Last updated on August 16th, 2021

There are so many robo-advisors that are available in Singapore. 2 of the more popular ones include Endowus and MoneyOwl.

How are they different and which one should you be choosing?

Contents

- 1 The difference between Endowus and MoneyOwl

- 2 Type of mutual funds they invest in

- 3 Investment strategy

- 4 Investment portfolios offered

- 5 Cash management portfolios offered

- 6 Currency denomination

- 7 Fund domicile

- 8 Performance

- 9 Dividend distribution

- 10 Funds you can invest with

- 11 Minimum sum to invest

- 12 Fees

- 13 Type of account used to handle your assets

- 14 Web platform

- 15 Mobile app

- 16 Verdict

- 17 Conclusion

- 18 👉🏻 Referral Deals

The difference between Endowus and MoneyOwl

Both robo-advisors invest your money into mutual funds. However, MoneyOwl only uses Dimensional funds while Endowus uses mutual funds from different managers.

Here’s an in-depth comparison between these 2 robo-advisors:

Type of mutual funds they invest in

Here are the different types of mutual funds that these robo-advisors invest in:

MoneyOwl only uses funds from Dimensional

MoneyOwl only uses funds that are being managed by Dimensional. MoneyOwl chose them as the fund provider as these funds are:

- Broadly diversified

- Market-based

- Low cost

Previously, the only way you could purchase these Dimensional funds would be via a financial advisor. However, MoneyOwl now offers this funds at a lower cost!

MoneyOwl uses 4 different funds managed by Dimensional in your different portfolios.

Endowus uses funds from different firms

Apart from Dimensional funds, Endowus also offers funds from many well-known firms, such as:

- Pimco

- Eastspring Investments

- First Sentier Investors

- Vanguard

- Schroders

If you were to invest in these funds by yourself, they are usually very costly. Endowus provides access to these funds at a lower cost.

These funds that you can purchase are institutional share classes. This means that you’ll be charged the lowest expense ratio among the different share classes.

These share classes would normally require you to have a minimum investment of around $200k!

Investment strategy

Both Endowus and MoneyOwl have a similar investing strategy. They both offer funds that invest in 2 different asset classes:

- Equities (i.e. stocks)

- Bonds

Based on the risk profile and time horizon that you have, both robo-advisors will decide the best asset allocation for you.

Your money will be allocated into equities if:

- You have a higher risk profile

- You have a longer time horizon

If that is not the case, your portfolio will have a higher weightage in bonds.

Investment portfolios offered

Here are the types of portfolios that both robo-advisors offer you:

Endowus offers 6 different portfolios based on your risk profile

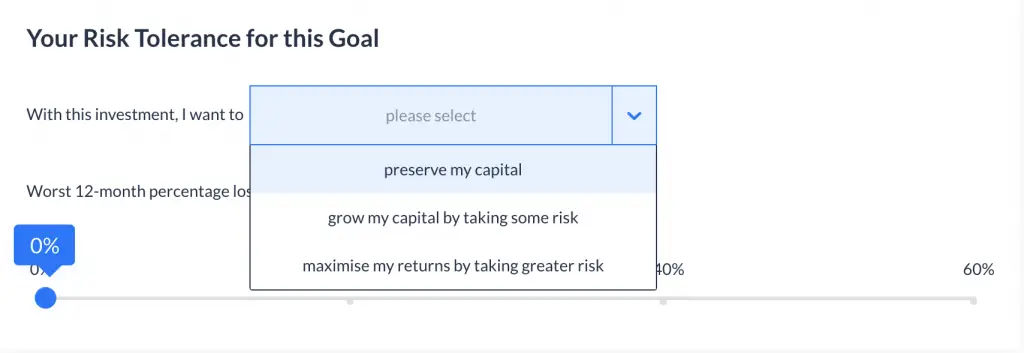

When you create a portfolio with Endowus, you’ll be asked about your risk tolerance.

Endowus will then suggest a portfolio for you based on your risk tolerance and time horizon. These portfolios will allocate your money into 2 different asset classes:

- Equities

- Fixed Income

| Portfolio | Equities | Fixed Income |

|---|---|---|

| Very Aggressive | 100% | 0% |

| Aggressive | 80% | 20% |

| Balanced | 60% | 40% |

| Measured | 40% | 60% |

| Conservative | 20% | 80% |

| Very Conservative | 0% | 100% |

The higher your risk tolerance, the greater the allocation towards equities and vice versa.

There are 2 types of advised portfolios that you can create with Endowus: Core and ESG portfolios. You can view my comparison between these portfolios to see which one is more suitable for you.

Different funds are available for you

The funds that are being used to invest both your Cash and SRS funds are the same. However, the CPFIS Scheme limits the number of funds that you can invest your CPF in.

Another difference is that the Endowus currently does not offer an ESG portfolio for your CPF funds.

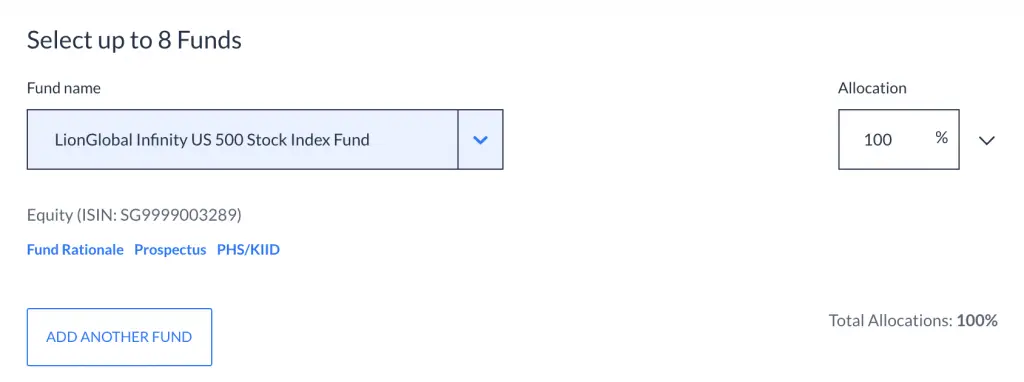

Endowus also offers a Fund Smart portfolio

Endowus also has a Fund Smart portfolio. This allows you to customise your portfolio to just the way that you like!

You get to decide:

- Which funds you want to invest in

- The allocation you wish to have in each fund

If you want to just invest in the S&P 500, you can create a portfolio that is 100% allocated into the Infinity US 500 Stock Index Fund.

The main advantage of using Fund Smart is that you get access to these mutual funds at the lowest cost possible!

MoneyOwl offers 5 different portfolios

MoneyOwl provides 5 different portfolios that have a different allocation into the 4 Dimensional funds.

When you are creating your portfolio, you will need to answer a questionnaire that determines your time horizon,

and some questions to determine your risk profile.

Based on your answers, MoneyOwl will determine the best portfolio for you.

Here are the asset allocations for the 5 different portfolios that MoneyOwl offers:

| Portfolio | Equities | Bonds |

|---|---|---|

| Equity | 100% | 0% |

| Growth | 80% | 20% |

| Balanced | 60% | 40% |

| Moderate | 40% | 60% |

| Conservative | 20% | 80% |

The portfolios being offered by Endowus and MoneyOwl are very similar. The only difference is that MoneyOwl does not offer a 100% bond portfolio.

Here are the 4 Dimensional Funds that MoneyOwl uses:

| Asset Class | Funds Used |

|---|---|

| Global Equities | Dimensional Global Core Equity Fund Dimensional Emerging Large Cap Core Equity Fund |

| Global Bonds | Dimensional Global Core Fixed Income Fund Dimensional Global Short Fixed Income Fund |

MoneyOwl does not use the Dimensional World Equity Fund, which can be found in Endowus Fund Smart.

The same funds are used regardless of whether you’re investing cash or SRS.

Fund overlap between Endowus and MoneyOwl

There are 2 Dimensional funds which are offered by both Endowus and MoneyOwl:

- Dimensional Emerging Markets Large Cap Core Equity Fund

- Dimensional Global Core Fixed Income Fund

Cash management portfolios offered

Both robo-advisors also offer a cash management portfolio as well. These portfolios are meant to provide you with a higher returns compared to leaving it in your bank account.

Moreover, these portfolios are also rather liquid for you to easily deposit and withdraw money at any time.

Here are the cash management portfolios that both robo-advisors offer:

Endowus Cash Smart

Endowus Cash Smart has 3 different portfolios:

- Cash Smart Core

- Cash Smart Enhanced

- Cash Smart Ultra

Depending on the portfolio that you choose, your money will be invested into different funds:

| Portfolio | Funds |

|---|---|

| Core | Fullerton SGD Cash Fund (50%) LionGlobal SGD Enhanced Liquidity (50%) |

| Enhanced | UOB United SGD Fund (50%) LionGlobal SGD Enhanced Liquidity (50%) |

| Ultra | LionGlobal SGD Enhanced Liquidity Fund (27.5%) Fullerton Short Term Interest Rate Fund (25%) LionGlobal Short Duration Fund (25%) Nikko Shenton Income Fund (12.5%) PIMCO Low Duration Income Fund (10%) |

You can read my full review on Endowus Cash Smart to see if it’s suitable for you.

You can customise your Cash Smart portfolio using Fund Smart

Apart from the Cash Smart portfolios that are being offered by Endowus, you can choose to create your own Cash Smart portfolio as well!

Similar to the Fund Smart portfolio, you can:

- Choose the funds you wish to invest in

- Choose your allocation into each fund

This may help you to earn a higher return compared to Endowus’ recommended portfolios!

MoneyOwl offers WiseSaver

MoneyOwl has a WiseSaver portfolio that aims to provide a better return compared to SGD dollar deposits.

MoneyOwl invests your funds fully into the Fullerton SGD Cash Fund.

This fund can also be found in Grab AutoInvest’s portfolio as well.

The selling point about WiseSaver is that you are able to make a transaction from as little as $10!

You can read my review of WiseSaver to see how this portfolio works for you.

Currency denomination

When you purchase a portfolio from either Endowus or MoneyOwl, they are all denominated in SGD. This reduces the currency risks you’re exposed to, such as:

- The currency conversion fees you’ll need to pay

- The fluctuation of the exchange rate between SGD and other currencies

Fund domicile

Both Endowus and MoneyOwl invest in UCITS funds.

This means that these funds are domiciled in Ireland, rather than the US.

This has significant implications on the taxes you’ll incur as a Singaporean investor. When you invest in a UCITS fund, you will reduce your taxes in 2 ways:

- Lower dividend withholding tax for US stocks (15% vs 30%)

- No estate tax for US assets

There are other robo-advisors that invest your money into US-domiciled ETFs like Syfe and StashAway. When you invest with either Endowus or MoneyOwl, your taxes are greatly reduced!

Performance

It is hard to compare the performances between these 2 robo-advisors since the portfolios are so different.

Moreover, the past returns can never be a good indicator of future returns. One portfolio that performs well now may not do so in the future.

Rather than looking at performance, you should be considering the investment strategy of these robo-advisors instead!

Dividend distribution

MoneyOwl invests your funds into 4 of Dimensional’s Accumulating funds. These funds will automatically reinvest any dividends that you receive back into the fund.

Similarly for Endowus, most of the funds that they invest in are accumulating funds. This means that any dividends you receive will be automatically reinvested for you.

Even if Endowus invests in distributing share class funds, they will still automatically reinvest the dividends for you.

These are similar to accumulating and distributing ETFs that are domiciled in Ireland.

As such, you should not expect to receive any dividends when you invest with Endowus or MoneyOwl.

Even though you do not receive the dividends, you are still subject to the 15% withholding tax on UCITS funds!

Funds you can invest with

Here are the types of funds you can use to invest in these 2 robo-advisors:

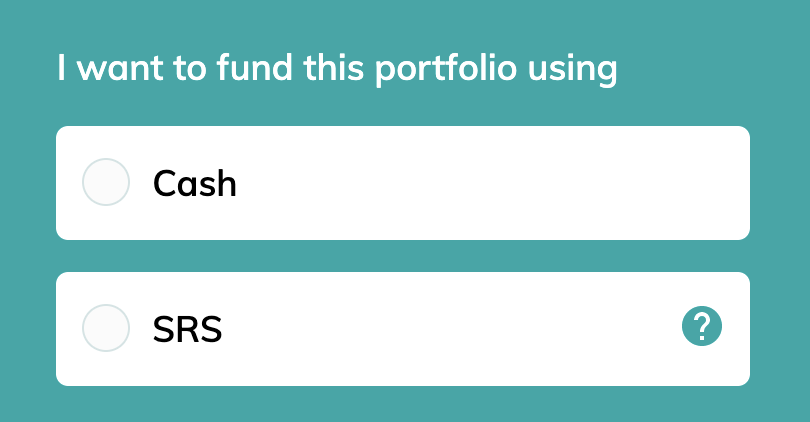

Endowus allows you to invest using cash, SRS and CPF

The main selling point of Endowus is that you are able to invest your CPF funds! So far, they are the only robo-advisor that allows you to do so.

Moreover, they also offer portfolios for your Cash and SRS funds. This makes Endowus an all-in-one platform to invest all of your different funds!

MoneyOwl only allows you to invest your Cash and SRS

You can only invest your Cash and SRS into MoneyOwl’s portfolios.

While this is more limited than Endowus, MoneyOwl is still one of the few robo-advisors that allow you to invest your SRS.

Minimum sum to invest

Here are the minimum sums required to start investing with either robo-advisor:

Endowus has a minimum investment of $1,000

To use the Endowus platform for investing, you will need an initial investment of $1k . This can come from 3 different sources:

- Cash

- SRS

- CPF

You are able to combine funds from your Cash, SRS and CPF to reach the $1k total. Moreover, you can use these funds to invest in any of Endowus’ portfolios.

You do not need to just invest all of your $1k into one portfolio!

Moreover, the minimum sum for each subsequent investment is $100. You aren’t able to invest anything less than a $100!

This may be a larger initial amount if you are just starting to invest. As such, this is something you should consider first before you start to use Endowus.

MoneyOwl has a lower minimum sum requirement

Here are the minimum sums required for you to invest with MoneyOwl:

| Type of Investment | Investment Amount |

|---|---|

| One-Time Investment | $100 |

| Monthly Investment | $50 |

The monthly investment amount of $50 is also lower compared to regular savings plans like OCBC BCIP and Invest Saver.

With the lower minimum requirements, MoneyOwl is more accessible if you only have a small amount!

Fees

Here are the fees that both robo-advisors will charge you:

Endowus charges you low fees

Endowus charges you low fees on the amount that you have invested with them:

Flat 0.3% for single fund portfolios with Fund Smart

If you have a Fund Smart portfolio that only has a single fund inside (i.e. 100% allocation), you will only be charged 0.3%. This is irregardless of whether you’re using your Cash, SRS or CPF to invest.

This makes it one of the cheapest fees that are being provided by a robo-advisor!

You can consider investing in a broadly diversified fund, such as:

- Infinity US 500 Stock Index Fund

- Dimensional World Equity Fund

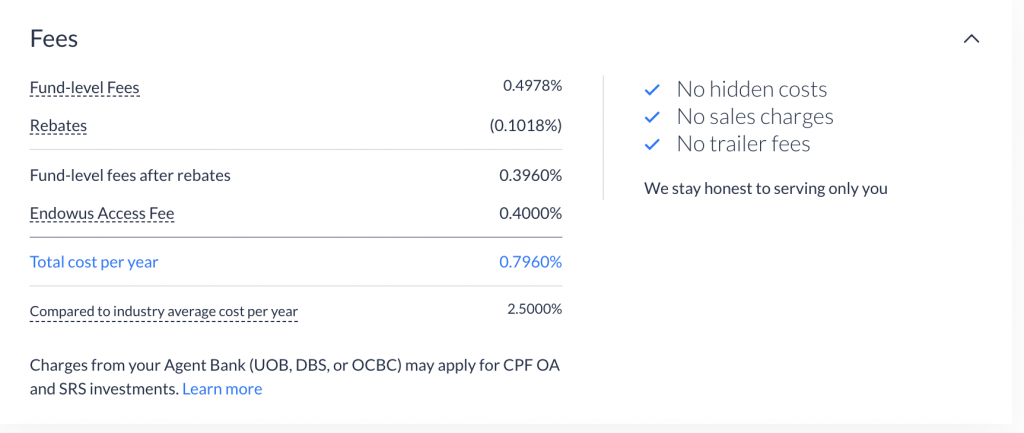

Flat 0.4% for CPF and SRS

Endowus charges a flat 0.4% fee for any amount of your CPF or SRS funds that you have invested.

This makes it one of the lowest costs being offered by a robo-advisor!

However, the reason why they are able to charge such low fees is due to the limitations that your CPF and SRS funds have.

Tiered pricing for Cash

Endowus has a tiered pricing for your cash investments:

| Amount | Fee |

|---|---|

| Up to S$200k | 0.6% |

| S$200,001 to S$1,000,000 | 0.5% |

| S$1,000,001 to S$5,000,000 | 0.35% |

| S$5,000,001 and above | 0.25% |

Endowus offers a tiered and not stacked pricing. This means that if you invest $200,001 into Endowus, you will be charged 0.5% for your entire $200,001.

Compared to other robo-advisors, Endowus’ fees are still pretty affordable.

0.05% flat fee for Cash Smart

You will still need to pay an access fee to use Cash Smart. However, this is very low at 0.05% for any amount.

It also does not matter whether you invest in Cash Smart with your Cash or SRS.

Full trailer fee rebate

Trailer fees are fees that a fund manager pays a platform. This is similar to a commission that the platform receives for introducing the investor to the fund.

With these trailer fee rebates, this will help to lower your cost of investing!

Pricing can be seen when you invest in any of their portfolios

What I really like about Endowus is the full transparency when it comes to the fees.

This is because you do not just need to pay management fees to the robo-advisor. You’ll need to pay an expense ratio to the funds managers too!

Endowus gives you the full breakdown of the fees that you’ll be charged, including fund-level fees.

This helps you to clearly see your true cost of investing with Endowus!

MoneyOwl charges slightly higher fees

Here are the fees that you’ll need to pay with MoneyOwl:

| Total Investment Amount | Advisory Fee |

|---|---|

| Below $10,000 | 0% |

| $10,001 to $100,000 | 0.60% |

| $100,001 and above | 0.5% |

MoneyOwl is having a promotional rate of 0% for the first $10k invested until 31 December 2021 for cash investments.

These fees applies to both Cash and SRS investments.

However, you’ll still need to pay an expense ratio to Dimensional Fund Advisors too!

This will range between 0.28%-0.32% p.a., depending on the portfolio you’ve chosen.

No fees charged for WiseSaver

MoneyOwl does not charge any fees for the WiseSaver portfolio. However, you will still need to pay a 0.15% fund-level fee that is paid directly to Fullerton Fund Management.

Type of account used to handle your assets

Both robo-advisors use different types of accounts to manage your assets:

Endowus creates an account under your own name

Endowus creates an account under your own name with UOB Kay Hian.

This gives you complete control over your assets, even in the unfortunate event that Endowus closes down!

iFAST manages your assets with MoneyOwl

MoneyOwl has engaged iFAST to provide custodial and transfer agent services. When you purchase assets using MoneyOwl, iFAST is actually the one who manages them.

However, iFAST holds all of your assets in their Client Trust account. This is similar to other robo-advisors (StashAway and Syfe) that hold all their customers’ assets in a co-mingled account.

Even in the unfortunate event that iFAST closes down, it would not really impact your assets much.

This is because you are able to buy and sell Dimensional funds using fractional units.

For Syfe and StashAway, they invest in US-listed ETFs. This means that they will be unable to sell off the fractional units of ETFs under your name if they close down!

Moreover, iFAST is a very well established financial service provider in Singapore. As such, you should not be too worried about them closing down!

You can see how different types of custodian accounts will affect your funds in my analysis of why Smartly closed down.

Web platform

Both robo-advisors have a web platform. Endowus’ platform looks very sleek and intuitive.

However, I find MoneyOwl’s platform to be pretty hard to navigate.

The platform is not as intuitive, and I spent some time trying to navigate around!

However, this is just a minor nitpick. Both platforms serve their purpose well and help you to see your portfolios’ performances.

Mobile app

Endowus has a mobile app that allows you to check your portfolios on the go.

However, MoneyOwl does not have a mobile app.

Verdict

Here’s a breakdown between these 2 robo-advisors:

| Endowus | MoneyOwl | |

|---|---|---|

| Mutual Fund Providers | Many | Only Dimensional |

| Investment Strategy | Risk profiling and time horizon | Risk profiling and time horizon |

| Investment Portfolios | Core ESG Fund Smart | Wealth Accumulation |

| Cash Management Portfolios | Cash Smart (Core / Enhanced / Ultra) | WiseSaver |

| Dividend Distribution | No (15% tax) | No (15% tax) |

| Funds to Invest | Cash SRS CPF | Cash SRS |

| Minimum Sum to Invest | $1,000 (Initial) $100 (Every subsequent transaction) | $100 (one-time) or $50 (monthly) |

| Fees (Investment) | 0.25-0.6% (Cash) 0.4% (SRS and CPF) 0.3% (Fund Smart Single Portfolio) | 0-0.60% |

| Fees (Cash Management) | 0.05% | 0% |

| Type of Account to Handle Assets | Account under your own name | Co-mingled under iFAST Client Trust Account |

So which robo-advisor should you choose?

Choose Endowus if you want a lower cost to investing

The greatest barrier to start investing with Endowus is the $1k minimum sum. However if you are able to commit this sum, Endowus is one of the cheapest platforms you could possibly use!

Moreover, it allows you to invest your SRS and CPF funds apart from your cash. It is possible for you to use Endowus for all of your investing needs!

With greater customisability and more products being offered, Endowus is a great platform to choose.

Choose MoneyOwl if you have a small amount to invest

You are able to start investing with MoneyOwl with just $50 a month. This is even lower than some regular savings plans!

If you want to purchase Dimensional Funds but are unable to meet Endowus’ requirements, then MoneyOwl is the next best choice.

MoneyOwl’s portfolios are simple and straight to the point. If you want to earn a good return without thinking too much, then MoneyOwl may be the better choice for you.

The only thing you’ll need to consider is if it’s worth the slightly higher fees!

Conclusion

Both robo-advisors offer very unique portfolios that cater to different kinds of investing needs.

However, the main considerations that you should have when choosing between these 2 platforms are:

- The amount of money you are able to invest

- The investment strategy you agree with

- The fees you are willing to pay

- The type of funds you wish to invest (Cash, SRS or CPF)

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

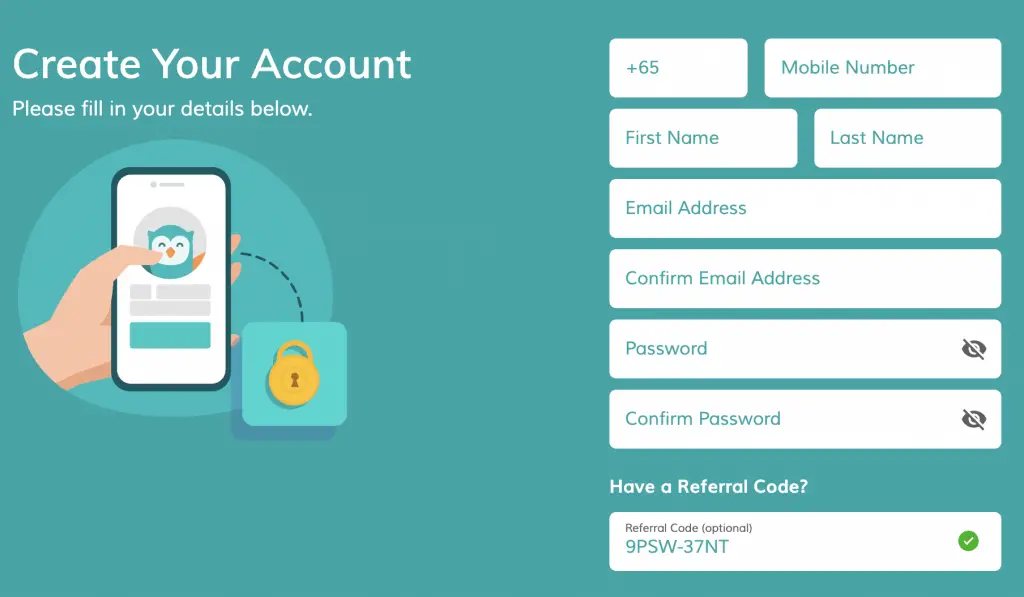

MoneyOwl Referral (Up to $65 GrabFood credits)

If you are interested in signing up for a MoneyOwl account, you can use my referral link to sign up. This will allow you to earn up to $65 GrabFood credits.

Here’s what you need to do:

- Sign up for a MoneyOwl account with my referral link

- Apply for MoneyOwl’s services

- Receive your GrabFood credits (up to 4 weeks later)

Here are the services you’ll need to sign up for to earn your GrabFood credits:

| Service | Condition | GrabFood Credit |

|---|---|---|

| Insurance | An insurance plan purchased and issued by MoneyOwl | $20 |

| Investment | An investment portfolio created and funded | $20 |

| Comprehensive Financial Planning | Financial plan is paid for and completed | $20 |

| Will Writing | Will successfully completed | $20 |

You can find out more about this referral program on MoneyOwl’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?