Last updated on June 6th, 2021

You’ve decided to invest in a bond ETF. However when you look at the SGX, you notice that 2 different bond ETFs are being listed!

How are they different and which one should you choose?

Here’s a head-to-head comparison of MBH and A35.

Contents

- 1 The difference between MBH and A35

- 2 Both are managed by Nikko AM

- 3 They track different indexes

- 4 They have different performances

- 5 MBH has a slightly higher liquidity

- 6 MBH has a higher tracking error

- 7 The expense ratios are rather similar

- 8 Dividends are distributed annually

- 9 You can buy them using different methods

- 10 Verdict

- 11 Conclusion

The difference between MBH and A35

MBH and A35 are bond ETFs that are both managed by Nikko AM. MBH tracks corporate bonds of companies from different sectors. Meanwhile, A35 tracks government bonds, and is heavily weighted in the Singapore government. MBH is a slightly riskier ETF, and it may have the potential to give you higher returns. You are able to invest in either ETF using a variety of methods, such as cash, SRS and your CPF.

Both are managed by Nikko AM

A35 (ABF Singapore Bond Index Fund) and MBH (Nikko AM SGD Investment Grade Corporate Bond ETF) are both managed by Nikko AM.

They track different indexes

Both of these bond ETFs track different indexes:

| A35 | MBH | |

|---|---|---|

| Index | iBoxx ABF Singapore Bond Index Total Return Series | iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index |

So how are these indexes different?

A35 invests mainly in government bonds

The iBoxx ABF Singapore Bond Index Total Return Series tracks bonds that are issued by:

- Singapore or other Asian Governments

- Agency or instrumentality of Singapore or other Asian Governments

- Sponsored entities of Singapore or other Asian Governments

- Quasi entities of Singapore or other Asian Governments

- Singapore dollar denominated debt obligations issued by supranational financial institutions

The countries included in the ‘other Asian Governments‘ are:

- Singapore

- China

- Hong Kong

- Indonesia

- Korea

- Malaysia

- The Philippines

- Thailand

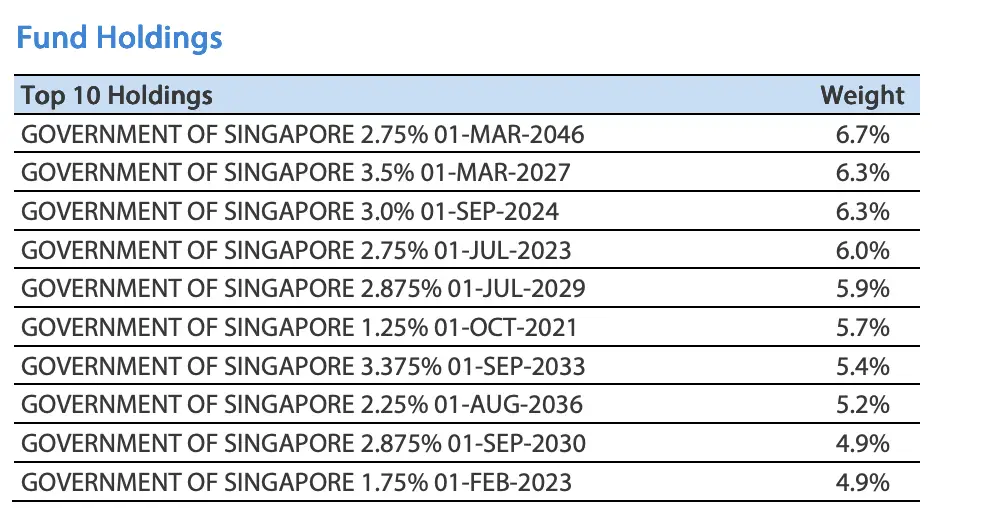

The top holdings of this fund are mainly Singapore government bonds.

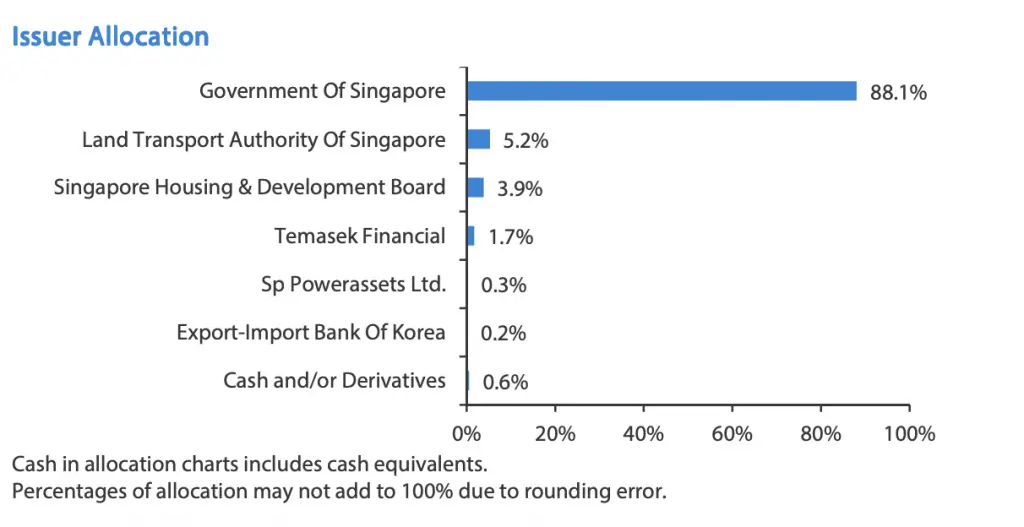

And most of the bonds are concentrated in Singapore.

The average credit rating for these bonds are AAA. This means that the risk of the bond defaulting is very low. As such, this makes A35 a very safe investment option for you!

MBH invests in large cap bonds

The iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index invests in SGD denominated non-sovereign investment grade bonds. However, this index excludes Singapore Government Securities.

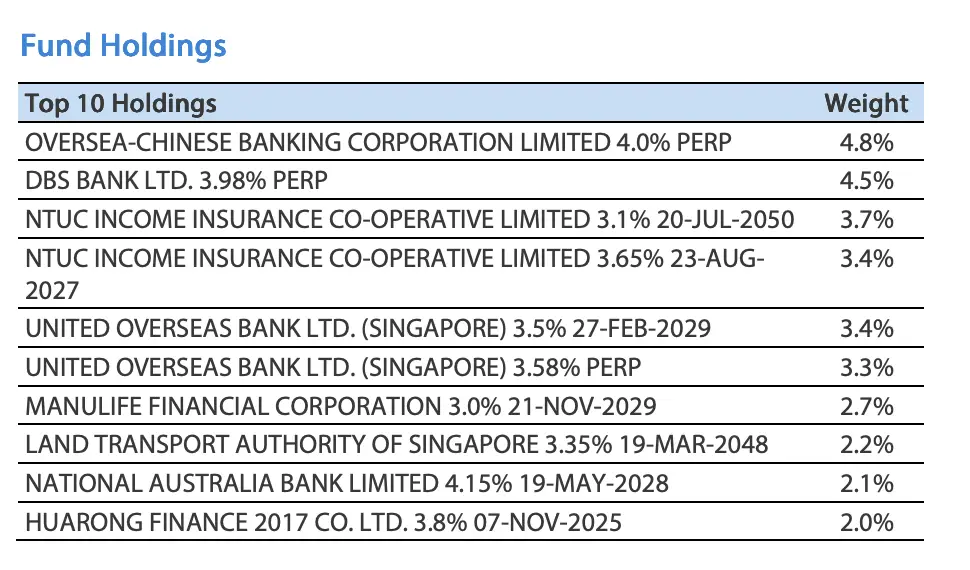

Instead of government bonds, the index tracks the bonds of some private companies like banks. Here are the top holdings in MBH.

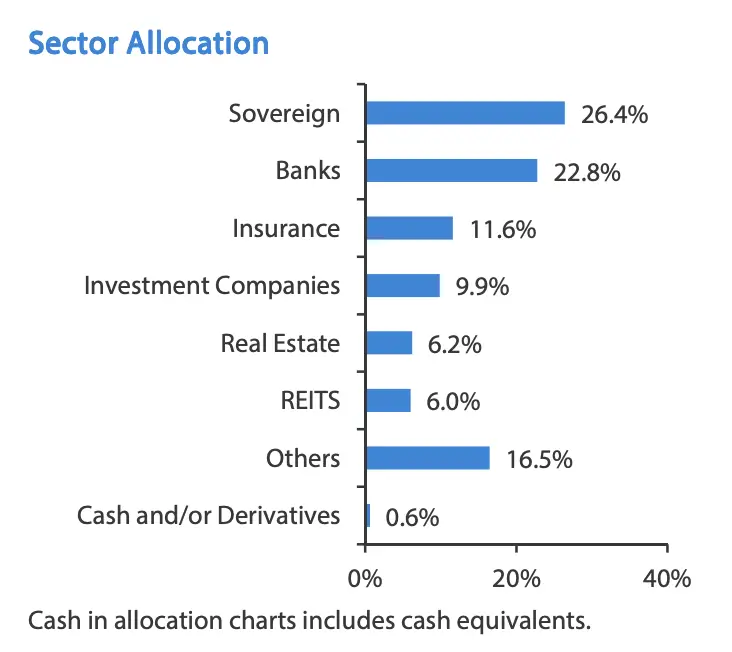

The bonds are also more diversified among the different sectors.

The average credit rating for the bonds in this index is A. This is slightly lower than A35, but is still considered as investment grade. The bonds in this ETF are still relatively safe, and have a low risk of default.

They have different performances

Due to the different indexes that they track, A35 and MBH have different performances.

Here are the one year returns for both of these ETFs (from 7 Nov 2019 to 7 Nov 2020):

It does seem that A35 is consistently performing better compared to MBH.

MBH has a slightly higher liquidity

If you are a frequent trader, liquidity might be something you might want to consider for these 2 ETFs. One of the ways that you can measure an ETF’s liquidity is by its average trading volume.

| A35 | MBH | |

|---|---|---|

| Average Trading Volume | 292,000 | 383,000 |

| Net Fund Size | $1.04 billion | $590 million |

It is quite interesting that MBH has a higher liquidity even though it is the newer fund and has a smaller fund size.

Both ETFs have a pretty decent trading volume.

MBH has a higher tracking error

One indicator you might want to consider when investing in an ETF is the tracking error.

A tracking error is the divergence between the performance of the index and that of the ETF.

Investopedia

As such, you should be investing in an ETF that has a low tracking error. This will result in the performance of the ETF to be very close to the index it is tracking. Here are the tracking errors for these ETFs:

| A35 | MBH | |

|---|---|---|

| Annualised Tracking Error | 0.28% (3-year) | 0.42% (1-year) |

It does look like MBH has a higher tracking error. However, MBH has only been around since August 2018. Meanwhile, A35 has been around since August 2005!

Since MBH is rather new, it may take a while to accurately track the performance of the index. Over a longer period of time, the tracking error should average out and eventually be reduced.

The expense ratios are rather similar

Expense ratios are the annual fees that you pay to the fund manager. Ideally, this should be as low as possible so that the fees do not eat into your returns.

Here are the total expense ratios that you will need to pay when investing in these ETFs:

| A35 | MBH | |

|---|---|---|

| Total Expense Ratio | 0.25% | 0.27% |

The total expense ratios of these 2 ETFs are rather similar. As such, this would not really affect your decision when you choose to invest in each ETF.

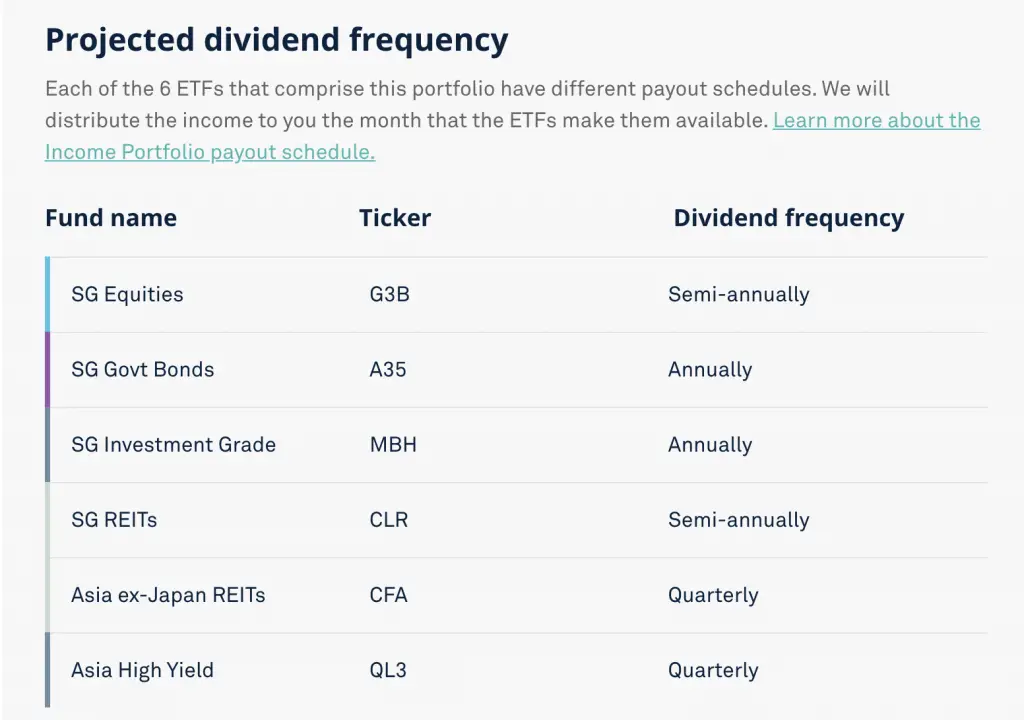

Dividends are distributed annually

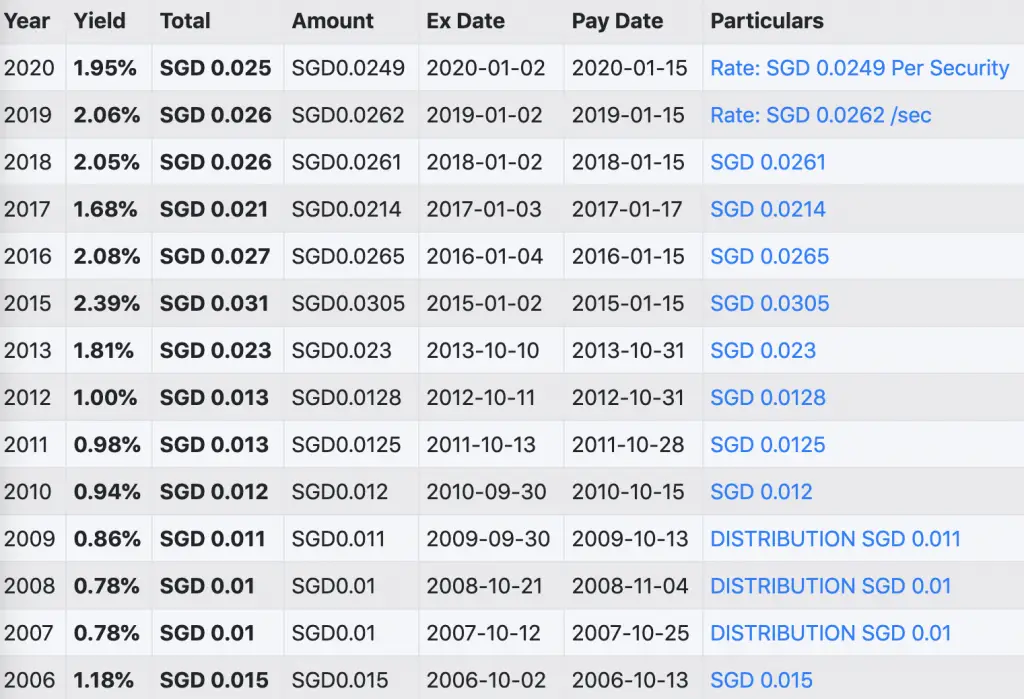

Both of these ETFs will distribute your dividends annually. Here is the dividend payout for A35,

as well as the dividend payout for MBH.

This may be a disadvantage when you invest in either ETF for a fixed income. The dividends are only distributed annually, so you will not be receiving consistent income each month.

If you are interested in tracking your dividends, you may want to check out the StocksCafe platform.

You can buy them using different methods

There are a few methods which you can purchase these bond ETFs from:

#1 Brokerages

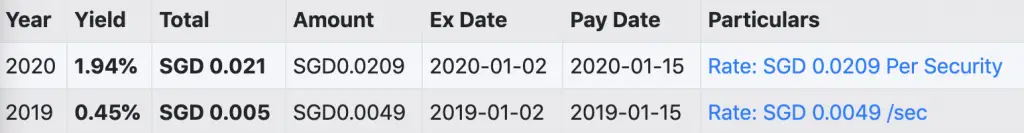

You are able to purchase MBH or A35 from any brokerage which allows you to invest in the SGX. The minimum lot size for both funds is 10 units per lot.

Since both of them are around $1 per unit, it is pretty affordable to start investing in them. You may want to consider low-commission brokers such as Tiger Brokers. This will help you to reduce the amount of fees that you’ll need to pay!

You can invest in both ETFs using Cash, SRS or CPF

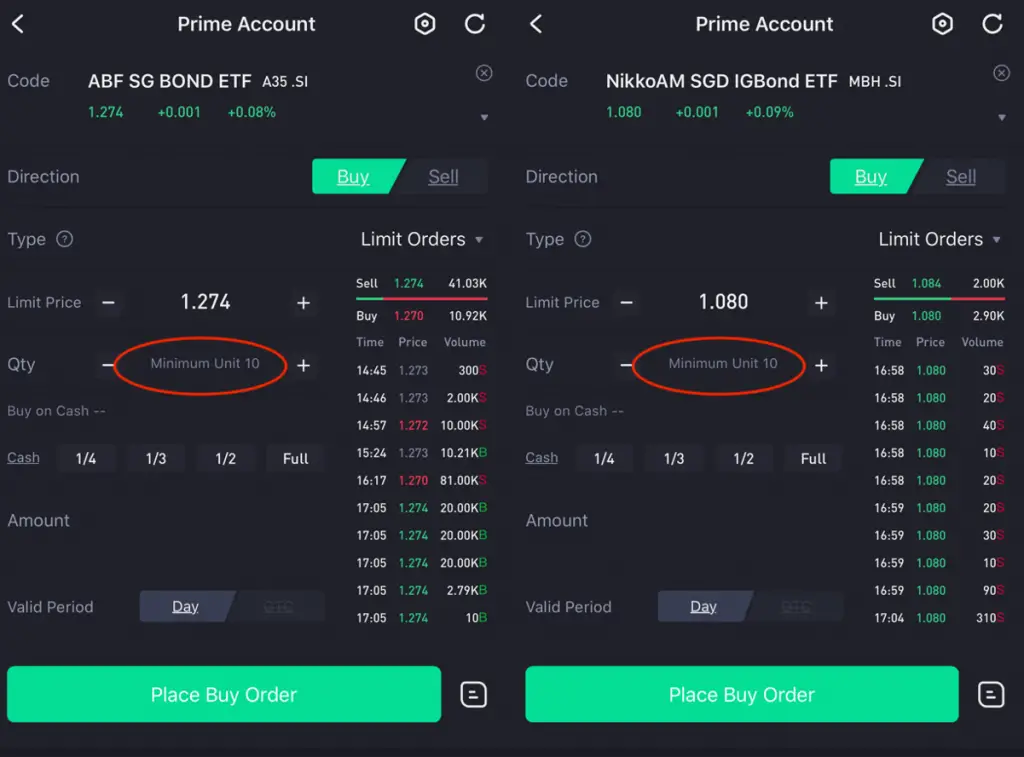

You are able to invest in both ETFs using your SRS or CPF funds as well.

For SRS, you are able to invest in any ETFs which are listed on the SGX.

Some brokers which allow you to invest using your SRS funds include:

Both ETFs are also classified as ‘Low to Medium Risk’ by the CPF board.

As such, you are able to invest in both ETFs using your CPF funds.

You will need to find a broker that allows you to invest your CPF funds with them as well. Most of these brokers are the same as the ones that are listed above.

#2 Regular Savings Plans

Regular Savings Plans are a good way to dollar cost average into this 2 ETFs.

By investing a fixed sum each month, you will not need to worry much about market timing. This will help you not to check your stocks everyday!

Here are the Regular Savings Plans that allow you to invest in this 2 ETFs:

| A35 | MBH | |

|---|---|---|

| POEMS SBP | ✓ | ✓ |

| Invest Saver | ✓ | ✓ |

| OCBC BCIP | ✓ | ✕ |

| FSMOne | ✓ | ✓ |

The only difference is that the OCBC BCIP does not allow you to invest in MBH.

Based on the transaction fees, I believe that the Invest Saver is the best choice if you have a small sum to invest. This is because you are charged a flat 0.5% with no minimum fee.

However, it may be more cost efficient to use FSMOne if you intend to invest a larger sum!

#3 Robo-Advisors (StashAway Income Portfolio)

Both bond ETFs are part of StashAway’s Income Portfolio.

So far, this is the only robo-advisor that allows you to invest in these ETFs. However, you cannot invest into these 2 ETFs directly.

You will only invest a part of your portfolio into A35 and MBH.

Verdict

Here’s a comparison between ABF Singapore Bond Index ETF vs Nikko AM SGD IG Bond ETF:

| A35 | MBH | |

|---|---|---|

| Fund Manager | Nikko AM | Nikko AM |

| Index Tracked | iBoxx ABF Singapore Bond Index Total Return Series | iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index |

| Average Credit Rating | AAA | A |

| One Year Returns | 7.10% (Nov 2019-2020) | 3.30% (Nov 2019-2020) |

| Average Trading Volume | 292,000 | 383,000 |

| Net Fund Size | $1.04 billion | $590 million |

| Annualised Tracking Error | 0.28% (3-year) | 0.42% (1-year) |

| Expense Ratio | 0.25% | 0.27% |

| Dividend Distribution | Annual | Annual |

| Minimum Lot Size | 10 | 10 |

| Types of Funds for Investing | Cash SRS CPF | Cash SRS CPF |

| Regular Savings Plan | All | All except OCBC BCIP |

So which bond ETF should you choose?

Choose A35 if you prefer government bonds

If you prefer to invest in government bonds, then A35 may be the better option. This ETF is heavily weighted in the Singapore Government’s bonds, which has an AAA credit rating. The default risk is extremely low, so this is as close to a risk-free investment as you can get!

However, the returns that you obtain may be comparatively lower.

Choose MBH if you want higher yields

MBH does have a lower performance compared to A35 so far. However, the fund only started in 2018, so it may take a while for the returns to average out over time.

The yields of the bonds in the top holdings are between 3-4%. In contrast, the A35 consists of bonds in the top holdings that have yields of 1.25-3.75%. As such, I believe that MBH will eventually outperform A35.

Moreover, average crediting rating for MBH is A, which is lower than A35. As such, it depends on whether you wish to invest in government bonds or corporate bonds. Corporate bonds (MBH) do have a slightly higher risk, but have a higher potential for returns.

Conclusion

Both bond ETFs will provide a stable return on your investment. As such, you will need to understand your risk profile first. This will help you to decide which bond ETF you are willing to invest in!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?