If you’re buying some stocks or ETFs on Tiger Brokers (e.g. the S&P 500 ETF), you may be wondering if you would be receiving any dividends from these stocks and ETFs that you own.

Here is a guide on the process of how you will be receiving your dividends from Tiger Brokers.

Contents

Do you get dividends from Tiger Brokers?

If you purchase any stocks or ETFs on Tiger Brokers which issue a dividend to their shareholders, the dividend will be credited into your Tiger Account, provided that you are a long position holder on the ex-dividend date.

How do I get my dividend from Tiger Brokers?

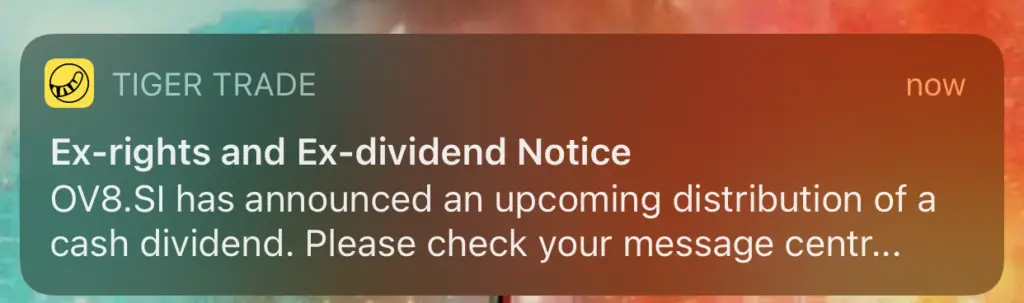

If the stocks that you’ve purchased on Tiger Brokers announces that they will issue a dividend, you will receive a notification like this from Tiger Brokers:

You can view the message to find out when the dividend will be issued.

You may also want to take note of the ex-dividend date, which is the date that will determine how many units you own of that particular stock. So long as you hold any long positions of the stock on this ex-dividend date, you will receive the dividend.

However, if you are a short position holder on the ex-dividend date, you will not receive any dividends!

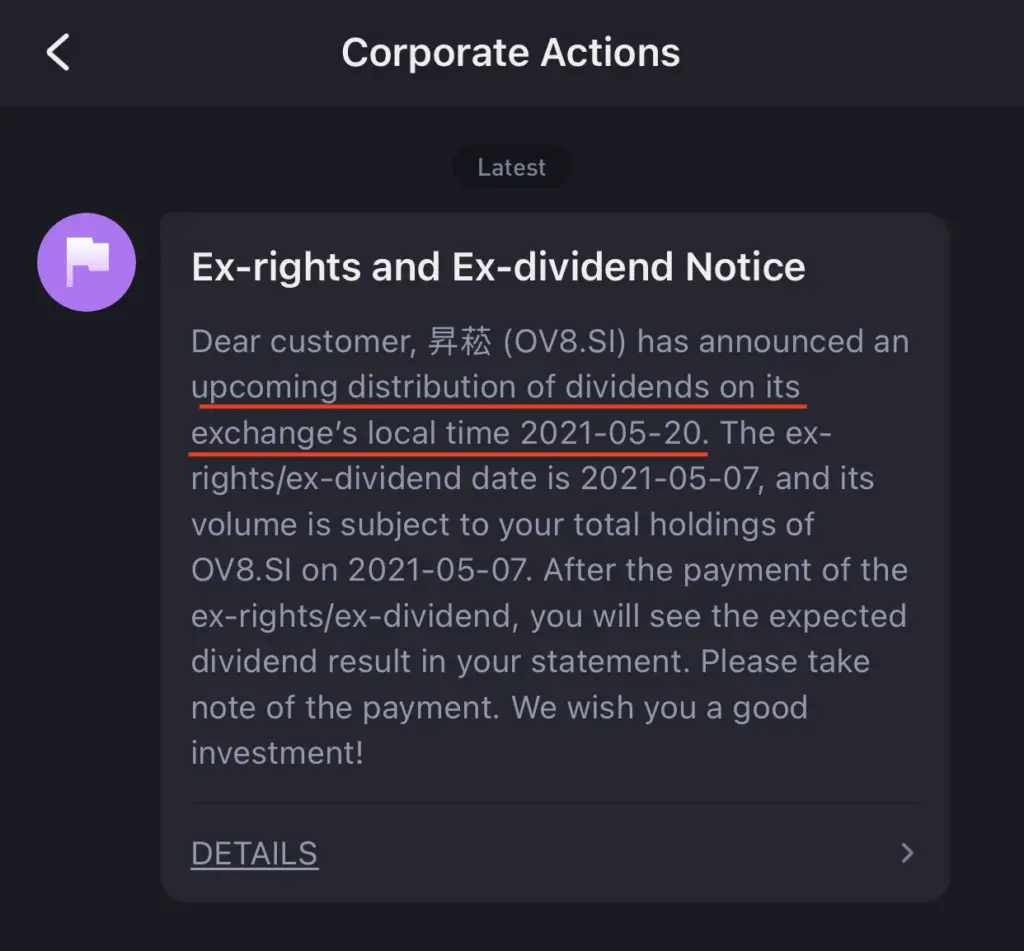

Once the dividends have been issued, you will receive another notification from Tiger Brokers.

The dividends that you receive from Tiger Brokers will be credited to your Tiger Account in its corresponding currency (SGD, USD, HKD or RMB).

You are able to view the amount of dividends you’ve received by checking your statement too.

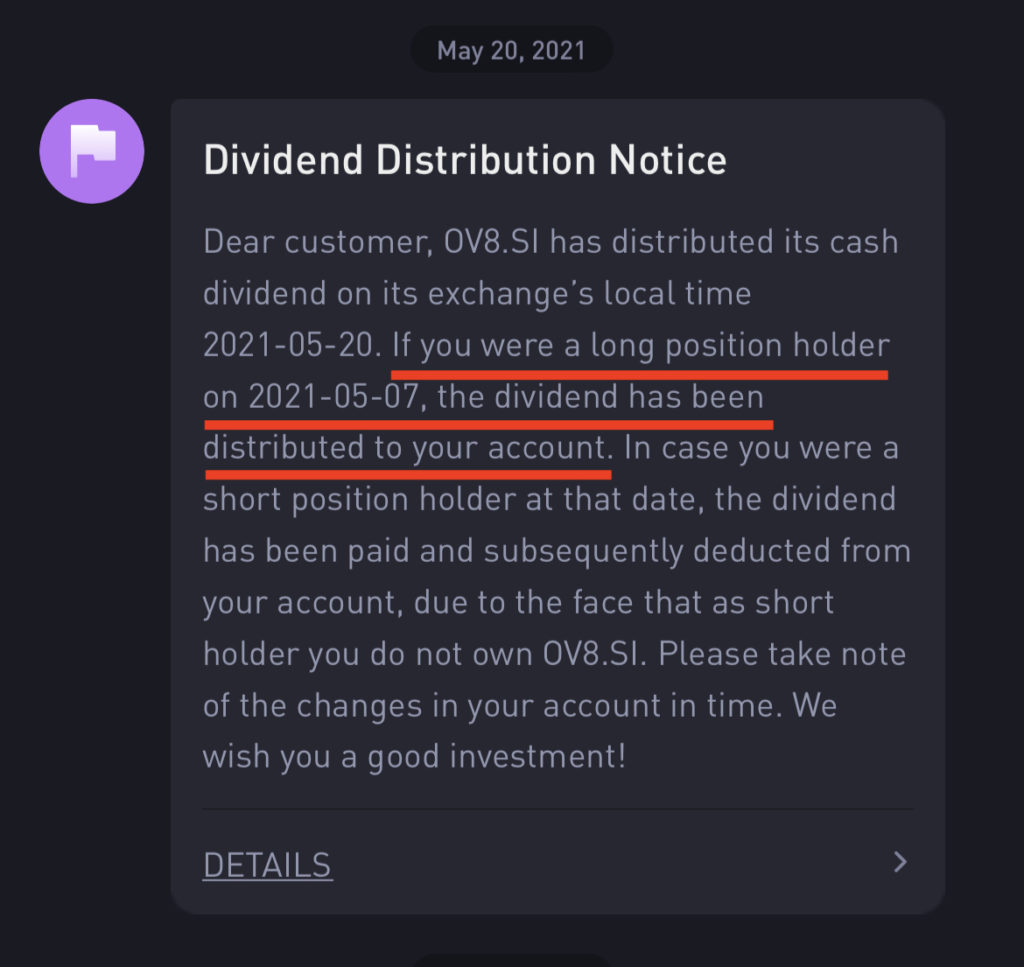

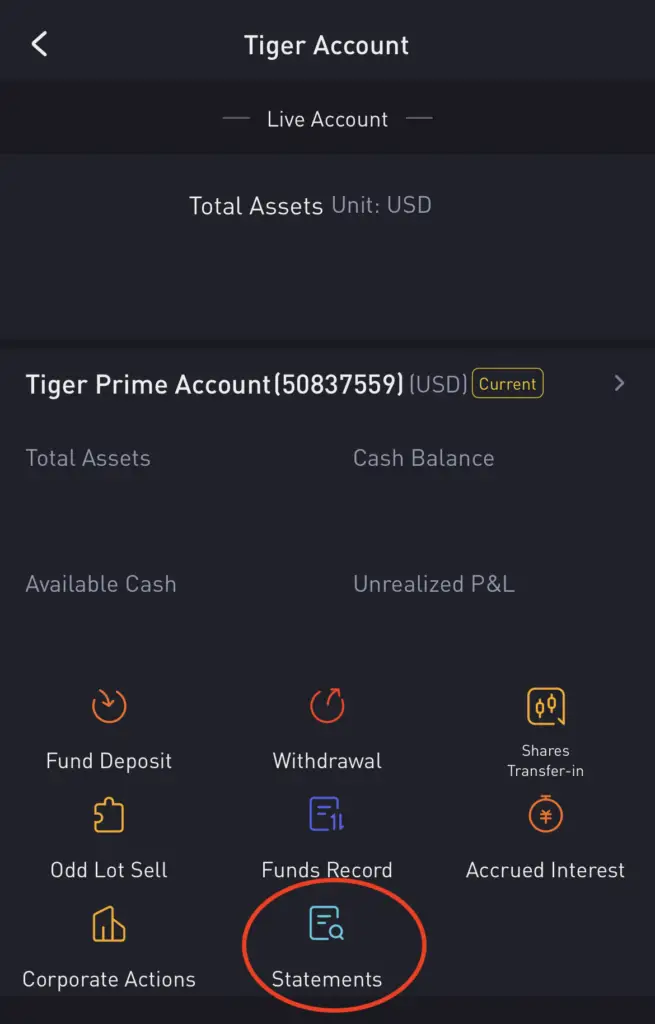

This is done by going to your Tiger Account,

and then selecting ‘Statements‘.

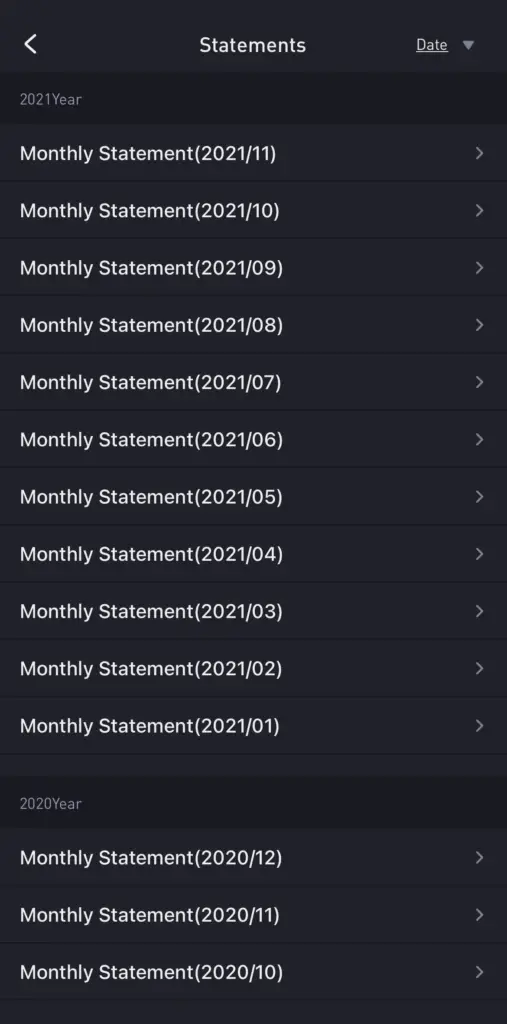

After selecting which month’s statement you would like to view,

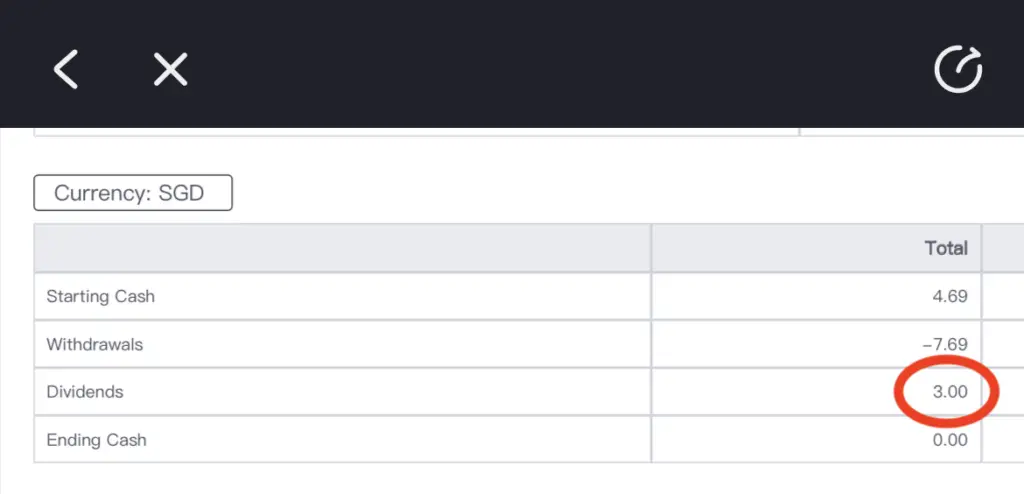

you can scroll down to view the dividends that you’ve received in a certain currency.

If you’ve received a dividend in a foreign currency, you can exchange it back to SGD, or you can even withdraw USD back to your DBS Multi-Currency Account.

Does Tiger Brokers reinvest my dividends?

Tiger Brokers does not reinvest your dividends automatically for you. You will only receive any dividends that you have been issued from the stock, and you will need to manually reinvest the dividends by yourself should you wish to do so.

Tiger Brokers does not offer any plans to automatically reinvest your dividends for you. Furthermore, Tiger Brokers does not give you access to the London Stock Exchange (LSE), hence you aren’t able to purchase accumulating ETFs.

As such, you will need to manually reinvest any dividends that you receive by yourself.

Will I be taxed on the dividends I receive on Tiger Brokers?

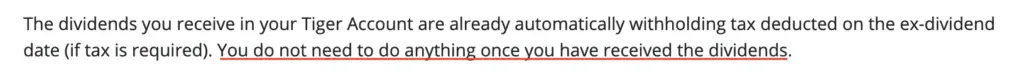

The dividends that you receive on Tiger Brokers have already been taxed before they are issued to your Tiger Account. The amount of tax that you incur is based on the dividend withholding taxes that are charged by the exchange that you are trading in.

For example, you will incur a 30% dividend withholding tax if you are investing in US stocks. However, this tax is already deducted from the dividend, before it is issued to you.

As such, you are able to withdraw the dividends that you have received, without having to pay any more taxes.

Conclusion

Any dividends that you receive from the stocks or ETFs that you hold on Tiger Brokers will be credited to your Tiger Account after they have been issued.

The dividends that you receive are after the tax deductions due to any dividend withholding taxes that you incur.

As such, you can withdraw these dividends right away to your bank account, or even reinvest them manually.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Tiger Brokers Referral (Free AAPL Share and 60 Commission-Free Trades)

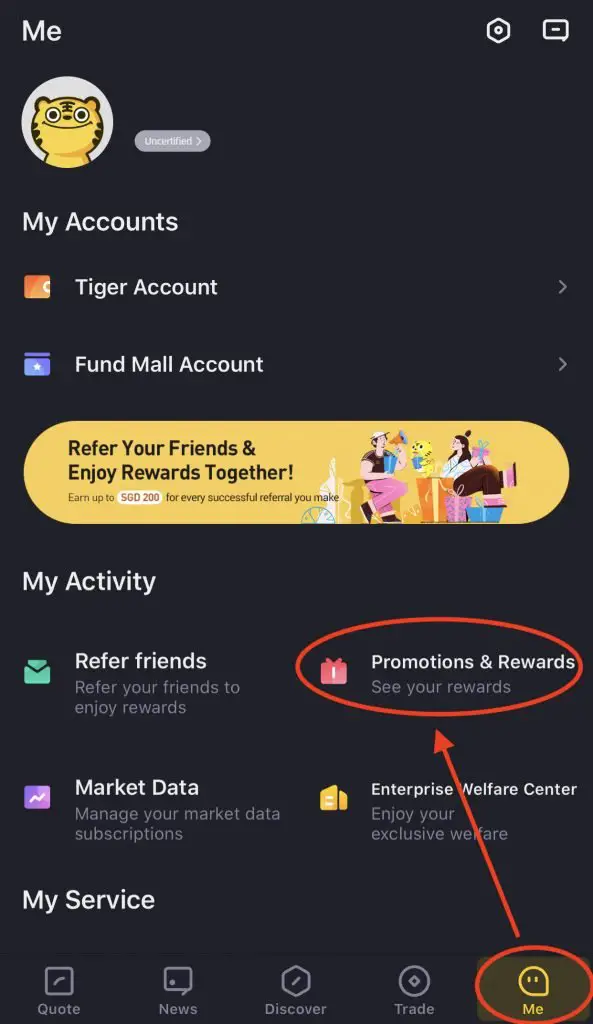

If you sign up for a Tiger Brokers account using my referral link, you will be eligible for some rewards. You can view and claim your rewards by going to ‘Me → Promotions & Rewards‘.

Here are 3 bonuses that you can receive:

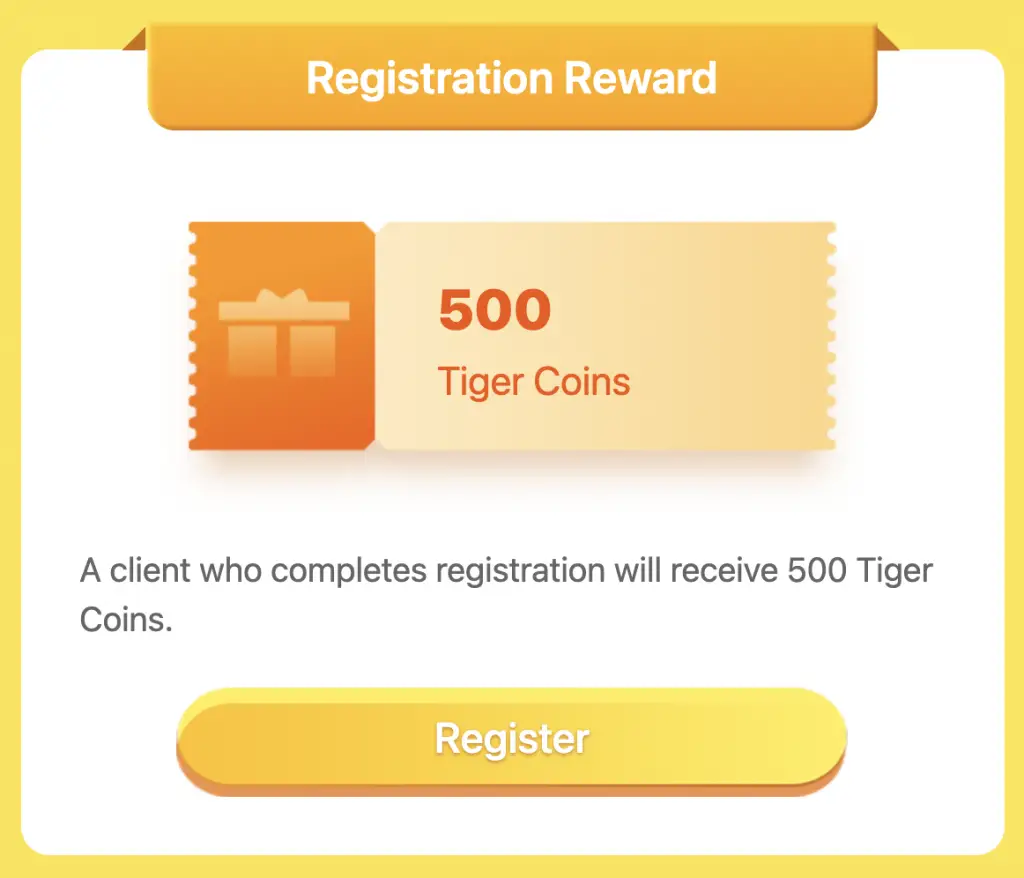

#1 Registration Reward

When you register for a Tiger Brokers Account, you will receive 500 Tiger Coins.

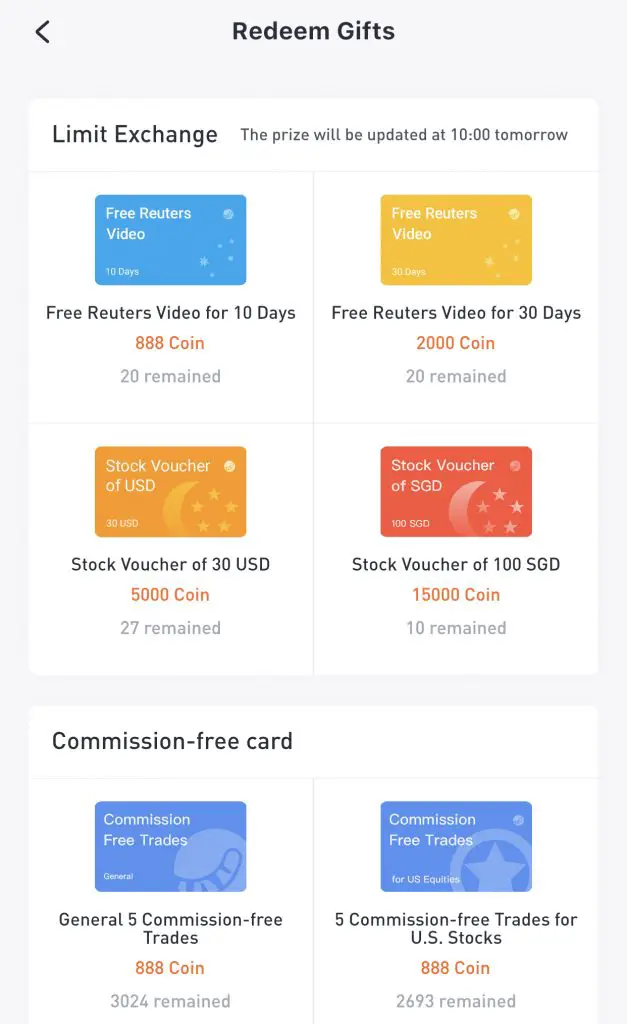

These Tiger Coins can be used to redeem a variety of rewards, such as:

- Stock vouchers

- Commission-free trades

- Reuters videos

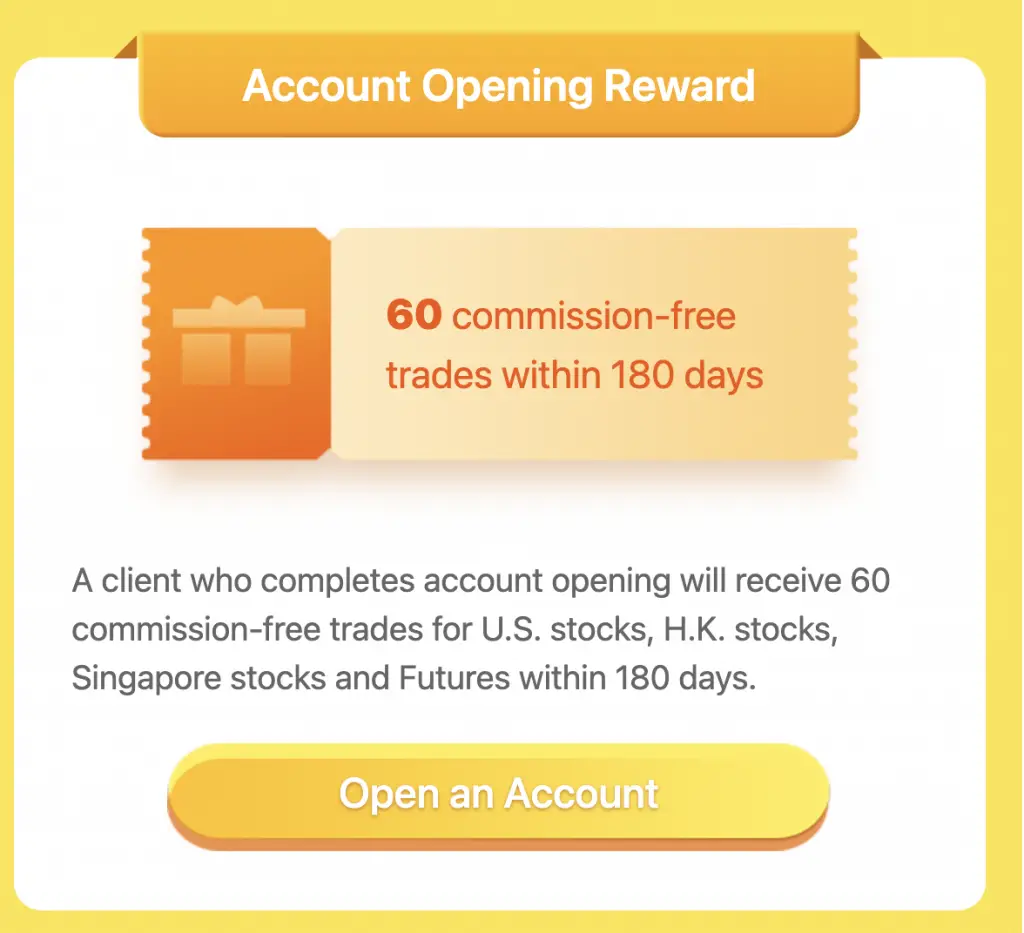

#2 Account Opening Reward

After successfully opening your account, you will receive 60 commission-free trades that you need to use within 180 days.

These commission free trades can be used for:

- US stocks

- HK stocks

- Singapore stocks

- Australia stocks

On top of that, you will receive 5 commission-free trades for futures within 30 days.

You will still need to pay the commission first. The commission should be refunded to you on the next working day.

#3 Funding Reward

If you fund at least $2,000 SGD into your Tiger Brokers account for your very first deposit, you will receive a free Apple (AAPL) share.

The shares will be added into your account within 10 working days.

On top of that, you will receive a stock voucher (SGD5) for SGX stocks only.

You can view the terms and conditions of this promotion on Tiger Brokers’ website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?