Last updated on June 6th, 2021

You may have realised that there are actually different S&P 500 indices being developed by S&P Global!

On their website, you can find the S&P 500 as well as the S&P 500 Growth indices.

How do these 2 indices differ from each other? Here’s what you need to know:

Contents

The difference between S&P 500 and S&P 500 Growth

The S&P 500 tracks all 505 holdings in the large-cap US equity market. Meanwhile, the S&P 500 is more focused on the growth stocks found in this market. This results in the indices having a different weightage into the multiple sectors in the market, such as financials.

Here is an in-depth comparison between these 2 indices:

Type of stocks

Both indices track large-cap US equities that are listed on the US exchanges.

A large cap company is one that has a market capitalisation of more than $10 billion.

Investopedia

The market cap of a company can be determined by multiplying the stock price by the number of outstanding shares.

Large cap companies are the largest companies that are found in the world. Most of them are globally recognisable brands, such as:

- Apple

- Microsoft

- Amazon

Strategy used

Both indices use slightly different strategies to include stocks into their index:

S&P 500 uses a blended strategy

The S&P 500 uses a blended strategy of both value and growth stocks.

| Type | Definition |

|---|---|

| Value | Stocks that are priced below their true value Returns are usually in the form of dividends |

| Growth | Stocks that have high potential for future growth Returns are usually in terms of capital appreciation |

The S&P 500 does not differentiate between value and growth. As such, it will include all 505 stocks that are found in the index!

S&P 500 Growth focuses on growth stocks

The S&P 500 Growth Index has a large emphasis on growth stocks.

This index uses 3 main factors to determine the stocks in the index:

| Factor | Definition |

|---|---|

| Sales growth | Three-Year Sales per Share Growth Rate |

| Ratio of earnings change to price | Three-Year Net Change in Earnings per Share (Excluding Extra Items) over Current Price |

| Momentum | 12-Month % Price Change |

The index uses these factors and ranks the 505 stocks found in the S&P 500.

The stocks that are found in the S&P 500 Growth index are ones that have high values in the 3 factors above.

As such, the Growth Index is geared more towards the growth stocks found in the S&P 500 universe!

Number of holdings

Due to the different strategies used, both indices have a different number of holdings:

| S&P 500 | S&P 500 Growth | |

|---|---|---|

| Number of Holdings | 505 | 232 |

As such, the S&P 500 is a more broadly diversified index! This is because it has more than twice the holdings of the S&P 500 Growth Index.

The S&P 500 Growth Index only contains stocks that form a subset of the entire S&P 500!

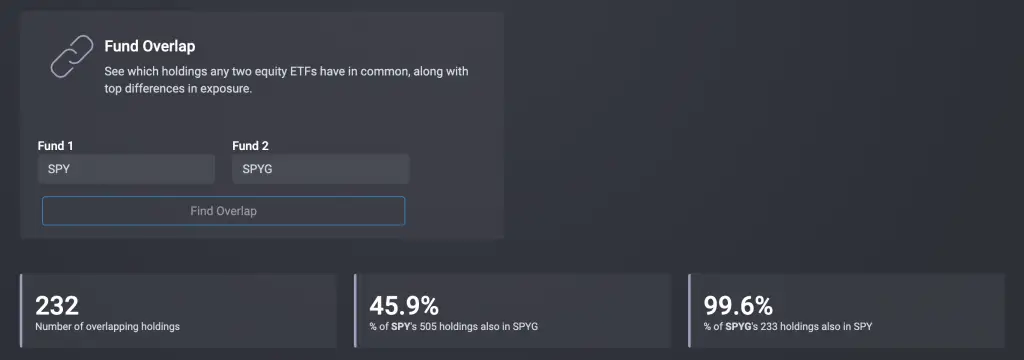

You can view this from ETF Research Center’s Fund Overlap tool.

Here is a comparison between the SPY and SPYG ETFs, which track these 2 indices.

As such, the S&P 500 Growth index contains almost 50% of the S&P 500’s holdings!

Top Sectors

Here is a comparison between the top sectors that are found in the S&P 500 and S&P 500 Growth Indices:

| S&P 500 | S&P 500 Growth |

|---|---|

| IT | IT |

| Healthcare | Consumer Discretionary |

| Consumer Discretionary | Communication Services |

| Communication Services | Healthcare |

| Financials | Industrials |

There is a difference in weightage between the 2 indices!

Both of them are heavily weighted in information technology. However, the S&P 500 Growth Index has a much higher allocation towards IT (~40%) compared to the S&P 500 (~25%)!

Moreover, the financials a major component in the S&P 500 index. This is not so for the S&P 500 Growth index as it is not in the top 5 sectors.

As such, you can see that the indices have a different weightage into the different sectors!

Top holdings

Here are the top 10 holdings of each index:

| S&P 500 | S&P 500 Growth |

|---|---|

| Apple | Apple |

| Microsoft | Microsoft |

| Amazon | Amazon |

| Facebook Inc A | Facebook Inc A |

| Tesla | Tesla |

| Alphabet Inc A (Google) | Alphabet Inc A (Google) |

| Alphabet Inc C (Google) | Alphabet Inc C (Google) |

| Berkshire Hathaway B | Nvidia Corp |

| Johnson & Johnson | PayPal Holdings |

| JP Morgan Chase & Co | Netflix |

The top 7 holdings of these 2 indices are all the same. However, the next 3 holdings are rather different!

The S&P 500 has financial stocks like Berkshire Hathaway B and JP Morgan.

Meanwhile, the S&P 500 Growth index has technological stocks like Nvidia and Netflix.

This is because the S&P 500 Growth index has a higher weightage to technological stocks, compared to financial stocks!

Financial stocks are usually considered to be value stocks, since they are already very well established. There is not much room for them to grow, and they provide returns via a dividend.

This is because the company may feel that it is worth it to give out their free cash flow compared to pursuing growth!

On the other hand, technological stocks have a much higher potential for growth. As such, they will have a higher weightage in the S&P 500 Growth index!

Performance

The main thing you’ll be concerned with which index to choose will be the performance.

If you compare these 2 indices, you can see that the S&P 500 Growth index has been performing much better in the past 5 years.

However if you zoom out to 2000, the S&P 500 index actually performed way better than the S&P 500 Growth!

2000 was taken as the starting point of comparison as that was when the SPYG ETF was started.

If you bought into the S&P 500 Growth index in 2000, you would currently have a lower return compared to holding the S&P 500!

Availability of ETFs

You are unable to buy directly into either of these indices. Instead, you will need to buy into a fund that tracks this index!

2 types of funds that can track an index include exchange-traded funds (ETFs) and mutual funds.

The S&P 500 index is such a prominent index, so ETFs that track it are listed all over the world!

You are able to find an S&P 500 ETF listed on exchanges from many different countries:

- New York Stock Exchange (NYSE)

- London Stock Exchange (LSE)

- Autralia Stock Exchange (ASX)

- Hong Kong Stock Exchange (HKEX)

- Tokyo Stock Exchange (TSE)

- Singapore Exchange (SGX)

- Korea Stock Exchange (KRX)

Here are some of the ETFs that track the S&P 500:

There are many S&P 500 ETFs listed on the LSE as there are both accumulating and distributing ETFs!

There are only 3 ETFs which track the S&P 500 Growth Index

Meanwhile, ETFs that track the S&P 500 Growth Index are only found on the NYSE! There are 3 ETFs which track this index:

This makes the S&P 500 index much more accessible compared to the S&P 500 Growth index!

Verdict

Here is a comparison between these 2 indices:

| S&P 500 | S&P 500 Growth | |

|---|---|---|

| Type of stocks | Large-cap US | Large-cap US |

| Strategy used | Blended (Growth + Value) | Growth |

| Number of holdings | 505 | 232 |

| Top sectors | IT Healthcare Consumer Discretionary Communication Services Financials | IT Consumer Discretionary Communication Services Healthcare Industrials |

| 5 Year Performance | Lower | Higher |

| 20 Year Performance | Higher | Lower |

| Availability of ETF | Multiple exchanges | Only on NYSE |

Which index should you choose?

Choose S&P 500 if you want a more diversified portfolio

The S&P 500 index is much more diversified as it has 505 holdings. Even if one company does badly and the stock price plunges, other stocks may perform better!

As such, your portfolio is not that reliant on each individual stock compared to the S&P 500 Growth Index.

Moreover, the S&P 500 index is found on the London Stock Exchange. These ETFs are Irish-domiciled, which are more tax efficient if you are a non-resident alien of the USA.

This is because:

- You incur a lower dividend withholding tax (15% vs 30%)

- You are not subject to the US estate tax

Investing in an Irish-domiciled S&P 500 ETF may be a better choice for you!

Choose S&P 500 Growth if you prefer to invest in growth stocks

The S&P 500 Growth Index is more heavily concentrated in growth stocks. However, they are still a subset of the entire S&P 500 index!

This means that the weightage towards each stock may be higher.

If you think that growth stocks will outperform value stocks, then this index will be the better choice.

So far, growth stocks have shown to be performing better. However, there are periods of times where value stocks can outperform growth too!

As such, you may want to decide if you want to solely concentrate on growth, or just buy the market as a whole!

Conclusion

The S&P 500 Growth index is a subset of the S&P 500 index. Since they overlap with one another, you should choose to invest in either one of them.

The choice of index you ultimately invest in would depend on:

- How diversified you want to be

- Whether you prefer investing in growth stocks or the market as a whole

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?