Last updated on February 3rd, 2022

You may be looking to grow your CPF funds by investing some of your CPF OA and SA funds using the CPF Investment Scheme.

However, the options are rather limited as the CPF Board does not want you to take too many risks.

If you are thinking of buying US stocks using your CPF funds, here’s what you need to know.

Contents

Can I buy US stocks with my CPF funds?

Under the restrictions set out in the CPF Investment Scheme, you are only able to invest up to 35% of the investible savings in your CPF OA into shares. However, the shares that you can buy are limited to those that are listed on the SGX. As such, you are unable to buy US stocks directly using your CPF funds.

The CPF Investment Scheme (CPFIS) offers you the option to purchase shares using your CPF OA.

However, this scheme does not allow you to use your CPF SA funds to invest in shares!

Here are some limitations regarding this scheme:

#1 You are only able to invest 35% of your investible savings

You are unable to use your entire CPF OA funds to invest in shares. Instead, you are only able to invest 35% of your investible savings.

You can find out more about calculating your CPF investible savings in this article.

#2 You are only able to invest in approved shares that are listed on the SGX

The shares that you can invest in using your OA funds have to be:

- Listed on the SGX

- Under the approved list of shares

These shares have to meet certain criteria that are set out by the CPF Board.

As such, you are unable to use your OA funds to buy any US stocks that are listed on the NYSE or Nasdaq!

#3 You can’t buy the S&P 500 ETF (S27) that is listed on the SGX

You are able to use your SRS funds to buy the S&P 500 ETF listed on the SGX (S27).

However, you can’t use your CPF OA funds to buy this ETF!

This is because there are only 5 ETFs that you can buy with the CPFIS:

| ETF | SGX Ticker |

|---|---|

| ABF Singapore Bond Index Fund | A35 |

| Nikko AM SGD Investment Grade Corporate Bond ETF | MBH |

| Nikko AM Singapore STI ETF | G3B |

| NikkoAM-StraitsTrading Asia ex Japan REIT ETF | CFA |

| SPDR Gold Shares | O87 |

| SPDR Straits Times Index ETF | ES3 |

Both G3B and ES3 track the Straits Times Index (STI). This is Singapore’s version of the S&P 500, and you can view a comparison here between these 2 indices.

Since S27 is not on this list of approved ETFs, you will be unable to buy this ETF using your CPF funds.

What options do I have if I want to buy US stocks with my CPF OA funds?

To gain exposure to US stocks with your CPF funds, you can buy Unit Trusts that are approved by CPF which contain US stocks. This is because you are unable to buy individual US stocks with your CPF funds.

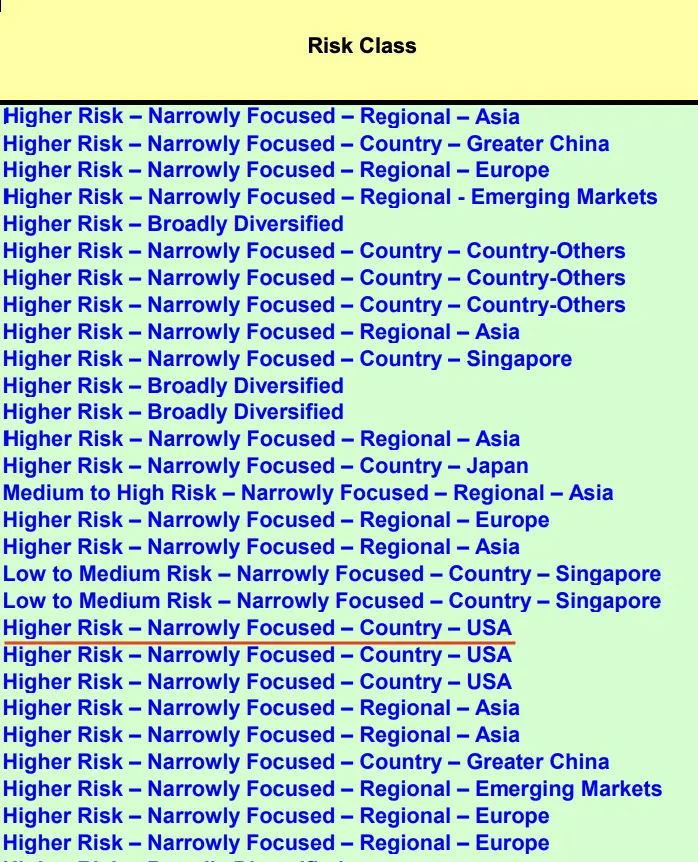

There are around 84 Unit Trusts that are on the approved list by CPF. To identify the ones that contain US stocks, you can take a look at the Risk Class column.

You can see that some of them have the label: ‘Higher Risk – Narrowly Focused – Country – USA‘.

This means that the fund is mainly exposed to stocks in the US.

To find out which US stocks are found in these funds, you will need to go to the fund’s information page to find out more.

An example: Franklin US Opportunities Fund

For example, here’s the link to the Franklin US Opportunities Fund. This fund mainly invests in US companies with strong growth potential, and you can view the entire holdings of their funds here.

This fund contains some of the well-known US stocks including Google and Tesla.

However, their charges are rather high. You will incur an initial charge of 5%, and an annual charge of 1.5%.

The fees that you pay are much higher than the expense ratios you may pay with an ETF!

Can I use my CPF funds to buy S&P 500?

You can use your CPF OA funds to buy the Lion Global Infinity US 500 Stock Index Fund which is available on Endowus Fund Smart. This fund tracks the S&P 500 index and is the main way of gaining exposure to US stocks at a lower cost.

Compared to actively managed funds, the Lion Global Infinity US 500 fund tracks the S&P 500 index, making it more passive.

The fees that you pay when investing with Endowus is greatly reduced, at 0.395% a year! However, you will need to add on the fees that are charged by Endowus too.

Nevertheless, it is still cheaper compared to buying other actively managed funds with your CPF OA funds.

How can I buy the S&P 500 using my CPF funds?

Here are 5 steps you’ll need to buy the Lion Global Infinity US 500 Stock Index Fund which tracks the S&P 500 using your CPF funds:

- Link your CPF IS Account with Endowus

- Create a Endowus Fund Smart account with your CPF funds

- Select the Lion Global Infinity US 500 Stock Index Fund

- Select 100% allocation for the Lion Global Infinity US 500 Stock Index Fund

- Select your initial investment amount

Here is each step explained in-depth:

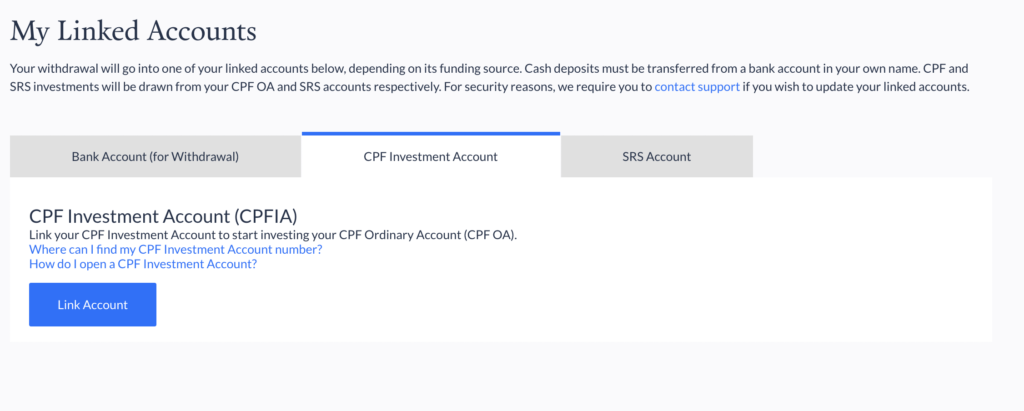

Link your CPF IS Account with Endowus

After creating an account with Endowus, you will need to link your CPF Investment Account with the platform.

This can be done by going to ‘My Linked Accounts‘, and selecting CPF Investment Account.

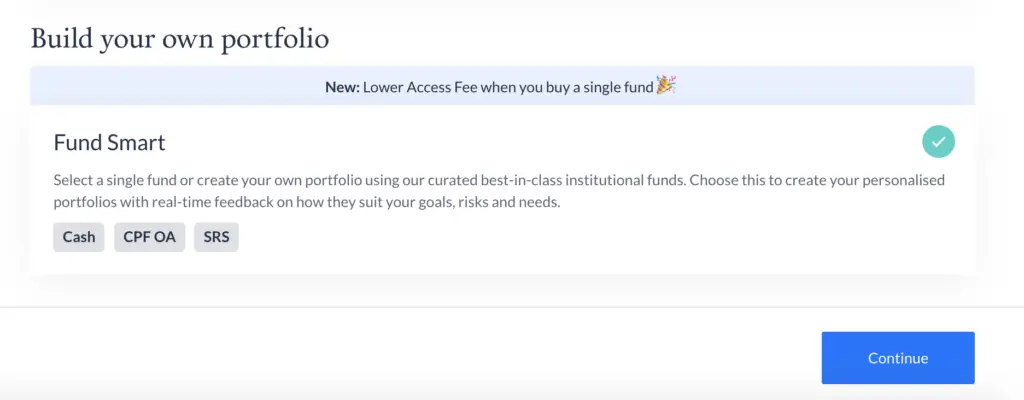

Create a Endowus Fund Smart account with your CPF funds

After linking your CPF-IA to Endowus, you can create a Fund Smart portfolio that just tracks the S&P 500.

You can go to Invest, and then scroll all the way down to Fund Smart.

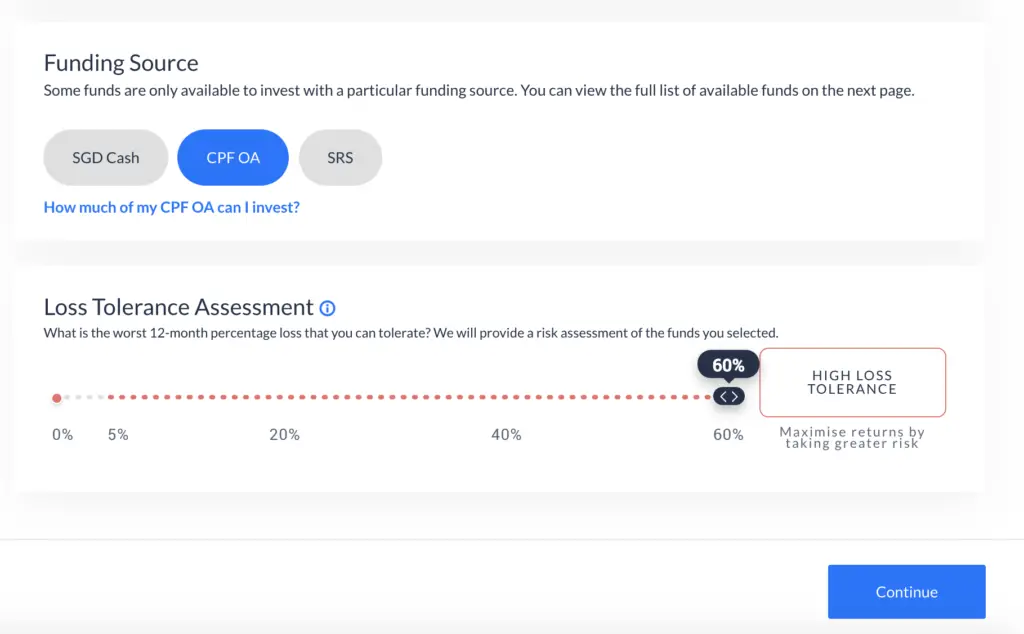

On the ‘Funding Source‘ page, you can select CPF OA as your source of funds.

This means that Endowus will use your CPF OA funds to invest in this Fund Smart Portfolio that you’re creating.

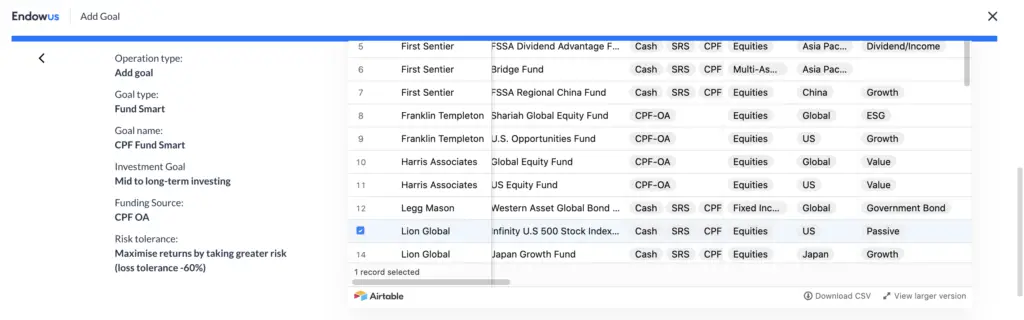

Select the Lion Global Infinity US 500 Stock Index Fund

Once that is done, you will need to select the Lion Global Infinity US 500 Stock Index Fund.

There are quite a lot of funds that you can invest with using Endowus’ Fund Smart. The Lion Global Infinity US 500 Stock Index Fund is one fund that you can buy using cash, SRS or CPF.

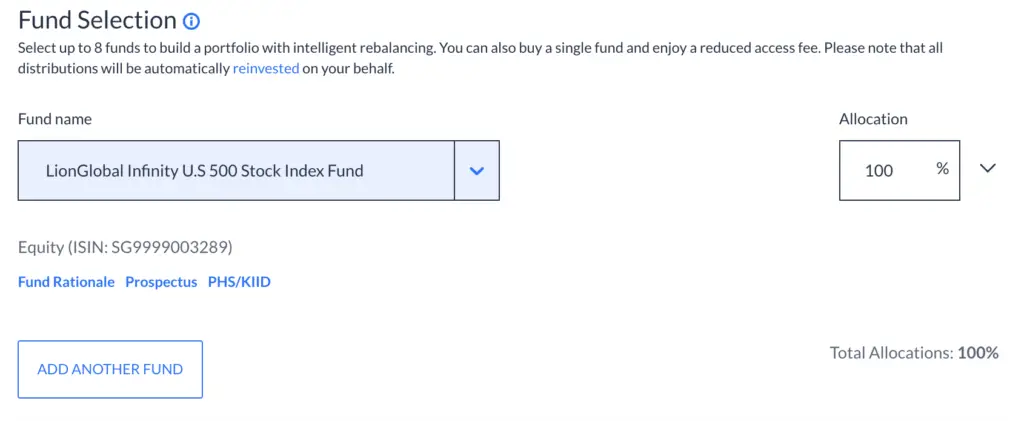

Select 100% allocation for the Lion Global Infinity US 500 Stock Index Fund

After selecting the Lion Global Fund, you can select a 100% allocation to this fund at the ‘Fund Selection’ page.

By creating a single fund portfolio, you will only pay 0.3% in management fees, compared to the usual 0.4%.

Even though this may seem like a small amount, it does come up to significant savings when you have a larger sum in this portfolio!

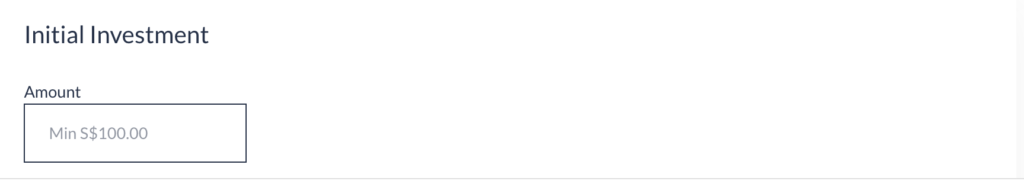

Select your initial investment amount

The last step will be to select the initial investment amount when you create this portfolio.

If this is the very first time that you’re funding your Endowus portfolio, the initial investment amount is $1,000. For every subsequent investment that you make, the minimum you will need to fund your account is $100.

After confirming the creation of this Fund Smart portfolio, Endowus will deduct the funds from your linked CPF account and invest it.

Fees involved (management fees and agent bank fees)

Apart from the expense ratio that the fund charges you, you will need to pay these fees to Endowus and the bank that holds your CPF-IA:

| Type | Fees |

|---|---|

| Endowus | 0.3% p.a. (Single fund) 0.4% p.a. (Multiple funds) |

| Agent Bank | Transaction: $2-$2.50 Service Charge: $2-$2.50 per quarter |

The transaction fees are rather high at between $2 – $2.50. To reduce the amount of fees that you are paying, you can try to make a lump sum investment, rather than multiple investments each month.

All of these will add up to the fees that you incur when investing in the S&P 500 using this method!

Conclusion

While you aren’t able to buy US stocks directly with your CPF funds, one way to still gain exposure to the US markets is by investing in a fund that contains US stocks.

Some of these funds are actively managed, which means that the annual management fees can be rather high.

If you are looking for a more passive approach to investing in US stocks, buying a fund that tracks the S&P 500 index with your CPF funds will be the best way.

Although Endowus charges rather low fees, you may still want to take note of the additional fees that you’ll incur apart from just the fund’s management fees!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?