Last updated on June 6th, 2021

Grab has just launched its AutoInvest platform. With so many robo-advisors already in the market, should AutoInvest be something that you should consider?

Here’s a breakdown of how this micro-investing solution works:

Contents

Grab AutoInvest review

Grab AutoInvest is an attractive offering only if you use the Grab ecosystem frequently. However, the amounts invested for each transaction you make may be too small to make a significant difference.

Here is AutoInvest reviewed in depth:

What is Grab AutoInvest?

AutoInvest is a micro-investment solution released by GrabInvest, the financial arm of Grab. This was after Grab had acquired Bento Invest, a robo-advisory startup in Singapore.

AutoInvest aims to grow your wealth through small transactions you make each day. Over a period of time, this may help you to amass a considerable sum!

How do I sign up for AutoInvest?

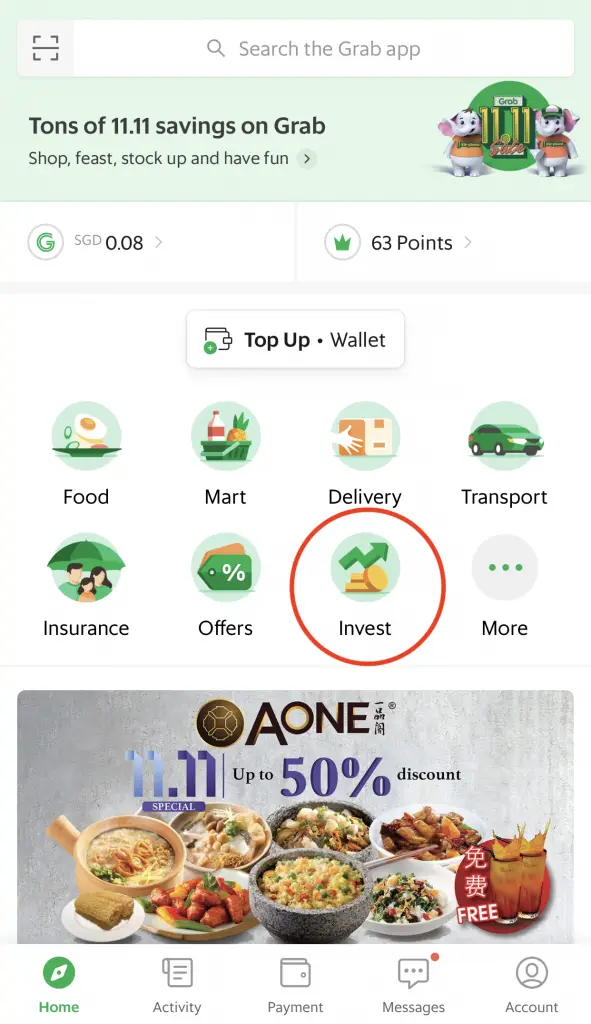

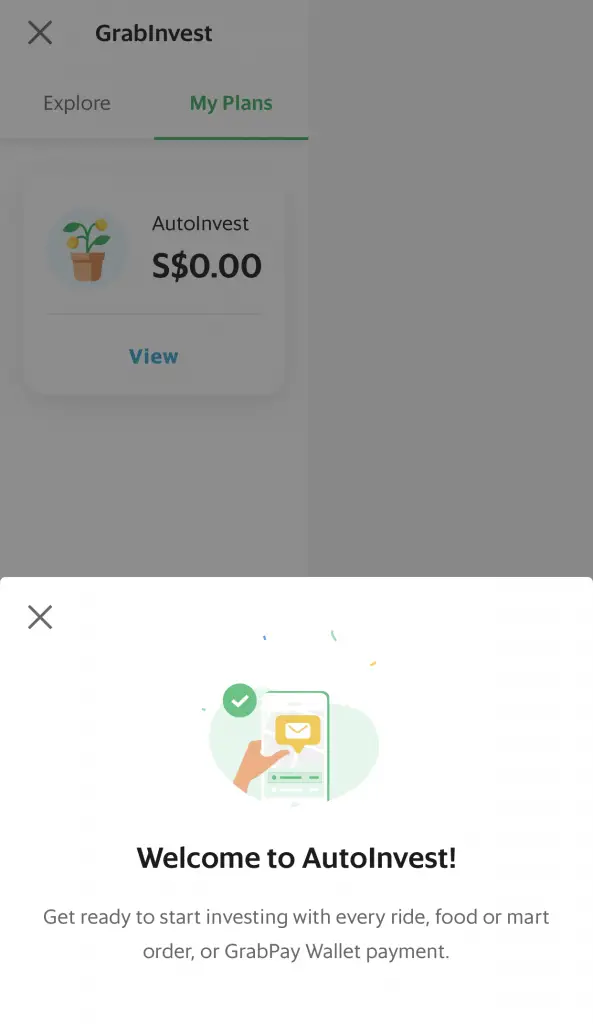

Signing up for AutoInvest is really easy. All you need to do is to tap on the ‘Invest’ icon in the Grab app.

If you can’t find the ‘Invest’ icon, do not worry! Grab is slowly rolling out the AutoInvest feature, so you should be able to use it soon!

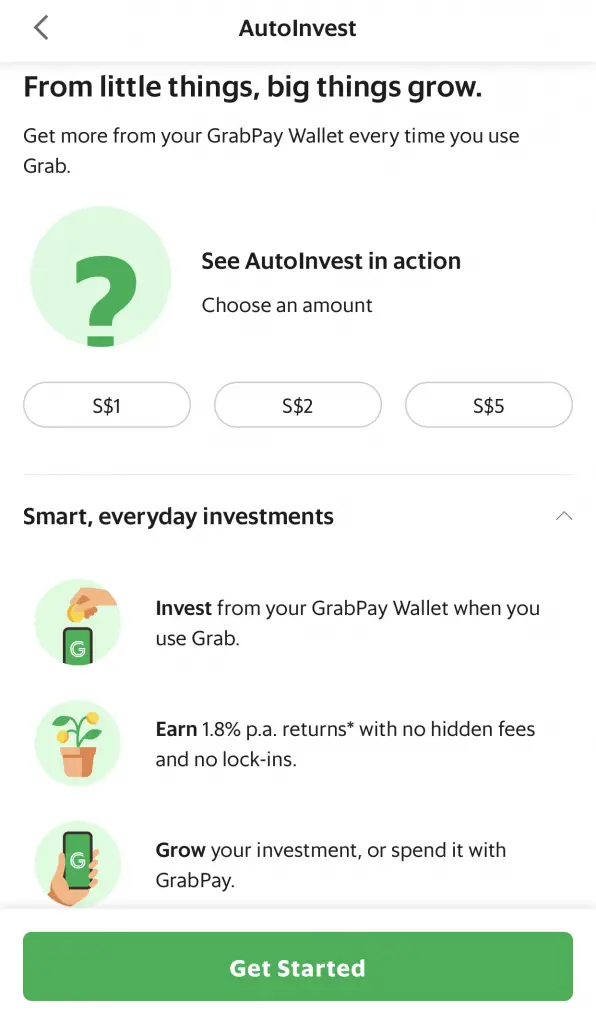

You will need to select the amount you wish to invest each time you perform an eligible transaction.

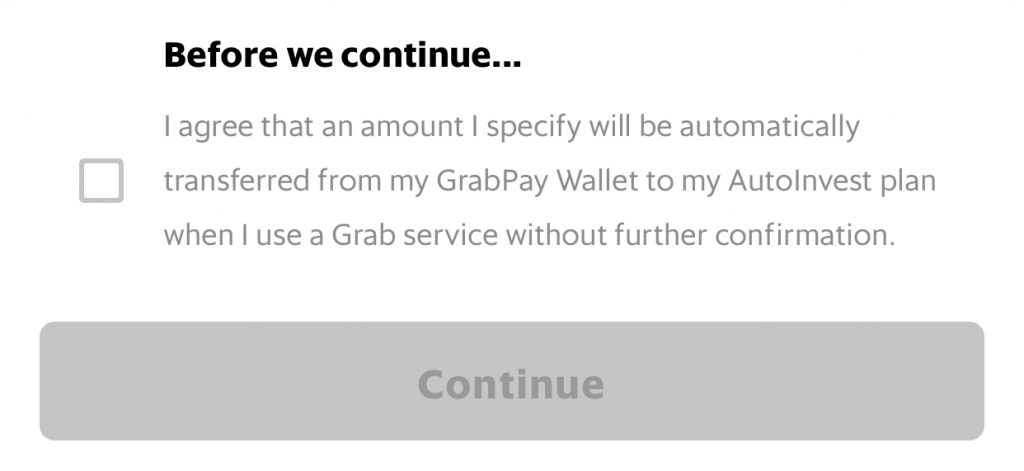

To use AutoInvest, you will have to allow Grab to automatically deduct the amount you’ve set to invest. This amount will be deducted from your GrabPay wallet and transferred to your AutoInvest portfolio for each transaction that you make.

After answering a short questionnaire, you will be able to start using AutoInvest.

How does AutoInvest work?

Here is a breakdown of how AutoInvest works:

Select the amount you wish to invest

When signing up for AutoInvest, you would have selected an amount that you wish to invest. This can be either $1, $2 or $5.

Whenever you perform an eligible transaction, your selected amount will be transferred from your GrabPay wallet to AutoInvest.

Perform an eligible transaction

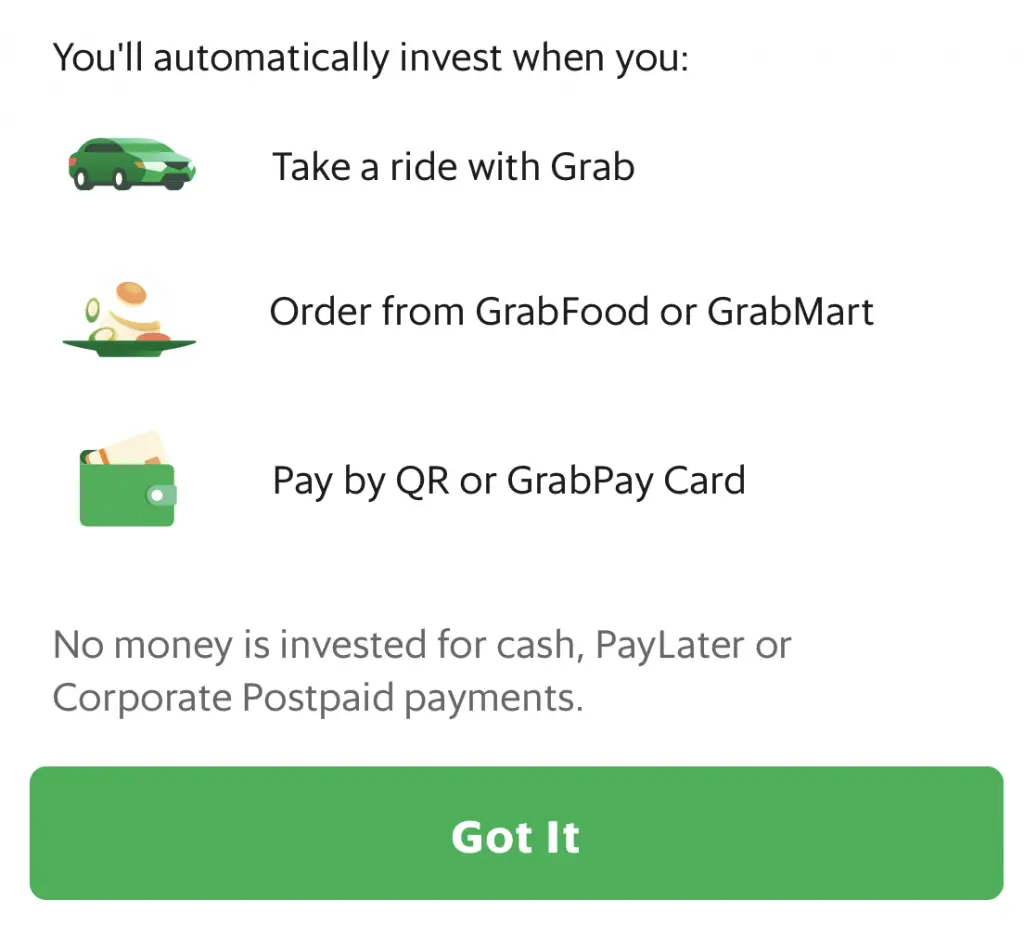

There are 3 types of eligible transactions that will trigger AutoInvest. This includes:

- Taking a ride with Grab

- Ordering from GrabFood or GrabMart

- Pay in-store or online using either your GrabPay Wallet or GrabPay Card

The transaction is only eligible if you pay for it using the following payment methods:

- Credit / Debit Card

- GrabPay Wallet

- GrabPay Card

Your transaction will not be eligible for AutoInvest if you use these 2 methods:

- Cash

- PayLater

This is similar to how SNACK by Income works as well.

Money from your GrabPay wallet will be transferred into AutoInvest

After performing an eligible transaction, the amount you’ve previously chosen will be deducted from your GrabPay wallet. It will then be transferred to your AutoInvest portfolio.

As such, you can start using AutoInvest with just $1!

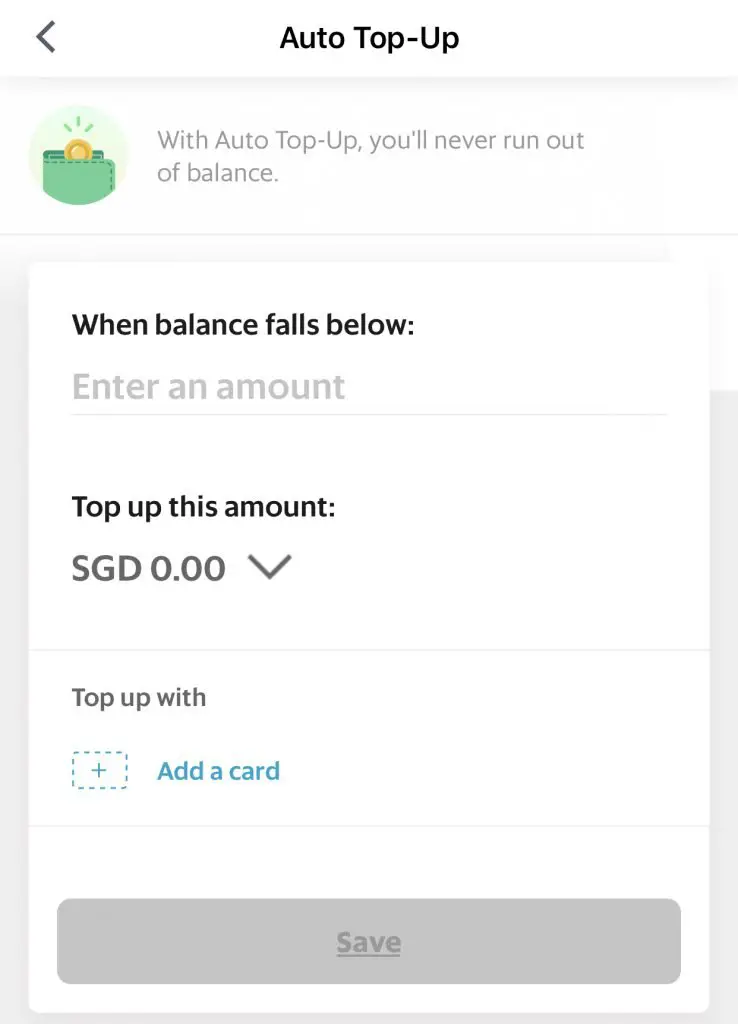

Grab advises you to have enough balance in your GrabPay wallet for both your transaction and investment amount. As such, you may want to set up an Auto Top-Up to your GrabPay wallet from the payments tab.

However once your money is transferred to your GrabPay wallet, you can only spend it via GrabPay! You are unable to transfer your money back to your bank account.

As such, you may want to consider carefully before you allow the Auto Top-Up function!

Unable to use SRS funds to invest

Unlike other cash management accounts, you are unable to use your SRS funds for AutoInvest. This is because AutoInvest can only use funds from your GrabPay wallet to invest into these funds.

Your funds will be invested

After AutoInvest receives your funds, they will invest it into the 4 different funds for you.

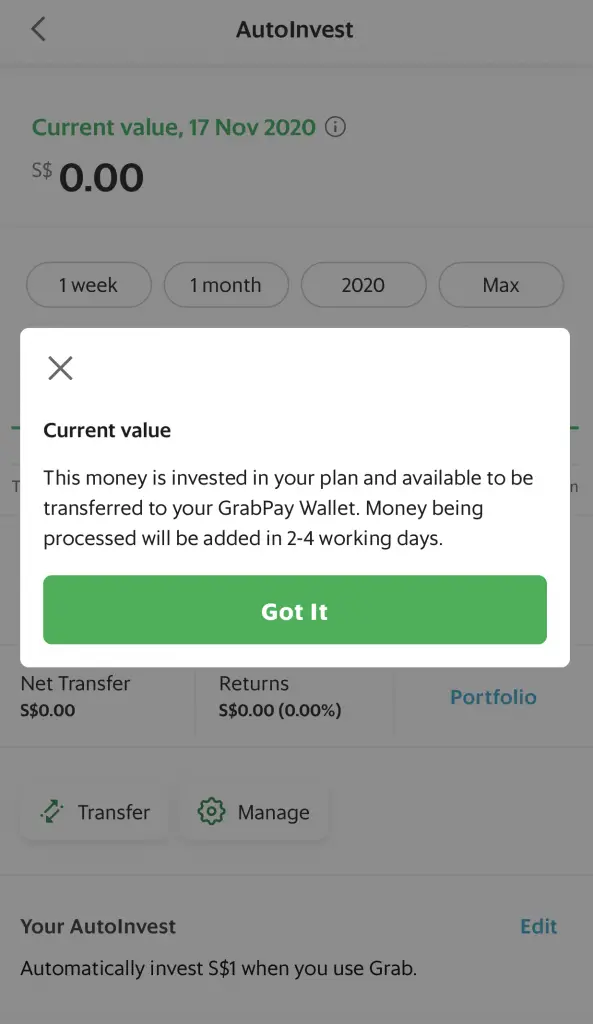

It may take up to 2-4 working days for your money to be invested into the funds, and be reflected in your plan.

View your returns

You can view the returns that you’ve received after investing your funds. Grab projects that you’ll receive a 1.18% p.a. return on your investment. However, this rate of return is not guaranteed and may fluctuate over time.

The returns will be added to your portfolio on a daily basis.

Rebalancing may occur every quarter

AutoInvest has a fixed allocation into the 4 different funds that form your portfolio. Depending on how the funds perform, one fund may have a higher or lower allocation then the preset allocation.

As such, AutoInvest will perform a rebalancing each quarter if the target allocation deviates more than 2%. You will be informed of the rebalancing 3 calendar days in advance.

The good thing is that you will not incur any fees for this rebalancing.

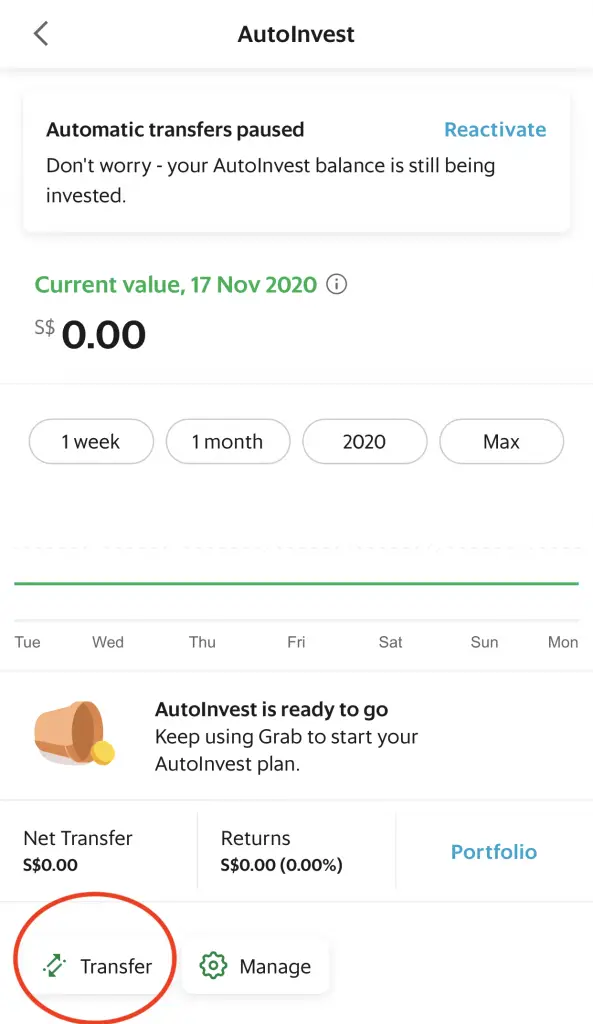

Transfer funds to your GrabPay wallet at any time

If you wish to withdraw your funds from AutoInvest, it will be credited back to your GrabPay wallet.

It is also possible for you to withdraw your funds from your GrabPay wallet to your bank account!

This transfer may take 2-4 working days to be completed.

Here are some other things you may want to take note about transferring your funds from AutoInvest to your GrabPay wallet:

- The minimum transfer amount is $1

- If your withdrawal amount is ≥ 90% of your entire portfolio, you will withdraw the entire portfolio instead

- After the transfer, your GrabPay wallet balance should not exceed $5k

Since AutoInvest invests in mutual funds, you are able to purchase fractional units. As such, you are able to make partial withdrawals of a minimum amount of $1.

What funds does AutoInvest use?

Grab has partnered with UOB Asset Management and Fullerton Fund Management to create your portfolio.

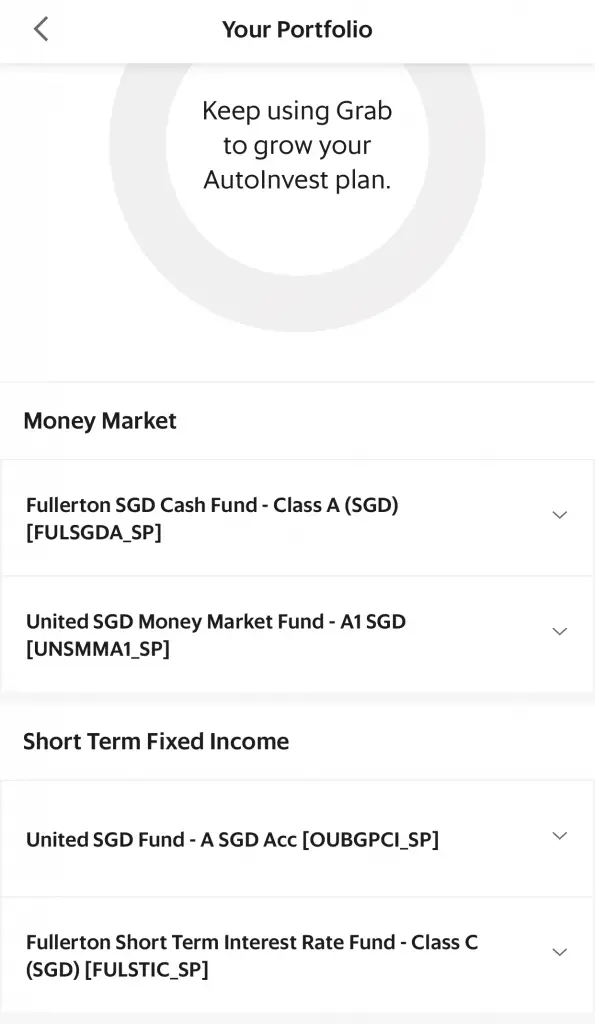

There are 4 main types of funds that AutoInvest uses, which are split into 2 different categories:

1. Funds following Money Market Fund Investment Guidelines

The funds in this category usually invest in high quality investments or bank deposits. MAS has set out certain limits for such funds, such as:

- Liquidity

- Exposure

- Concentration

Your investments are rather risk free. However, this also means that your returns are only slightly higher than banks’ deposit rates.

Nevertheless, these funds form a stable anchor for your AutoInvest portfolio. Here are the 2 funds that have been selected:

#1 Fullerton SGD Cash Fund – Class A (28%)

This fund aims to provide you with returns and liquidity that is similar to a bank deposit. Your money will be mainly placed into fixed deposits from different banks.

This is the same fund that is found in MoneyOwl WiseSaver and Endowus Cash Smart Core.

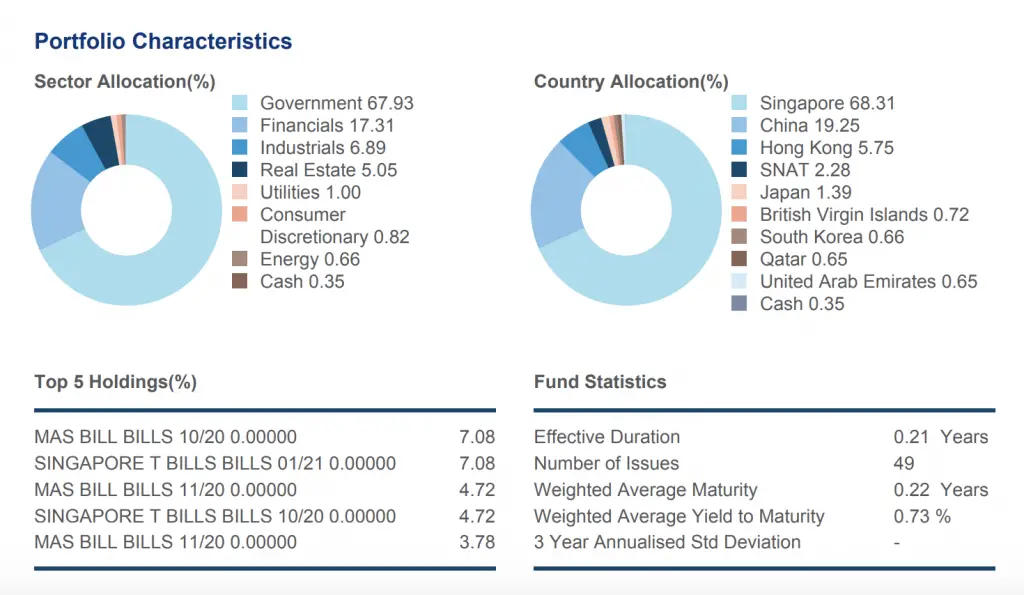

#2 United SGD Money Market Fund – A1 (25%)

The United SGD Money Market is offered by UOB Asset Management. This fund invests in high quality bonds as well as money market instruments.

Here are some statistics of the fund’s portfolio in October 2020.

This fund is heavily concentrated in the Singapore government. You are mainly investing in Singapore T-bills and MAS bills.

2. Short term fixed income funds

These funds invest in bonds that have a longer maturity of around 2-3 years. This is longer compared to the money market funds above, which only have a maturity of 3-6 months.

With a longer maturity, you are able to get better returns. However, this means that these funds are riskier as well. As such, your risks and returns will be balanced out between the money market funds and these funds.

The two funds found in this category include:

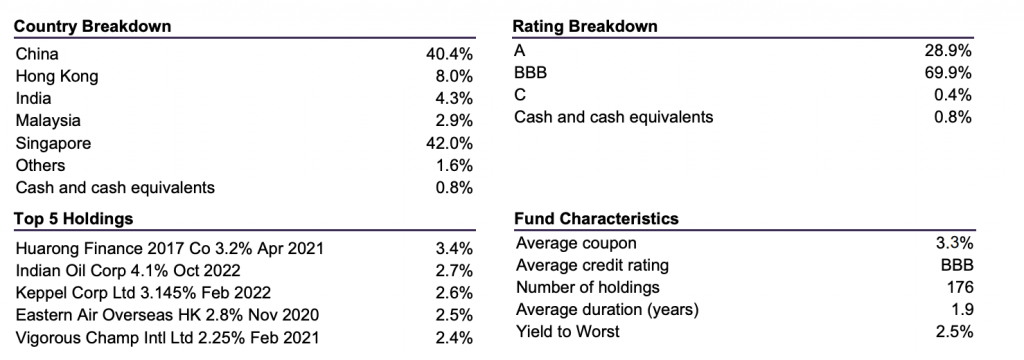

#3 Fullerton Short Term Interest Rate Fund – Class C (15%)

This Fullerton fund focuses on investing in securities and money market instruments. Here are some characteristics of this fund:

- The bonds that Fullerton invests in are heavily concentrated in China and Singapore

- The bonds are more broadly diversified across different sectors like finance and manufacturing

- The average credit rating of the bonds is BBB

One important thing to note is that the average credit rating of the fund’s holdings is BBB. Even though it is quite low, it is still considered investment grade.

Bonds with a lower credit rating will be able to provide you with better yields. This is to compensate you for the risk that the company might default.

This fund by Fullerton is the riskiest of all 4 funds in your portfolio.

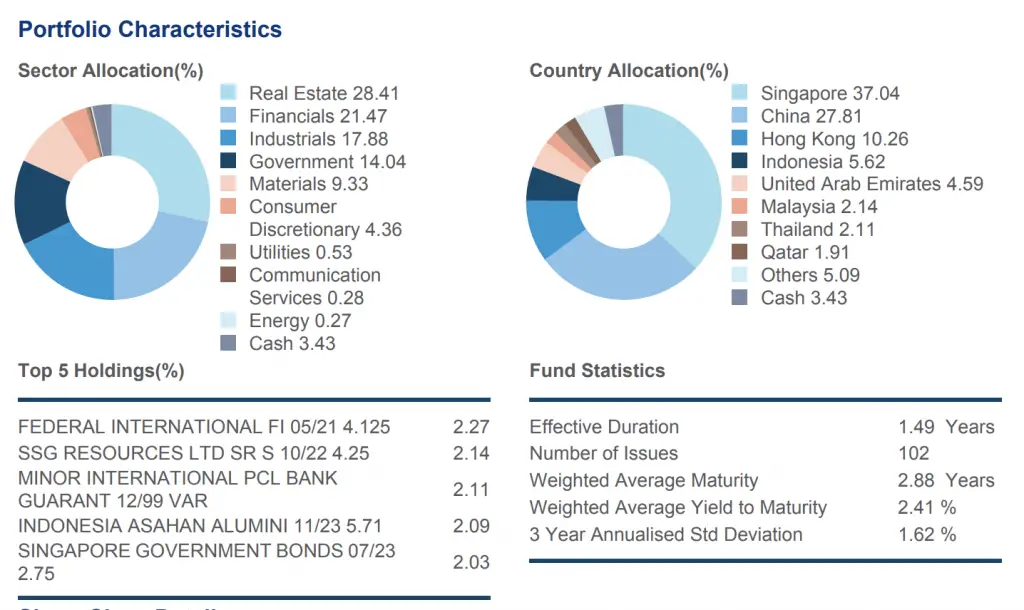

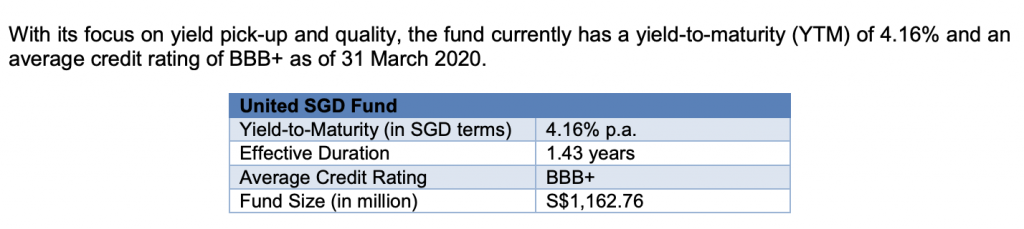

#4 United SGD Fund – A (Acc) SGD (32%)

The United SGD Fund is the second fund offered by UOBAM. Here are the assets that you’ll invest in with this fund:

This fund is more spread out and less heavily concentrated in Singapore and China. Moreover, it is also slightly less risky than Fullerton’s as it has a credit rating of BBB+.

What are the returns of AutoInvest?

Grab projects that you will receive a 1.18% return on your invested funds. This is a blended return that you’ll receive from the 4 funds.

Grab recently sent an email to reduce the yield from 1.8% to 1.18%!

This is a really huge drop in the yield!

Previously, AutoInvest had one of the highest yields of any cash management accounts available.

However, there are many products which are much better than them now! This includes:

| Portfolio | Projected Yield |

|---|---|

| Syfe Cash+ | 1.75% |

| Endowus Cash Smart | 0.8-1.6% |

| StashAway Simple | 1.4% |

However, all of these yields are not guaranteed! There is a chance that these portfolios may reduce their yields in the future too.

As such, AutoInvest may no longer be such an attractive option!

What fees does AutoInvest charge?

Similar to other robo-advisors, Grab charges you an all-inclusive fee of 0.45% p.a. This includes:

- Expense ratios of the funds in your portfolio

- Grab’s share of the fund fees

The projected 1.18% p.a. returns that you’ll receive are net of all fees.

With this management fee, you will not incur additional fees when making any buy or sell orders.

However, this fee is pretty steep compared to Endowus’ Cash Smart, which charges between 0.23-0.35% for a pretty similar portfolio.

Is AutoInvest safe?

With yet another robo-advisor coming into the market, you may be worried that AutoInvest might close down like Smartly. However, here are some things that Grab has done to ensure that AutoInvest is safe:

#1 GrabInvest is licensed by MAS

GrabInvest has a Capital Market Services License that is issued by MAS.

This CMS license is similar to what other robo-advisors have as well, such as Syfe and StashAway.

As such, GrabInvest is licensed to manage your money and invest on your behalf.

#2 Your assets are kept in a custodian account

Your assets are kept in a custodian account which is separate from the accounts of GrabInvest. Should GrabInvest close down in the future, your assets are still held with these custodians.

This is one of the requirements of the CMS license that GrabInvest has.

Here are the licensed custodians for the fund managers that GrabInvest has partnered with:

| Fund Manager | Licensed Custodian |

|---|---|

| Fullerton Fund Management | HSBC |

| UOB Asset Management Ltd | State Street Bank and Trust Company |

As such, you will be able to have control of your investments even if GrabInvest stops operating.

Verdict

Is AutoInvest something that you should invest in? Here are some of its pros and cons:

| Pros | Cons |

|---|---|

| Fuss-free way of cultivating an investing habit | There may be better yields elsewhere compared to the 1.18% p.a. |

| Easy to use and familiar Grab interface | Management fees are rather hefty |

| CMS license by MAS ensures that your funds are rather safe | Amount invested for each transaction is rather little |

Here are some key pointers about this product:

#1 AutoInvest is more of a micro-investment

AutoInvest is not really actual investing. Rather, it is similar to a micro-investment.

You can’t put in a lump sum or dollar cost average into this investment. The only way that you can invest more into this portfolio is by making more transactions.

Moreover, the transaction amounts ($1, $3 or $5) are too little to make much of a difference. You will need to make lots of Grab transactions to have a substantial amount in AutoInvest!

As such, I believe that this is great if you are having troubles with investing regularly every month. AutoInvest does not require you to make huge lifestyle changes to start investing. By carrying out your daily activities, you will already start investing a small sum each time.

Again, this assumes that you are making lots of transactions with Grab. If you use Grab and order GrabFood rather often, AutoInvest will be more suitable for you.

#2 Better yields can be found elsewhere

There are other products out there that offer similar or even better rates of return than AutoInvest. This includes:

| Account | Rate of Return |

|---|---|

| SingLife Account | 2% for your first $10k |

| GIGANTIQ | 1.18% for your first $10k |

| Syfe Cash+ | Up to 1.75% on any amount |

| Endowus Cash Smart | 0.8-1.6% on any amount |

I would suggest that you use these products first, before even considering AutoInvest.

Conclusion

Due to AutoInvest’s extremely poor liquidity, I do not think that AutoInvest is not for everyone. I feel that you can use AutoInvest if you:

- Want to cultivate an investing habit

- Intend to use AutoInvest for your short term goals

- Are frequently using GrabPay to make your transactions

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?