Last updated on October 15th, 2021

With so many different S&P 500 ETFs out there, which one should you choose?

Here is a comparison between the S&P 500 ETF listed on the SGX (S27) against the one listed on the NYSE (SPY).

Contents

S27 vs SPY

Both S27 and SPY are ETFs that track the S&P 500 index. They are managed by SPDR, but are listed on different stock exchanges. Even though S27 is listed on the SGX, it is domiciled in the US. As such, you will incur the same amount dividend withholding tax when you invest in either ETF. SPY has an edge over S27 due to its superior trading volume. This makes this ETF more liquid compared to S27.

Both are managed by SPDR

Both the S27 and SPY are managed by SPDR. As such, you will be investing in exactly the same fund, just that they are listed in different exchanges.

This will mean that both S27 and SPY will have the same:

#1 Returns

Both ETFs are tracking the S&P 500 Index.

The S&P 500 Index tracks the performance of 500 companies that are listed on the US stock exchanges.

Here are the top 10 holdings of the S&P 500.

As such, the 5-year returns of these 2 ETFs are pretty similar.

#2 Expense ratio

Since these 2 ETFs are managed by SSGA, you will have the same expense ratio of 0.0945%. This is a pretty affordable fee to invest in this ETF.

They are listed on different exchanges

S27 is listed on the SGX, while SPY is listed on the NYSE. As such, there may be some differences when you invest in these 2 exchanges.

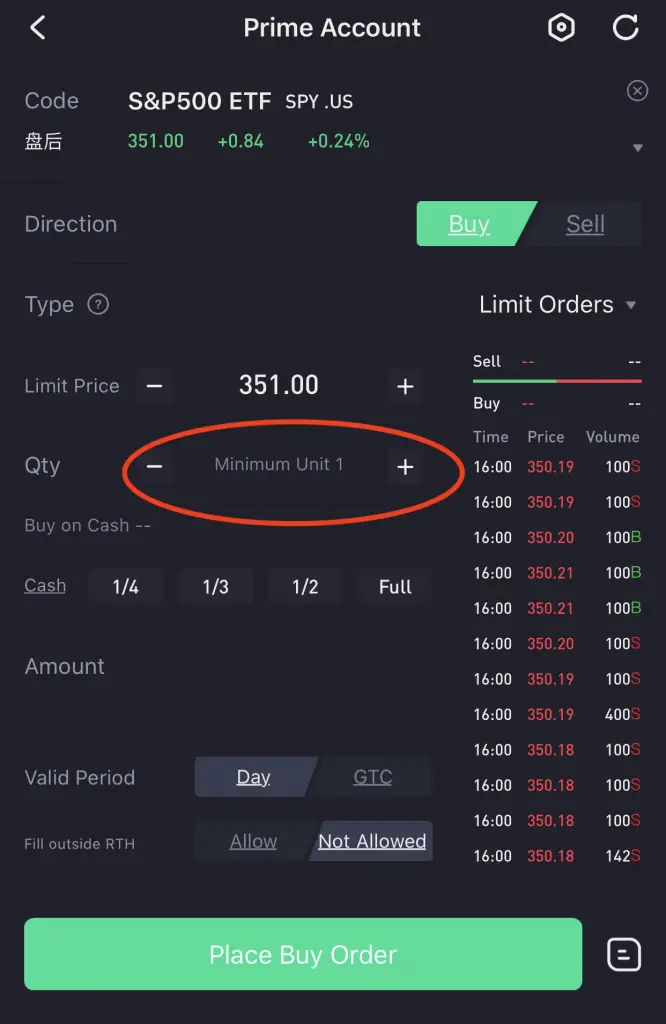

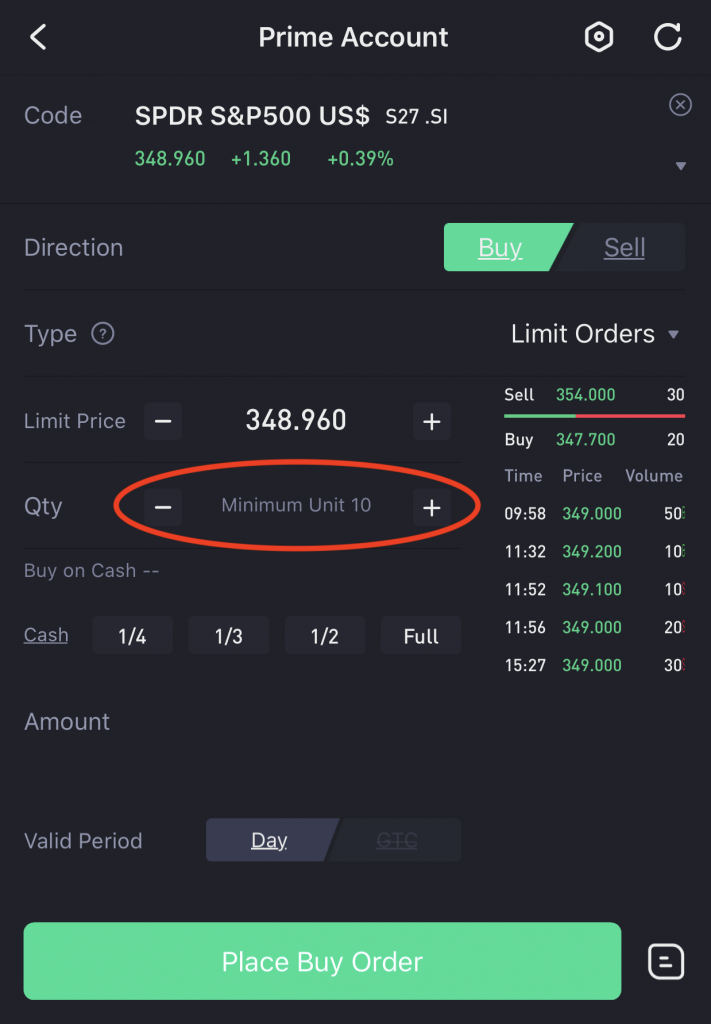

Minimum Units to invest

The minimum unit to invest in the SPY is 1.

However, S27 requires you to invest in a minimum of 10 units. You will also need to invest in subsequent units of 10.

As such, it will be hard for you to invest in S27 if you have a smaller sum to begin with.

Different commissions being charged

Brokerages will charge different commissions, depending on which exchange you invest in.

For example, here are the commissions that Tiger Brokers charges:

| SGX | US Markets |

|---|---|

| 0.08% * trade value, minimum SGD$2.88 | 0.01 USD per share, minimum $1.99USD per trade |

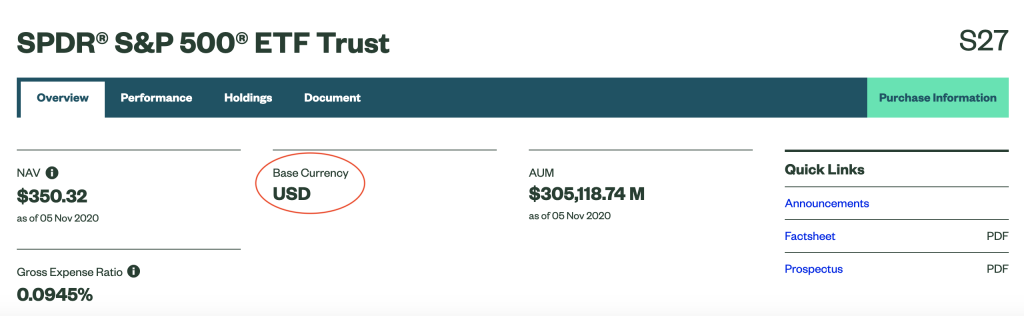

Even though S27 is listed on the SGX, it is still denominated in USD.

As such, you will not have any currency exchange advantages when you invest in S27. You will incur a currency exchange risk when you invest in either ETF.

Dividends

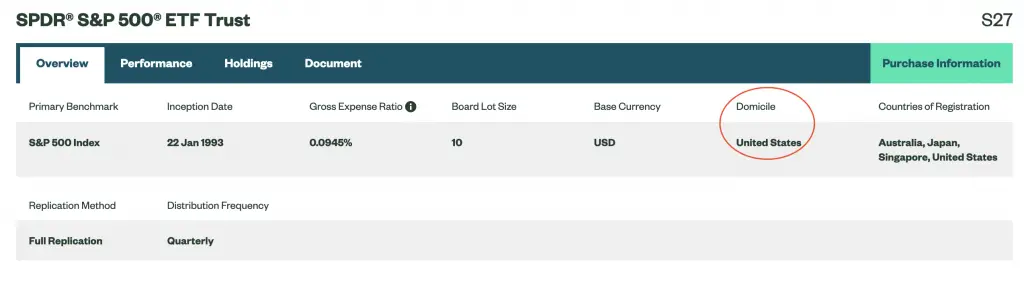

Even though S27 is listed on the SGX, the fund is still domiciled in the US.

As such, the 30% dividend withholding tax still applies to S27.

How does the dividend withholding tax work?

A dividend withholding tax is a tax on the dividends that you receive. Singapore does not have a tax treaty with the US. As such if you invest in stocks that are listed in the US, you will incur a 30% tax on your dividends.

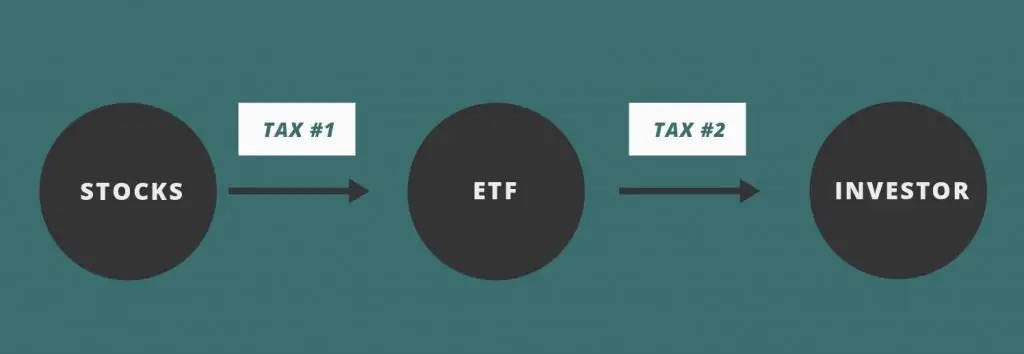

For ETFs, it is slightly complicated. When you invest in an ETF, the fund manager will buy the stocks that are part of the index they are tracking. Any dividends that they receive will be redistributed to you.

As such, there are 2 ways that the withholding tax will be incurred:

- From the stock to the ETF

- From the ETF to the investor

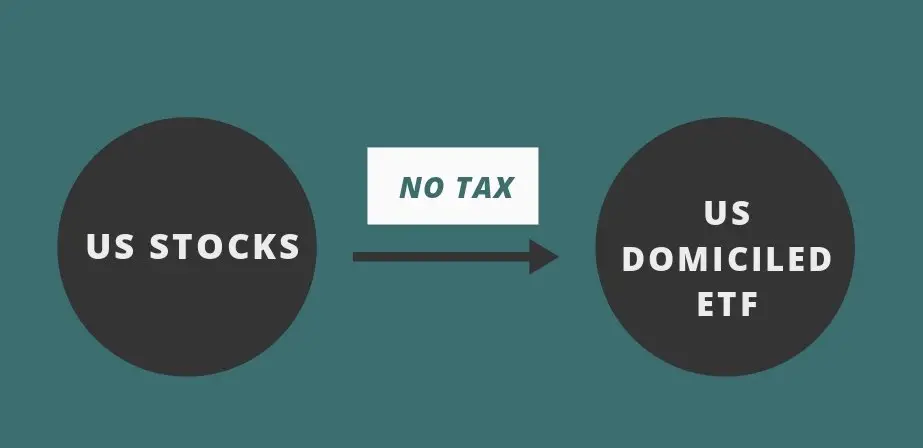

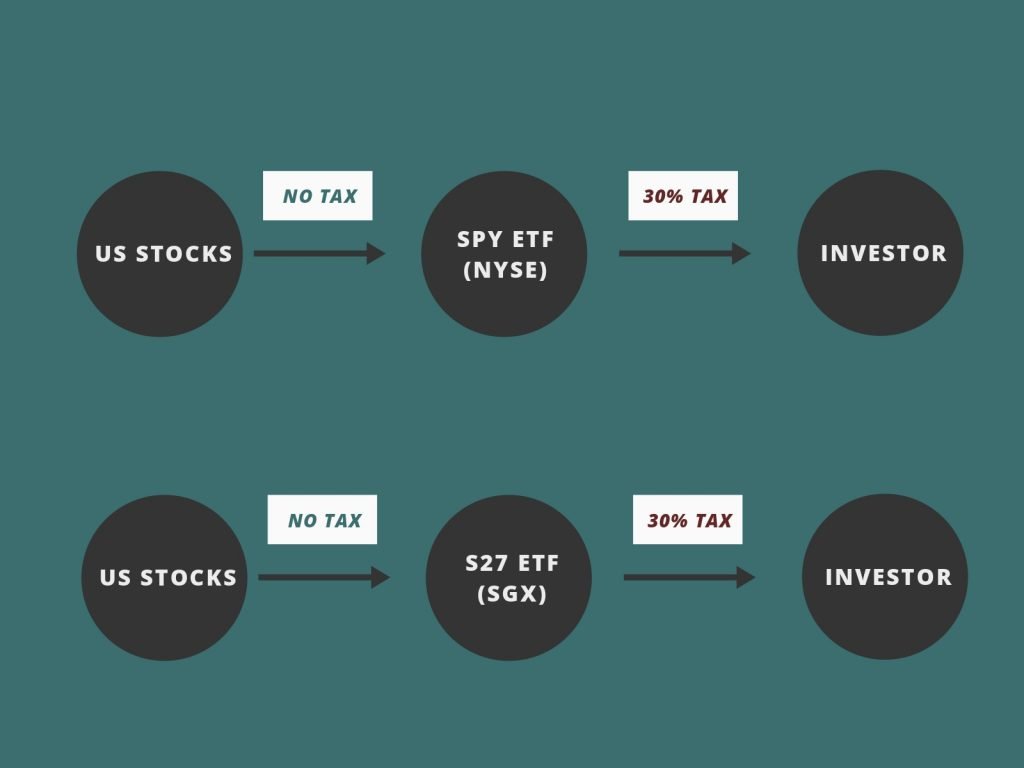

For both S27 and SPY, the funds are domiciled in the US. Since both ETFs track the S&P 500 index, they will only invest in stocks listed on the US exchanges. As such, there is no withholding tax incurred on the first layer.

The only withholding tax that you will incur is between the ETF and the investor. This is because the dividends are distributed by a US-domiciled fund to you, a Singaporean investor.

As such, investing in either ETF will still incur you the same 30% dividend withholding tax. You will also incur the same US estate tax rates too, depending on your estate value.

There is no advantage when you invest in the SGX-listed ETF!

Current dividend yield of 1.68%

The index dividend yield is currently set at 1.68%. As such, you will most likely receive a dividend yield of around 1.18%.

If you wish to track all your dividends with the withholding taxes taken into consideration, you may want to check out StocksCafe’s platform.

Liquidity

When it comes to the liquidity of the ETF, this is where S27 really loses out. To determine an ETF’s liquidity, you can do so by looking at the ETF’s trading volume.

Here are the average trading volumes for these 2 ETFs:

| S27 | SPY | |

|---|---|---|

| Average Trading Volume | 337 | 73,400,000 |

The trading volume for S27 is really appalling! If you wish to trade the S27, it may be very hard to buy or sell at your ideal price.

Even if you are a long term investor, you may find problems trying to sell off your assets in the future!

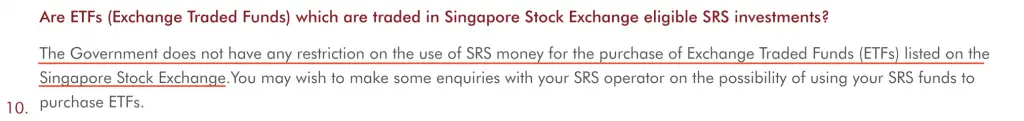

You can invest in S27 using your SRS funds

S27 is an ETF that is listed on the SGX. As such, it is possible for you to use your SRS funds to purchase this ETF, and gain exposure to the S&P 500.

The Singapore Government does not have any restrictions on using your SRS to invest in ETFs on the SGX.

As such, it is possible for you to use your SRS funds to invest in an S&P 500 ETF!

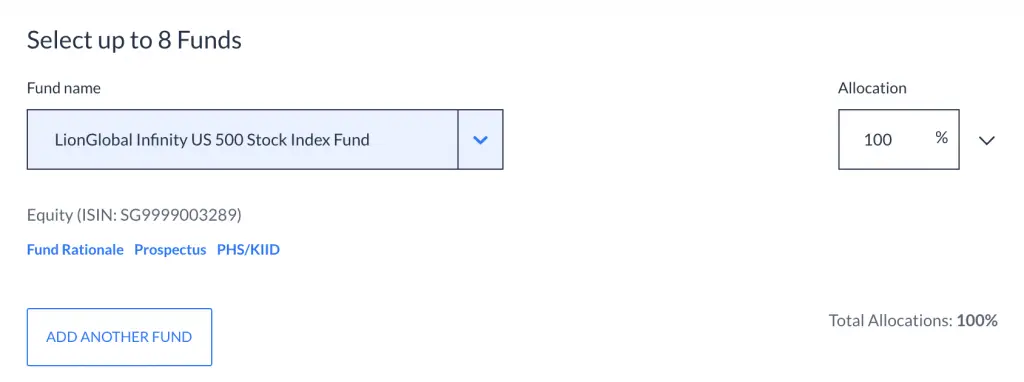

However, due to S27’s poor liquidity, you may want to use another option to invest your SRS funds in the S&P 500. One such example is Endowus’ Fund Smart, which allows you to customise your own portfolio.

You are able to invest in the LionGlobal Infinity US 500 Stock Index Fund, which also tracks the S&P 500 index.

What’s more, you’re able to use both your CPF and SRS to invest in Fund Smart! This is something you may want to consider instead of investing in S27.

You can find out more about using your SRS funds to invest in US stocks or ETFs with my guide.

Verdict

Here’s the comparison between SPY and S27:

| S27 | SPY | |

|---|---|---|

| Fund Manager | SSGA | SSGA |

| Index Tracked | S&P 500 | S&P 500 |

| Exchange | SGX | NYSE |

| Net AUM | 277.6 billion | 277.6 billion |

| Currency Denomination | USD | USD |

| Expense Ratio | 0.0945% | 0.0945% |

| Minimum Unit To Invest | 5 | 1 |

| Dividend Withholding Tax | 30% | 30% |

| Average Trading Volume | 337 | 73,400,000 |

| Funds to Invest | Cash SRS | Cash Only |

Since SPY and S27 are so similar, which ETF should you choose?

SPY offers higher liquidity and you require a lower minimum lot size to invest in this ETF (1 unit). The amount of dividend withholding tax you incur is the same, and both ETFs are denominated in USD. As such, SPY will be the better choice over S27.

The only time you might want to consider investing in S27 is when you wish to use your SRS funds. However, there might be better options to invest in the S&P 500 with your SRS. One example is to invest in the LionGlobal Infinity US 500 Stock Index Fund using Endowus’ Fund Smart.

Conclusion

Since both of these ETFs are very similar, the SPY will have an edge over S27 due its superior liquidity.

You can check out my guide to investing in the S&P 500 in Singapore to find out more too.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?