Last updated on June 12th, 2021

The fight for your cash is real. Every robo-advisor is now offering a cash management portfolio!

With so many portfolios out there, how does Syfe’s new Cash+ fare against the competition?

Contents

- 1 Syfe Cash+ Review

- 2 What is Syfe Cash+?

- 3 What are the funds used by Syfe Cash+?

- 4 What are the characteristics of Syfe Cash+?

- 5 No minimum balance

- 6 What are the fees that Syfe Cash+ charges?

- 7 What are the returns?

- 8 Is Syfe Cash+ capital guaranteed?

- 9 How liquid is Syfe Cash+?

- 10 Is Syfe Cash+ safe?

- 11 Verdict

- 12 Conclusion

- 13 👉🏻 Referral Deals

Syfe Cash+ Review

Syfe Cash+ provides a slightly higher return on your funds compared to other cash management portfolios. With no minimum amount and relatively fast withdrawals, it is an ideal place to store your short-term savings.

Here is Syfe Cash+ reviewed in-depth:

What is Syfe Cash+?

Syfe Cash+ is a cash management portfolio that aims to give you a higher return on your funds compared to banks savings accounts.

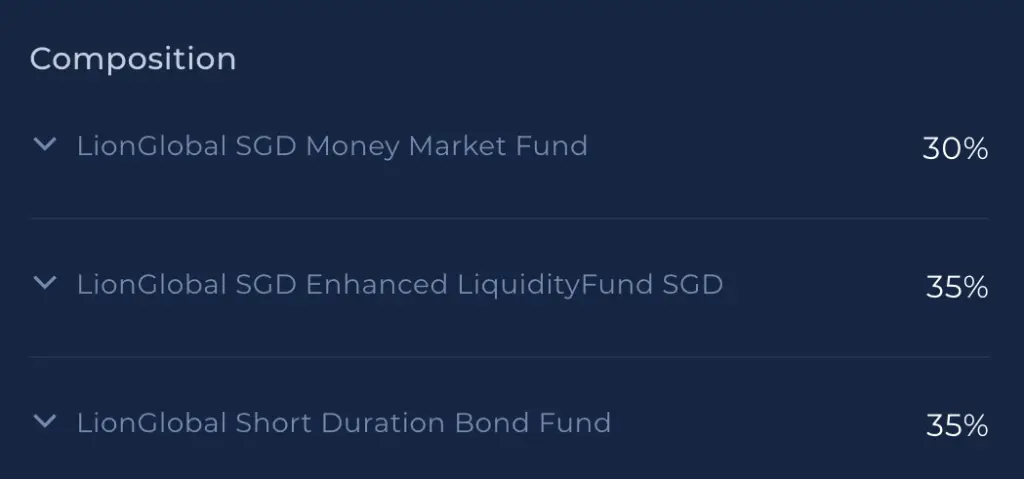

It invests your money into 3 funds by LionGlobal. These funds have different yields as they contain different assets.

As such, you will receive the weighted returns of these 3 portfolios combined!

You are able to open an account with Syfe just to use this cash management portfolio. As such, you can just use Cash+ if you do not want to invest your money!

What are the funds used by Syfe Cash+?

When you transfer your funds to Syfe Cash+, they will be invested into these 3 funds:

#1 LionGlobal SGD Money Market Fund

This fund will invest your money in 2 main instruments:

- High quality short-term money market instruments

- Debt securities

Some of the types of investments that this fund will invest in include:

- Government and corporate bonds

- Commercial bills

- Deposits with banks

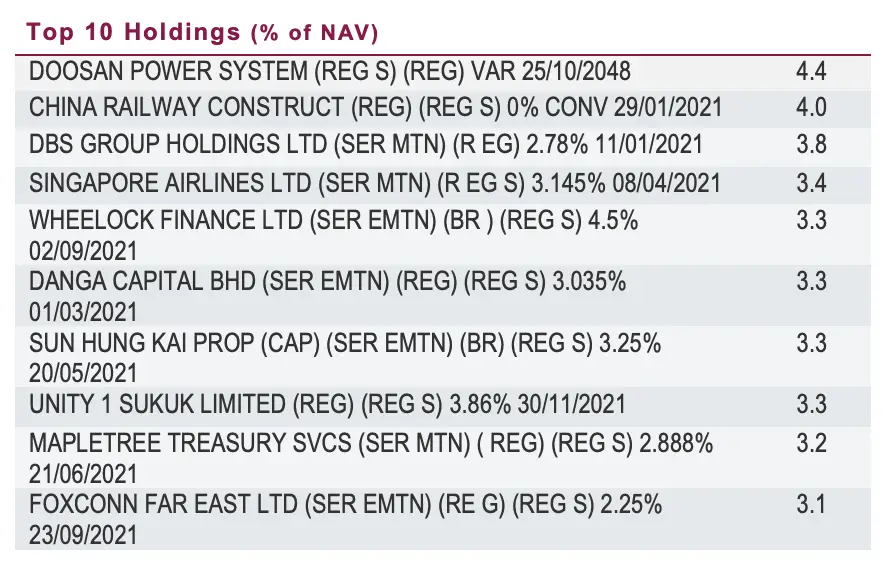

Here are the top holdings of this fund:

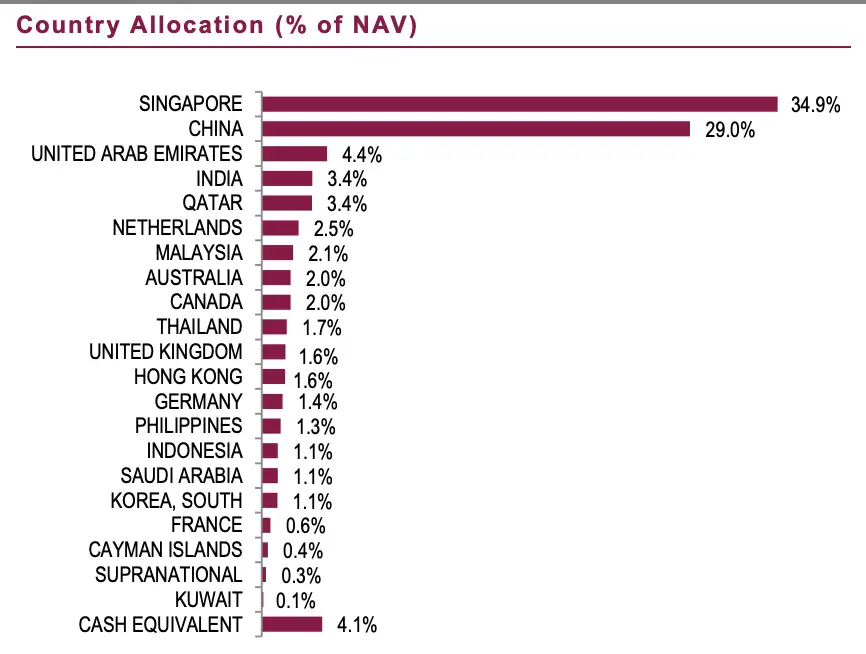

This fund still has a high allocation of assets in Singapore (31%). The next highest is China at 10.5%.

However, quite a significant amount of the fund is kept as ‘Cash Equivalent’ (21.6%). This makes the fund rather liquid.

The aim of this fund is to provide a return that is similar to SGD fixed deposits.

The weighted credit rating of this fund is ‘A’. As such, your investments into these funds are pretty safe!

#2 LionGlobal SGD Enhanced Liquidity Fund

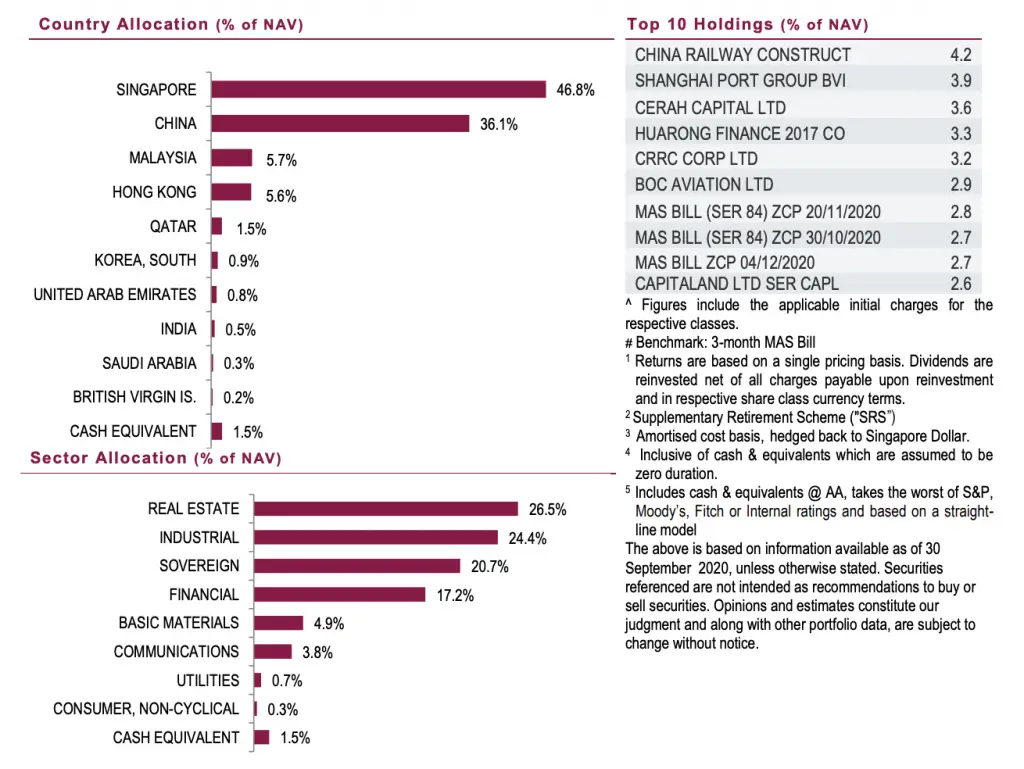

The LionGlobal SGD Enhanced Liquidity Fund aims to invest in high quality debt instruments. Here is the allocation of where your funds will be invested in.

The main things you would want to take note include:

- The assets are heavily weighted in Singapore (almost 50%)

- It is pretty diversified across different sectors

The average credit rating of the assets in this fund is ‘A’ as well. However, these assets give a slightly higher return compared to the LionGlobal Money Market Fund.

This is probably due to the higher weighted duration of the assets found in the Enhanced Liquidity fund.

The higher the duration, the more a bond’s price will drop as interest rates rise (and vice versa).

Investopedia

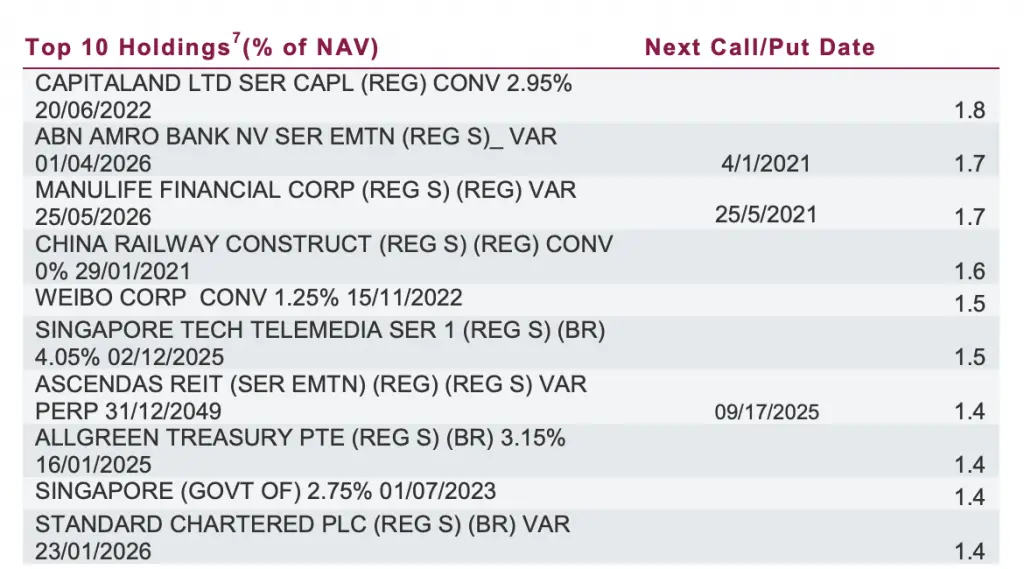

#3 LionGlobal Short Duration Bond Fund

This fund aims to provide a total return of capital growth and income over the medium to long term. It mainly consists of bonds from different companies.

Here are the top holdings of this fund:

This fund is mainly concentrated in both Singapore and China.

The fund manager normally invests in investment-grade bonds (‘BBB’ or above). However, some of the fund’s holdings may be bonds which are lower than the investment grade!

This leads to the fund’s weighted credit rating to be ‘BBB‘.

Moreover, the weighted duration of this fund is much higher compared to either the Money Market Fund or the Enhanced Liquidity Fund.

As such, you should expect the Short Duration Bond Fund to have the highest weighted performance!

This also means that you may experience more volatility compared to the other 2 funds.

These 3 funds have a different performance and risk profile

The 3 funds above all have a different investing strategy. As such, you will gain different kinds of returns:

| Fund | Returns | Risk |

|---|---|---|

| LionGlobal SGD Money Market Fund | Lowest | Lowest |

| LionGlobal SGD Enhanced Liquidity Fund | Mid | Mid |

| LionGlobal Short Duration Bond Fund | Highest | Highest |

The LionGlobal Short Duration Bond Fund has the highest performance of these 3 funds. This also means that this fund may have more short term volatilities as well!

Syfe has a high allocation towards the Enhanced Liquidity Fund and Short Duration Bond Fund.

Since they give a higher return compared to the Money Market Fund, your weighted returns will be higher!

This is in contrast to StashAway Simple, which has an equal weightage in the Money Market Fund, and the Enhanced Liquidity Fund. This could explain why StashAway Simple’s yield is lower compared to Syfe’s.

Can’t I just purchase these funds myself?

LionGlobal’s 3 funds are available on other platforms, such as FSMOne. You may be wondering if you should be purchasing them by yourself instead?

However, it may be more expensive for you to do so!

This is because Syfe Cash+ invests in the institutional share classes of each fund. These share classes have the lowest expense ratios of the different share classes.

If you were to invest in these funds by yourself, you will not be able to purchase the institutional share class. This is because they are only available for individuals with high net worth!

Even though the yield may be the same, the net returns you receive after fees may be lower!

What are the characteristics of Syfe Cash+?

Here are some characteristics of Syfe Cash+:

No minimum balance

Syfe does not have a minimum sum to use its cash management portfolio. As such you are able to put in any amount that you wish into this portfolio!

It also does not have a limit to how much funds you can have inside this portfolio. The amount you have will earn the same return, no matter the amount.

This is in comparison to the SingLife Account, which only allows you to earn 1.5% for your first $10k only.

You can transfer your funds to Syfe’s other investment portfolios anytime

Syfe makes it easy for you to transfer your funds to Syfe’s 4 investment portfolios:

You will be able to invest your funds which can help you earn potentially higher returns!

It may take around 2-3 business days for your transaction to be processed.

What are the fees that Syfe Cash+ charges?

Syfe Cash+ does not charge any management fees for using this portfolio. However, you will need to pay the fund-level fees, which have been taken into account by Syfe before they display the projected yield.

Here is a breakdown of the fees you may incur:

#1 Management fees

Both Syfe Cash+ does not charge any management fees to use this portfolio.

Moreover, you do not need to pay any fees whenever you make any buy or sell orders!

As such, you’ll be paying a lesser amount of fees! Ultimately, this will help to ensure you get higher returns on your investment.

The amount you have in Syfe Cash+ will not be considered in the total asset under management. You will only need to pay the fees for your funds invested in Syfe’s 3 investment portfolios.

#2 Fund-level fees

Even though Syfe Cash+ does not charge any fees, you’ll still need to pay some fees to LionGlobal.

This is because they will need to cover the costs of running the fund.

Here are the expense ratios of these 3 funds:

| Fund | Expense Ratio |

|---|---|

| LionGlobal SGD Money Market Fund | 0.35% |

| LionGlobal SGD Enhanced Liquidity Fund | 0.36% |

| LionGlobal Short Duration Bond Fund | 0.34% |

Based on the allocation of these funds for both portfolios, you’ll need to pay a blended expense ratio of 0.35%.

However, these fees are before the trailer fee rebates.

#3 Trailer fees (refunded)

Some funds will charge a trailer fee when you invest in their funds as well.

Trailer fees are fees that a fund manager pays a platform. This is similar to a commission that the platform receives for introducing the investor to the fund.

Both Syfe Cash+ provides you with a 0.30% rebate from the commissions that they earn. and StashAway Simple provide you with rebates from these trailer fees.

With these rebates that you receive, this will help to further lower your cost of investing!

What are the returns?

After accounting for fees, Syfe Cash+ has a projected yield of 1.5% p.a.

Syfe recently revised their projected return from 1.75% to 1.5%. This was done to reflect the low interest rate environment that we are currently now.

| Gross Return | 1.55% |

| Fund-level Fee | -0.35% |

| Overall Rebates | 0.3% |

| Management Fee | None |

| Projected Return | 1.5% |

However, this is only a projected return. The returns you receive may be higher or lower than this projected return.

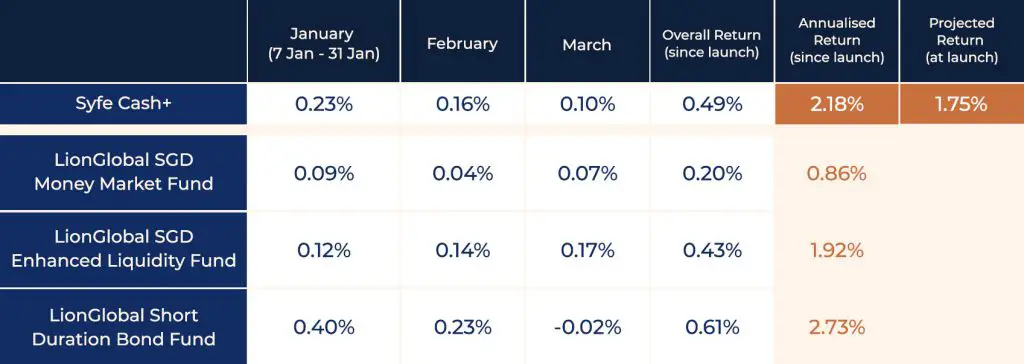

Syfe Cash+ actually had an annualised return of 2.18% (from 7 Jan to 31 Mar 2021), compared to its projected rate of 1.75%.

However, the returns have only been tracked for around 3 months. Over time, the returns may average out to be higher or lower than the 2.18% return.

Your returns will be credited daily into your Cash+ portfolio.

This is better compared to bank savings accounts which only credit your interest at the end of the month!

Moreover, both the Enhanced Liquidity and Short Bond Funds are accumulating share classes. Whatever returns that you earn will be reinvested into more units of the funds.

This is similar to accumulating ETFs which reinvest your dividends.

In the end, this will help to further compound the growth of your funds!

The projected return may fluctuate

The performance of these 3 LionGlobal funds heavily depends on the prevailing interest rates. This is because they contain many fixed income assets, such as:

- Domestic and international bonds

- Debt instruments

- Deposits with financial institutions

If the interest rates continue to be low, the returns you receive may decrease.

Syfe has revised their Cash+ rates, along with StashAway Simple and Endowus Cash Smart. All of them invest in similar funds that are dependent on interest rates.

However if interest rates continue to be low, you should expect a lower yield in the future!

Is Syfe Cash+ capital guaranteed?

Syfe Cash+ is not capital guaranteed as it invests your money into low-risk funds. The performance of these funds may fluctuate, and you may experience a negative performance on certain days. However, most of the underlying assets are very low-risk, which greatly reduces the chances of you losing all of your funds in Cash+.

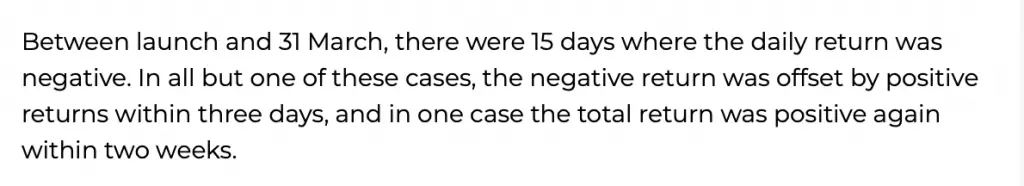

Based on the performance of Cash+ between 7 Jan – 31 Mar 2021, there were days when the daily return was negative.

In a few days during April 2021, the total value of my funds fell below my initial capital.

There are days when your portfolio’s value may be lower than the previous day. However, if you hold it for the long term, you should be able to receive an overall positive return.

This was also mentioned in Syfe’s email regarding Cash+:

Placing your funds in Syfe Cash+ is definitely riskier than placing it in a bank account. However, with higher risks comes better returns.

The performance may fluctuate, but you should be able to receive positive returns in the long run.

You’ll need to decide if you’re willing to take more risks to earn a better return on your cash!

If you aren’t willing to take the risk, you may want to consider capital guaranteed options, such as Dash PET.

How liquid is Syfe Cash+?

Syfe Cash+ takes around 3-4 business days to receive your deposits, and around 4-5 business days to process the withdrawal to your bank account.

When you are placing funds inside Cash+, you may be worried about the liquidity of your funds.

Here are the number of days it will take to deposit and withdraw your funds:

| Type of Transaction | Number of Days |

|---|---|

| Deposits | 3-4 business days |

| Withdrawal | 4-5 business days |

The withdrawal process may take quite a while! As such, I would recommend not to put your emergency funds inside Cash+.

In the event of an emergency, you may need the cash immediately. However, you can’t get your money from Cash+ straightaway!

I would think that Syfe Cash+ will be more suitable for your short term goals. These are planned purchases that you intend to make in the future, such as:

- Car

- House

- Tech gadgets

There may be a fixed date where you’ve set to make the purchase. This allows you to plan in advance and withdraw your money from Cash+ at least 1 week before the planned purchase!

Even though bank accounts have a lower return, they provide the best liquidity. As such, I believe that you should still leave your emergency fund in a savings account.

Is Syfe Cash+ safe?

Unlike bank accounts, Syfe Cash+ is not insured under the SDIC. In the event that Syfe closes down, you will not be able to receive any insurance payouts from SDIC.

However, your assets are held in a separate custodian account from Syfe. They are held in an account with HSBC Institutional Trust Services (Singapore) Limited.

If Syfe closes down, they are unable to touch your assets.

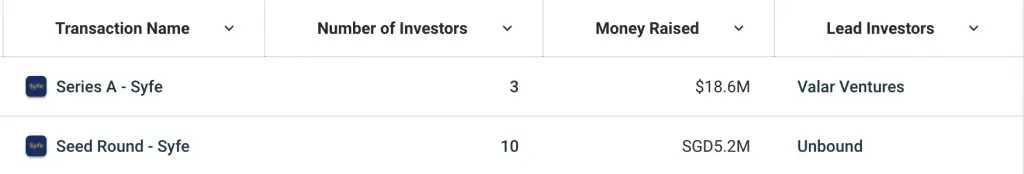

Syfe has received substantial funding

However, you may not need to worry so much about Syfe closing down. Syfe managed to secure USD$18.6 million in their Series A funding.

They received SGD$5.2 million in their seed funding too.

This alone doesn’t mean that Syfe is truly profitable. However, it is a good indicator that investors are confident in this company.

As such, this should give you some confidence that Syfe is here to stay!

Verdict

Here are some key pointers for this cash management portfolio:

The yield is one of the highest for a cash management portfolio

Syfe is just one of the many robo-advisors that have their own cash management portfolio. Compared to the others, Syfe gives the highest returns:

| Portfolio | Returns |

|---|---|

| Syfe Cash+ | 1.5% |

| StashAway Simple | 1.2% |

| Endowus Cash Smart Core | 0.8-0.9% |

| Endowus Cash Smart Enhanced | 1.2%-1.4% |

However, Endowus Cash Smart Ultra currently has the highest yield at around 1.8% – 2%.

There could be a few reasons for this:

- Syfe has a greater trailer fee rebate compared to StashAway

- Syfe does not charge any management fee (Endowus charges 0.05%)

Syfe Cash+ has no minimum investment

Syfe Cash+ does not have a minimum investment. You can invest any amount into this portfolio!

This is much better than Endowus which has stricter requirements:

- You are required to make an initial investment of $10,000

- Each subsequent transaction needs to be at least $100

Syfe Cash+ is much more accessible if you only want to save a small sum!

Cash+ takes a longer time to withdraw compared to StashAway Simple

The main drawback of Cash+ is the time taken for withdrawals to be processed.

It takes slightly longer compared to StashAway Simple (3-4 business days), but it is faster compared to Endowus Cash Smart (6-10 business days).

However, I still think that Syfe Cash+ may be worth that extra return in exchange for the slightly lower liquidity!

Conclusion

Syfe Cash+ provides a strong contender to place the money you’re saving for a short term goal.

With a higher yield and no minimum, you should be considering this if you want to earn a higher interest rate!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

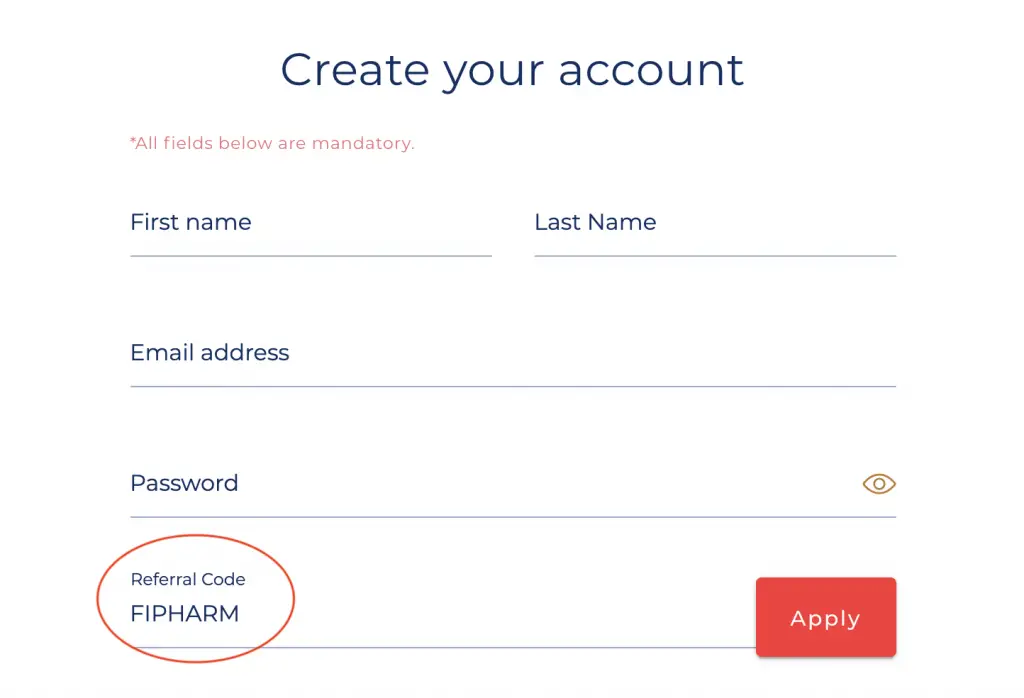

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 3 months.

You will be able to save up to $75 worth of fees!

This applies only to the money that you’ve invested in Syfe’s 3 portfolios. If you are using only Syfe Cash+, you will not be charged any fees by Syfe!

You can view more information about this referral program on Syfe’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?