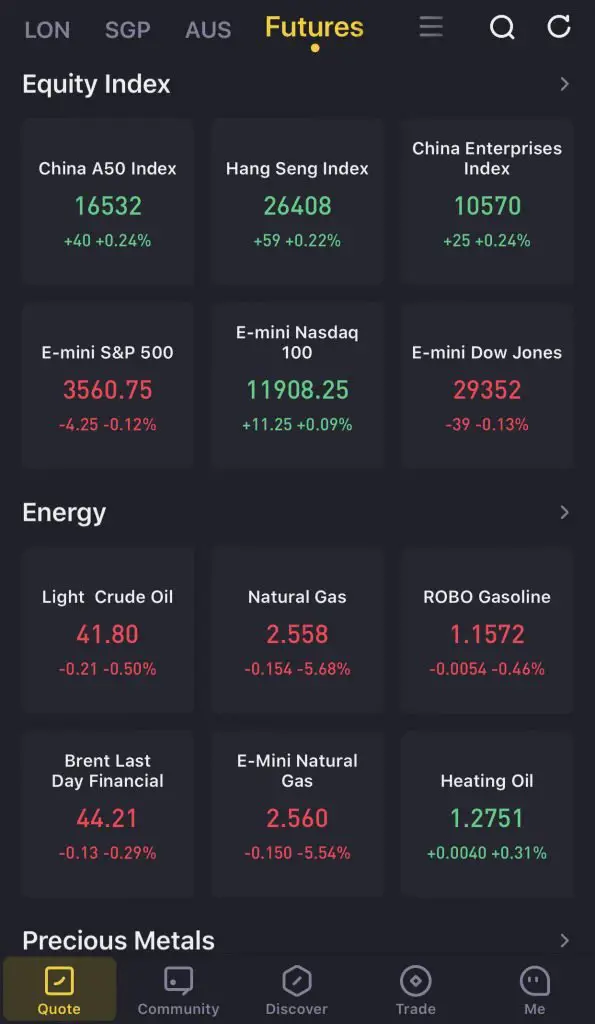

- Futures

- Options

You are able to trade futures and options on Tiger Broker’s platform too.

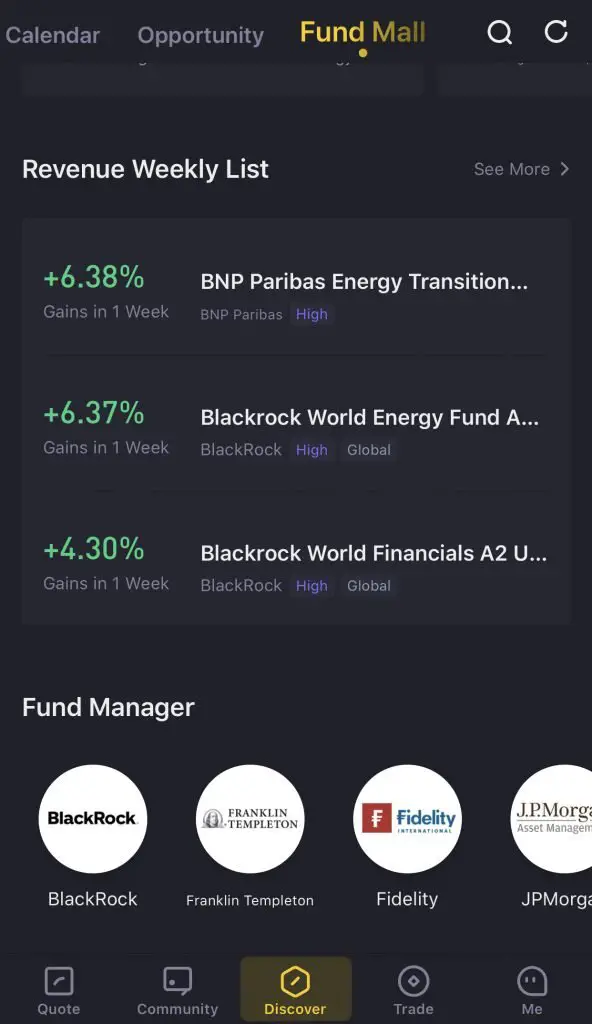

You can also buy mutual funds with Fund Mall

Tiger Brokers has a Fund Mall, where you can buy mutual funds from it. However, the offering is much more limited compared to FSMOne’s.

Moomoo has less options

Moomoo allows you to trade in these products:

- Stocks

- ETFs

- REITs

- ADRs

- Options

These products can all be bought on Tiger Brokers too. As such, Moomoo has a lower variety of products that you can invest in.

Types of Exchanges Available

Here are the different exchanges that you are able to trade on using both platforms:

| Tiger Brokers | Moomoo | |

|---|---|---|

| SGX | ✓ | ✓ |

| HKEX | ✓ | ✓ |

| US | ✓ | ✓ |

| ASX (Australia) | ✓ | ✕ |

| SZSE and SSE (China) | ✓ | ✕ |

Tiger Brokers offers 2 more exchanges compared to Moomoo!

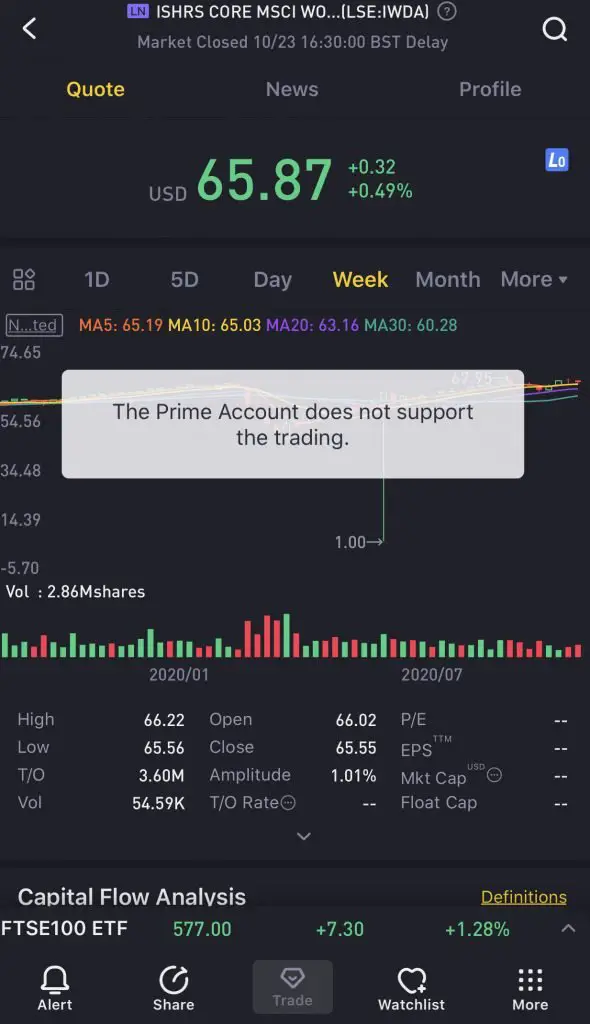

The exchange that most Singaporeans may be interested in is the London Stock Exchange (LSE). You are able to buy Irish-domiciled ETFs that help to reduce your taxes in 2 ways:

- Reduce your dividend withholding tax (30% to 15%)

- Reduce the estate taxes that you incur

Tiger Brokers has the LSE listed on their platform. However, you can’t trade equities that are listed on the LSE.

Fees

The fees that you incur are one of the most important factors that affect your returns.

You’ll need to consider 2 types of fees that you’ll pay each broker:

- Trading commission

- Platform fee

Here are the fees that you’ll incur with both brokers:

| Tiger Brokers | Moomoo | |

|---|---|---|

| SGX | 0.04% * trade value (commission) + 0.04% * trade value (platform fee) No minimum (until 31 Dec 2021) Min $2.88 SGD/trade (after 31 Dec 2021) | 0.03% * trade value Min $0.99/trade (commission) + 0.03% * trade value Min SGD $1.50 (platform fee) |

| HKEX | 0.03% * trade value (commission) + 0.03% * trade value (platform fee) Min 15 HKD/trade | 0.03* trade value Min 3 HKD/trade (commission) + 15 HKD/order (platform fee) |

| US | 0.01 USD/share (commission + platform fee) Min 1.99 USD/trade | USD 0.0049/share Min USD 0.99/order (commission) + USD 0.005/share Min USD 1/order (platform fee) |

The fees that you’ll incur with both brokers can seem really confusing, so here are the minimum fees that you’ll incur:

| Market | Tiger Brokers | Moomoo |

|---|---|---|

| SGX | No minimum (until 31 Dec 2021) Min $2.88 SGD/trade (after 31 Dec 2021) | Min $2.49 per trade |

| HKEX | Min 15 HKD/trade | Min 18 HKD/trade |

| US | Min 1.99 USD/trade | Min 1.99 USD/trade |

You are able to receive 90 days of commission-free trading as your sign-up bonus for Moomoo.

After all of the promotions have ended, are is the comparison of the minimum commissions for both brokers:

| Market | Cheaper Commission? |

|---|---|

| SGX | Moomoo |

| HKEX | Tiger Brokers |

| US | Both are similar |

Depending on which market you frequently trade in, one platform may offer a cheaper commission compared to the other.

Is moomoo cheaper than Tiger Brokers?

When considering the base commission rates that each broker charges you, both Tiger Brokers and moomoo charge similar fees for the US markets. Tiger Brokers charges cheaper commissions for the HKEX (15 HKD vs 18 HKD), while moomoo charges cheaper commissions for the SGX ($2.49 vs $2.88).

Fees incurred for trading in respective exchanges

On top of the fees that you pay for each platform, you will be charged exchange-specific fees as well. These fees are the same across both brokerages.

For example, you will be charged an additional 0.04% by SGX for each trade that you make.

This includes:

- Trading fee (0.0075% * transaction amount)

- Clearing fee (0.0325% * transaction amount)

Exchange Rates

If you wish to trade in overseas stocks, you will have to exchange your SGD for a foreign currency.

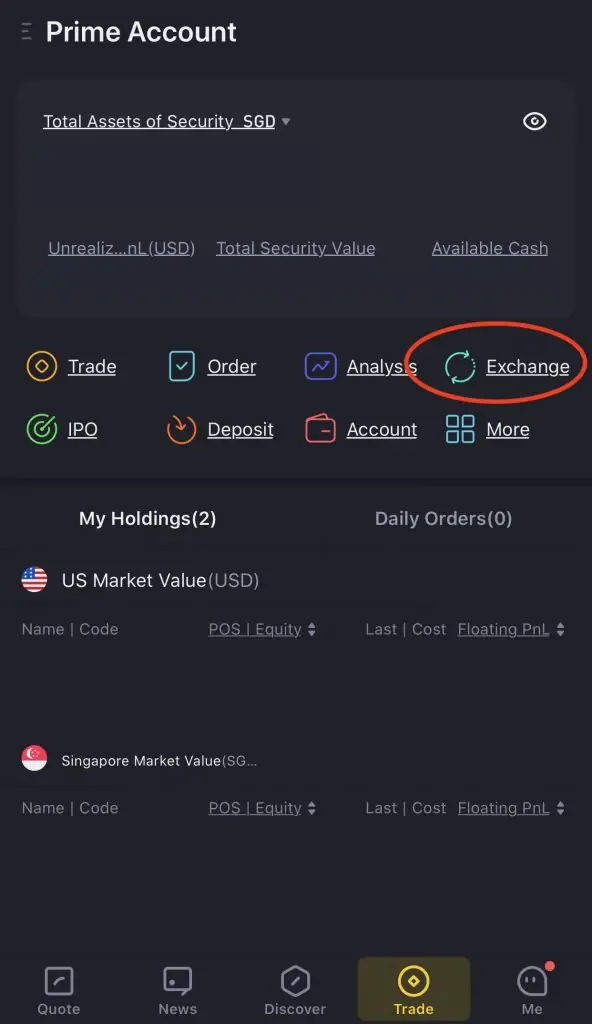

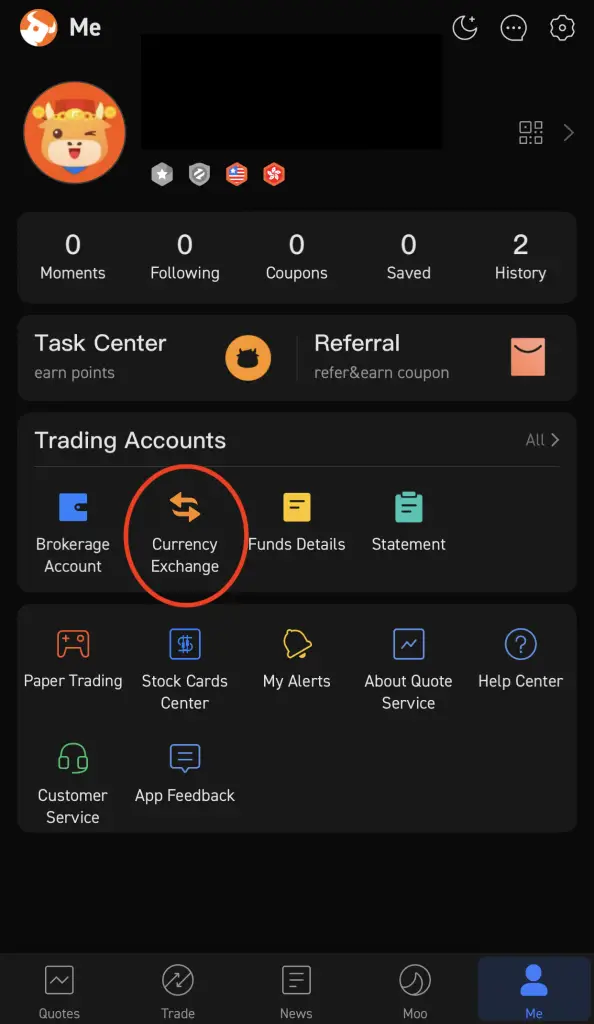

This can be easily done in-app for Tiger Brokers,

as well as Moomoo.

Tiger Brokers has slightly better exchange rates

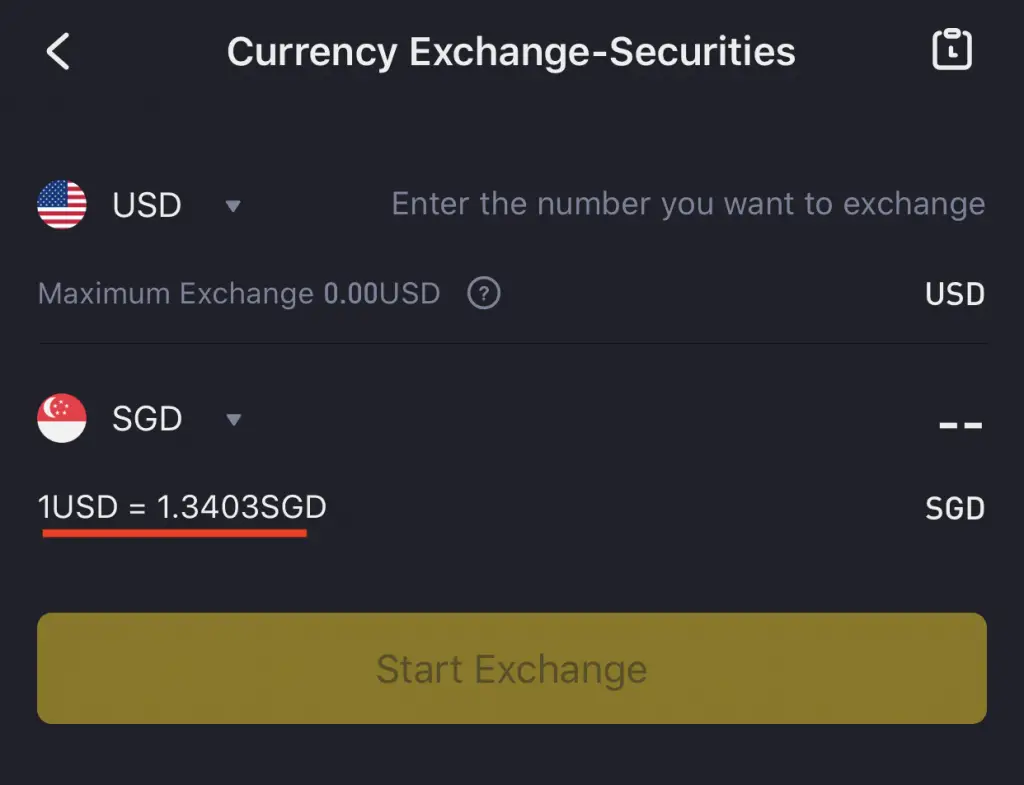

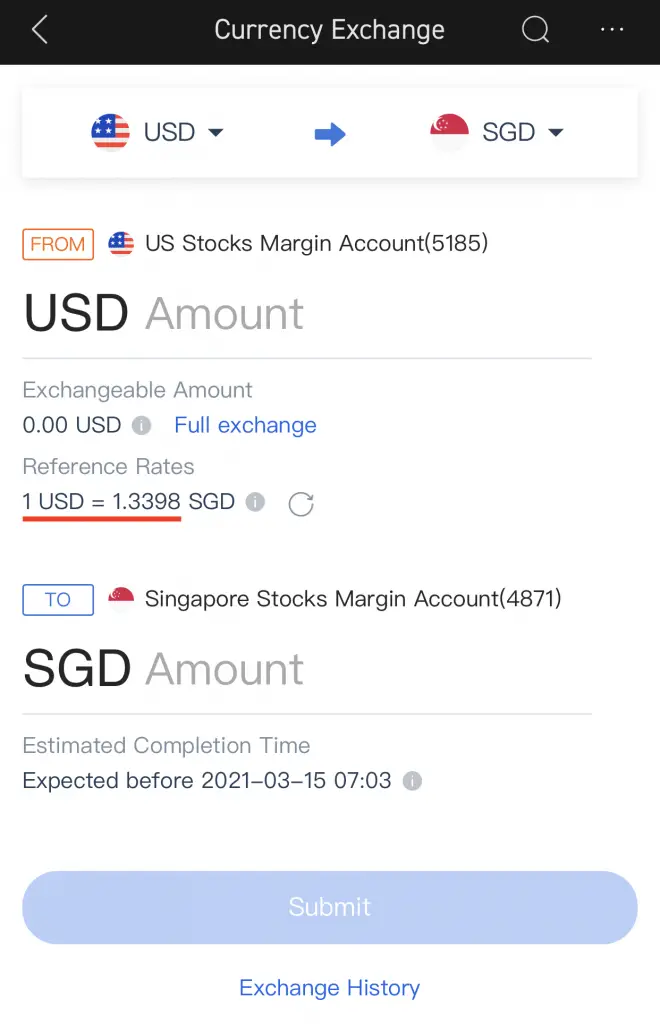

Here are the exchange rates between USD to SGD on Tiger Brokers,

as well as Moomoo which are taken around the same time.

The rates for Tiger Brokers is slightly better compared to Moomoo!

However, the difference is only 0.0005. It will only make a significant difference if you are exchanging a large amount of money.

Pre and aftermarket trading

Both Tiger Brokers and Moomoo allow you to conduct pre and aftermarket trading on its platform. Here are the timings for the 3 periods in Singapore time (GMT +8).

| Trading Period | Timing (GMT +8) |

|---|---|

| Premarket | 1600-2130 |

| Regular Trading | 2130-0400 |

| Aftermarket | 0400-0800 |

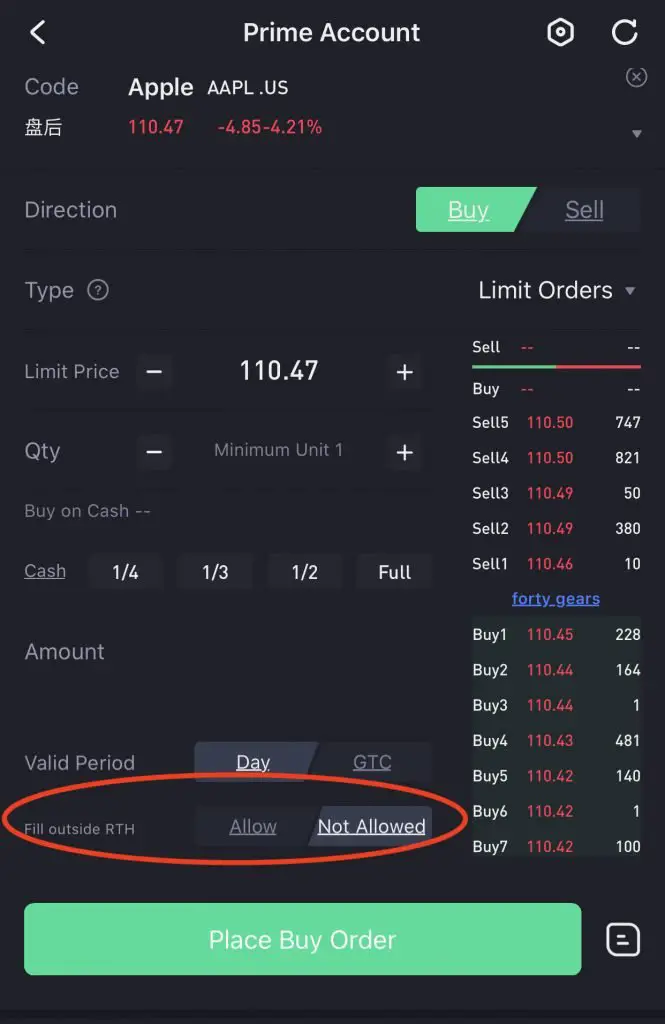

To enable pre and aftermarket trading, you will need to enable the ‘Fill Outside RTH‘ option on the trading page.

The same can be done for Moomoo when you fill outside RTH too.

App and Platform Experience

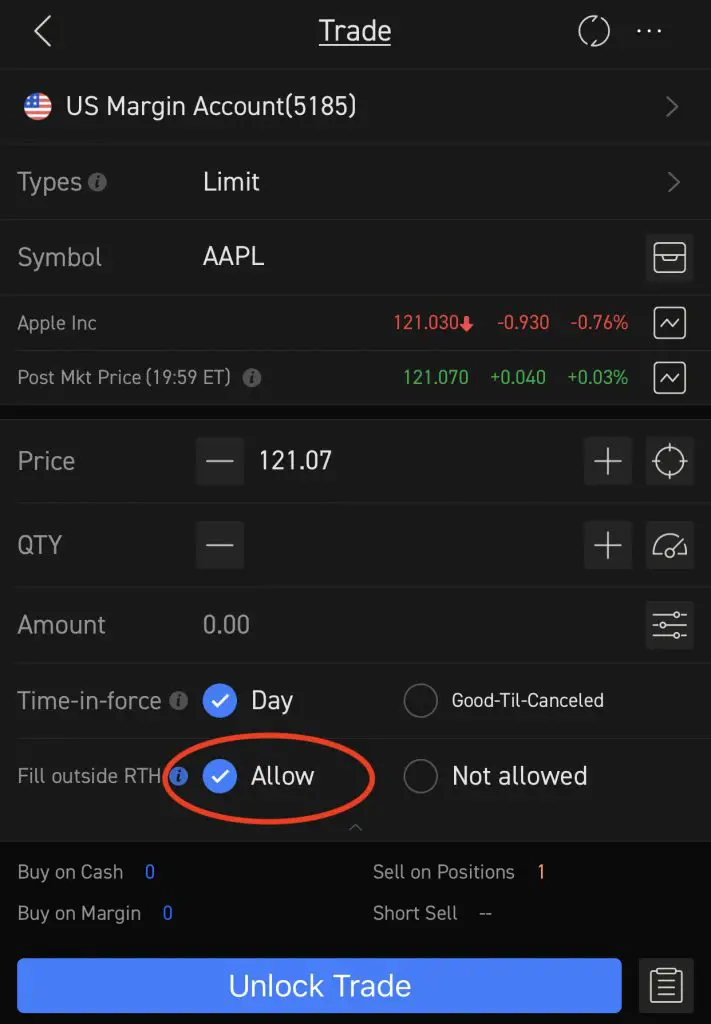

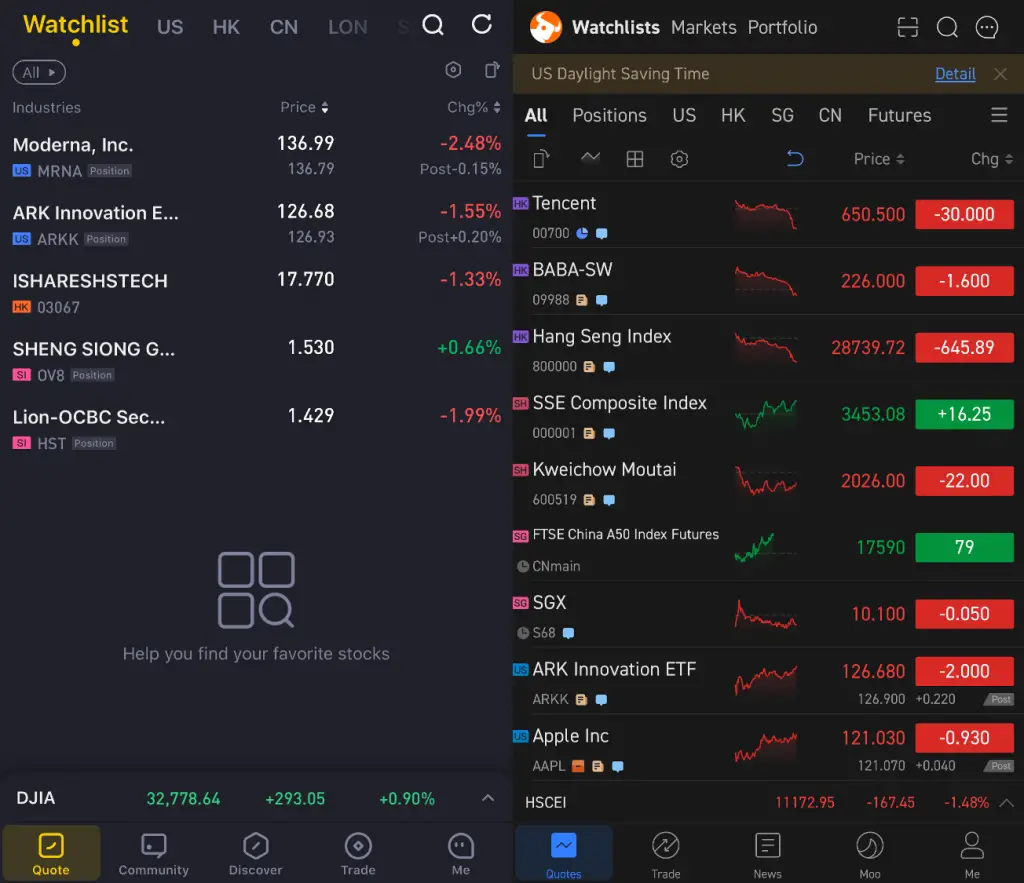

The user experience on the brokerage platform may help you to decide on a broker. However, both of these brokers’ apps are very similar!

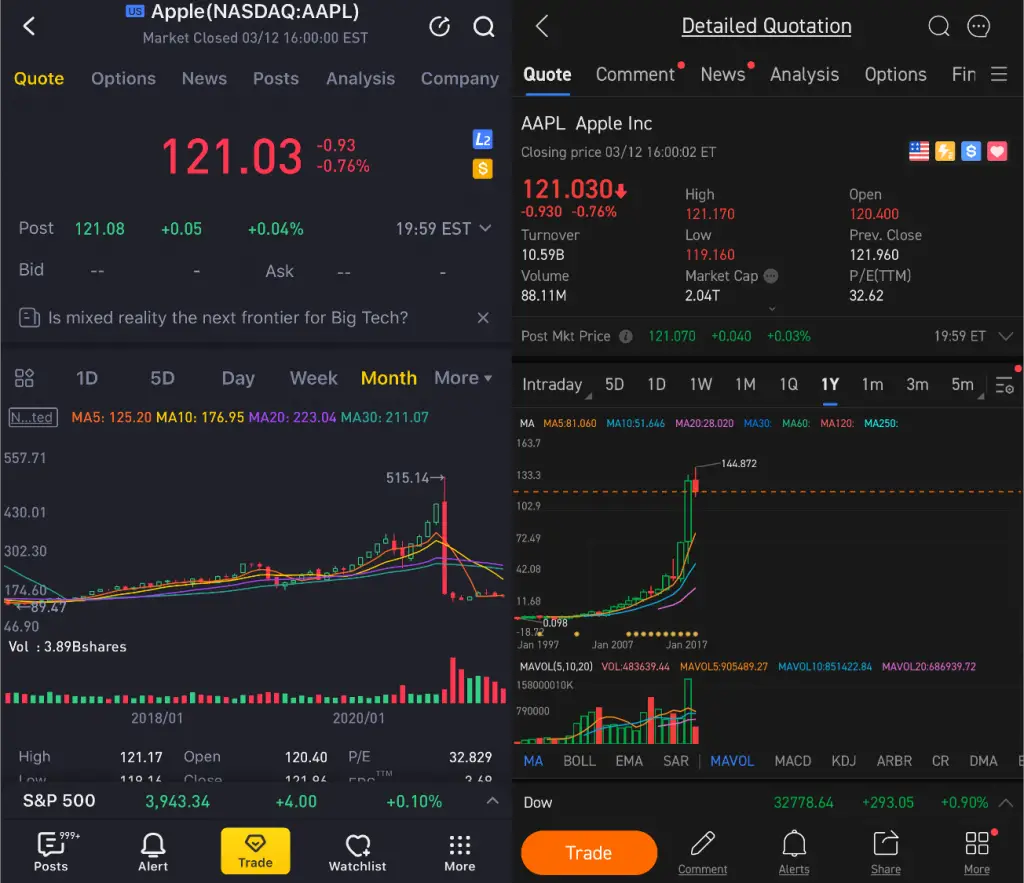

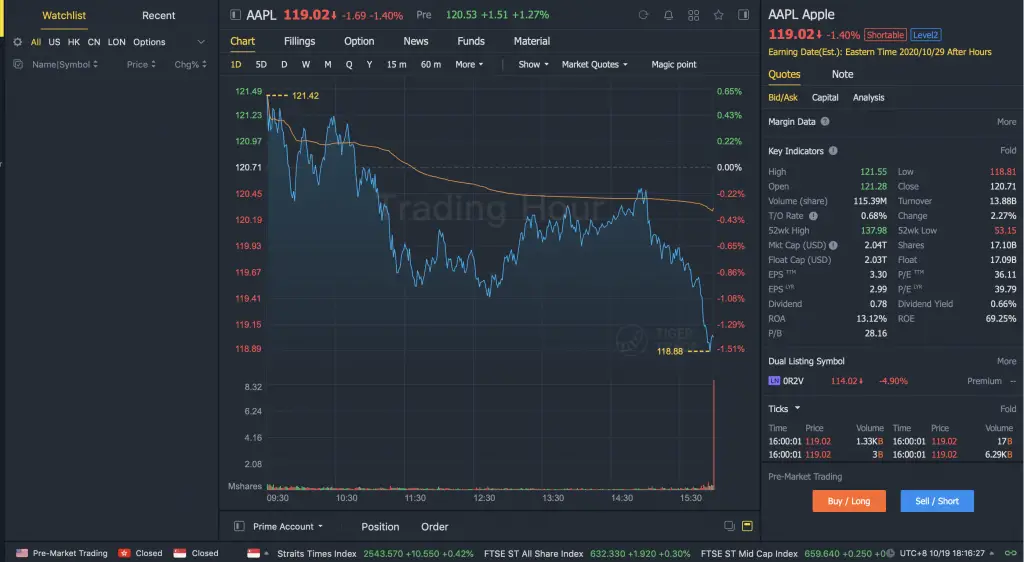

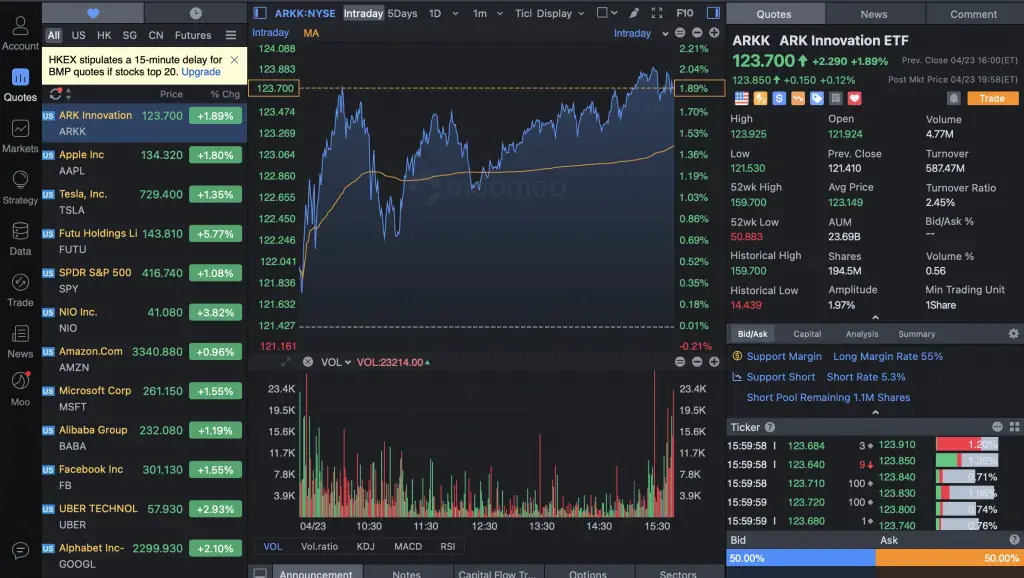

Here is how some of their pages look like:

#1 Watchlist

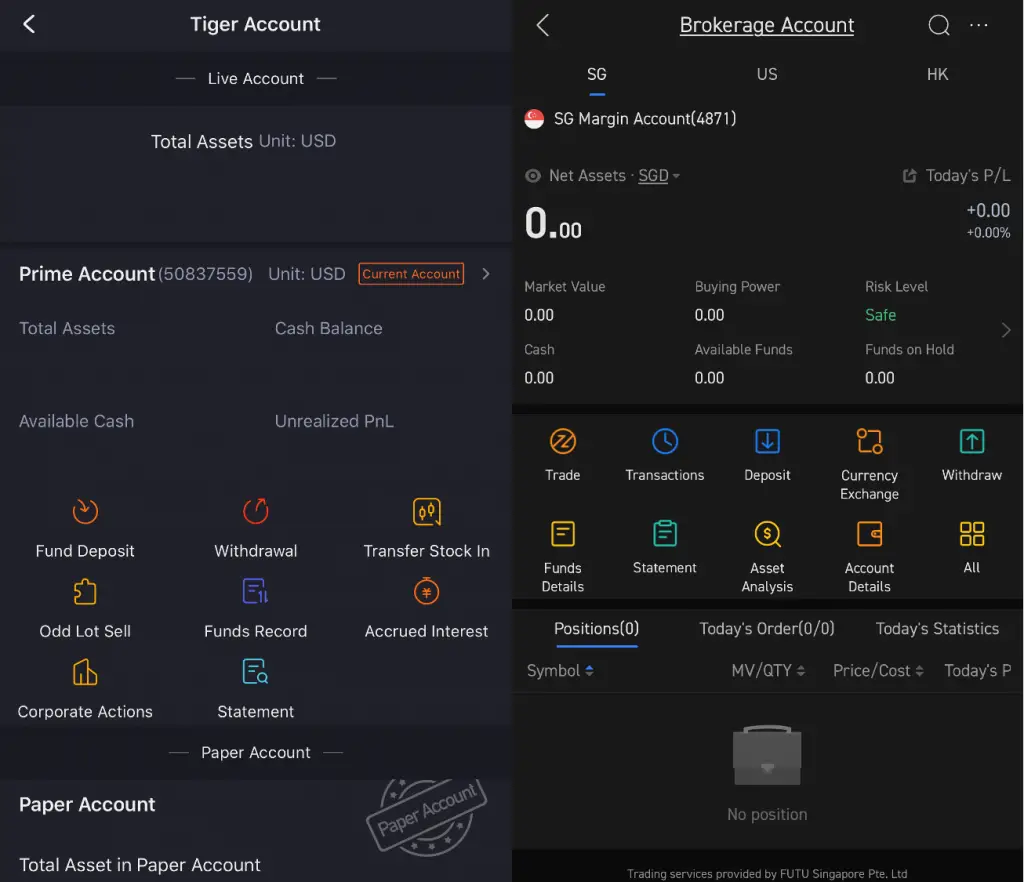

#2 Trading account

#3 Stock information

Both of these apps look really similar!

Tiger Brokers has a desktop app,

as well as Moomoo.

Moomoo’s desktop app does pack in a lot of features if you are a frequent trader. However, I do find that the features can be extremely overwhelming if you are a beginner investor.

It was quite hard to find the ‘Trade’ button which is rather small!

Personally, I prefer using Tiger Brokers’ app, as I feel that it is more user-friendly.

Ease of Opening Account

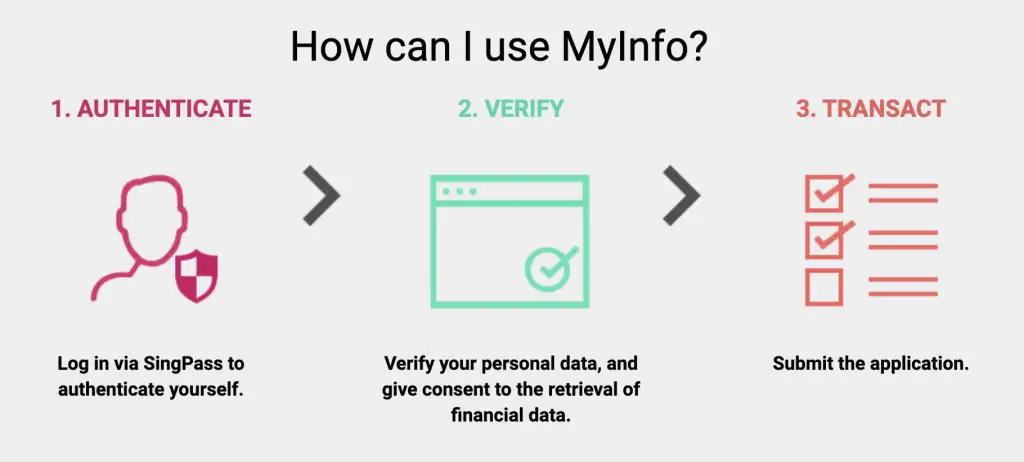

Both Tiger Brokers and Moomoo use MyInfo during the signup process.

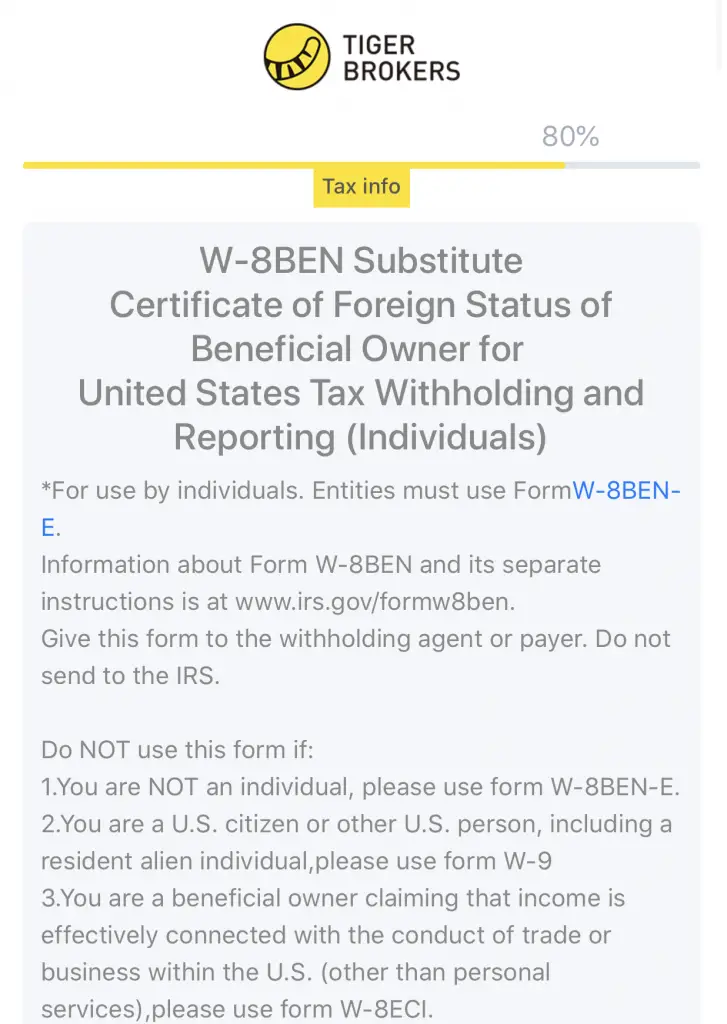

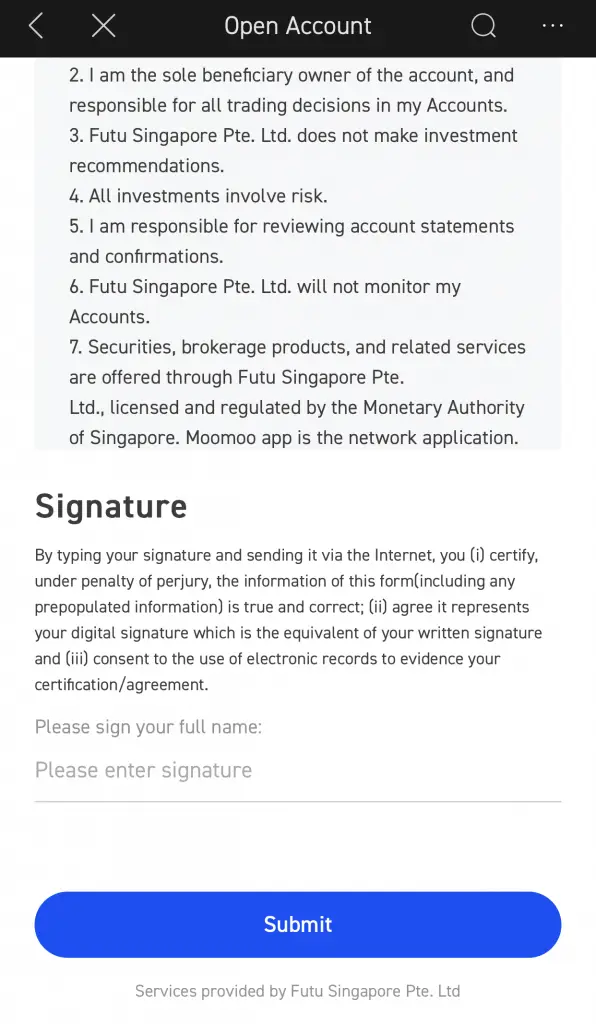

If you wish to trade in the US markets, you are required to sign a W-8 BEN form to declare that you are a non-US citizen.

For Tiger Brokers, you can sign the W-8 BEN form digitally.

For Moomoo, you do not have to sign the W-8 BEN form. However, you are required to fill up a questionnaire and sign at the bottom of the page.

The account opening process for both platforms is rather smooth. Your account should be opened within the day!

Deposits and Withdrawal

Both online brokerages are pre-funded accounts. This means that you will have to fund your account on either platform first before you can start trading.

No minimum sum to maintain

Both online brokerages do not have a minimum sum to maintain in your account. This is great if you only have a small sum to invest.

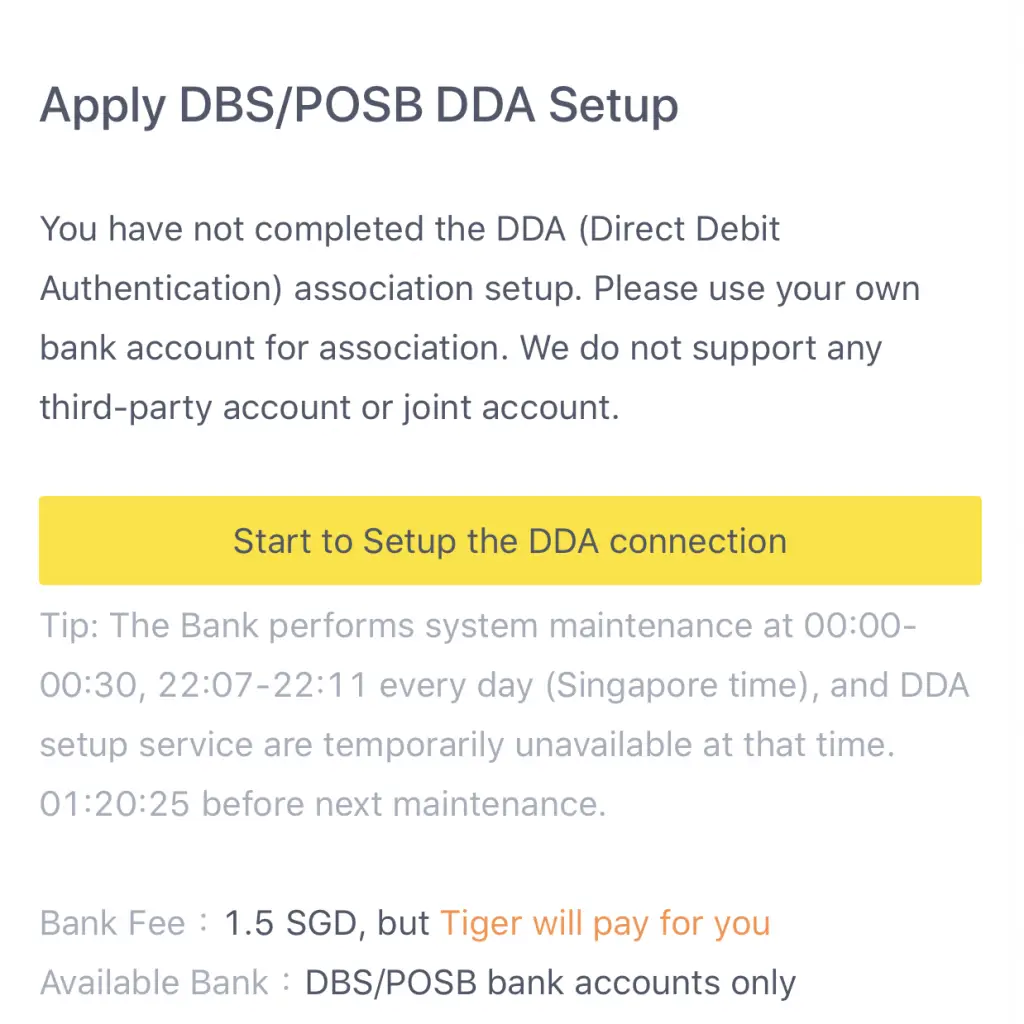

Tiger Brokers has direct debit for DBS / POSB customers

If you are a DBS or POSB customer, you can opt to have a direct debit from your bank account to Tiger Brokers.

Your funds will be credited into your Tiger Brokers account almost instantly.

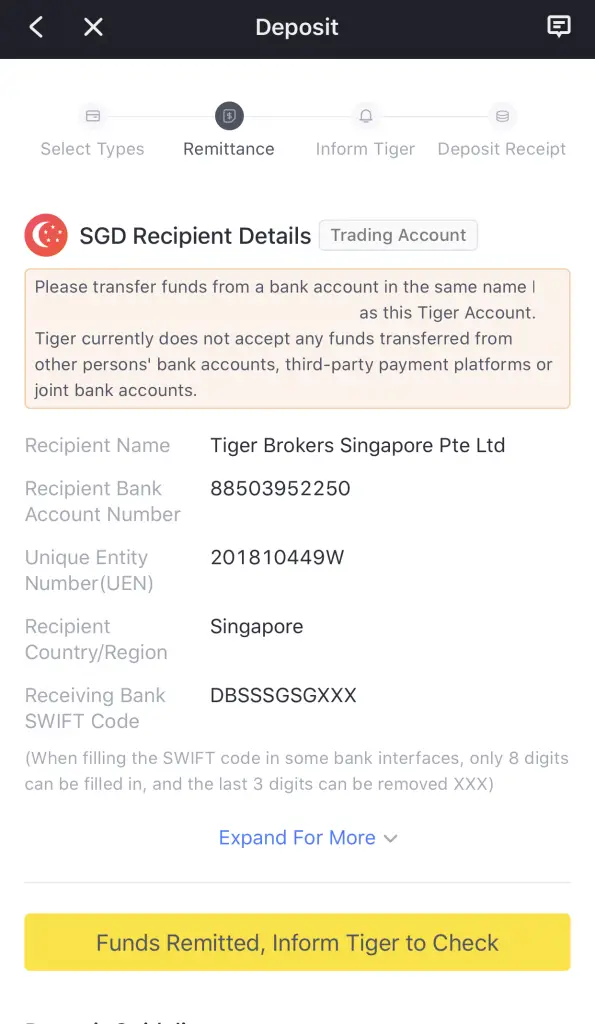

However if you do not have a DBS or POSB account, you can still transfer your funds via FAST.

However, this process may take a few hours before your funds reach your Tiger account.

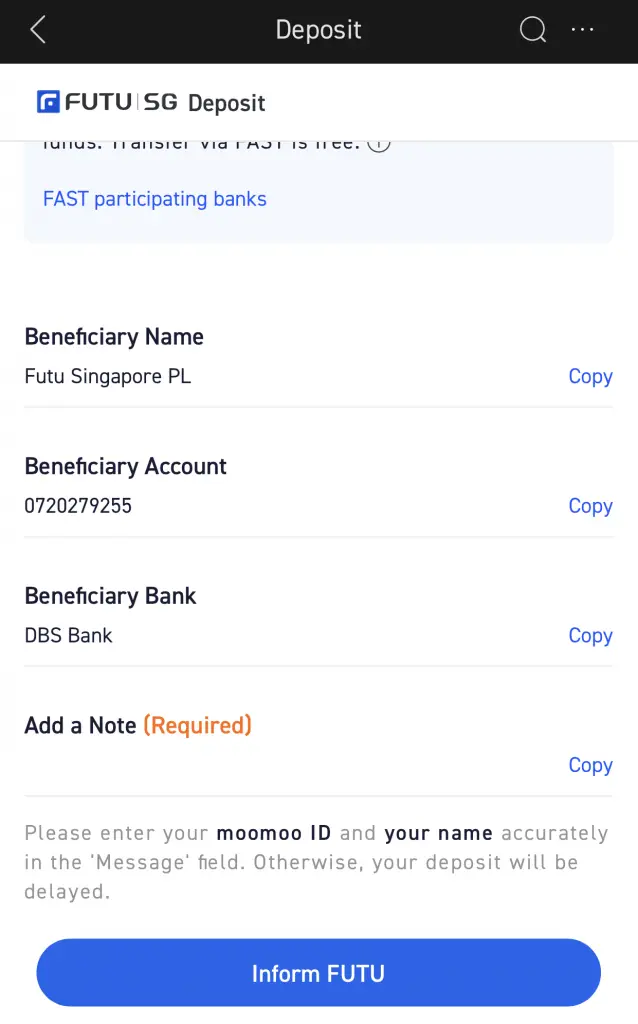

You can only use FAST transfers for Moomoo

For Moomoo, you can only do deposits via FAST.

When I deposited my funds with them, it took a few hours before I received an email that Moomoo received my funds.

Withdrawals may take a few business days

When you want to withdraw your funds from either platform, it may take a few business days before the funds reach your bank account.

The waiting time is around the same for either platform.

Type of Custodian Account

When you trade your assets on both brokerage firms, your assets will be under a custodian account.

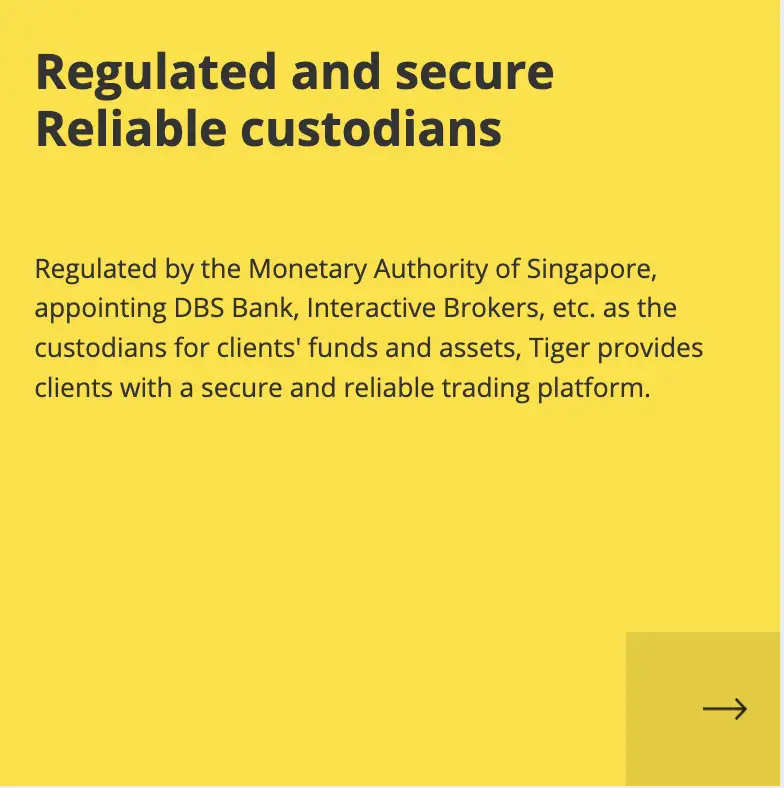

Tiger Brokers has a 3rd party custodian account for you

Tiger Brokers uses 3rd party custodians to manage your assets for you.

DBS bank manages your Singapore assets. Meanwhile, Interactive Brokers most likely is handling your assets from other countries.

This is part of the requirements of the Capital Markets License that Tiger Brokers has.

In the unfortunate event that Tiger Brokers closes down, your assets are still kept safe under these custodian accounts.

This 3rd party custodian account arrangement is similar to what robo-advisors use as well.

moomoo has a CMS License too

moomoo (under FUTU) is also licensed with the MAS under the Capital Markets License as well.

However, they do not disclose who their custodians are.

Nevertheless, they still should follow similar practices of keeping your assets separate from theirs.

In the unfortunate event that Moomoo closes down, FUTU is unable to touch your assets.

Both accounts do not allow CDP linkage

Since both Tiger Brokers and Moomoo are custodian accounts, they are unable to be linked to your CDP account.

If you wish to transfer your shares from a CDP-linked broker to either broker, you would have to do a manual share transfer by contacting support.

This may be advantageous if you want to trade SGX stocks with a custodial broker, and not one that is linked to your CDP account.

Verdict

Here is a head-to-head comparison of Tiger Brokers and Moomoo:

| Tiger Brokers | Moomoo | |

|---|---|---|

| Type of Products Available | Stocks ETFs Mutual funds Futures Options Margin | Stocks REITs ETFs Options Margin |

| Number of Exchanges Available | 5 countries | 3 countries |

| Trading Commissions | Lower for HKEX Same for US | Lower for SGX Same for US |

| Exchange Rate | Comparable | Comparable |

| Pre and Aftermarket Funding | Present | Present |

| Platforms | Mobile and Desktop | Mobile and Desktop |

| Ease of Opening Account | Similar | Similar |

| Funding Account Speed | A few hours | A few hours |

| Custodian Account | 3rd party (e.g. DBS) | Did not mention |

So which broker should you choose?

Choose Tiger Brokers for access to more markets

Tiger Brokers offers you better options as you are able to purchase stocks from 2 additional countries:

- Australia

- China

As such, this gives you greater variety in the markets that you can trade in!

Tiger Brokers has slightly cheaper commissions for the HKEX compared to Moomoo.

It also has an attractive offer of no minimum commissions for SGX trades.

Tiger Brokers currently offers a wider variety of products such as mutual funds and futures. If you are looking for those trading options, then Tiger Brokers will be the platform that’s more suitable for you.

Choose Moomoo for cheaper SGX trades

When Tiger Brokers’ ‘no minimum commission’ promotion ends, Moomoo actually offers a cheaper commission when you make SGX trades ($2.49 vs $2.88).

Even though the difference is just $0.39, it can make a huge difference if you are making multiple trades!

In the long term, Moomoo will help to lower your costs if you are mainly trading in the SGX.

With their current ‘commission-free’ promotion for 90 days, it is a great time for you to use their platform and see if it’s suitable for you.

Conclusion

Both platforms offer a great way to trade in stocks and ETFs, especially with their low commissions.

Even though these brokers have really low commission fees, I would like to caution you from making too many trades.

A broker makes its money when you trade more often on their platform. It is in their interest that you make as many trades as possible.

This is similar to how Robinhood works.

I personally feel that these brokers have made it really easy for you to invest, which may make you treat investing as gambling. This can be quite detrimental to your finances if you have just started your investing journey!

Nevertheless, with these low-cost brokers entering the trading scene, it may push other brokers to lower their fees too!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

moomoo Referral ($200 Stock Cash Coupon Bundle, AAPL Shares and Commission Free Trades for 180 Days)

If you are interested in signing up for a moomoo (powered by FUTU SG) account, you can use my referral link.

Here are some of the rewards you can receive (From 2 Oct 2021):

- Commission-free trading for 180 days (SGX, HKEX and US markets)

- $200 or $2,000 Stock Cash Coupon Bundle (First Deposit Reward)

- Apple share and iPhone 13 (First Transfer-In Rewards)

To receive these bonuses, here are the steps you’ll need to do:

#1 Sign up for a Moomoo account

You’ll need to use my referral link to sign up for a moomoo (powered by FUTU SG) account.

Once you have successfully opened a FUTU SG Securities Account, you will receive:

- 180 days unlimited commission-free trading for the US, HK & SG stock market (to be activated within 90 days)

- Lvl 2 US stock Market Data

- Lvl 1 SG stock Market Data

- Lvl 1 China A-Shares Market Data

First Deposit Reward

You will be able to receive a Stock Cash Coupon Bundle, depending on the amount that you deposit for your very first deposit:

| S$ 2,700 – S$ 199,999 | $200 Stock Cash Coupon Bundle |

| ≥ S$ 200,000 | $2,000 Stock Cash Coupon Bundle |

First Transfer-In Reward (US & HK stocks only)

If you transfer your US or HK stocks from another brokerage account to moomoo, you will be able to receive some rewards:

| SGD 50,000 – SGD 99,999 | 1 Free Apple (AAPL) share |

| SGD 100,000 – SGD 199,999 | 2 Free Apple (AAPL) shares |

| ≥ SGD 200,000** | 1 iPhone 13 (256GB; first 50 sets) OR 3 Free Apple (AAPL) shares |

To learn more, you can view more about this promotion on the FUTU SG website.

Tiger Brokers Referral (Free AAPL Share and 60 Commission-Free Trades)

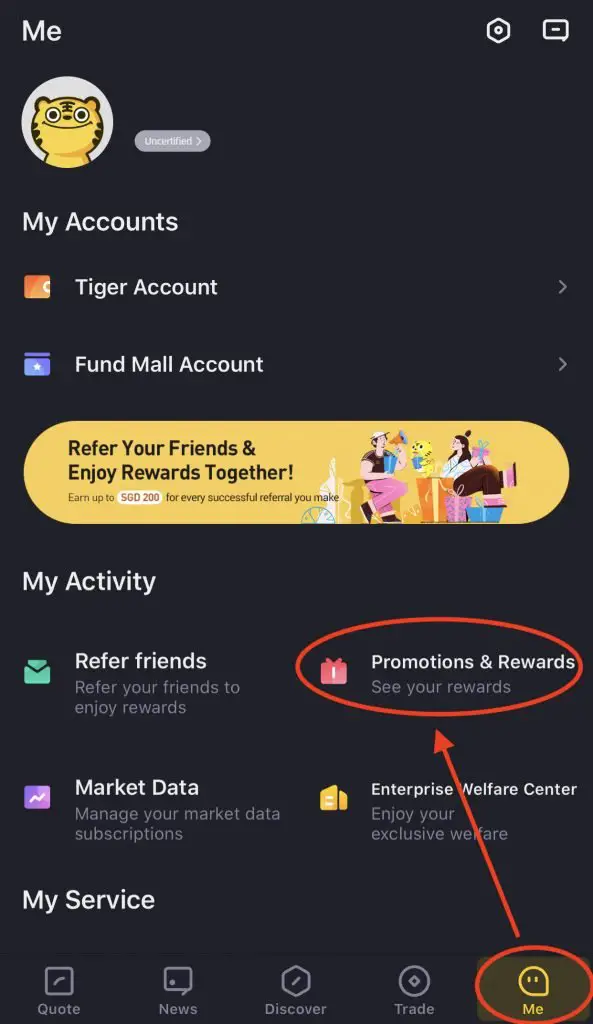

If you sign up for a Tiger Brokers account using my referral link, you will be eligible for some rewards. You can view and claim your rewards by going to ‘Me → Promotions & Rewards‘.

Here are 3 bonuses that you can receive:

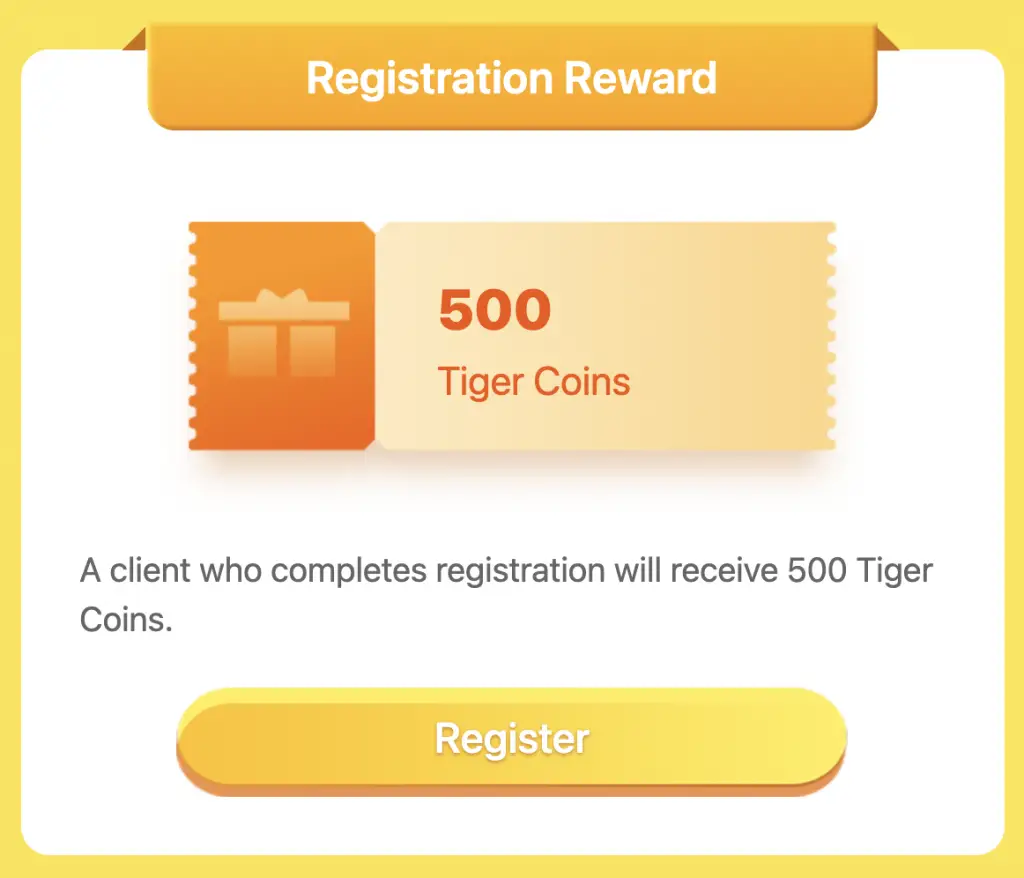

#1 Registration Reward

When you register for a Tiger Brokers Account, you will receive 500 Tiger Coins.

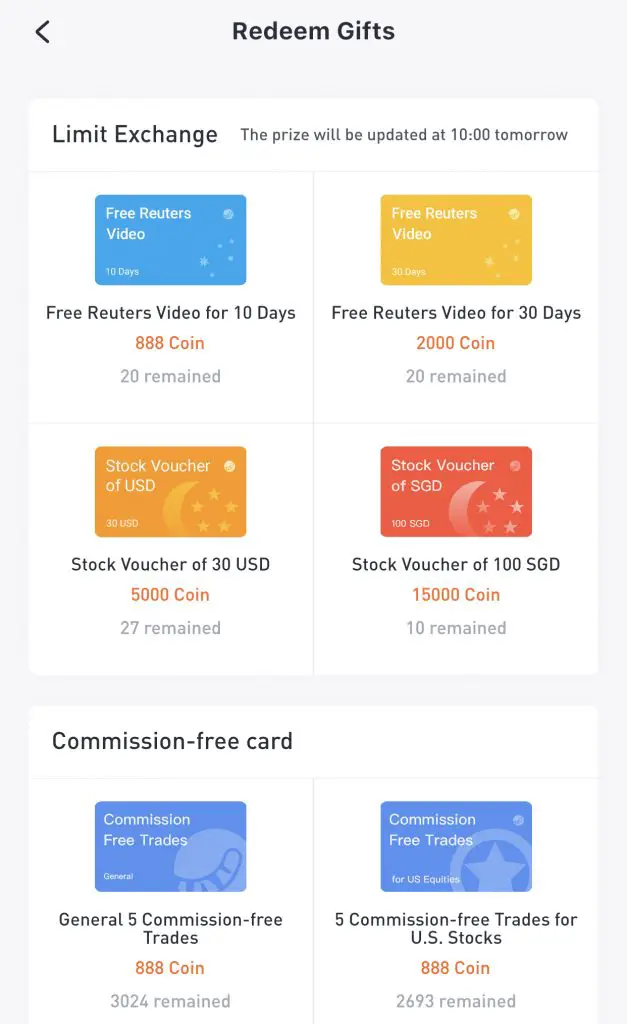

These Tiger Coins can be used to redeem a variety of rewards, such as:

- Stock vouchers

- Commission-free trades

- Reuters videos

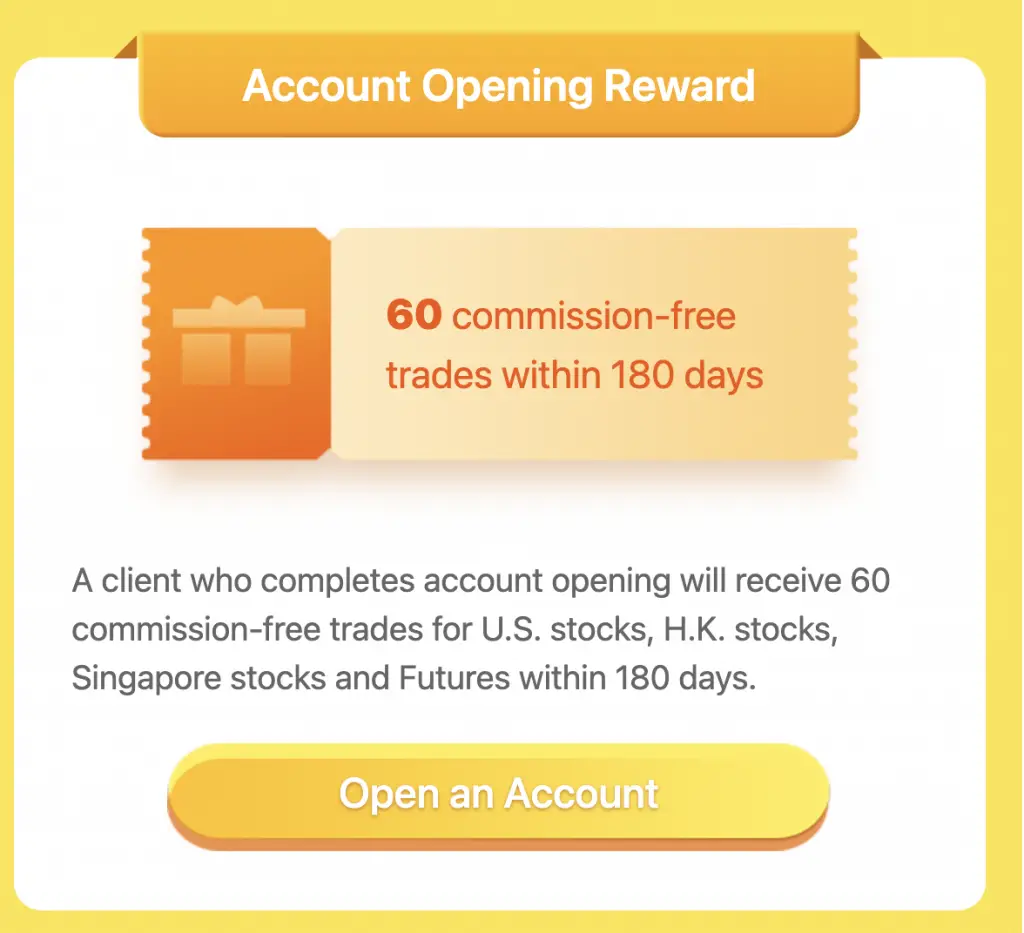

#2 Account Opening Reward

After successfully opening your account, you will receive 60 commission-free trades that you need to use within 180 days.

These commission free trades can be used for:

- US stocks

- HK stocks

- Singapore stocks

- Australia stocks

On top of that, you will receive 5 commission-free trades for futures within 30 days.

You will still need to pay the commission first. The commission should be refunded to you on the next working day.

#3 Funding Reward

If you fund at least $2,000 SGD into your Tiger Brokers account for your very first deposit, you will receive a free Apple (AAPL) share.

The shares will be added into your account within 10 working days.

On top of that, you will receive a stock voucher (SGD5) for SGX stocks only.

You can view the terms and conditions of this promotion on Tiger Brokers’ website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?