Last updated on June 6th, 2021

You’ve decided to invest in Dimensional Funds. However, there are rather limited ways on how you can invest in them in Singapore.

Moreover, it’s quite hard to find information online regarding Dimensional Funds too!

So how do you exactly go about investing in these Dimensional Funds?

Contents

How to buy Dimensional Funds in Singapore

Here are the 3 ways that you can buy Dimensional Funds in Singapore:

- Financial advisor

- Endowus

- MoneyOwl

Here is an deep dive on how you can invest in Dimensional Funds using these 3 methods:

Financial advisor

Some financial advisors are able to provide you with access to Dimensional Funds.

However, not all financial advisors can help you to invest in these funds too!

Only selected financial advisors can work with Dimensional

If a financial advisor wants to be a partner of Dimensional Fund Advisors (DFA), they will have to go through a long process to approved.

This includes going through various trainings and being taught Dimensional’s investment philosophy.

With such a rigorous process, there are not many approved advisors in Singapore. Some of them include:

This shows how limited the access is for Dimensional Funds!

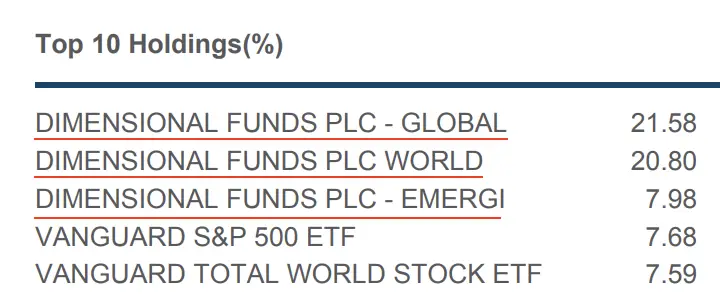

13 funds are available for investment

According to this file by the MAS, there are 13 funds that you can invest when you have access to Dimensional Funds:

- Global Short Fixed Income Fund

- Global Short-Term Investment Grade Fixed Income Fund

- World Allocation 20/80 Fund

- World Allocation 40/60 Fund

- World Allocation 60/40 Fund

- World Allocation 80/20 Fund

- World Equity Fund

- Global Core Equity Fund

- Global Core Fixed Income Fund

- Global Targeted Value Fund

- Emerging Markets Large Cap Core Equity Fund

- European Value Fund

- Pacific Basin Small Companies Fund

The fees charged may be quite high

Due to this strict process, the advisors who have access to these funds tend to charge quite a high fee.

According to Seedly, the fees can range anywhere between 1-2% p.a.

This advisory fee is on top of the expense ratios you’ll need to pay to DFA!

You are only able to purchase funds through a portfolio

Some of these financial advisory firms only allow you to invest in Dimensional Funds via their various portfolios.

For example, GYC offers the United G Strategic Fund that includes some Dimensional Funds in the portfolio.

Providend also uses a mixture of Dimensional Funds in their Index Plus portfolios.

As such, you may not be able to select exactly which Dimensional Fund you can invest in.

You may want to contact the financial advisors to find out more

The information regarding investing in Dimensional Funds through an advisor is rather limited.

You may want to contact these advisors to see if their fees are suitable for you.

Endowus

Endowus is a robo-advisory platform that provides you with access to institutional-class funds at the lowest costs possible.

They allow you to have access to Dimensional Funds via 2 ways:

#1 Advised Portfolios

Endowus offers various advised portfolios on their platform. Endowus both offer funds that invest in 2 main asset classes:

- Equities (i.e. stocks)

- Bonds

Based on the risk profile and time horizon that you have, Endowus decides on the best asset allocation for you.

Your money will be allocated into equities if:

- You have a higher risk profile

- You have a longer time horizon

If that is not the case, your portfolio will have a higher weightage in bonds.

Endowus offers 6 different portfolios based on your risk profile

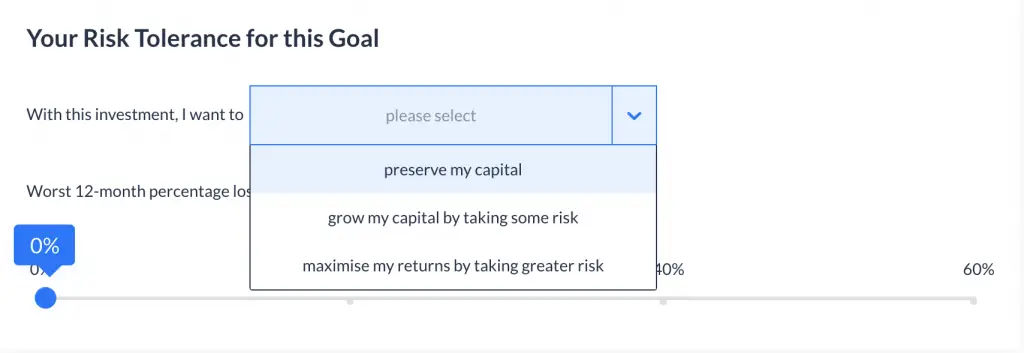

When you create a portfolio with Endowus, you’ll be asked about your risk tolerance.

Endowus will then suggest a portfolio for you based on your risk tolerance and time horizon. These portfolios will allocate your money into 2 different asset classes:

- Equities

- Fixed Income

| Portfolio | Equities | Fixed Income |

|---|---|---|

| Very Aggressive | 100% | 0% |

| Aggressive | 80% | 20% |

| Balanced | 60% | 40% |

| Measured | 40% | 60% |

| Conservative | 20% | 80% |

| Very Conservative | 0% | 100% |

The higher the risk tolerance you can take, the greater the allocation towards equities and vice versa.

You are given access to 5 different Dimensional Funds on Endowus:

- Dimensional Global Core Equity Fund

- Dimensional Emerging Markets Large Cap Core Equity Fund

- Dimensional Pacific Basin Small Companies Fund

- Dimensional Global Core Fixed Income Fund

- Dimensional World Equity Fund

The funds that you can invest in depends on the portfolio that you’re allocated with.

You can only invest in Dimensional Funds using Cash or SRS

Endowus is a unique robo-advisor as it is the only one that allows you to invest your CPF.

However, these funds are not found in the CPF-approved list of unit trusts.

As such, you can’t invest your CPF into these funds. You are only able to do so with your cash or SRS.

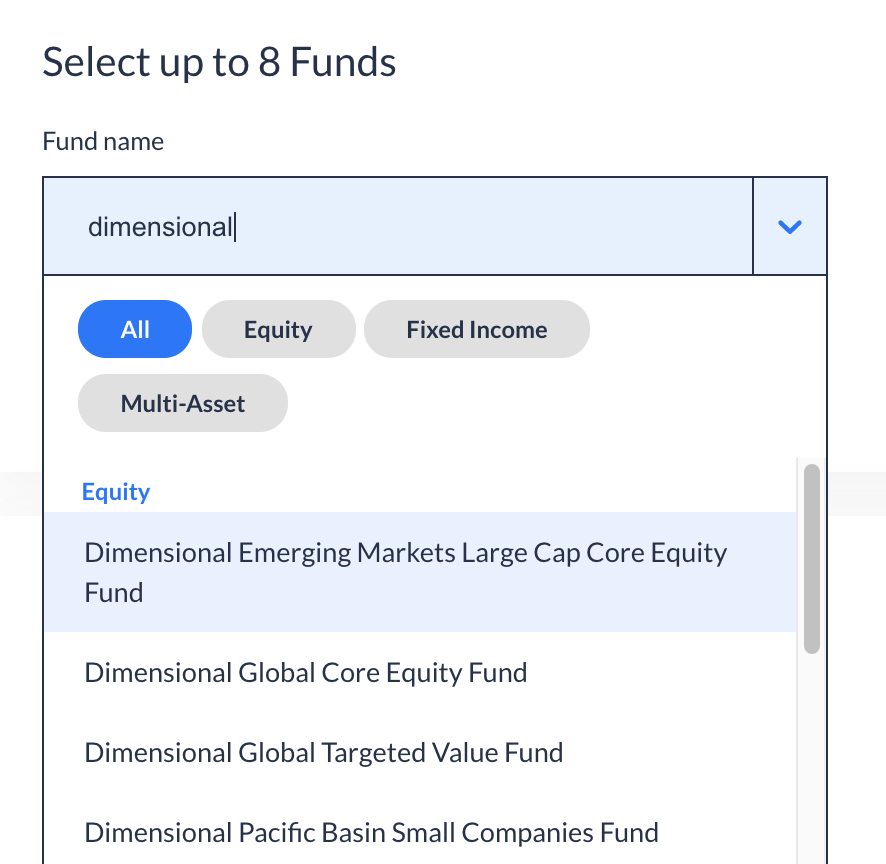

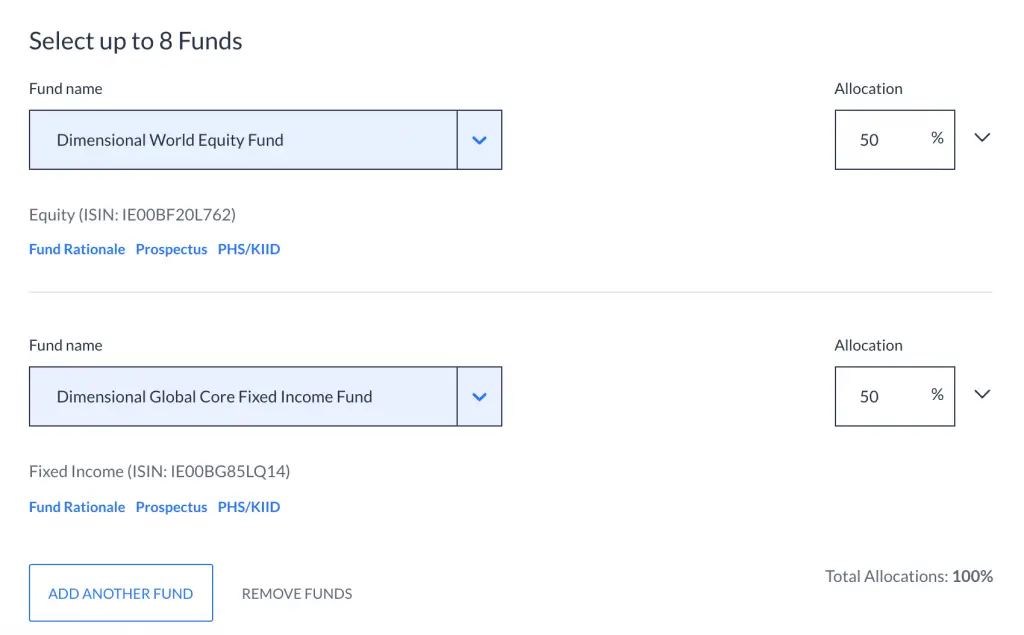

#2 Fund Smart

You can choose a specific Dimensional Fund to invest in using the Fund Smart portfolio.

Fund Smart gives you the opportunity to choose which funds and the allocation you wish to have.

Fund Smart gives you access to 8 Dimensional Funds:

- Dimensional Global Core Equity Fund

- Dimensional Emerging Markets Large Cap Core Equity Fund

- Dimensional Global Targeted Value Fund

- Dimensional Pacific Basin Small Companies Fund

- Dimensional Global Core Fixed Income Fund

- Dimensional World Equity Fund

- Dimensional Global Short Fixed Income Fund

- Dimensional Global Short-Term Investment Grade Fixed Income Fund

Similar to the Advised Portfolios, you can only invest in Dimensional Funds on Endowus’ platform using cash or SRS.

You can then choose the allocation of your funds into each of these Dimensional Funds.

You can select up to 8 funds to use in Fund Smart. This means that you can use all 8 of the funds in your portfolio!

However, there may be some overlap in the stocks or bonds that you’ll own across these funds.

Fund Smart should be used only if you are an experienced investor

I believe that you should only use Fund Smart if you are an experienced investor. This is because you have the freedom to choose which funds you can invest in.

If you’ve just started your investing journey, this can be pretty overwhelming!

I would suggest sticking to Endowus’ Advised Portfolios until you gain more experience.

Endowus charges you lower fees

Endowus charges you low fees on the amount that you have invested with them:

Flat 0.4% for SRS

Endowus charges a flat 0.4% fee for any amount of your SRS funds that you have invested.

This makes it one of the lowest costs being offered by a robo-advisor!

This could be due to the limitations that the government has placed on your SRS funds.

Tiered pricing for Cash

Endowus has a tiered pricing for your cash investments:

| Amount | Fee |

|---|---|

| Up to S$200k | 0.6% |

| S$200,001 to S$1,000,000 | 0.5% |

| S$1,000,001 to S$5,000,000 | 0.35% |

| S$5,000,001 and above | 0.25% |

Endowus offers a tiered and not stacked pricing. This means that if you invest $200,001 into Endowus, you will be charged 0.5% for your entire $200,001.

Compared to other robo-advisors, Endowus’ fees are still pretty affordable.

Full trailer fee rebate

Apart from the low management fees charged, Endowus also gives you a full trailer fee rebate.

Trailer fees are fees that a fund manager pays a platform. This is similar to a commission that the platform receives for introducing the investor to the fund.

With these trailer fee rebates, this will help to lower your cost of investing!

Endowus has a minimum investment of $10,000

To use the Endowus platform for investing, you will need an initial investment of $10k . This can come from 3 different sources:

- Cash

- SRS

- CPF

You are able to combine funds from your Cash, SRS and CPF to reach the $10k total. Moreover, you can use these funds to invest in any of Endowus’ portfolios.

You do not need to just invest all of your $10k into one portfolio!

Moreover, the minimum sum for each subsequent investment is $100. You aren’t able to invest anything less than a $100!

This may be a huge initial amount if you are just starting to invest.

MoneyOwl

Another platform that gives you access to Dimensional Funds is MoneyOwl.

Unlike Endowus which uses funds from different fund managers, MoneyOwl only allows you to invest in Dimensional Funds.

MoneyOwl chose them as the fund provider as these funds are:

- Broadly diversified

- Market-based

- Low cost

MoneyOwl uses 4 different funds from Dimensional

MoneyOwl only gives you access into 4 funds from Dimensional:

| Asset Class | Funds Used |

|---|---|

| Global Equities | Dimensional Global Core Equity Fund Dimensional Emerging Large Cap Core Equity Fund |

| Global Bonds | Dimensional Global Core Fixed Income Fund Dimensional Global Short Fixed Income Fund |

These 4 funds can be found in Endowus’ offerings as well.

MoneyOwl offers 5 different portfolios

Similar to Endowus’ Advised Portfolios, MoneyOwl selects the best portfolio for you, based on your:

- Time horizon

- Risk profile

If your time horizon is long and you’re willing to take more risks, you will have a higher allocation towards equities. If not, you will have a greater allocation towards bonds.

MoneyOwl will then allocate your money into the 2 different types of asset classes:

| Portfolio | Equities | Bonds |

|---|---|---|

| Equity | 100% | 0% |

| Growth | 80% | 20% |

| Balanced | 60% | 40% |

| Moderate | 40% | 60% |

| Conservative | 20% | 80% |

MoneyOwl only allows you to invest your Cash and SRS

You can only invest your Cash and SRS into MoneyOwl’s portfolios.

While this is more limited than Endowus, MoneyOwl is still one of the few robo-advisors that allow you to invest your SRS.

MoneyOwl has a lower minimum sum requirement

Here are the minimum sums required for you to invest with MoneyOwl:

| Type of Investment | Investment Amount |

|---|---|

| One-Time Investment | $100 |

| Monthly Investment | $50 |

The monthly investment amount of $50 is also lower compared to regular savings plans like OCBC BCIP and Invest Saver.

With the lower minimum requirements, MoneyOwl is more accessible if you only have a small amount!

MoneyOwl charges slightly higher fees

Here are the fees that you’ll need to pay with MoneyOwl:

| Total Investment Amount | Advisory Fee |

|---|---|

| Below $10,000 | 0% |

| $10,001 to $100,000 | 0.60% |

| $100,001 and above | 0.5% |

MoneyOwl is having a promotional rate of 0% for the first $10k invested until 31 December 2021 for cash investments.

These fees applies to both Cash and SRS investments.

However, you’ll still need to pay an expense ratio to Dimensional Fund Advisors too!

This will range between 0.28%-0.32% p.a., depending on the portfolio you’ve chosen.

You can view my comparison between Endowus and MoneyOwl to see which platform is more suitable for you.

Extra information regarding Dimensional Funds

Here are some additional things you may want to know regarding Dimensional Funds:

#1 You’ll have to factor in the expense ratios of these Dimensional Funds too

Apart from the fees that you’ll have to pay the robo-advisor or financial advisor, you’ll have to pay the expense ratio of the fund too.

The expense ratio is charged by the fund manager to cover the costs of running the fund.

Based on the value of your assets in the fund, you will be charged an annual fee.

Here are the expense ratios of some of the funds (from DFA’s website):

| Fund | Expense Ratio |

|---|---|

| Emerging Markets Large Cap Core Equity Fund | 0.44% |

| Global Core Equity Fund | 0.30% |

| Global Short Fixed Income Fund | 0.27% |

| Global Short-Term Investment Grade Fixed Income Fund | 0.28% |

| Global Targeted Value fund | 0.55% |

| Pacific Basin Small Companies Fund | 0.64% |

| World Allocation 60.40 Fund | 0.37% |

| World Allocation 80/20 Fund | 0.40% |

| World Equity Fund | 0.40% |

The expense ratios are another layer of costs that you’ll have to pay. As such, your total cost of investing will be both the platform fee and the expense ratio.

Most of these expense ratios are rather high, compared to those charged by S&P 500 ETFs (< 0.1%).

#2 Dimensional Funds are hedged to SGD

All of these Dimensional Funds are hedged to SGD. This means that you’ll use SGD to purchase the funds, instead of converting it to the fund’s base currency.

The fund manager will still need to convert your SGD to the fund’s base currency. However, they should be able to receive a more favourable exchange rate compared to you.

#3 Dimensional Funds are accumulating funds

All of the funds which are hedged to SGD on Dimensional’s platform are accumulating funds.

This is similar to accumulating ETFs which automatically reinvest your dividends for you.

As such, you should not expect to receive any dividends when you invest in Dimensional Funds.

#4 Dimensional Funds are domiciled in Ireland

Dimensional Funds are all domiciled in Ireland. These are more tax efficient compared to US-domiciled funds, as:

- You incur a lower dividend withholding tax (15% vs 30%)

- You are not subject to the US estate tax

Even though you do not receive your dividends, the 15% tax will still be deducted from them before they are reinvested.

Verdict

Here is a comparison between the different methods you can use to purchase Dimensional Funds:

| Financial Advisor | Endowus | MoneyOwl | |

|---|---|---|---|

| Number of Funds Available | 13 | 8 | 4 |

| Minimum Sum to Invest | Depends | $10,000 initial $100 for each transaction | $100 (lump sum) $50 (monthly) |

| Fees | ~1-2% | 0.4% (SRS) 0.6 | 0-0.60% |

So which method should you choose?

Choose Endowus if you want to have the most flexibility

Endowus seems to be the best way for you to invest in Dimensional Funds since:

- You have access to most of the Dimensional Funds (8 out of 13)

- The fees are rather reasonable

- You can choose your own allocation using Fund Smart

However, the main deterrence is the high initial investment amount of $10,000. For most beginner investors, this is not a sum you may have at hand.

Moreover, you should only use Fund Smart if you have enough investing experience!

Choose MoneyOwl if you only have a small investment sum

MoneyOwl provides the easiest access to Dimensional Funds, due to the low investment amount required.

If you are just looking for a way to be exposed to Dimensional Funds, MoneyOwl is the best choice for you.

However, their fees are slightly higher than Endowus. You’ll need to consider if their fees are worth it in the end!

Choose financial advisors if you want personalised advice

Financial advisors are the best option if you wish to receive personalised advice on your investments.

They will help to decide what is the best way for you to meet your financial goals. If you want someone to manage your money for you, this is the best option for you.

However, the fees they charge are not widely available compared to robo-advisors. As such, you may want to get to know the advisor’s fees before making a commitment!

Conclusion

Your access to Dimensional Funds in Singapore is rather limited. In the past, it used to be just financial advisors who can offer you access to these funds.

However, robo-advisors have partnered with DFA to make these funds more accessible for you!

With these 3 methods being available, you’ll need to decide which method is the most suitable for your investing goals!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

MoneyOwl Referral (Up to $65 GrabFood credits)

If you are interested in signing up for a MoneyOwl account, you can use my referral link to sign up. This will allow you to earn up to $65 GrabFood credits.

Here’s what you need to do:

- Sign up for a MoneyOwl account with my referral link

- Apply for MoneyOwl’s services

- Receive your GrabFood credits (up to 4 weeks later)

Here are the services you’ll need to sign up for to earn your GrabFood credits:

| Service | Condition | GrabFood Credit |

|---|---|---|

| Insurance | An insurance plan purchased and issued by MoneyOwl | $20 |

| Investment | An investment portfolio created and funded | $20 |

| Comprehensive Financial Planning | Financial plan is paid for and completed | $20 |

| Will Writing | Will successfully completed | $20 |

You can find out more about this referral program on MoneyOwl’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?