Last updated on March 5th, 2022

There are many different S&P 500 ETFs for you to choose from.

So how exactly does the UCITS ETF (VUSA) differ from the US-listed VOO?

Contents

The difference between VUSA and VOO

VUSA is listed on the London Stock Exchange while VOO is listed on the NYSE. While they both track the same S&P 500 index, they will differ mainly in terms of their currency (GBP vs USD), expense ratio, and the taxes you’ll incur.

Here’s an in-depth comparison between these 2 ETFs:

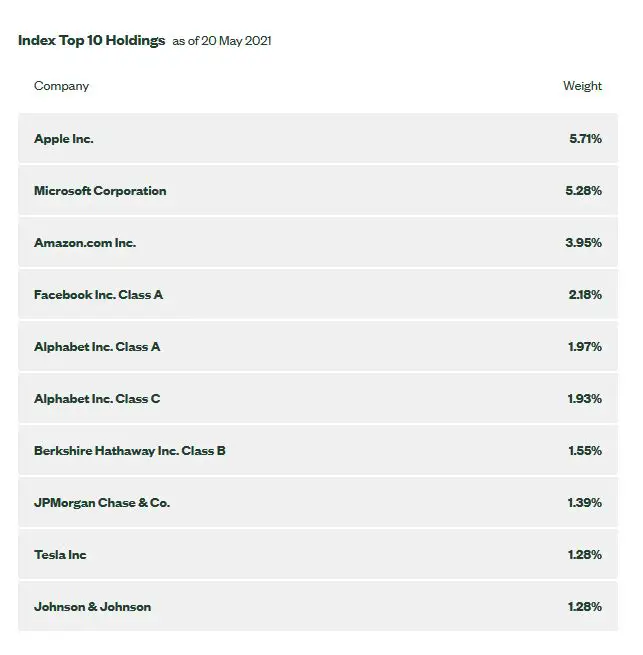

Index tracked

Both ETFs track the S&P 500 index. As such, they should have almost the same performance in the stock market.

This is because both funds will have the same holdings in the same proportion.

You can find out more about investing with the S&P 500 in Singapore with my guide.

The fund manager is the same

Both VUSA and VOO are managed by Vanguard.

VUSA was started in May 2012, while VOO started in September 2010. With that extra 2 years and being listed on the US exchange, VOO has a much larger assets under management (AUM).

| VUSA | VOO | |

|---|---|---|

| AUM | 29,200 million | 731,500 million |

In fact, VUSA and VUSD are exactly the same ETF. The only difference is that they are denominated in different currencies (GBP vs USD)!

They are listed on different exchanges

VUSA is listed on the London Stock Exchange (LSE), while VOO is listed on the NYSE. This does have certain implications on how you can buy these ETFs.

Both have the same minimum unit number of 1

The minimum units that you can purchase on the NYSE or LSE is 1. Compared to the SGX which has a minimum lot size of 10 units, this makes it really accessible for you to purchase either ETF.

Not all brokers allow you to trade on both exchanges

Some brokers do not allow you to trade on the London Stock Exchange. In contrast, the NYSE is offered by many brokers.

| Broker | LSE | NYSE |

|---|---|---|

| FSMOne | ✕ | ✓ |

| Interactive Brokers | ✓ | ✓ |

| Saxo Markets | ✓ | ✓ |

| Standard Chartered | ✓ | ✓ |

| Maybank Kim Eng | ✓ | ✓ |

| KGI Securities | ✓ | ✓ |

| OCBC Securities | ✓ | ✓ |

| Tiger Brokers | ✕ | ✓ |

| POEMS | ✓ | ✓ |

| TD Ameritrade | ✕ | ✓ |

| DBS Vickers | ✓ | ✓ |

To invest in the LSE, you may need to find a specific broker to do so. You can view my guide to see what are the best ways to buy LSE ETFs from Singapore.

You can also view my comparison between Tiger Brokers and FSMOne to see which broker is better for you.

Commissions charged may be different

When you are trading in different exchanges, you may incur different costs. For example, here are some of the commissions when you trade online in both markets:

| Broker | US | LSE |

|---|---|---|

| Interactive Brokers | 1% of trade value Minimum USD 0.35 | 0.05% * trade value Minimum GBP 1 |

| OCBC Securities | 0.3% of trade value Minimum USD20 | 0.7% of trade value Minimum GBP55 |

You can also consider Tiger Brokers which offers you a minimum of USD1.99/trade.

As such, you should try to find the lowest brokerage fees so that they won’t eat into your returns!

Different currency denomination

VUSA is denominated in GBP, while VOO is denominated in USD.

This may have some implications based on the currency that you wish to trade in. If your home currency is either GBP or USD, you may want to invest in VUSA or VOO respectively to avoid currency risk!

However, one thing you might want to note is that the base currency of both ETFs is in USD. This means that even though VUSA is denominated in GBP, the underlying assets are still in USD.

The only difference is that you can only use GBP to purchase units of VUSA!

Unit Price

The unit price of each ETF is the price you’ll need to pay for 1 unit. Both VUSA and VOO have rather different unit prices.

| VUSA | VOO | |

|---|---|---|

| Estimated Unit Prices | 60 GBP | $400 USD |

If you convert 60 GBP to USD, it will roughly be around $85 USD. This makes investing in VUSA much more flexible compared to VOO!

This is because you require a much smaller sum to start investing in VUSA.

Dividend withholding taxes

VUSA is domiciled in Ireland while VOO is domiciled in the US. You will incur a lower dividend withholding tax when you invest in Irish-domiciled ETFs.

| VUSA | VOO | |

|---|---|---|

| Dividend Withholding Tax | 15% | 30% |

If you are a non-resident alien to the US, you will incur the 30% dividend withholding tax.

However, there is a tax treaty between Ireland and US. Any dividends issued from US stocks will only incur a 15% withholding tax.

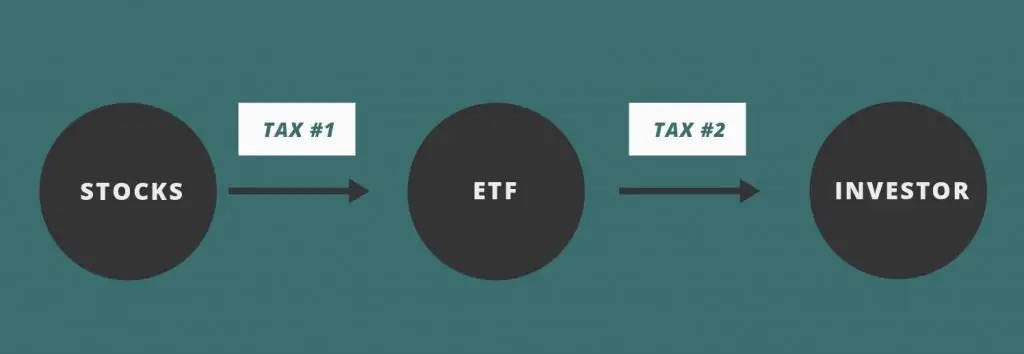

2 layers of taxes

For any ETF, the fund manager buys the stocks based on the index they are tracking. The dividends that they distribute are collected from the stocks in their fund.

As such, there are 2 layers where you may incur some taxes:

- From stock to ETF

- From ETF to you, the investor

VUSA incurs the tax on the first layer

For VUSA, the dividends from the US stocks are distributed to an Irish-domiciled ETF. As such, the 15% withholding tax applies on the first layer.

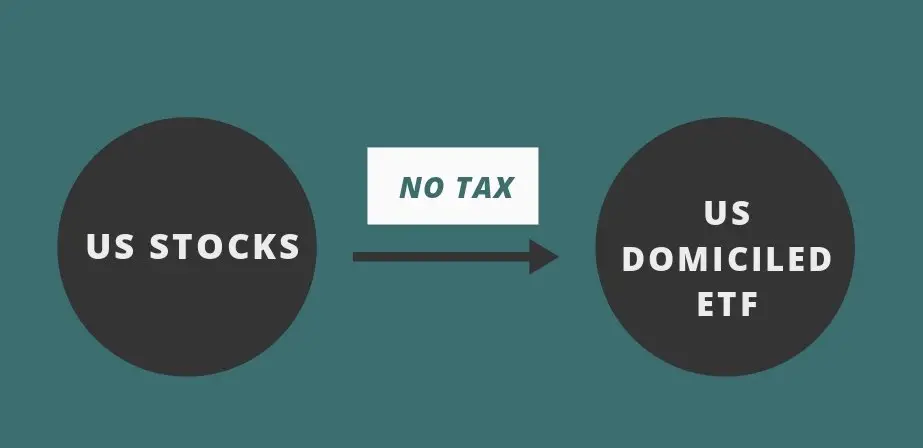

VOO incurs the tax on the second layer

When the stock distributes its dividend to the ETF, no tax is incurred. This is because it is from a US stock to a US-domiciled ETF.

However when the dividends are distributed to you, they will incur the 30% tax. This is because you are a non-resident alien.

If you wish to track your dividends with the taxes accounted for, you can consider trying out StocksCafe’s platform.

Dividend distribution

Both VUSA and VOO are distributing ETFs. This means that they will issue a dividend to you each quarter.

However, you would still need to factor in the withholding tax! The taxes will eat into your returns, especially if you invest in VOO.

You can read my comparison between accumulating and distributing ETFs to see how they are different.

Estate tax

Another significant cost of investing in US-related assets is the estate tax. This can go from 18% all the way to 40%!

An estate tax is a tax on the right for you to transfer your assets after you have passed on.

Since VOO is domiciled in the US, it will be included in your taxable estate.

However, VUSA is domiciled in Ireland.

Even though it owns US stocks, you will not incur the estate tax!

You will only incur an estate tax on your Irish-domiciled ETFs if:

- You or your beneficiary are an Irish citizen

- You own an Irish property

If you wish to leave behind a legacy for your loved ones, VUSA may be the more ideal ETF to invest in.

Expense ratio

On top of the trading commissions you’ll need to pay the broker, you will have to pay an expense ratio to the fund manager as well.

The expense ratio is charged by the fund manager to cover the costs of running the fund.

Based on the value of your assets in the fund, you will be charged an annual fee.

Here are the expense ratios for these 2 funds:

| VUSA | VOO | |

|---|---|---|

| Expense Ratio | 0.07% | 0.03% |

The expense ratio for VUSA is more than twice that of VOO’s. While this difference may seem small, it will affect you in the long run!

If you are a US investor, VOO will be a much better choice due to the lower fees you’ll need to pay.

Liquidity

If you are looking to actively trade using these ETFs, you may want to look at their liquidity. One of the indicators you may want to look at is the ETF’s trading volume.

| VUSA | VOO | |

|---|---|---|

| Liquidity | 289,813 | 4,421,350 |

VOO has a much higher trading volume than VUSA due to it being listed on the NYSE.

If you are a frequent trader, VOO will be a better ETF to invest in. This is because you will be able to buy or sell the ETF at your intended price.

Verdict

Here is the complete breakdown between VUSA and VOO:

| VUSA | VOO | |

|---|---|---|

| Index Tracked | S&P 500 | S&P 500 |

| Fund Manager | Vanguard | Vanguard |

| AUM | 29,200 million | 731,500 million |

| Exchange | LSE | NYSE |

| Currency | GBP | USD |

| Estimated Unit Prices | 60 GBP | $400 USD |

| Dividend Withholding Tax | 15% | 30% |

| Dividend Distribution | Distributing | Distributing |

| Estate Tax | No | Yes |

| Expense Ratio | 0.07% | 0.03% |

| Liquidity | 289,813 | 4,421,350 |

So which ETF should you choose?

Choose VUSA if you want a lower dividend withholding tax

If you are a non-US investor, VUSA seems to be the more tax-efficient ETF to invest in.

You will receive a lower dividend withholding tax, and not be subject to the US estate tax. However, the expense ratio is slightly higher!

As such, you’ll need to consider the total costs of investing in an ETF, rather than just the withholding tax that you’ll incur. This will help you to make a better decision on which ETF you should invest in!

The lower unit price makes VUSA more accessible

If you can only invest a small amount each time, then VUSA may be better for you. This is because you can buy each unit of the ETF with around 60 GBP. This is much lower compared to VOO’s unit price of $400 USD.

However, you’ll need to see if the trading fees are worth it for this small amount!

VUSA is also more suitable if you live in the UK

Your base currency is in GBP if you live in the UK. As such, it may be better if you invest in VUSA instead.

This is because you do not need to exchange your GBP to another currency to start investing in this ETF, hence avoiding currency risk!

By investing in VUSA, you will also save on any currency conversion fees you may incur.

The fund manager will still need to convert your GBP to USD. However, they should be able to get a better exchange rate compared to you as an individual investor.

Choose VOO if you want an ETF with a higher liquidity and lower expense ratio

If you are a US investor, VOO is a no-brainer for you. However, the dividend withholding tax may deter you if you’re a non-US investor.

What you get in return for the higher taxes is a higher trading volume and lower expense ratio. The higher trading volume is more applicable to you if you’re a frequent trader.

Moreover, most brokers may provide a cheaper trading commission when trading on US exchanges compared to the LSE. As such, you may actually be saving more when you invest with VOO!

The only thing that you’ll need to really take note of is your estate tax. This becomes very significant when your assets in US become larger than $60k!

Conclusion

Both ETFs track the same index, so their performances should be very similar. The ETF that you choose may depend on these few factors:

- The amount of money you can invest each time (based on the unit price)

- The currency you wish to trade in

- The amount of taxes incurred

- The exchange that you want to trade in (which affects the commissions you’ll pay)

- The expense ratio you’re willing to pay

If you’re looking for a way to track the markets and your portfolio, you can consider using TradingView, which allows you to monitor more than 50 stock exchanges.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?