Last updated on September 4th, 2021

Have you checked your Syfe portfolio one day, and noticed that it has decreased in value?

Why is this so, and what should you do about it?

Here’s what you need to know.

Contents

- 1 Why is my Syfe portfolio losing money?

- 2 Syfe’s portfolios are rather diversified

- 3 You can adjust your risk levels for Global ARI and Core

- 4 Syfe’s portfolios are more suited for long-term investing

- 5 It would be best not to check your portfolio everyday

- 6 Can you lose money with Syfe?

- 7 Conclusion

- 8 👉🏻 Referral Deals

Why is my Syfe portfolio losing money?

Your Syfe portfolio contains a variety of ETFs or REITs, which are listed in stock exchanges in the US or Singapore. These ETFs or REITs will have daily fluctuations in their price. If these investments start to go down in value due to market sentiment, your Syfe portfolio will start to lose money too.

There are 5 different Syfe portfolios that you can choose from:

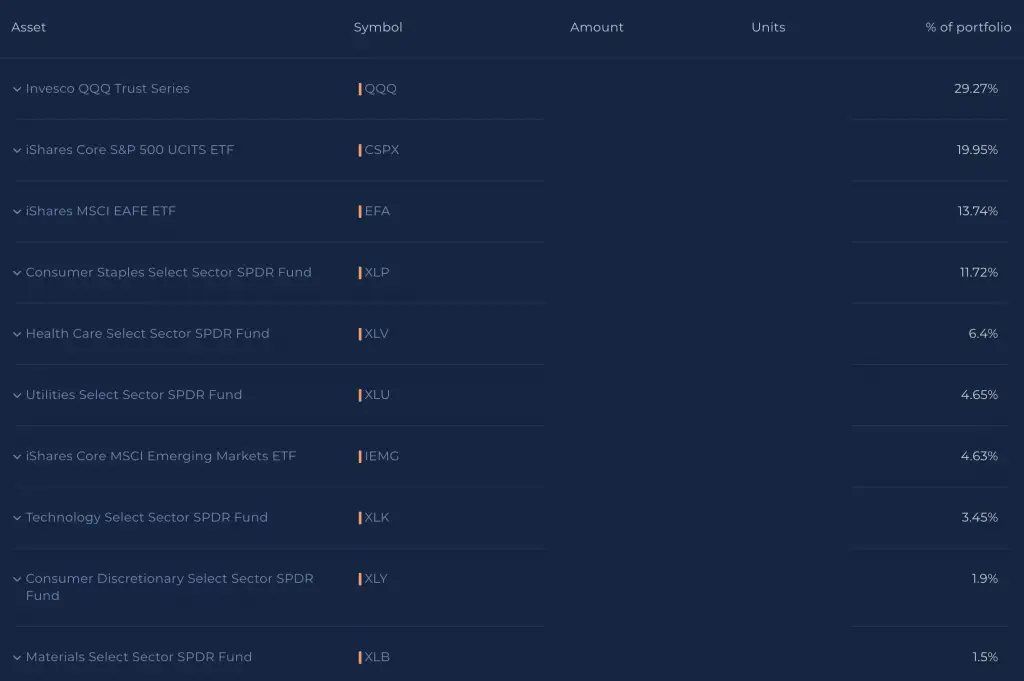

For Global ARI, Equity 100 and Core, your funds will be invested in a variety of ETFs.

These ETFs contain different asset classes, like stocks, bonds or gold.

As such, the value of each fund depends on the value of their underlying assets.

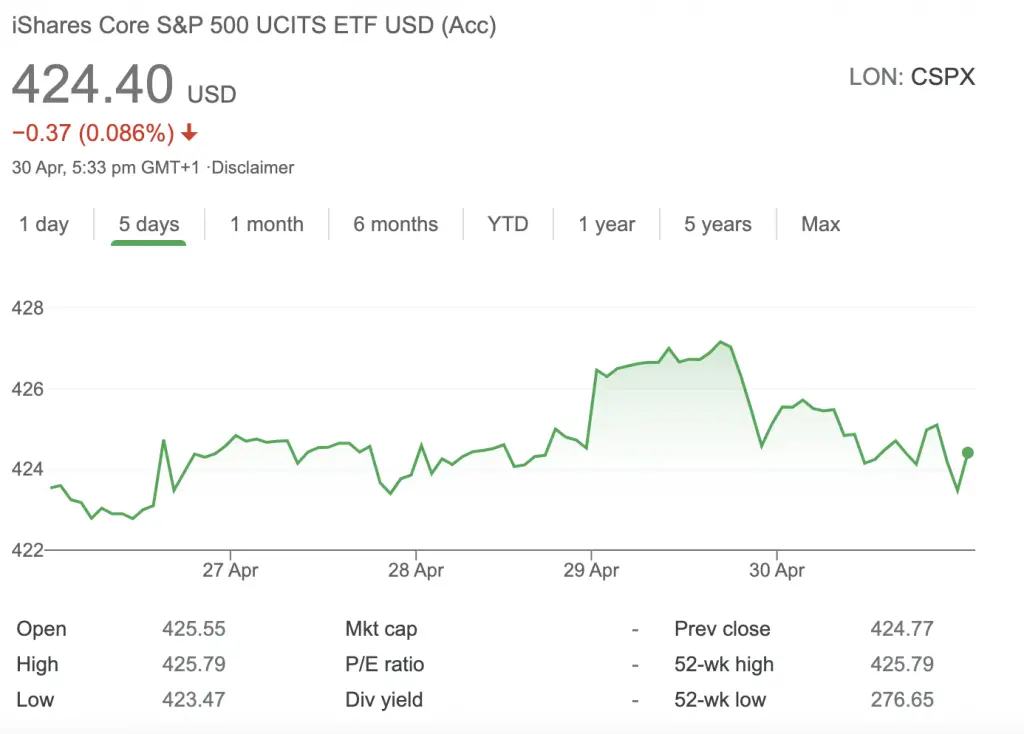

For example, CSPX is a S&P 500 ETF that tracks the top 500 companies in the US.

All of these assets will have a certain market value.

If they all happen to decrease in value, your ETF’s value will decrease too!

You can see how the price of the CSPX ETF fluctuates over a few days.

As such, your Syfe portfolio will fluctuate in value each day too! Your portfolio’s value will change based on the performances of all the ETFs that are found inside it.

This was how my portfolio fared during a 1-week period.

You can see that there are some days where my portfolio’s value has dropped a lot. However, over time, the value may increase again.

This is just how my portfolio has performed within one week. However, I believe that if I stay invested, it will increase in value over time.

Syfe’s portfolios are rather diversified

Syfe’s portfolios offer you access to a wide variety of ETFs within a single portfolio. This means that your funds are spread across many different stocks and bonds.

When you diversify your portfolio, you are reducing its risk. If your portfolio is too concentrated in just one stock or bond, you may perform well if it performs well.

However, if the stock or bond drops in value, your entire portfolio will be heavily affected too!

By spreading your funds across more assets, you will be able to reduce this risk.

Even if one asset performs poorly, there are many others that may perform well. In the end, your portfolio will still increase in value!

You can adjust your risk levels for Global ARI and Core

Some portfolios like Equity 100 do not give you the option to customise its risk level to your risk appetite.

However, there are some portfolios that allow you to adjust the amount of risk you’re willing to take.

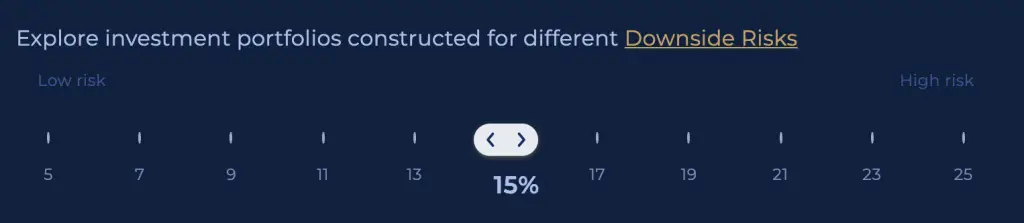

Global ARI has 11 different risk levels

Global ARI portfolio has 11 different risk levels. This depends on the downside risk that you’re willing to take.

The higher the downside risk, the higher the allocation towards stocks.

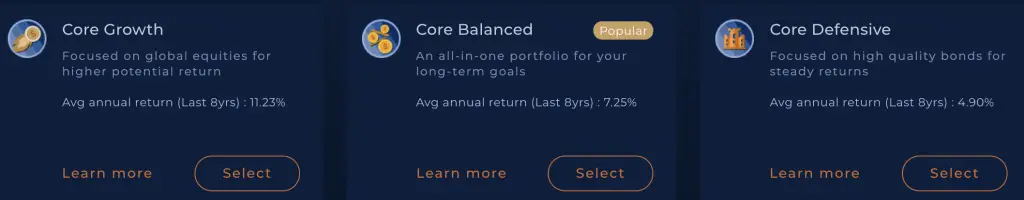

Core has 3 different portfolios

Syfe Core has 3 different portfolios:

- Defensive

- Balanced

- Growth

They all invest in the same ETFs.

However, the allocation towards each asset class will be different.

If you choose Core Growth, you have a higher allocation towards stocks. Meanwhile, Core Defensive has a higher allocation towards bonds.

As such, it really depends on your risk appetite!

Syfe REIT+ allows you to use Syfe’s Global ARI strategy

When you create your Syfe REIT+ portfolio, you will be given 2 choices on the portfolio you want to create:

- 100% REITs

- REITs with risk management

If you choose REITs with Risk Management, you will use Syfe’s Global ARI strategy. This will include a bond component into your portfolio.

In this case, Syfe has chosen to use the ABF Singapore Bond Index Fund as the bond component.

This helps to reduce the risk of your portfolio as you are not solely concentrated in REITs!

Bonds help to reduce volatility, but they reduce returns too

When you add a bond component into your portfolio, your portfolio’s value may not fall as quickly as an all-stock portfolio.

However, this also means that the returns you receive will be lower than an all-stock portfolio!

It is recommended that you choose a portfolio that best suits your risk appetite.

The Equity 100 portfolio is an all-stock portfolio. As such, it is only suitable if:

- You have a long term horizon

- If you are able to stomach the volatility

If you can’t handle so much risk, you may want to choose a portfolio that takes less risks with your funds!

Syfe’s portfolios are more suited for long-term investing

When you invest your funds in one of these portfolios, you will need to have a long time horizon.

Usually, you should have at least a 5 year time horizon before you invest in Syfe’s portfolios. This means that you should only aim to withdraw the funds that you’ve put into Syfe ≥ 5 years later!

If you need the money in the shorter term, then you may want to place your funds in another platform that provides you more stable returns with lower risks.

Syfe Cash+ can be one consideration for you. This is a great place to put your savings for a short-term goal, such as a house or car.

However, it is best not to put all of your emergency funds, or the funds for your daily spending into these account! This is because Syfe Cash+ is not capital guaranteed, so there is a chance that you may lose your capital.

My Cash+ portfolio decreased in value until it was less than my initial capital.

This shows that there is a chance that you may lose some of the money that you’ve put in!

If you are looking for safer options, you may want to consider capital guaranteed plans. Some of these include insurance savings plans or short term endowment plans.

It would be best not to check your portfolio everyday

Syfe has both a mobile application and a web platform. This makes it very easy for you to access this investment platform.

Furthermore, your Syfe portfolios are updated twice a day, based on the market data for the given day.

Even though it is so easy to access your portfolio, I would suggest not to check your portfolio’s value everyday.

If you see your portfolio’s value continuously falling, there is a very high chance that you might panic sell!

In this way, you are realising your paper loss into an actual loss!

However, you do not know how the market performs tomorrow.

If you had just held on for another day, your portfolio’s value may actually become positive!

Investing is buying and holding an asset for the long term. This is because you see its inherent value, and you know that it will be worth something more in the future.

However, if you are looking at the price of your portfolio everyday, you are trading more than investing.

Trading is the buying and selling of stocks in the short term. This strategy mainly takes advantage of any fluctuations in value.

It is very important to know the difference between these 2 strategies!

Syfe’s portfolios are meant for investing, and not for trading. The best advice I can give you is to set up a standing instruction into your Syfe portfolio, and not check the app.

This way, your investments are automated. Moreover, you do not have to worry about the performance of your portfolio.

If you continue to invest, I am very confident that you will be able to receive a nice surprise when you check your portfolio a few years later!

Can you lose money with Syfe?

It is possible that your investments with Syfe may lose money in the short-term. This mainly occurs when the ETFs that form your Syfe portfolios start to decrease in value, possibly due to poor market sentiment. However, when you invest in Syfe, you should have a long investment horizon to realise some returns in the long run.

One thing you may want to note is that Syfe charges you the management fee, regardless of how your portfolio performs.

Even if your portfolio is losing money, you will still need to pay the annual management fee!

This is something you’ll need to factor in when deciding whether you want to use a robo-advisor to invest.

If you are someone like me who prefers a convenient method of investing, then these management fees may be worth it.

Conclusion

Investing doesn’t come without risk. However, the higher the risk, the greater potential returns you may receive.

When you invest with Syfe, you are taking on extra risks, compared to leaving your funds in your bank account.

There are days when your investments may be performing badly. However, these are only short term fluctuations.

If you continue to stay invested, your portfolio will slowly gain in value over time.

Over a longer period of time, your investments will go up. As such, all you need to do is to buy and hold, and continue putting a small sum each month.

In this way, you should be able to receive a really good return on investment in a few years time!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 6 months.

You will be able to save up to $75 worth of fees!

You can view more information about this referral program on Syfe’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?