Last updated on June 8th, 2021

You may have heard over and over again to invest in the STI ETF.

But how exactly do you invest in it?

With the DBS / POSB Invest-Saver, you are able to dollar-cost average into different unit trusts and ETFs, like the STI ETF. What’s more, you only need $100 to start!

Here’s how this regular savings plan works.

Contents

- 1 Invest-Saver Review

- 2 What is Invest-Saver?

- 3 How does Invest-Saver work?

- 4 What are the counters that I can invest in with Invest-Saver?

- 5 What kinds of funds can I use to invest into Invest-Saver?

- 6 How do I set up my Invest-Saver account?

- 7 How do I change the amount or cancel my Invest-Saver plan?

- 8 How do I sell the units I have with Invest-Saver?

- 9 What fees does Invest-Saver charge?

- 10 How will my dividends be credited?

- 11 What is the performance of Invest-Saver?

- 12 Should I invest in the Nikko STI ETF or ABF Fund using Invest-Saver?

- 13 Can Invest-Saver be used for DBS Multiplier?

- 14 Can I transfer the units I bought using Invest-Saver to my CDP account?

- 15 Is Invest-Saver good?

- 16 Conclusion

- 17 Cashback promotion for Invest-Saver

Invest-Saver Review

Invest-Saver is an easy-to-use regular savings plan that provides you with 4 ETFs to choose from. With its affordable fees and a minimum of $100, it is a good way for beginner investors to start their investment journey.

Here is Invest-Saver reviewed in-depth:

What is Invest-Saver?

The DBS / POSB Invest-Saver is a regular savings plan that allows you to dollar-cost average into Unit Trusts or Exchange Traded Funds (ETFs). You are able to start investing from $100 a month.

You may be wondering if the DBS Invest-Saver is the same as POSB Invest-Saver. In fact, both DBS and POSB are actually the same bank!

As such, both the DBS and POSB Invest-Saver are exactly the same. They only differ in terms of the branding.

Invest-Saver is different from DBS digiPortfolio

Although both services are being provided by DBS bank, Invest-Saver is a regular savings plan that invests in a specific ETF or mutual fund that you choose. Meanwhile DBS digiPortfolio selects a portfolio of ETFs, based on your risk profile and geographical exposure.

Both of these services mainly differ from each other based on:

- Investment strategy

- Minimum sum required

- Fees charged

Even though they are provided by the same bank, they are 2 very different services.

How does Invest-Saver work?

To start investing with Invest-Saver, you will need to consider 2 things:

- Which Unit Trust or ETF do you want to invest in?

- What is the monthly amount that you wish to invest?

The minimum amount to invest is $100 each month, and you can invest in further multiples of $100.

Once invested, the funds will be deducted from your account on the 15th of every month.

If the 15th is a Sunday or a Public Holiday, it will be deducted on the next business day.

No fractional units for ETFs

When you invest using Invest-Saver, you will only be able to buy whole units of the ETF.

As such, Invest-Saver will buy the maximum number of units possible with the amount that you’ve invested.

For example, you invested $100 each month, and the ETF that you want to buy costs $10.

Including the fees (0.5%), you can only buy a maximum of 9 units.

9*$10 + 0.5% * 90 = $90.45

You will be refunded $9.55.

Your refund will be credited to your account a few days later.

On the other hand, if you wish to purchase unit trusts, you are able to purchase fractional units. This means that your entire investment amount will be invested into that particular fund.

What are the counters that I can invest in with Invest-Saver?

There are two types of products that you can purchase with Invest-Saver:

Exchange Traded Funds (ETFs)

Most of you will use Invest-Saver to invest in ETFs. There are 4 ETFs that you can choose to invest in:

| ETF Name | Ticker | Type of ETF |

|---|---|---|

| Nikko AM Singapore STI ETF | G3B | Singapore Equity ETF |

| ABF Singapore Bond Index Fund | A35 | SGD Fixed Income ETF |

| Nikko AM SGD Investment Grade Corporate Bond ETF | MBH | SGD Fixed Income ETF |

| Nikko AM-StraitsTrading Asia ex Japan REIT ETF | CFA | REIT ETF |

The 2 most popular ETFs are the Nikko AM STI ETF and the ABF Singapore Bond Index Fund.

Both A35 and MBH invest in bonds, so which one is better for you? You can view my head-to-head comparison of A35 vs MBH.

If you are purchasing into ETFs, you will also have to consider the expense ratio of the fund.

An expense ratio is the fee that you are required to pay the fund manager for managing the ETF.

This expense ratio will be deducted from the net asset value of each unit of the ETF.

On top of the transaction fees that you will need to pay, this will be an additional cost.

Here are the expense ratios for the 4 ETFs:

| ETF Name | Expense Ratio |

|---|---|

| Nikko AM Singapore STI ETF | 0.30% |

| ABF Singapore Bond Index Fund | 0.25% |

| Nikko AM SGD Investment Grade Corporate Bond ETF | 0.27% |

| Nikko AM-StraitsTrading Asia ex Japan REIT ETF | 0.60% |

The Nikko AM-StraitsTrading Asia ex Japan REIT ETF has the highest expense ratio of 0.60%. The other 3 ETFs have a similar expense ratio.

You may want to reconsider investing in the REIT ETF as a 0.60% expense ratio is pretty high.

Unit Trusts

You are also able to invest in Unit Trusts using Invest-Saver. There is an extensive list of funds that you can choose from.

However, I would like to caution you against jumping into investing with Unit Trusts.

Invest-Saver seems to be heavily promoting Unit Trusts instead of ETFs. I believe this could be due to the higher commission that DBS receives if you invest in a Unit Trust.

Moreover, Unit Trusts are very complicated products.

There are a lot of underlying fees, and they are usually actively managed funds.

If you are a beginner investor, I would recommend starting with ETFs first. They are passive instruments and have a lower cost too.

When you become more familiar with Unit Trusts, then you may consider purchasing these products instead.

If you would like to find out more about unit trusts, you can view an opinion about them below:

What kinds of funds can I use to invest into Invest-Saver?

Here are the type of funds that you can invest in Invest-Saver, depending on which product you choose:

| Product | Types of Funds |

|---|---|

| ETFs | Cash only |

| Unit Trusts | Cash SRS |

It is possible to invest your SRS funds using Invest-Saver. However, you are only able to purchase unit trusts with your SRS funds, and not ETFs.

How do I set up my Invest-Saver account?

To set up an Invest-Saver account, you will need to either have a DBS or POSB account.

Here’s a step-by-step guide to set up your Regular Savings Plan via the iBanking platform:

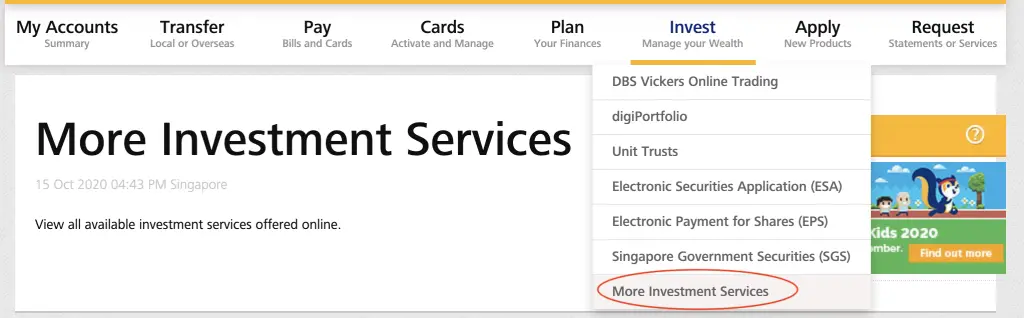

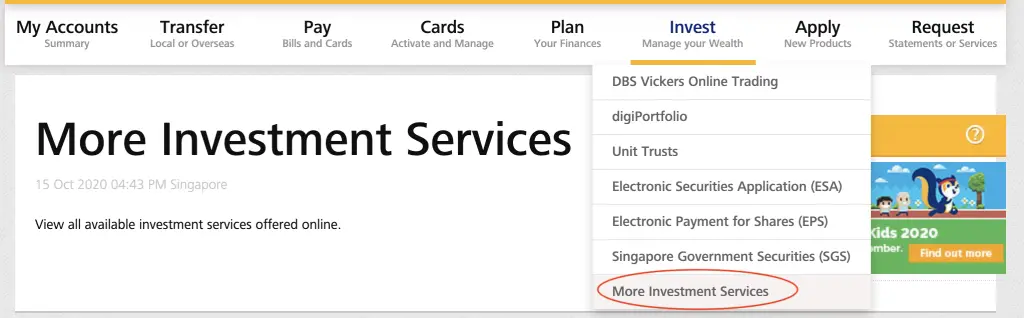

#1 Go to Invest → More Investment Services

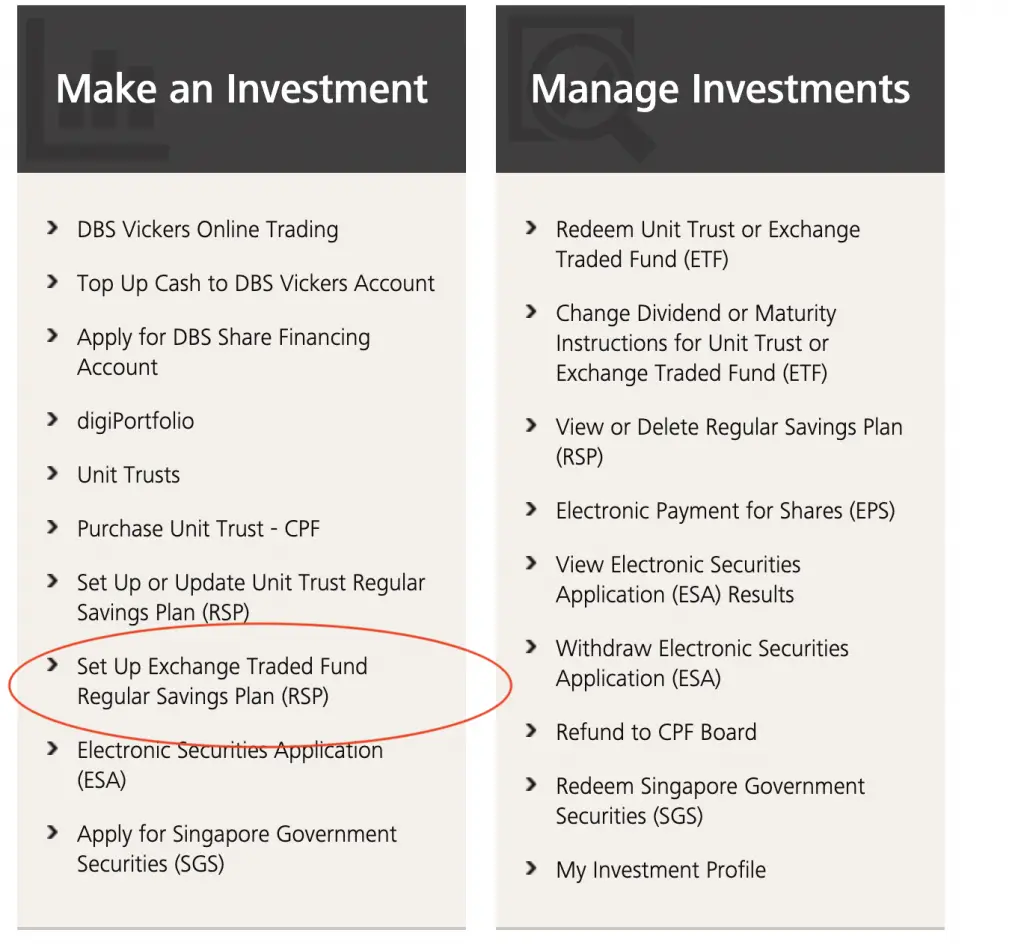

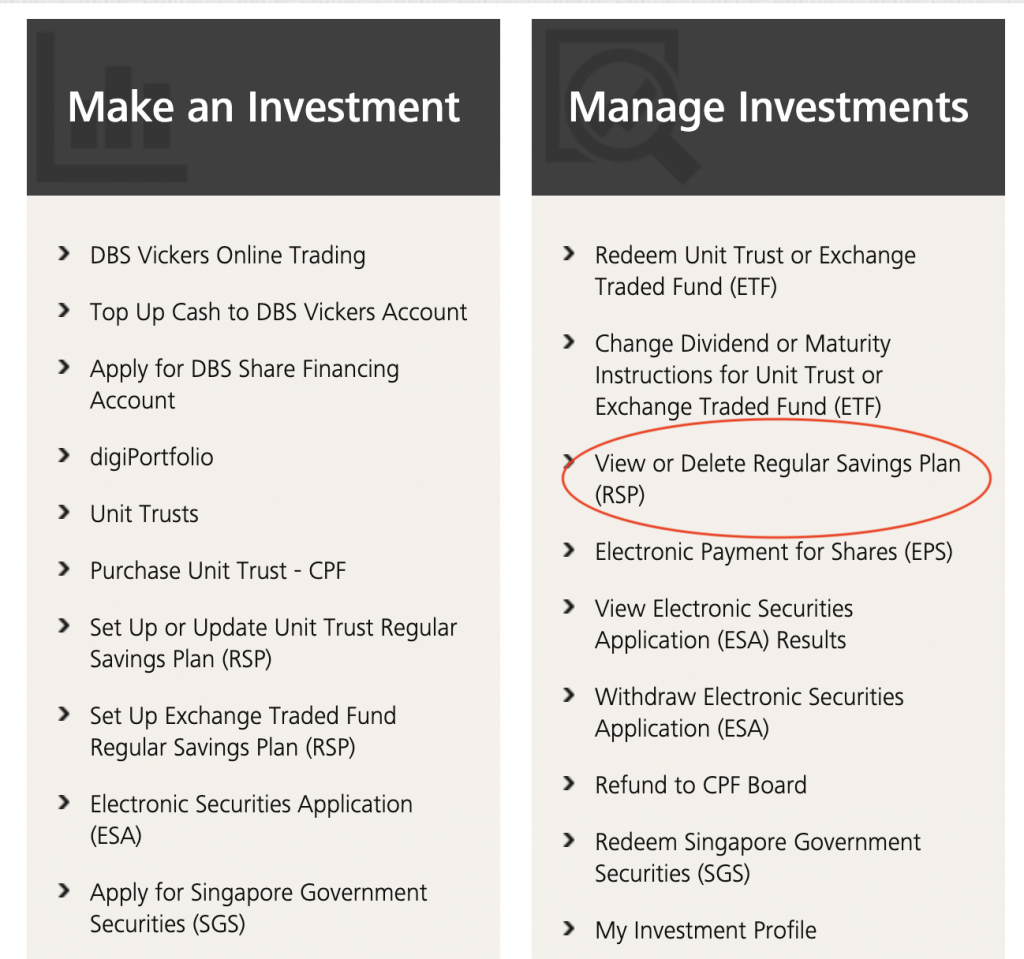

#2 Scroll down and select ‘Set Up Exchange Traded Fund Regular Savings Plan’

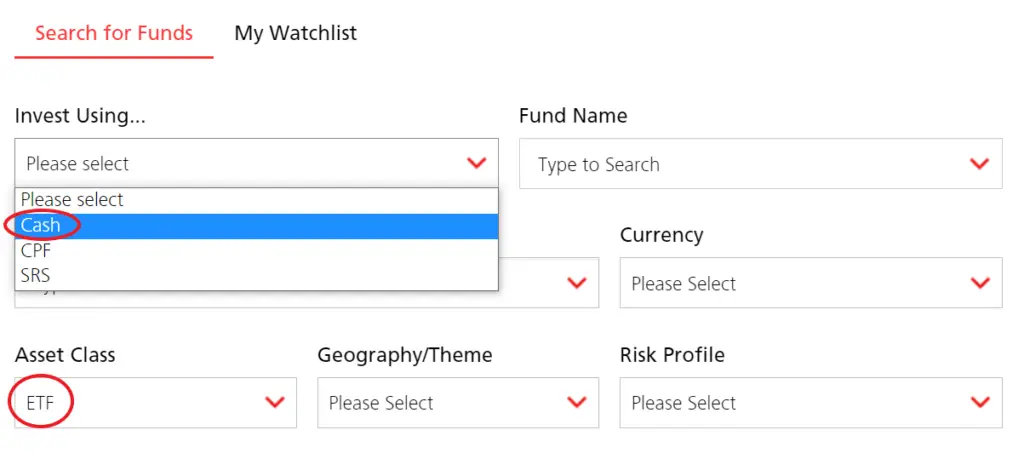

#3 Select ‘Cash’ for the ‘Invest Using’ Field and click ‘Search’

You may want to check that ‘ETF’ is selected for the ‘Asset Class’ field.

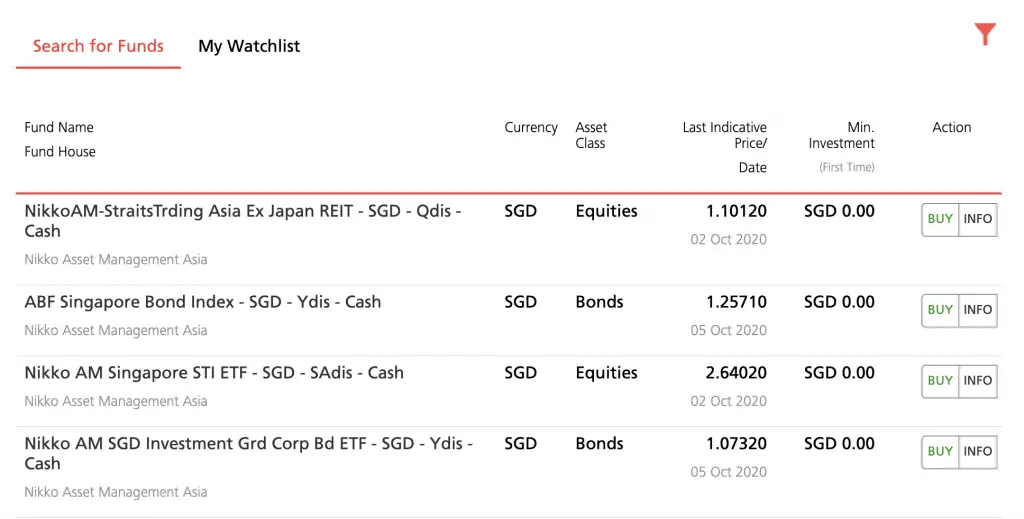

#4 Select the ETF you want to RSP into and click ‘Buy’

You can select ‘INFO’ to view more information about the ETF as well.

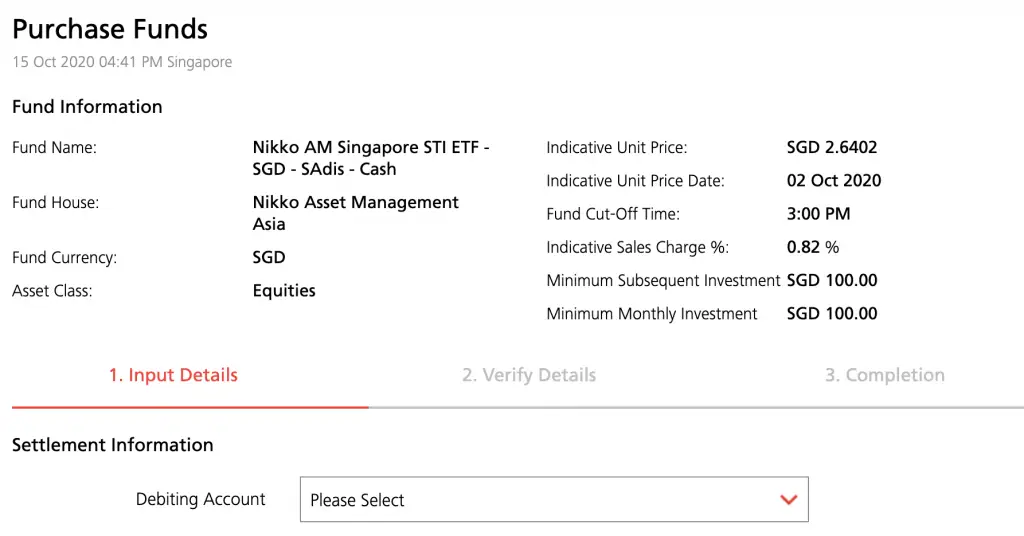

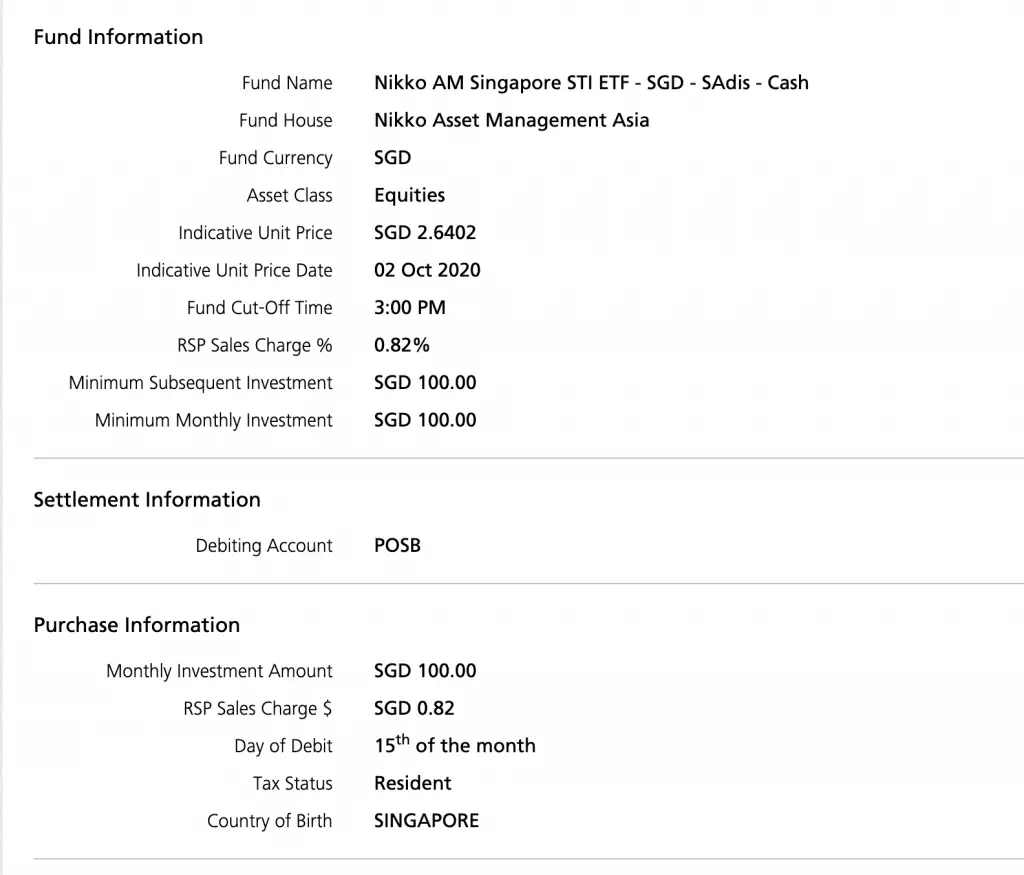

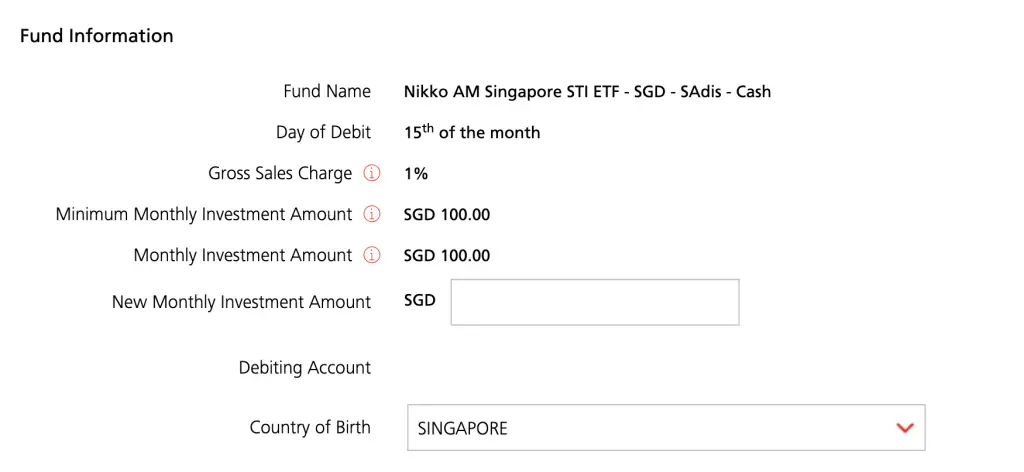

#5 Input the necessary details

You will need to select your debiting account.

The debiting account can be any DBS or POSB account under your name.

You can also use a joint-alternate Current or Savings account, but the Invest-Saver plan will be under your name.

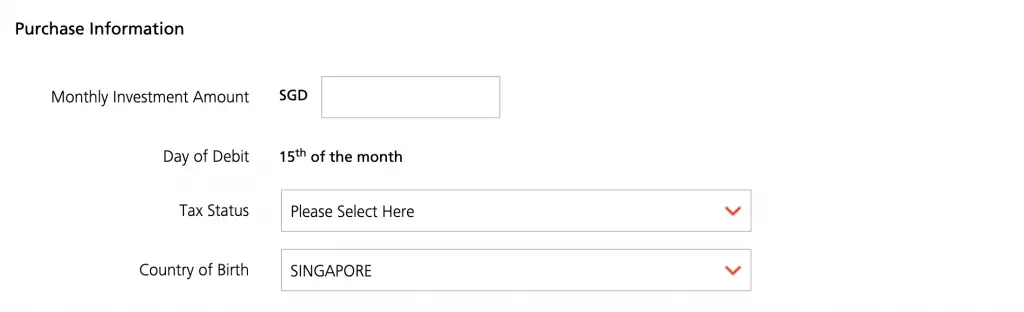

You will then need to select the monthly investment amount and your tax status.

The minimum monthly investment amount is $100. You can then invest in further multiples of $100.

Before applying, you can view more information about the product.

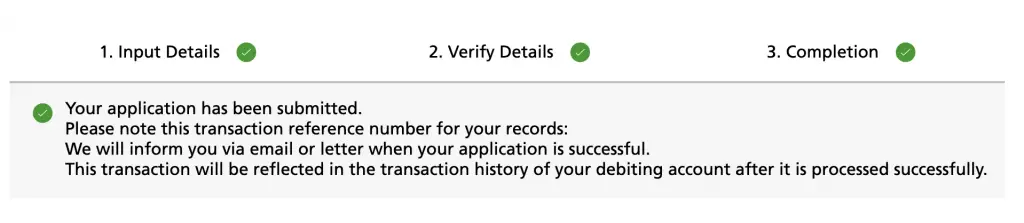

#6 Confirm your details

After confirming this step, your application will be processed.

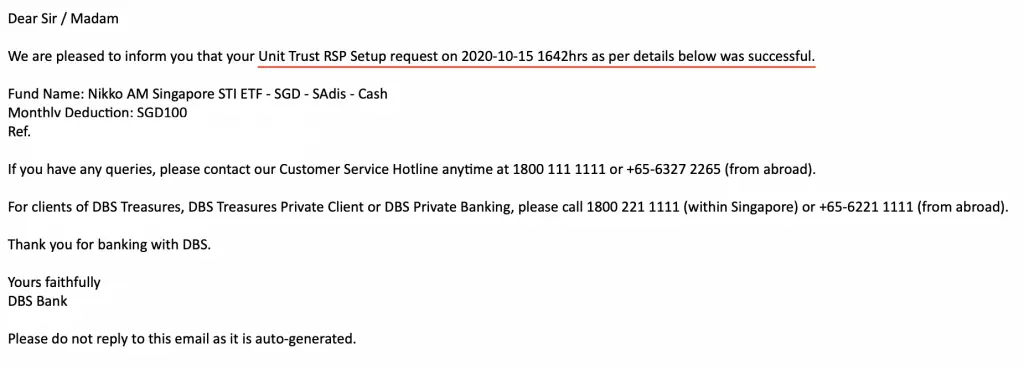

You should receive a confirmation email once your application has been approved.

Even though you applied for an ETF RSP, it will still be referred to as a Unit Trust RSP.

How do I change the amount or cancel my Invest-Saver plan?

The first 2 steps are similar if you wish to change the amount or cancel your RSP.

#1 Go to Invest → More Investment Services

#2 Scroll down and select ‘View or Delete Regular Savings Plan (RSP)’

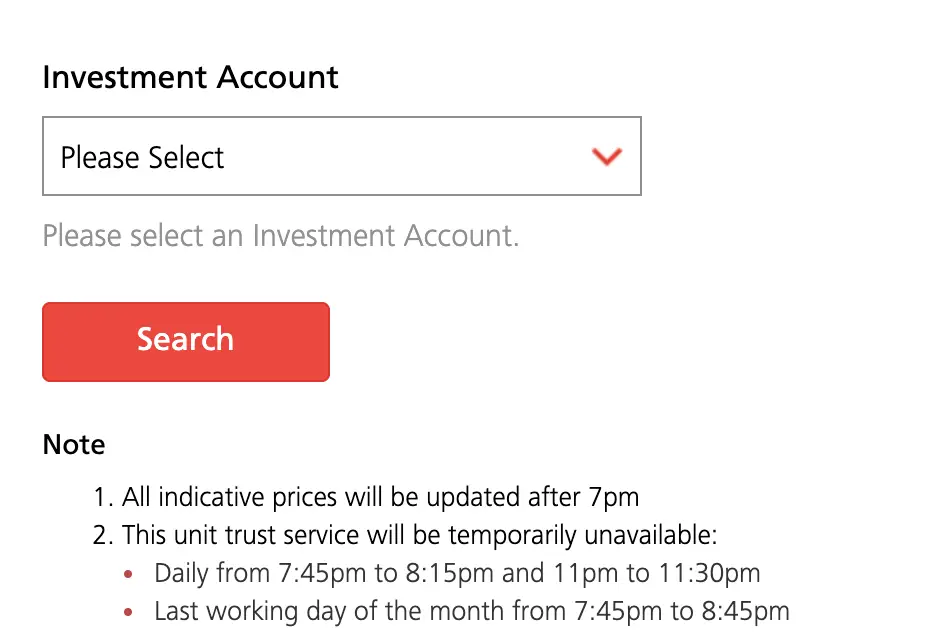

#3 Select your ‘Investment Account’

#4 Amend or delete your RSP

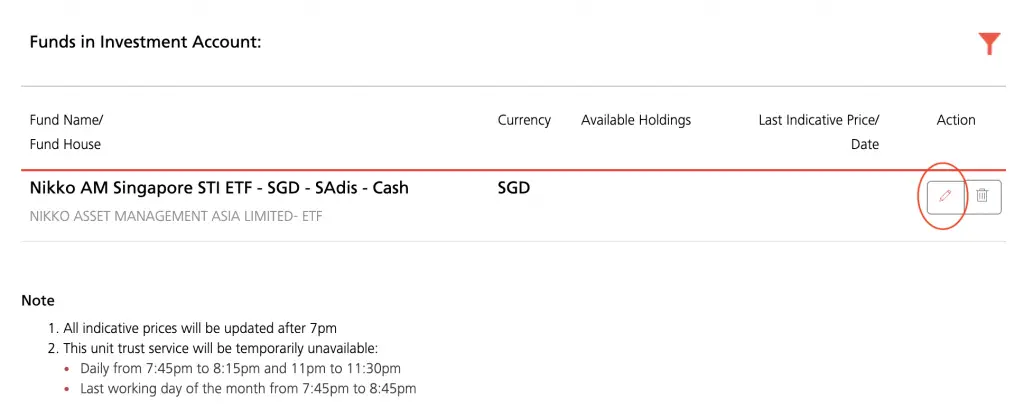

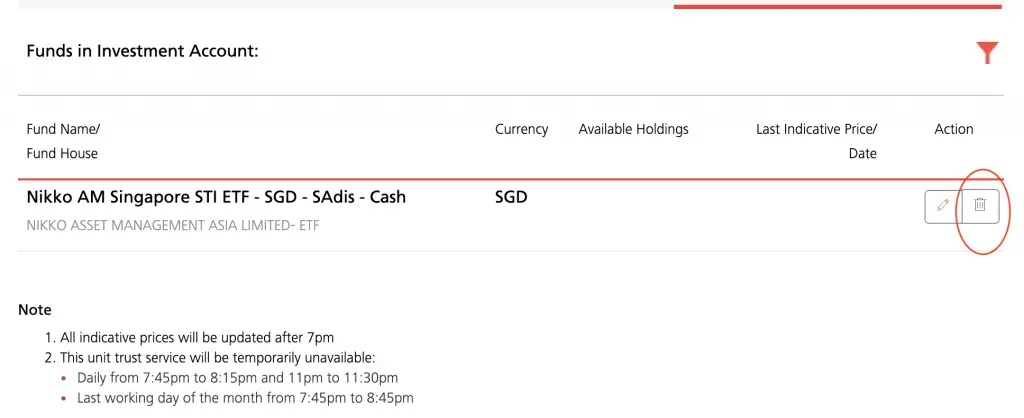

When you scroll down to your RSP, you can choose these 2 options:

Amend your RSP

1. Click on the ‘Pencil’ icon

2. Change your monthly investment amount

However, you can only change the amount in multiples of $100.

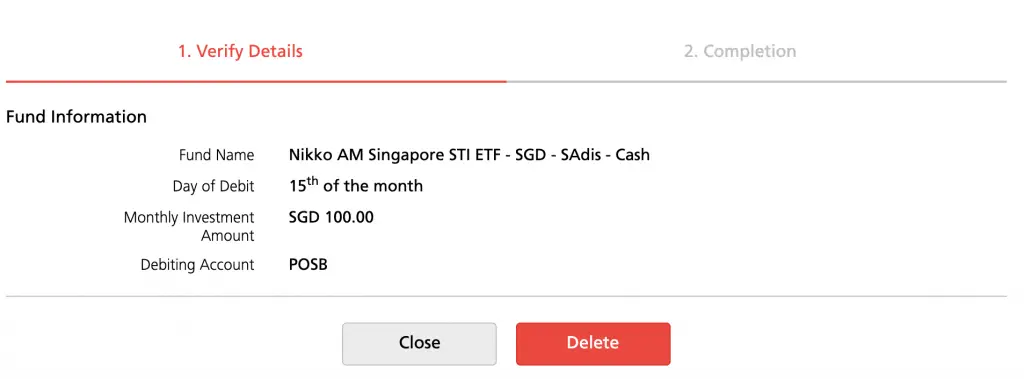

Cancel your RSP

1. Click on the ‘Trash’ icon

2. Confirm your deletion

When you cancel your RSP, it does not mean that you have to sell your units!

You are still able to hold onto your units and receive the dividends.

How do I sell the units I have with Invest-Saver?

You may decide to sell some or even all your units that you have with Invest-Saver.

Here’s how you can do it:

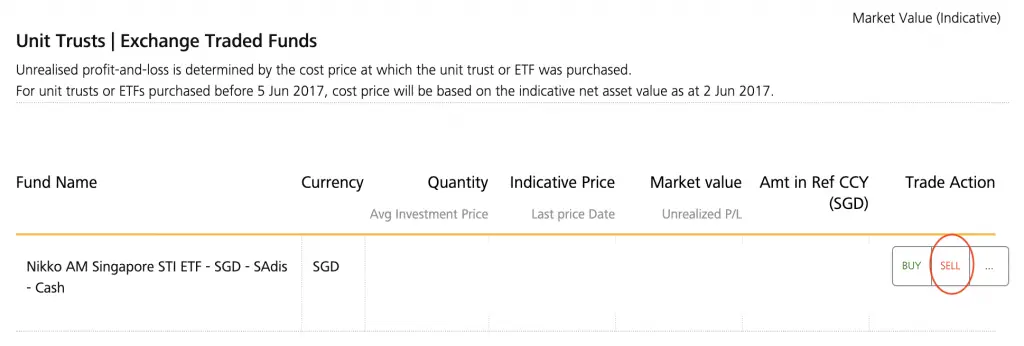

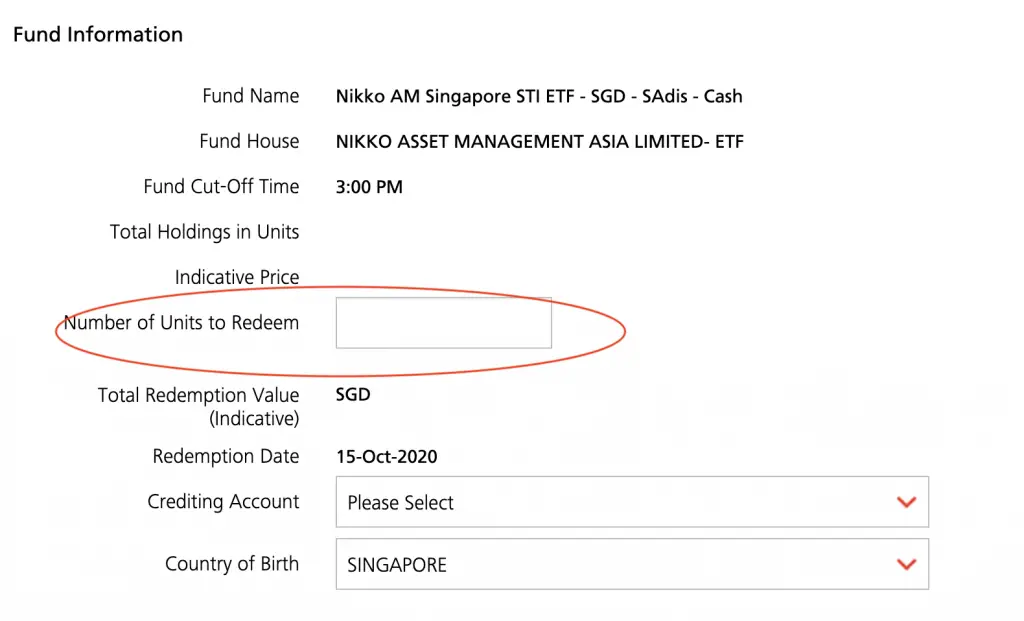

#1 Scroll down to the ‘Investments’ tab and click on ‘Unit Trusts’

#2 Click on ‘SELL’

#3 Select the number of units to redeem

What fees does Invest-Saver charge?

Invest-Saver will have a sales charge for each transaction you make. This includes both buy and sell orders.

Here are the fees that Invest-Saver charges:

| Fund Name | Fee |

|---|---|

| Nikko AM Singapore STI ETF | 0.82% |

| ABF Singapore Bond Index Fund | 0.50% |

| Nikko AM SGD Investment Grade Corporate Bond ETF | 0.50% |

| Nikko AM-StraitsTrading Asia ex Japan REIT ETF | 0.82% |

| All Unit Trusts | 0.82% |

If you are below 30 years old, the transaction fees for Invest-Saver are slightly lower than the OCBC Blue Chip Investment Plan (0.88%).

However, if you are 30 years old and above, Invest-Saver’s 0.82% is a much higher fee compared to OCBC BCIP’s 0.30%.

If you wish to purchase ETFs via a regular savings plan and you are below 30 years old, I would recommend to use Invest-Saver instead of OCBC’s BCIP.

Moreover, you may want to note that the fees you’re paying include both the transaction fee and the expense ratio!

As having these fees will eat into your returns, it is very important for you to consider if it’s worth investing in Invest-Saver given these costs.

How will my dividends be credited?

The ETFs that you invest in may issue dividends.

For example, the NikkoAM STI ETF will give out dividends every 6 months.

If you would like to track your dividends in a single platform, you may want to consider StocksCafe.

Normally, the dividends will be issued per unit of the ETF that you own. You should receive your dividends one day after the distribution date.

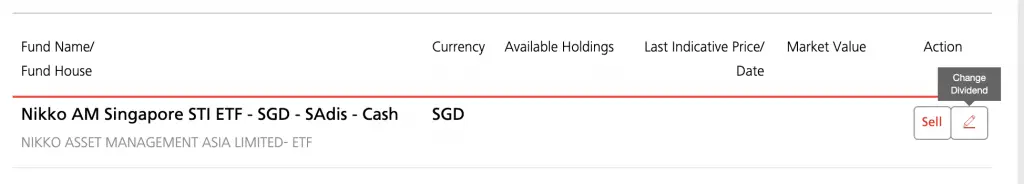

Changing your dividend crediting account

You are can choose the account that you would like the dividends to be credited to.

This can be done either on the web or mobile platform.

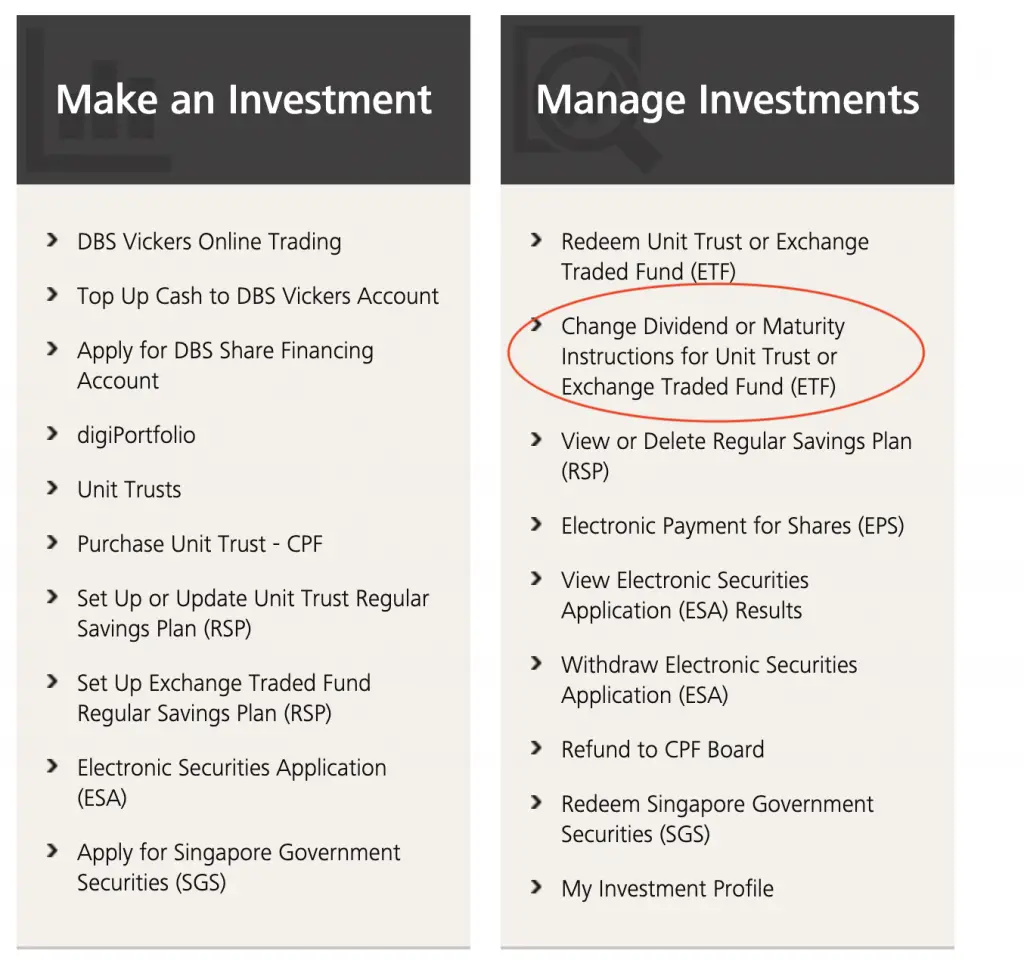

#1 Web Platform

Similar to last time, you will need to go to ‘Invest → More Investment Services‘.

Then you’ll need to scroll down to ‘Change Dividend or Maturity Instructions for Unit Trust or ETF’.

After selecting your investment account, you’ll need to click on the ‘Pencil’ icon.

You will then be able to select which POSB or DBS account you would like the dividends to be credited to.

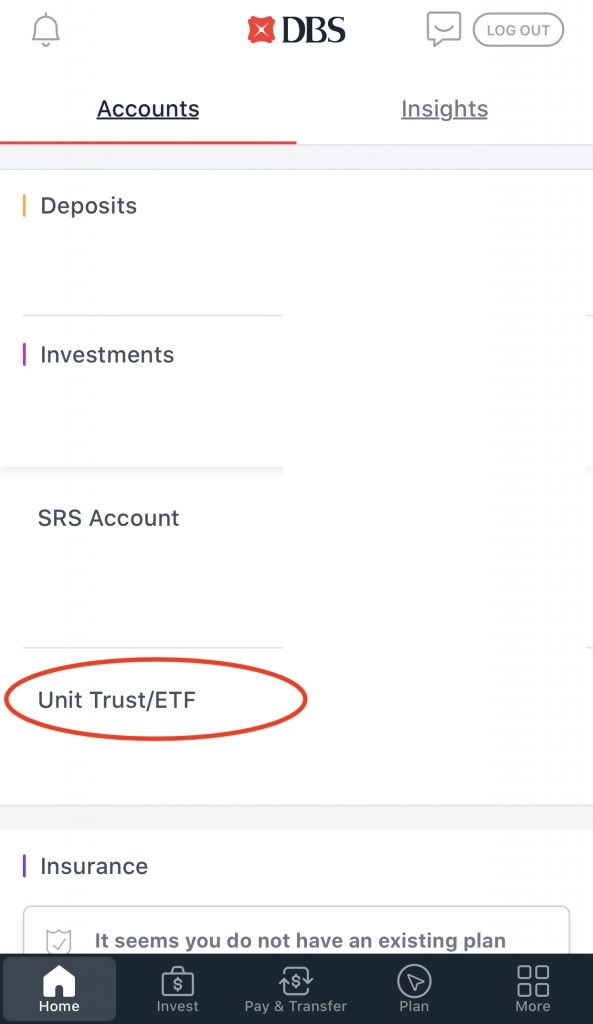

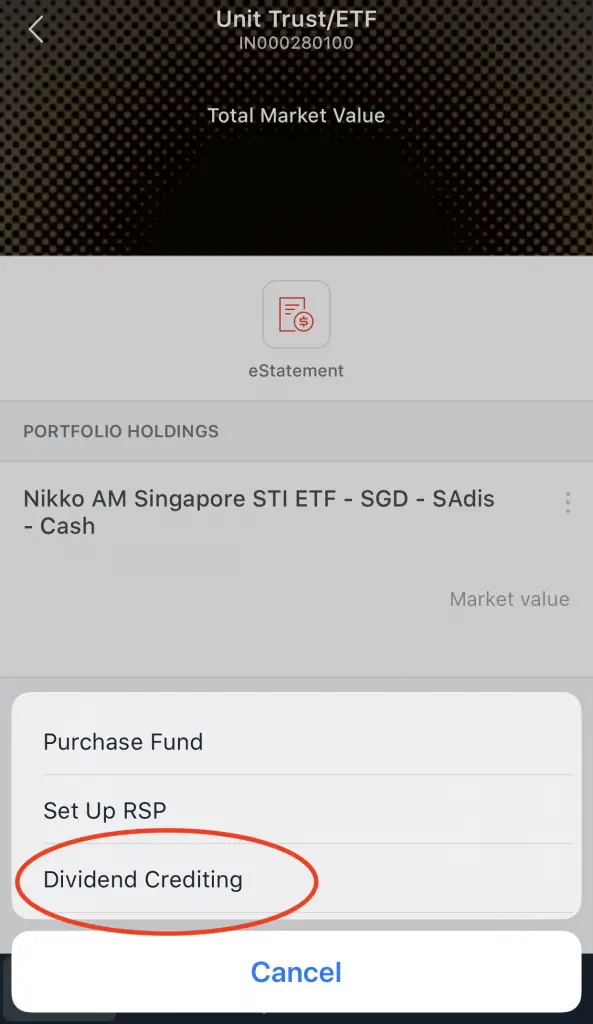

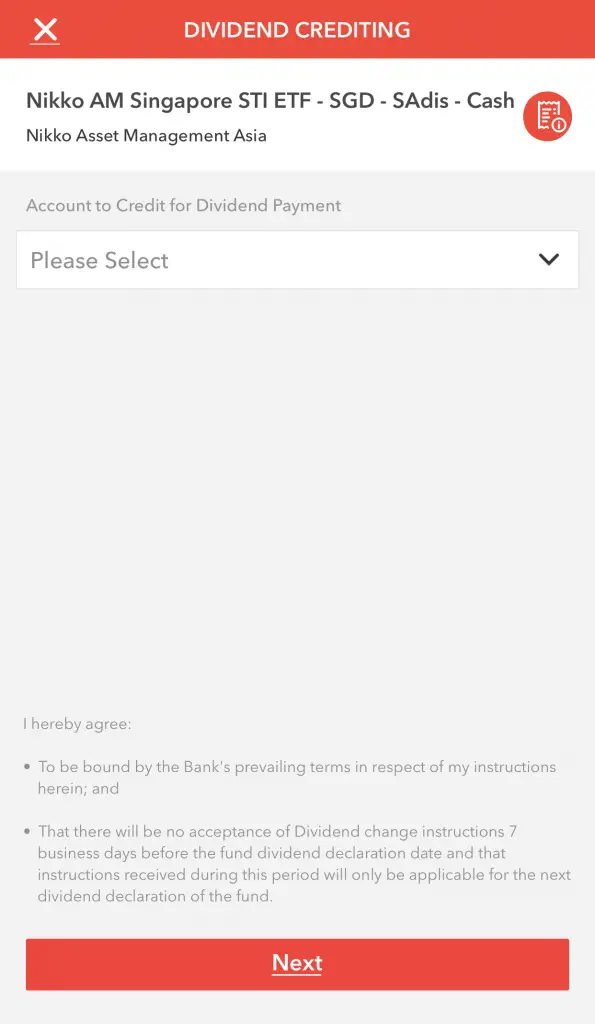

#2 iBanking App

You would be able to use the mobile banking app to change your dividends too.

You would need to scroll down to your investments and select ‘Unit Trust/ETF‘.

Afterwards, select ‘Dividend Crediting‘.

You would then be able to choose the account to credit your dividends to.

What is the performance of Invest-Saver?

When you are investing using Invest-Saver, you are either investing in an individual ETF or Unit Trust.

As such, the performance of your Invest-Saver plan depends on the performance of that ETF or Unit Trust that you’ve purchased.

If you are buying into an ETF, your risk is rather diversified.

This is because you are buying into a basket of stocks. As a result, the performance of the investment depends on a few stocks, rather than just one stock.

Should I invest in the Nikko STI ETF or ABF Fund using Invest-Saver?

The 2 most popular ETFs that most people would invest in are the STI ETF and the ABF Bond Fund.

The STI ETF invests in equities (stocks) while the ABF Bond Fund invests in bonds.

As such, the ETF that you choose depends on your:

Based on these two factors, here’s what I would recommend you to choose:

Invest in the STI ETF if you have a larger risk appetite and longer time horizon

If you are able to take a higher risk and have a longer time horizon, then the STI ETF will be the better choice.

The STI ETF will provide you with higher returns over the long run. However, in the short term, it will have more volatility compared to the ABF fund.

Invest in the ABF Bond Fund if you have a lower risk appetite

If you are not willing to take a lot of risks, then ABF Bond Fund may be a better option for you.

This is because the ABF fund invests in bonds, which are fixed income products.

This makes it less of a risk compared to investing in the STI ETFs, which invests in stocks.

Both ETFs should give you rather decent returns.

You can’t really go wrong with choosing to invest in either the STI ETF or the ABF fund. Both are relatively ‘low-risk’ products. Moreover, you wouldn’t be tempted to check your stocks everyday since they have a rather steady return.

Nonetheless, I would still recommend you to research into each ETF before you invest in it!

You shouldn’t invest in ETFs if you’re saving up for a short-term goal

If you are saving for a short-term goal, placing them in an ETF may be a bit too risky for you.

Instead, you may want to consider leaving it in an insurance savings plan. Some examples include GIGANTIQ or the SingLife Account.

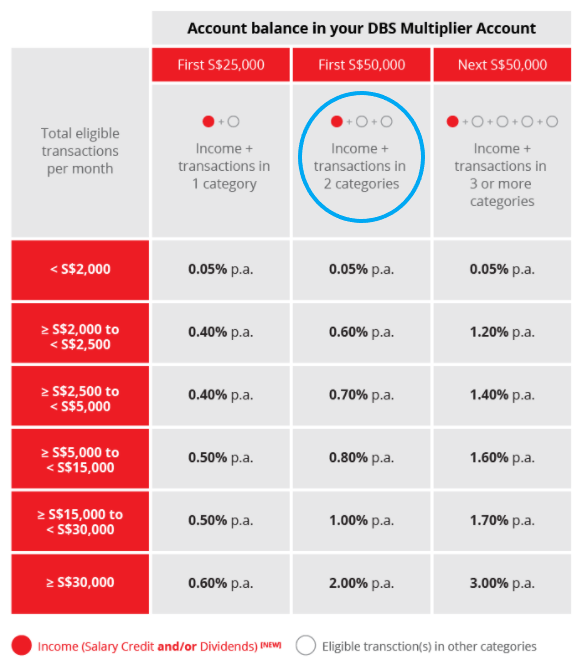

Can Invest-Saver be used for DBS Multiplier?

If you create a new DBS Invest-Saver after opening your Multiplier Account, it will be counted towards the Investment category. This may allow you to earn additional interest on the funds in your Multiplier Account.

For example, let’s say you are meeting both the Income and Spend categories.

With the Investment category, you are now able to have an additional eligible category.

This allows you to earn additional interest in your Multiplier Account!

However, the Invest-Saver will only be recognised for the first 12 consecutive months.

After 12 months, you would no longer be able to count your Invest-Saver contributions toward the Investment category.

As such, I would recommend against setting up an Invest-Saver just to earn that extra interest rate.

Investing is always risky, so you should be aware of the risks before starting an Invest-Saver plan!

Can I transfer the units I bought using Invest-Saver to my CDP account?

When you are investing using Invest-Saver, your assets are in custody of POSB Bank.

This means that you do not have full custody of your shares.

Unfortunately, Invest-Saver does not give you an option to transfer your shares to your Central Depository (CDP) account.

If you wish to eventually transfer your units to your CDP account, you may want to consider using the OCBC Blue Chip Investment Plan instead.

Is Invest-Saver good?

Here are the pros and cons of using the DBS / POSB Invest-Saver:

| Pros | Cons |

|---|---|

| Able to start investing from $100 | Poor user interface which makes it hard to create and amend your RSP |

| Cheaper fees compared to OCBC BCIP under 30 years old | Limited to only 4 ETFs to choose from |

| Unable to transfer to CDP account | |

| DBS Multiplier promotion only lasts for 1 year | |

| SRS can only be used to invest in Unit Trusts and not ETFs | |

| Unable to purchase individual stocks like OCBC BCIP or POEMS Share Builders Plan |

Although the Invest-Saver has many cons, it is still one of the most fuss-free ways of starting your investing journey.

Conclusion

The DBS POSB Invest-Saver is a good way for beginner investors to begin your investment journey. It is fuss-free once you set it up, and it will instill that discipline in you to invest every month.

In addition, the returns that you receive will definitely be higher than leaving your money in the bank.

However, the ETFs offered by Invest-Saver may not be the best investment as there are many investments out there which have much better returns.

If you are looking for a more diversified portfolio, you may want to consider investing using robo-advisors instead.

You can also consider investing in StashAway’s Income Portfolio which invests in some of these ETFs too.

Nevertheless, the DBS / POSB Invest-Saver is a great stepping stone for you. You are able to make your money work harder for you first, as you start to build up your investing knowledge.

Once you’ve gained more knowledge, you may want to consider other investments instead!

Cashback promotion for Invest-Saver

You are able to receive a cashback promotion when you use the Invest-Saver plan.

You will be able to receive full rebates on your sales charges, provided you set up an Invest-Saver plan between the specified period.

However, there are some conditions you’ll need to take note of:

- You are only eligible for this promotion if you set up your Invest-Saver plan during the promotional period

- You will have to use Invest-Saver for at least 3 months before you are eligible for the cashback

For more information, you can view this promotion on DBS’ website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?