Last updated on June 6th, 2021

You may have heard of people recommending you to buy the STI ETF. However, when you look it up, there are actually 2 STI ETFs that are listed on the SGX!

How are they different and which one should you be choosing?

Contents

The difference between SPDR (ES3) and Nikko AM (G3B) STI ETFs

ES3 is managed by State Street Global Advisors, while G3B is managed by Nikko AM. There are not many significant differences between both ETFs, apart from their assets under management, and the methods you can use to invest in these ETFs.

Here’s a further breakdown between these 2 ETFs:

Index tracked

Both ETFs track the Straits Times Index.

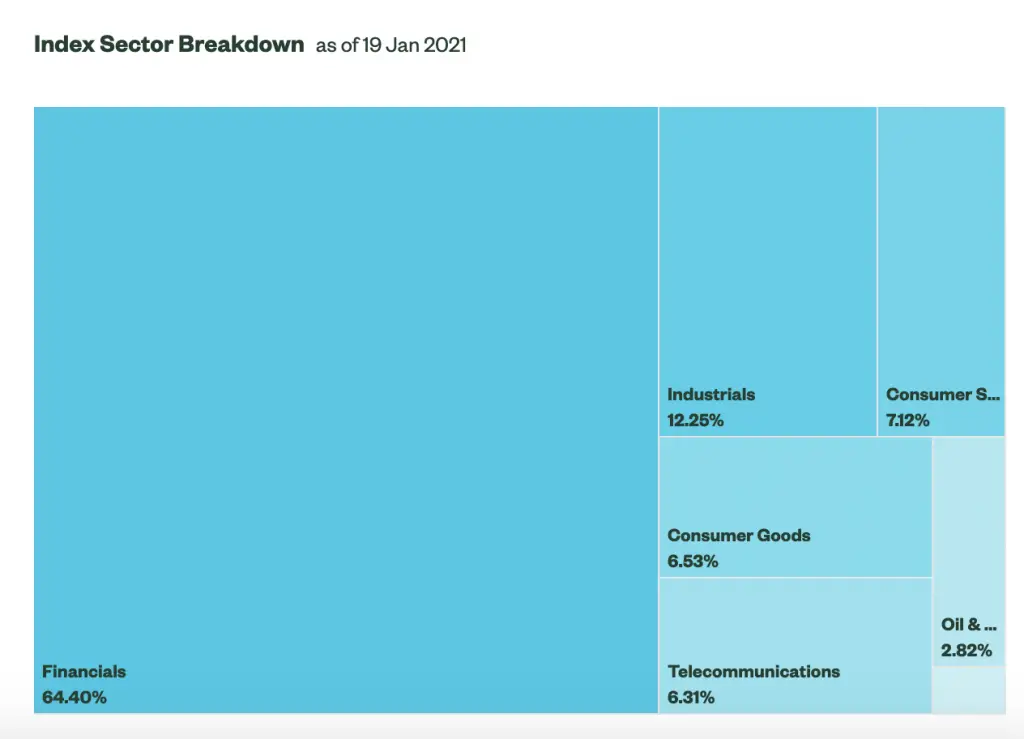

The Straits Times Index (STI) is a market capitalisation weighted index that tracks the performance of the top 30 companies listed on SGX.

Both funds should hold the same 30 stocks in the same proportion.

As such, they should have the same net asset value for each unit you purchase.

Apart from minor differences in the funds like tracking error, their performance will be very similar!

Fund manager

ES3 is managed by State Street Global Advisors (SSGA), while G3B is managed by Nikko Asset Management.

SSGA is a well established fund manager, and they manage the SPDR family of ETFs.

Meanwhile, Nikko AM was started in Japan, and is one of the largest asset managers in Asia.

Both fund managers are rather well established.

Asset Under Management (AUM)

ES3 was started in April 2002, while G3B was listed in February 2009.

Due to this 7 year gap between these 2 ETFs, ES3 has amassed a larger asset under management.

| ES3 | G3B | |

|---|---|---|

| AUM | $1,715 million | $449 million |

Estimated unit price

Both STI ETFs have very similar unit prices.

| ES3 | G3B | |

|---|---|---|

| Estimated Unit Price | $3 | $3 |

Since both ETFs have a unit price of around $3, this makes it very accessible for you to purchase one unit.

If you are investing with a broker, the minimum lot size is 10. You can invest in the STI ETF using brokers like DBS Vickers.

This is still rather accessible as you’ll only need to pay around $30 to own 10 units.

However, you’ll need to consider the trading commissions charged by the broker. If the broker has a minimum commission for each trade (e.g. $10), then it may be very costly to invest only a small sum!

Dividend distribution

Both ETFs will issue a dividend. The fund managers will first collect the dividends being issued by the stocks.

Afterwards, they will distribute these dividends to you on a half-yearly basis.

ES3 distributes your dividends in early February and August

ES3 is the much older fund, and has been issuing dividends at the same months since 2006!

G3B distributes your dividends in early January and July

G3B has a consistent schedule of distributing your dividends in early January and July. They have been doing so since 2015.

Dividend distributions are consistent and similar

Both ETFs have been distributing their dividends in a consistent fashion. As such, it may not really make much difference which ETF you choose!

A main reason why you’ll choose one ETF over another is if you prefer to have the dividends credited to you in a specific month.

You can track all of the dividends you’ll receive using StocksCafe’s platform.

Dividend yield

Both ETFs have a very similar dividend yield, since:

- They have very similar unit prices

- The dividends they distribute are around the same

The dividend yield depends on both the dividend amount as well as the unit price of the ETF.

As such, they should have very similar yields!

You can view the dividend history of both ES3 and G3B to see how similar they are.

Expense ratio

One of the costs that you’ll incur when investing with an ETF is the fund’s expense ratio.

The expense ratio is charged by the fund manager to cover the costs of running the fund. Based on the value of your assets in the fund, you will be charged an annual fee.

Here are the expense ratios for both ETFs:

| ES3 | G3B | |

|---|---|---|

| Expense Ratio | 0.3% | 0.3% |

Both ES3 and G3B have exactly the same expense ratio!

This is interesting as you may think that ES3 will have a larger economies of scale due to the larger fund. With greater cost savings, it should be able to charge a lower expense ratio. However, this is not the case!

The cost of investing in either ETF is exactly the same. As such, this will not really affect your decision in choosing which ETF to invest in.

However, the expense ratios of these 2 ETFs are quite high compared to S&P ETFs which charge less than 0.1%!

Average trading volume

If you are looking to actively trade using these ETFs, you may want to look at their liquidity. One of the indicators you may want to look at is the ETF’s trading volume.

| ES3 | G3B | |

|---|---|---|

| Average Trading Volume | 2.2 million | 0.3 million |

The SPDR STI ETF has a superior trading volume compared to the Nikko AM STI ETF.

If you are a frequent trader, you may want to choose to invest in ES3 instead. This gives you a greater chance to buy or sell your units at your intended price.

Methods to invest

Here are some methods where you can invest in either ETF:

#1 Brokers

There are few brokers which allow you to trade stocks and ETFs that are listed on the SGX. Some examples include:

- DBS Vickers

- FSMOne

- Tiger Brokers

- UOB Kay Hian

- OCBC Securities

You can view my comparison between Tiger Brokers and FSMOne to see which one is more suitable for you.

If you use any of these brokers to perform your trades, you will be able to purchase either ETF.

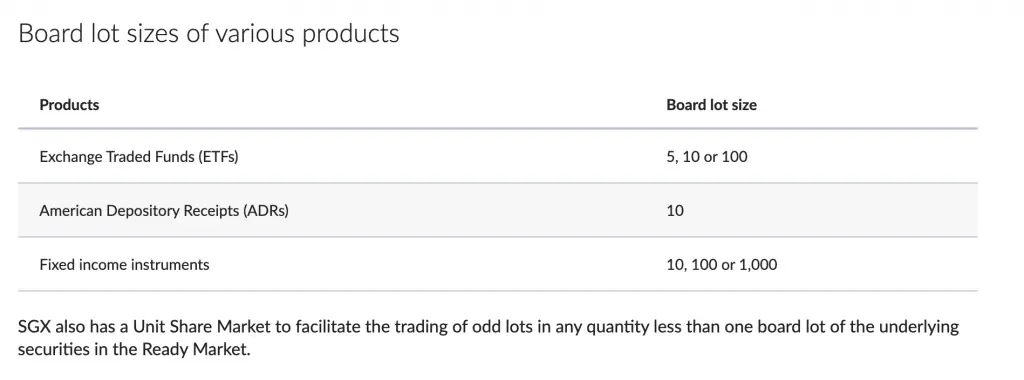

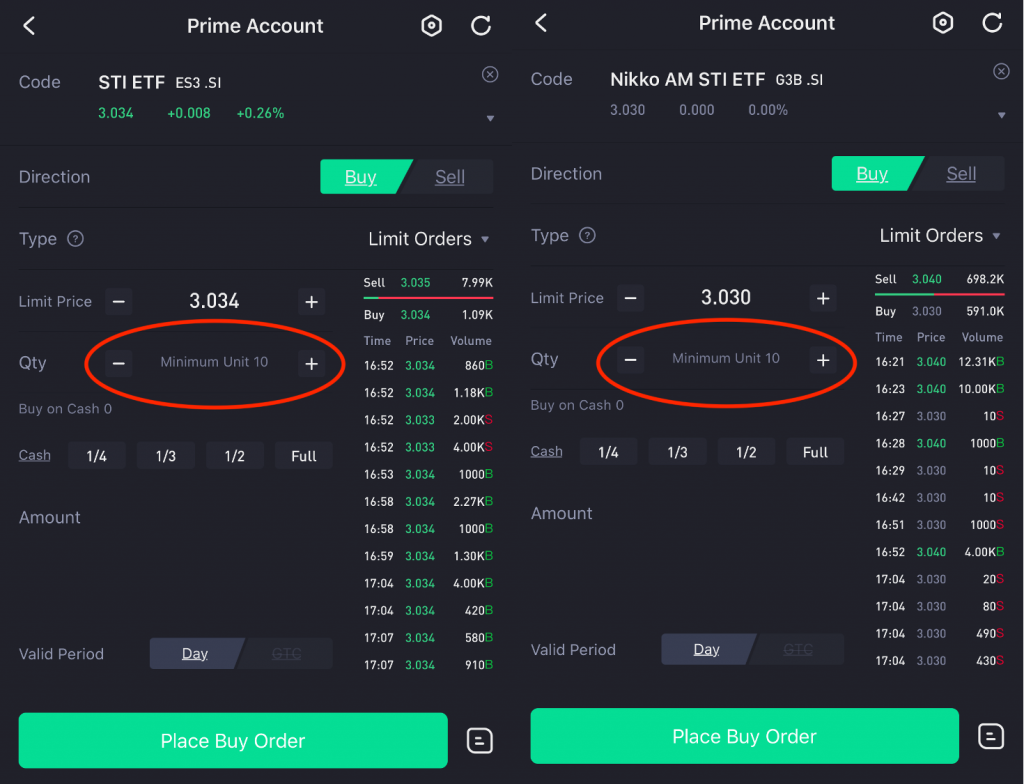

The minimum number of units you can purchase for each ETF is 10

SGX is unlike the NYSE or London Stock Exchange, where the minimum number of units you can purchase is 1.

Instead, the minimum lot size you can purchase for either ETF is 10.

It is still rather affordable as you’ll only need to spend around $30 to start investing in either ETF!

You’ll need to consider the trading commissions too

Besides the initial investment amounts, you’ll need to consider the trading commissions you’ll incur.

When you make a trade with a broker, they will usually charge you a fee for each trade.

Some brokers may charge a minimum fee for each trade. If you are only able to invest a small amount of money, the fees are not worth it.

For example, OCBC Securities charges a minimum commission of $25 when you trade in the SGX. The amount you pay in fees is almost the same as your investment amount!

You may want to consider Tiger Brokers, which charges only 0.08% of your trade amount, with no minimum! The ‘no minimum’ promotion is valid until 30 April 2021.

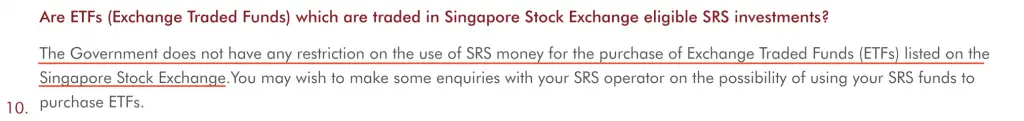

You can invest in both ETFs using Cash, SRS or CPF

You are able to invest in both ETFs using your SRS or CPF funds as well.

For SRS, you are able to invest in any ETFs which are listed on the SGX.

Some brokers which allow you to invest using your SRS funds include:

Both ETFs are also classified as ‘Low to Medium Risk’ by the CPF board.

As such, you are able to invest in both ETFs using your CPF funds.

You will need to find a broker that allows you to invest your CPF funds with them as well. Most of these brokers are the same as the ones that are listed above.

#2 Regular savings plans

Regular savings plans adopt a dollar-cost averaging approach to investing. This means that you are investing the same amount of money into the market every month.

When the price is higher, you will buy less units. When the price is lower, you will buy more units with the same investment amount.

In the end, the average price that you pay is somewhere between your highest and lowest prices.

There are 4 regular savings plans available in Singapore that let you invest in the STI ETF. However, all of these plans only allow you to invest in only one of the 2 ETFs available:

| ES3 | G3B | |

|---|---|---|

| OCBC BCIP | ✕ | ✓ |

| Invest Saver | ✕ | ✓ |

| POEMS Share Builders Plan | ✓ | ✕ |

| FSMOne RSP | ✓ | ✓ |

Interestingly, only the POEMS Share Builders Plan and FSMOne RSP allow you to invest in ES3.

Depending on which RSP you choose, you may be restricted to only choosing one ETF to invest in.

#3 Robo-advisors

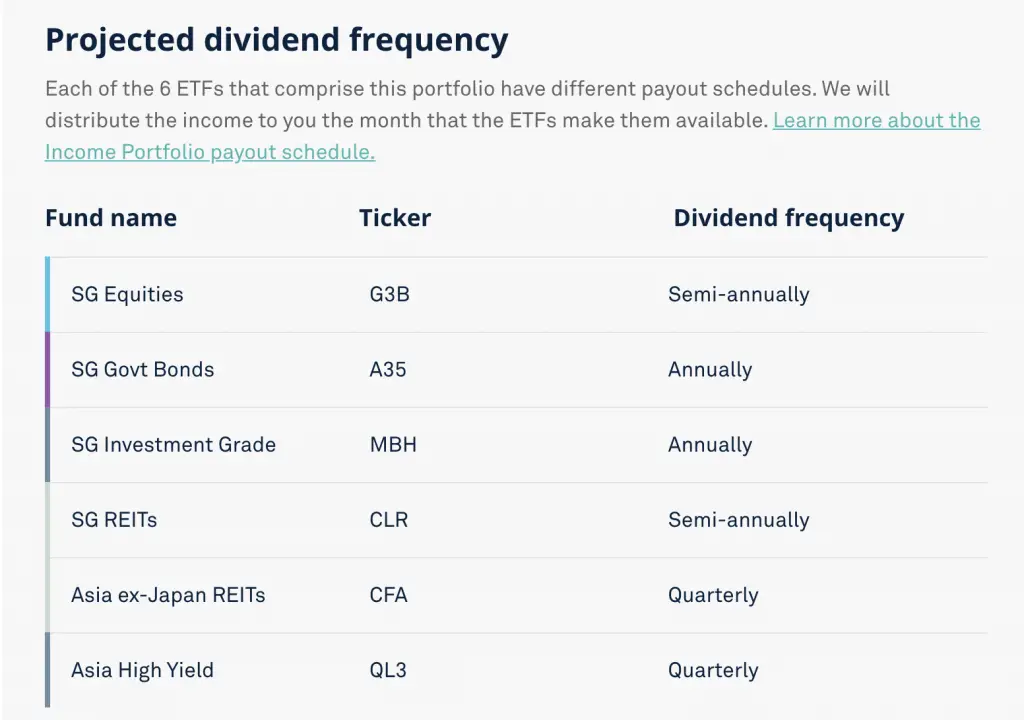

You can invest in the STI ETF as part of your robo-advisory portfolio as well. So far, only StashAway’s Income Portfolio has the STI ETF included in its portfolio.

This portfolio also only allows you to invest in G3B!

It is quite interesting to see that G3B is the more popular choice among both robo-advisors and regular savings plans.

Verdict

Here is a comparison between these 2 ETFs:

| ES3 | G3B | ||

|---|---|---|---|

| Index Tracked | STI | STI | |

| Fund Manager | SPDR | Nikko AM | |

| AUM | $1,715 million | $449 million | |

| Exchange | SGX | SGX | |

| Estimated Unit Price | $3 | $3 | |

| Dividend Distribution | Feb and Aug | Jan and July | |

| Dividend Yield | Similar | Similar | |

| Expense Ratio | 0.3% | 0.3% | |

| Average Trading Volume | 2.2 million | 0.3 million | |

| Methods to Invest | Brokers POEMS SBP FSMOne RSP | Brokers OCBC BCIP Invest Saver FSMOne RSP StashAway Income PortfolioFunds to InvestCash SRS CPF | Cash SRS CPF |

Which STI ETF is better?

There are not many significant differences between the 2 STI ETFs that are available. As such, investing in either one should help you to obtain rather similar returns.

You may want to trade with ES3 if you are a frequent trader due to the higher trading volume. However if you are a passive investor, the difference in trading volume does not really matter!

Another major difference may be the funds’ availability in the investment method that you choose. For example, some regular savings plans may only allow you to invest in one of the 2 ETFs available.

Depending on which method you wish to use to invest, this may limit your investment choice to only one ETF.

Conclusion

Both STI ETFs should provide you with very similar performances since they track the same index.

Since their expense ratio is similar, this will not affect your investment decision too.

As such, it does not really matter which STI ETF you choose to invest in!

However, G3B may be the more accessible STI ETF, especially if you choose to invest using regular savings plans.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?