Last updated on June 6th, 2021

Every robo-advisor has their own cash management plan. There are so many different portfolios you can choose from!

Here’s a breakdown of Syfe Cash+ and StashAway Simple to help you make a better decision:

Contents

The difference between Syfe Cash+ and StashAway Simple

Syfe Cash+ differs from StashAway Simple mainly in terms of the funds they invest in, and the ability to use your SRS funds. They are both cash management portfolios that offer higher returns compared to bank accounts.

Here’s an in-depth comparison between these 2 portfolios:

Funds invested

There are 3 different funds that can be found in these 2 portfolios:

#1 LionGlobal SGD Money Market Fund

This fund will invest your money in 2 main instruments:

- High quality short-term money market instruments

- Debt securities

Some of the types of investments that this fund will invest in include:

- Government and corporate bonds

- Commercial bills

- Deposits with banks

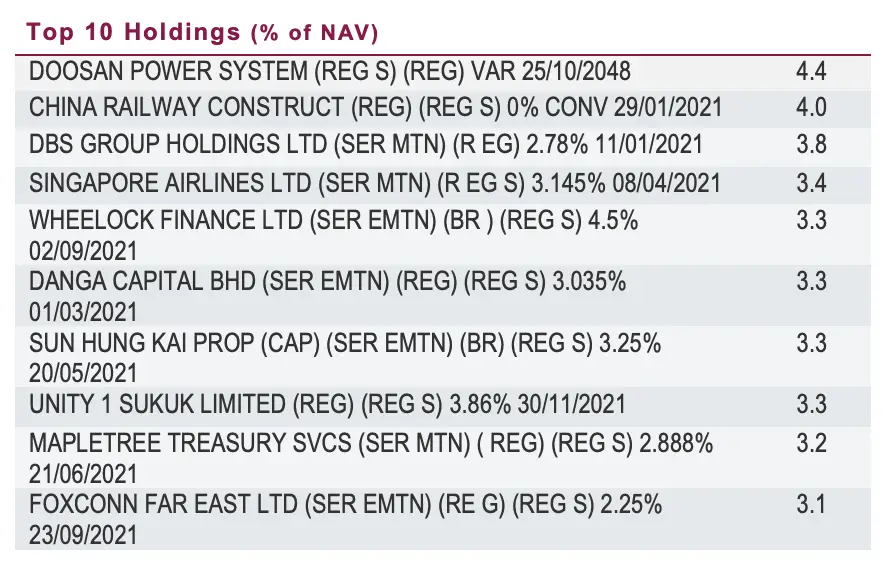

Here are the top holdings of this fund:

This fund still has a high allocation of assets in Singapore (31%). The next highest is China at 10.5%.

However, quite a significant amount of the fund is kept as ‘Cash Equivalent’ (21.6%). This makes the fund rather liquid.

The aim of this fund is to provide a return that is similar to SGD fixed deposits.

The weighted credit rating of this fund is ‘A’. As such, your investments into these funds are pretty safe!

#2 LionGlobal SGD Enhanced Liquidity Fund

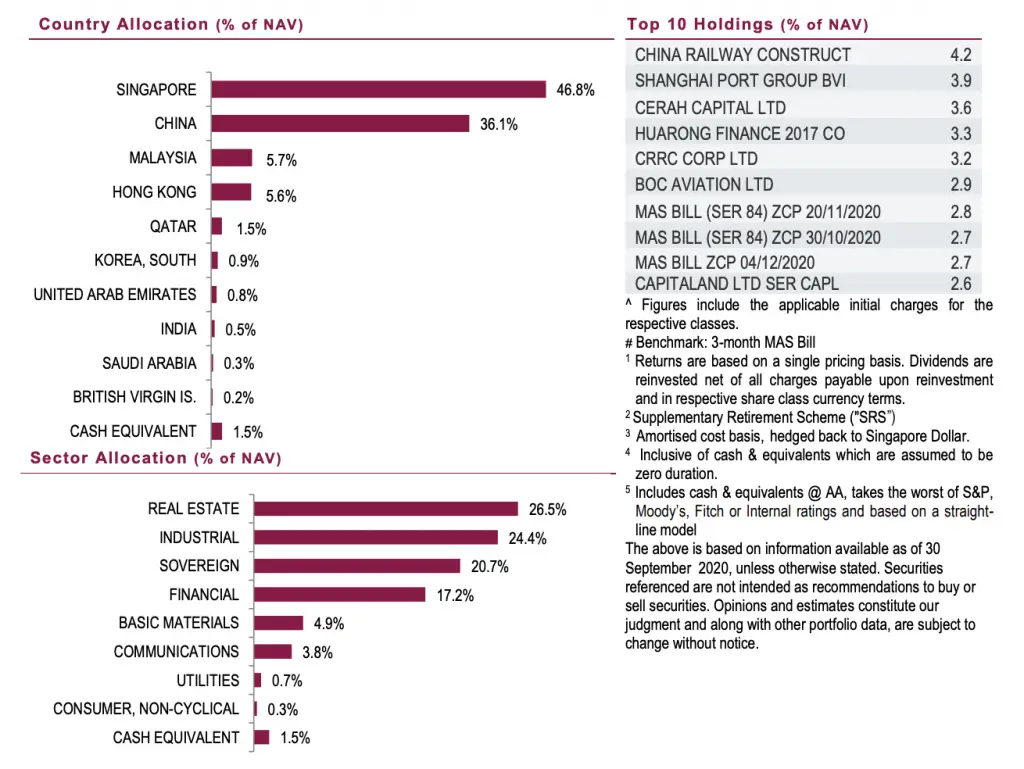

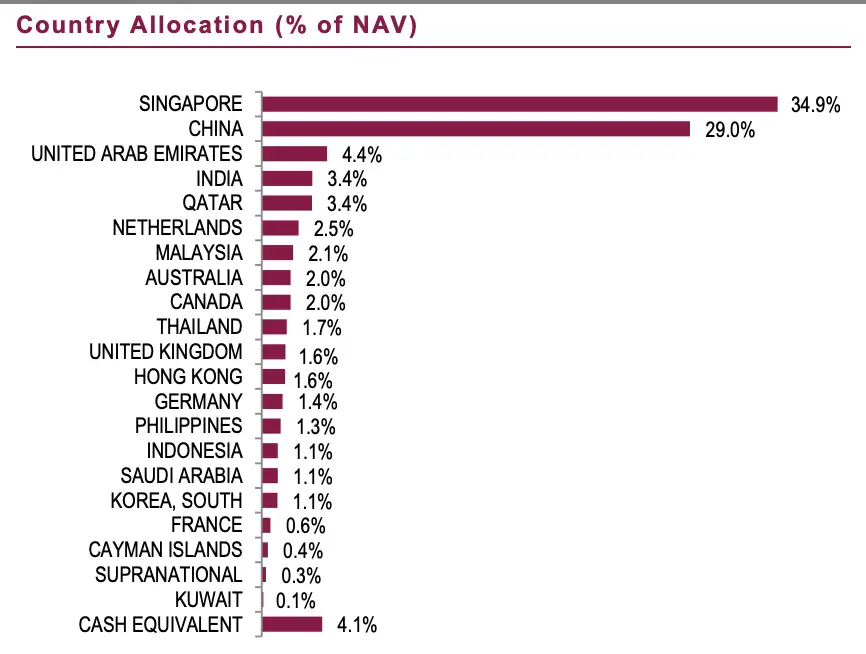

The LionGlobal SGD Enhanced Liquidity Fund aims to invest in high quality debt instruments. Here is the allocation of where your funds will be invested in.

The main things you would want to take note include:

- The assets are heavily weighted in Singapore (almost 50%)

- It is pretty diversified across different sectors

The average credit rating of the assets in this fund is ‘A’ as well. However, these assets give a slightly higher return compared to the LionGlobal Money Market Fund.

This is probably due to the higher weighted duration of the assets found in the Enhanced Liquidity fund.

The higher the duration, the more a bond’s price will drop as interest rates rise (and vice versa).

Investopedia

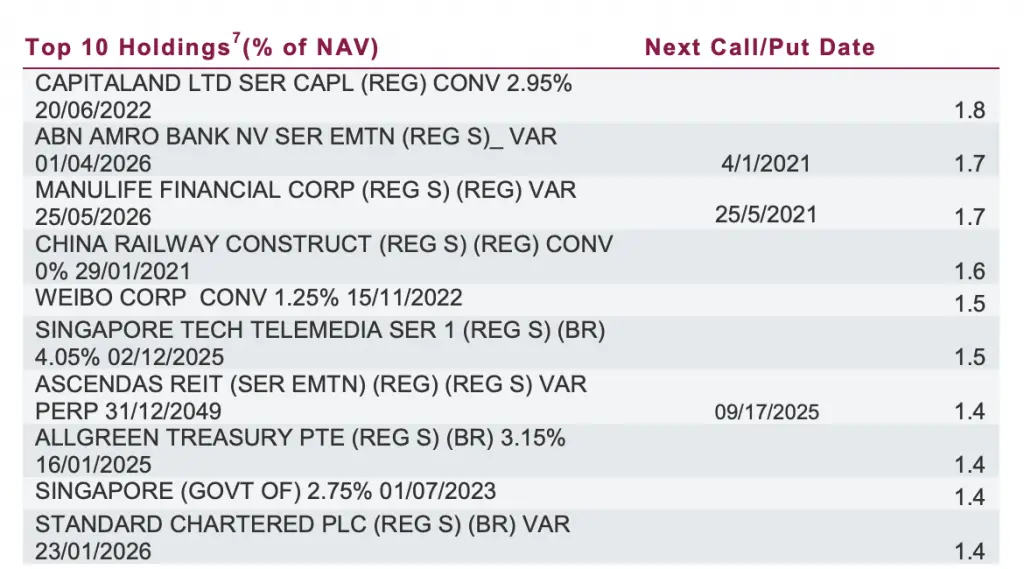

#3 LionGlobal Short Duration Bond Fund

This fund aims to provide a total return of capital growth and income over the medium to long term. It mainly consists of bonds from different companies.

Here are the top holdings of this fund:

This fund is mainly concentrated in both Singapore and China.

The fund manager normally invests in investment-grade bonds (‘BBB’ or above). However, some of the fund’s holdings may be bonds which are lower than the investment grade!

This leads to the fund’s weighted credit rating to be ‘BBB‘.

Moreover, the weighted duration of this fund is much higher compared to either the Money Market Fund or the Enhanced Liquidity Fund.

As such, you should expect the Short Duration Bond Fund to have the highest weighted performance!

This also means that you may experience more volatility compared to the other 2 funds.

These 3 funds have a different performance and risk profile

The 3 funds above all have a different investing strategy. As such, you will gain different kinds of returns:

| Fund | Performance | Risk |

|---|---|---|

| LionGlobal SGD Money Market Fund | Lowest | Lowest |

| LionGlobal SGD Enhanced Liquidity Fund | Mid | Mid |

| LionGlobal Short Duration Bond Fund | Highest | Highest |

The LionGlobal Short Duration Bond Fund has the highest performance of these 3 funds. This also means that this fund may have more short term volatilities as well!

Both portfolios invest in a different allocation into each of these funds

Both Syfe Cash+ and StashAway Simple do not invest in only one of the funds above. Instead, they will invest in a mixture of these funds.

This is usually done to balance out the riskier funds with a fund that has a lower risk.

Here are the allocations of the 3 funds into these 2 portfolios:

| Fund | Syfe Cash+ | StashAway Simple |

|---|---|---|

| LionGlobal SGD Money Market Fund | 30% | 50% |

| LionGlobal SGD Enhanced Liquidity Fund | 35% | 50% |

| LionGlobal Short Duration Bond Fund | 35% | 0% |

Both Syfe and StashAway may rebalance your portfolio from time to time to maintain this allocation.

Syfe Cash+ has a lower allocation into the LionGlobal Money Market Fund. Moreover, it is more diversified over the 3 funds. This may result in a higher yield compared to StashAway Simple.

Meanwhile, StashAway Simple invests in an equal weightage of the Money Market Fund and the Enhanced Liquidity Fund.

Fees charged

Here are the fees that you may incur when investing in either cash management portfolio:

#1 Management fees

Both Syfe Cash+ and StashAway Simple do not charge any fees to use their cash management portfolios.

As such, you’ll be paying a lesser amount of fees! Ultimately, this will help to ensure you get higher returns on your investment.

#2 Fund level fees

Even though Syfe Cash+ and StashAway Simple do not charge any fees, you’ll still need to pay some fees to LionGlobal.

This is because they will need to cover the costs of running the fund.

Here are the expense ratios of these 3 funds:

| Fund | Expense Ratio |

|---|---|

| LionGlobal SGD Money Market Fund | 0.35% |

| LionGlobal SGD Enhanced Liquidity Fund | 0.36% |

| LionGlobal Short Duration Bond Fund | 0.34% |

Based on the allocation of these funds for both portfolios, here are the blended fees you’ll need to pay:

| Fund | Expense Ratio |

|---|---|

| Syfe Cash+ | 0.35% |

| StashAway Simple | 0.355% |

However, these fees are before the trailer fee rebates.

#3 Trailer fees (refunded)

Some funds will charge a trailer fee when you invest in their funds as well.

Trailer fees are fees that a fund manager pays a platform. This is similar to a commission that the platform receives for introducing the investor to the fund.

Both Syfe Cash+ and StashAway Simple provide you with rebates from these trailer fees.

Here are the rebates that both portfolios will give you (according to their websites):

| Fund | Trailer Fee Rebate |

|---|---|

| Syfe Cash+ | 0.30% |

| StashAway Simple | 0.125% |

Even though both portfolios invest in very similar funds, Syfe seems to be giving out more rebates compared to StashAway.

With these rebates that you receive, this will help to further lower your cost of investing!

Performance

The returns that are being advertised for these portfolios are shown after deducting any fees charged.

| Syfe Cash+ | StashAway Simple | |

|---|---|---|

| Projected Return | 1.55% | – |

| Fund-Level Fees | (0.35%) | (0.355%) |

| Trailer Fee Rebate | 0.3% | 0.125% |

| Platform Fees | 0% | 0% |

| Net Return | 1.5% | 1.2% |

Syfe Cash+ has a higher projected return, possibly due to the low fees that you need to pay. This shows how important fees are and how they affect your returns!

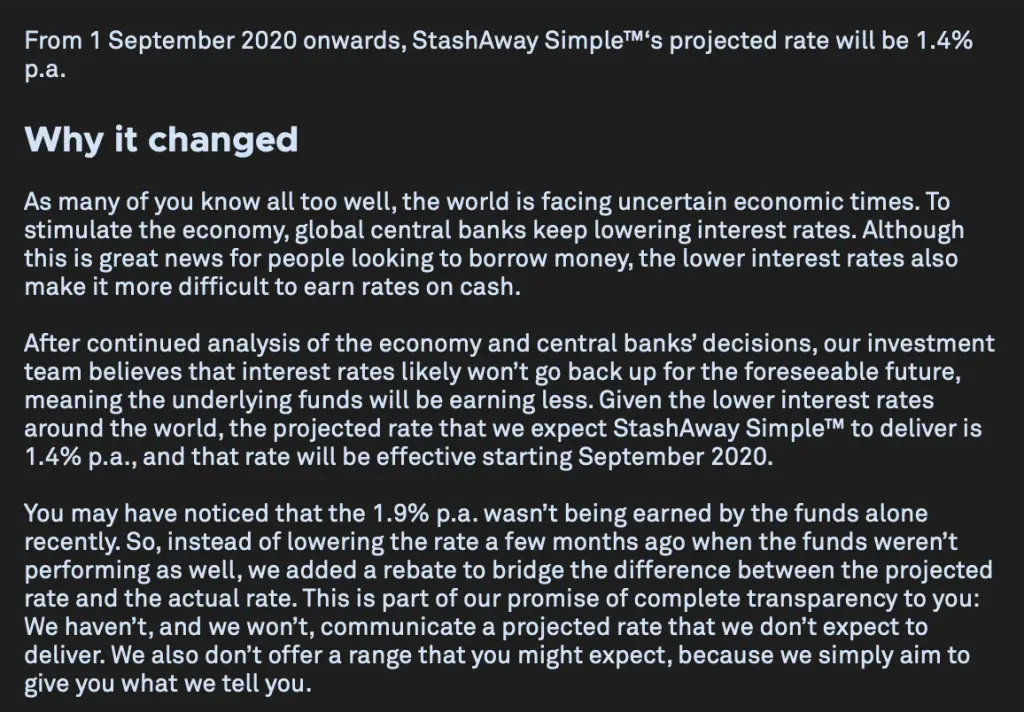

StashAway Simple used to provide a 1.9% return

Back in late 2019, StashAway Simple was still able to provide you with a 1.9% return. However, StashAway announced that they will be decreasing the return from 1.9% to 1.4% from September 2020.

StashAway could no longer afford to continue giving you rebates to make up to the 1.9% return rate. As such, they decided to decrease the return to 1.4%.

Recently, they have further lowered their rates to 1.2%.

Syfe Cash+ reduced its yield from 1.75% to 1.5%

Syfe also revised its yield on Cash+ from 1.75% to 1.5% to reflect the low interest rate environment.

If interest rates continue to be low, then the returns may decrease over time.

Even then, both accounts still give you a relatively higher yield compared to leaving your cash in a bank account!

Minimum sum required

Both Syfe and StashAway do not have a minimum sum to use their cash management portfolios.

This makes both portfolios much more accessible compared to Endowus Cash Smart. This is because Endowus has stricter requirements:

- You are required to make an initial investment of $10,000

- Each subsequent transaction needs to be at least $100

You can view my comparison between Endowus Cash Smart and StashAway Simple to see which portfolio is better for you.

As such, you can start using either portfolio even though you only have a small sum!

Type of funds you can use

Syfe Cash+ only allows you to use Cash. In contrast, you can also use your SRS funds for StashAway Simple.

If you want to grow your SRS funds without investing in higher risk assets, StashAway Simple may be more suitable for you.

Deposits and withdrawals

Another thing you’ll have to consider is the time it takes to process your deposits and withdrawals.

This is important as it’ll help you to determine how liquid your funds really are!

Here are the estimated time periods for both Syfe Cash+ and StashAway Simple:

| Portfolio | Deposits | Withdrawals |

|---|---|---|

| Syfe Cash+ | 2-4 business days | 2-5 business days |

| StashAway Simple (Cash) | 2-3 business days | 3-4 business days |

| StashAway Simple (SRS) | 3-4 business days | 3-4 business days |

Based on this comparison, StashAway is able to process your deposits and withdrawals slightly faster than Syfe.

This makes StashAway Simple slightly more liquid compared to Syfe Cash+.

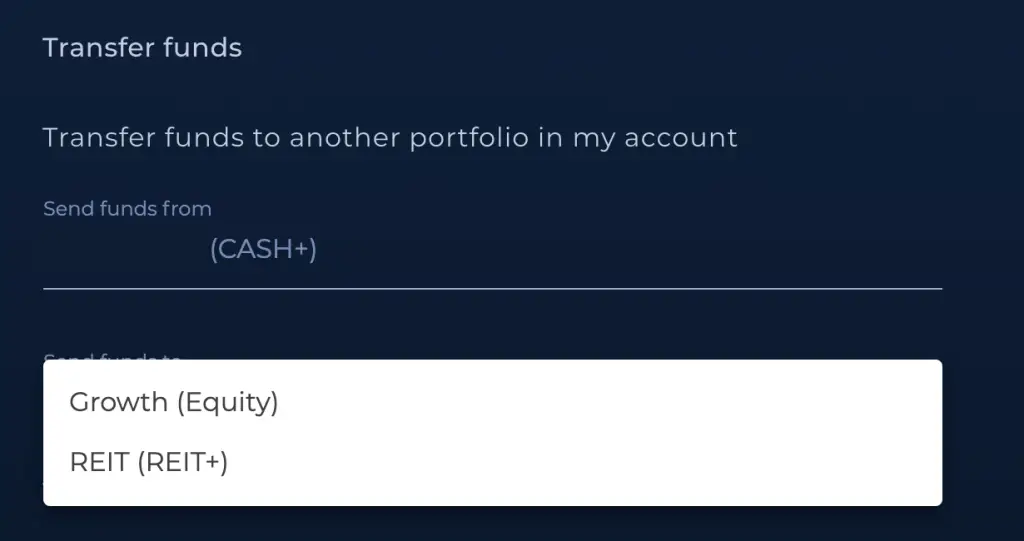

Transfer to other other portfolios

You can transfer your funds to the other portfolios that are offered by these robo-advisors.

For example, you can transfer your funds from Cash+ into Syfe’s 4 other portfolios:

You can also transfer your funds from StashAway Simple to StashAway’s other portfolios:

- General Investing

- Income Portfolio

This makes it very easy for you to start investing with either robo-advisor’s portfolios.

However, this also means that you’ll have to start paying management fees too.

Safety of your funds

Both StashAway and Syfe store all of your funds in a co-mingled account. This account includes all of the funds that all their customers have invested.

This is one reason why they are able to have no minimum investment for their investment portfolios.

The type of account may not be really relevant for cash management portfolios

However, these differences mainly come into play when you use their investment portfolios. Due to the co-mingled account, you will own fractional shares of the ETFs in each portfolio.

For cash management portfolios, your funds are invested in mutual funds. Since they allow you to purchase fractional shares, you still will have some control over how you can manage your assets.

To find out more about how robo-advisors manage their assets, you can view my analysis on why Smartly closed down.

Verdict

Here is a breakdown between Syfe Cash+ and StashAway Simple:

| Syfe Cash+ | StashAway Simple | |

|---|---|---|

| Funds Invested | LionGlobal MMF LionGlobal Enhanced Liquidity Fund LionGlobal Short Duration Bond Fund | LionGlobal MMF LionGlobal Enhanced Liquidity Fund |

| Platform Fees | 0% | 0% |

| Trailer Fee Rebates | 0.3% | 0.125% |

| Projected Yield | 1.5% | 1.2% |

| Minimum Sum to Invest | None | None |

| Type of Funds | Cash only | Cash SRS |

| Relative Liquidity | Slightly less liquid | Slightly more liquid |

| Type of Account Used to Manage Your Funds | Assets held in a co-mingled account | Assets held in a co-mingled account |

Both portfolios are really similar. So which one should you be choosing?

Choose Syfe Cash+ for higher yields

Syfe Cash+ has a higher projected yield since it places your funds into the LionGlobal Short Duration Bond Fund.

This is the riskiest of the 3 funds found in Syfe Cash+. However, it has the highest potential to give you a better return.

This fund is also not found in StashAway Simple, which could explain Simple’s lower yield.

Moreover, the fees you incur when using Syfe Cash+ is much lower. This is because Syfe gives you a larger trailer fee rebate of 0.3%!

Since both portfolios are so similar, Syfe Cash+ will be the better choice based on its higher yield.

Choose StashAway Simple if you wish to use your SRS funds

The main advantage that StashAway Simple has over Syfe Cash+ is the ability to use your SRS funds.

StashAway Simple provides a ‘low risk’ method of growing your SRS funds, especially if you don’t want to invest them.

However, Endowus Cash Smart provides a slightly higher return for your SRS funds too.

Another advantage of StashAway Simple is its higher liquidity. Since it takes 1 less day for the funds to appear in your bank account, is gives you slightly more flexibility in managing your funds!

That being said, it is strongly recommended that you do not place your emergency funds with StashAway Simple. This is because you may need the money immediately, and it will take a while to process your withdrawal.

Instead, you should be using StashAway Simple to save up for a short-term goal!

Conclusion

With the SingLife Account putting sign-ups on hold, and GIGANTIQ closing its tranche, you may be searching for an account that provides you with higher yields.

Either of these cash management portfolios can provide you with yields that are better than bank savings accounts.

Moreover, these cash management portfolios are very similar. As such, it does not really make a difference whether you choose one over the other.

The extra 0.3% yield that you can earn with Syfe Cash+ will only be significant after many years!

As such, the things you may want to consider when deciding between these 2 portfolios include:

- How liquid you want your funds to be

- The projected returns you wish to receive

- Whether you wish to use your SRS funds

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

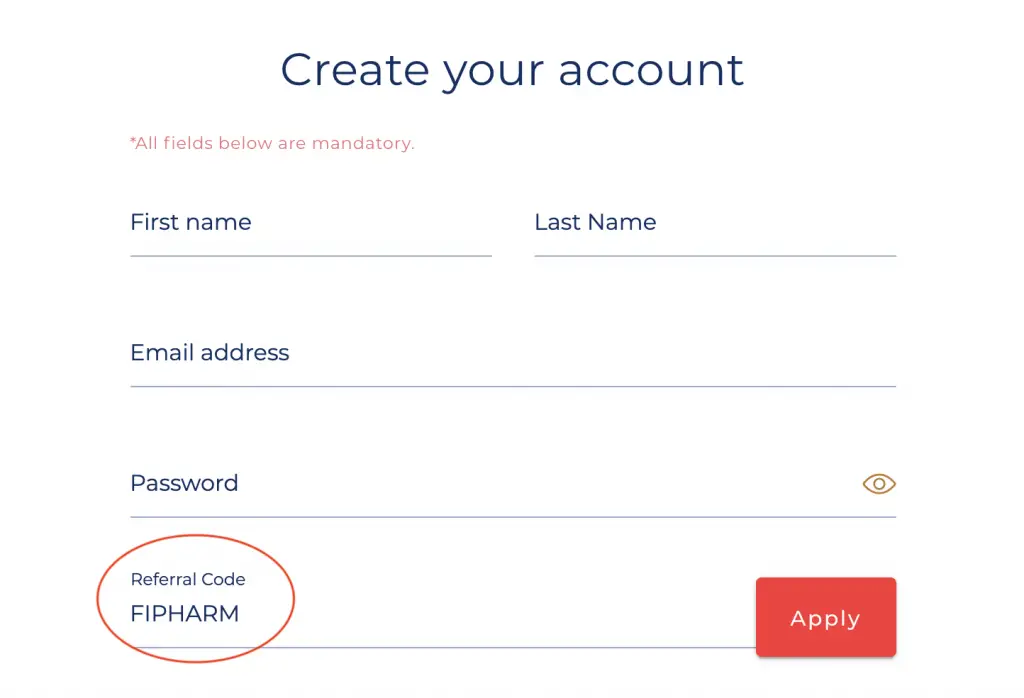

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 3 months.

You will be able to save up to $75 worth of fees!

This applies only to the money that you’ve invested in Syfe’s 3 portfolios. If you are using only Syfe Cash+, you will not be charged any fees by Syfe!

You can view more information about this referral program on Syfe’s website.

StashAway Referral (Up to $40,000 SGD managed for free for 6 months)

If you are interested in signing up for StashAway, you can use my referral link to sign up.

Here’s what you’ll need to do:

- Sign up for a StashAway account

- Make a deposit of ≥ $10k within 4 weeks of signing up

- Receive a fee waiver for 6 months (up to $40k)

You can find out more about this program on SingSaver.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?