Last updated on June 6th, 2021

There are so many different S&P 500 ETFs that you can invest in. Some of the ETFs that you may have come across include S27 and CSPX.

How are they different and which one should you choose to invest in?

Contents

The difference between S27 and CSPX

S27 is listed on the SGX while CSPX is listed on the LSE. They are managed by different fund managers (SSGA and BlackRock). The main difference is the dividend withholding tax that you will incur (30% vs 15%). Since both track the S&P 500 index, the performance should be similar.

Here is a further breakdown between these 2 ETFs:

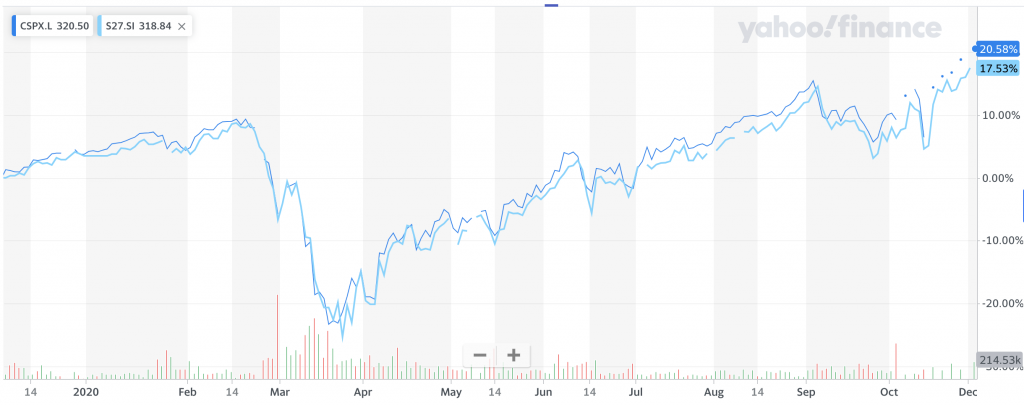

They both track the same index

Both ETFs track the S&P 500 index. As such, they should have very similar performances.

This is because both funds will have the same holdings in the same proportion.

Fund managers are different

S27 is managed by SSGA, while CSPX is managed by BlackRock.

S27 was launched together with SPY by SPDR. As such, it has a very early inception date in January 1993.

CSPX is an UCITs ETF and was launched much later in May 2010. As such, S27 has a much larger net assets compared to CSPX.

| S27 | CSPX |

|---|---|

| 326,497 million | 42,725 million |

They are listed on different exchanges

S27 is listed on the SGX, while CSPX is listed on the LSE. As such, there may be some differences when you wish to buy these 2 ETFs.

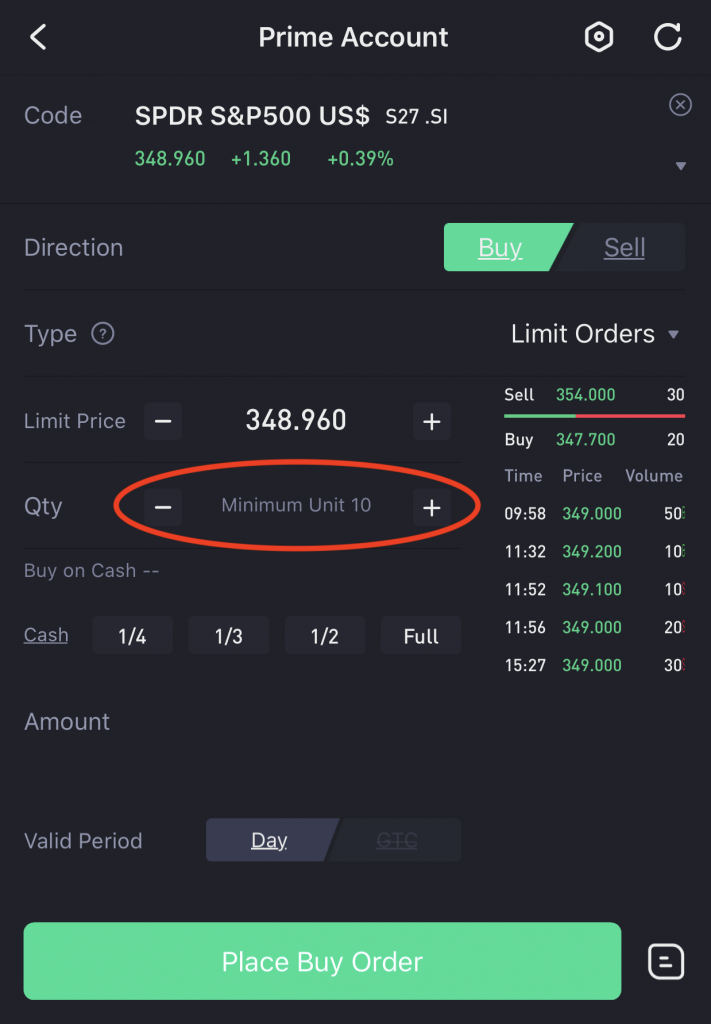

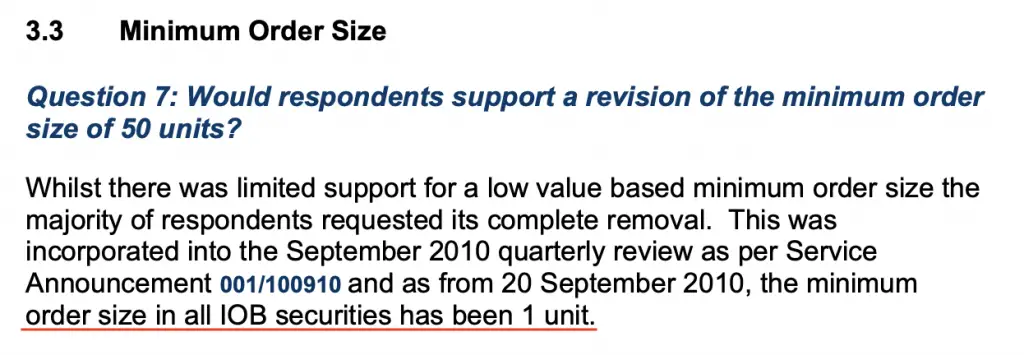

Minimum units to purchase

S27 requires you to purchase a minimum unit of 10 on the SGX.

Meanwhile, you are able to purchase a minimum unit of 1 for CSPX since it is on the LSE.

Trading commissions

The commissions you pay to make a trade may differ based on the exchange you are trading in.

For example, Tiger Brokers offers a very attractive commission for SGX stocks.

| Commission | 0.08% * trade value |

| Minimum | No minimum (until 30 April 2021) 2.88 SGD/trade (after 30 April 2021) |

Here are the commissions for some brokers that allow you to trade on the LSE:

| Brokerage | Fees |

|---|---|

| Interactive Brokers | 0.05% * trade value Minimum 1 GBP per order |

| Standard Chartered | 0.25% * trade value Minimum $10.70 per order |

You can view my guide to see what are the best ways to buy LSE ETFs from Singapore.

You should try to find the lowest brokerage fees so that they won’t eat into your returns!

Expense ratio

On top of the trading commissions, you’ll need to pay an expense ratio to the fund manager of the ETFs.

Here are the 2 expense ratios that the ETFs will charge you:

| S27 | CSPX |

|---|---|

| 0.0945% | 0.07% |

Even with the larger net assets, S27 is still charging a higher expense ratio!

CSPX has a slightly lower expense ratio compared to S27. However, both fees are still pretty low compared to other ETFs’ expense ratios.

Dividend withholding tax

S27 is domiciled in the US while CSPX is domiciled in Ireland. You will incur a lower dividend withholding tax when you invest in Irish-domiciled ETFs.

| ETF | Dividend Withholding Tax |

|---|---|

| S27 | 30% |

| CSPX | 15% |

If you are a non-resident alien to the US, you will incur the 30% dividend withholding tax.

However there is a tax treaty between Ireland and US. Any dividends issued from US stocks will only incur a 15% withholding tax.

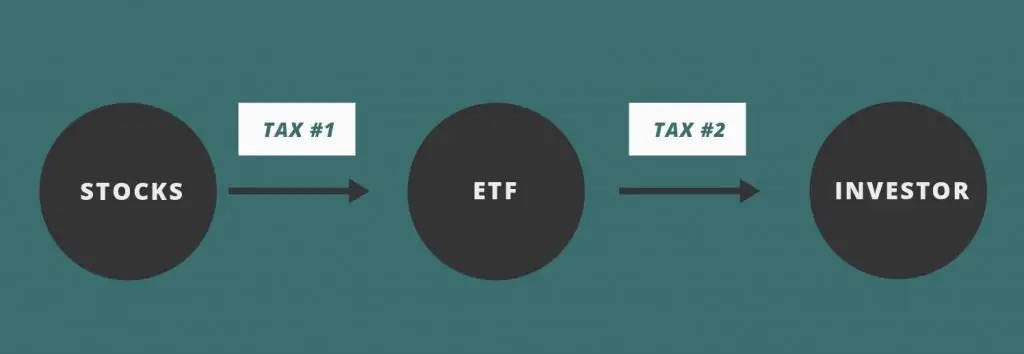

2 layers of taxes

For any ETF, the fund manager buys the stocks based on the index they are tracking. The dividends that they distribute are collected from the stocks in their fund.

As such, there are 2 layers where you may incur some taxes:

- From stock to ETF

- From ETF to you, the investor

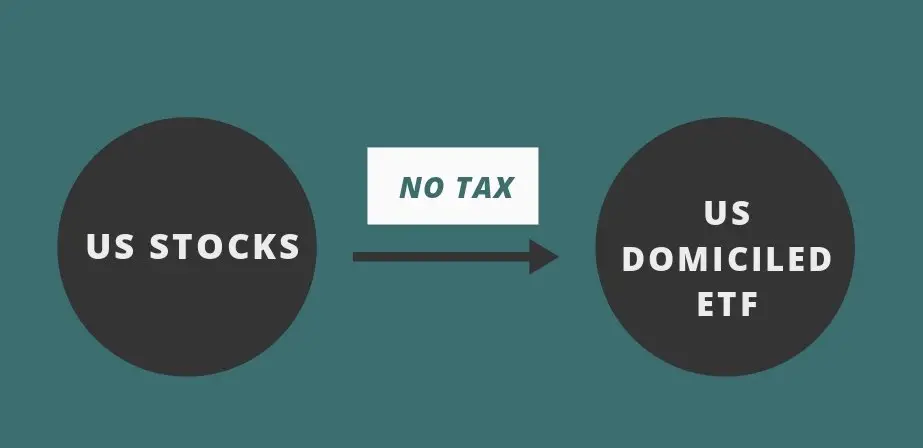

S27 incurs the tax on the second layer

When the stock distributes its dividend to the ETF, no tax is incurred. This is because it is from a US stock to a US-domiciled ETF.

However when the dividends are distributed to you, they will incur the 30% tax. This is because you are a non-resident alien.

Even though S27 is listed on the SGX, it is still domiciled in the US. As such, you will still incur the 30% withholding tax.

CSPX incurs the tax on the first layer

For CSPX, the dividends from the US stocks are distributed to an Irish-domiciled ETF. As such, the 15% withholding tax applies on the first layer.

Ireland does not have any dividend taxes charged to you. You will only incur the 15% tax from the first layer.

Due to the lower withholding tax, CSPX may be the more tax efficient ETF to invest in.

If you wish to track your dividends with the taxes accounted for, you can consider trying out StocksCafe’s platform.

Dividend distribution

S27 and CSPX will manage your dividends differently:

S27 distributes your dividends every quarter

S27 will distribute your dividend every 3 months. They will gather all of the dividends that they receive and pay it to you each quarter.

This is great if you intend to receive some passive income via dividends.

CSPX automatically reinvests your dividends

CSPX is an accumulating ETF. This means that they will not distribute your dividends to you. Instead, they will reinvest the dividends they receive into the same stocks in the index.

If you are looking to reinvest your dividends from the start, the CSPX may be a better choice.

This is because you do not need to incur any additional transaction fees when the ETF reinvests your dividends for you.

You can read my comparison between accumulating and distributing ETFs to see how they are different.

Liquidity

If you are looking to actively trade using these ETFs, you may want to look at their liquidity. One of the indicators you may want to look at is the ETF’s trading volume.

The trading volume for S27 is really, really poor! As such, you might not buy or sell your units at the price that you originally had in mind.

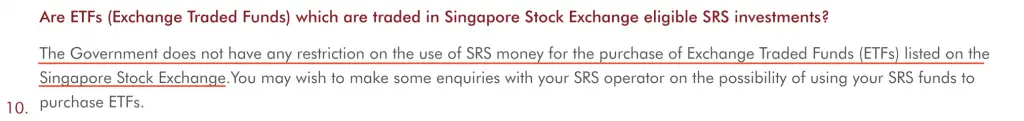

You can invest in S27 using SRS

Here’s one possible advantage of investing in the S27. Since S27 is listed on the SGX, you are able to use your SRS to invest in this ETF.

The Singapore Government does not have any restrictions on using your SRS to invest in ETFs on the SGX.

As such, it is possible for you to use your SRS funds to invest in a S&P 500 ETF!

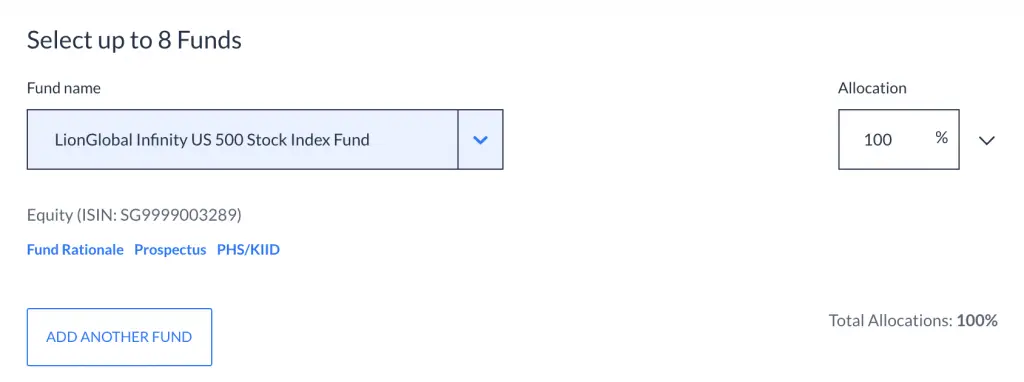

However, due to S27’s poor liquidity, you may want to use another option to invest your SRS funds in the S&P 500. One such example is Endowus’ Fund Smart, which allows you to customise your own portfolio.

You are able to invest in the LionGlobal Infinity US 500 Stock Index Fund, which also tracks the S&P 500 index.

What’s more, you’re able to use both your CPF and SRS to invest in Fund Smart! This is something you may want to consider instead of investing in S27.

Verdict

Here is the complete breakdown between these 2 ETFs:

| S27 | CSPX | |

|---|---|---|

| Index Tracked | S&P 500 | S&P 500 |

| Fund Manager | SSGA | BlackRock |

| Net Assets | 326,497 million | 42,725 million |

| Exchange | SGX | LSE |

| Currency Denomination | USD | USD |

| Minimum Units to Invest | 5 | 1 |

| Expense Ratio | 0.0945% | 0.07% |

| Dividend Withholding Tax | 30% | 15% |

| Type of ETF | Distributing | Accumulating |

| Average Trading Volume | 343 | 132,000 |

| Funds to Invest | Cash and SRS | Cash only |

So which ETF should you be choosing?

Choose CSPX if you have a long term horizon

If you intend to invest in the S&P 500 for the long term, CSPX will be the better choice. Your dividends are automatically reinvested.

This allows you to compound your money to a very large extent!

CSPX also helps you to save on the withholding taxes compared to US-domiciled ETFs. However, it may always not be so cost effective to invest using UCITS ETFs.

You can read this analysis by New Academy of Finance to see if they are truly more tax efficient.

Invest in S27 if you want to use your SRS

The only reason why I think you may want to invest in S27 is if you wish to use your SRS funds. There are many drawbacks to this ETF like poor trading volume and a large minimum amount to invest.

If you wish to invest in a US-domiciled ETF, you may want to consider the NYSE-listed ETFs instead.

Conclusion

Both ETFs track the same index, so their performances should be very similar. The ETF that you choose depends on a few things:

- The dividend withholding tax you wish to incur

- The exchange that you want to trade in

- Whether you wish to invest your SRS or not

- Whether you prefer an accumulating or distributing ETF

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?