Last updated on June 6th, 2021

There are many robo-advisors that are available on the market. With the different products that they are offering, which should you be considering?

Here is a comparison between Syfe and MoneyOwl.

Contents

- 1 The difference between Syfe and MoneyOwl

- 2 Type of products they invest in

- 3 Investment strategies used

- 4 Investment portfolios offered

- 5 Cash management portfolios offered

- 6 Currency denomination

- 7 Performance

- 8 Dividend distribution

- 9 Funds you can invest with

- 10 Minimum sum to invest

- 11 Fees

- 12 Type of account used to handle your assets

- 13 Web platform

- 14 Mobile app

- 15 Verdict

- 16 Conclusion

- 17 👉🏻 Referral Deals

The difference between Syfe and MoneyOwl

Syfe invests in ETFs or REITs, while MoneyOwl invests your money into Dimensional Funds. You will pay a different amount of fees, withholding taxes and expense ratios depending on the platform that you choose.

Here’s an in-depth comparison between these 2 platforms:

Type of products they invest in

Both robo-advisors invest your funds into different products:

Syfe invests mainly in ETFs

Syfe mainly invests in ETFs. Based on the portfolio that you choose, your funds will be invested into a variety of ETFs.

Most of these ETFs are listed on US exchanges. However, Syfe’s Equity 100 also invests in CSPX, which is domiciled in Ireland.

The only exception is Syfe REIT+ which invests in Singapore REITS directly. You are not investing in an ETF, which saves some of the fees that you’ll need to pay!

MoneyOwl only uses funds from Dimensional

MoneyOwl only uses funds that are being managed by Dimensional. MoneyOwl chose them as the fund provider as these funds are:

- Broadly diversified

- Market-based

- Low cost

Previously, the only way you could purchase these Dimensional funds would be via a financial advisor. However, MoneyOwl now offers this funds at a lower cost!

MoneyOwl’s funds are UCITS funds that help to reduce your tax

Another advantage of the funds that MoneyOwl offers is that they are all UCITS funds.

This means that these funds are domiciled in Ireland, rather than the US. For Syfe, majority of the ETFs will be domiciled in the US.

This has significant implications on the taxes you’ll incur as a Singaporean investor. When you invest in a UCITS fund, you will reduce your taxes in 2 ways:

- Lower dividend withholding tax for US stocks (15% vs 30%)

- No estate tax for US assets

While Syfe claims that you should not incur any estate taxes, they are not 100% certain on this matter.

Investment strategies used

These 2 robo-advisors also use very different investing strategies:

Syfe has different investment strategies for different portfolios

Syfe has 2 main strategies that are used for their different portfolios:

#1 Automated Risk-managed Investments (ARI)

Syfe believes that managing risk is the most important to help you receive good returns.

Their Automated Risk-managed Investments (ARI) strategy helps you to:

- Optimise your returns when the markets are calm

- Limit your losses in volatile times

First, you’ll need to choose your risk level. Syfe’s ARI algorithm will then ensure that your portfolio remains at this risk level.

From time to time, the market conditions may change to become more stable or more volatile. The ARI algorithm will try to limit the amount of fluctuations you may experience.

This ARI algorithm is only applicable to 2 of Syfe’s portfolios:

- Global ARI

- REIT+ with risk management

#2 Smart beta strategy

Both Syfe Equity 100 and Core focus on building a smart beta portfolio for you. This is sometimes referred to as factor-based investing.

Syfe aims to provide high returns by concentrating on a few factors. These factors are chosen to ensure that your portfolio will outperform a certain index. Currently, Syfe has selected these 3 factors:

- Growth

- Low-volatility

- Geographical tilt towards China

Syfe will then select the best ETFs that are weighted towards these factors.

For example, the current portfolio is heavily weighted in the QQQ ETF. This will help to tilt the portfolio towards the growth factor.

Meanwhile, the low-volatility factor is achieved by investing in multiple sector ETFs.

This is different from the original Fama-French 3-factor model, which focused on:

- Size of firms

- Book-to-market values

- Excess return on the market

In the long run, the factors that give the best returns in the future may no longer be these 3 factors.

As such, Syfe has a dynamic factor selection to choose the best factors in the current economic climate. Your portfolio will be over or under-weighted in certain factors to produce the highest risk-adjusted returns.

This helps to ensure that your portfolio will continue to perform in any market condition!

MoneyOwl offers a mixture between equities and bonds

MoneyOwl offers Dimensional funds that invest in 2 different asset classes:

- Equities (i.e. stocks)

- Bonds

Based on your risk profile and time horizon, MoneyOwl will decide the best asset allocation for you.

Your money will be allocated into equities if:

- You have a higher risk profile

- You have a longer time horizon

If that is not the case, your portfolio will have a higher weightage in bonds.

Investment portfolios offered

Here are the types of portfolios that both robo-advisors offer you:

Syfe offers 4 investment portfolios

Here are the 4 different portfolios that Syfe offers:

#1 Global ARI

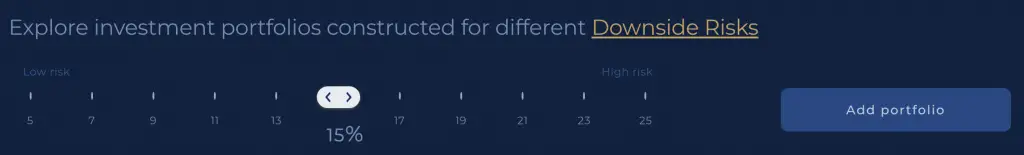

Syfe’s Global ARI portfolio uses the ARI algorithm to manage your risks. There are 11 different portfolios, based on the Downside Risk that you are able to stomach.

In 39 out of every 40 years, a Syfe portfolio in a 15% Downside Risk category (at 95% MTL) will not lose more than 15% in a given year.

Syfe

The Downside Risk ranges from 5%-25%.

Syfe will purchase assets across 3 different asset classes:

- Equity

- Bonds

- Gold

#2 REIT+

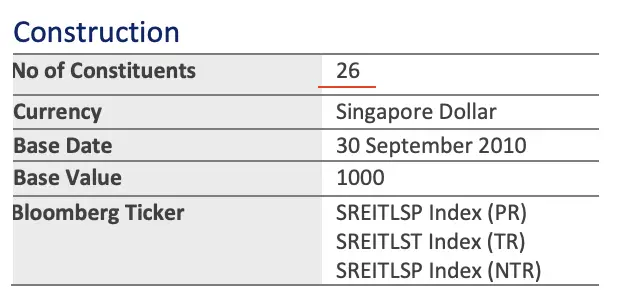

REIT+ tracks the iEdge S-REIT Leaders Index. This index measures the performance of the largest and most tradable REITs in Singapore.

This was previously called the iEdge S-REIT 20 Index. However, SGX changed it to the Leaders Index which now has 26 holdings instead.

Despite this change in the index, Syfe REIT+ still tracks the top 20 holdings out of the 26 holdings in the Leaders Index.

With the merger of CapitaLand Mall Trust and CapitaLand Commercial Trust, Syfe now only tracks 19 REITs in the index.

You can choose to invest in 100% REITs or REITS with risk management. If you choose the risk management option, you will utilise Syfe’s ARI algorithm.

This will add an allocation of ABF Singapore Bond Index Fund (A35) which is used as the bond component.

If you are wondering about the different types of bond ETFs, you can view my comparison of A35 against MBH.

If you are looking for stable returns with high dividend yields, you can choose to invest in the REIT+ portfolio!

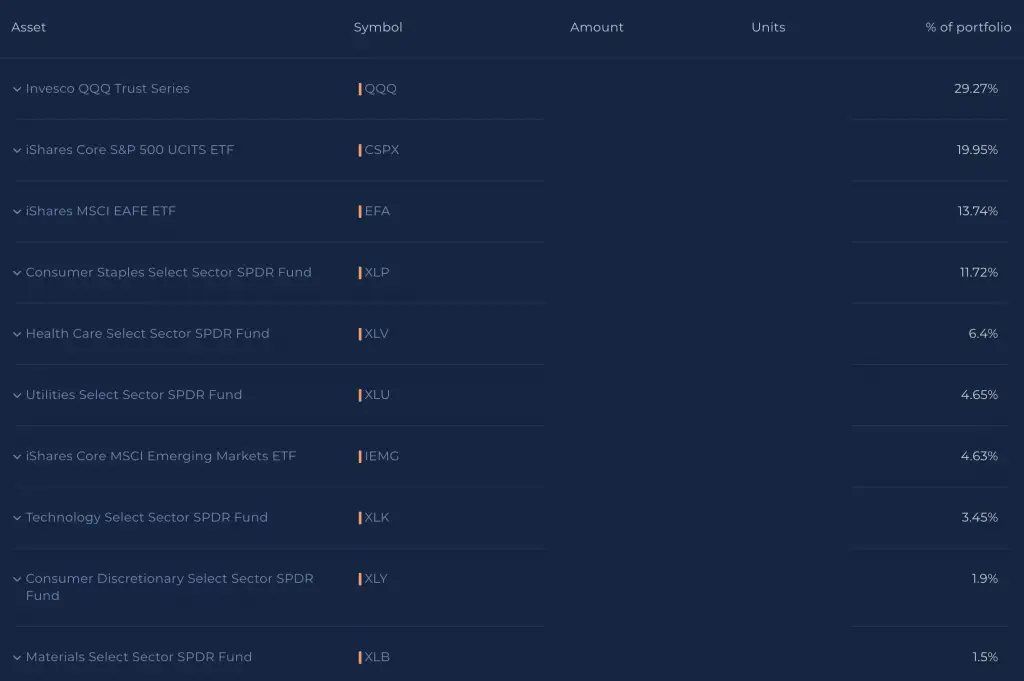

#3 Equity 100

In your Equity 100 portfolio, you will invest in a portfolio of equity ETFs. Here are some of the equity ETFs that Syfe will invest in:

Currently, Equity 100 is very heavily concentrated towards tech stocks (QQQ).

Since you are fully concentrated in stocks, you have the highest potential for returns. However, investing in stocks also come with extreme volatility!

It is only recommended that you invest in a 100% stock portfolio if you have a long time horizon. Usually, this will mean at least 40 years before your retirement.

This allows you to ride the short term volatility to have high returns in the long run!

You can view my comparison of Syfe’s Equity 100 against REIT+ and StashAway to see which portfolio is most suitable for you.

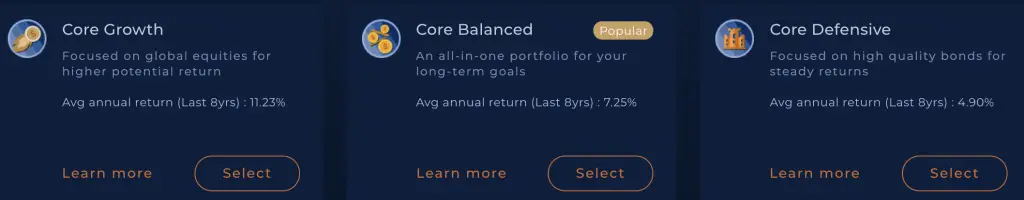

#4 Core

Syfe Core is the latest portfolio, that is somewhat similar to Global ARI, but it has greater exposure to Chinese stocks.

There are 3 different profiles that you can choose from, depending on your risk level:

- Growth (highest risk)

- Balanced

- Defensive (lowest risk)

MoneyOwl offers 5 different portfolios

MoneyOwl provides 5 different portfolios that have a different allocation into the 4 Dimensional funds.

When you are creating your portfolio, you will need to answer a questionnaire that determines your time horizon,

and some questions to determine your risk profile.

Based on your answers, MoneyOwl will determine the best portfolio for you.

Here are the asset allocations for the 5 different portfolios that MoneyOwl offers:

| Portfolio | Equities | Bonds |

|---|---|---|

| Equity | 100% | 0% |

| Growth | 80% | 20% |

| Balanced | 60% | 40% |

| Moderate | 40% | 60% |

| Conservative | 20% | 80% |

Here are the 4 Dimensional Funds that MoneyOwl uses:

| Asset Class | Funds Used |

|---|---|

| Global Equities | Dimensional Global Core Equity Fund Dimensional Emerging Large Cap Core Equity Fund |

| Global Bonds | Dimensional Global Core Fixed Income Fund Dimensional Global Short Fixed Income Fund |

MoneyOwl does not use the Dimensional World Equity Fund, which can be found in Endowus.

The same funds are used regardless of whether you’re investing cash or SRS.

Cash management portfolios offered

Both robo-advisors also offer a cash management portfolio as well. These portfolios are meant to provide you with a higher returns compared to leaving it in your bank account.

Moreover, these portfolios are also rather liquid for you to easily deposit and withdraw money at any time.

Here are the cash management portfolios that both robo-advisors offer:

Syfe Cash+

Syfe Cash+ invests your money into 3 different funds:

- LionGlobal SGD Money Market Fund

- LionGlobal SGD Enhanced Liquidity Fund SGD

- LionGlobal Short Duration Bond Fund

Syfe does not charge any management fees and gives you a full rebate on any trailer fees that they receive!

| Gross Return | 1.55% |

| Fund-level Fee | -0.35% |

| Overall Rebates | 0.3% |

| Management Fee | None |

| Projected Return | 1.5% |

You can view my comparison between Syfe Cash+ and StashAway Simple to see which portfolio is better for you.

MoneyOwl offers WiseSaver

MoneyOwl has a WiseSaver portfolio that aims to provide a better return than SGD dollar deposits.

MoneyOwl invests your funds fully into the Fullerton SGD Cash Fund.

This fund can also be found in Grab AutoInvest’s portfolio as well.

The unique point about WiseSaver is that you are able to make a transaction from as little as $10!

You can read my review of WiseSaver to see how this portfolio works for you.

Currency denomination

If you invest in Syfe’s portfolios, some of them are denominated in USD:

- Global ARI

- Equity 100

- Core

This is because the ETFs that make up these portfolios are denominated in USD.

As a result, there is another factor that affects the portfolio’s performance: the exchange rate between SGD and USD.

In contrast, the Dimensional Funds offered by MoneyOwl are denominated in SGD. This reduces the currency risks you’re exposed to, such as:

- The currency conversion fees you’ll need to pay

- The fluctuation of the exchange rate between SGD and other currencies

Performance

It is hard to compare the performances between these 2 robo-advisors since the portfolios are so different.

Moreover, the past returns can never be a good indicator of future returns. One portfolio that performs well now may not do so in the future.

Rather than looking at performance, you should be considering the investment strategy of these robo-advisors instead!

Dividend distribution

Syfe invests in US-listed ETFs in their Equity 100, Global ARI and Core portfolios. When any dividends are issued, they will incur a 30% dividend withholding tax.

The dividends that you receive is after this 30% deduction.

If you invest in REIT+, your dividends are not subject to any withholding taxes.

Meanwhile, MoneyOwl invests your funds into 4 of Dimensional’s Accumulating funds. These funds will automatically reinvest any dividends that you receive back into the fund.

These are similar to accumulating ETFs that are domiciled in Ireland.

As such, you should not expect to receive any dividends when you invest with MoneyOwl.

Even though you do not receive the dividends, you are still subject to the 15% withholding tax on UCITS funds!

Funds you can invest with

Here are the types of funds you can use to invest in these 2 robo-advisors:

Syfe only allows you to invest in cash

One of the major limitations of Syfe is that it only allows you to invest your cash. Syfe intends to have an option for you to invest your SRS funds in the future.

MoneyOwl allows you to invest both your Cash and SRS

You can invest both your Cash and SRS into MoneyOwl’s portfolios.

MoneyOwl could be one option to consider if you are looking for a way to use your SRS funds to buy international stocks.

Minimum sum to invest

Here are the minimum sums required to start investing with either robo-advisor:

Syfe has no minimum investment

Syfe stores your funds in a co-mingled account with Syfe’s other customers. This allows you to invest in fractional shares of the various ETFs and REITs that Syfe offers.

This is also similar to how StashAway manages your funds.

As such, Syfe does not have a minimum investment required to start investing with them.

This makes investing extremely accessible, especially if you only have a small sum to invest!

MoneyOwl has low minimum requirements too

Here are the minimum sums required for you to invest with MoneyOwl:

| Type of Investment | Investment Amount |

|---|---|

| One-Time Investment | $100 |

| Monthly Investment | $50 |

The monthly investment amount of $50 is also lower compared to regular savings plans like OCBC BCIP and Invest Saver.

With the low minimum requirements, MoneyOwl is also rather accessible!

Fees

Here are the fees that both robo-advisors will charge you:

Syfe charges you 0.65% for your first $20k

Here is Syfe’s pricing structure:

| Total Amount Invested | Management Fee |

|---|---|

| < $20k | 0.65% |

| ≥ $20k and < $100k | 0.50% |

| ≥ $100k | 0.40% |

Unlike other fee structures, Syfe does not have a tiered fee structure. For example if you have $30k invested with Syfe, you will incur a 0.5% fee on your entire investment amount.

You will need to pay an expense ratio to the fund managers too!

Syfe has no fees for Cash+

Syfe does not charge you any fees for Cash+. As such, the amount of funds in your Cash+ portfolio will not be included in the total amount chargeable.

MoneyOwl charges slightly lower fees

Here are the fees that you’ll need to pay with MoneyOwl:

| Total Investment Amount | Advisory Fee |

|---|---|

| Below $10,000 | 0% |

| $10,001 to $100,000 | 0.60% |

| $100,001 and above | 0.5% |

MoneyOwl is having a promotional rate of 0% for the first $10k invested until 31 December 2021 for cash investments.

These fees applies to both Cash and SRS investments.

However, you’ll still need to pay an expense ratio to Dimensional Fund Advisors too!

This will range between 0.28%-0.32% p.a., depending on the portfolio you’ve chosen.

No fees charged for WiseSaver

MoneyOwl also does not charge any fees for the WiseSaver portfolio. However, you will still need to pay a 0.15% fund-level fee that is paid directly to Fullerton Fund Management.

Type of account used to handle your assets

Both robo-advisors use different types of accounts to manage your assets:

Syfe uses a co-mingled account

Syfe co-mingles your assets with all of its other customers under one account.

This allows Syfe to purchase fractional shares for your portfolio. While this makes investing very accessible, there may be problems when Syfe closes down.

Your fractional shares may not be able to be sold off in the NYSE and SGX! This is because you can only sell off whole shares and not fractional ones on these exchanges.

As such, you do not have control over the fate of your assets, especially for your fractional shares.

iFAST manages your assets with MoneyOwl

MoneyOwl has engaged iFAST to provide custodial and transfer agent services. When you purchase assets using MoneyOwl, iFAST is actually the one who manages them.

However, iFAST holds all of your assets in their Client Trust account. This is similar to other robo-advisors (StashAway and Syfe) that hold all their customers’ assets in a co-mingled account.

Even in the unfortunate event that iFAST closes down, it would not really impact your assets much.

This is because you are able to buy and sell Dimensional funds using fractional units.

For Syfe and StashAway, they invest in US-listed ETFs. This means that they will be unable to sell off the fractional units of ETFs under your name if they close down!

Moreover, iFAST is a very well established financial service provider in Singapore. As such, you should not be too worried about them closing down!

You can see how different types of custodian accounts will affect your funds in my analysis of why Smartly closed down.

Web platform

This is how Syfe’s web platform looks like.

However, I find MoneyOwl’s platform to be pretty hard to navigate.

The platform is not as intuitive, and I spent some time trying to navigate around!

However, this is just a minor nitpick. Both platforms serve their purpose well and help you to see your portfolios’ performances.

Mobile app

Syfe has a mobile app too.

However, I would suggest not installing the app on your phone! This may make you check your portfolio constantly since it is too convenient.

You may be tempted to sell your funds, especially when your portfolio is losing money!

Meanwhile, MoneyOwl does not have a mobile app.

Verdict

Here’s a breakdown between these 2 robo-advisors:

| Syfe | MoneyOwl | |

|---|---|---|

| Type of Product | ETFs or REITS | Dimensional Funds |

| Investment Strategy | ARI Smart Beta | Risk profiling and time horizon |

| Investment Portfolios | Global ARI REIT+ Equity 100 Core | Wealth Accumulation |

| Cash Management Portfolios | Syfe Cash+ | WiseSaver |

| Dividend Distribution | Yes 30% tax (ARI / Equity 100 / Core) No tax for REIT+ | No (15% tax) |

| Funds to Invest | Cash only | Cash SRS |

| Minimum Sum to Invest | None | $100 (one-time) or $50 (monthly) |

| Fees (Investment) | 0.4-0.65% | 0-0.60% |

| Fees (Cash Management) | 0% | 0% |

| Type of Account to Handle Assets | Co-mingled | Co-mingled under iFAST Client Trust Account |

So which robo-advisor should you choose?

Choose Syfe if you want exposure to specialised portfolios

Syfe has 4 portfolios that help you to achieve different investment goals.

Each of these portfolios have a different investment strategy. As such, you can choose to invest in a strategy that you believe in.

Furthermore, Syfe’s REIT+ has a very unique feature as it does not buy into an ETF. Instead, you are buying into the individual REITs.

In this way, you do not need to pay one layer of costs, which is the expense ratio of the ETF!

I personally find the REIT+ portfolio as a great way to reinvest any small dividends that I receive.

Choose MoneyOwl for lower fees and the ability to invest your SRS funds

MoneyOwl charges slightly lower fees compared to Syfe. It may be slightly more cost efficient for you use this advisor instead.

MoneyOwl’s portfolios are more standard in their allocation towards stocks and bonds. If you prefer a rather generalised portfolio, then this platform may be more suitable for you.

MoneyOwl also allows you to invest your SRS funds, which is something that Syfe does not offer.

Conclusion

Both robo-advisors offer very unique portfolios that cater to different kinds of investing needs. It is even possible to invest in both of them together!

However, the main considerations that you should have when choosing between these 2 platforms are:

- The amount of money you are able to invest

- The investment strategy you agree with

- The fees you are willing to pay

- The type of funds (SRS or cash) you wish to invest

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

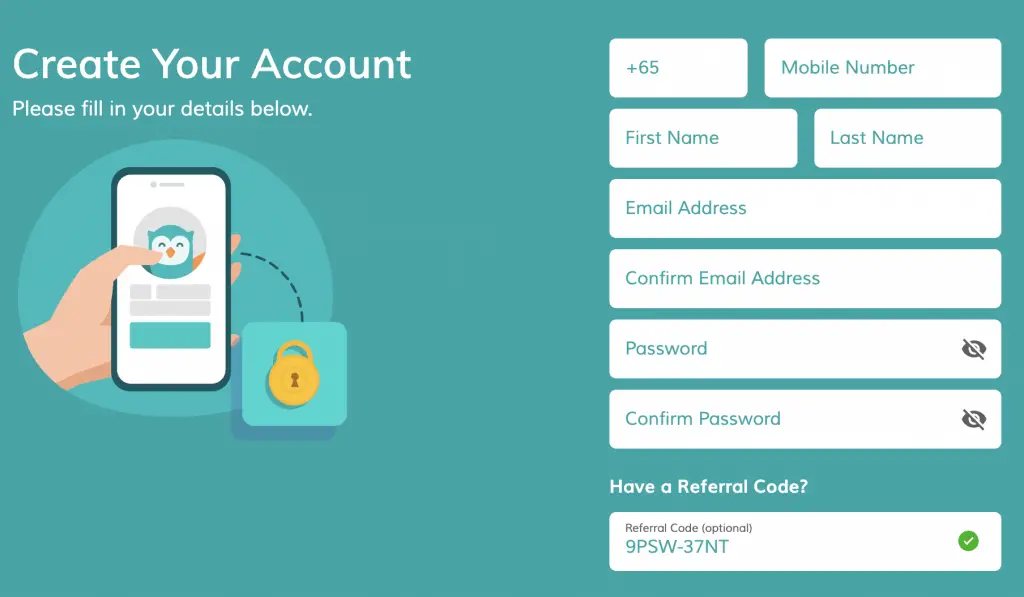

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 3 months.

You will be able to save up to $75 worth of fees!

This applies only to the money that you’ve invested in Syfe’s 3 portfolios. If you are using only Syfe Cash+, you will not be charged any fees by Syfe!

You can view more information about this referral program on Syfe’s website.

MoneyOwl Referral (Up to $65 GrabFood credits)

If you are interested in signing up for a MoneyOwl account, you can use my referral link to sign up. This will allow you to earn up to $65 GrabFood credits.

Here’s what you need to do:

- Sign up for a MoneyOwl account with my referral link

- Apply for MoneyOwl’s services

- Receive your GrabFood credits (up to 4 weeks later)

Here are the services you’ll need to sign up for to earn your GrabFood credits:

| Service | Condition | GrabFood Credit |

|---|---|---|

| Insurance | An insurance plan purchased and issued by MoneyOwl | $20 |

| Investment | An investment portfolio created and funded | $20 |

| Comprehensive Financial Planning | Financial plan is paid for and completed | $20 |

| Will Writing | Will successfully completed | $20 |

You can find out more about this referral program on MoneyOwl’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?