Last updated on August 8th, 2021

You may be looking for an alternative method to invest your SRS funds.

Did you know that you can invest your SRS funds using robo-advisors like StashAway too?

Here’s what you need to know about investing your SRS funds with StashAway.

Contents

- 1 StashAway SRS Review

- 2 Do I need a SRS account to invest my funds with StashAway?

- 3 What portfolios does StashAway offer for my SRS funds?

- 4 How do I invest my SRS in StashAway?

- 5 What are the fees that I’ll incur when investing my SRS funds with StashAway?

- 6 How do I withdraw my SRS funds that I have with StashAway?

- 7 Conclusion

- 8 👉🏻 Referral Deals

StashAway SRS Review

StashAway allows you to invest your SRS funds in the same 3 portfolios that you can invest with using cash. These portfolios allow you to earn a better return on your SRS funds, compared to the 0.05% interest rate that your SRS account offers you.

Here is a closer look into StashAway’s offering for your SRS funds:

Do I need a SRS account to invest my funds with StashAway?

You will need to create a SRS account from either OCBC, UOB or DBS first, before you can use StashAway’s SRS portfolios. StashAway will automatically transfer the funds from your SRS account to StashAway after successfully linking your accounts.

What portfolios does StashAway offer for my SRS funds?

The SRS portfolios that are offered by StashAway are the same as those that you can invest with using cash.

This includes:

- StashAway Simple

- StashAway General Investing

- StashAway Income Portfolio

As such, there are not much differences in the portfolios! For the general investing portfolio, you’ll need to choose a suitable StashAway Risk Index that fits your risk profile.

How do I invest my SRS in StashAway?

Here are 4 steps you’ll need to take to invest your SRS funds with StashAway:

- Create your portfolio and select ‘SRS account’ as your source of funds

- Go to your portfolio and select ‘Deposit’

- Select whether you want to make a one-time or recurring investment

- Enter your SRS account information

Here is each step explained in detail:

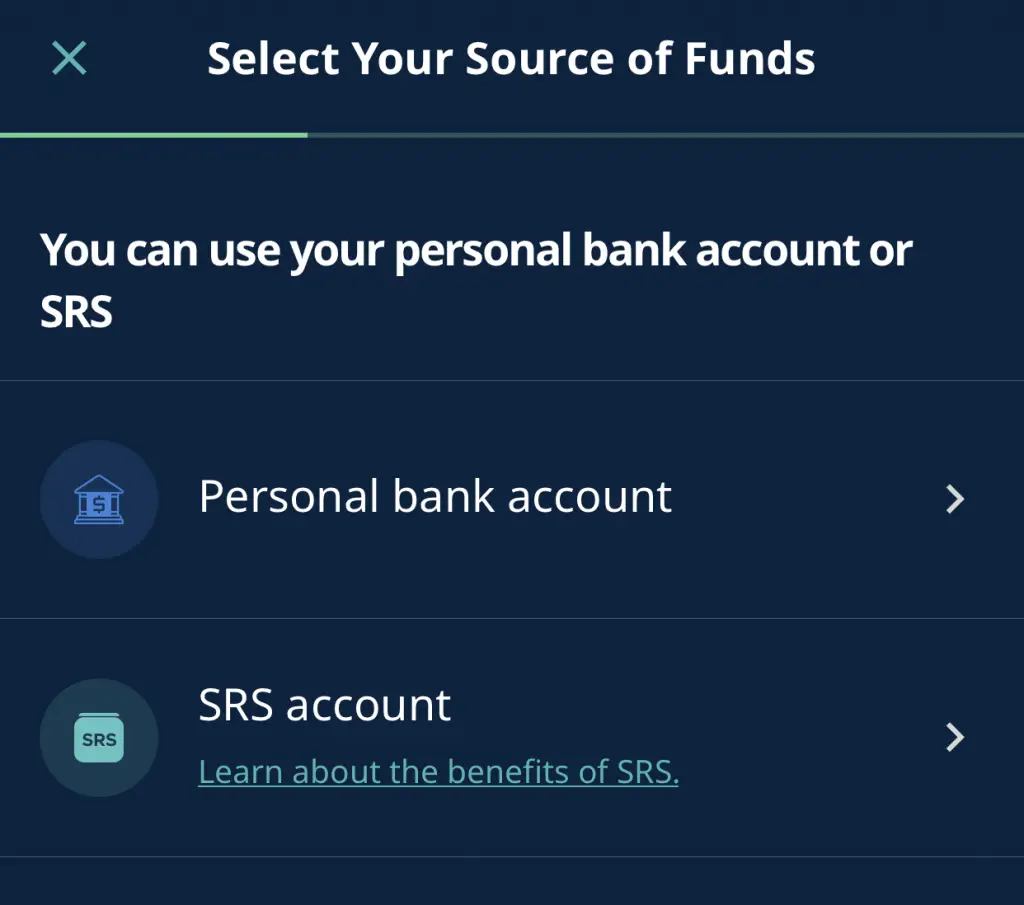

#1 Create your portfolio and select ‘SRS account’ as your source of funds

When you’re creating a portfolio on StashAway, one of the first things that you’ll be asked about is your source of funds.

You’ll need to select SRS, instead of your personal bank account.

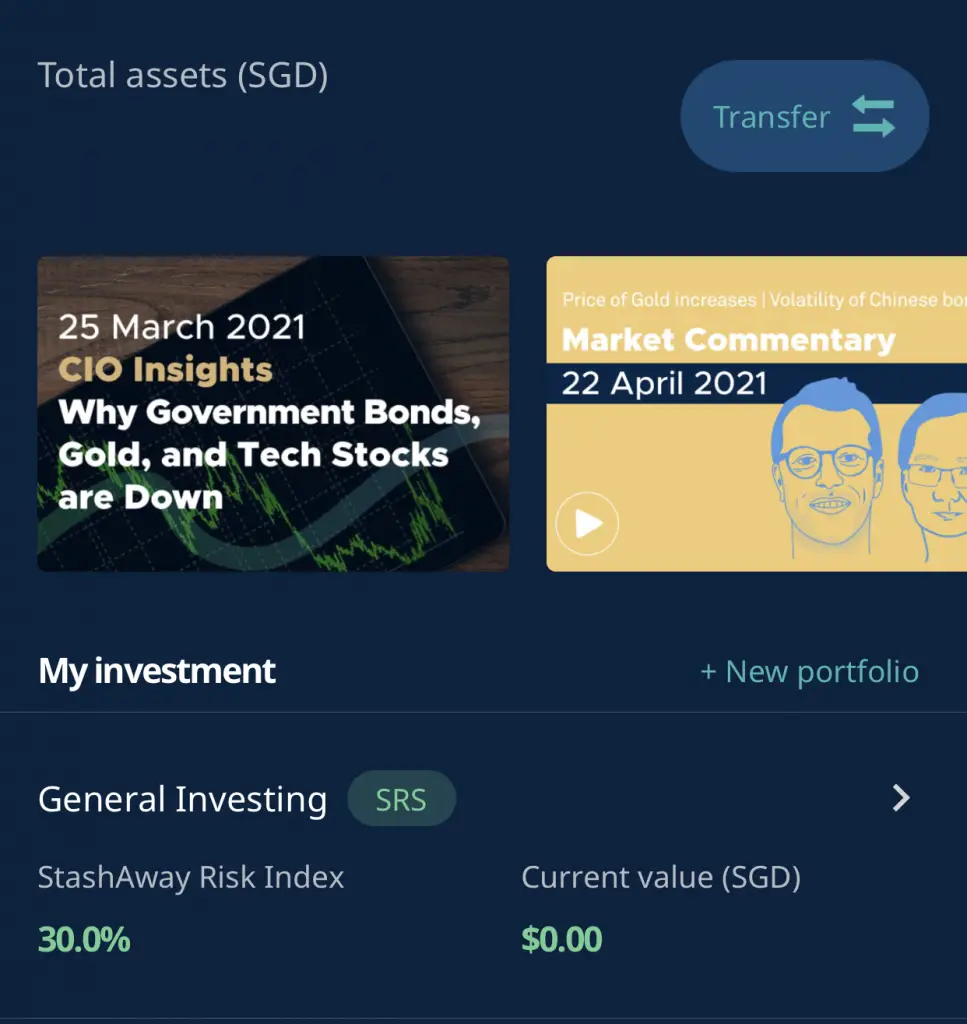

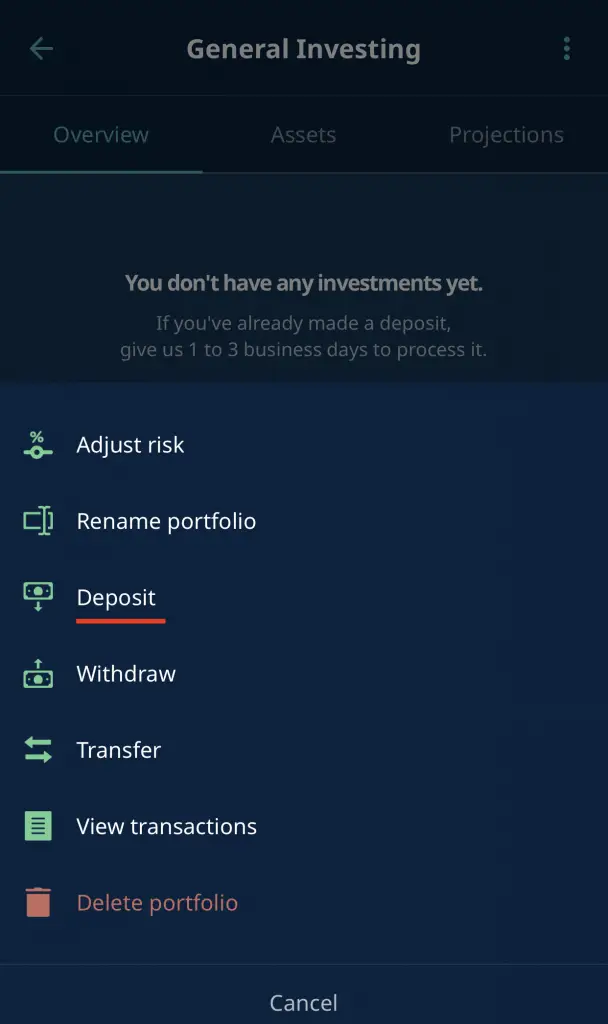

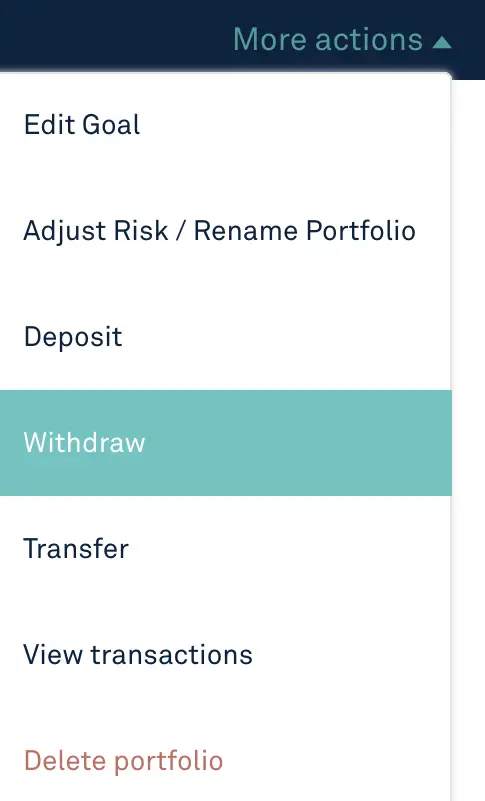

#2 Go to your portfolio and select ‘Deposit’

After selecting the type of portfolio that you wish to create, it’ll appear as one of your portfolios.

If you’ve selected ‘SRS’ as your source of funds, there will be a SRS tag on the portfolio.

After selecting your portfolio, you’ll need to go to ‘Deposit’.

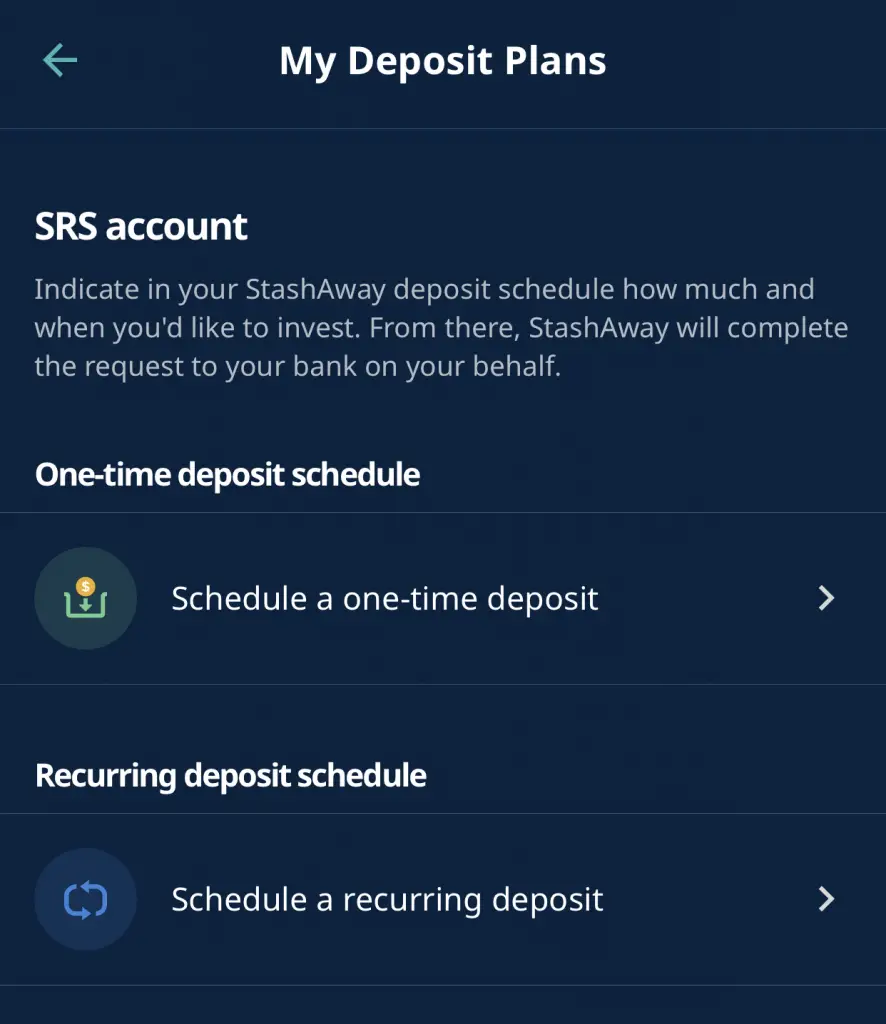

#3 Select whether you want to make a one-time or recurring investment

You’ll be asked whether you want to make a one-time or recurring investment.

Based on your instructions, StashAway will deduct the amounts from your SRS funds automatically.

This means that you’ll need to have the funds available in your SRS account, before you make the deposit instruction!

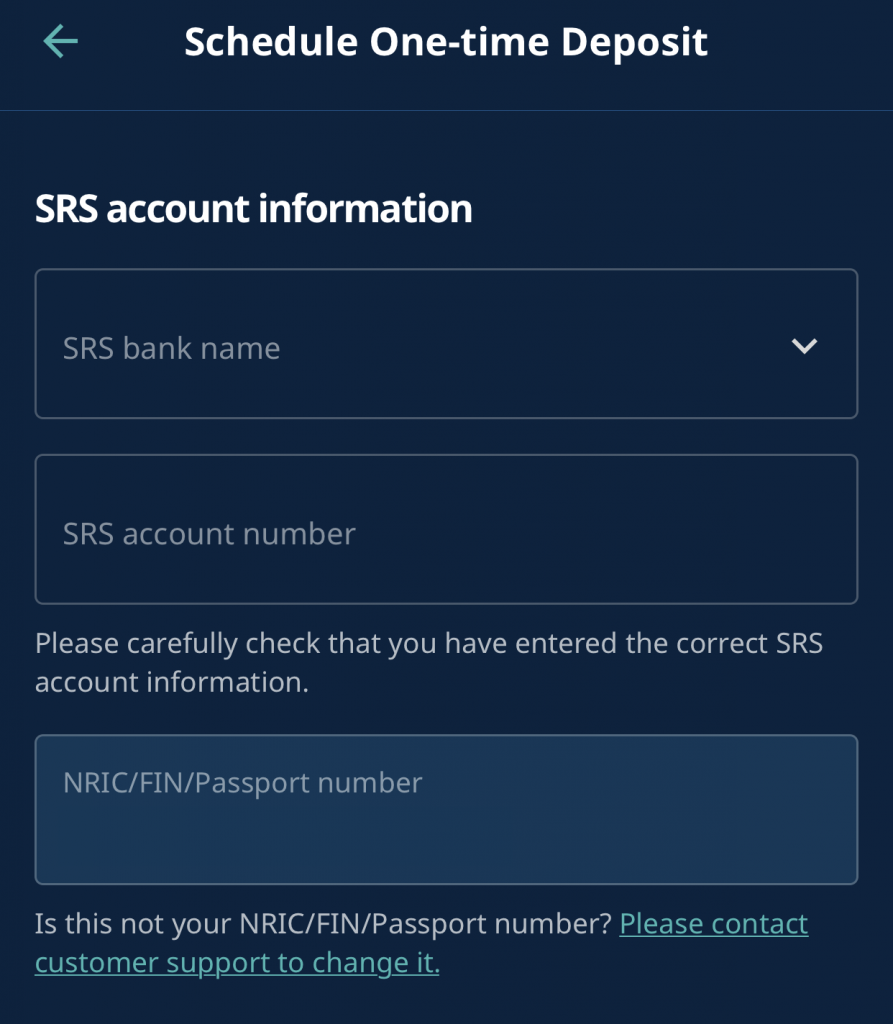

#4 Enter your SRS account information

If you are depositing from your SRS account for the first time, then you’ll need to enter the details of your SRS account.

The NRIC of the SRS account has to be the same as the NRIC that you’ve used to register for your StashAway account.

After making confirming the deposit, StashAway will transfer your funds from your SRS account.

What are the fees that I’ll incur when investing my SRS funds with StashAway?

The fee structure for using your SRS funds to invest with StashAway is the same as using cash. You will be charged between 0.2% – 0.8% a year, based on the total value of the funds that are managed with StashAway.

Here is the fee structure for StashAway:

| Amount Invested | Management Fee |

|---|---|

| First $25k | 0.8% |

| > $25k and ≤ $50k | 0.7% |

| > $50k and ≤ $100k | 0.6% |

| > $100k and ≤ $250k | 0.5% |

| > $250k and ≤ $500k | 0.4% |

| > $500k and ≤ $1 million | 0.3% |

| > $1 million | 0.2% |

The higher amount that you have with StashAway, the lower fees you’ll need to pay.

The fees that you need to pay, particularly for your first $25k, is quite high compared to Syfe or Endowus.

How do I withdraw my SRS funds that I have with StashAway?

To withdraw your SRS funds from StashAway, you will need to request for a withdrawal via the app or browser platform. StashAway will sell your portfolio, and the proceeds will be transferred back to your SRS account.

Just like withdrawing from your StashAway cash account, you’ll need to place a withdrawal request on the app.

Once StashAway processes your withdrawal, the funds will be transferred to your SRS account.

Conclusion

StashAway offers you a variety of portfolios to grow your SRS funds.

However, they do not offer lower fees if you invest your SRS funds, which Endowus does.

If you are aiming to invest for your retirement, you can consider investing in StashAway with your SRS funds.

The best part is that you can receive tax relief on these funds too!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

StashAway Referral (Up to $40,000 SGD managed for free for 6 months)

If you are interested in signing up for StashAway, you can use my referral link to sign up.

Here’s what you’ll need to do:

- Sign up for a StashAway account

- Make a deposit of ≥ $10k within 4 weeks of signing up

- Receive a fee waiver for 6 months (up to $40k)

You can find out more about this program on SingSaver.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?