Last updated on June 6th, 2021

There are many S&P 500 ETFs out there, so it may be really confusing for you.

Two of these ETFs are CSPX and VUSD.

Since they are rather similar, which one should you choose?

Contents

The difference between CSPX and VUSD

CSPX is managed by iShares, while VUSD is managed by Vanguard. Both of them track the same index (S&P 500). Their main difference is how they distribute their dividends, where CSPX is an accumulating ETF while VUSD is distributing.

Index tracked

Both ETFs track the S&P 500 index. As such, they should have very similar performances.

This is because both funds will have the same holdings in the same proportion.

If you are looking to invest in the S&P 500, here’s a guide to get you started.

Fund manager

CSPX is managed by BlackRock under the iShares family of ETFs. Meanwhile, VUSD is managed by Vanguard.

VUSD is actually the same ETF as VUSA, just that they are denominated in different currencies!

CSPX was the ETF that started earlier in 2010. VUSD was only created 2 years later, in 2012. Due to the longer age of the fund, CSPX has a larger assets under management.

| CSPX | VUSD | |

|---|---|---|

| AUM | 45,112 million | 27,624 million |

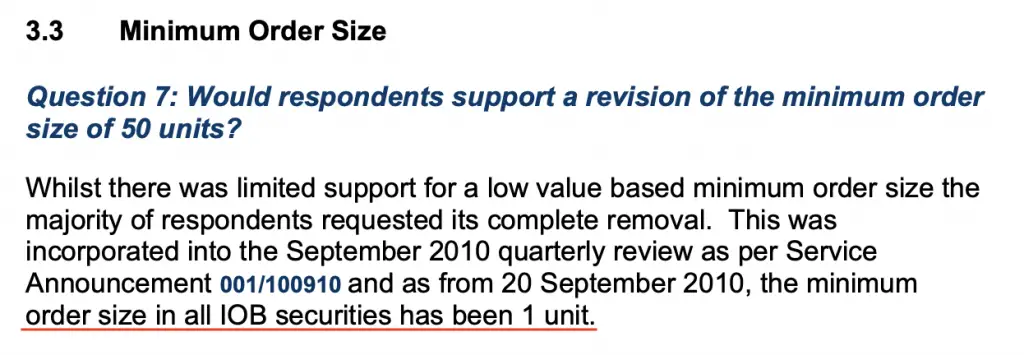

They are listed on the same exchange

Both CSPX and VUSD are listed on the London Stock Exchange (LSE). This means that you are able to purchase a minimum unit of 1 for either ETF.

This is similar to the US exchanges.

The brokers that allow you to trade on the LSE are pretty limited. One example is Tiger Brokers which does not offer LSE as one of their exchanges.

You can view my guide to see what are the best ways to buy LSE ETFs from Singapore.

Their unit price is different

Both CSPX and VUSD have a different unit price. This becomes significant when you only have a small amount to invest into these ETFs each time.

| CSPX | VUSD | |

|---|---|---|

| Estimated Unit Price | $300 USD | $70 USD |

If you only have a small sum of less than $300 USD to invest, VUSD may be a better option for you.

This is because you are still able to purchase some units of VUSD with your small investment amount.

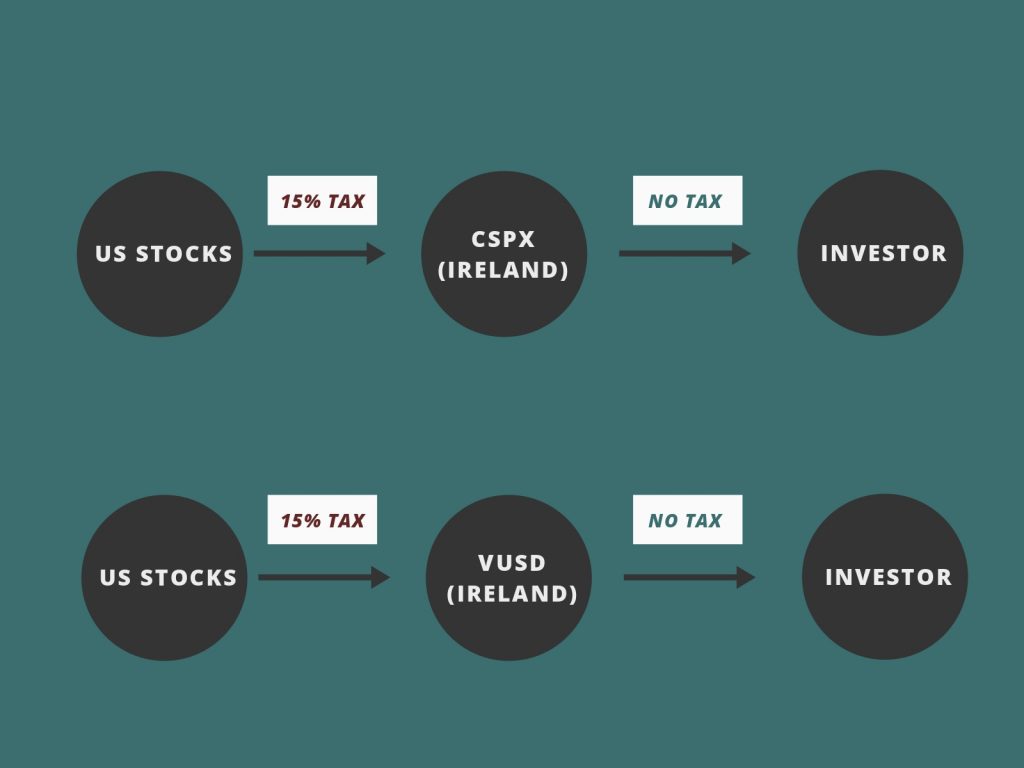

Dividend withholding tax

Both ETFs are domiciled in Ireland. As such, you will incur a 15% dividend withholding tax if you are a non-resident alien to the US.

This is due to a tax treaty between Ireland and US. As such, both of these ETFs do not incur the US estate tax too.

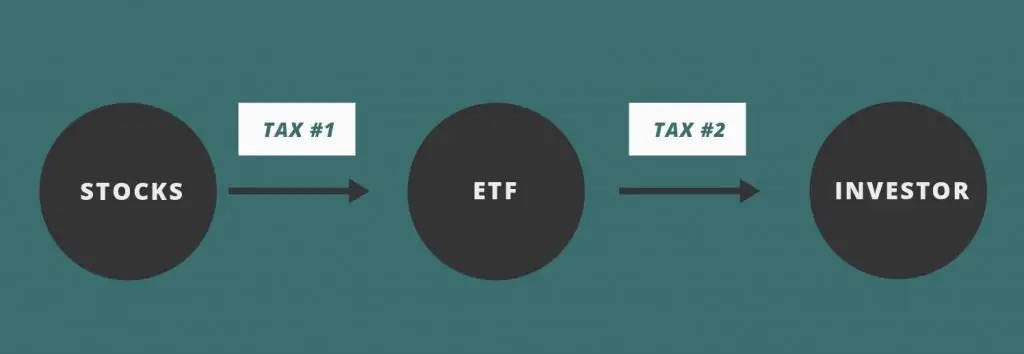

2 layers of taxes

For any ETF, the fund manager buys the stocks based on the index they are tracking. The dividends that they distribute are collected from the stocks in their fund.

As such, there are 2 layers where you may incur some taxes:

- From stock to ETF

- From ETF to you, the investor

Both ETFs incur the tax on the first layer

For both CSPX and VUSD, the dividends from the US stocks are distributed to an Irish-domiciled ETF. As such, the 15% withholding tax applies on the first layer.

If you wish to track your dividends with the taxes accounted for, you can consider trying out StocksCafe’s platform.

Dividend distribution

VUSD and CSPX will manage your dividends differently:

VUSD distributes your dividends every quarter

VUSD will distribute your dividend every 3 months. They will gather all of the dividends that they receive and pay it to you each quarter.

This is great if you intend to receive some passive income via dividends.

However, you need to invest a large amount into VUSD to receive a substantial quarterly payout!

CSPX automatically reinvests your dividends

CSPX is an accumulating ETF. This means that they will not distribute your dividends to you. Instead, they will reinvest the dividends they receive into the same stocks in the index.

If you are looking to reinvest your dividends from the start, the CSPX may be a better choice.

This is because you do not need to incur any additional transaction fees when the ETF reinvests your dividends for you.

You can read my comparison between accumulating and distributing ETFs to see how they are different.

Expense ratio

On top of the trading commissions, you’ll need to pay an expense ratio to the fund manager of the ETFs.

Here are the 2 expense ratios that the ETFs will charge you:

| CSPX | VUSD | |

|---|---|---|

| Expense Ratio | 0.07% | 0.07% |

Both of them have exactly the same expense ratio! As such, this cost should not be a huge factor in deciding which ETF to invest in.

Liquidity

If you are looking to actively trade using these ETFs, you may want to look at their liquidity. One of the indicators you may want to look at is the ETF’s trading volume.

| CSPX | VUSD | |

|---|---|---|

| Liquidity | 72,000 | 96,000 |

Both ETFs have a rather similar trading volume. Their volume may be lower compared to the NYSE-listed ETFs which have trading volumes in the millions!

However, you should still be able to buy or sell your units at your intended price.

Verdict

Here is a breakdown of CSPX and VUSD:

| CSPX | VUSD | |

|---|---|---|

| Fund Manager | BlackRock | Vanguard |

| AUM | 45,112 million | 27,624 million |

| Exchange | LSE | LSE |

| Estimated Unit Price | $300 USD | $70 USD |

| Dividend Withholding Tax | 15% | 15% |

| Dividend Distribution | Accumulating | Distributing |

| Expense Ratio | 0.07% | 0.07% |

| Liquidity | 72,000 | 96,000 |

Both of them look really similar, so which one should you choose? The major difference boils down to whether you prefer an accumulating or distributing ETF.

Choose CSPX if you want to reinvest your dividends

CSPX makes more sense to invest in if you wish to reinvest your dividends.

An accumulating ETF is most suitable if you are young and have a long time horizon. You should be in the wealth accumulation phase at this stage.

As such, reinvesting your dividends will help to compound your growth even further!

With the automatic reinvestment of your dividends for you, this will save you a lot of transaction costs.

However, once you invest in an accumulating ETF, you lose the option of earning any dividends!

High unit price may be a deterrence

One major disadvantage of investing with CSPX is its high unit price. If you have less than $300 USD, you can’t invest in this ETF!

If you can only invest a small amount each time, then VUSD may be better for you. However, you’ll need to see if the trading fees are worth it for this small amount!

Choose VUSD if you want to receive a regular income

If you intend to receive dividends as an additional source of income, then VUSD may be a better choice for you.

VUSD will distribute its dividends to you every quarter. As such, you will get a pretty stable source of income every 3 months.

However, you will need to invest a significant amount of money into the ETF for the dividends to sustain you in the long run!

Conclusion

Both ETFs track the same index, so their performances should be very similar.

The ETF that you ultimately choose to invest in will mainly depend on:

- Whether you want to invest in an accumulating or distributing ETF

- The amount that you are able to invest each time

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?