Last updated on June 6th, 2021

MoneyOwl recently announced their new WiseSaver portfolio.

It provides you with an alternative to “earn higher returns with the added flexibility and liquidity to withdraw your funds whenever you need them”.

Is this cash savings plan worth your consideration? Here’s my review of what it offers.

Contents

What is WiseSaver?

MoneyOwl’s WiseSaver is a cash management portfolio. This is meant for any spare cash that you are saving up for a future purchase.

WiseSaver invests your funds into a money market fund, where you will be credited with interest daily.

How Does WiseSaver Work?

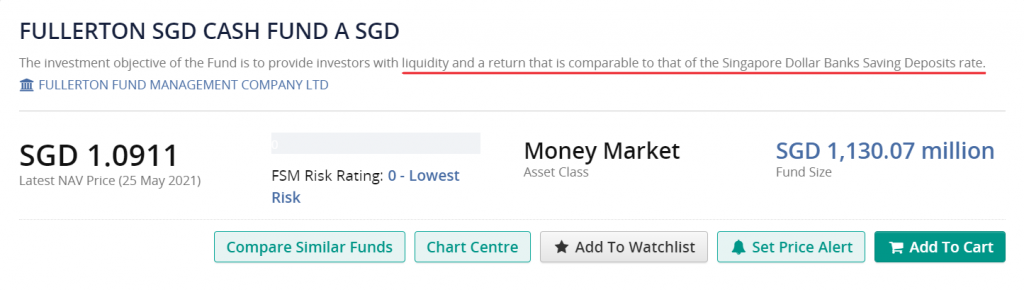

WiseSaver puts your money into the Fullerton SGD Cash Fund, which invests in Singapore Dollar bank deposits of local financial institutions.

This fund can be found in Endowus Cash Smart Core and Grab AutoInvest too.

Type of funds to invest

You are able to use both cash as well as your SRS funds to invest with WiseSaver.

WiseSaver has good liquidity

WiseSaver is really liquid since there is no lock-in period.

Also, when you make a withdrawal request, your funds will be sent to your bank account within 2 business days.

Minimum amounts required for WiseSaver

Here are the minimum amounts you’ll need to invest in WiseSaver.

| Type of Transaction | Minimum Amount Required |

|---|---|

| One-Time Transaction | $10 |

| Regular Savings Plan | $50 per month |

Compared to other cash management portfolios, WiseSaver does have a rather low minimum amount to start investing with.

This makes it extremely accessible for almost everyone!

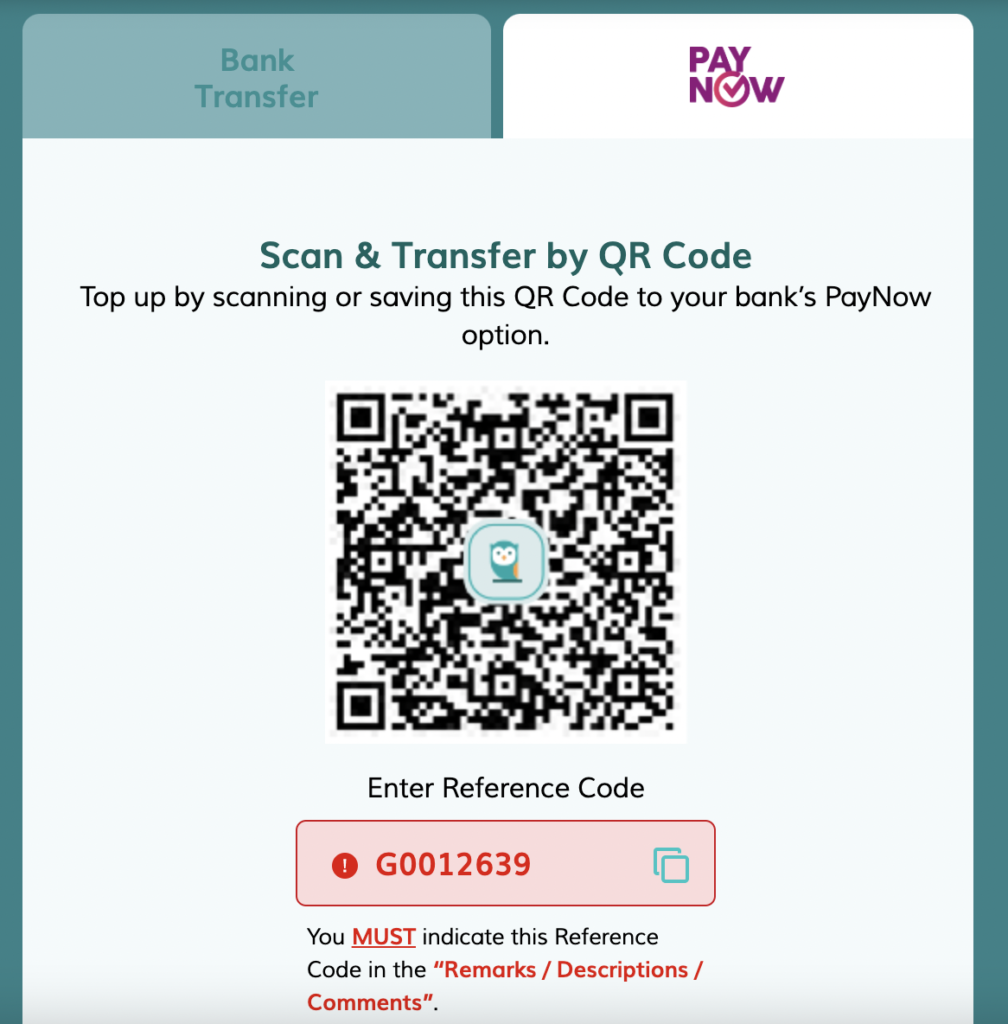

To transfer money to MoneyOwl, you can either choose to do a bank transfer or a PayNow transfer by scanning their QR code.

Make sure you remember to include your designated reference code in the comments field!

I’ve been investing with MoneyOwl via their Investment portfolio, and the funds transfer has been fast and convenient.

Once your money is invested into the fund, it will earn interest for you daily.

Withdrawing your funds

When you choose to withdraw your funds, your funds as well as the returns generated will be transferred to your bank account.

However, after clarifying with their Customer Service, the minimum amount that you can withdraw from the portfolio is $50.

If your portfolio has less than $50, you can choose to withdraw the full amount.

This makes it slightly inflexible compared to a regular savings account which has no minimum withdrawal rate.

What Are WiseSaver’s Returns Like?

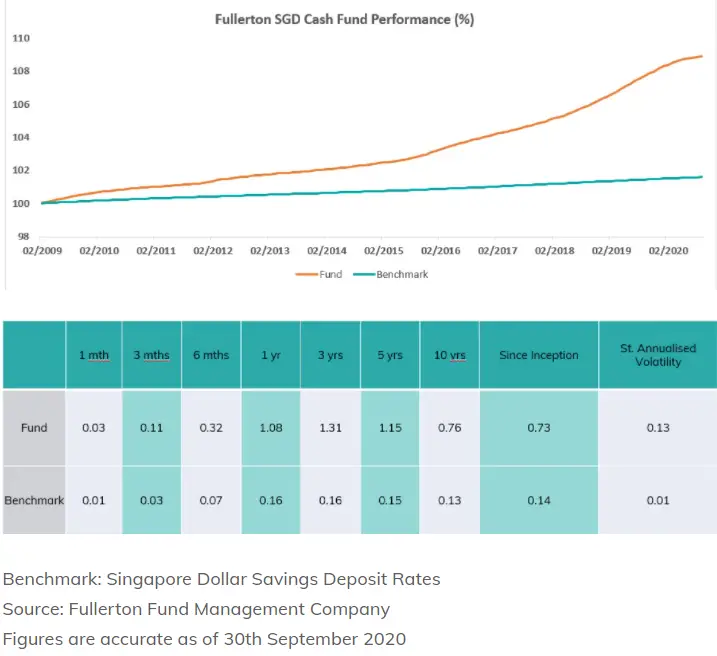

WiseSaver’s returns are very heavily dependent on the fixed deposit rates of banks. As such, your returns will be based on those rates as well.

This also means that the rate of returns will fluctuate over time. When the bank deposit rates are high, WiseSaver’s returns will be high as well.

The current rate for WiseSaver has been at 0.4% p.a. as of May 2021.

Essentially, WiseSaver is a risk-free product that you can put your cash in. This is ideal for those of you who are risk-averse.

By comparing against the savings deposit rates in Singapore, the returns for the Fullerton Cash Fund performance had been much better as shown in the chart below.

What Fees Does WiseSaver Charge?

No fees are being charged by MoneyOwl.

However, there is a “0.15% p.a. fee charged by the fund manager, factored into the price of each unit”. This fee is paid directly to Fullerton Fund Management.

Comparing with similar products, WiseSaver’s expense ratio is slightly lower than StashAway Simple’s ratio of about 0.217% p.a. (though StashAway Simple has a much higher yield since it invests in riskier money-market funds).

Is WiseSaver The Product For Me?

According to the rates of the Singapore Savings Bonds (SSB) in May 2021, the yield for the 1st year is at 0.38%.

On top of that, you incur a $2 transaction fee for each redemption request before the bond matures.

The minimum investment for SSB is $500 each time as well.

In terms of both liquidity and returns, the WiseSaver is the better alternative.

If you compare the returns of WiseSaver with most of the fixed deposit rates offered by banks in May 2021, WiseSaver has slightly lower returns.

This lower return for WiseSaver is a trade-off for that increased liquidity and lower minimum sum required.

For fixed deposits, most have a minimum investment amount ranging from $500 to $30k.

You would have to lock up your funds for a minimum period as well, with the shortest period being 8 months.

Here’s a quick comparison against fixed deposits and SSBs.

| Product | WiseSaver | Fixed Deposits | SSB |

|---|---|---|---|

| Offered By | MoneyOwl | Banks | MAS |

| Minimum Sum | $10 for one-time saving and monthly regular savings plan | Ranges from $500 – $30k | $500, and subsequent multiples of $500 |

| Returns | 0.40% | 0.35% – 0.70% | 0.38% if you withdraw after the first year |

| Withdrawal | Anytime, funds deposited within 2 business days Minimum withdrawal amount is $50 | Only after minimum tenure, earliest is 8 months for some banks | Anytime, funds deposited within a week to a month, $2 transaction fee for each withdrawal request |

Each of the options here are suitable for you according to your own circumstances and your available funds. From the table, the WiseSaver looks to be the best option among the 3 in terms of the lowest in both minimum sum and withdrawal amount.

Conclusion

To sum up, let’s compare the pros and cons of this product.

| Pros | Cons |

|---|---|

| Low minimum amount required to start saving | Fund level fee of 0.15% p.a. that is factored into the price of each unit |

| Fast and convenient transfer of funds to MoneyOwl | Returns may fluctuate in relation to market conditions |

| Interest rate is comparable to fixed deposits and SSBs | Minimum amount of $50 to withdraw from account |

| Relatively liquid | |

| No lock-in period | |

| Low risk of capital loss | |

| Able to use SRS funds to invest |

WiseSaver allows you to receive your funds within 2 business days. This provides better liquidity compared to other investment products, such as:

- Short-term endowment plans (e.g., NTUC Income Gro Capital Ease)

- Insurance savings plans (e.g., SingLife Account)

- Other cash management portfolios (e.g., Syfe Cash+ and Endowus Cash Smart)

In addition, WiseSaver would be a good option if one or more of the following conditions describe you:

- Usually place your extra funds into fixed deposits/SSB

- Wish to find a place to store your ‘war chest’ while waiting for the markets to drop to a discounted price

- Are risk-averse and prefers not to invest

- Find it hard to save and want to inculcate a good saving habit

- Are planning to save for just a year

- Have limited funds

Overall, the WiseSaver portfolio is attractive for different demographics, and it’s really worth considering due to its relatively high liquidity.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

MoneyOwl Referral (Up to $65 GrabFood credits)

If you are interested in signing up for a MoneyOwl account, you can use my referral link to sign up. This will allow you to earn up to $65 GrabFood credits.

Here’s what you need to do:

- Sign up for a MoneyOwl account with my referral link

- Apply for MoneyOwl’s services

- Receive your GrabFood credits (up to 4 weeks later)

Here are the services you’ll need to sign up for to earn your GrabFood credits:

| Service | Condition | GrabFood Credit |

|---|---|---|

| Insurance | An insurance plan purchased and issued by MoneyOwl | $20 |

| Investment | An investment portfolio created and funded | $20 |

| Comprehensive Financial Planning | Financial plan is paid for and completed | $20 |

| Will Writing | Will successfully completed | $20 |

You can find out more about this referral program on MoneyOwl’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?

Carl

June 26, 2020 at 9:58 pmFullerton SGD Cash Fund is available from many other distributors. For a fair comparison, banks’ deposits are covered up to 75K and insurance policies are covered up to 500K aggregated guaranteed sum assured and 100K for aggregated guaranteed surrender value per life assured per insurer under SDIC. Money Market Funds do not enjoy SDIC’s coverage.

FI Pharmacist

June 26, 2020 at 10:55 pmThank you for the information, I did not know that. Will edit my post accordingly!

I think that MoneyOwl adds accessibility and credibility to such funds, especially for those who are unaware of such cash management solutions.

Chris Tan

June 27, 2020 at 6:04 pmThank you Carl for your comment. While it is true that the Fullerton Cash Fund is available via other distributors, some of them charge a platform fee. Savers should check this before committing to the Fullerton Cash Fund. MoneyOwl does not charge platform fee or advisory fee for this fund. Just for your information and like what Gideon has said, What MoneyOwl is essentially doing is to provide accessibility at the lowest cost possible.

Carl

June 27, 2020 at 9:10 pmThank you Chris for your clarifications. BTW are you from MoneyOwl? Fullerton Cash Fund is a MMF and I will be very surprised if any particular distributor (if you can name them) charges a platform fee for a MMF. Customers will simply go to the next distributor. Anyway the market is big enough for everyone and it is good that consumers have more choices now with more and more robo-advisors coming up with cash management solutions.