Last updated on June 10th, 2021

There are around 17 different brokerages available in Singapore, so which one is suitable for you?

2 of the more popular platforms are Tiger Brokers and FSMOne. Here is a complete breakdown of these brokers:

Contents

- 1 The difference between Tiger Brokers and FSMOne

- 2 Type of Products Available

- 3 Types of Exchanges Available

- 4 Fees

- 5 Exchange Rates

- 6 App and Platform Experience

- 7 Ease of Opening Account

- 8 Deposits and Withdrawal

- 9 Pre and aftermarket trading

- 10 Type of funds you can use to invest

- 11 Research available

- 12 Type of Custodian Account

- 13 Verdict

- 14 Conclusion

- 15 👉🏻 Referral Deals

The difference between Tiger Brokers and FSMOne

Tiger Brokers charges lower commissions for each trade you make on its platform compared to FSMOne. However, FSMOne has more flexibility, as you can use your CPF and SRS funds to invest in a wider variety of products.

Here is an in-depth comparison between these 2 platforms:

Type of Products Available

Both brokerages offer different kinds of products:

Tiger Brokers offers basic products for your trading needs

You are able to buy the standard products from the different exchanges using Tiger Broker’s platform. This includes:

- Stocks

- ETFs

- Mutual funds

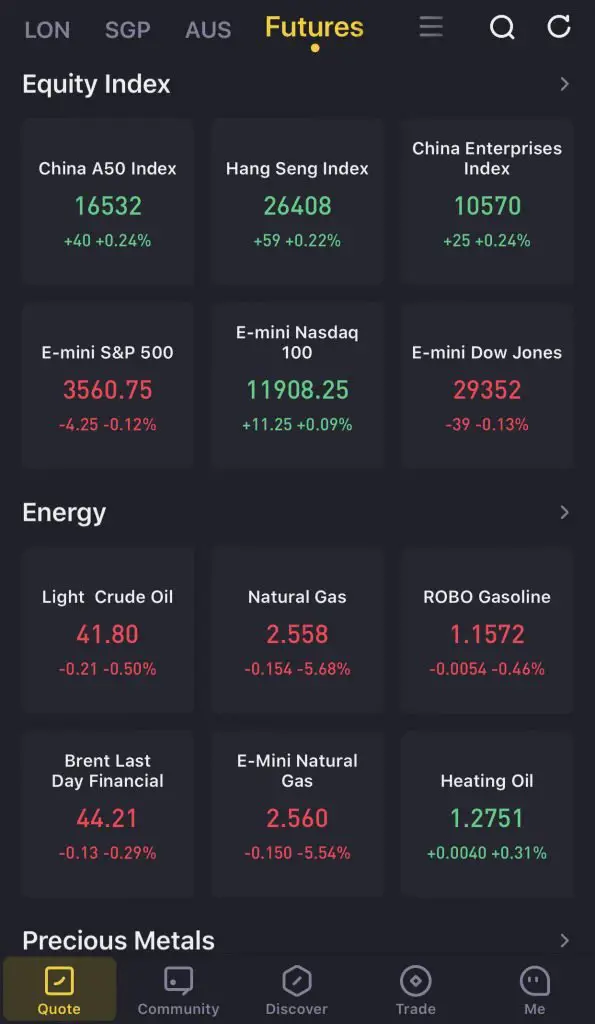

Tiger Brokers also offers you futures and options trading

You are able to trade futures and options on Tiger Broker’s platform, which is not available on FSMOne.

FSMOne offers a wider variety of products

You are able to buy a wider variety of products on FSMOne’s platform, compared to Tiger Brokers.

This includes:

- Stocks and ETFs

- Cash management solutions

- Regular Saving Plan

- Mutual funds

- Managed portfolio

- Insurance

FSMOne offers you interest for your uninvested funds

If you have some spare cash left in your FSMOne account, you are able to store your cash in 2 ways:

The multi-currency account gives you some interest on your uninvested funds

You are able to receive some interest on your funds, based on the currency it is in.

| Currency | Interest Rate |

|---|---|

| SGD | 0.25% |

| USD | 0.10% |

| HKD | 0.11% |

| CNH | 1.50% |

| NZD | 1% |

| JPY and EUR | Up to -2% |

| All other currencies | 0% |

You may want to take note that you can earn a negative interest rate on your JPY and EUR currencies!

All you need to do is to leave your money in your FSMOne cash account. The interest will be accrued over time.

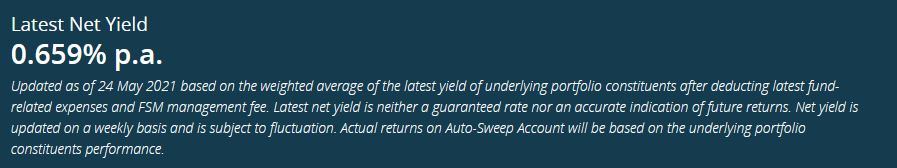

You can earn higher returns with FSMOne’s Auto-Sweep account

You can place your uninvested funds into FSMOne’s Auto-Sweep account. This is a cash management solution similar to accounts like:

As of 24 May 2021, you will earn a yield of 0.659% p.a.

For the uninvested funds that you have with Tiger Brokers, you are unable to earn any interest on them.

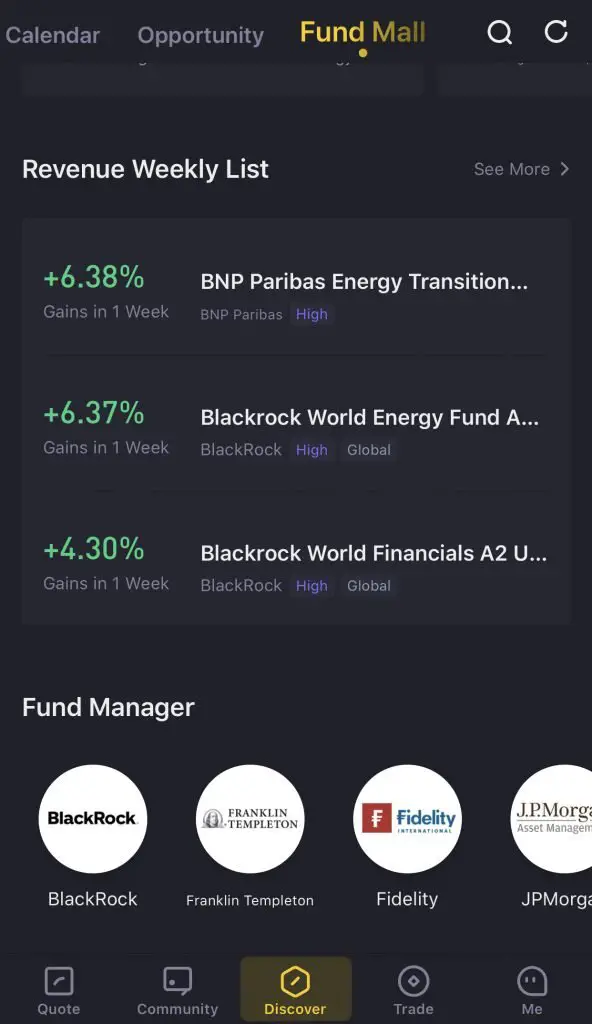

FSMOne has a larger variety of mutual funds

Although Tiger Brokers has its Fund Mall, it is very limited to a few mutual funds that you can invest in.

FSMOne provides a larger variety of mutual funds you can invest in.

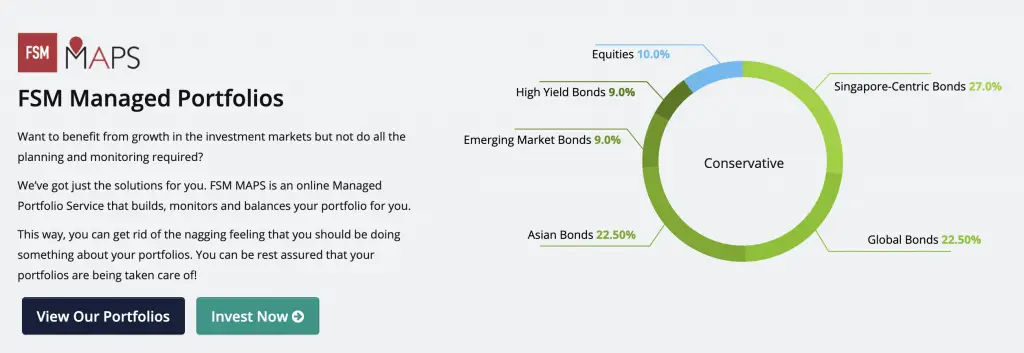

FSMOne offers to manage a portfolio for you

If you do not want to manage your own portfolio, FSMOne has its Managed Portfolio (MAPS) solution for you. This is similar to a robo-advisor, where you are given a portfolio based on your risk appetite.

This is great if you are just starting your investment journey. However, you will need to consider the management fees as well as the minimum sums to invest.

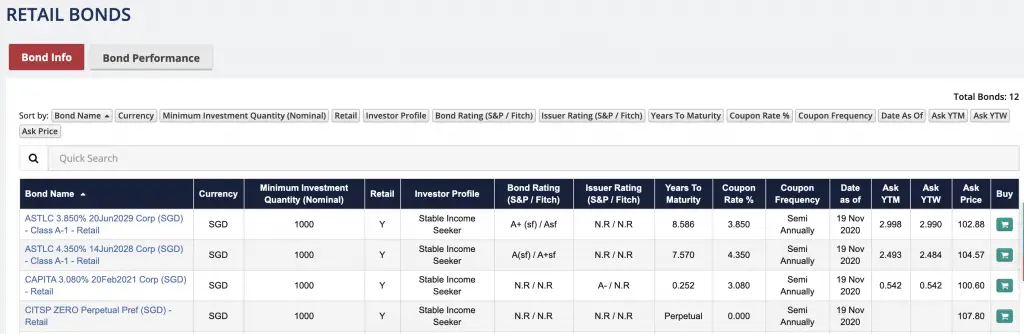

FSMOne allows you to purchase bonds

You can invest in bonds using FSMOne’s platform as well. For retail and SGS bonds, the minimum investment amount is $1,000.

However, you may want to note that the minimum investment amount for wholesale bonds is $250,000, which is a sum most cannot afford.

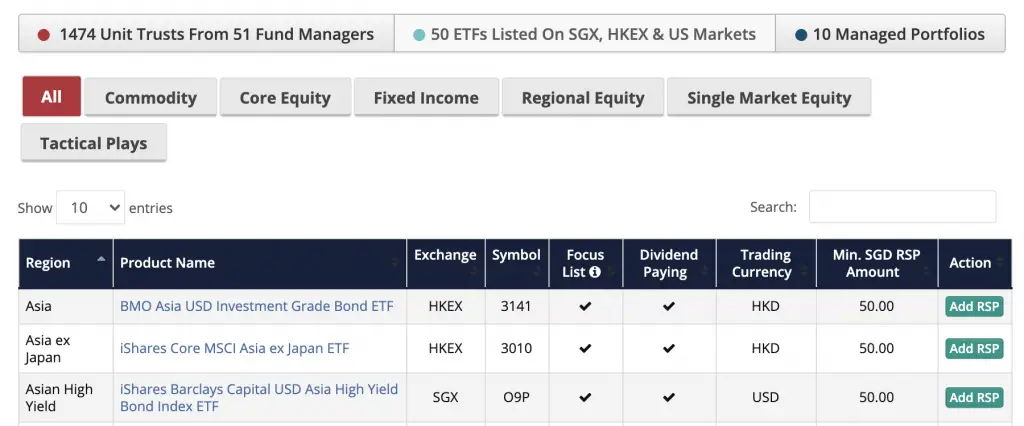

Regular savings plan into ETFs and mutual funds

FSMOne allows you to RSP into both ETFs and mutual funds. This is in contrast to Tiger Brokers which only allow you to RSP into mutual funds.

As such, you are able to dollar cost average into ETFs that are listed on SGX, HKEX and US markets.

FSMOne’s ETF RSP allows you to invest into markets outside of Singapore. This allows you to buy a greater variety of ETFs compared to OCBC BCIP, Invest Saver or POEMS’ Share Builders Plan.

FSMOne allows you to buy insurance too

Last but not least, you are able to buy insurance with FSMOne as well! You are able to buy Motor and Travel insurance on FSMOne’s platform.

Furthermore, FSMOne partners with insurance companies such as Manulife, NTUC Income, FWD and more to offer you a variety of health and term insurance products.

To sweeten the deal, they also boast a 30 – 45% rebate on commission for up to 6 years!

FSMOne is the clear winner for types of products

In terms of the types of products that both platforms offer, FSMOne is the better option!

However if you are just looking at a platform to buy stocks and ETFs, then it will not really matter for you.

Types of Exchanges Available

Here are the different exchanges that you are able to trade on using both platforms:

| Exchange | Tiger Brokers | FSMOne |

|---|---|---|

| SGX | ✓ | ✓ |

| HKEX | ✓ | ✓ |

| US | ✓ | ✓ |

| ASX (Australia) | ✓ | ✕ |

| SZSE and SSE (China) | ✓ | ✕ |

Tiger Brokers allows you to invest in Australian and China stocks, which FSMOne does not offer you. As such, Tiger Brokers has a slightly wider variety of exchanges to invest in.

Fees

Across the 3 similar exchanges, Tiger Brokers charges lower commission fees:

| Exchange | Tiger Brokers | FSMOne |

|---|---|---|

| SGX | 0.08% * trade value No minimum (until 31 Dec 2021) 2.88 SGD/trade (after 31 Dec 2021) | SGD 8.80/trade |

| HKEX | 0.06% * trade value Min 15 HKD/trade | 0.08% * trade value Min HKD 50 |

| US | 0.01 USD/share Min 1.99 USD/trade | 0.08% * trade value Min USD 8.80 |

Tiger Brokers has a lower minimum commission for all 3 exchanges. If you are investing a smaller sum, it will be more cost effective to purchase your stocks with Tiger Brokers.

Fees incurred for trading in respective exchanges

On top of the fees that you pay for each platform, you will be charged exchange-specific fees as well. These fees are the same across both brokerages.

Tiger Brokers has a more affordable pricing structure

When comparing both pricing structures, Tiger Brokers does offer you cheaper fees. Both brokerages allow you to invest in the same products across these 3 exchanges.

As such, it may be more cost effective to invest using Tiger Brokers.

Exchange Rates

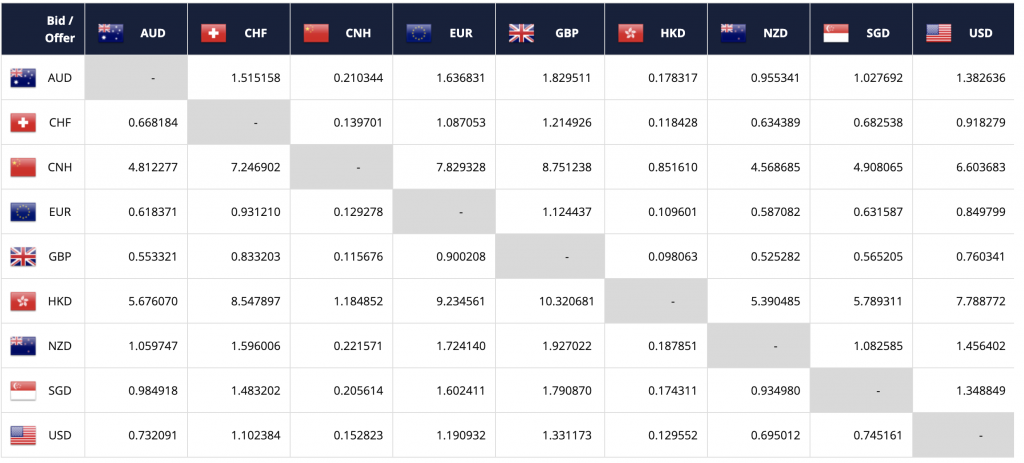

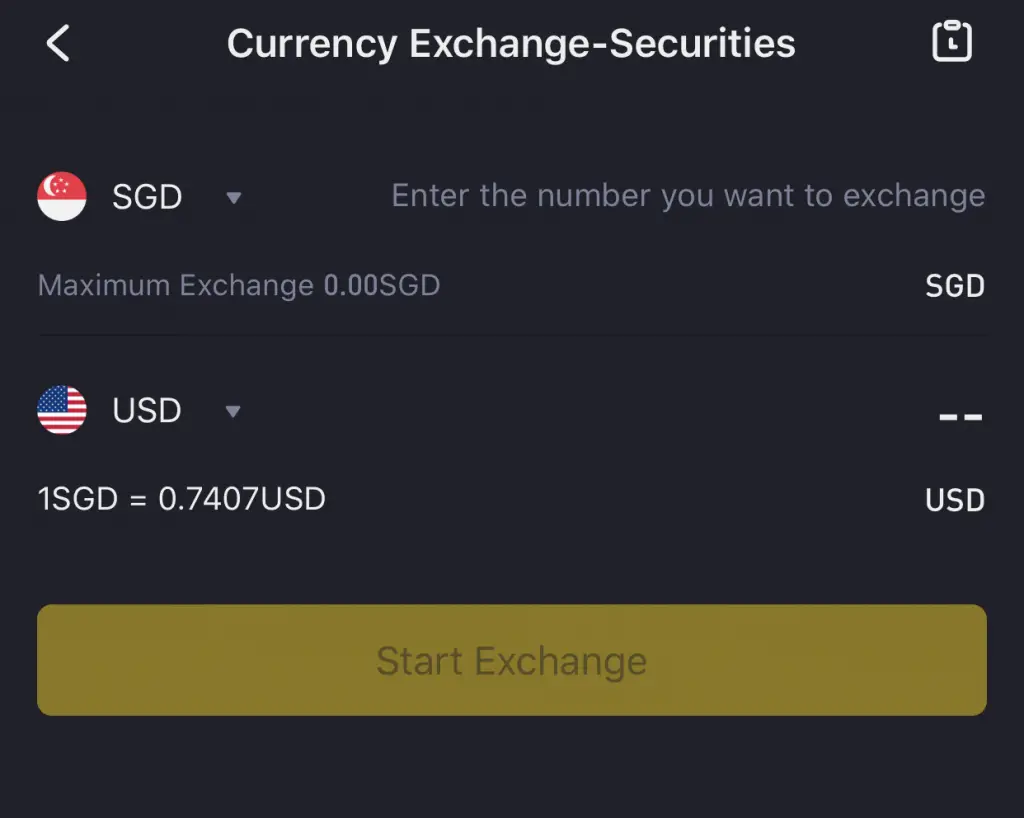

Both platforms offer pretty similar exchange rates. Here is FSMOne’s exchange rates compiled into one table,

And here is Tiger Broker’s rate for converting SGD to USD at the same time:

App and Platform Experience

The user experience on the brokerage platform may help you to decide on a broker.

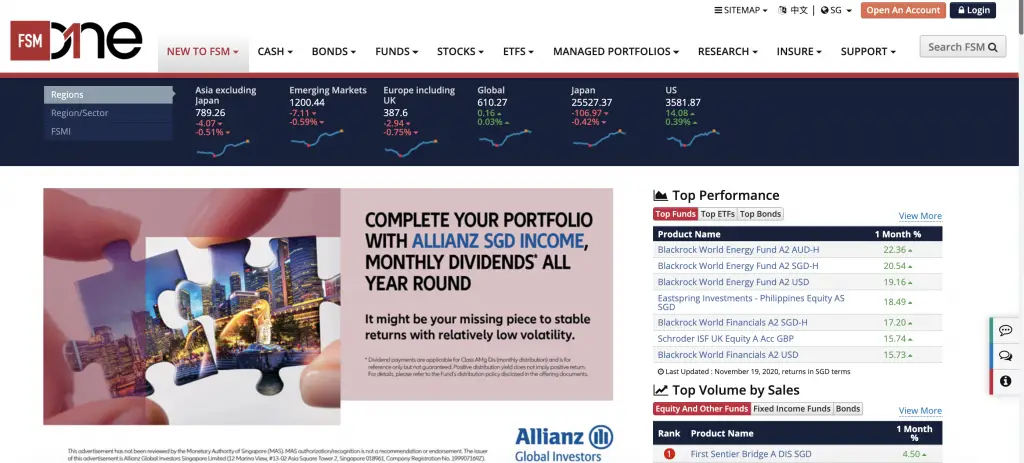

FSMOne has a poorer user experience, especially on the mobile app

FSMOne has a pretty solid web platform that allows you to purchase their various products.

However, I feel that their menus can be quite overwhelming and hard to navigate at times.

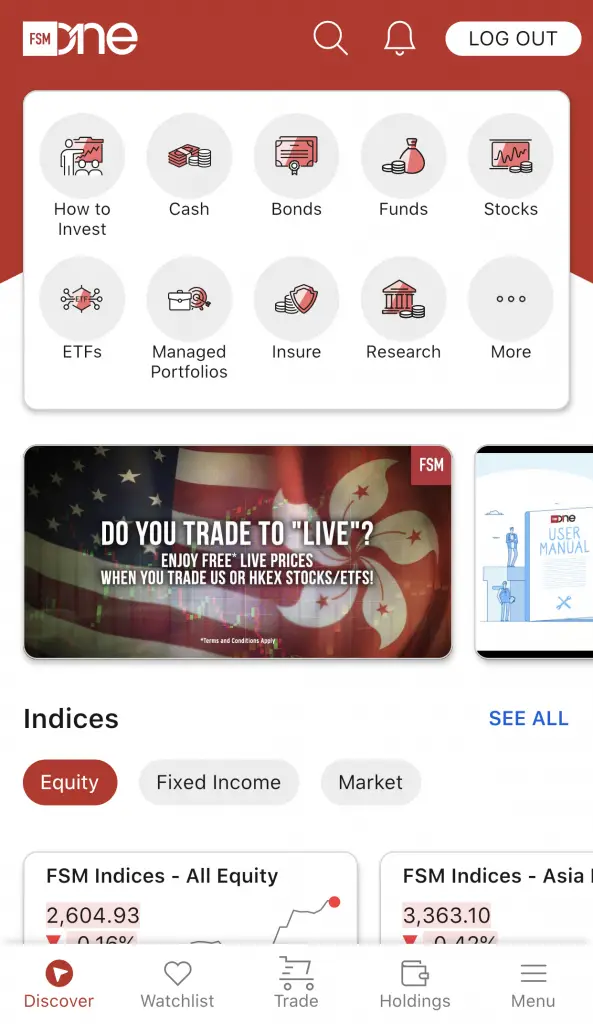

FSMOne’s mobile app used to be rather outdated. They did revamp it, and it looks much better now.

However, I feel that the app can be pretty hard to navigate around too. Pulling the information for a certain ETF may also take a while.

Tiger Brokers provides a much better experience

In general, Tiger Brokers has a much better user experience. The platform is sleek, loads fast and is very easy to use.

However, some pages are still in Chinese, which could have been due to migration problems.

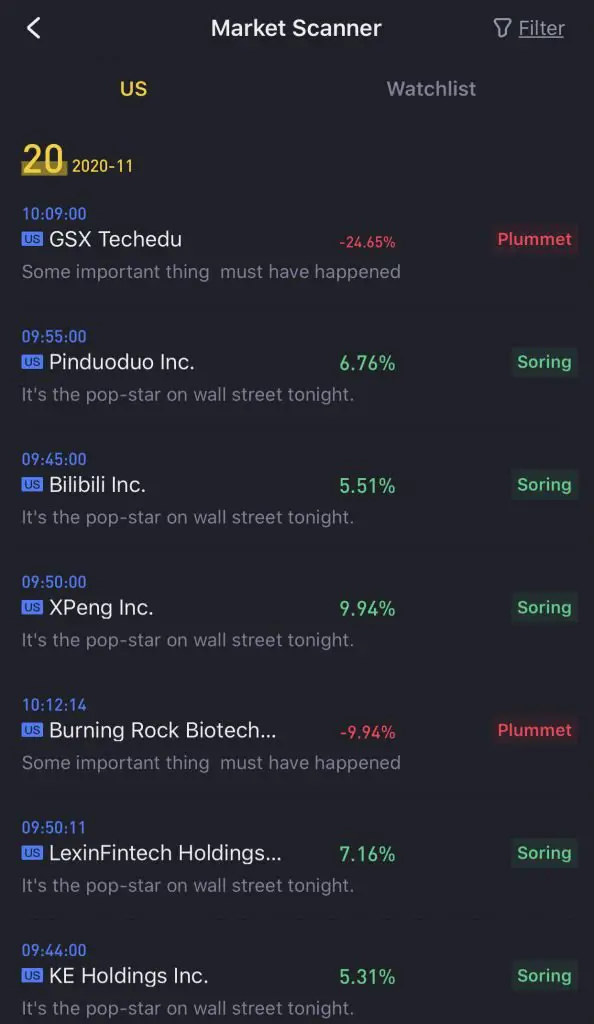

Some of the pages have broken English as well.

This could lead to a frustrating experience, especially if you’re trying to view the latest headlines!

Ease of Opening Account

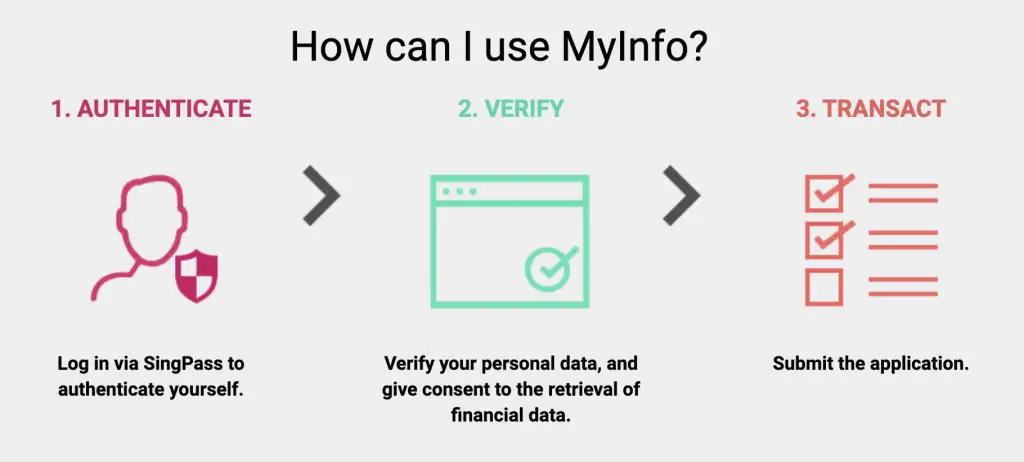

Both Tiger Brokers and FSMOne use MyInfo during the signup process.

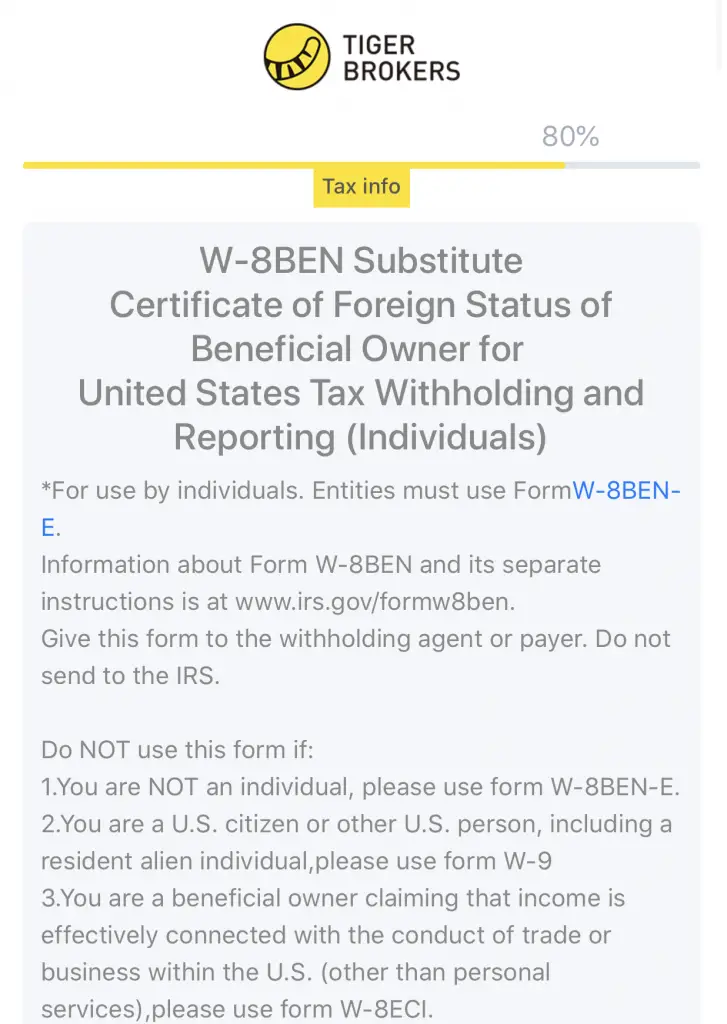

However, the process is much faster when you’re signing up for a Tiger Brokers account. If you wish to trade in the US markets, you are required to sign a W-8 BEN form to declare that you are a non-US citizen.

For Tiger Brokers, you can sign the W-8 BEN form digitally.

Once your account has been approved, you can start trading US stocks right away!

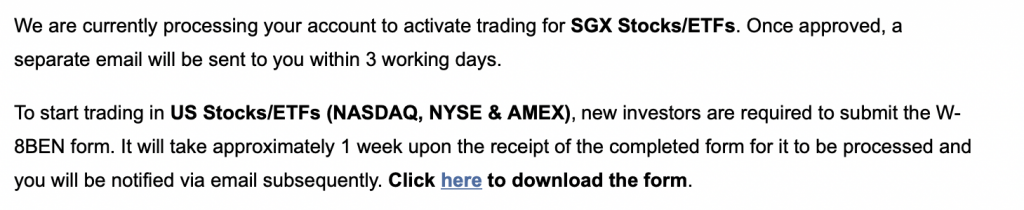

However for FSMOne, you will have to fill up the W-8 BEN form and send it to them.

It may take up to 1 week before your account is approved.

As such, Tiger Brokers has a faster sign up process especially if you wish to trade in US stocks.

Deposits and Withdrawal

Both online brokerages are pre-funded accounts. This means that you will have to fund your account with either Tiger Brokers or FSMOne first before you can start trading.

No minimum sum to maintain

Both online brokerages do not have a minimum sum to maintain in your account. This is great if you only have a small sum to invest.

Deposits are almost instant for FSMOne

When you deposit funds into your FSMOne Cash Account, it is almost instant. I transferred money to them on a Sunday night and I received this notification almost instantly!

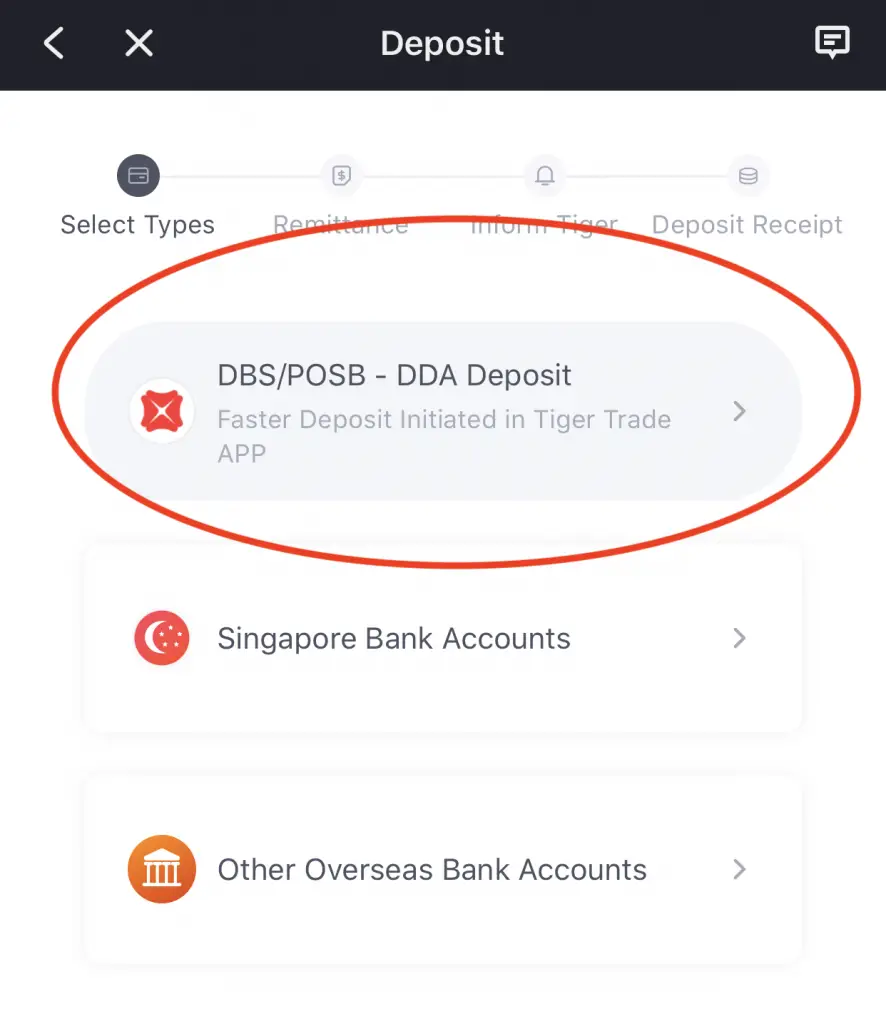

It may take a while longer for Tiger Brokers to receive your deposits. It normally takes around 1-2 hours before your funds are reflected in your account.

However, if you have a DBS or POSB account, you are able to transfer your funds via Direct Debit.

This allows you to deposit your funds almost instantly as well.

Withdrawals may take slightly longer

If you wish to withdraw money from both online brokerages, it may take between 1-2 business days for the funds to reach your account.

If you are not withdrawing in SGD or are transferring to an overseas account, you may need to pay additional charges.

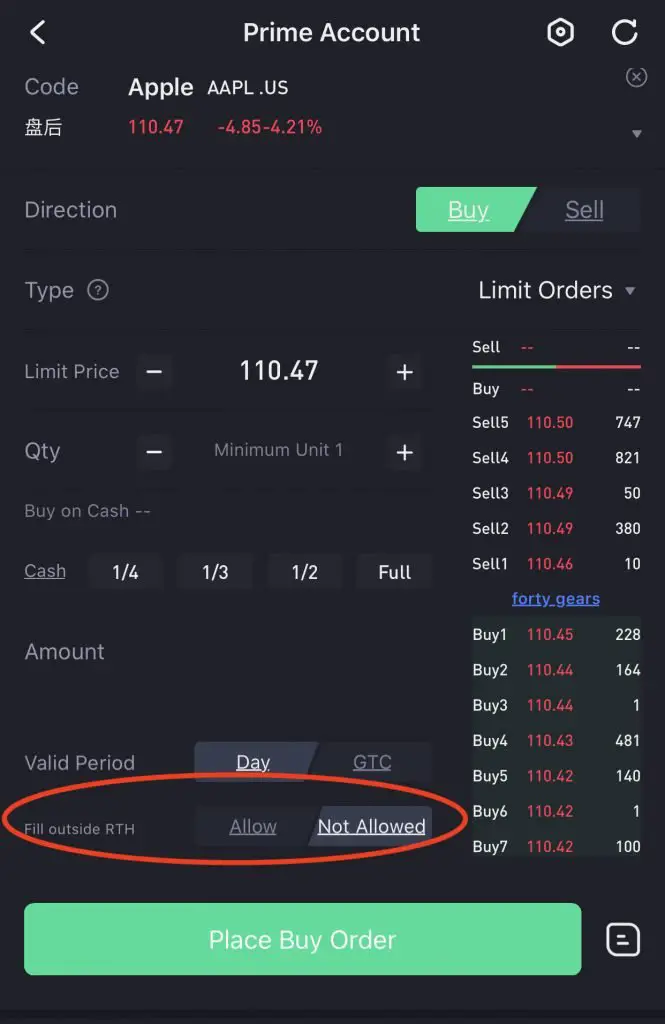

Pre and aftermarket trading

Tiger Brokers allows you to conduct pre- and aftermarket trading on its platform. Here are the timings for the 3 periods in Singapore time (GMT +8).

| Trading Period | Timing (GMT +8) |

|---|---|

| Premarket | 1600-2130 |

| Regular Trading | 2130-0400 |

| Aftermarket | 0400-0800 |

To enable pre and aftermarket trading, you will need to enable the ‘Fill Outside RTH‘ option on the trading page.

This feature is not available on FSMOne’s platform.

Type of funds you can use to invest

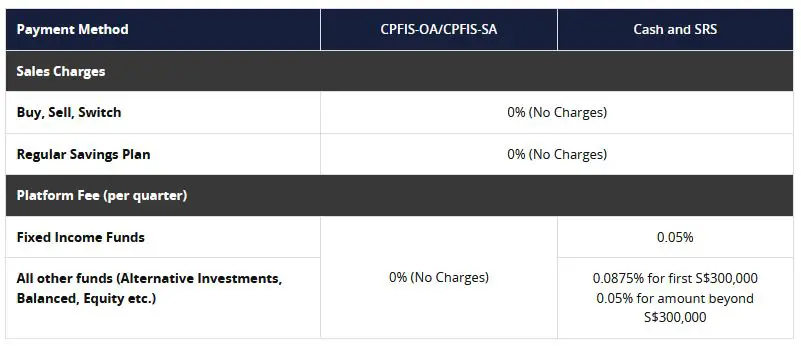

FSMOne allows you to invest your CPF and SRS funds into SGX stocks and selected mutual funds.

However, you are unable to do so with Tiger Broker’s platform. If you are looking for a place to invest your CPF and SRS, FSMOne may be the better option for you.

Research available

Brokerage firms may provide some research that their firm’s analysts have conducted. These information can be useful in helping you decide which investments you should buy.

Tiger Brokers does not provide much research

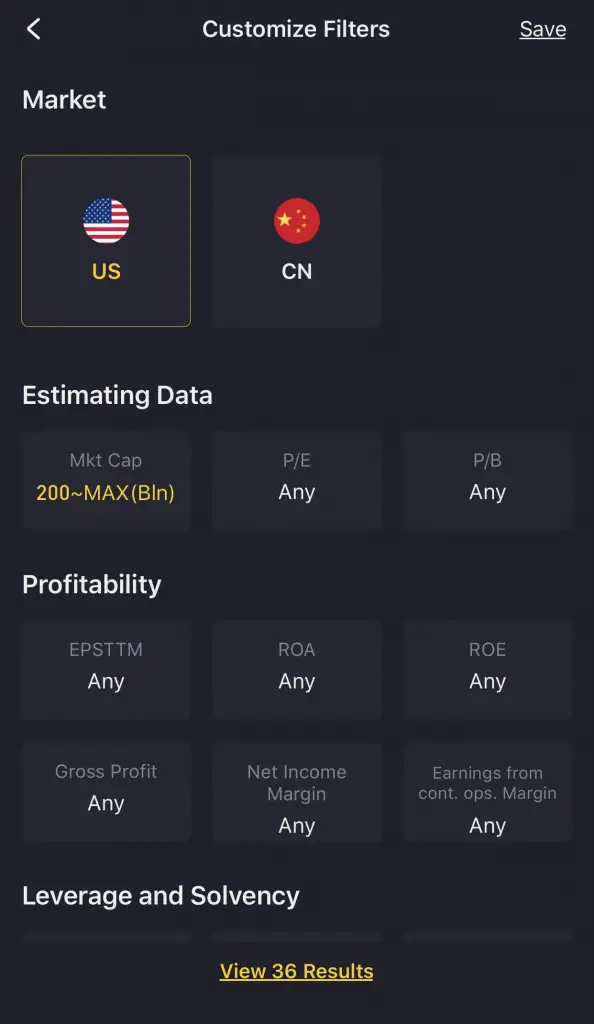

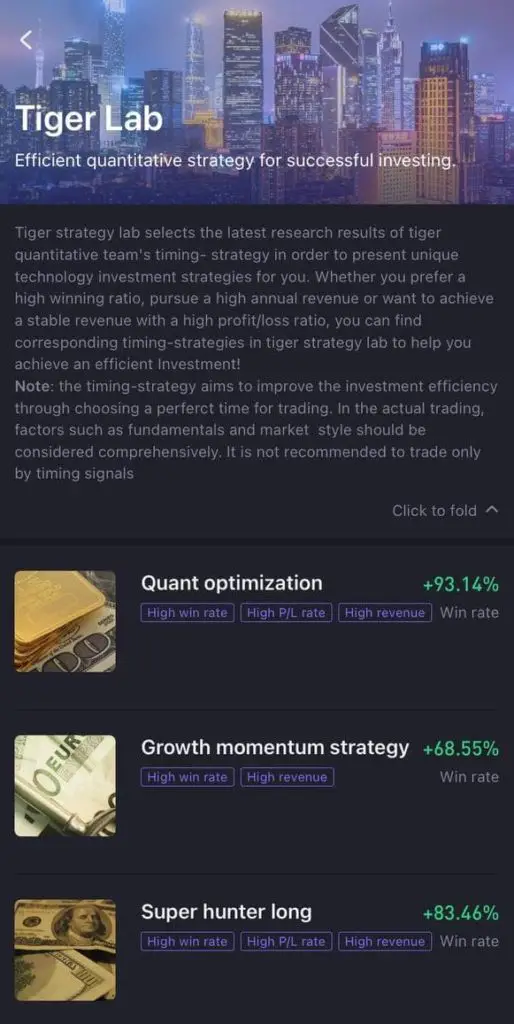

Tiger Brokers does have a rather limited stock screener,

and provides quant screening in its Tiger Lab section as well.

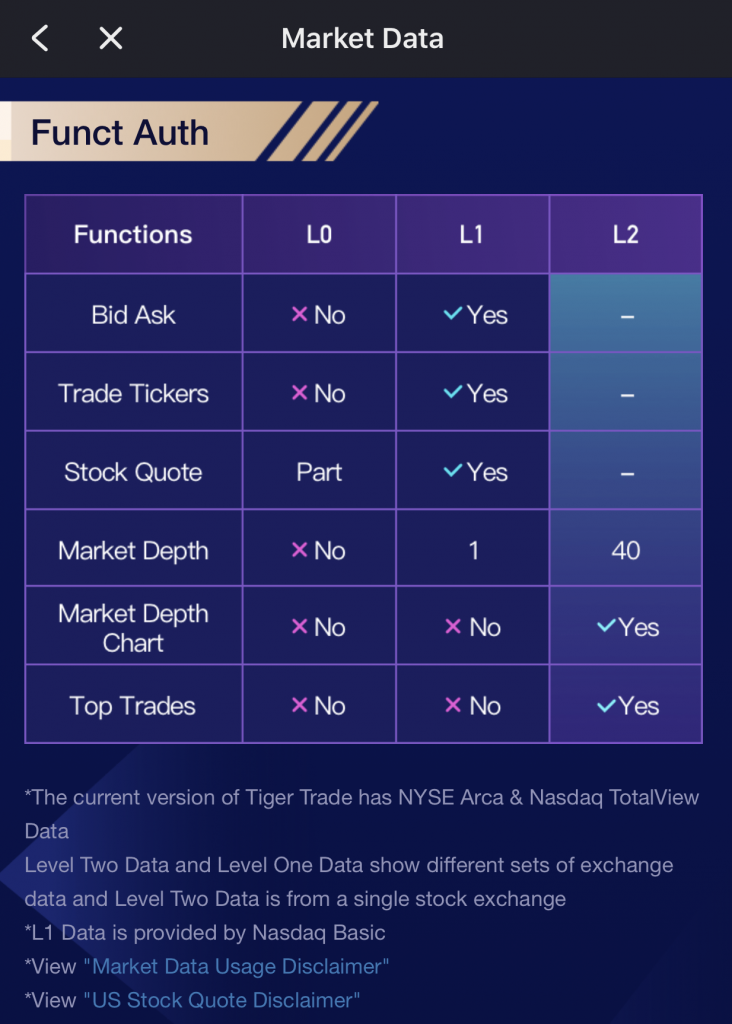

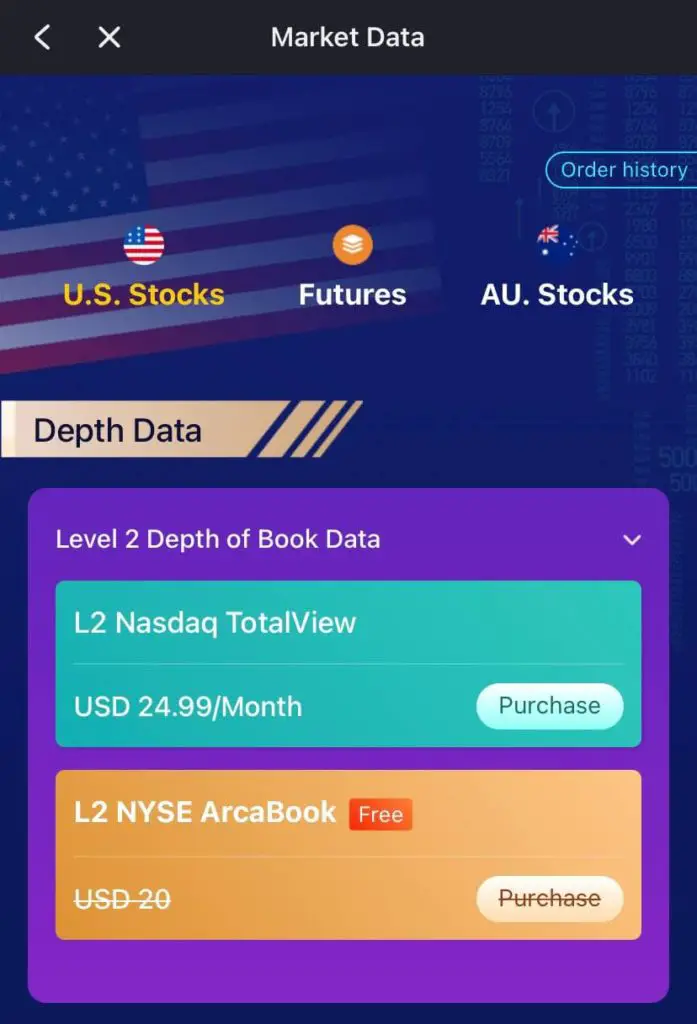

You are able to view Market Data for US stocks, Australia stocks and futures.

However, you would need to pay for the higher level market data.

Tiger Brokers does offer valuable information for each individual stock.

However if you are not familiar with these indicators, they are pretty much useless to you.

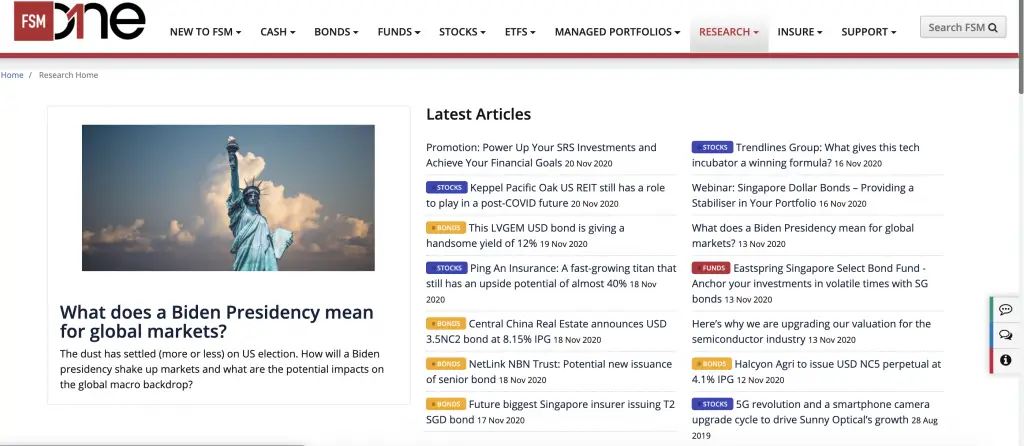

FSMOne has an extensive research hub

FSMOne has in-house analysts that write articles on the latest investment news.

The analysts provide in-depth articles that justify why a certain investment is worth buying now.

These articles are divided into categories including:

- Macro research

- Bonds

- Mutual funds & ETFs

- Stocks

If you are looking for ideas, FSMOne’s research hub may be something you can consider using.

However, don’t forget to do your own research first before following any advice given on FSMOne’s platform!

Type of Custodian Account

When you trade your assets on both brokerage firms, your assets will be under a custodian account. However, the way that both brokerages keep your assets are slightly different.

Tiger Brokers has a 3rd party custodian account for you

Tiger Brokers uses 3rd party custodians to manage your assets for you.

DBS bank manages your Singapore assets while Interactive Brokers handles your assets from other countries.

This is part of the requirements of the Capital Markets License that Tiger Brokers has.

In the unfortunate event that Tiger Brokers closes down, your assets are still kept safe under these custodian accounts.

This 3rd party custodian account arrangement is similar to what robo-advisors use as well.

Your assets with FSMOne are kept under a custody account with iFAST

When you trade with FSMOne, your assets will be in a custody account with iFAST. iFAST is the parent company of FSMOne.

For your HKEX and US-listed securities, they will be under the custody of iFAST’s appointed custodians.

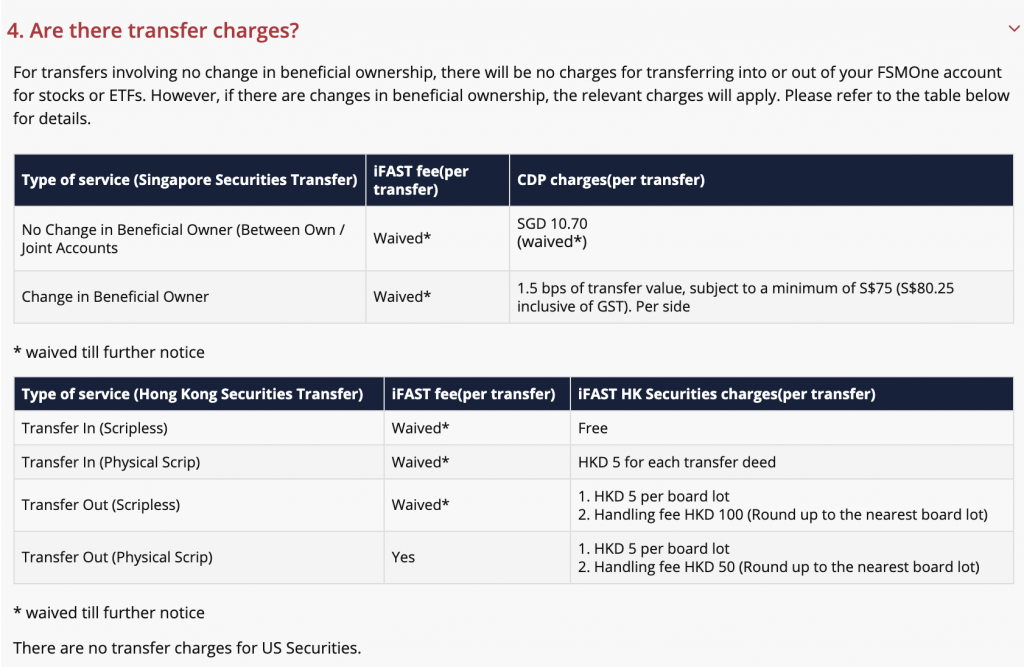

iFAST is also a CDP Approved Depository Agent. This means that it is possible for you to transfer your assets to your CDP account. However, these transfer charges can be pretty hefty.

Another method you can use is to link your CDP account with FSMOne. This will allow you to use FSMOne’s platform to sell your CDP stocks and ETFs.

Verdict

Here is a head-to-head comparison of both brokerages:

| Tiger Brokers | FSMOne | |

|---|---|---|

| Type of Products Available | Stocks ETFs Mutual funds Futures Options | Stocks ETFs Mutual funds Cash management Regular Savings Plan Managed Portfolio Insurance |

| Number of Exchanges Available | 5 countries | 3 countries |

| Trading Commissions | Lower | Higher |

| Exchange Rate | Comparable | Comparable |

| App and Platform Experience | Better | Poorer |

| Ease of Opening Account | Faster | Slower |

| Pre and Aftermarket Trading | Present | Absent |

| Funding Account Speed | Almost instant (Direct debit) | Almost instant |

| Market Research Available | More data driven which may require payment | Extensive Research Hub that provides in-depth articles |

| Type of Funds Available to Invest | Cash only | Cash SRS CPF |

| Custodian Account | 3rd party (e.g. DBS) | iFAST |

So which brokerage should you be using?

Choose Tiger Brokers if you are looking for cheaper fees

Tiger Brokers has cheaper trading commissions compared to FSMOne. Moreover, it offers you access to Chinese and Australian markets.

One of the ways to receive higher returns on your investments is by keeping your costs low. If you are investing with a smaller sum, Tiger Brokers may be the better choice for you.

Choose FSMOne if you wish to purchase a wider variety of products

FSMOne offers an extensive list of products that you can choose from. This includes regular savings plans, managed portfolios and cash management.

Earning some interest on your uninvested funds could be something attractive for you as well.

Although the fees are more expensive, FSMOne’s commissions are still quite competitive compared to other brokerages.

I would recommend you to use FSMOne if you:

- Prefer to have someone manage your portfolio for you

- Prefer to dollar cost average into a certain ETF

Conclusion

Both brokerages do have their advantages. Ultimately, it depends on what you are looking for in a broker, such as:

- The fees that you’ll have to pay

- The exchanges you can trade in

- The types of products you can purchase

- The amount of research data you can obtain

- The type of funds you can invest in

If you decide to use both brokers, you can track your portfolios from these 2 brokerages using StocksCafe.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Tiger Brokers Referral (Free AAPL Share and 60 Commission-Free Trades)

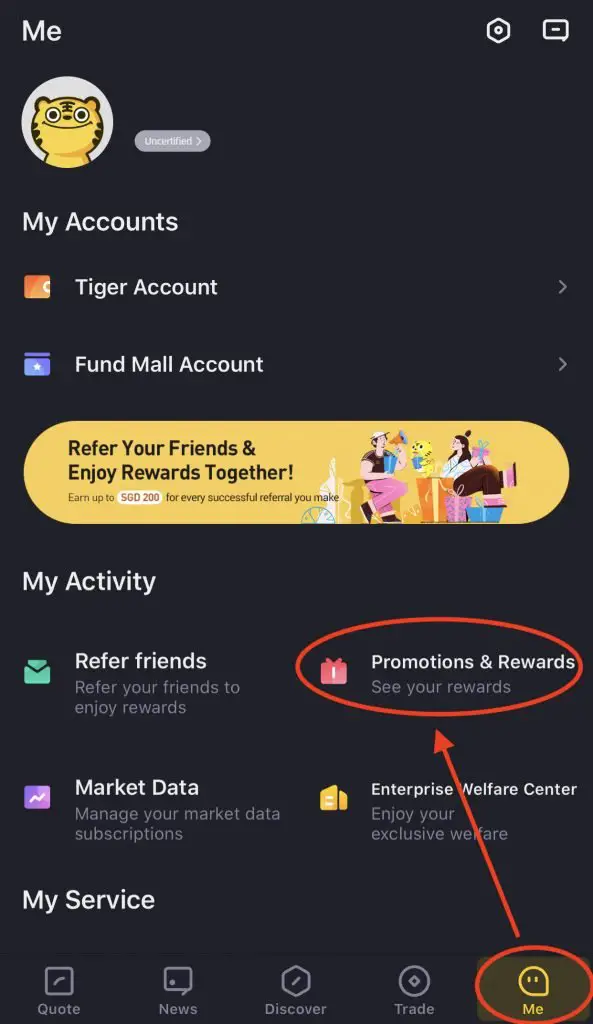

If you sign up for a Tiger Brokers account using my referral link, you will be eligible for some rewards. You can view and claim your rewards by going to ‘Me → Promotions & Rewards‘.

Here are 3 bonuses that you can receive:

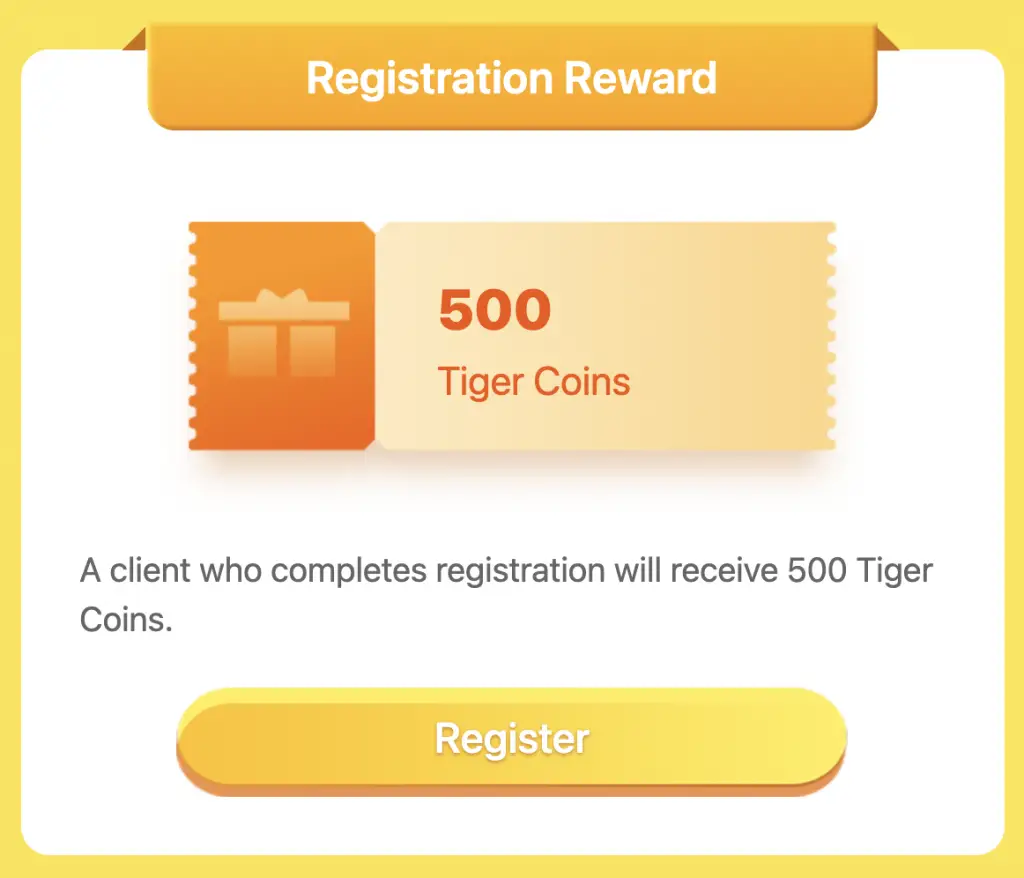

#1 Registration Reward

When you register for a Tiger Brokers Account, you will receive 500 Tiger Coins.

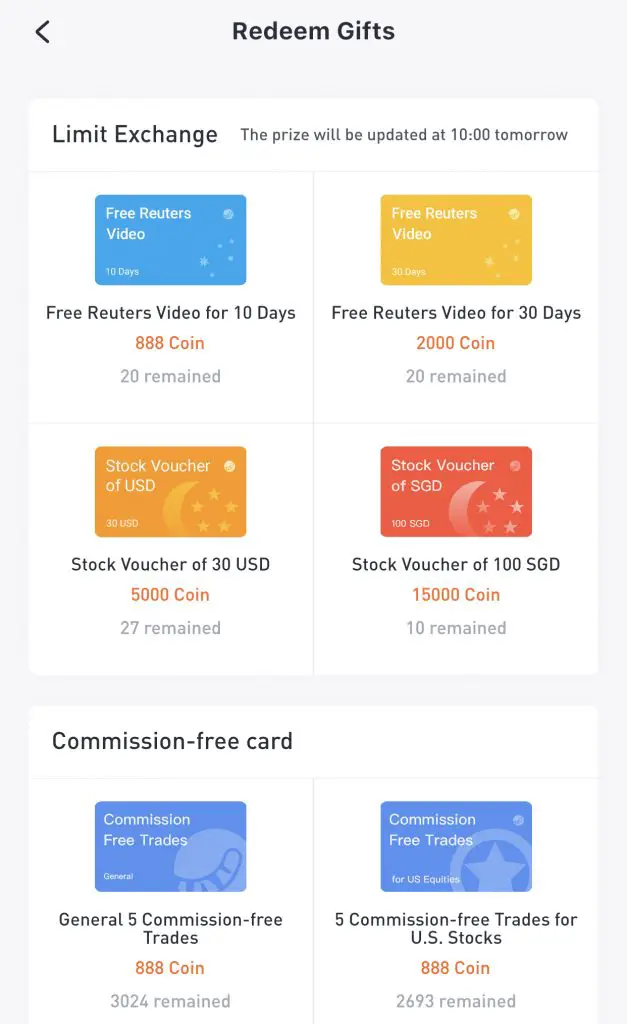

These Tiger Coins can be used to redeem a variety of rewards, such as:

- Stock vouchers

- Commission-free trades

- Reuters videos

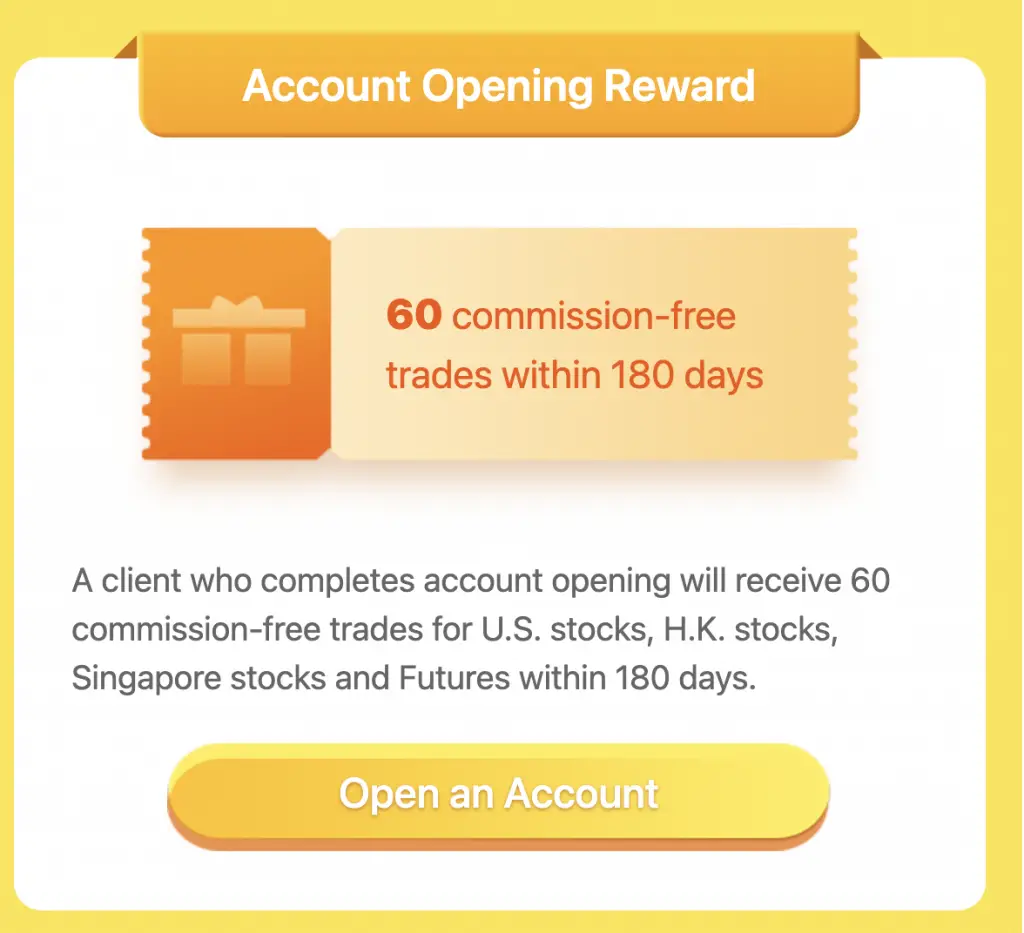

#2 Account Opening Reward

After successfully opening your account, you will receive 60 commission-free trades that you need to use within 180 days.

These commission free trades can be used for:

- US stocks

- HK stocks

- Singapore stocks

- Australia stocks

On top of that, you will receive 5 commission-free trades for futures within 30 days.

You will still need to pay the commission first. The commission should be refunded to you on the next working day.

#3 Funding Reward

If you fund at least $2,000 SGD into your Tiger Brokers account for your very first deposit, you will receive a free Apple (AAPL) share.

The shares will be added into your account within 10 working days.

On top of that, you will receive a stock voucher (SGD5) for SGX stocks only.

You can view the terms and conditions of this promotion on Tiger Brokers’ website.

FSMOne Referral

If you would like to create an FSMOne account, you can enter my account number ‘P0381515‘ into the referral code field.

I will receive 1,000 reward points for referring you. Although you do not receive any benefits, I would appreciate your support!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?