Last updated on November 27th, 2021

You may have transferred some funds into your SRS account to reduce your taxable income.

Your SRS funds can be used for a wide variety of investments.

However, can it be used to buy US stocks and ETFs?

Here’s what you need to know.

Contents

Can I use my SRS funds to buy US stocks and ETFs?

Most SRS-approved brokers only allow you to buy stocks or ETFs that are listed on the Singapore Exchange (SGX). As such, it is not possible for you to buy stocks that are listed on US stock exchanges. You can, however, buy a SGX-listed ETF that tracks an index of the US stock market.

Here are some brokers in Singapore which allow you to invest your SRS funds:

- FSMOne

- POEMS

- DBS Vickers

- OCBC Securities

- UOB Kay Hian

- Lim and Tan

There are some brokers who operate in Singapore, but do not offer you the option to invest your SRS funds. This includes Tiger Brokers, Moomoo and Standard Chartered.

For all of these brokers, they only allow you to use your SRS funds to buy stocks listed on the Singapore Exchange (SGX).

This means that you can’t use your SRS funds to buy a stock that is listed on US exchanges, like Apple or Google.

There is only one US-listed stock that has a secondary listing on the SGX

Some stocks that are listed on other exchanges may have a secondary listing on the SGX. Even though some of them are denominated in USD, only one stock has its primary listing on the NYSE: AMTD International.

It is hard for you to buy single US stocks with your SRS funds. The only way you can do so is to buy a fund that owns different US stocks.

What options do I have if I want to buy US stocks with my SRS funds?

Here are some options you can consider when you want to buy US stocks with your SRS funds:

- SGX-listed ETFs that own US stocks

- Mutual funds (unit trusts)

- Robo-advisors

#1 SGX-listed ETFs that own US stocks

While you can’t buy a single US stock with your SRS funds, you can purchase an Exchange Traded Fund that is listed on the SGX.

An exchange traded fund (ETF) is a basket of securities that trade on an exchange, just like a stock.

Investopedia

This means that instead of owning a single stock, you will own a basket of stocks with each unit that you purchase.

Some of these ETFs listed on the SGX track indices that measure the performance of the US stock market.

On the SGX, there are 2 main ETFs that you can purchase that track these indices:

Both of these ETFs are secondary listings that were originally listed on the NYSE (DIA and SPY).

Both D07 and S27 track US stock indices. This means that by buying either ETF, you will be able to own a basket of stocks!

SGX-listed ETFs have their disadvantages

However, since both ETFs are listed on the SGX, there are some disadvantages:

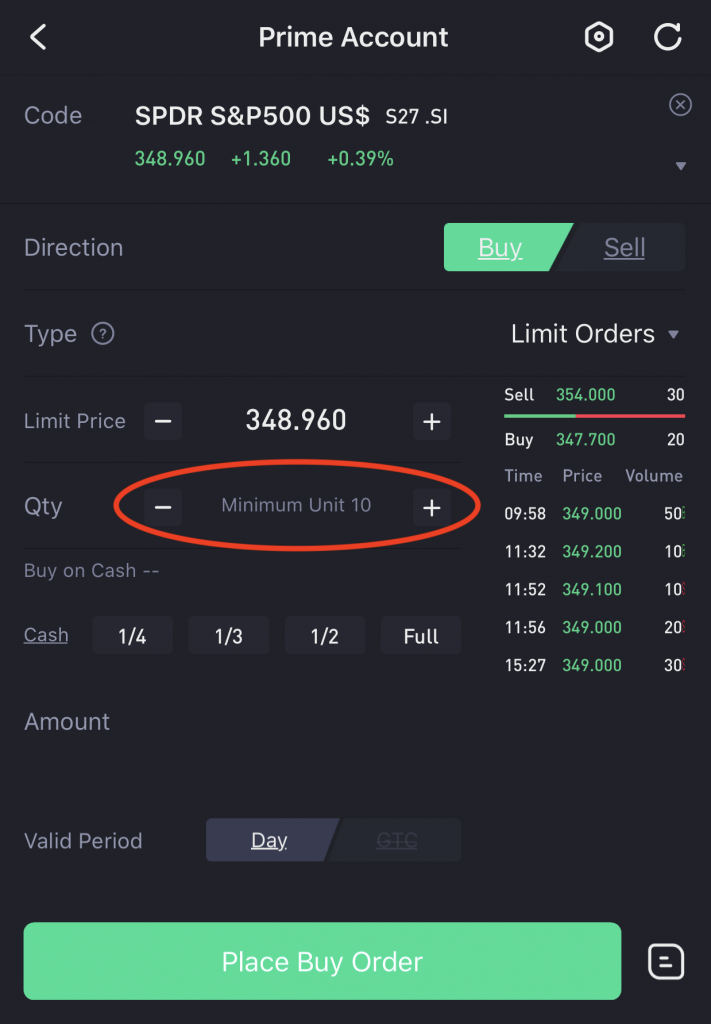

- You need to purchase a minimum of 10 shares per trade

- The trading volume is very low compared to their NYSE counterparts

On the SGX, the minimum lot size for ETFs can range from 5-100. For both D07 and S27, the minimum lot size is 10.

The unit price to purchase either ETF is at least $300 USD. This means you’ll need to have at least $3,000 USD to purchase one lot of either ETF!

This can be quite a huge sum that you’ll need to fork out, especially if you’ve just started building up your SRS funds.

If you just want to own an odd lot, it is possible to use the SGX Unit Share Market. However, it may be hard to find a buyer or seller of either ETF.

As such, these ETFs may be rather inaccessible for you!

The trading volume can be really low

Here is a comparison between the trading volume of S27 and SPY:

| S27 | SPY |

|---|---|

| 318 | 81 million |

The trading volume of S27 is extremely low! This means that only around 318 units of S27 are being traded each day.

Due to the very low liquidity, it may be hard for you to sell or even buy one lot of this ETF.

Furthermore, you may not be able to buy or sell your lot at the intended unit price!

Verdict

Buying SGX-listed ETFs like S27 or D07 does give you exposure to a basket of US stocks.

However, they have many disadvantages, such as:

- A minimum lot size of 10 units

- Very low liquidity

This may make either ETF rather inaccessible for you!

#2 Mutual funds (Unit trusts)

Instead of buying an ETF that is listed on a stock exchange, you can choose to buy a mutual fund that owns a basket of US stocks too.

There are many mutual fund platforms available in Singapore, such as:

- POEMS

- FSMOne

- DollarDex

- CIMB Bank

- DBS

- Standard Chartered

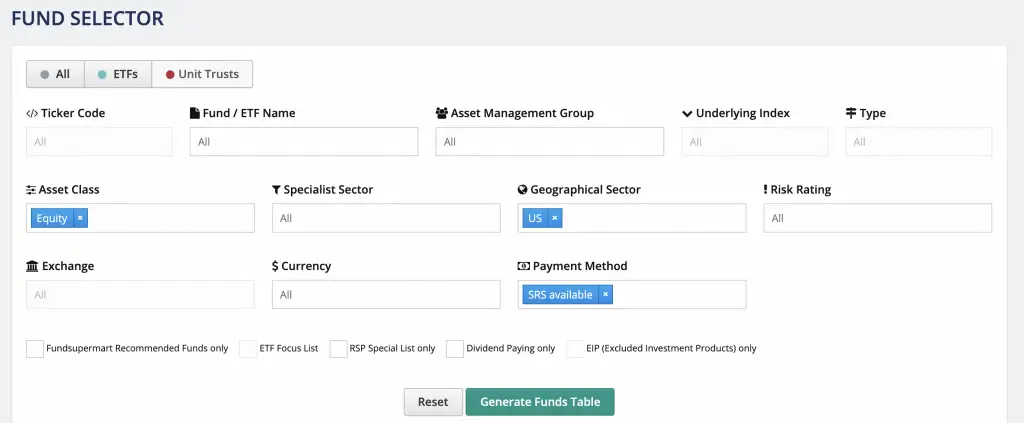

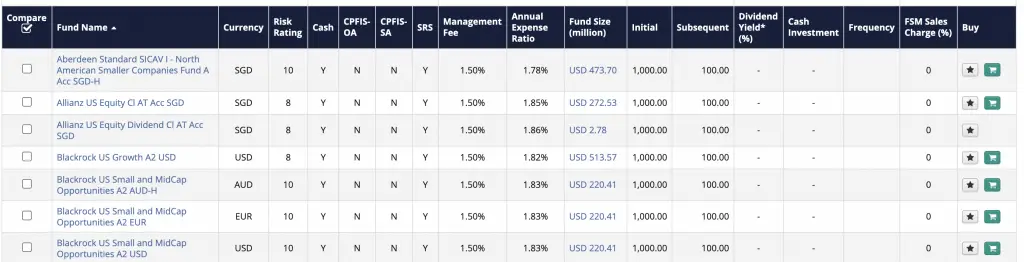

For example, you can go into FSMOne’s platform and use these filters to select funds that have US stocks:

| Asset Class | Equity |

| Geographical Sector | US |

| Payment Method | SRS |

You will be able to see some of the funds that are being offered on their platform!

While mutual funds and ETFs have the similar goal of owning a basket of stocks, here are some things you may need to take note about mutual funds:

1. Mutual funds may be actively managed

The 2 ETFs that are listed on the SGX are considered to be ‘passive investing’. This is because they track an index, which means the holdings in the funds are similar to the index.

For example, an S27 tracks the S&P 500 index, which means it will hold the same 505 stocks as the index.

However, not all mutual funds may track an index! They may use an actively managed strategy.

This means that the fund manager may be the one who picks the stocks.

For example, here is what is mentioned in the Fidelity America Fund.

The Fund invests principally in US equity securities. The Fund is actively managed and references the S&P500 Index (the “Index”) for performance comparison only.

This means that the mutual fund intends to beat the S&P 500. The fund manager would pick a basket of stocks that they believe will do better than the index.

If a fund is actively managed, you will most likely incur higher fees compared to a fund that tracks an index.

As such, you’ll need to go to the fund’s factsheet and look at the fund’s investment methodology.

It would be best for you to understand what the fund will invest in, and see if it fits your investment strategy!

2. Mutual funds may have a very complex fee structure

Some fund platforms advertise themselves as having very low fees (some may even advertise as 0%) when you buy mutual funds on their platform.

However, these are just the platform fees that you’ll incur. You will also be incurring a fund-level fee, which is what the fund manager charges you.

You can check the fees that you will be charged when investing in a certain unit trust or mutual fund. Most of them charge an annual management fee of more than 1%.

As such, these high fees will eat into your returns!

Verdict

I personally find the fee structure of most mutual funds to be very confusing. As such, I do not like to invest in these funds as there are better options out there.

If you are looking to invest in these funds, I would suggest trying to find out every single detail about the fund, especially the fees.

This will help you to determine if it’s worth investing your SRS funds with these fund managers.

#3 Robo-advisors

Robo-advisors have become very popular with Singaporeans, due to their low costs and low initial investments.

There are 3 robo-advisors in Singapore that allow you to invest your SRS funds:

- StashAway

- Endowus

- MoneyOwl

All of these platforms provide you access to US stocks via investing in their different portfolios:

1. StashAway

StashAway allows you to use your SRS funds to invest in their General Investing portfolios.

These portfolios invest your funds into a range of ETFs which are listed on the US stock exchanges.

There are 3 main asset classes that StashAway invests in are:

- Stocks (Equities)

- Bonds

- Gold

StashAway uses their Economic Regime-based Asset Allocation (ERAA) framework to select the best ETFs in the given economic condition.

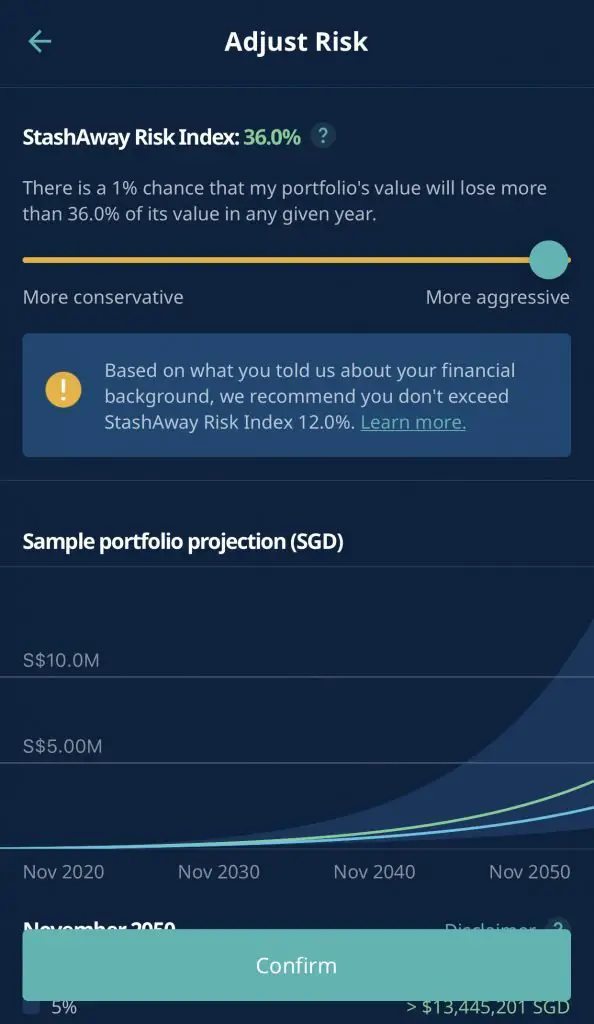

StashAway has a risk index which ranges from 6.5% (lowest risk) to 36% (highest risk).

This allows you to choose a portfolio that bests suits your risk profile.

The Risk Index means that there is a 99% probability that you will not lose more than x% of your portfolio in a year.

The x% is the amount of risk you are willing to take.

The higher risk you are willing to take, the higher your allocation towards stocks.

If you are interested in gaining exposure to US stocks, you can choose the 36% risk index.

StashAway will buy a variety of US-equity ETFs, which allows you to own a basket of US stocks with your SRS funds.

Fees

StashAway charges you up to 0.8% a year as their platform fee:

| Amount Invested | Management Fee |

|---|---|

| First $25k | 0.8% |

| > $25k and ≤ $50k | 0.7% |

| > $50k and ≤ $100k | 0.6% |

| > $100k and ≤ $250k | 0.5% |

| > $250k and ≤ $500k | 0.4% |

| > $500k and ≤ $1 million | 0.3% |

| > $1 million | 0.2% |

The higher amount you have with StashAway, the lower the fees you’ll need to pay.

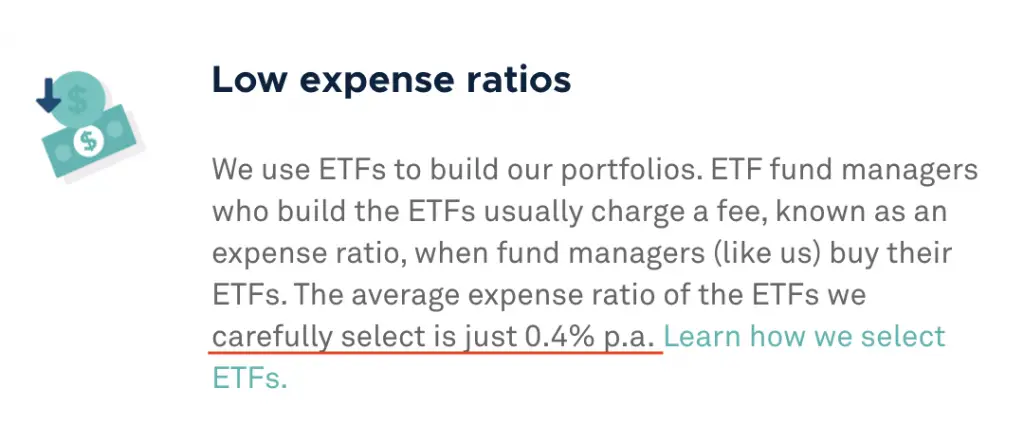

However, you’ll need to factor in the expense ratios of the ETFs too. This is similar to the fees that a mutual fund manager charges.

StashAway projects the annual expense ratio you’ll need to pay is around 0.4%.

If you add this together, it will roughly cost you around 1.2% a year to invest with StashAway.

However, what makes StashAway unique is that they invest in fractional shares. This allows you to start investing with no minimum amount!

2. Endowus

Endowus is different from StashAway, as they invest in mutual funds, compared to ETFs.

However, they provide you with access to the institutional share class of the mutual funds on their platform.

The costs you incur when investing with Endowus is much lower compared to when you’re investing on other platforms. This is because these platforms only offer the retail share classes of the fund!

You can use your SRS funds to invest in 2 different portfolios:

- Advised Portfolios

- Fund Smart

For example, this is the allocation for the 100% Equity portfolio.

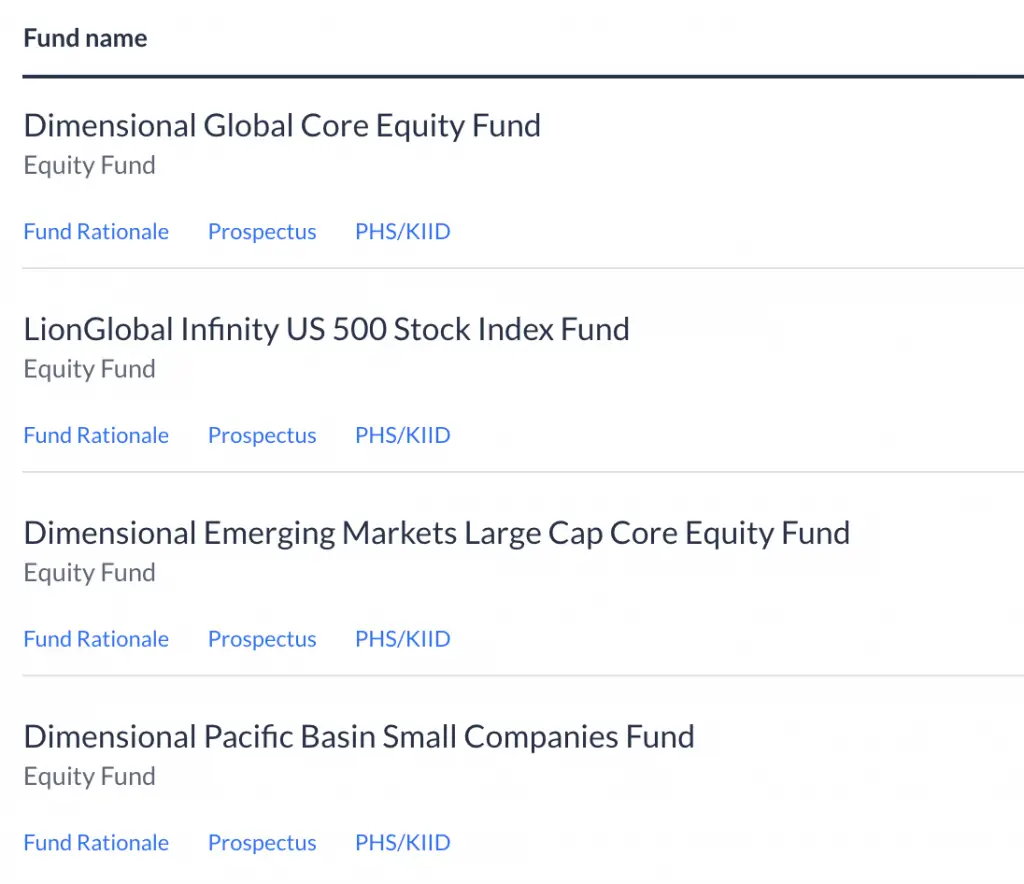

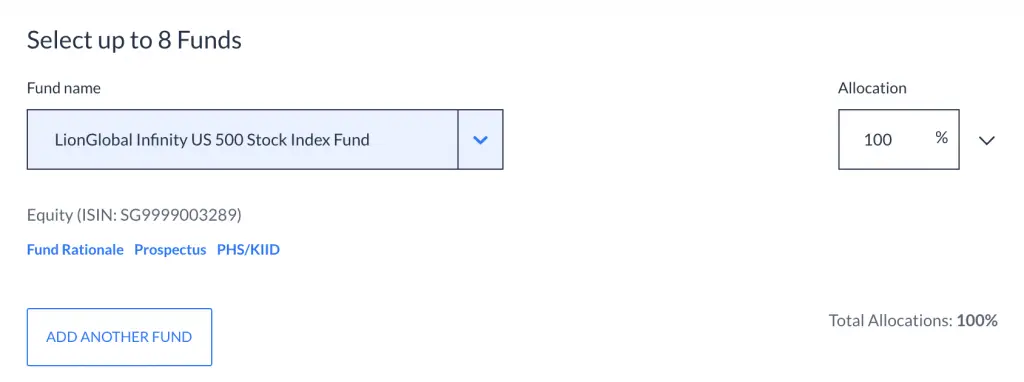

You can choose to use Fund Smart, where you can create your own portfolio too!

You are able to create your customised portfolio with up to 8 funds each time.

Fund Smart allows you to invest in funds from a variety of fund managers, including:

- Pimco

- Dimensional

- Eastspring Investments

- First Sentier Investors

- Vanguard

- Schroders

It is possible for you to have a portfolio that is 100% allocated to the LionGlobal Infinity US 500 Stock Index Fund.

This is a fund that tracks the S&P 500.

While you can’t buy individual US stocks, you are able to buy a basket of them with these funds.

Fees

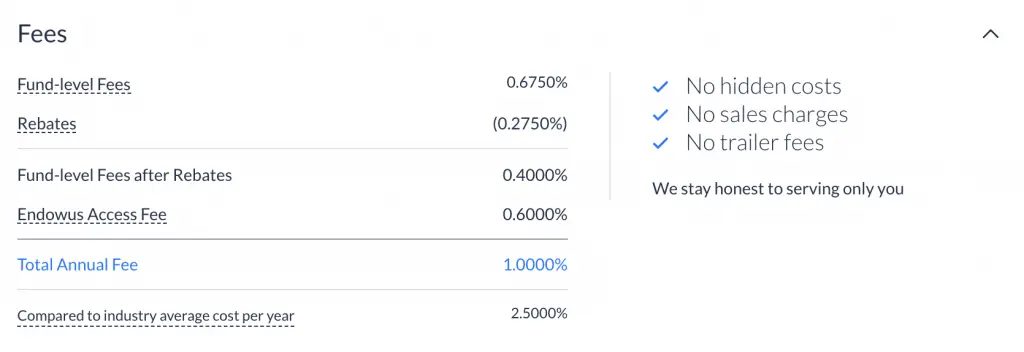

Endowus charges a 0.4% management fee for all of their management portfolios, including Fund Smart. This is much cheaper compared to StashAway!

However, you’ll need to consider the fund-level fees of each fund that you invest in.

What I really like about Endowus is that they are very transparent with their fees.

For some funds, you may be able to receive a trailer fee rebate. This helps to lower your costs too!

Overall, Endowus provides you with the flexibility of choosing how you want to invest your SRS funds. Furthermore, the fees are rather competitive too!

3. MoneyOwl

MoneyOwl is the last robo-advisor that you are able to invest your SRS funds with.

Similar to Endowus, you can invest in Dimensional Funds too.

However, you can’t choose which funds you want to invest in!

MoneyOwl offers 5 different portfolios for you to choose from, depending on your risk profile:

| Portfolio | Equities | Bonds |

|---|---|---|

| Equity | 100% | 0% |

| Growth | 80% | 20% |

| Balanced | 60% | 40% |

| Moderate | 40% | 60% |

| Conservative | 20% | 80% |

The 2 equity Dimensional funds that MoneyOwl uses are:

- Dimensional Global Core Equity Fund

- Dimensional Emerging Large Cap Core Equity Fund

These are globally diversified funds that own stocks from around the world and not just the US!

As such, you can’t gain exposure solely into US stocks.

Fees

Here are the fees that you’ll need to pay with MoneyOwl:

| Total Investment Amount | Advisory Fee |

|---|---|

| Below $10,000 | 0% |

| $10,001 to $100,000 | 0.60% |

| $100,001 and above | 0.5% |

MoneyOwl is having a promotional rate of 0% for the first $10k invested until 31 December 2021 for cash investments.

However, you’ll still need to pay an expense ratio to Dimensional Fund Advisors too!

This will range between 0.28%-0.32% p.a., depending on the portfolio you’ve chosen.

Verdict

If you want pure exposure into US stocks, using Endowus Fund Smart to invest in the LionGlobal Infinity US 500 Stock Index Fund would be the best method.

This allows you to gain exposure to the top 500 companies in the US!

If you want a broader diversification into other countries besides the US, then you can consider using MoneyOwl or StashAway too.

Here are some things to consider when deciding between these 3 robo-advisors:

- The type of funds (ETF or mutual fund) that you’ll invest in

- The fees that you’ll pay (both fund-level and platform-level)

- The customisability of the portfolio

How can I buy the S&P 500 using my SRS account?

Currently, the only way to buy the S&P 500 using your SRS account is by purchasing the Lion Global Infinity U.S 500 Stock Index Fund. You can use your SRS funds to buy this mutual fund from a variety of platforms, such as Endowus, FSMOne, POEMS and OCBC.

The Lion Global Infinity U.S 500 Stock Index Fund is the only SRS approved fund that tracks the S&P 500. There are quite a few platforms that offer this fund, such as:

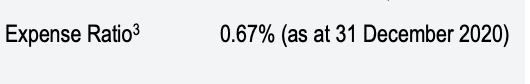

The fees that you pay for buying into the fund is at 0.67%.

If you choose to use Endowus to buy this fund, you will be able to receive a trailer fee rebate that lowers your costs. However, you’ll need to factor in the platform fee of 0.4% that Endowus charges you as well!

Conclusion

It is not possible for you to buy a single US stock using your SRS funds. This is similar to how you can’t use your CPF funds to buy stocks on the US markets.

However, you can buy a basket of US stocks using 3 different methods:

- SGX-listed ETFs that track a US stock index

- Mutual funds (or unit trusts)

- Robo-advisors

I personally do not think that SGX-listed ETFs are that attractive, especially due to their low liquidity.

As such, the best 2 options that you can consider are mutual funds or robo-advisors.

Some things you can consider when deciding between the 2 include:

- The minimum investment amount you’ll need

- The fees that you incur

- The variety of funds that you are able to invest in

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

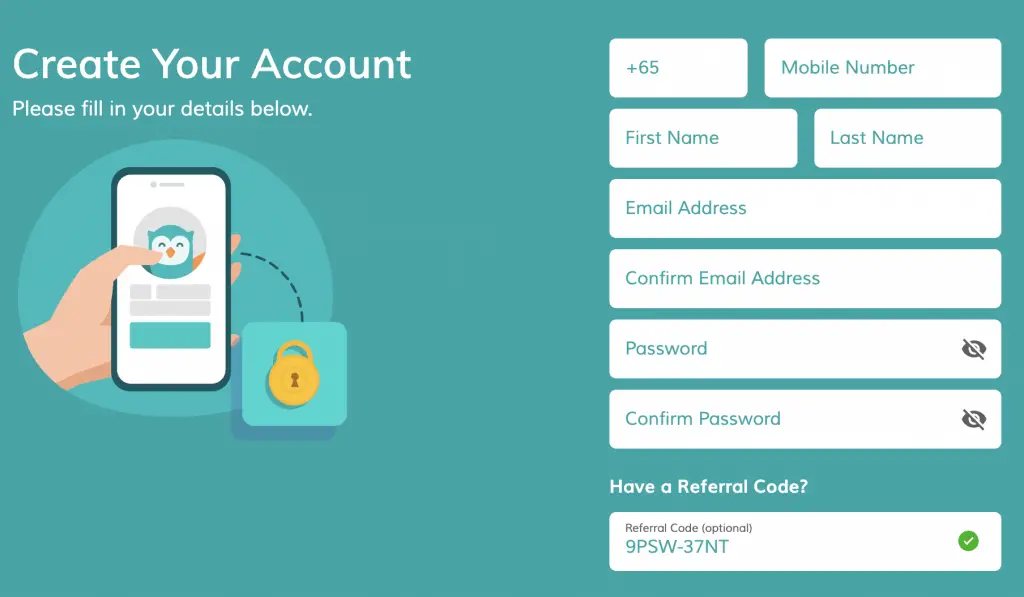

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

StashAway Referral (Up to $40,000 SGD managed for free for 6 months)

If you are interested in signing up for StashAway, you can use my referral link to sign up.

Here’s what you’ll need to do:

- Sign up for a StashAway account

- Make a deposit of ≥ $10k within 4 weeks of signing up

- Receive a fee waiver for 6 months (up to $40k)

You can find out more about this program on SingSaver.

MoneyOwl Referral (Up to $65 GrabFood credits)

If you are interested in signing up for a MoneyOwl account, you can use my referral link to sign up. This will allow you to earn up to $65 GrabFood credits.

Here’s what you need to do:

- Sign up for a MoneyOwl account with my referral link

- Apply for MoneyOwl’s services

- Receive your GrabFood credits (up to 4 weeks later)

Here are the services you’ll need to sign up for to earn your GrabFood credits:

| Service | Condition | GrabFood Credit |

|---|---|---|

| Insurance | An insurance plan purchased and issued by MoneyOwl | $20 |

| Investment | An investment portfolio created and funded | $20 |

| Comprehensive Financial Planning | Financial plan is paid for and completed | $20 |

| Will Writing | Will successfully completed | $20 |

You can find out more about this referral program on MoneyOwl’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?