Last updated on June 6th, 2021

You’ve decided to buy a S&P 500 ETF. However, there are so many to choose from!

What’s the difference between S27 and VOO? Here’s what you’ll need to know:

Contents

The difference between S27 and VOO

S27 is managed by SSGA and listed on the SGX. Meanwhile, VOO is managed by Vanguard and is listed on the NYSE. Both of them track the same index: the S&P 500. However, they may differ in terms of liquidity and the minimum number of units to invest in.

Here’s a complete breakdown of these 2 ETFs:

They both track the same index

Both S27 and VOO track the S&P 500 index. As such, their performances are rather similar.

Since they track the same index, the holdings in both funds are rather similar too.

Their fund managers are different

S27 is managed by SPDR, while VOO is managed by Vanguard.

S27 is the older fund as it was started in January 1993, along with SPY. Meanwhile, VOO was only incepted on September 2010.

Interestingly, VOO has the larger asset under management (AUM).

| S27 | VOO | |

|---|---|---|

| Net AUM | 277.6 billion | 557 billion |

They are listed on different exchanges

S27 is listed on the SGX, while VOO is listed on the NYSE. This will lead to some differences when you wish to buy either ETF.

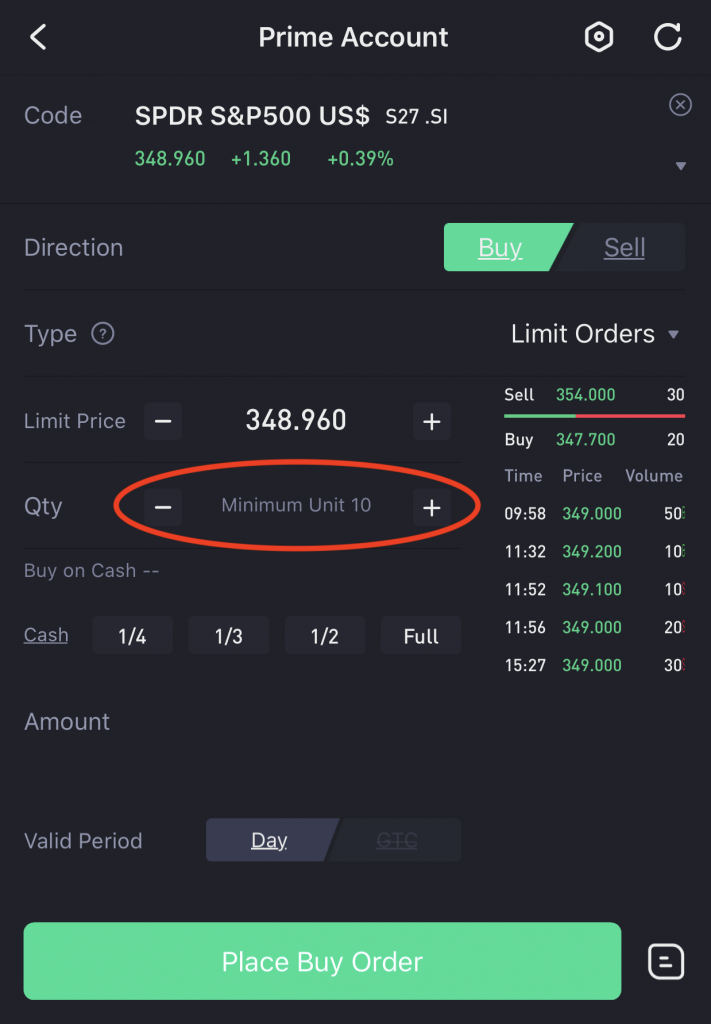

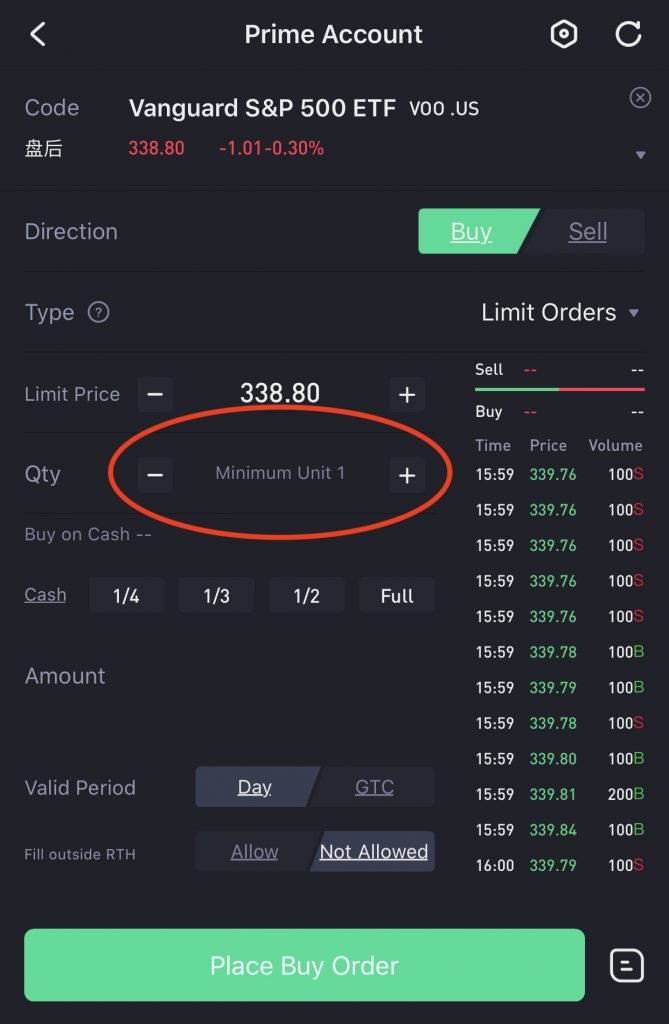

Minimum units to purchase

The minimum number of units of S27 you can buy is 10. If you have a small sum to invest, you may not have enough capital to buy S27.

Meanwhile, you can buy a minimum of 1 unit of VOO on the exchange.

As such, VOO will be more accessible if you only have a small capital.

Both funds are denominated in USD

Even though S27 is listed on the SGX, it is still denominated in USD.

As such, there is no reduction of currency risk even if you invest in S27.

Trading commissions

Brokerages may charge you different commissions depending on which exchange you’re trading in.

For example, here are the commissions charged by Tiger Brokers:

| SGX | US Markets |

|---|---|

| 0.08% * trade value, minimum SGD$2.88 | 0.01 USD per share, minimum $1.99USD per trade |

You may want to choose the broker that gives you the cheaper fees, based on your trade amount!

Expense ratio

On top of the trading commissions you’ll need to pay the broker, you will have to pay an expense ratio to the fund manager as well.

This expense ratio is usually deducted at the end of each year.

Here are the expense ratios for these 2 funds:

| S27 | VOO | |

|---|---|---|

| Expense ratio | 0.0945% | 0.03% |

The expense ratio charged by S27 is almost 3 times greater than VOO!

Since both of them are tracking the same index, it may be more cost effective to invest with VOO instead.

Dividends

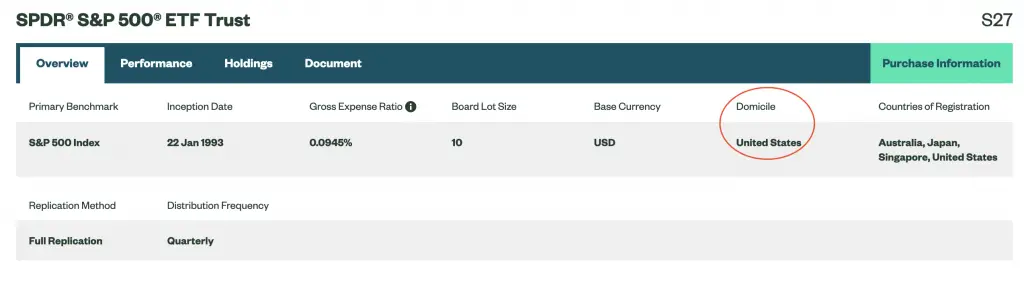

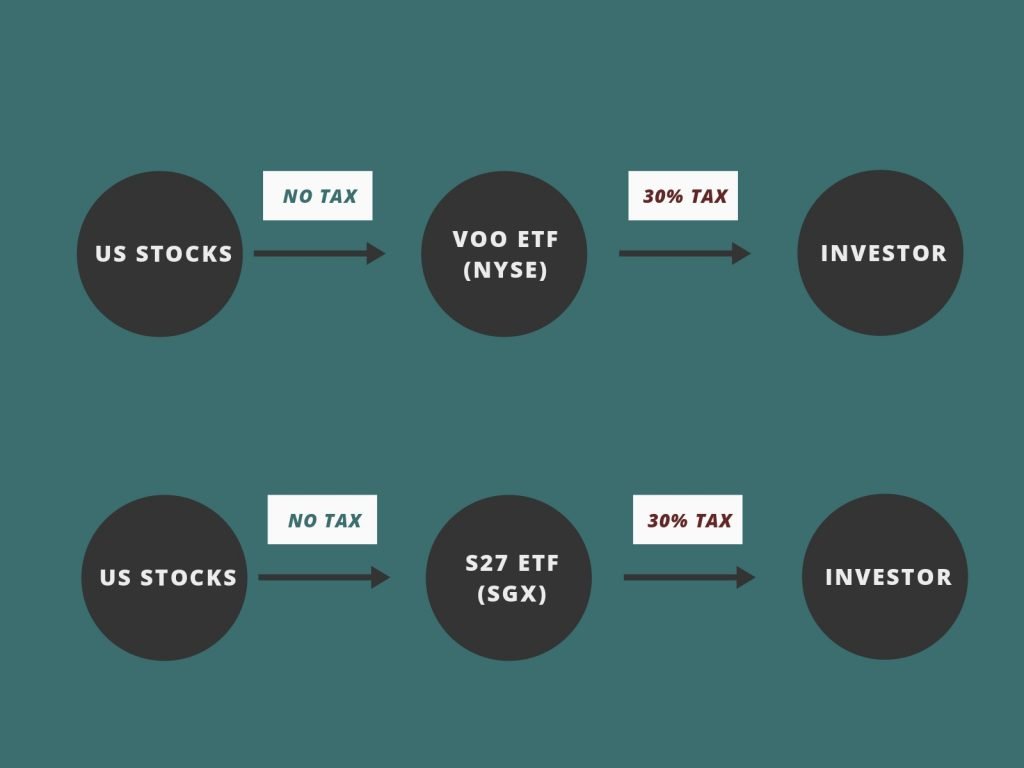

You will incur dividend withholding taxes on your dividends if you are a non-resident alien of the USA.

Even though S27 is listed on the SGX, it is still domiciled in the US.

As such, the dividend withholding tax applies to S27 as well.

Both ETFs will incur a 30% dividend withholding tax

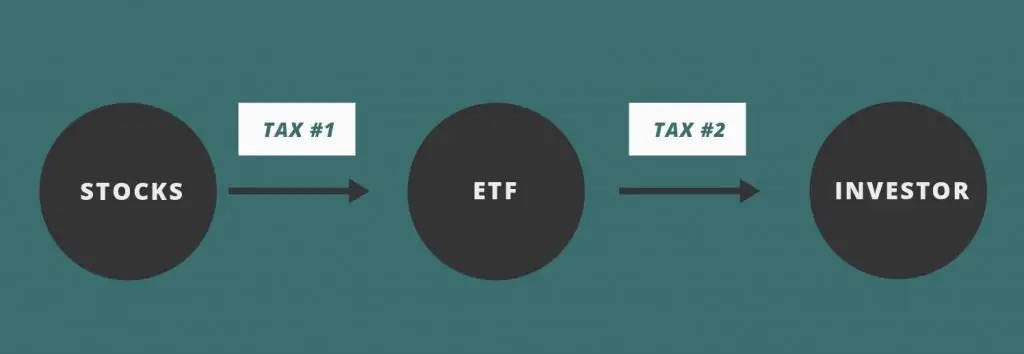

ETFs invest in a basket of stocks. They will collect the dividends distributed from these stocks, and issue them to you.

As such, there are 2 layers where your dividends may be taxed:

- From stock to ETF

- From ETF to you, the investor

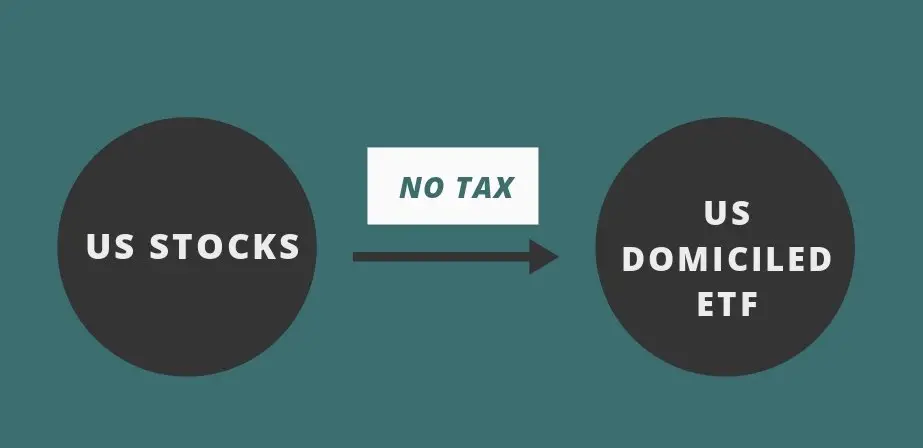

Both ETFs incur the tax on the second layer

Since both ETFs are domiciled in the US, there are no taxes when the stock distributes its dividends to the ETF.

You will only incur the tax at the second layer, when the ETF distributes the ETF to you.

As such, there is no tax advantage when you invest in S27 compared to VOO. Both ETFs are also domiciled in the US. As such, you will incur the same US estate tax as well.

If you would like to track your dividend history with the taxes accounted for, you may want to consider using StockCafe’s platform.

Liquidity

If you are looking to frequently trade this ETF, you may want to look at an ETF’s liquidity. One of the main parameters to look at is the average trading volume.

Here are the average trading volumes for these 2 ETFs:

| S27 | VOO | |

|---|---|---|

| Average Trading Volume | 343 | 3,100,000 |

S27 has a really low trading volume! You may not be able to buy or sell this ETF at the price you originally intended to.

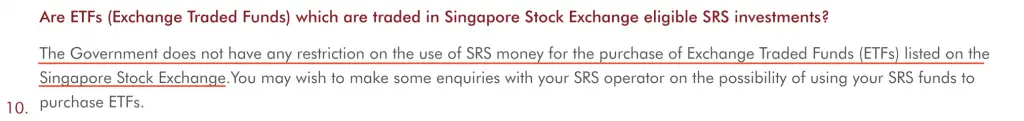

You can invest your SRS funds into S27

Here’s one possible advantage of investing in the S27. Since S27 is listed on the SGX, you are able to use your SRS to invest in this ETF.

The Singapore Government does not have any restrictions on using your SRS to invest in ETFs on the SGX.

As such, it is possible for you to use your SRS funds to invest in a S&P 500 ETF!

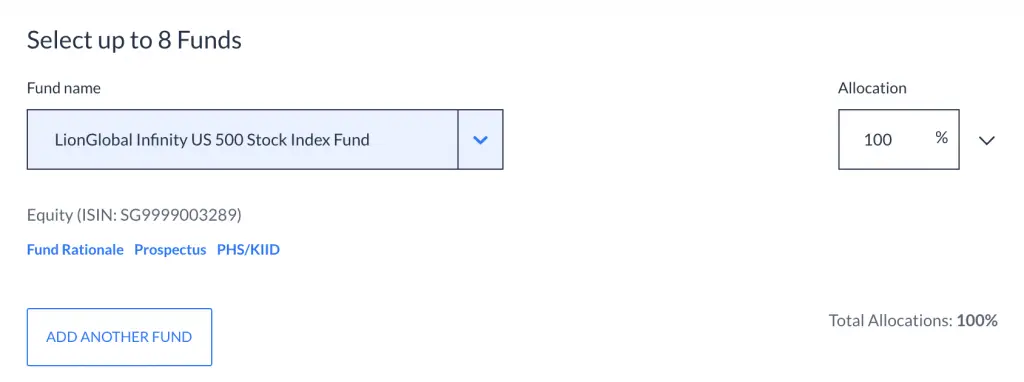

However, due to S27’s poor liquidity, you may want to use another option to invest your SRS funds in the S&P 500. One such example is Endowus’ Fund Smart, which allows you to customise your own portfolio.

You are able to invest in the LionGlobal Infinity US 500 Stock Index Fund, which also tracks the S&P 500 index.

What’s more, you’re able to use both your CPF and SRS to invest in Fund Smart! This is something you may want to consider instead of investing in S27.

Verdict

Here’s a comparison between these 2 ETFs:

| S27 | VOO | |

|---|---|---|

| Index Tracked | S&P 500 | S&P 500 |

| Fund Manager | SPDR | Vanguard |

| Exchange | SGX | NYSE |

| Currency Denomination | USD | USD |

| Minimum Units to Invest | 5 | 1 |

| Net AUM | 277.6 billion | 557 billion |

| Expense Ratio | 0.0945% | 0.03% |

| Dividend Withholding Tax | 30% | 30% |

| Average Trading Volume | 343 | 3,100,000 |

| Funds to Invest | Cash and SRS | Cash only |

Both ETFs are pretty similar, so which one should you choose?

Choose VOO for greater liquidity and flexibility

VOO has superior liquidity compared to S27. Moreover, the minimum units to invest in this ETF is 1. Moreover, VOO has a lower expense ratio.

In the long run, it will be more cost effective to invest with VOO.

As such, VOO seems to be the much better choice compared to S27.

S27 may only be worth investing if you wish to invest your SRS funds

The only reason why I see that you’ll invest in S27 is if you want to invest your SRS funds. Then again, there are better options that you can consider.

One such option is using Endowus Fund Smart to invest in the LionGlobal Infinity US 500 Stock Index Fund.

If you wish to invest in a US-domiciled ETF, you may want to consider the NYSE-listed ETFs instead.

Conclusion

Both ETFs track the same index, so their performances should be very similar. The ETF that you choose depends on a few things:

- The exchange that you want to trade in

- Whether you wish to invest your SRS or not

- The flexibility in the number of units you can invest in

- The liquidity of the fund

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?