Last updated on June 6th, 2021

With the launch of Syfe Core, there are now 4 different portfolios you can choose from!

In fact, both Syfe Core and Equity 100 use the same Smart Beta strategy.

So how exactly are they different?

Here’s what you need to know.

Contents

The difference between Syfe Core and Equity 100

Syfe Equity 100 invests fully in stocks, while Syfe Core consists of stocks, bonds and gold. Although they both use the Smart Beta strategy in the selection of stock ETFs, Syfe Core includes Chinese stock ETFs in their investment universe. This gives you a greater exposure to China, compared to Equity 100 which is more US-focused.

Here is an in-depth comparison between these 2 portfolios:

Investing Strategy

Both Syfe Core and Equity 100 use the Syfe’s Smart Beta strategy.

However, this Smart Beta strategy is only applicable to the stocks component of Syfe Core.

This strategy focuses on building a smart beta portfolio for you. This is sometimes referred to as factor-based investing.

Syfe aims to provide high returns by concentrating on a few factors. These factors are chosen to ensure that your portfolio will outperform a certain index. Currently, Syfe has selected these 3 factors:

- Growth

- Large-cap

- Low-volatility

Syfe will then select the best ETFs that are weighted towards these factors.

This is different from the original Fama-French 3-factor model, which focused on:

- Size of firms

- Book-to-market values

- Excess return on the market

Syfe will dynamically select the best factors for you

In the long run, the factors that give the best returns in the future may no longer be these 3 factors. As such, Syfe has a dynamic factor selection to choose the best factors in the current economic climate.

Your portfolio will be over or under-weighted in certain factors to produce the highest risk-adjusted returns.

This helps to ensure that your portfolio will perform in any market condition!

Syfe Core also uses Asset Class Risk Budgeting

Apart from the Smart Beta strategy, Syfe Core uses an ‘Asset Class Risk Budgeting‘ too.

This process is used to allocate your funds into the different asset classes.

This means that the risk that you take is distributed between the 3 asset classes found in Syfe Core:

- Stocks

- Bonds

- Gold

Stocks are the riskiest asset class among the 3.

Each portfolio has a ‘risk budget’ to meet. As such, your funds will be allocated to the different asset classes to give your portfolio a certain amount of risk.

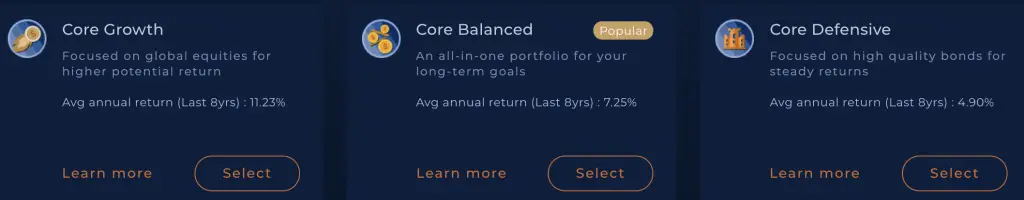

Here are the 3 different Core portfolios that you can choose from:

| Portfolio | Stocks | Bonds | Gold |

|---|---|---|---|

| Growth | 68.8% | 25.8% | 5.4% |

| Balanced | 38.0% | 51.2% | 10.8% |

| Defensive | 18.9% | 72.1% | 9.0% |

The greater the risk budget, the higher allocation towards stocks.

Type of Assets

Both of these portfolios invest in different types of assets.

Syfe Core invests in 17 ETFs

Here are the 17 ETFs that are found in the Syfe Core portfolio:

| ETF | ETF Name | Asset Class |

|---|---|---|

| QQQ | Invesco QQQ Trust Series | Equity |

| TLT | iShares 20+ Year Treasury Bond ETF | Bonds |

| CSPX | iShares Core S&P 500 UCITS ETF | Equity |

| EFA | iShares MSCI EAFE ETF | Equity |

| MCHI | iShares MSCI China ETF | Equity |

| XLP | Consumer Staples Select Sector SPDR Fund | Equity |

| IEF | iShares 7-10 Year Treasury Bond ETF | Bond |

| GLD | SPDR Gold Trust | Commodity |

| KWEB | KraneShares CSI China Internet ETF | Equity |

| AGG | iShares Core US Aggregate Bond ETF | Bond |

| XLV | Health Care Select Sector SPDR Fund | Equity |

| IEMG | iShares Core MSCI Emerging Markets ETF | Equity |

| XLU | Utilities Select Sector SPDR Fund | Equity |

| XLK | Technology Select Sector SPDR Fund | Equity |

| IJH | iShares Core S&P Mid-Cap ETF | Equity |

| BNDX | Vanguard Total International Bond Index Fund ETF | Bond |

| IJR | iShares Core S&P Small-Cap ETF | Equity |

The 3 asset classes in Syfe Core is similar to that of their Global ARI portfolio.

If you chose the Growth portfolio, your funds will be used to buy more of the equity ETFs.

Equity 100 invests only in stock ETFs

In your Equity 100 portfolio, you will invest in a portfolio of equity ETFs. Here are the 12 equity ETFs that Syfe currently invests in:

| ETF | ETF Name |

|---|---|

| QQQ | Invesco QQQ Trust Series 1 |

| CSPX | iShares Core S&P 500 UCITS ETF USD (Acc) |

| EFA | iShares MSCI EAFE ETF |

| XLP | Consumer Staples Select Sector SPDR Fund |

| XLV | Health Care Select Sector SPDR Fund |

| XLU | Utilities Select Sector SPDR Fund |

| IEMG | iShares Core MSCI Emerging Markets ETF |

| XLK | Technology Select Sector SPDR Fund |

| XLY | Consumer Discretionary Select Sector SPDR Fund |

| XLB | Materials Select Sector SPDR Fund |

| IJH | iShares Core S&P Mid-Cap ETF |

| IJR | iShares Core S&P Small-Cap ETF |

Equity 100 invests in a variety of equity ETFs. Moreover, they are diversified across a wide range of sectors and countries.

Most of these ETFs are listed on the NYSE. The only exception is the CSPX ETF which is an Irish-domiciled S&P 500 ETF.

There are ETFs that are found in both Syfe Core and Equity 100

You may have noticed that there are some ETFs that are found in both the Core and Equity 100 portfolios!

This is similar to how the ARKK ETF has overlaps with the other ARK ETFs (ARKQ, ARKW, ARKG and ARKF).

Syfe Core has greater exposure into China

The major difference between the 2 portfolios is that Syfe Core has a higher Chinese stock exposure due to these ETFs:

As a result, Syfe Core contains a higher allocation towards Chinese stocks compared to Equity 100.

Most of the ETFs in Equity 100 mainly consist of companies that are from the US.

If you want to get more exposure to China, then Syfe Core may be a better choice for you.

Number of portfolios

Syfe Equity 100 only has one portfolio that invests in 100% stocks. You do not have the flexibility to choose another portfolio.

Meanwhile, Syfe Core has 3 different portfolios:

- Growth

- Balanced

- Defensive

These portfolios cater to the amount of risk you’re willing to take.

The more risk you’re willing to take, the higher allocation towards stocks. If you can afford to take less risks, your funds will be allocated more towards bonds.

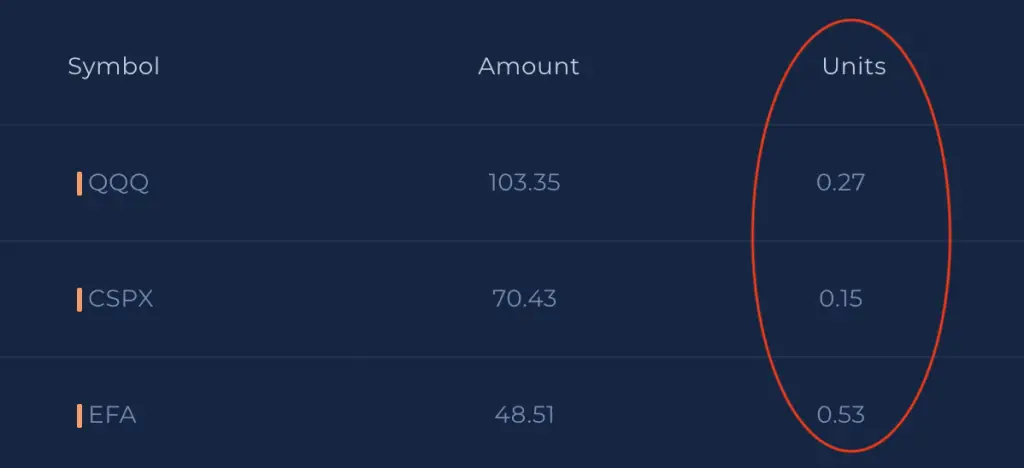

Syfe manages your assets by co-mingling them with the assets of their other customers. This means that all assets are held in a single custodian account.

As such, you will be able to invest in fractional shares for both portfolios.

When you are able to invest in fractional shares, you are able to fully invest your funds. You do not need to worry about the price of each ETF!

However, there comes a risk if Syfe closes down like Smartly did in early 2020. Since your assets are co-mingled, you may not be able to sell off your fractional shares.

As such, you may not have full control over the fate of your assets!

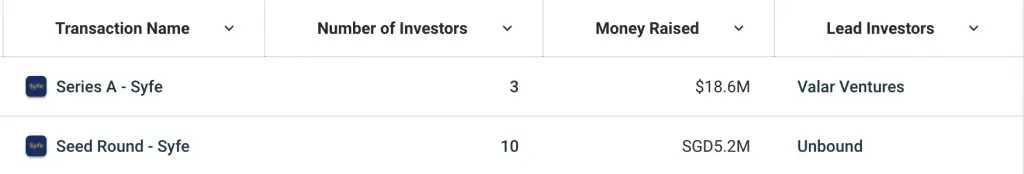

Syfe has received substantial funding

However, you may not need to worry so much about Syfe closing down. Syfe managed to secure USD$18.6 million in their Series A funding.

They received SGD$5.2 million in their seed funding too.

This alone doesn’t mean that Syfe is truly profitable. However, it is a good indicator that investors are confident in this company.

As such, this should give you some confidence that Syfe is here to stay!

Performance

It is hard to compare the performances between these 2 portfolios since they are rather different.

Both portfolios allocate your funds into similar asset classes. However, not all of the ETFs found in the portfolios are the same!

For example, the Chinese ETFs may perform better than the US ETFs. This means that Syfe Core may have a better performance overall.

Moreover, the past returns can never be a good indicator of future returns. One portfolio that performs well now may not do so in the future.

Rather than looking at performance, you should be considering the investment strategy that is being used instead!

Fees

Here are the fees that you’ll need to pay when you invest in either portfolio.

Both portfolios have the same pricing structure under Syfe

Both portfolios are managed by Syfe. As such, they will have the same management fees being charged:

| Total Amount Invested | Management Fee |

|---|---|

| < $20k | 0.65% |

| ≥ $20k and < $100k | 0.50% |

| ≥ $100k | 0.40% |

The management fees are pretty reasonable for a robo-advisor. It is slightly lower compared to StashAway’s fee of 0.8% for the first $25k invested with them.

You can read my comparison between Syfe Equity 100 and StashAway’s 36% portfolio to see which one is more suitable for you.

You will need to pay an expense ratio for the ETFs in both portfolios

On top of the management fees, you will need to pay for the expense ratios of the ETFs in both portfolios.

For most of the ETFs, the expense ratio may go up to 0.30%.

However, the expense ratio for both Chinese ETFs are much higher:

This may make investing in Syfe Core more costly, especially if your funds have a high allocation towards both of these ETFs.

You will incur withholding taxes with both portfolios

Syfe Core and Equity 100 invest in ETFs that are domiciled in the US. The only exception is CSPX, which is Irish domiciled.

As such, you will incur a dividend withholding tax from these ETFs.

Here are the amount of taxes you will incur:

| CSPX | All other US ETFs | |

|---|---|---|

| Dividend Withholding Tax | 30% | 15% |

The dividends that you receive will be after these deductions have been made.

The dividend withholding tax may be more hefty for China ETFs in Syfe Core

Most of the stocks that are found in the ETFs are listed on US exchanges. However, for the 2 Chinese ETFs, the assets are either listed on:

- US exchanges

- HKEX

For the stocks that are listed on the US exchanges, they are American Depositary Receipts (ADRs) of the actual Chinese stocks.

An example is BABA, the US ADR of Alibaba, while 9988 is the stock listed on the HKEX.

Meanwhile, the other Chinese stocks are listed on the HKEX as H-shares.

As such, you will incur a dividend withholding tax on 2 layers:

- When the Chinese stock issues a dividend to the US-listed ETF

- When the US-listed ETF issues the dividend to you (a non-resident alien)

China charges a 10% dividend withholding tax when a Chinese company distributes its dividends to a US ETF.

After that, you’ll still be taxed a 30% withholding tax by the US ETF!

In total, your total withholding tax will be 37%.

This will affect the total dividends that you’ll receive from MCHI and KWEB.

Although it may not be significant with a small sum of money, it may eat into your returns in the long run!

As such, you may want to consider if this is the most cost efficient way of being exposed to Chinese stocks.

You may be subject to estate tax with both portfolios

Both portfolios mainly invests in US-domiciled ETFs. As such, you may be subject to an estate tax when you pass on.

An estate tax is a tax on the right to transfer your estate to someone else.

The only exception is CSPX, which is an Irish-domiciled ETF. Ireland does not have an estate tax, unless:

- You or the beneficiary are Irish citizens

- You own property in Ireland

Syfe claims that you should not be subject to any estate tax. This is because your assets are held in a co-mingled account. Since you are not investing as an individual, you should not be subject to this tax.

However, they have added a disclaimer, which shows that they are unable to give a definite answer.

You’ll need to convert your SGD to USD

Both portfolios invest in ETFs which are denominated in USD. As such, you will incur another cost which is the currency conversion fee.

This occurs when you convert your SGD to USD to invest in these ETFs.

When you decide to withdraw your funds from either portfolio, the exchange rate may slightly affect your returns.

Verdict

With both portfolios being rather similar, which one should you choose?

Choose Syfe Core if you want a balanced portfolio

Syfe Core provides a better diversification into the different asset classes.

Stocks have the highest returns of all of the asset classes. However, you will need to buy and hold to be able to achieve those high returns!

If your time horizon is too short, then Syfe Core may be more suitable for you.

This is especially if you are only a few years before your retirement, and you are depending on this sum of money to last your retirement.

By mixing in bonds and gold, you may not get the same returns as stocks. However, the returns you receive will be less volatile!

As such, Syfe Core offers you a balanced portfolio that will still help you to grow your wealth.

Choose Syfe Equity 100 if you have a longer time horizon

Syfe Equity 100 is great if you have a longer time horizon. I would use this portfolio to save up for my retirement, especially if you are in your 20s.

This is because from now till your retirement, there are many years for you to ride through the volatility.

The reward that you get for all of this short term volatilities is the long term gains in the end!

So long as you buy and hold and do not make decisions based on your emotions, you should be able to get a rather decent return.

As such, Equity 100 is suitable if you are young and are looking for a lot of capital appreciation.

Conclusion

Both portfolios offered by Syfe provide different investing options based on your time horizon.

The portfolio that you pick may depend on these factors:

- The amount of risk you’re willing to take

- The number of asset classes you wish to have in your portfolio

- The amount of exposure you wish to have in Chinese stocks

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 6 months.

You will be able to save up to $75 worth of fees!

You can view more information about this referral program on Syfe’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?