If you’re looking to buy the S&P 500 on Tiger Brokers, you will need to buy an ETF that tracks this index.

Here’s a guide on how you can do so.

Contents

How to invest in the S&P 500 with Tiger Brokers

Here are 3 steps to use Tiger Brokers to invest in the S&P 500:

- Decide which S&P 500 ETF you would like to use

- Convert your SGD to USD

- Purchase the S&P 500 ETF using USD

And here is each step explained further:

Decide which S&P 500 ETF you would like to use

The first step you’ll need to do is to decide on the S&P 500 ETF that you would like to buy.

Tiger Brokers provides you access to the Singapore Stock Exchange (SGX) and the US markets (NYSE and NASDAQ), so here are the different S&P 500 ETFs that you can buy:

| Ticker | Exchange | Fund Manager | Expense Ratio |

|---|---|---|---|

| S27 | SGX | SSGA | 0.09% |

| VOO | NYSE | Vanguard | 0.03% |

| IVV | NYSE | BlackRock | 0.03% |

| SPY | NYSE | SSGA | 0.09% |

You aren’t able to buy ETFs that are listed on the London Stock Exchange (LSE), so you can’t buy ETFs such as CSPX or VUSD.

In terms of performance, all of these ETFs should give you the same returns since they track the same index. As such, the ETF that you ultimately choose may depend on:

- The expense ratio that you’ll incur

- The average trading volume of the ETF (if you intend to trade the ETF regularly)

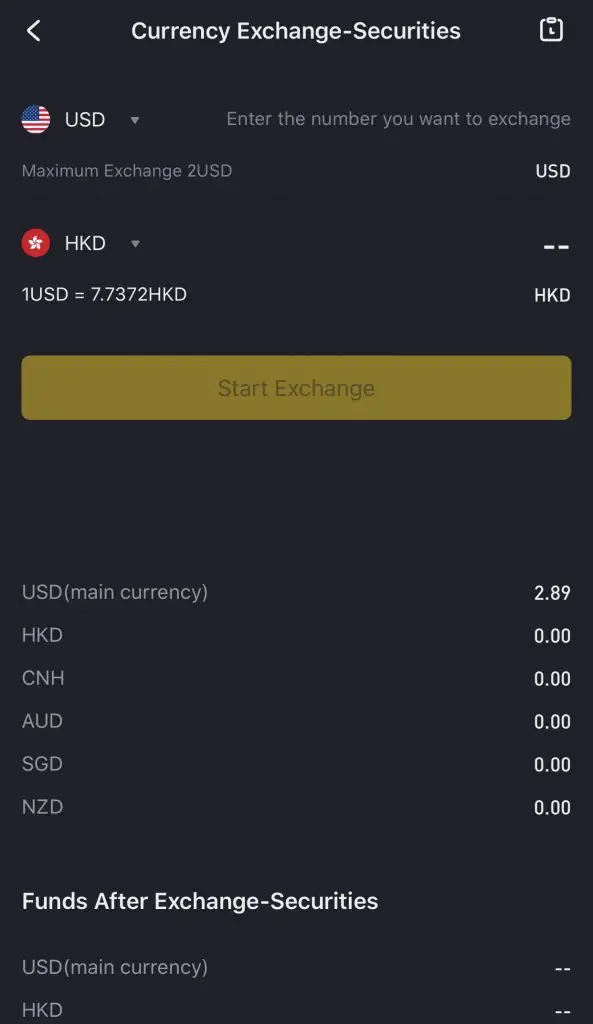

Convert your SGD to USD

The next step will be to fund your Tiger Account with SGD, and then convert it to USD.

You can view my guide on exchanging currency on Tiger Brokers to find out more.

One thing you may want to note is that even though the S27 ETF is listed on the SGX, you will still need to use USD to purchase this ETF!

Purchase the S&P 500 ETF using USD

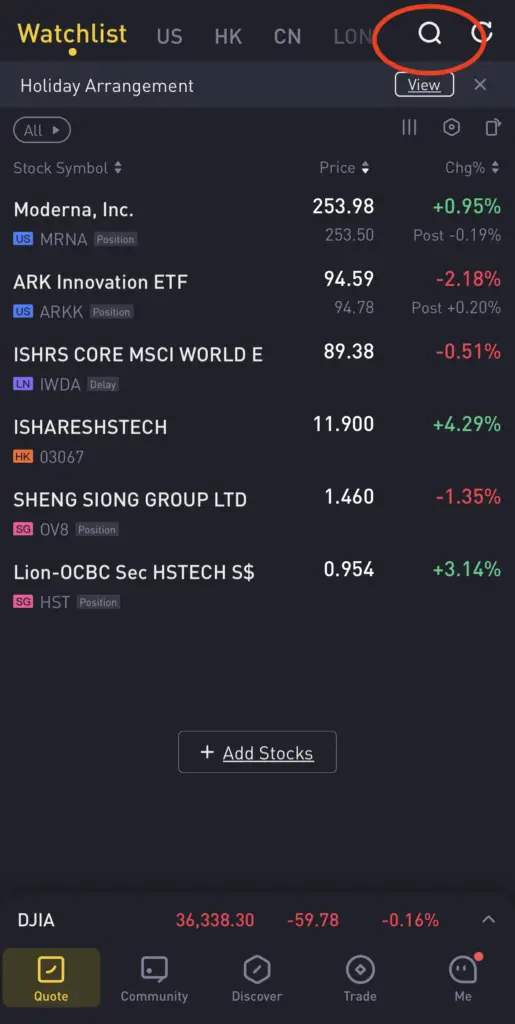

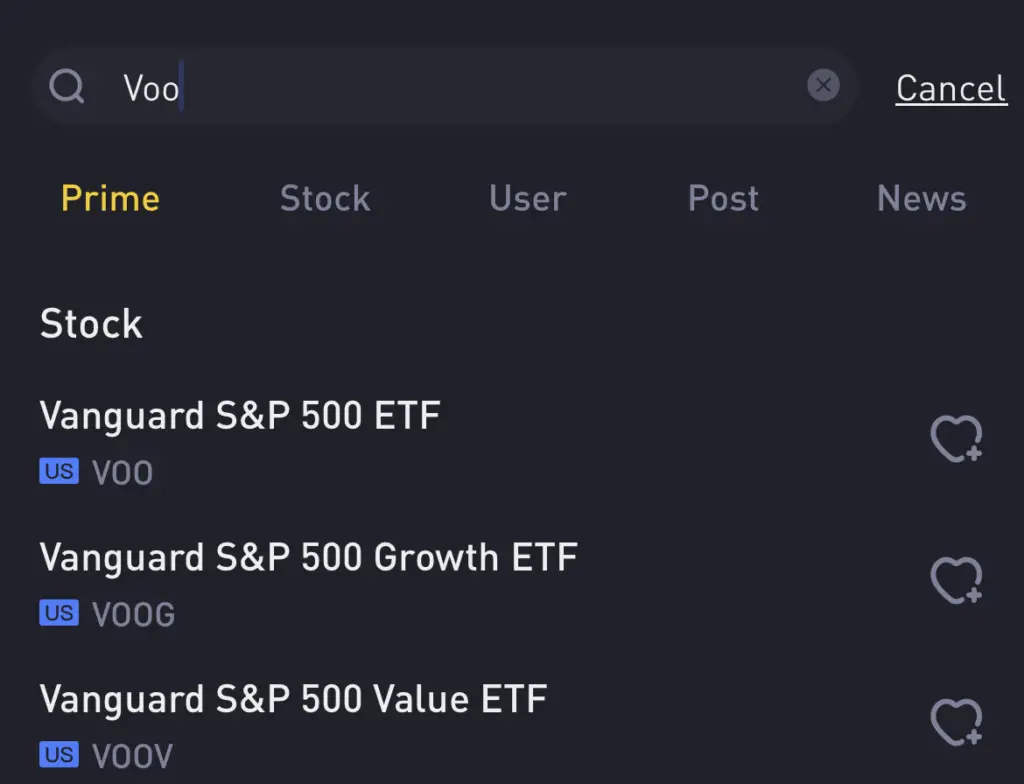

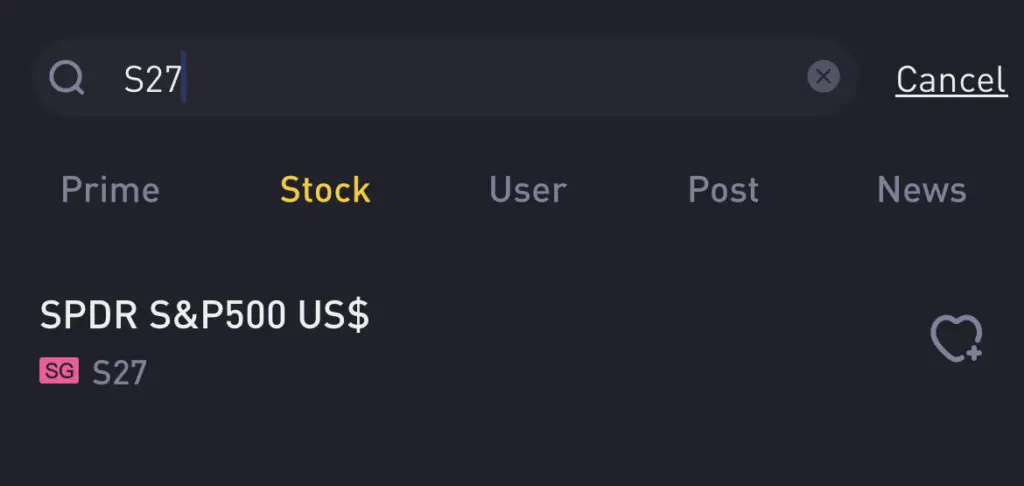

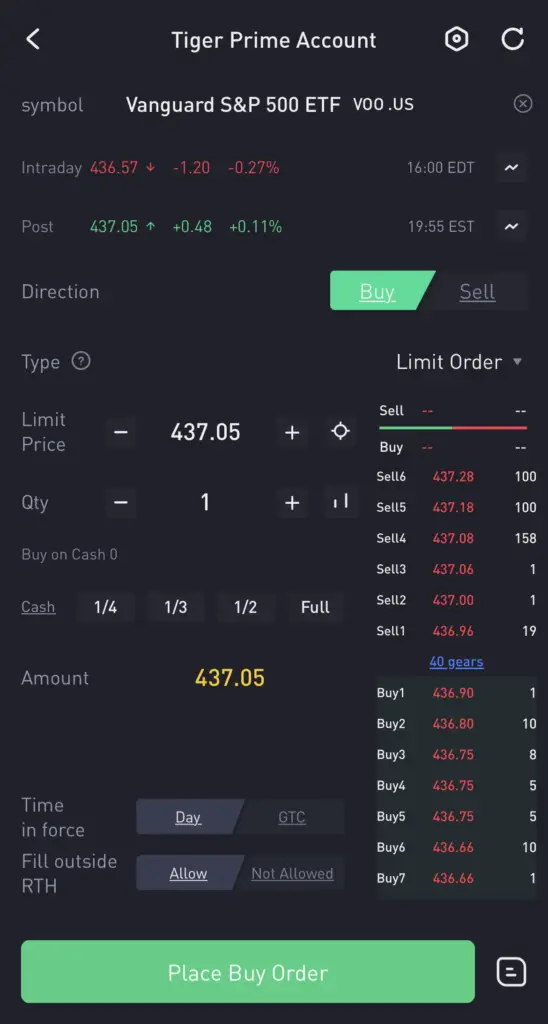

Once you have USD in your Tiger Account, you can now buy the S&P 500 ETF of your choice. You can go to the Search icon in your Tiger Brokers app,

and then search for some of the S&P 500 ETFs including VOO,

and S27.

After selecting the ETF, you can go to the ‘Trade‘ button,

and then select ‘Buy‘.

This will bring you to the transaction page, where you can enter:

- The price that you want to buy the ETF

- The number of units to buy the ETF

The minimum number of units for ETFs on the US stock exchanges is 1, so you’ll roughly need about $400 USD to purchase 1 unit of the ETF.

After you have placed the order, it will be filled if someone is willing to sell the S&P 500 ETF at that price.

What are the fees for trading US stocks on Tiger Brokers?

Here are the fees that Tiger Brokers charges for US stocks and ETFs:

| Fee | Amount |

|---|---|

| Trading Fee | 0.01 USD / Share Min 1.99 USD / Order |

| Currency Conversion Fees | None |

| Dividend Handling Fees | None |

| Custodian Fees | None |

| Inactivity Fees | None |

The fees for Tiger Brokers is pretty reasonable at a minimum of USD $1.99 per order that you make.

However, you may want to take note of the dividend withholding tax, as well as the estate tax that you will incur when trading US stocks!

The S&P 500 ETFs will issue a dividend every quarter, and you can check out my guide to find out how your dividends will be issued on Tiger Brokers.

Conclusion

If you are looking to buy the S&P 500, you will need to choose an ETF that tracks this index.

Tiger Brokers does not provide you with access to the London Stock Exchange, so you are only able to buy the S&P 500 ETFs from the SGX or US stock markets.

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Tiger Brokers Referral (Free AAPL Share and 60 Commission-Free Trades)

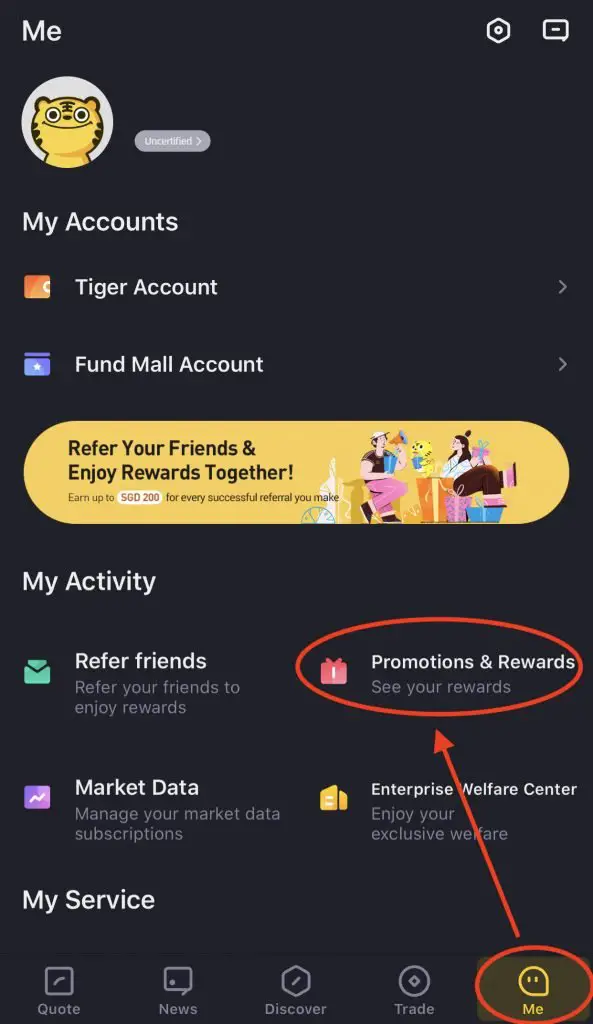

If you sign up for a Tiger Brokers account using my referral link, you will be eligible for some rewards. You can view and claim your rewards by going to ‘Me → Promotions & Rewards‘.

Here are 3 bonuses that you can receive:

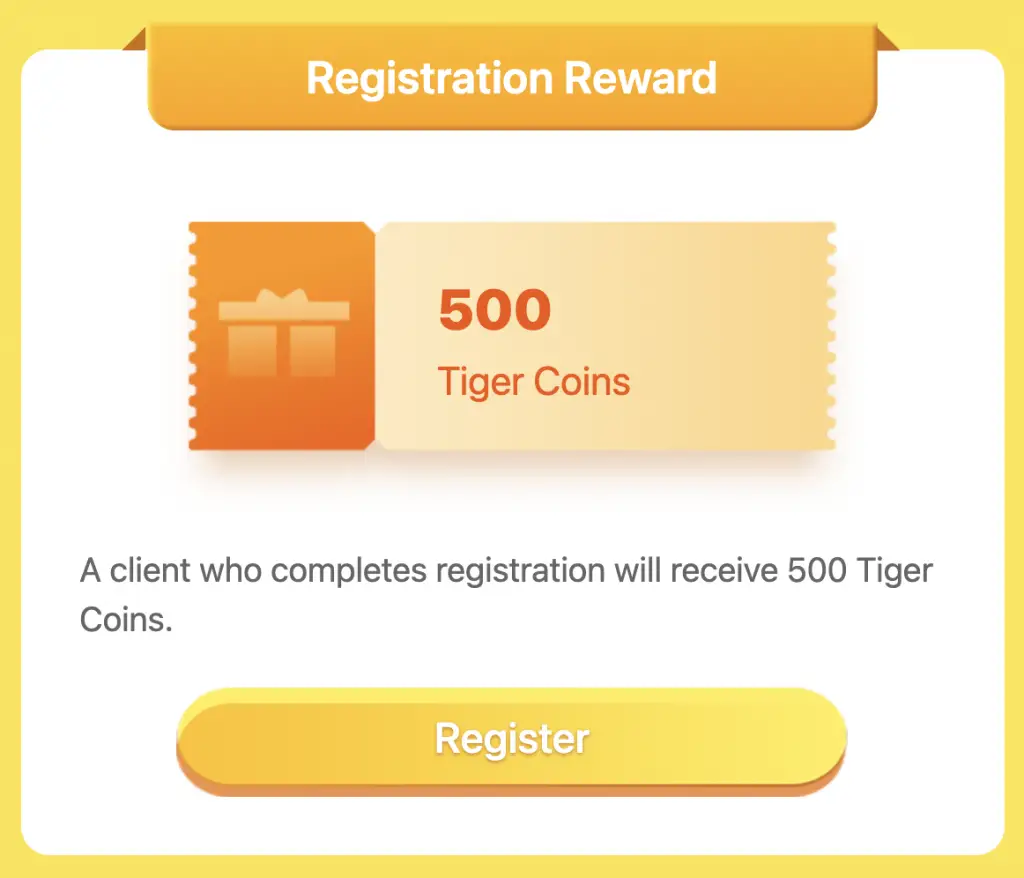

#1 Registration Reward

When you register for a Tiger Brokers Account, you will receive 500 Tiger Coins.

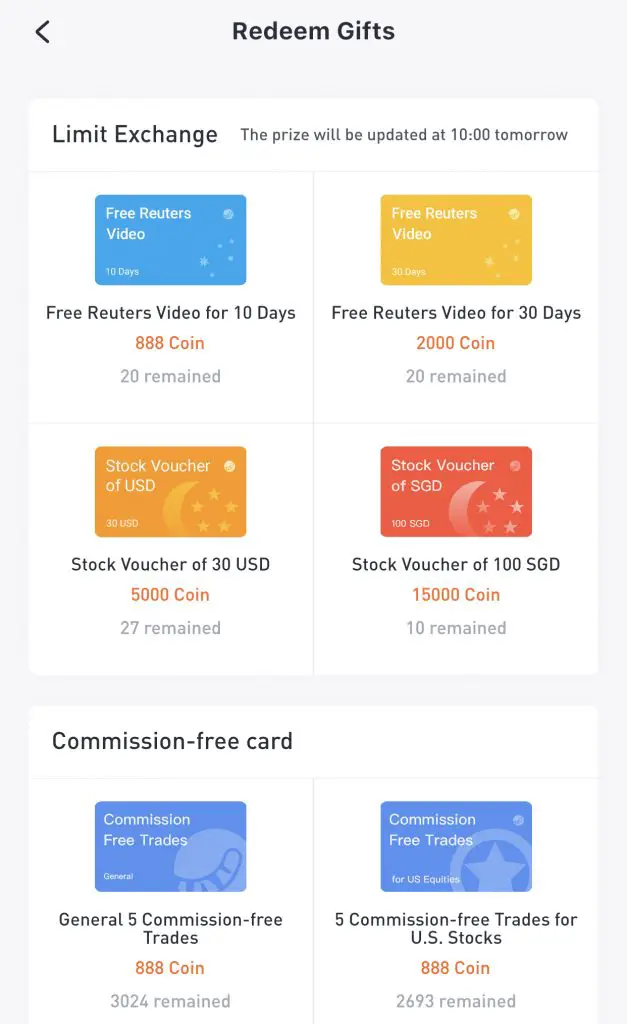

These Tiger Coins can be used to redeem a variety of rewards, such as:

- Stock vouchers

- Commission-free trades

- Reuters videos

#2 Account Opening Reward

After successfully opening your account, you will receive 60 commission-free trades that you need to use within 180 days.

These commission free trades can be used for:

- US stocks

- HK stocks

- Singapore stocks

- Australia stocks

On top of that, you will receive 5 commission-free trades for futures within 30 days.

You will still need to pay the commission first. The commission should be refunded to you on the next working day.

#3 Funding Reward

If you fund at least $2,000 SGD into your Tiger Brokers account for your very first deposit, you will receive a free Apple (AAPL) share.

The shares will be added into your account within 10 working days.

On top of that, you will receive a stock voucher (SGD5) for SGX stocks only.

You can view the terms and conditions of this promotion on Tiger Brokers’ website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?