Last updated on January 2nd, 2022

You may have heard of that you may receive higher returns when you are investing in the US market.

However, how do you go about doing it?

You’ll need to find a broker that gives you access to the US exchanges, such as the NYSE or NASDAQ.

Here’s what you need to know.

Contents

- 1 Can Singaporeans buy US stocks and ETFs?

- 2 How to buy US stocks and ETFs in Singapore

- 3 Tiger Brokers

- 4 moomoo (powered by FUTU SG)

- 5 Saxo

- 6 Interactive Brokers

- 7 Standard Chartered Online Trading

- 8 FSMOne

- 9 POEMS

- 10 TD Ameritrade

- 11 Firstrade

- 12 Other Singapore Brokers

- 13 Can I buy US stocks with SGD?

- 14 Is Robinhood and Webull available in Singapore?

- 15 Things you’ll need to know about the US market

- 16 Conclusion

- 17 👉🏻 Referral Deals

Can Singaporeans buy US stocks and ETFs?

Singaporeans are allowed to buy and sell US stocks and ETFs on any brokers that offer you access to the US stock exchanges. Before doing so, you are required to fill up the a W-8 BEN form to declare that you a non-resident alien of the USA and you will be subject to withholding taxes.

Most popular brokers should provide you with access to the US markets. As such, you are able to start trading with them almost right away!

However, you will need to fill up the W-8 BEN form first. This is an important step that most brokers require you to do so, before you are able to buy and sell in the US markets.

How to buy US stocks and ETFs in Singapore

Here are 10 brokers you can buy US stocks and ETFs in Singapore:

- Tiger Brokers

- moomoo (powered by FUTU SG)

- Saxo

- Interactive Brokers

- Standard Chartered

- FSMOne

- POEMS

- TD Ameritrade

- Firstrade

- Other Singapore Brokers

This is a summary of each broker,

| Platform | Minimum Fee Per Order | Additional Fees? |

|---|---|---|

| Tiger Brokers | 1.99 USD | No |

| moomoo | 1.99 USD | No |

| Saxo | 4 USD | Yes |

| Interactive Brokers | 0.35 USD | Yes |

| Standard Chartered | 10 USD | No |

| FSMOne | 8.80 USD | No |

| POEMS | 3.88 – 20 USD | Yes |

| TD Ameritrade | None | No |

| Firstrade | None | Yes |

| Other Singapore Brokers | 18 – 25 USD | Yes |

and here is each broker explained in-depth:

Tiger Brokers

Tiger Brokers was launched in 2020, and they introduced low trading commissions for exchanges in 5 countries.

They provide one of the cheaper fees when you are looking to buy US stocks and ETFs!

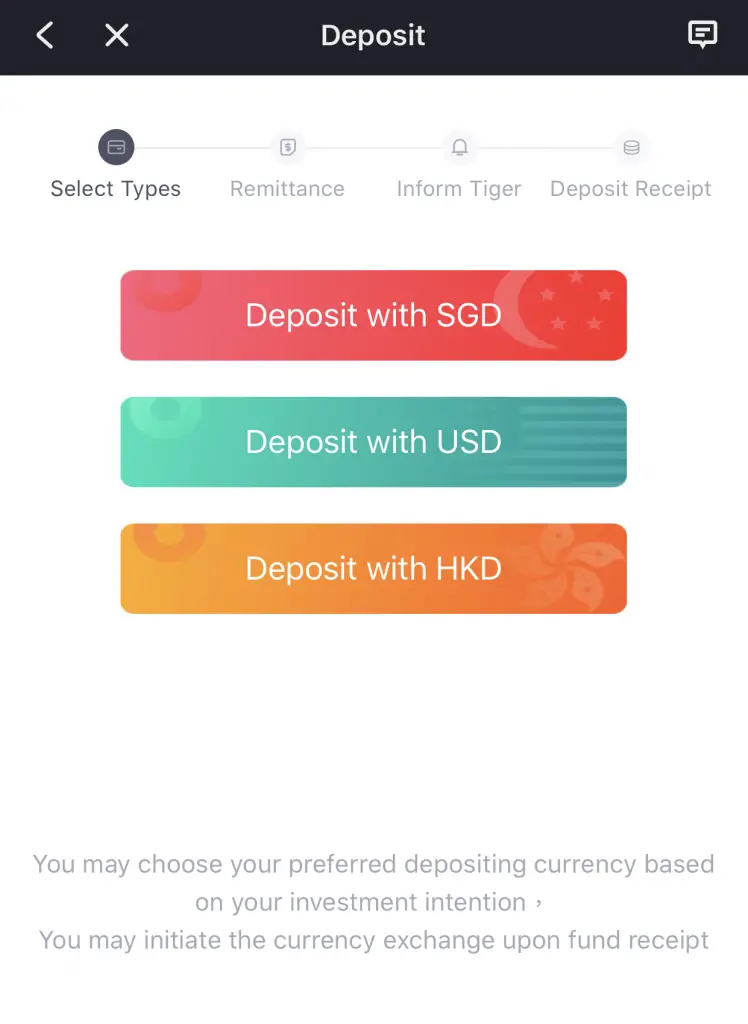

Funding of account

When you want to fund your Tiger Brokers account, you can deposit 3 different currencies:

- SGD

- USD

- HKD

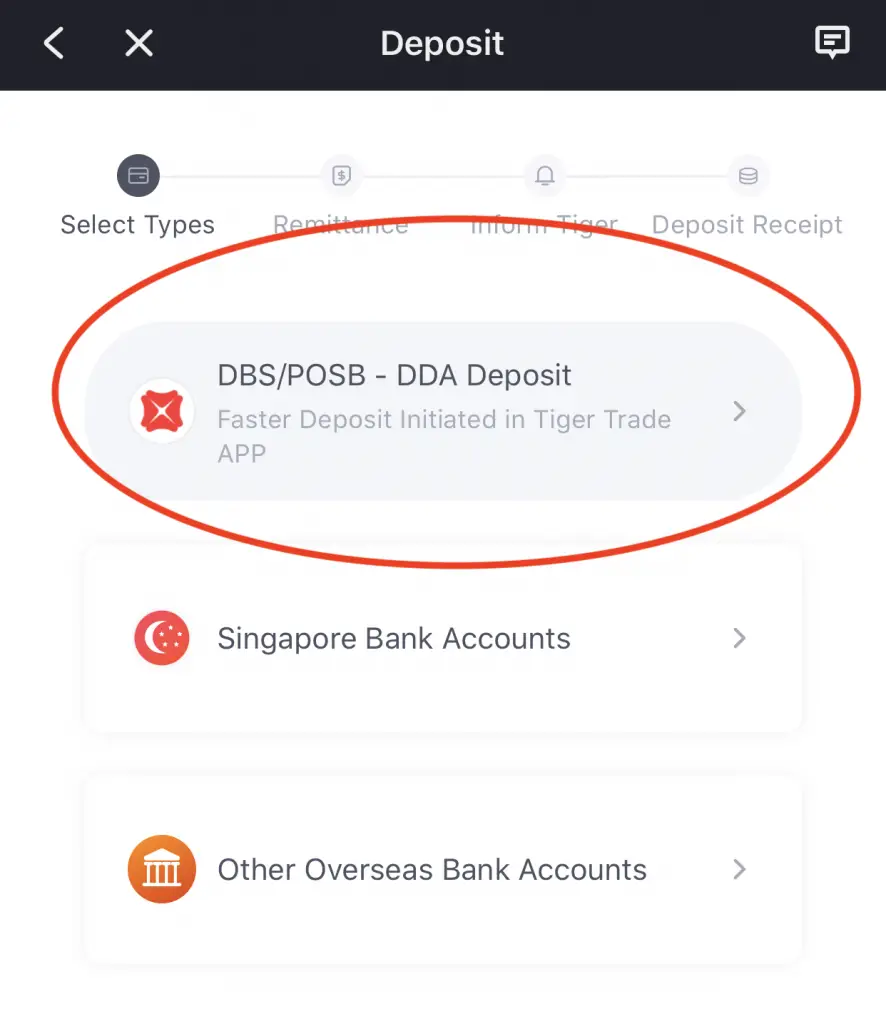

You’ll need to indicate if you want to deposit your funds from a Singaporean bank account or overseas bank account.

If you have a DBS or POSB bank account, you can deposit SGD into Tiger Brokers via Direct Debit.

You’ll be able to deposit your funds much quicker this way!

Conversion of SGD to USD

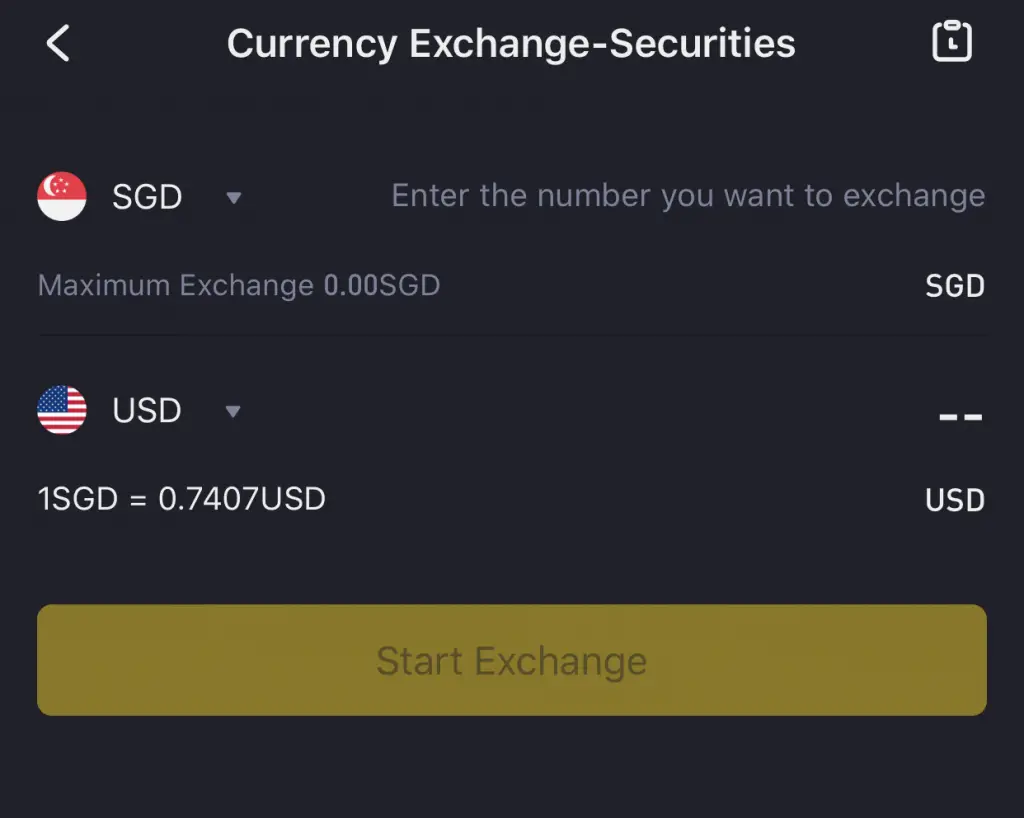

The currency conversion from SGD to USD is pretty straightforward.

You will be shown the rates before you convert your funds to USD.

You can find out more on how to convert currencies on Tiger Brokers with my guide.

Buying US stocks and ETFs

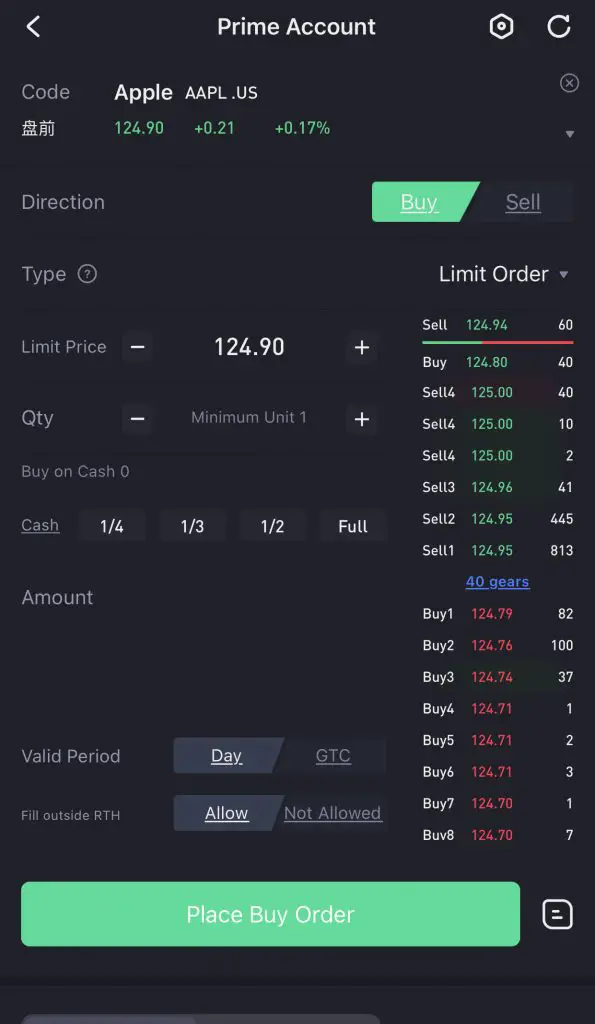

When you are looking to buy a US stock or ETF, you can search for the stock in the quotes section.

After selecting the stock that you want to buy, you’ll need to enter the details of your order, such as:

- The price that you want to buy the stock at

- The number of units of the stock you’d like to buy

Once a seller has been found for your order, the stock will be credited to your account.

Fees

Here are the fees that Tiger Brokers charges for US stocks and ETFs:

| Fee | Amount |

|---|---|

| Trading Fee | 0.01 USD / Share Min 1.99 USD / Order |

| Currency Conversion Fees | None |

| Dividend Handling Fees | None |

| Custodian Fees | None |

| Inactivity Fees | None |

The fees for Tiger Brokers is pretty reasonable at a minimum of USD $1.99 per every order that you make.

Furthermore, they do not charge you any extra fees, which helps to reduce your costs.

MAS regulation

Tiger Brokers has a Capital Markets License that was issued by the Monetary Authority of Singapore.

Tiger Brokers uses 3rd party custodians to manage your assets for you.

DBS bank manages your Singapore assets. Meanwhile, Interactive Brokers most likely is handling your assets from other countries.

In the unfortunate event that Tiger Brokers closes down, your assets are still safe under these custodians.

This 3rd party custodian account arrangement is similar to what robo-advisors use as well.

Verdict

Tiger Brokers provides a very affordable way for you to start trading in the US markets.

If you are a beginner investor with only a small sum of money, you can consider using this broker for its low fees.

However, I personally feel that the platform makes it fun and easy to trade. This may make investing seem like a game, rather than something that you are investing for the long term.

I would like to caution you to do your own research, and only invest in stocks or ETFs that you are familiar with!

moomoo (powered by FUTU SG)

moomoo (powered by FUTU SG) is another low cost broker that entered the Singapore market in 2021.

Here is a look into their features:

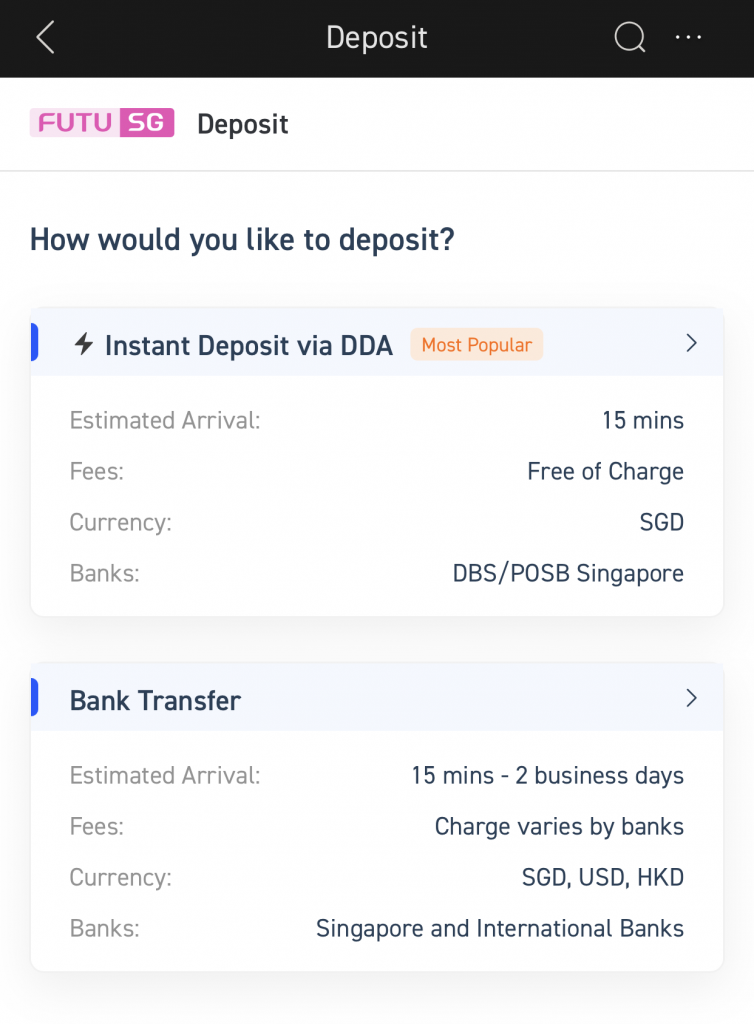

Funding of account

Similar to Tiger Brokers, you can fund your account using 2 methods:

- FAST transfer

- Direct debit with DBS / POSB bank accounts (SGD only)

You are able to deposit SGD, USD or HKD if you are sending funds over via bank transfer.

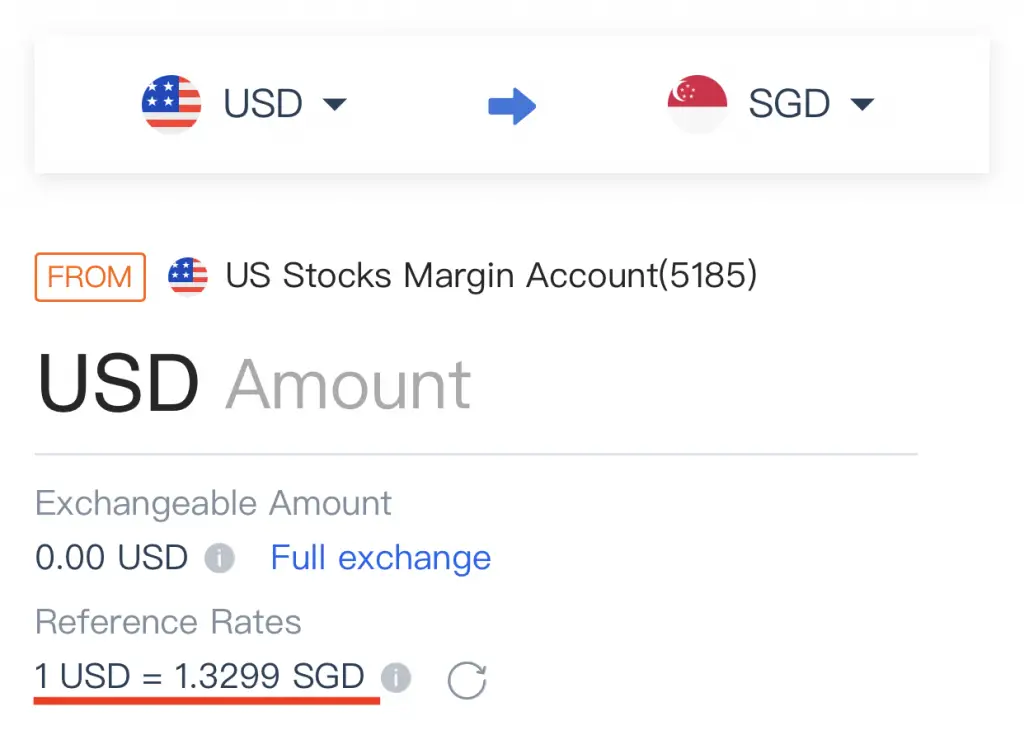

Conversion of SGD to USD

You are able to easily convert your SGD to USD to start trading in the US markets.

You will be able to see the exchange rate before you convert your SGD to USD.

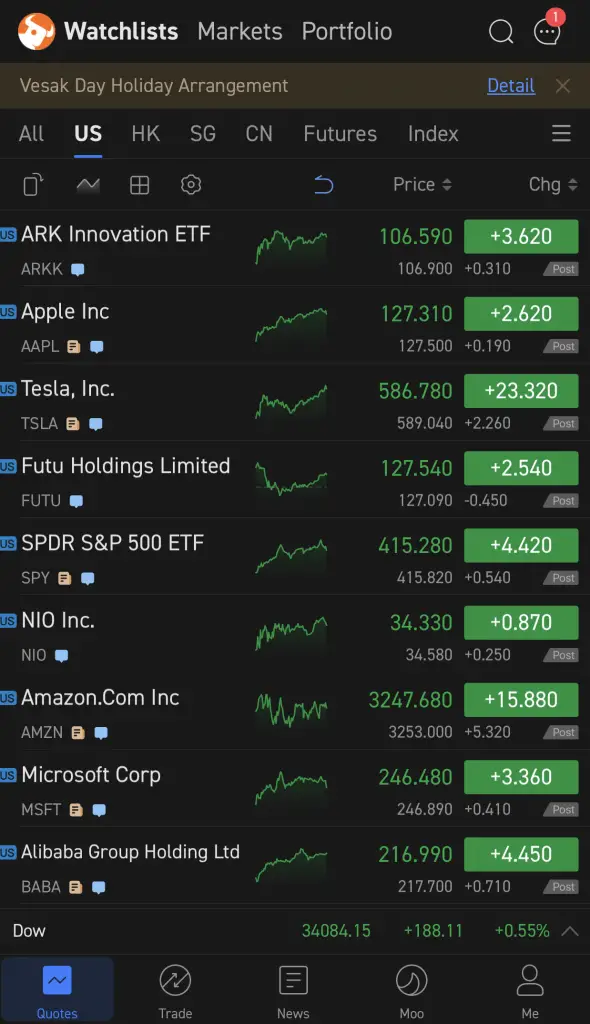

Buying US stocks and ETFs

You can look for the stock or ETF you want to buy on the quotes page,

and then selecting ‘Trade‘ on the stock’s info page.

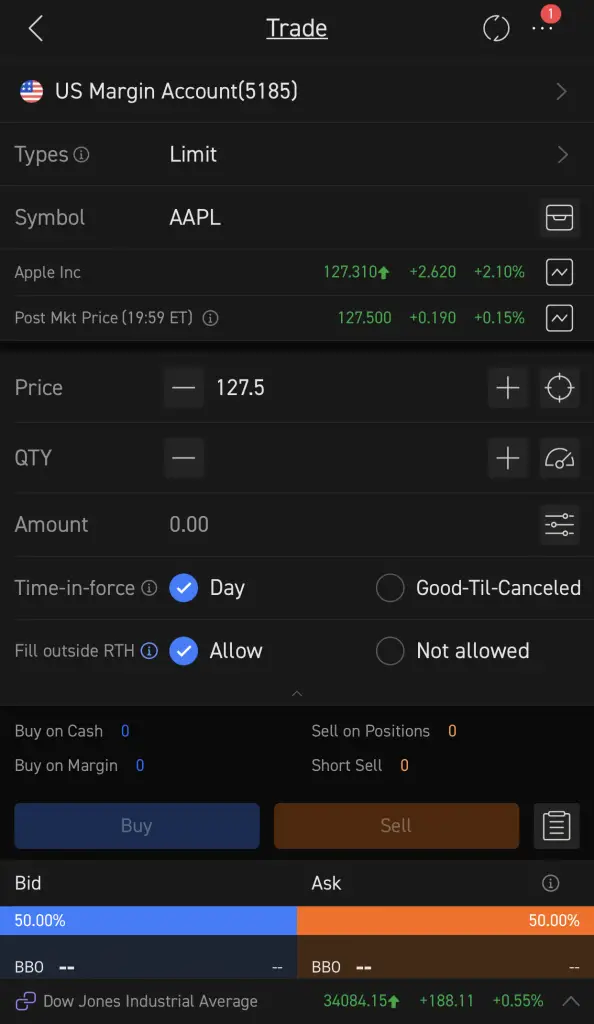

From there, you’ll need to enter some details, such as:

- The price (in USD) that you’d like to buy the stock or ETF at

- The number of units that you’d like to buy

Fees

Here are the fees that moomoo (powered by FUTU SG) charges:

| Fee | Amount |

|---|---|

| Trade Commission | USD 0.0049 / share Min. USD 0.99 / order |

| Platform Fee | USD 0.005 / share Min. USD 1 / order |

| Custodian Fee | None |

| Currency Conversion Fee | None |

| Dividend Handling Fee | None |

| Withdrawal Fee | None |

Whenever you’re making a trade, you’ll need to consider both the trade commission and the platform fee.

For each trade you make, the minimum that you’ll need to pay is USD 1.99 (when you factor in both fees).

MAS regulation

moomoo (powered by FUTU SG) is also licensed with the MAS under the Capital Markets License as well.

In the unfortunate event that moomoo closes down, FUTU SG is unable to touch your assets.

Verdict

moomoo (powered by FUTU SG) is another low cost broker that makes it accessible for you to purchase US stocks and ETFs.

You can consider their attractive sign-up bonus which provides you with commission-free trades for 180 days.

Saxo

Saxo Markets is a subsidiary of Saxo Bank, and has been operating in Singapore ever since 2006.

Here is a summary of this brokerage account:

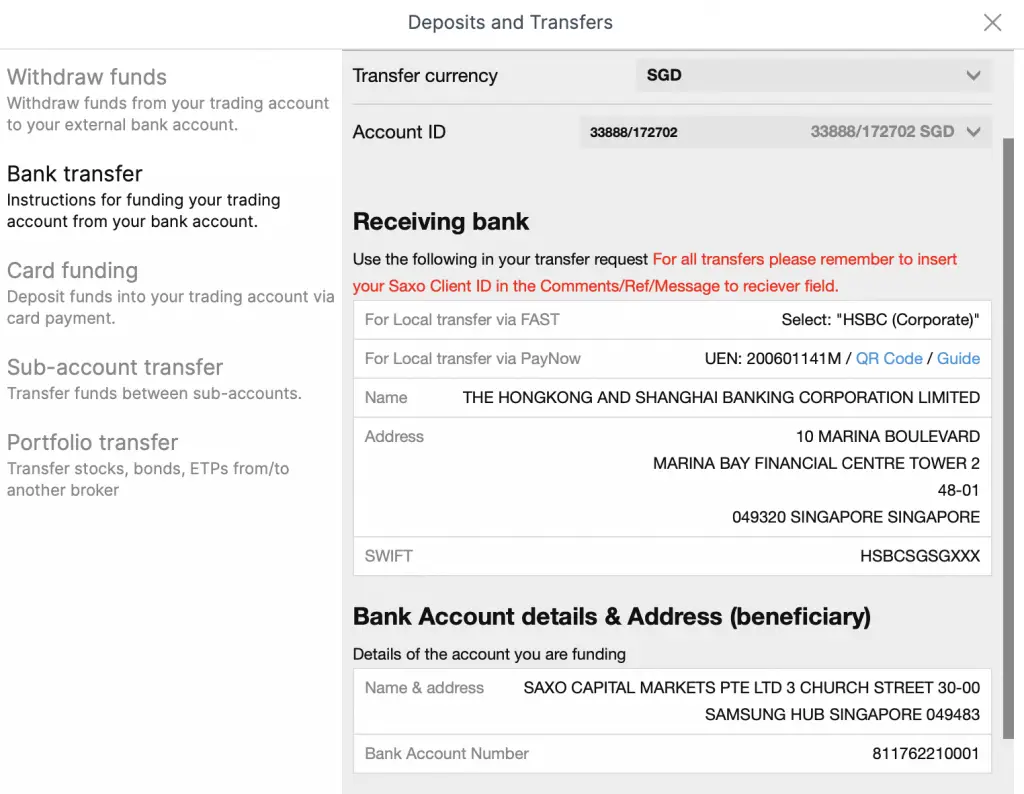

Funding of account

For Saxo, you can transfer your funds in a variety of ways. This includes:

- FAST

- PayNow

- MEPS

- Wire transfer

The easiest way to deposit your funds will be either via FAST or PayNow.

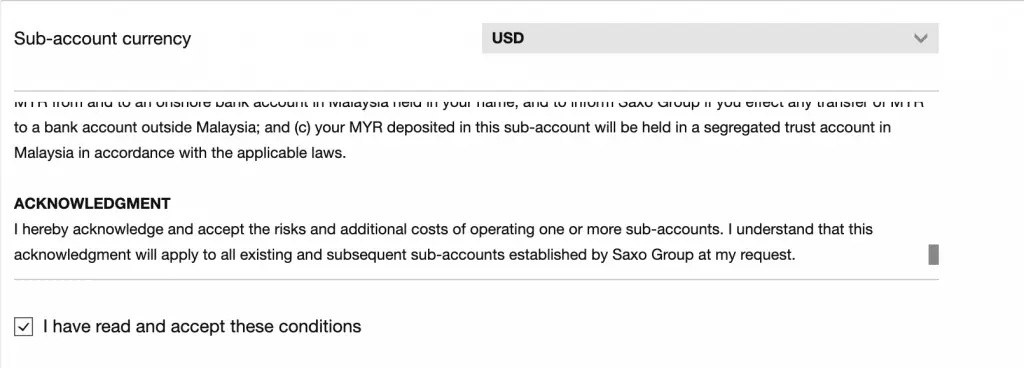

Conversion of SGD to USD

The conversion of SGD to USD can be done via 2 ways:

- Converting SGD to USD when you are making the trade

- Transferring SGD to your USD sub-account and then using that USD to trade

You may want to use the sub-account method, as you will pay lower currency conversion fees.

The fees that you pay depend on how you exchange your currency:

| Type of Exchange | Fees |

|---|---|

| Cash Products | 0.75% |

| Account Transfer | 0.30% |

You will pay a lower currency conversion fee when you are doing an account transfer from your SGD to USD sub accounts.

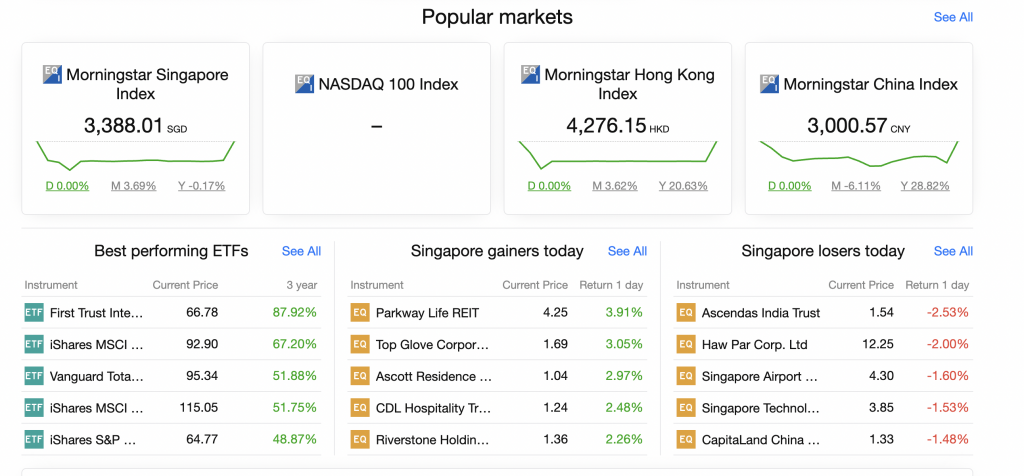

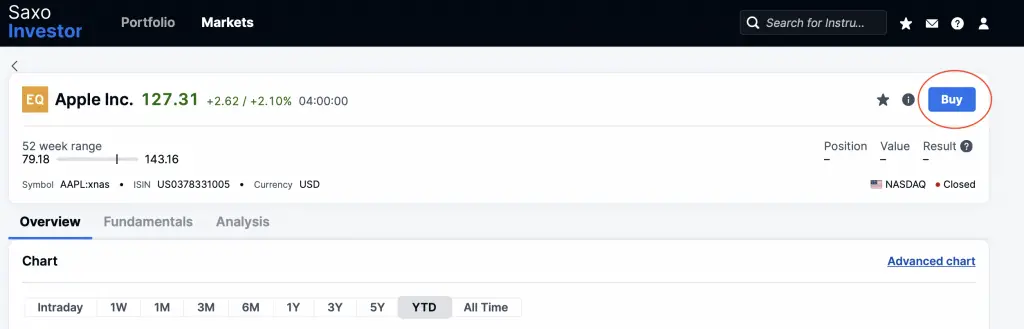

Buying US stocks and ETFs

Saxo has 3 different interfaces which you can use:

- SaxoInvestor

- TraderGO

- TraderPRO

If you are just beginning your investment journey into stocks, I would recommend using the SaxoInvestor platform.

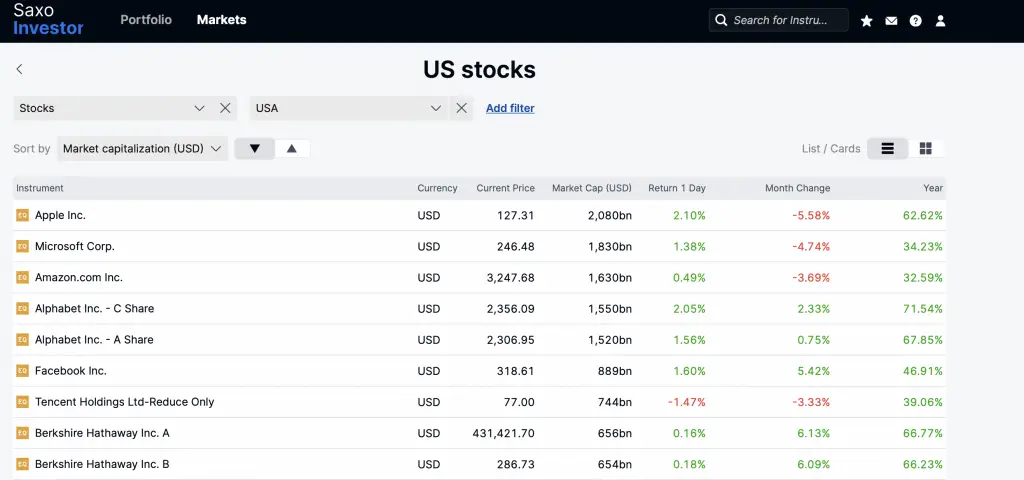

To find a stock that you’d like to buy, you will need to go to ‘Markets → Stocks → USA‘.

This will bring you to a page that shows the US stock quotes.

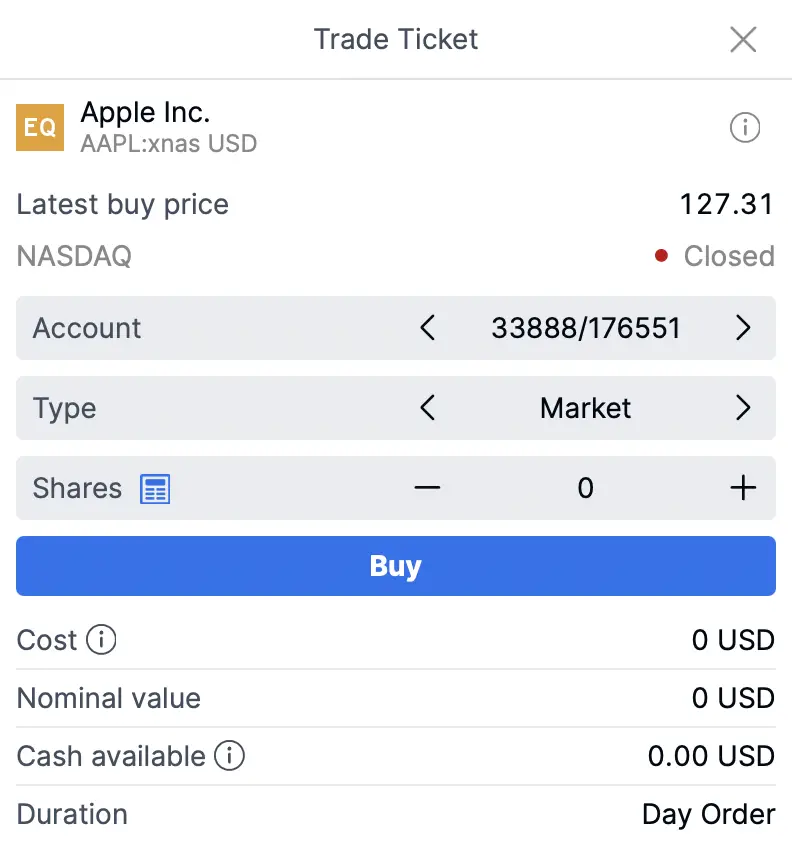

After selecting the stock you’d like to buy, you can click on ‘Buy‘ on that stock’s page.

You will need to select:

- The price that you want to buy the stock at

- The number of shares that you’d like to buy

The same process can be done for US ETFs too.

Fees

Here are the fees that you’ll incur with Saxo:

| Fee | Amount |

|---|---|

| Trade Commission | 0.06% * trade value Min $4 USD |

| Custodian Fee | 0.12% |

| Currency Conversion Fee | 0.75% (Cash Product) 0.30% (Account Transfer) |

| Inactivity Fee | None |

| Dividend Handling Fee | None |

Compared to Tiger Brokers or moomoo (powered by FUTU SG), Saxo has a complicated fee structure.

The minimum trade commission is higher compared to either broker. Moreover, you will incur extra fees like the custodian fee and currency conversion fee.

One thing you may want to take note is that Saxo Markets does not charge you an inactivity fee. It is only Saxo Bank (the US version) which charges you this fee!

MAS regulation

Saxo is also regulated by the MAS under the Capital Markets License.

In the event that Saxo goes bankrupt, your assets will be kept separately from Saxo’s.

Saxo has also been operating in Singapore since 2006. This should give you the reassurance that Saxo is here to stay for the long term.

Verdict

If you are just looking to trade in the US markets, then Saxo may not be the most suitable for you.

However, Saxo provides you with access to many more markets, such as the London Stock Exchange and Tokyo Stock Exchange.

If you are looking to buy stocks from other exchanges, then you may want to use Saxo. If not, there are other options that have cheaper fees when trading in the US market!

Interactive Brokers

Interactive Brokers is another online broker that gives you access to the US markets. Here are some of the things you need to know when you want to use this broker:

Funding of account

You are able to deposit your money via a variety of methods. This includes:

- Wire transfer

- US ACH

- Check

The most common way would be to transfer your funds via wire transfer.

Conversion of SGD to USD

You are able to convert your currency on Interactive Broker’s platform to USD.

The charges for this conversion is rather low too.

Fees

Here are the fees that you’ll incur when trading on Interactive Brokers:

| Fee | Amount |

|---|---|

| Trade Commission (Tiered) | USD 0.0035 per share Min. USD 0.35 |

| Trade Commission (Fixed) | USD 1 per order |

| Monthly Fee | None |

| Currency Conversion Fee | 0.002% * trade value Min. USD 2 per order |

| Dividend Handling Fee | None |

| Withdrawal Fee | 1st withdrawal free SGD$15 for subsequent wire transfers |

There are 2 pricing structures that you can use with Interactive Brokers:

| Account Type | Definition |

|---|---|

| Tiered | Commission charged is based on your investment amount Clearing and exchange fees are separate from the commission |

| Fixed | A fixed commission is charged for all trades Clearing and exchange fees are included |

Even though the tiered pricing seems cheaper, you’ll need to pay for the clearing and exchange fees.

Here are some of the other fees explained:

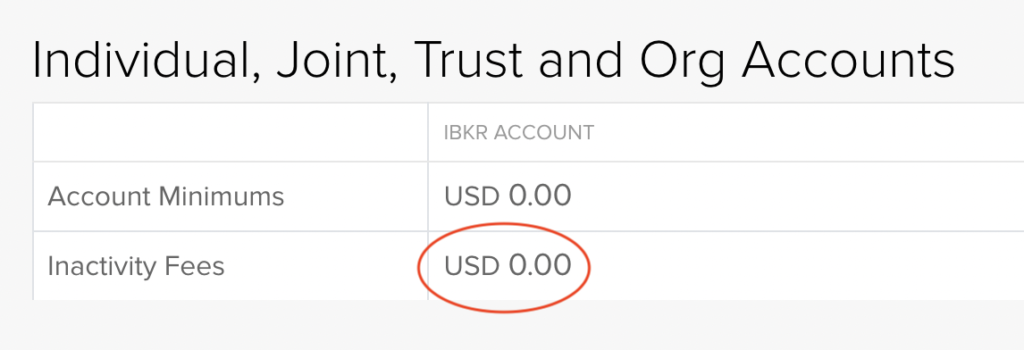

Interactive Brokers no longer has an inactivity fee

Previously, Interactive Brokers charged an inactivity fee if you did not pay USD$10 in commissions a month. However, this has now been abolished!

Since you do not pay this fee, it makes trading with Interactive Brokers really cheap. If you intend to dollar-cost average and only make one trade per month, this greatly reduces the costs you’ll incur!

Currency conversion fee

Interactive Brokers also allows you to convert your currency on their platform.

The pricing is slightly different from Saxo:

0.2 basis points (0.002%) * trade value, minimum of USD2 per order

Depending on the amount that you choose to invest, it could be slightly cheaper compared to Saxo.

MAS regulation

Interactive Brokers Singapore also has a CMS License issued by the MAS.

This will ensure that your funds are kept separate from Interactive Brokers’ accounts.

Verdict

Interactive Brokers does provide a very decent trading platform. This is mainly due to its lower commissions.

The main problem is that the platform can be rather confusing if you are a beginner investor.

If you are willing to go through all of the hassle, you can consider trying out Interactive Brokers.

Standard Chartered Online Trading

Standard Chartered is one of the banks in Singapore that allows you to trade in the US markets.

Here’s what you need to know about this platform:

Funding of account

If you have a Standard Chartered online banking account, then things will be quite easy for you.

All you’ll need to do is to create a USD Securities Settlement Account.

After that, you can transfer your funds to this account.

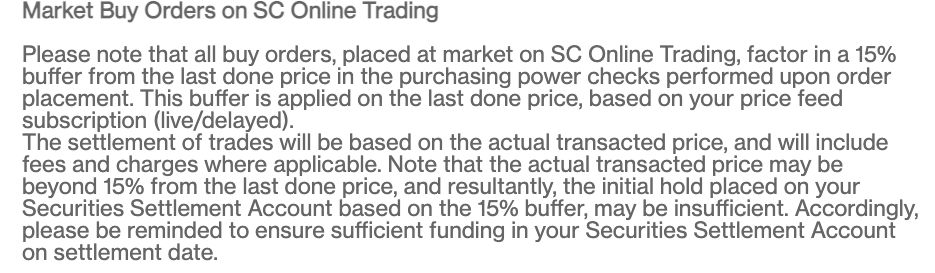

Since Standard Chartered is a pre-funded platform, you’ll need to have funds in your Securities Settlement Account first before you can make a trade.

You will need around 15% of buffer in your Securities Settlement Account.

Conversion of SGD to USD

There are 2 ways that you can convert your SGD to USD:

1. Transfer directly to your Securities Settlement Account

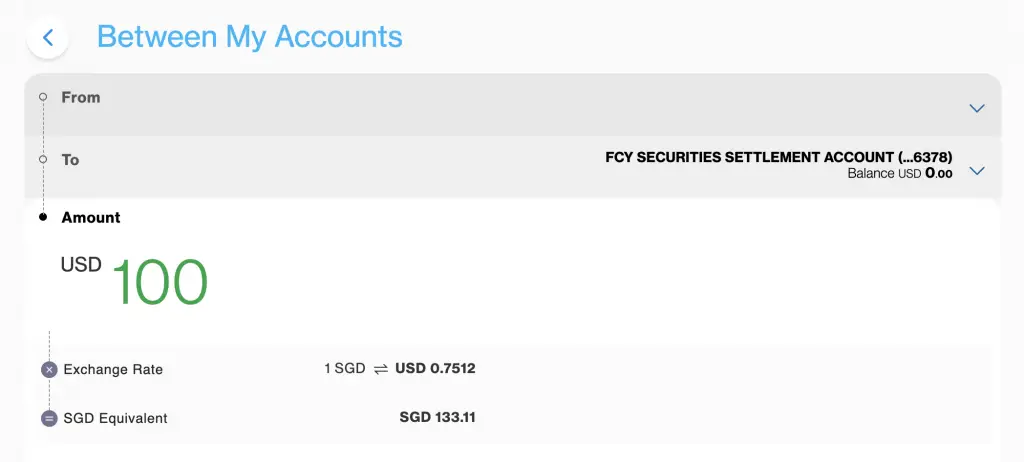

You can use the ‘Transfer Between My Accounts‘ function. This allows you to transfer from your bank account to the Securities Settlement Account.

You can choose the amount of USD you wish to have in your Securities Settlement Account.

You will be shown the exchange rate as well as the equivalent amount you’ll exchange from SGD.

The spread can be pretty high from this trade!

For example, I was trading at a rate of 1 SGD = 0.7512 USD.

When I looked at the current rate on XE, it was 1 SGD = 0.754420 USD!

This FX spread will affect how much SGD you’ll need to convert into USD!

This method of exchanging your currency is very convenient. However, it may increase the costs that you incur!

2. Using the LiveFX platform

Another way that you can exchange your SGD to USD is using the LiveFX platform.

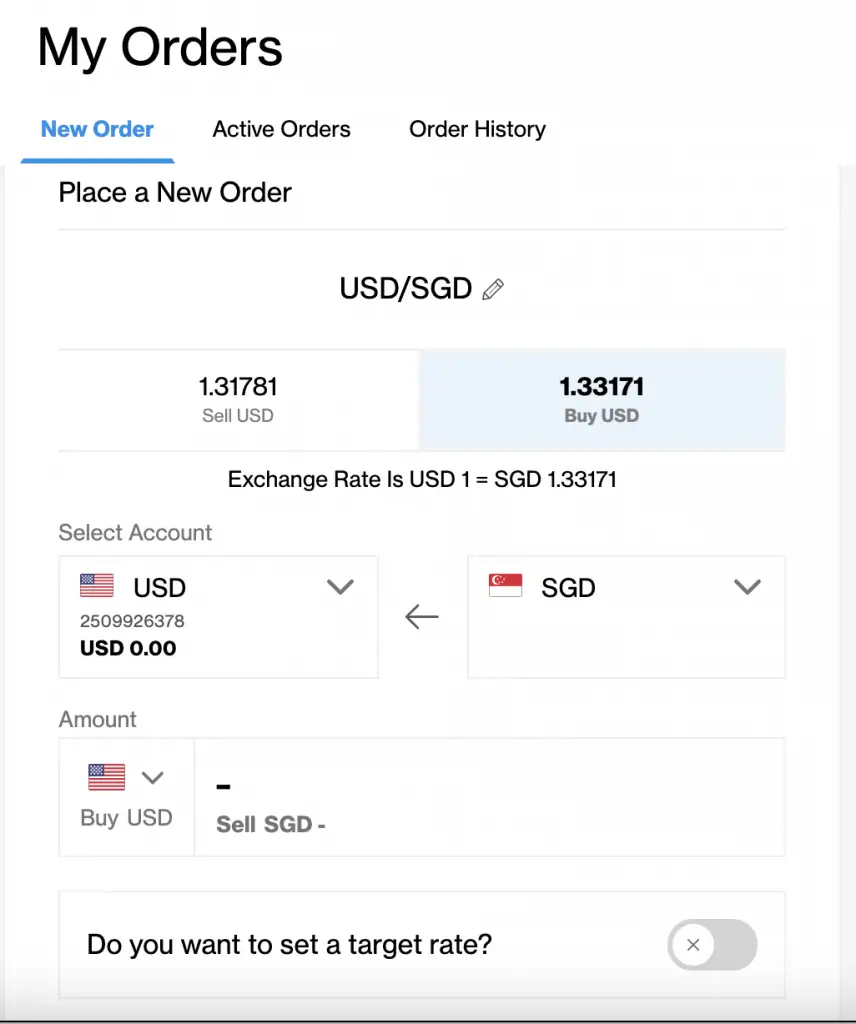

This works quite similar to a stock broker. However, you’re trading currencies instead of stocks!

You can place a buy order to convert your SGD to USD.

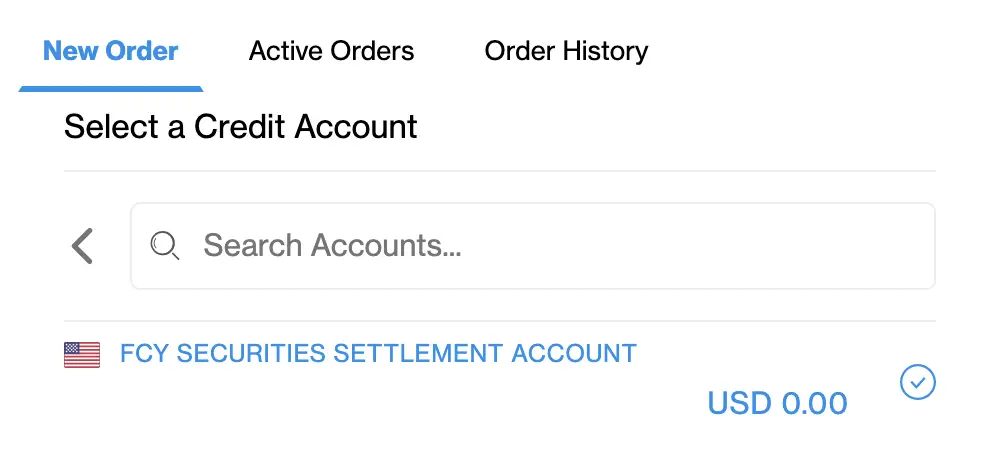

Don’t forget to choose your destination to be your USD Securities Settlement Account!

The spread is still quite high. However, you are able to trade and choose a price that you’d like to either buy or sell.

As such, you may be able to obtain a slightly more favourable exchange rate!

Buying US stocks and ETFs

Once you have transferred USD to the Securities Settlement Account, you can start trading in the US market.

If you already know what stock you want to buy, you can use the search function to find that stock or ETF.

Similar to other platforms, you’ll need to enter details of the trade, such as:

- The price that you want to buy the stock or ETF at

- The number of units you want to buy

Fees

Here are the fees that you’ll need to pay when trading with Standard Chartered:

| Fee | Amount |

|---|---|

| Trade Commission (Personal Banking) | 0.25% * trade value Min. $10 |

| Trade Commission (Priority Banking) | 0.20% * trade value No Minimum |

| Currency Conversion Fees | None |

| Custody Fees | None |

You will be charged 7% GST on every commission that you make. For example, you will be charged a minimum of USD $10.70 if you are just a personal banking client!

The fees are slightly higher compared to Tiger Brokers or moomoo (powered by FUTU SG).

Verdict

Standard Chartered is a pretty attractive option to trade in the US markets. However, the interface is pretty outdated, and the commissions are slightly higher.

Due to its higher trading fees but no monthly fee, it is suitable if you are looking at making lump sum investments.

It may be cheaper when you make a lump sum investment with Standard Chartered compared to Interactive Brokers.

FSMOne

FSMOne is one of the Singapore-based brokers that offers you access to the US markets.

Here’s what you need to know about this platform.

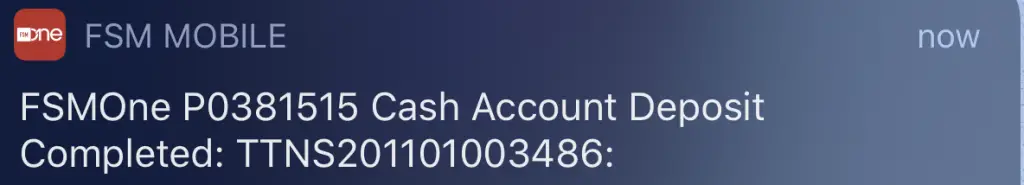

Funding of account

To start trading on FSMOne, you will need to transfer to your FSMOne Cash Account.

I previously transferred some money via FAST, and it was almost instant.

This was even though I deposited my funds at night!

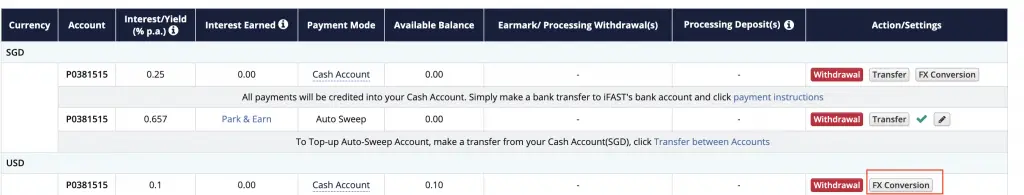

Conversion of SGD to USD

To convert your SGD to USD, you’ll need to go to your Cash Account, and click on FX conversion at your USD account.

This will allow you to convert your SGD to USD.

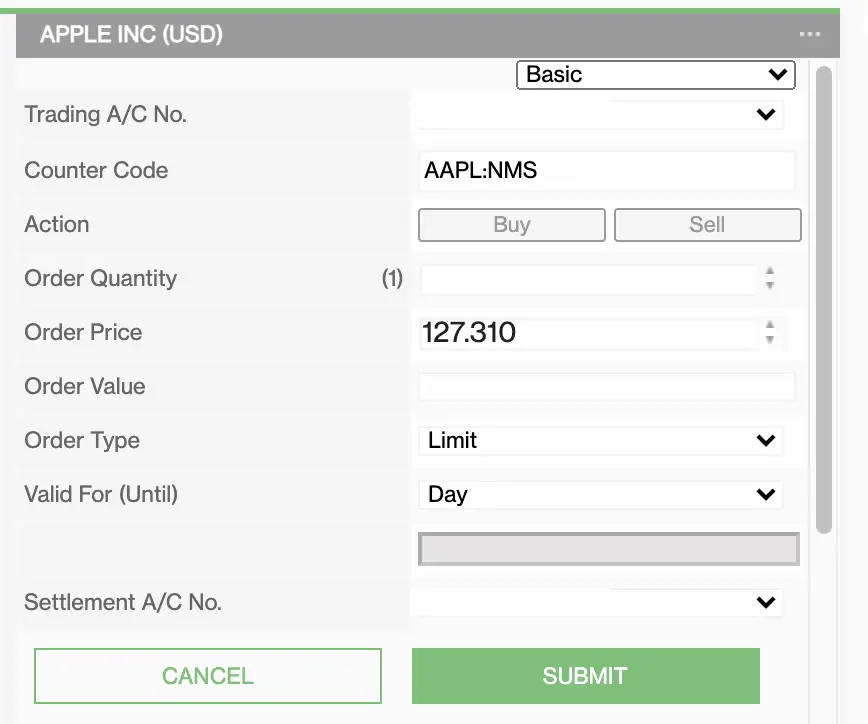

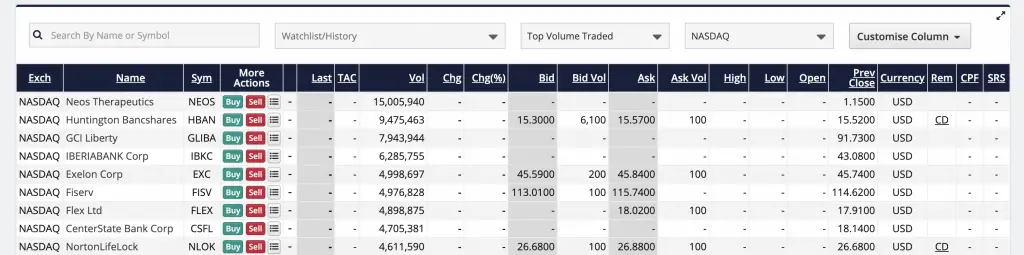

Buying US stocks and ETFs

You will need to go to ‘Stocks → Live Trading‘ and select the US exchange that you would like to trade in.

You can select the stock that you want to buy on the search bar as well.

After clicking on ‘Buy‘ for the stock, you will be brought to the order page.

You can decide on:

- The type of order you want to make

- The price that you want to buy the stock at

- The number of shares that you want to buy

You can use the same process to buy US ETFs too.

Fees

Here are the fees that are charged by FSMOne:

| Fee | Amount |

|---|---|

| Trade Commission | 0.08% * trade value Min. USD 8.80 |

| Currency Conversion Fees | None |

| Custody Fees | None |

The commissions for FSMOne are quite high compared to Tiger Brokers!

MAS regulation

FSMOne is being managed by iFAST, who has a Capital Markets License as well.

iFAST is quite a big company in Singapore, so your funds should be rather safe with them.

Verdict

I personally find FSMOne’s user interface to be rather hard to navigate around. As such, you may need to take a while to get used to the interface.

The fees that FSMOne charges are rather high compared to the other platforms. However if you want to use a broker that is well established in Singapore, FSMOne may be one that you can consider.

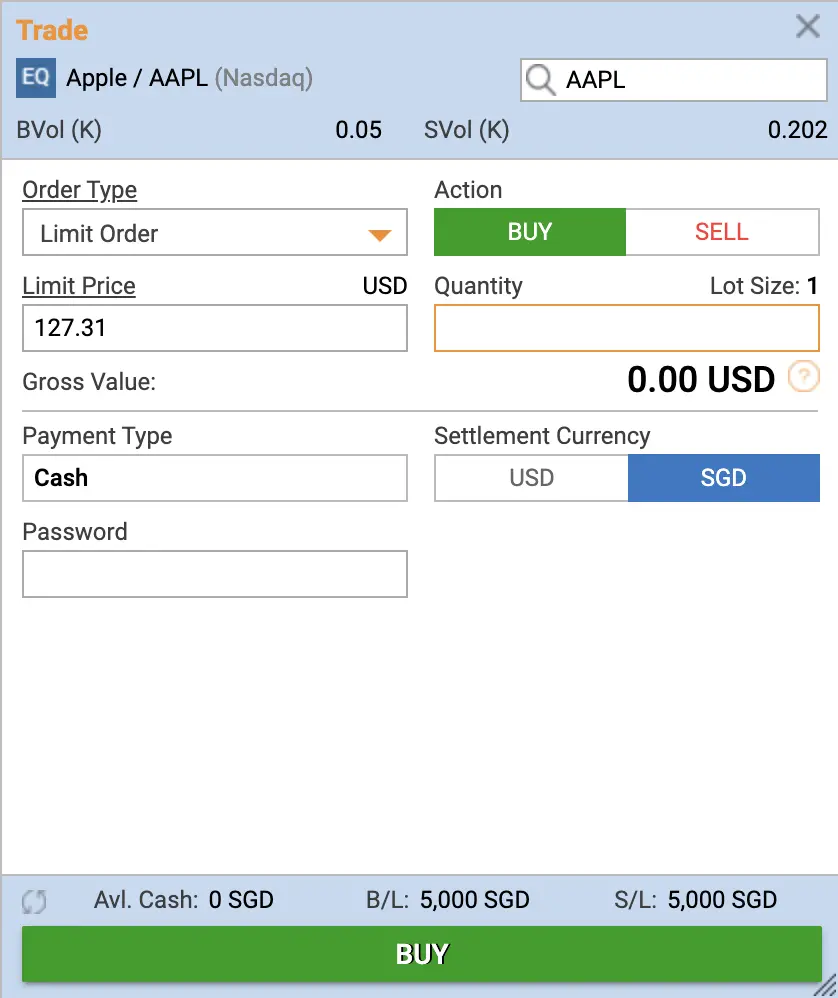

POEMS

POEMS is another Singapore brokers that has been around since 1996.

Here’s how you can use this platform to buy US stocks and ETFs:

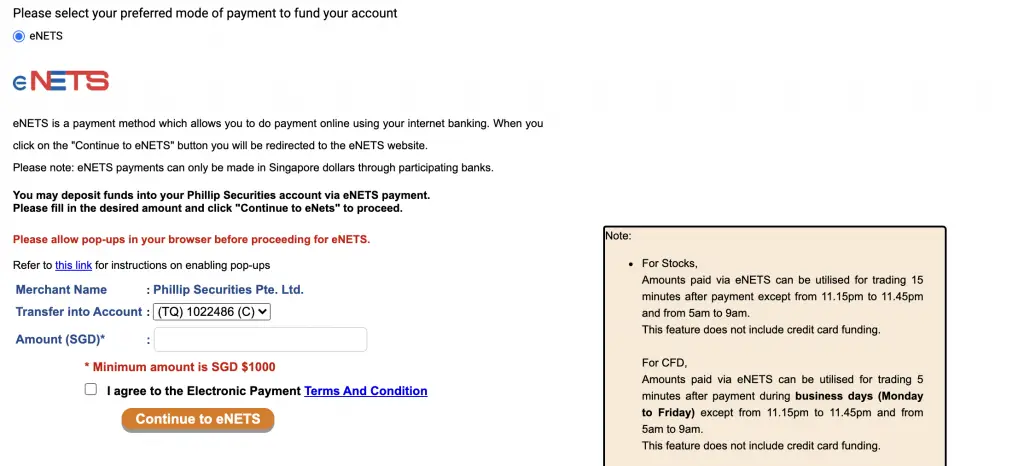

Funding of account

There are a few ways that you can deposit your funds into POEMS:

- PayNow

- FAST

- eNETS

- GIRO

If you want to use eNETS, the minimum amount that you need to deposit is $1000.

Don’t forget to add in your account number in the comments section when you are making the transfer!

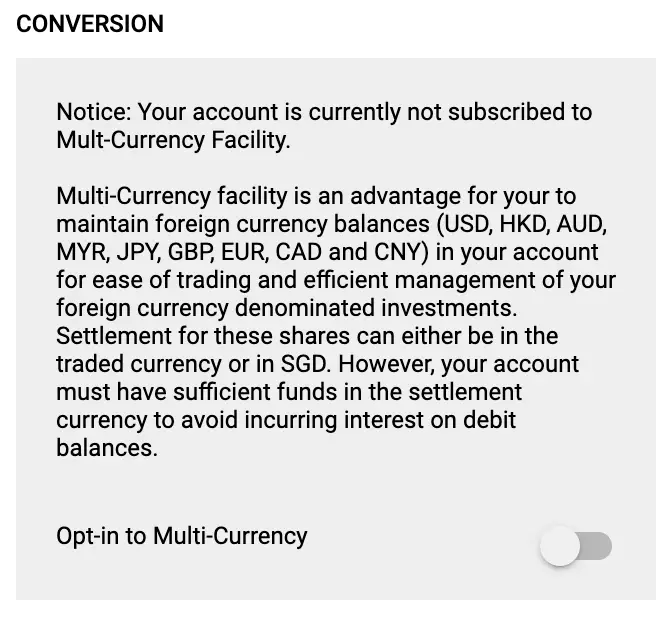

Conversion of SGD to USD

If you want to convert your SGD to USD, you’ll have to opt in for the ‘Multi Currency Facility‘.

However, if you’ve created a POEMS account after 26 Oct 2020, you will be auto-enrolled into this feature.

When you want to settle your trade in USD, the auto-currency conversion process will be performed at 7.15pm.

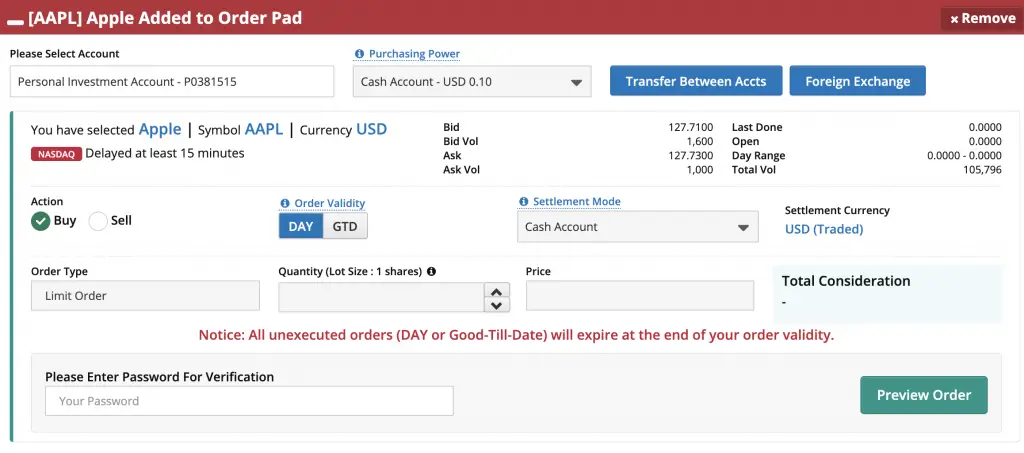

Buying US stocks and ETFs

To start trading in the US markets, you’ll need to go to the ‘Prices‘ or ‘Trade‘ bars, and then select a US exchange.

Alternatively, you can use the search bar on the top right hand corner to find the stock you want.

You’ll be brought to the order page, and you can enter the details of your order.

You’ll need to decide if you want to settle your trade in either USD or SGD.

Fees

POEMS has 2 different accounts that you can create:

- Cash Plus

- Cash Management

Here are the fees that you’ll need to pay for the account that you choose:

| Cash Plus | Cash Management | |

|---|---|---|

| Commission | Up to USD 3.88 (until 31 Dec 2021) Up to USD 10.88 (after 31 Dec 2021) | 0.3% * trade value Min. USD 20 |

If you are a frequent trader, Cash Plus seems to be the better option for you. You will receive a very preferential rate of USD 1.88 per trade, if you have a total of $250,000 worth of assets in POEMS.

You will also need to take note of other fees which include:

- Custody fees (can be waived)

- Dividend processing fee

- Account maintenance fee (can be waived)

There are quite a few fees that you will be charged on POEMS. Furthermore, I feel that the fee structure can be very overwhelming if you are not familiar with these charges.

MAS regulation

POEMS is the trading platform offered by Phillips Capital, and Phillips has a Capital Markets Services License with the MAS.

Phillips Capital has been around for quite a while, so your money should be rather safe with them.

Verdict

POEMS has a rather complex fee structure that can be really confusing. Furthermore, the interface of the platform is rather outdated, compared to the newer brokerages.

You may want to consider trading on POEMS due to their trading promotion of USD 3.88 up until 31 Dec 2021.

TD Ameritrade

TD Ameritrade is one of the brokerages that offers commission-free trading for Singaporeans.

Here’s what you need to know about this platform.

Funding of account

You can fund your account on TD Ameritrade via a variety of ways:

- DBS / POSB electronic transfer

- Cheque

- Wire transfer

If you choose to deposit SGD to TD Ameritrade, it will be automatically converted to USD. This will be subject to TD Ameritrade’s rates.

Buying US stocks and ETFs

You will need to use TD Ameritrade’s thinkorswim platform to trade in the US market.

This is a great platform to use, especially if you are a frequent trader.

Fees

Here are the fees that you’ll be charged when trading with TD Ameritrade:

| Commission | Amount |

|---|---|

| US Stocks and ETFs | USD $0 per trade |

| OTC Stocks | USD $7.44 |

You will be able to trade US stocks and ETFs at zero commissions, which greatly reduces your fees!

Furthermore, there is no mention about any deposit or withdrawal fees. This makes TD Ameritrade extremely attractive.

MAS regulation

TD Ameritrade also has a Capital Markets Services License with MAS.

Verdict

TD Ameritrade is one of the MAS-licensed brokers that does not charge trading commissions.

If you are a frequent trader, this would be the best platform to use!

However, there have been many complaints about the slow registration process. Some customers have waited a few months for their account to be opened.

If you’re willing to wait for your account to be opened, then this is one platform you should definitely consider.

Firstrade

Firstrade is another brokerage platform that charges zero commission fees.

However, you may want to note that Firstrade is not regulated by MAS!

Funding of account

When you want to fund your Firstrade account, one way you can do so is via wire transfer.

You are only able to wire USD to your account, so you may need to use services like DBS Remit to send the fees over.

One thing you may want to note is that you can’t use online money transfer services, like Wise or Revolut!

Fees

Here are the fees that Firstrade charges you:

| Fee | Amount |

|---|---|

| Trading Commissions | USD $0 |

| Withdrawal Fee | USD $35 |

You may also want to consider the fees you’ll incur when remitting the money over from your Singapore bank account.

Firstrade does not charge any fees when you make a trade. However, you will be charged USD $35 for each withdrawal you make.

As such, you may not want to only withdraw a small amount each time, as this will eat into your returns.

MAS regulation

Firstrade is the only brokerage platform listed here that is not licensed by the MAS. This may carry some risks as your interests may not be protected, should Firstrade close down.

Nevertheless, Firstrade is a member of FINRA/SIPC. This organisation will help to protect your rights in the event that Firstrade becomes insolvent.

Verdict

Firstrade is the only broker that is not regulated by MAS. However, it is very attractive with its zero commission trading structure.

If you want zero commissions and aren’t willing to wait for TD Ameritrade, you may want to consider Firstrade instead.

However, I would advise you not to put all of your funds into this broker! In the unfortunate event that it closes down, you may not be able to recover all of your funds.

Other Singapore Brokers

There are other Singapore retail brokers that allow you to buy US stocks and ETFs on their platforms.

However, their fee structure is just too costly and you will incur quite a bit of fees:

| Broker | Commission | Minimum |

|---|---|---|

| OCBC Securities | 0.30% | USD 20 |

| Lim and Tan | 0.30% | USD 20 |

| Maybank Kim Eng | 0.30% | USD 20 |

| KGI Securities | 0.30% | USD 20 |

| DBS Vickers | 0.15% (Cash Upfront) 0.18% (Cash) | USD 18 (Cash Upfront) USD 25 (Cash) |

| UOB Kay Hian | 0.30% | USD 20 |

The commissions are extremely hefty! Based on this alone, it is definitely not worth trading with any of these brokers.

What’s more, some of these brokers may charge GST on your commissions, making it even more costly!

Custodian fee

When you trade with these brokers in foreign stocks, you may need to pay a custodian charge.

All of these brokers have the same charge of $2 per counter per month (max of $150).

However, the custodian charge can be waived if you make a certain number of trades, either:

- 2 trades in the same calendar month

- 6 trades in the same calendar quarter

Verdict

The fee structures for Singapore retail brokers are too high for you to consider using these platforms.

This is especially when there are much cheaper options that are available to you!

Can I buy US stocks with SGD?

You are unable to buy US stocks directly using SGD, as all US-listed stocks are denominated in USD. To buy these US stocks, you will need to either convert your SGD to USD on the brokerage platform, or remit USD to the platform.

Apart from the platform and trading fees that each brokerage charges you, you will need to take note of the currency conversion charges too.

These are usually a ‘hidden fee‘ that you will incur, so it’s something you’ll need to take into account too!

Another alternative is to remit USD into the brokerage platform. Some of these platforms like Saxo allow you to deposit USD directly into your account.

However, you’ll need to take note of the remittance fees that are charged too! This is because most banks or services may charge you an admin fee for remitting USD from Singapore.

You are also able to use platforms with lower remittance fees, such as Wise.

Is Robinhood and Webull available in Singapore?

Both Robinhood and Webull do not allow Singaporeans to create a brokerage account on their platforms. To operate in Singapore, these platforms would first need to receive the regulatory approval by the MAS.

If you are looking for commission-free trading with the popular platforms like Robinhood and Webull, it is not possible to create an account with them from Singapore!

Robinhood requires you to either:

- Be a US citizen

- Be a US permanent resident

- Have a valid US visa

As a Singaporean, it may be quite hard for you to sign up for a Robinhood account.

There may be some hope for Webull, as they are operating in other Asian countries, such as:

- Japan

- China

- Korea

There may be a chance that they may choose to operate in Singapore too, but nothing has been confirmed as of yet.

If you want to perform commission-free trading, the only possible way would be to open an account with TD Ameritrade.

Things you’ll need to know about the US market

After you have chosen which brokerage you want to use, here are some things you’ll need to take note about the US market:

W-8 BEN Form

When you open a US trading account on any of these brokers, you will need to fill up the W-8 BEN form.

This form is used to declare that you are a foreign person to the USA. As such, you will ned to pay the necessary withholding taxes.

For some of the newer platforms, you are able to fill up these forms electronically.

For other platforms like FSMOne, you will have to manually fill up the form and then email to their customer service.

Trading hours

Here are the trading hours for the US exchanges (in GMT +8 timing):

| Trading Period | Timing (GMT +8) |

|---|---|

| Premarket | 1600-2130 |

| Regular Trading | 2130-0400 |

| Aftermarket | 0400-0800 |

Some brokerages allow you to conduct pre and aftermarket trading. This is done outside of the regular trading hours.

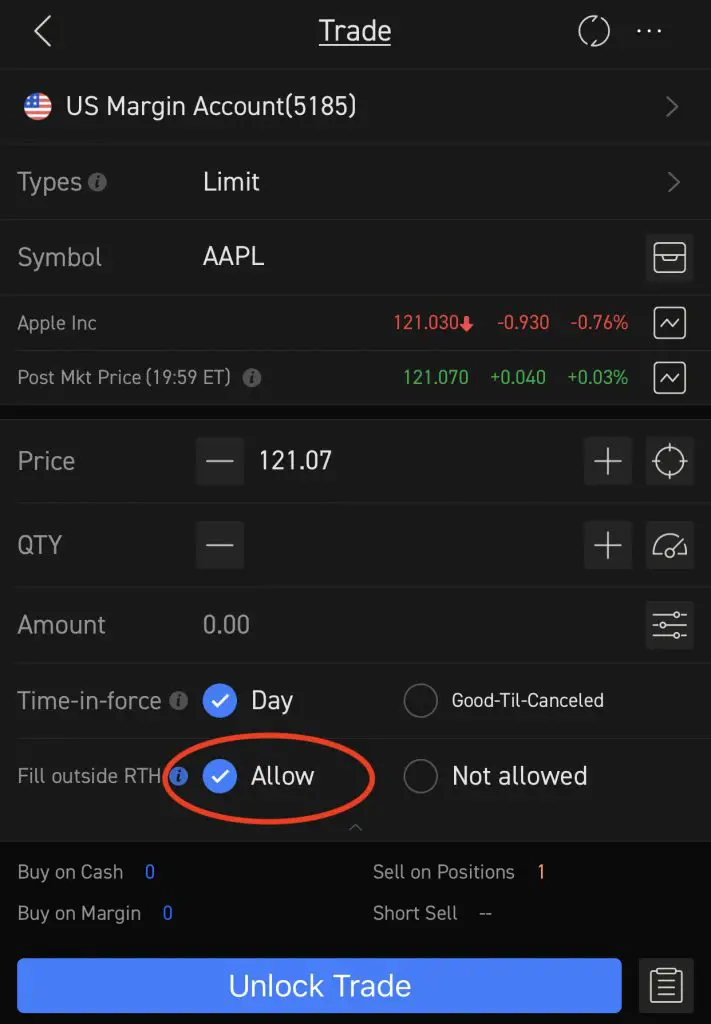

To perform a pre or aftermarket trade, you may need to select the ‘Fill outside RTH‘ option.

RTH stands for ‘Regular Trading Hours‘.

Exchange fees

On top of the fees that you need to pay the brokerages, you will need to pay some exchange fees too.

The main fee which you’ll need to pay is the SEC fee (0.00051% on sell trades).

However, there are some brokers, like moomoo (powered by FUTU SG), which have other fees being charged:

- Settlement fee

- Trading activity fee

You will need to see the fee structure for the broker you’re choosing to understand these costs better!

Minimum unit to invest

The minimum units you need to invest in the US markets is 1 unit.

This is in contrast to the SGX, which has a minimum lot size of 100 for stocks.

However, some of the stocks or ETFs have a rather high unit price.

For example, the S&P 500 ETFs will cost you around USD $400.

This is something you’ll have to take note of when deciding how much you can invest into your selected stock or ETF!

Dividend withholding tax

Since you are a non-resident alien of the USA, you will be subject to a 30% dividend withholding tax.

This can be rather hefty, and it will greatly decrease your dividend yield!

As such, you should try not to invest in any stocks or ETFs that provide you with high dividend yields.

Instead, you may want to invest in growth stocks that have potential for capital appreciation. This is because you would not be taxed on these capital gains.

US estate tax

Since you are owning US-listed stocks and ETFs, you may be subject to the US estate tax.

If the total amount of your US-based assets is more than $60k, you may be subject to a tax that ranges from 18% – 40%.

This can be really hefty, especially if you intend to handover your assets to your loved ones.

If you are just investing in ETFs that track an index like the S&P 500, you may want to consider Irish-domiciled ETFs instead.

These ETFs are listed on the London Stock Exchange, and they are not subject to this tax.

Conclusion

Buying stocks and ETFs from the US markets can be really complex. This is because there are so many options for you to choose from, so it can be quite overwhelming!

However, you do not need a CDP account to trade them as a CDP account is only used for SGX stocks.

Moreover, you can’t buy these stocks or ETFs using your SRS funds.

Here are some things you may want to consider when choosing a platform:

- The commissions you’ll pay

- The ease of depositing and withdrawing funds from the platform

- The spread and currency conversion fees that you’ll pay

- The availability to trade in the premarket and aftermarket hours

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Tiger Brokers Referral (Free AAPL Share and 60 Commission-Free Trades)

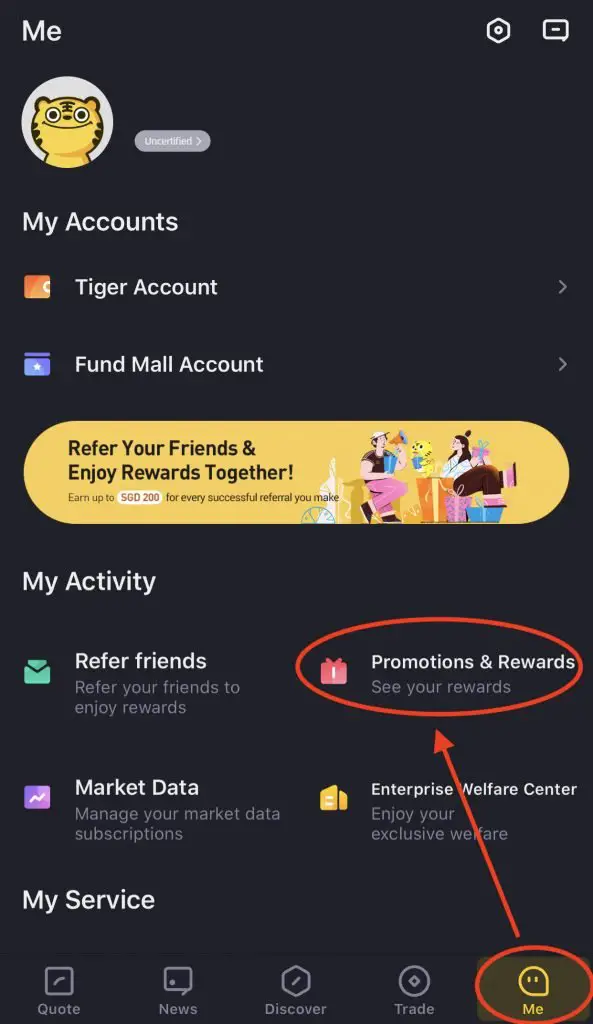

If you sign up for a Tiger Brokers account using my referral link, you will be eligible for some rewards. You can view and claim your rewards by going to ‘Me → Promotions & Rewards‘.

Here are 3 bonuses that you can receive:

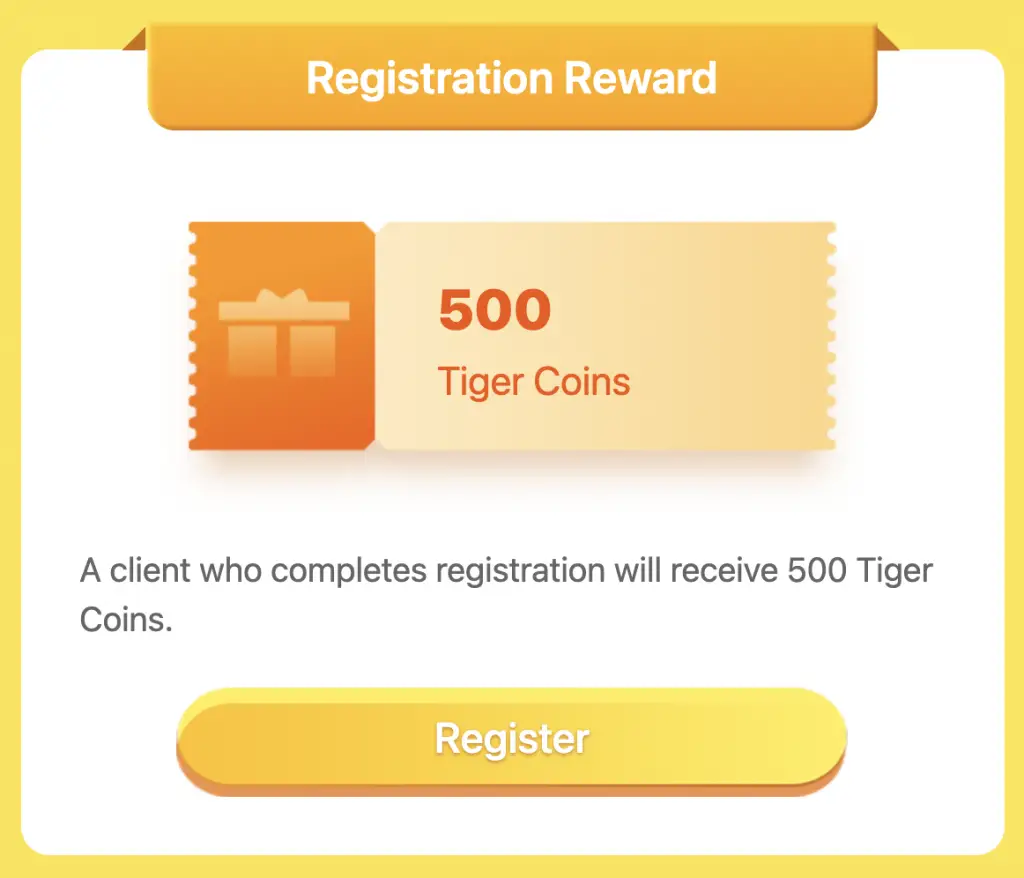

#1 Registration Reward

When you register for a Tiger Brokers Account, you will receive 500 Tiger Coins.

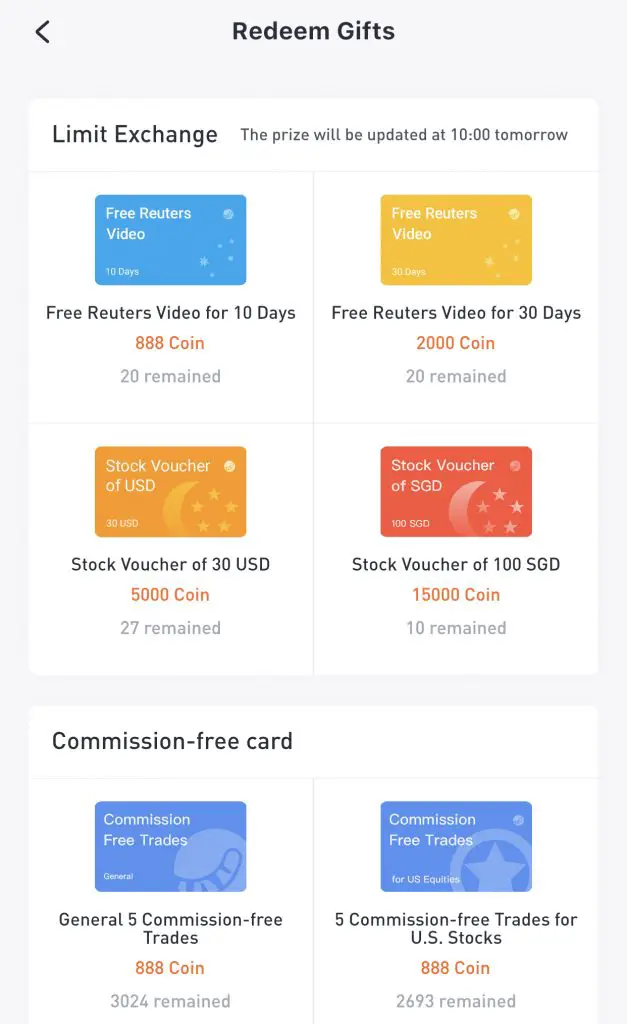

These Tiger Coins can be used to redeem a variety of rewards, such as:

- Stock vouchers

- Commission-free trades

- Reuters videos

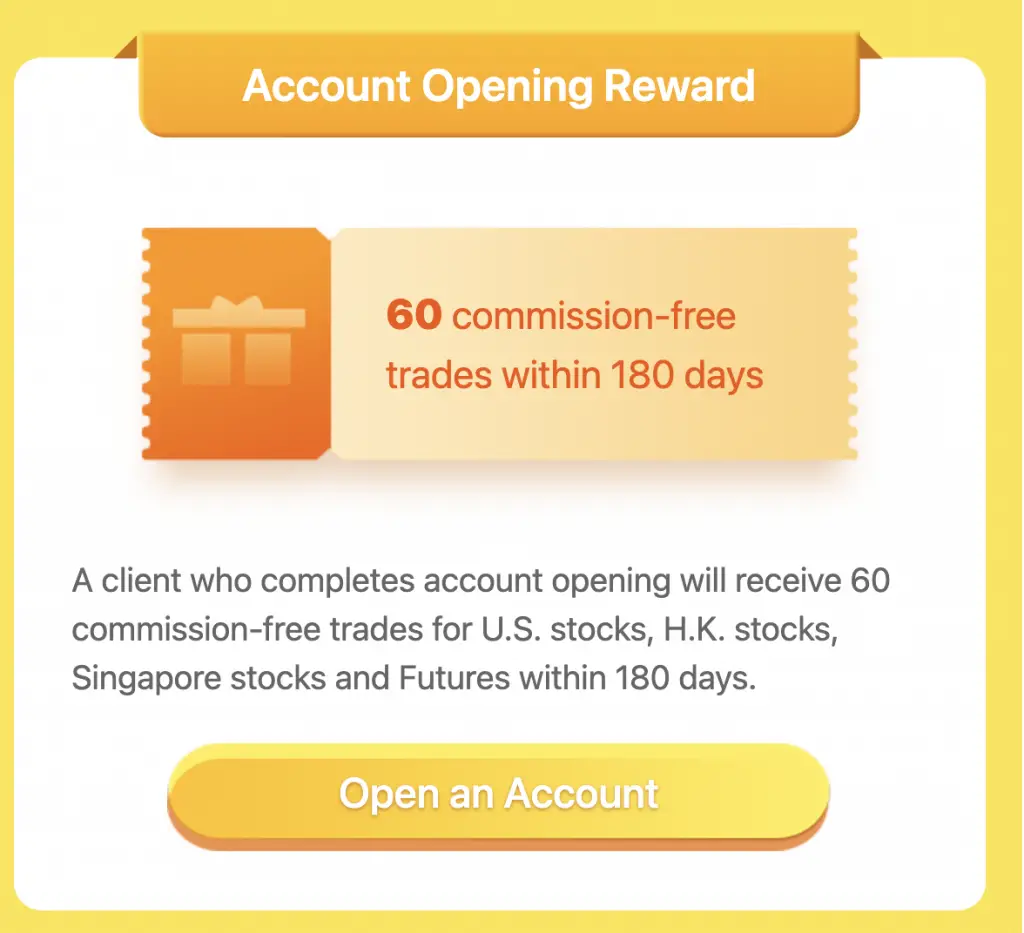

#2 Account Opening Reward

After successfully opening your account, you will receive 60 commission-free trades that you need to use within 180 days.

These commission free trades can be used for:

- US stocks

- HK stocks

- Singapore stocks

- Australia stocks

On top of that, you will receive 5 commission-free trades for futures within 30 days.

You will still need to pay the commission first. The commission should be refunded to you on the next working day.

#3 Funding Reward

If you fund at least $2,000 SGD into your Tiger Brokers account for your very first deposit, you will receive a free Apple (AAPL) share.

The shares will be added into your account within 10 working days.

On top of that, you will receive a stock voucher (SGD5) for SGX stocks only.

You can view the terms and conditions of this promotion on Tiger Brokers’ website.

moomoo Referral ($200 Stock Cash Coupon Bundle, AAPL Shares and Commission Free Trades for 180 Days)

If you are interested in signing up for a moomoo (powered by FUTU SG) account, you can use my referral link.

Here are some of the rewards you can receive (From 2 Oct 2021):

- Commission-free trading for 180 days (SGX, HKEX and US markets)

- $200 or $2,000 Stock Cash Coupon Bundle (First Deposit Reward)

- Apple share and iPhone 13 (First Transfer-In Rewards)

To receive these bonuses, here are the steps you’ll need to do:

#1 Sign up for a Moomoo account

You’ll need to use my referral link to sign up for a moomoo (powered by FUTU SG) account.

Once you have successfully opened a FUTU SG Securities Account, you will receive:

- 180 days unlimited commission-free trading for the US, HK & SG stock market (to be activated within 90 days)

- Lvl 2 US stock Market Data

- Lvl 1 SG stock Market Data

- Lvl 1 China A-Shares Market Data

First Deposit Reward

You will be able to receive a Stock Cash Coupon Bundle, depending on the amount that you deposit for your very first deposit:

| S$ 2,700 – S$ 199,999 | $200 Stock Cash Coupon Bundle |

| ≥ S$ 200,000 | $2,000 Stock Cash Coupon Bundle |

First Transfer-In Reward (US & HK stocks only)

If you transfer your US or HK stocks from another brokerage account to moomoo, you will be able to receive some rewards:

| SGD 50,000 – SGD 99,999 | 1 Free Apple (AAPL) share |

| SGD 100,000 – SGD 199,999 | 2 Free Apple (AAPL) shares |

| ≥ SGD 200,000** | 1 iPhone 13 (256GB; first 50 sets) OR 3 Free Apple (AAPL) shares |

To learn more, you can view more about this promotion on the FUTU SG website.

POEMS Referral (Free US trades for 1 month)

If you are interested in signing up for a POEMS account, you can use my referral link. You will be able to receive free US trades for one month after you deposit SGD $3,000 into POEMS!

Here’s what you need to do:

- Sign up for a POEMS Cash Plus Account

- Deposit ≥ SGD $3,000 into your Cash Plus Account within 1 week of opening your account

- Enjoy 1 month worth of free US trades

Saxo Referral (Earn $100-$250 in cash)

If you are interested in creating a Saxo trading account, you can take part in the referral program.

Here’s are the rewards that you can receive from this program:

| Action | Reward |

|---|---|

| Fund ≥ SGD $3,000 and make ≥ 3 qualifying trades | SGD $100 |

| Fund ≥ SGD $100,000 and make ≥ 3 qualifying trades | SGD $250 |

The 3 qualifying trades that you need to make have to be on margin products, such as:

- CFDs

- FX

- Futures / Forwards

- Options

The process is quite different from other referral programmes, so you can contact me for the next steps for the referral!

You can find out more about the referral program on Saxo’s website.

FSMOne Referral

If you would like to create an FSMOne account, you can enter my account number ‘P0381515‘ into the referral code field.

I will receive 1,000 reward points for referring you. Although you do not receive any benefits, I would appreciate your support!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?