Last updated on June 6th, 2021

There are so many different robo-advisors out there that offer you a wide range of portfolios.

You may be torn between investing with Syfe’s Equity 100 and StashAway’s Highest Risk (36%) portfolio. Both of them are really accessible for beginner investors, so which one should you choose?

Here’s a comparison on these 2 robo-advisory portfolios.

Contents

Syfe Equity 100 vs StashAway

Syfe’s Equity 100 portfolio is 100% concentrated in equities, while StashAway offers you a diversified portfolio across different asset classes. The returns on Equity 100 will be higher, but the returns in the short term will be much more volatile. Syfe also charges cheaper fees compared to StashAway. The portfolio that you should choose depends on the time horizon that you have.

Investing Strategy

The 2 robo-advisors use very different investment strategies:

StashAway uses their ERAA framework

StashAway uses an Economic Regime-based Asset Allocation (ERAA) framework. This framework focuses on asset allocation instead of securities selection.

This means that StashAway focuses on your allocation into each asset class, rather than choosing which specific stock or bond they would invest in.

Essentially, StashAway’s ERRA framework follows the Modern Portfolio Theory.

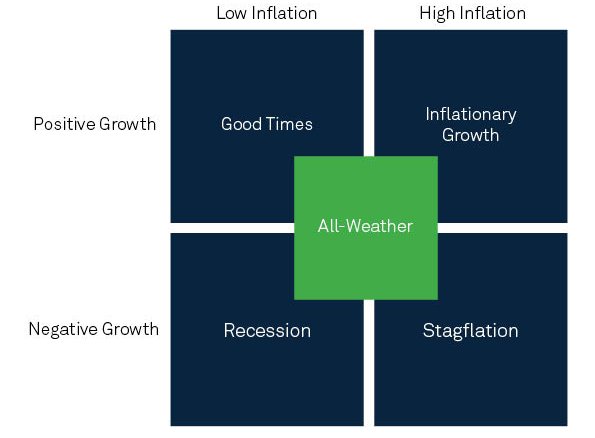

StashAway decides on your allocation based on the current economic conditions. Here are the 4 economic regimes that are defined by StashAway:

The ERAA has a certain allocation for each regime. For example, you will be weighted more towards equities in periods of strong growth. Meanwhile during poor economic times, you may be allocated more towards bonds.

The ERAA will re-optimise your for you when it detects a change in the economic regime. A recent re-optimisation was done in May to account for the effects of COVID-19.

StashAway Risk Index

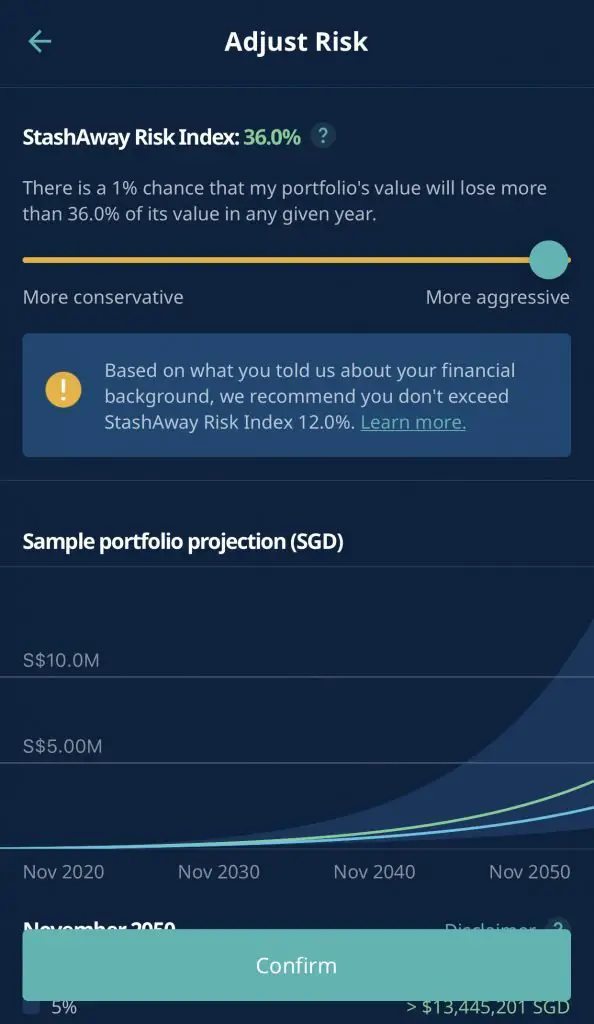

StashAway also has a risk index that determines the ‘riskiness’ of your portfolio.

The Risk Index means that there is a 99% probability that you will not lose more than x% of your portfolio in a year.

The x% is the amount of risk you are willing to take.

The more risk you’re willing to take, the higher the Risk Index. The highest risk profile that you can create is 36%.

You can consider investing in StashAway’s Income Portfolio as well.

Syfe Equity 100 uses a Smart Beta investing strategy

Syfe’s Equity 100 focuses on building a smart beta portfolio for you. This is sometimes referred to as factor-based investing.

Syfe aims to provide high returns by concentrating on a few factors. These factors are chosen to ensure that your portfolio will outperform a certain index. Currently, Syfe has selected these 3 factors:

- Growth

- Large-cap

- Low-volatility

Syfe will then select the best ETFs that are weighted towards these factors.

For example, the current portfolio is heavily weighted in the QQQ ETF. This will help to tilt the portfolio towards the growth and large cap factors. Meanwhile, the low-volatility factor is achieved by investing in multiple sector ETFs.

This is different from the original Fama-French 3-factor model, which focused on:

- Size of firms

- Book-to-market values

- Excess return on the market

Syfe will dynamically select the best factors for you

In the long run, the factors that give the best returns in the future may no longer be these 3 factors. As such, Syfe has a dynamic factor selection to choose the best factors in the current economic climate. Your portfolio will be over or under-weighted in certain factors to produce the highest risk-adjusted returns.

This helps to ensure that your portfolio will continue to perform in any market condition!

Allocation

The way that StashAway and Syfe allocate their assets are rather different:

StashAway has a broad allocation among the asset classes

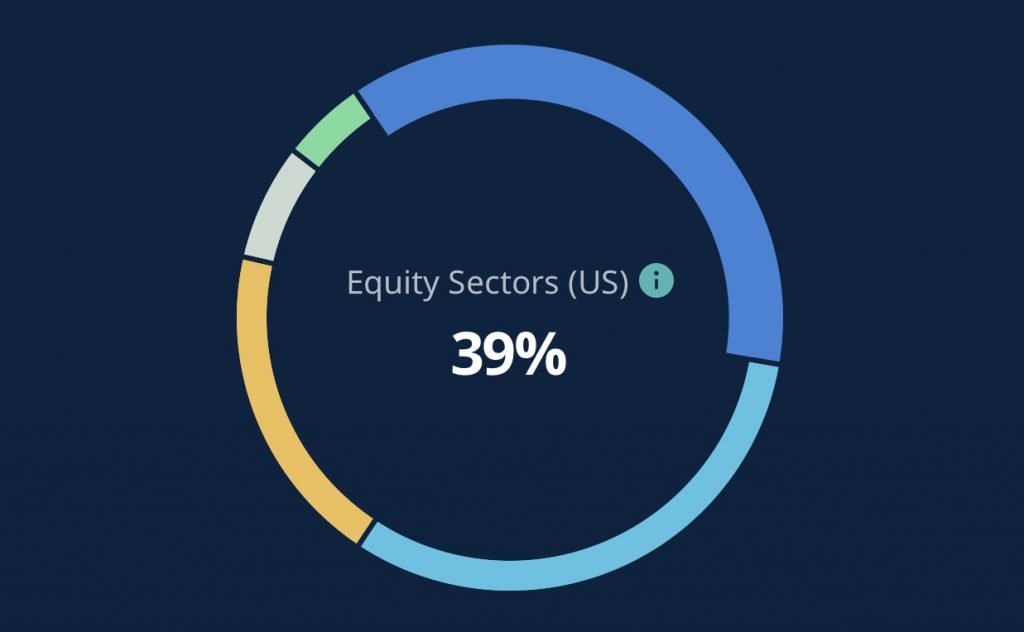

In StashAway’s 36% risk portfolio, you will be allocated to these 4 main asset classes:

- International Equities

- Equity Sectors (US)

- Real Estate

- Commodities

You will be most heavily weighted in US Equities.

Syfe’s Equity 100 is 100% concentrated in stocks

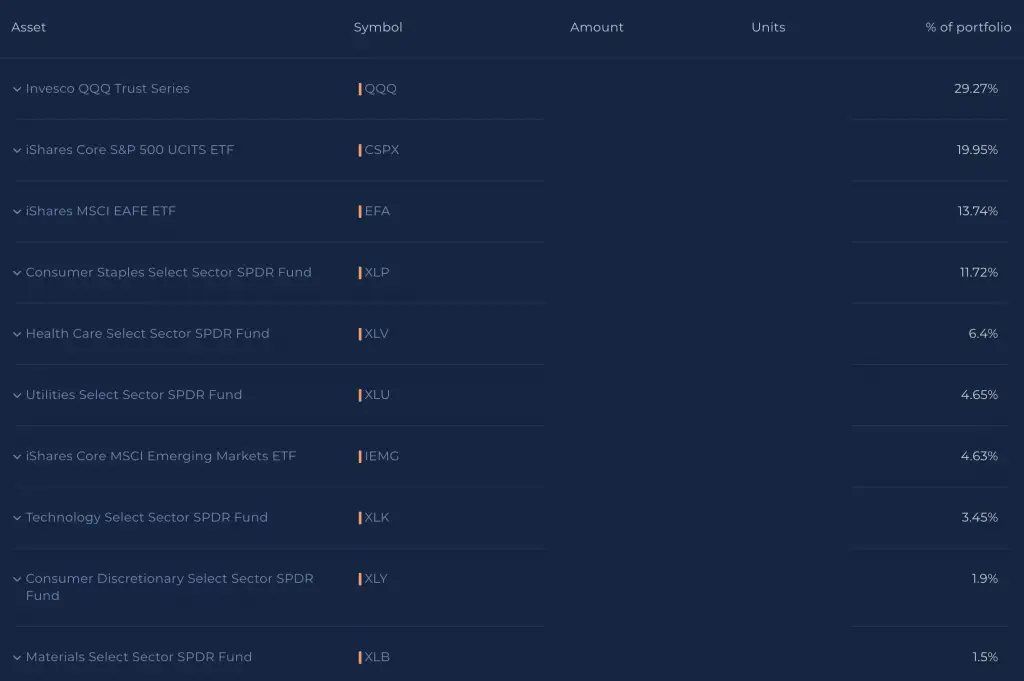

When you invest in Syfe’s Equity 100, your assets will be 100% allocated towards stocks. Here are some of the equity ETFs that Syfe will invest in:

Currently, Equity 100 is very heavily concentrated towards tech stocks (QQQ).

Both invest in ETFs

Both StashAway and Syfe Equity 100 invest in exchange-traded funds (ETFs) instead of individual stocks.

An ETF is a fund that buys into a basket of stocks, rather than just buying into just one stock.

This ensures that your risk is diversified over different companies.

The ETFs’ domicile is slightly different

The amount of dividend withholding tax and estate tax that you will need to pay depends on the fund’s domicile.

Equity 100’s S&P 500 ETF is domiciled in Ireland

The S&P 500 ETF that Syfe invests in is CSPX, which is domiciled in Ireland. This provides some tax advantage as you will only incur a 15% withholding tax. In contrast, funds that are domiciled in the US will incur a 30% withholding tax.

This does help you to reduce the amount of tax that you’ll incur!

You can read my guide to investing in the S&P 500 from Singapore to find out more.

However, this is only for the S&P 500 ETF. Other ETFs like QQQ are still domiciled in the US. This means that you will still incur the 30% withholding tax for the other ETFs in your portfolio.

All of StashAway’s ETFs are US-domiciled

For StashAway’s general investing portfolios, they will invest your funds into US-domiciled ETFs. As such, you will incur a 30% dividend withholding tax on all of your dividends.

However, StashAway believes that the higher tax you incur is a trade-off. StashAway still chooses US-domiciled ETFs as they are:

- Cost-efficient

- Simple

- Low tracking error

All ETFs are listed in USD

All of these ETFs that you invest in are listed in USD. As such, there may be some foreign currency risk that you will have to incur when you invest in either portfolio.

Funds you can use to invest in their portfolios

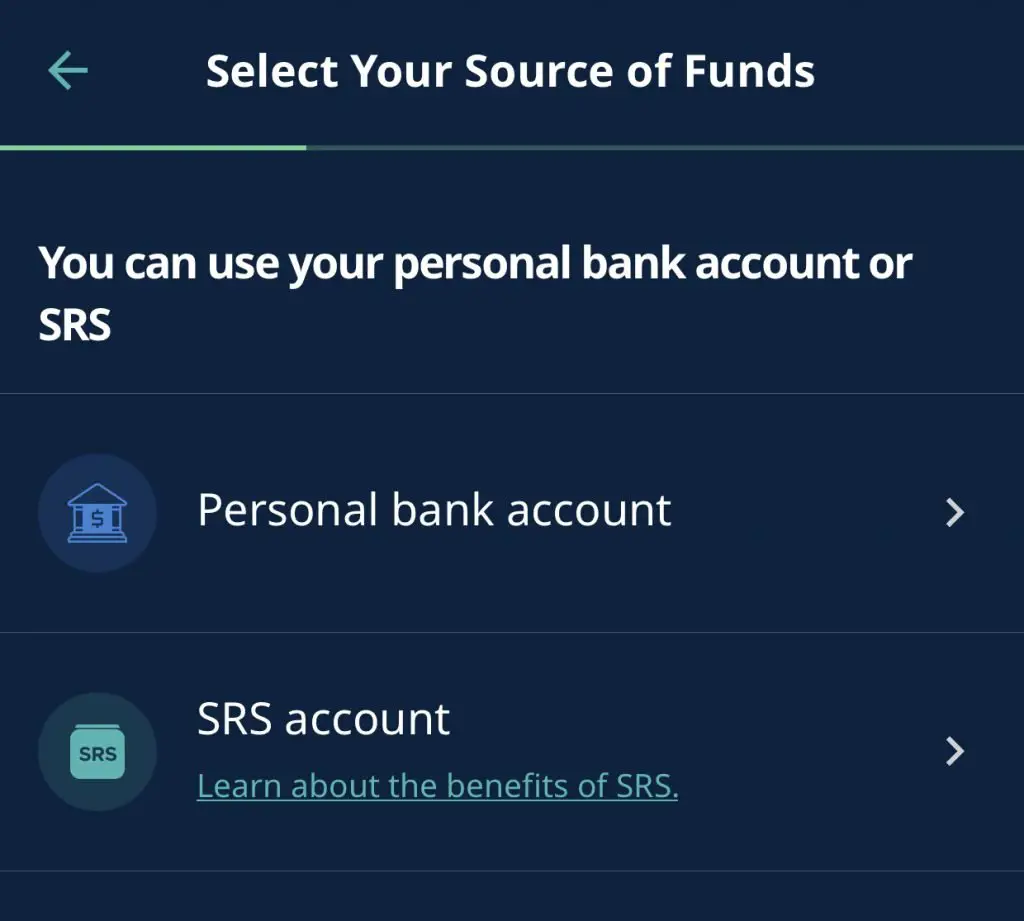

You are able to invest in StashAway’s portfolios using both your cash and SRS funds.

However, you are unable to invest your SRS funds into Syfe. As such, StashAway may be a better choice if you wish to use your SRS funds for investing.

Performance

It can be rather hard to compare the performance of these portfolios since they are so different. However, here is my attempt on comparing their returns.

StashAway’s 36% Risk Index Portfolio provides you with a 2-year return of 23%

StashAway announced that their 36% Risk Index Portfolio grew 23% from July 2017-2019. Compared to the benchmark’s (MSCI World Equity Index) performance of 17%, this is pretty respectable.

StashAway’s portfolio does provide a broad diversification of your risk. You may not receive as high a return if you have fully invested in stocks. However when stocks do plummet, your portfolio will not drop as sharply.

As such, you will receive stable returns with lower volatility when investing with StashAway.

Syfe Equity 100 has a 10 year annualised return of 13.2%

Syfe’s Equity 100 has a rather respectable 13.2% return. This was done via backtesting of the Equity 100 portfolio in the last 10 years.

If you would like to backtest your own investment strategy, you can consider using the PyInvesting platform.

This is the average return that you would have received in the past 10 years. There will be some years that you will perform well, while there will be others that you will perform poorly. For example, both 2018 and 2020 were bad years for stocks.

Syfe Equity 100 is 100% concentrated in stocks. They are the riskiest form of assets, but have the highest potential for great returns.

Stocks will always go up, but only in the long run. As such, you will need to stay invested for a long time (minimum 5 years) before you can reap the high returns!

Track your investments’ performance with StocksCafe

You may be investing just a part of your portfolio into these robo-advisors. If you would like to track it together with your other investment portfolio, you can consider using the StocksCafe platform.

Minimum Sum

Both portfolios do not have a minimum sum for you to begin investing with them. This makes it very accessible even if you just have a small sum to start investing!

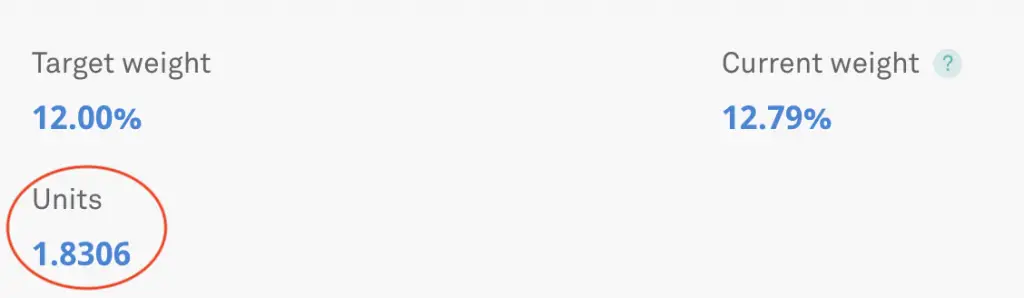

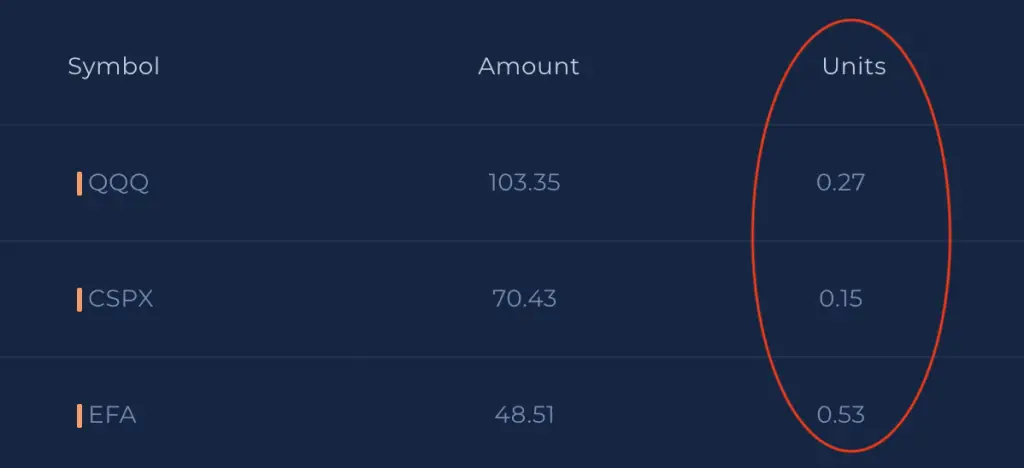

Syfe and StashAway invest your money into fractional shares.

For example, a single unit of the ETF may cost $100. If you can only invest $10, you will receive 0.1 units of that ETF.

Both robo-advisors are able to do this as they co-mingle your assets with other investors in one custodian account. While this makes investing very accessible, there will be issues if either robo-advisor closes down like Smartly. You are not given full control of your assets since they are not under your own name!

However, both Syfe and StashAway have received considerable funding from investors. This shows the investors’ confidence in these 2 firms, and I believe that both firms will be here for the long run.

Fees

Here are the fees that you will need to pay when using these robo-advisors:

StashAway charges you 0.8% a year for your first $25k

You will need to pay 0.8% each year in fees for your first $25k invested with StashAway.

| Amount Invested | Management Fee |

|---|---|

| First $25k | 0.8% |

| > $25k and ≤ $50k | 0.7% |

| > $50k and ≤ $100k | 0.6% |

| > $100k and ≤ $250k | 0.5% |

| > $250k and ≤ $500k | 0.4% |

| > $500k and ≤ $1 million | 0.3% |

| > $1 million | 0.2% |

Moreover, you will need to pay the expense ratios of the ETFs as well. This will further add to your costs. StashAway claims that the average expense ratio you will need to pay is around 0.4%.

This means that you will have to pay around 1.2% in fees each year!

Syfe charges you 0.65% for your first $20k

Syfe’s management fees are slightly lower than StashAway. Here is Syfe’s pricing structure:

| Total Amount Invested | Management Fee |

|---|---|

| < $20k | 0.65% |

| ≥ $20k and < $100k | 0.50% |

| ≥ $100k | 0.40% |

Unlike other fee structures, Syfe does not have a stacked fee structure. For example if you have $30k invested with Syfe, you will incur a 0.5% fee on your entire investment amount.

You will have to pay the ETF’s expense ratios as well. Here are the expense ratios of some of the ETFs in Equity 100:

| ETF | Expense Ratio |

|---|---|

| QQQ | 0.20% |

| CSPX | 0.07% |

| EFA | 0.32% |

| XLP | 0.13% |

| XLV | 0.13% |

| XLU | 0.13% |

| IEMG | 0.13% |

| XLK | 0.13% |

| XLY | 0.08% |

| XLB | 0.13% |

| IJH | 0.05% |

| IJR | 0.06% |

As such, the average expense ratio that you will need to pay would most likely be somewhere between 0.2-0.3%. The total amount that you will need to pay will be slightly less than 1%.

You will incur lower fees if you invest with Syfe.

Verdict

Here is a comparison between the 2 portfolios:

| Syfe Equity 100 | StashAway (36%) | |

|---|---|---|

| Investment Strategy | Smart Beta | ERAA Framework |

| Asset Class | 100% in Equities | Equities (Global and US) Real Estate Commodities |

| Fund Domicile | Ireland (only for CSPX) US (all other ETFs) | US |

| Source of Funds | Only Cash | Cash and SRS |

| Minimum Investment Sum | None | None |

| Fees | Slightly lower (~1%) | Slightly higher (~1.2%) |

| Performance | Higher in the long term | Lower short term volatilities |

| Useful For | Long term investing | Balanced portfolio |

Which portfolio is better for you?

Choose StashAway if you prefer a balanced portfolio

StashAway’s 36% Risk Index Portfolio is the riskiest portfolio that StashAway offers you. However, your risk is still diversified across different asset classes.

StashAway also offers periodic rebalancing as well. As such, you can be assured that you will continue to receive steady returns, no matter the economic outlook.

Moreover, you are able to invest in StashAway using your SRS funds. This is an added advantage if you are looking for a portfolio to invest your SRS funds with.

Choose Syfe’s Equity 100 if you have a long time horizon

Syfe’s Equity 100 portfolio is extremely aggressive portfolio that invests fully in stocks. You will be guaranteed to earn a higher return on your investment. However, you will need to stay invested for the long term (at least 5 years).

Stocks are extremely volatile, and they can go up and down very quickly. If you invest at the wrong time, the value of your stocks may plummet in the short run.

If you continue to stay invested in the market, the value of your stocks will go up. However, this will only occur in the long run! You will need to have the willpower and not check your stocks everyday. This will reduce the chances of you making emotional decisions and selling your stocks at a loss!

Long term, passive investing in stocks will really help your money to grow!

Conclusion

Both portfolios offer a unique way to invest your money. The portfolio that you should choose depends on:

- Your time horizon

- The fees you’re willing to pay

- The investment strategy that you agree with

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 6 months.

You will be able to save up to $75 worth of fees!

You can view more information about this referral program on Syfe’s website.

StashAway Referral (Up to $40,000 SGD managed for free for 6 months)

If you are interested in signing up for StashAway, you can use my referral link to sign up.

Here’s what you’ll need to do:

- Sign up for a StashAway account

- Make a deposit of ≥ $10k within 4 weeks of signing up

- Receive a fee waiver for 6 months (up to $40k)

You can find out more about this program on SingSaver.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?