Last updated on July 11th, 2021

You’ve set aside some funds for a big purchase in the near future. However, the interest rates offered by banks are really low! Is there a better place to place your savings?

If you are looking for a relatively liquid and low risk option, Endowus Cash Smart may be something you can consider.

Here is how this cash management portfolio can help you grow your savings.

Contents

- 1 Endowus Cash Smart review

- 2 What is Cash Smart?

- 3 What funds does Cash Smart invest in?

- 4 What portfolios does Cash Smart offer?

- 5 Key characteristics of Cash Smart

- 6 How does Cash Smart work?

- 7 How do I withdraw my funds from Endowus Cash Smart?

- 8 What are the fees to invest using Cash Smart?

- 9 Is Endowus Cash Smart safe?

- 10 What’s the difference between Endowus Cash Smart and Fund Smart?

- 11 What’s the difference between Endowus Cash Smart and General Investing?

- 12 Verdict

- 13 Conclusion

- 14 👉🏻 Referral Deals

Endowus Cash Smart review

Endowus Cash Smart is a fuss-free cash management solution that helps you to earn a higher rate of return on your funds compared to bank accounts. It is most suitable for any savings that you are keeping for a short term goal.

Here is Cash Smart reviewed in-depth:

What is Cash Smart?

Endowus Cash Smart is a cash management portfolio that invests your money into different funds. These funds are usually rather liquid and provides a better yield than a savings account.

Some examples of the funds that Cash Smart invests in include:

- Cash funds

- Money market funds

- Short duration bond funds

Cash Smart aims to offer you access to these funds at low costs.

This is similar to StashAway Simple, which gives you a slightly lower return but with a higher liquidity.

What is the difference between Endowus Cash Smart and Fund Smart?

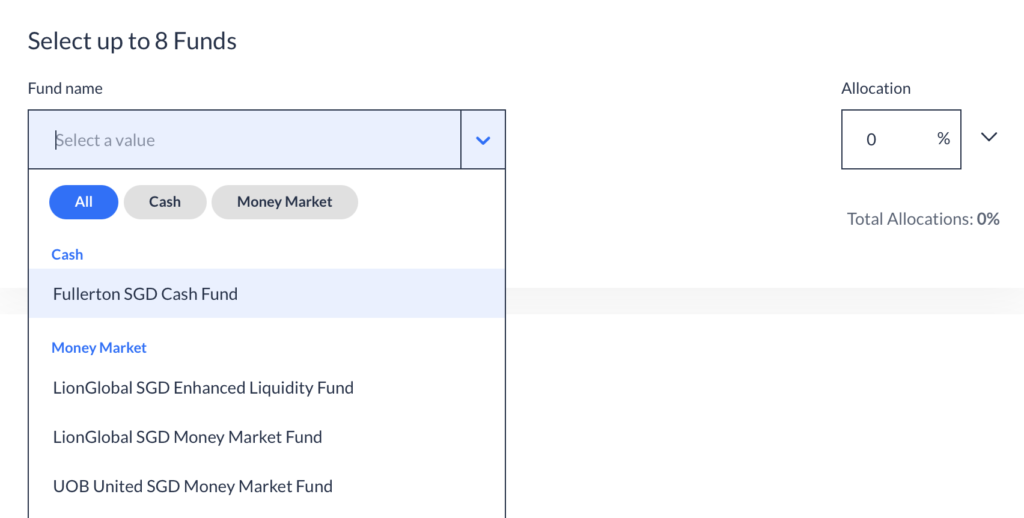

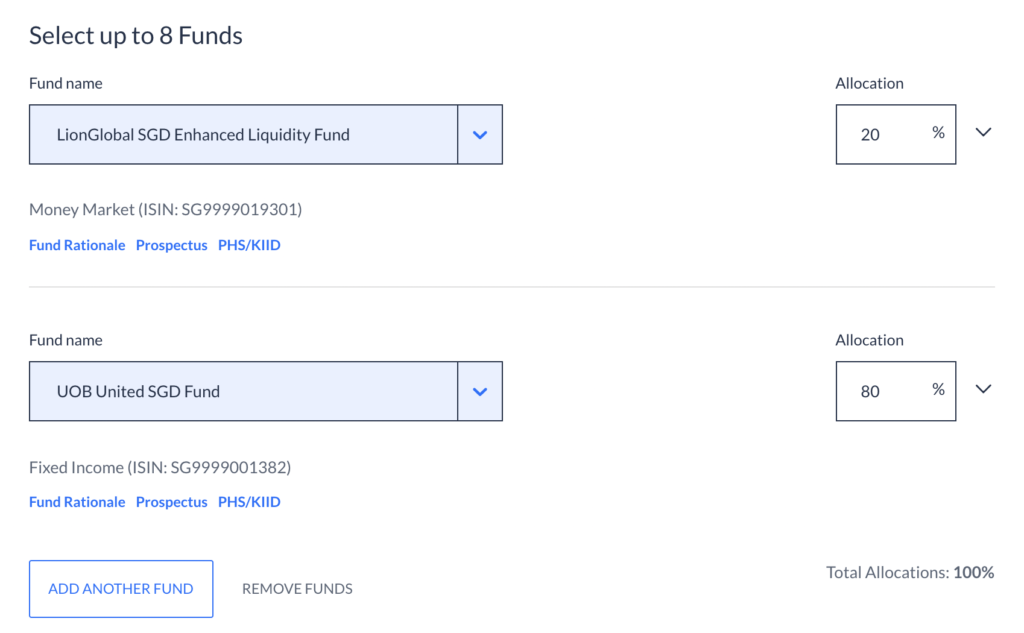

Endowus Cash Smart offers portfolios with a target allocation into certain money market funds. However, Fund Smart allows you to customise your own portfolio by choosing up to 8 funds to include in your investing strategy.

The Cash Smart portfolios include the allocation into various funds which is recommended by Endowus. They aim to provide the highest yield based on your time horizon.

However, you may not like the advised allocation. In this way, you can use Fund Smart instead to create your own portfolio!

For Fund Smart, you can choose up to 8 funds to include in your portfolio. Moreover, you can choose the target allocation for each fund.

Fund Smart would be more suitable if you are very familiar with the funds offered by Endowus. If you just want to have a higher yield, you can choose Endowus’ Cash Smart portfolios instead.

What funds does Cash Smart invest in?

Here are the following funds that Cash Smart invests in. You may find some of them familiar, as they are included in MoneyOwl WiseSaver and Grab AutoInvest portfolios.

Firstly, we shall start off with the lower risk funds:

#1 Fullerton SGD Cash Fund

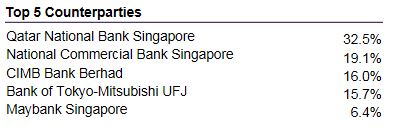

Right off the bat: The Fullerton SGD Cash Fund aims to provide you with a return that is comparable to fixed deposits. Your funds will be placed mainly in Singapore Dollar Deposits which are held in eligible financial institutions.

Here are the main banks where your funds will be deposited in.

The returns that you receive are benchmarked against fixed deposit rates. As such, the returns you earn on your funds will be stable, but rather low.

#2 LionGlobal SGD Enhanced Liquidity Fund

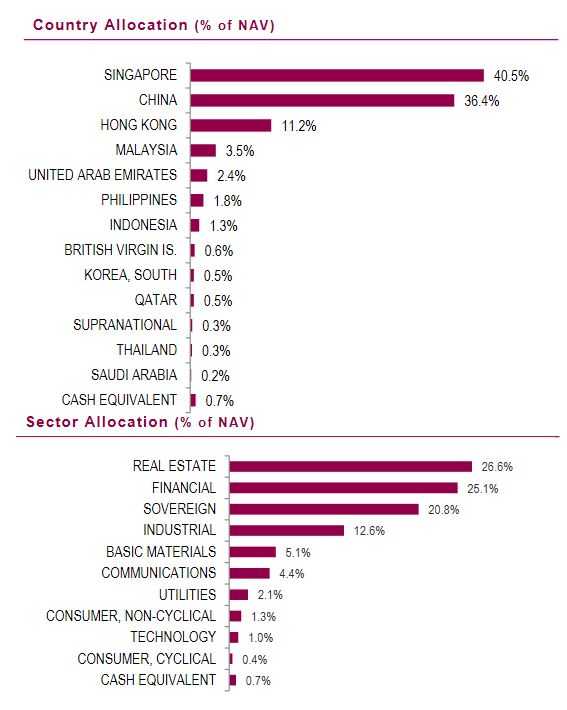

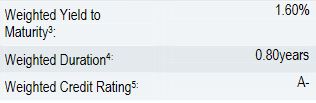

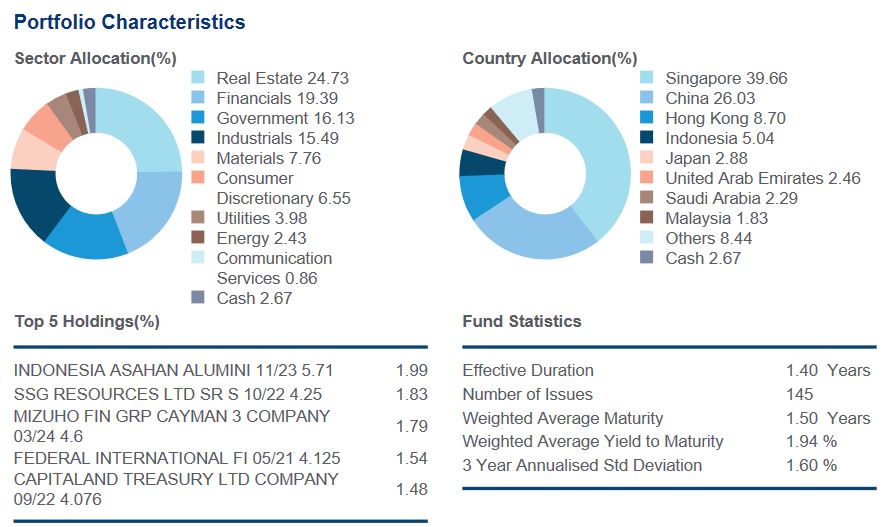

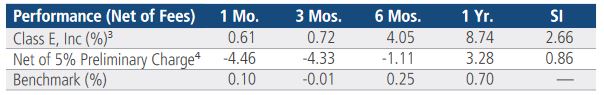

The LionGlobal SGD Enhanced Liquidity Fund aims to invest in high quality debt instruments. Here are the fund allocation and statistics.

The main things you would want to take note include:

- The assets are heavily weighted in Singapore and China (over 75%)

- It is pretty diversified across different sectors as part of the fund’s objective

- The fund has a safe credit rating of A- and a low weighted duration of 0.80 years

Duration risk is the sensitivity of a bond’s price to a 1% change in interest rates.

The longer a bond’s duration, the greater the sensitivity towards interest rate changes.

FINRA

#3 UOB United SGD Fund

Thirdly, the UOB United SGD Fund will invest your funds in these few instruments:

- Money market

- Short term interest bearing debt instruments

- Bank deposits

This fund aims to provide you a better return compared to Singapore dollar deposits. Here are some characteristics of this fund:

These are some things you may want to take note of:

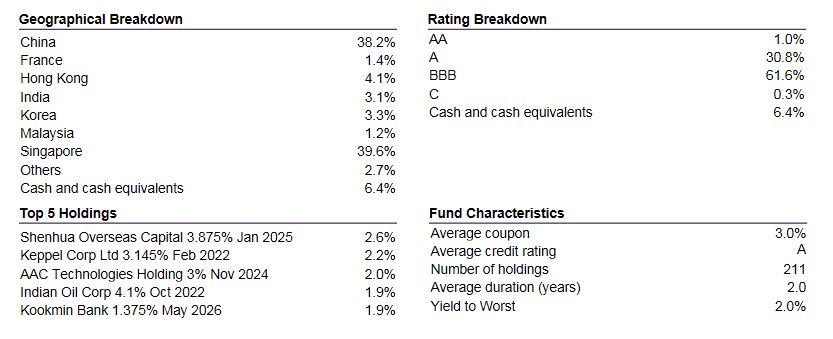

- The fund is less weighted to Singapore and China (about 65%)

- The top 5 holdings are more spread out (each only constitutes around 2% of the entire fund)

The UOB United SGD Fund provides a higher yield (annualised return of 3.13%). However, it is considered to be riskier than the previous 2 funds. This is because it has the highest duration and credit risk.

Next, we will look at higher risk (with higher returns) funds offered in the Cash Smart Ultra portfolio:

#4 Fullerton Short Term Interest Rate Fund

The aim of the Fullerton Short Term Interest Rate Fund is to provide medium-term capital appreciation through fixed income securities and money market instruments.

Here are some pointers to take note of:

- Portfolio holdings are also concentrated in China and Singapore, making up a total of almost 80% of the portfolio.

- Most of its holdings hold a subpar credit score of BBB (61.6%). This gives the portfolio a decent 3.22% annualised rate of return (excl. charges) since inception at the expense of credit risk.

#5 LionGlobal Short Duration Bond Fund

The LionGlobal Short Duration Bond Fund aims to provide medium to long term growth through a portfolio of Singapore and international bonds. While the fund generally invests in bonds with investment grade quality, it may also be exposed to sub-investment grade securities.

Bonds that have BBB credit ratings and above are classified as investment grade.

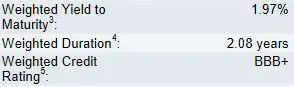

See the similarity with the Fullerton Short Term Fund? This fund also mainly invests in Singapore and China (almost 70% of the portfolio) and has a weighed credit rating of BBB+. However, it outperforms the Fullerton Short Term Fund in the long run, with an annualised rate of return of 3.9% p.a. since inception!

Bonds with low credit ratings may sound like an investment to avoid. But when managed well, it provides opportunities for appreciable returns!

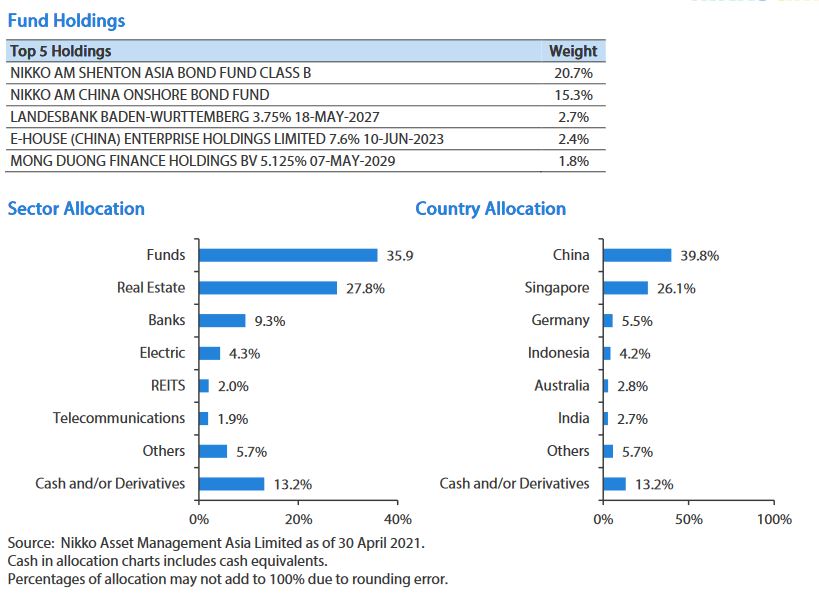

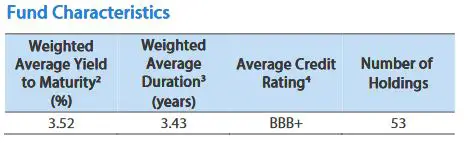

#6 Nikko Shenton Income Fund

Sounds like you are getting the hang of how bond funds work? Let’s look at the next fund offered: The Nikko Shenton Income Fund. Unlike its other bond market counterparts so far, it offers a target return of at least 4% p.a through a of bonds, money market instruments and currencies.

Here are the holdings and country allocation of the fund.

Despite that a sizeable portion of the fund still focuses on China and Singapore (about 66%), it’s interesting to note that 2 of its top 5 holdings are not from Asia!

Let’s check out the fund’s characteristics:

Similar to the Fullerton Short Term and LionGlobal Short Duration bond funds, this fund has an average credit rating of BBB+. However, it carries a longer average duration of 3.43 years, thus increasing its interest rate risk.

Now to the most question: Has the fund met its 4% p.a. target as advertised? Let’s find out!

It turns out that it had, with a return of 4.31% p.a. since inception!

However, you may want to note that its performance over the past 5 years has been relatively subpar.

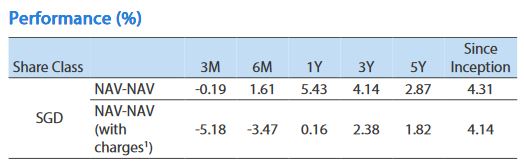

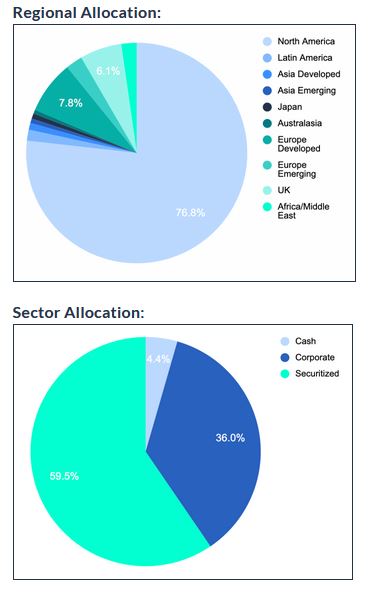

#7 PIMCO Low Duration Income Fund

The last fund offered on Cash Smart is the PIMCO Low Duration Income Fund. This is a UCITS fund whose aim is to seek attractive income, with long term capital-term capital appreciation being its secondary objective.

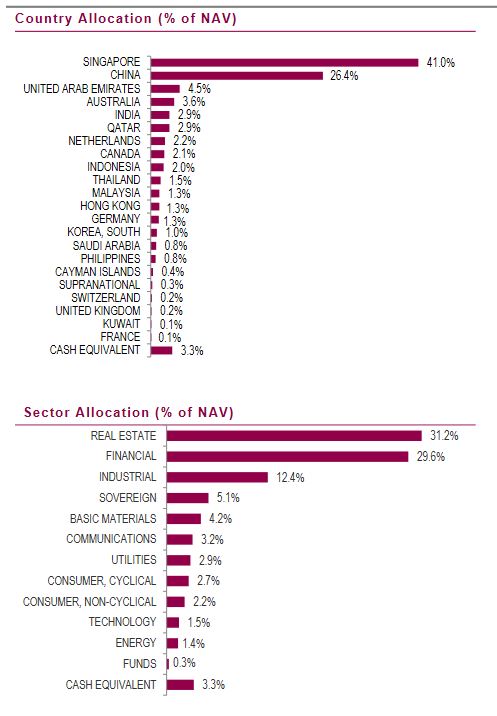

Unlike the other 3 short-term bond funds mentioned above (#4 – #6) which has a Singapore-China focus, the PIMCO Low Duration Income Fund invests mainly in the USA (almost 80% of its portfolio).

When combined with these other funds, it offers an opportunity for geographical diversification to reduce risk.

This fund is generally safer too. It boasts an average credit quality of A, along with a lower effective duration of 1.12 years.

As it focuses on bonds that have higher credit ratings, we can see that its returns are lower than its counterparts with lower credit quality (at 2.66% p.a.).

What portfolios does Cash Smart offer?

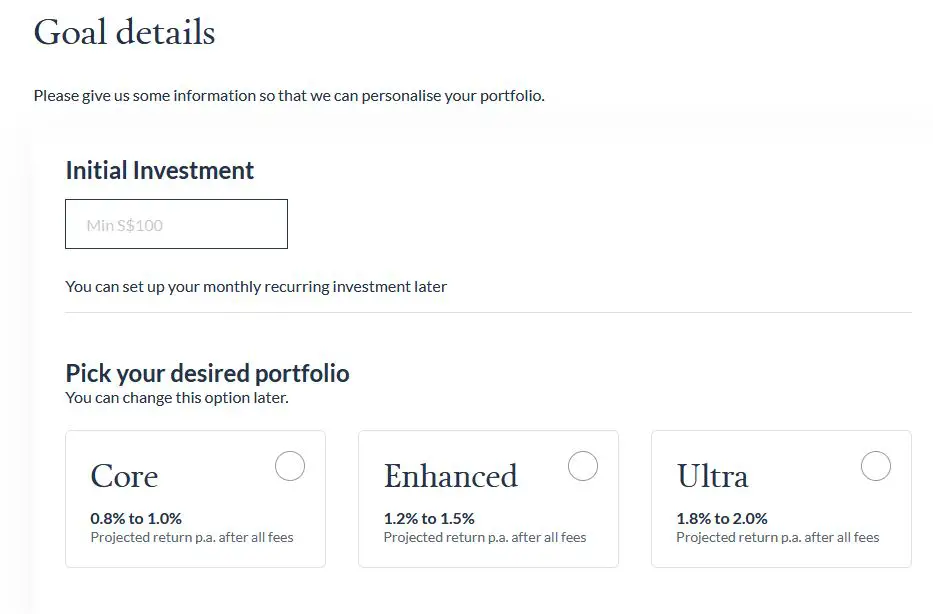

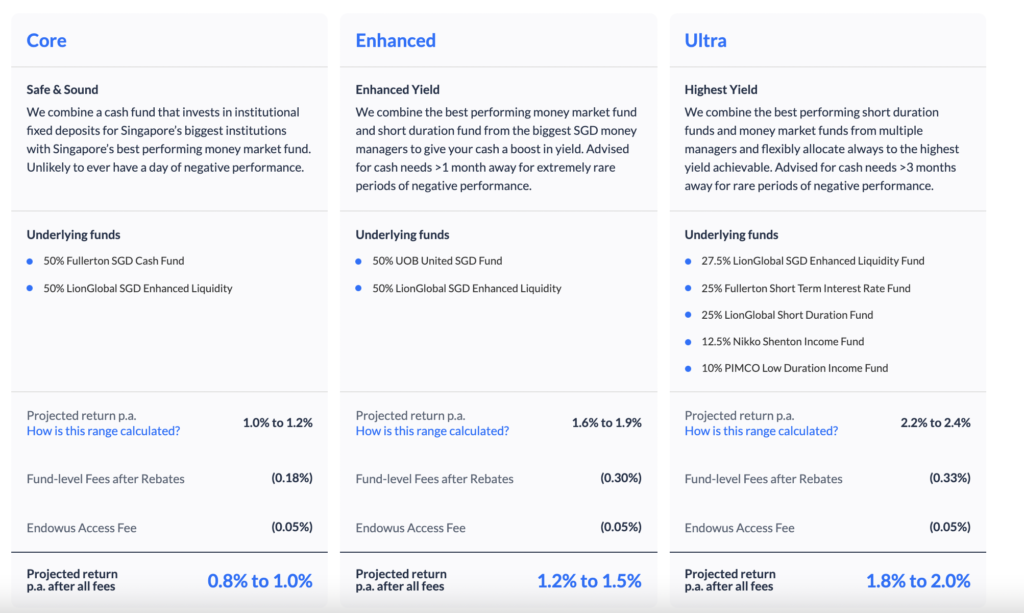

Based on these 7 funds, Cash Smart offers you 3 different portfolios:

#1 Core Portfolio

The Core Portfolio consists of relatively risk free investments in money market funds. The 2 funds found in this portfolio are:

- Fullerton SGD Cash Fund (50%)

- LionGlobal SGD Enhanced Liquidity (50%)

It provides you with a projected return of 0.8-1.0% (after fees). Endowus believes that you most likely will not experience negative performances.

As such, you are able to store the cash that you need in the very short term, such as in the next few days or weeks.

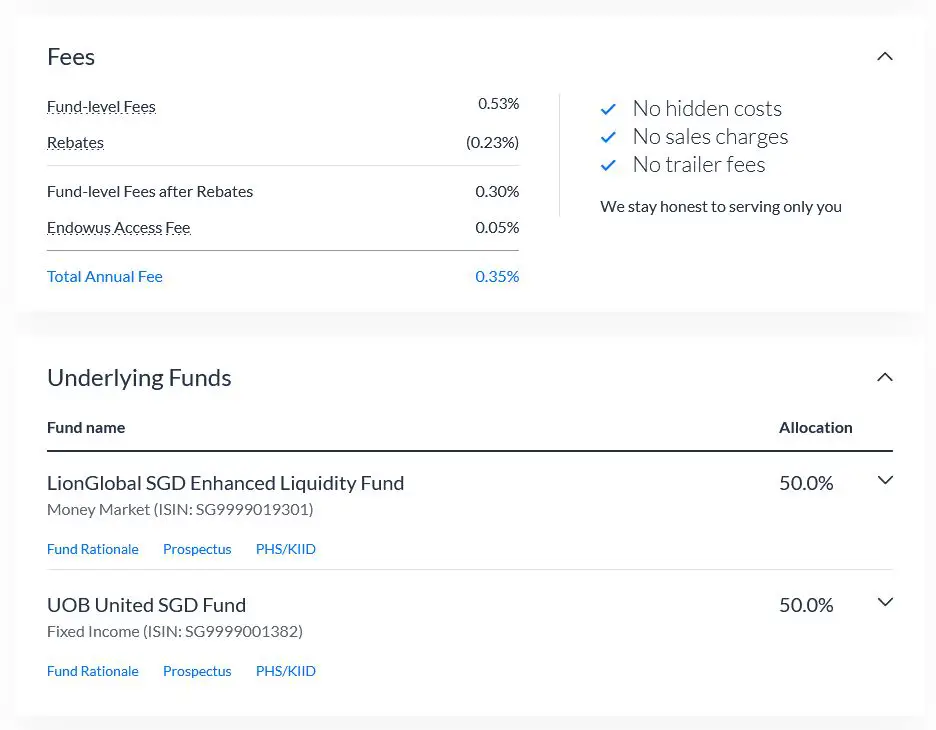

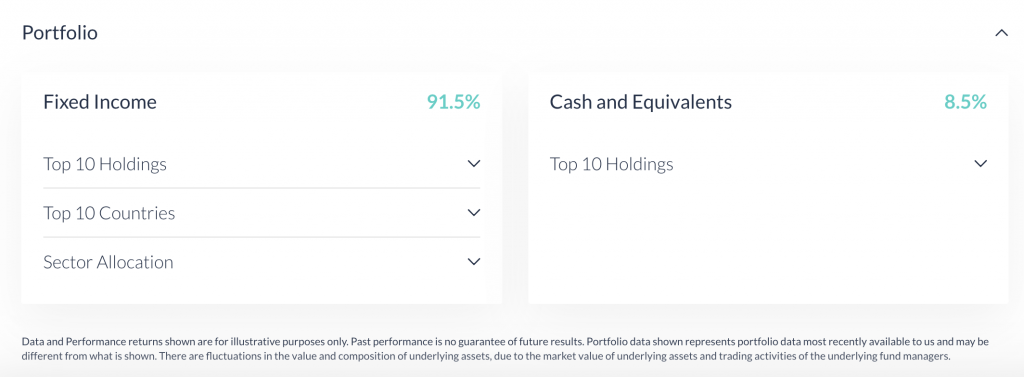

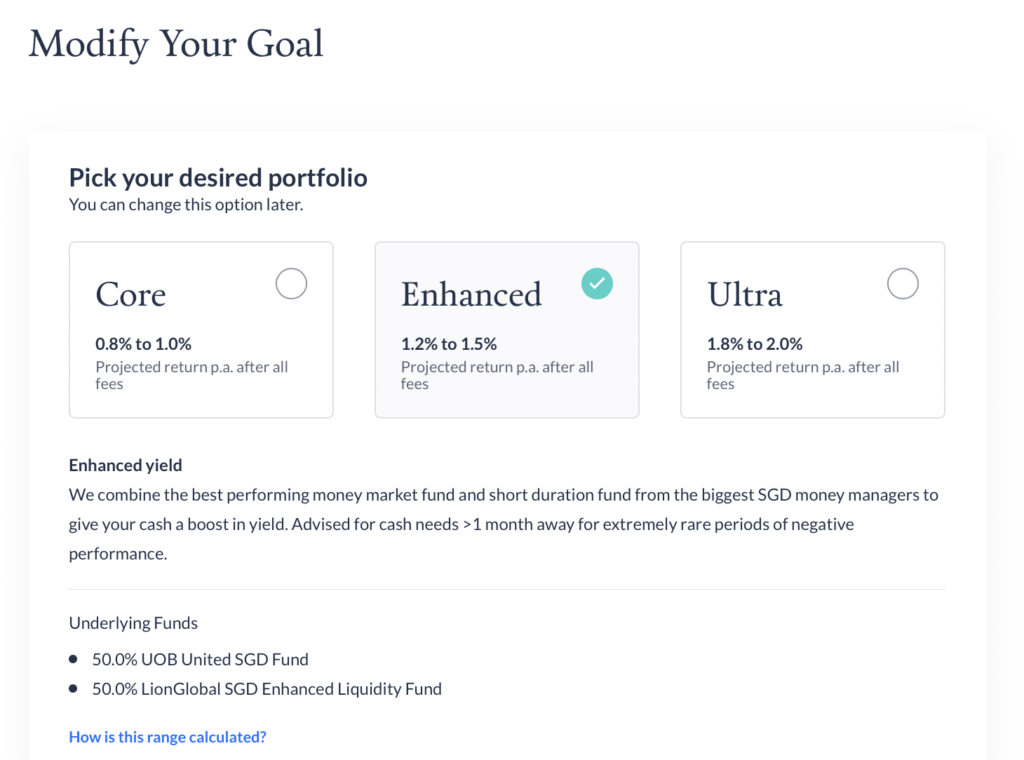

#2 Enhanced Portfolio

The Enhanced Portfolio provides a slightly riskier composition. This portfolio consists of:

- UOB United SGD Fund (50%)

- LionGlobal SGD Enhanced Liquidity (50%)

You are projected to have a yield between 1.2-1.5% (after fees). Endowus recommends this portfolio if you only require the money later than 1 month from the time you invest.

This is because there is a slight possibility that you may experience negative performances.

#3 Ultra Portfolio

The Ultra portfolio contains 5 different funds in this allocation:

| Fund | Allocation |

|---|---|

| LionGlobal SGD Enhanced Liquidity Fund | 27.5% |

| Fullerton Short Term Interest Rate Fund | 25% |

| LionGlobal Short Duration Fund | 25% |

| Nikko Shenton Income Fund | 12.5% |

| PIMCO Low Duration Income Fund | 10% |

The aim of this portfolio is to maximise the yields of your portfolio by investing in different funds. The projected yield is between 1.8% – 2% (after fees).

However, you will need to have a time horizon of at least 3 months, as there are higher risks involved with this fund compared to the other 2.

Why is there a range of projected returns?

Endowus believes in giving you full transparency on the yields of the portfolios. The returns that you earn in your investments may fluctuate each day.

This is because your returns are tied to the interest rates of that day.

As such, a range of projected returns will help you to see how well the portfolio performs in scenarios when:

- The market is bad

- The market is performing well

Moreover, Cash Smart may update their yields from time to time. You can view the latest updates on Endowus’ blog.

Key characteristics of Cash Smart

Here are 3 things you may want to take note:

#1 The minimum amount to begin using the Endowus platform is $1k

To start investing in Cash Smart, you will need to make an initial investment of $1,000. For every subsequent transaction, you will need to invest a minimum of $100.

The initial investment can come from 3 different sources:

- Cash

- SRS

- CPF

You are able to combine funds from your Cash, SRS and CPF to reach the $1k total. Moreover, you can use these funds to invest in Endowus’ other portfolios, such as:

- General Investing (for Cash, SRS or CPF)

- Fund Smart

This may be a huge initial amount if you are just starting your investment journey. As such, this is something you should consider first before you start to use Endowus.

#2 No lock-ups or transaction fees

There is no lock-up when you invest in Cash Smart. This means that you can freely deposit and withdraw from your portfolio from anytime. You will also not be charged any transaction fees.

This really makes the money in Cash Smart very liquid. This is unlike insurance savings plans like GIGANTIQ which charge you a withdrawal fee.

However, you may want to note that the minimum amount for each transaction is $100. You will not be able to withdraw any amounts that are less than $100.

#3 No limits or tiers

Cash Smart does not have any limits or tiers. This means that you can invest as much as you want into this portfolio.

Moreover, the yield that you will receive will be the same, no matter how much money you put into this portfolio!

#4 You can only use Cash or SRS to invest in Cash Smart

Cash Smart only allows you to invest your Cash or SRS. You will not be able to invest your CPF funds into Cash Smart.

How does Cash Smart work?

Here are the 3 main aspects on how Cash Smart works.

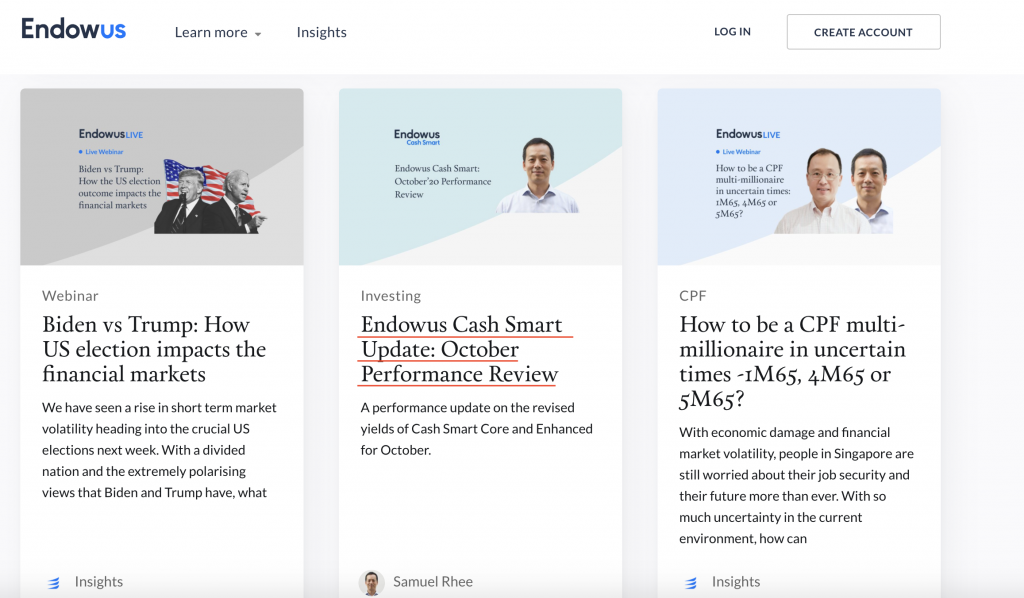

#1 Creating your portfolio

To create your Cash Smart portfolio, here’s what you’ll need to do:

1. 1. Go to ‘Add Goal’ on the left side of the webpage

If you’ve just created your Endowus account, you would not need to do this step.

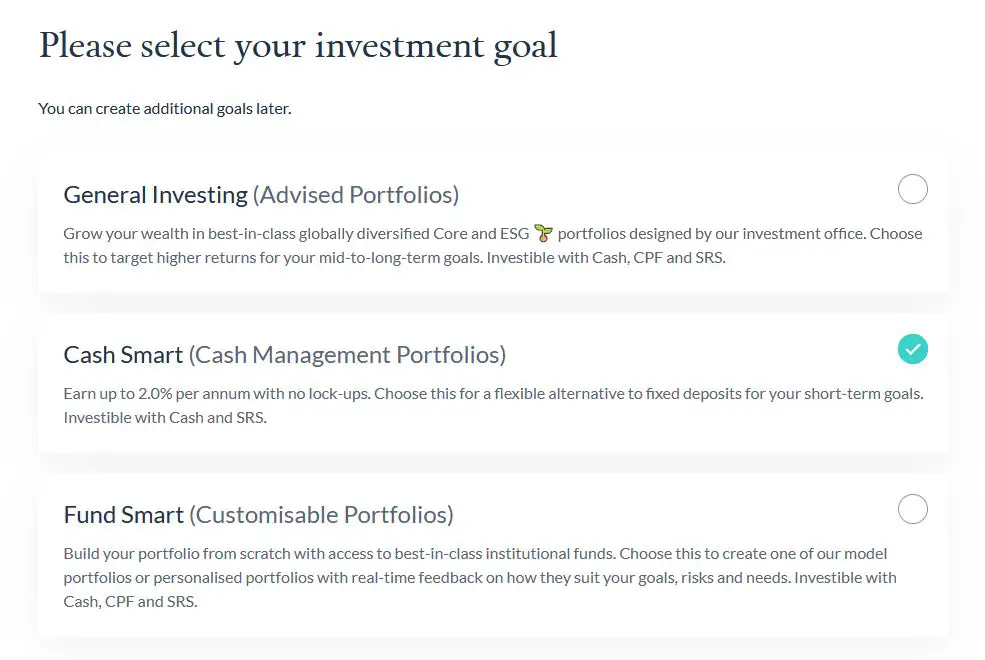

2. Select Cash Management as the portfolio you wish to create

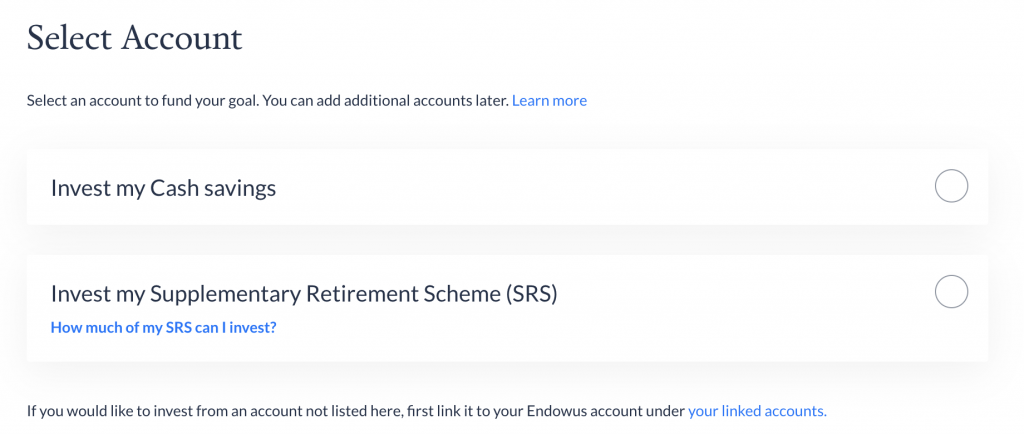

3. Select the funds that you wish to use to fund this portfolio

You can choose to invest either your Cash or SRS funds.

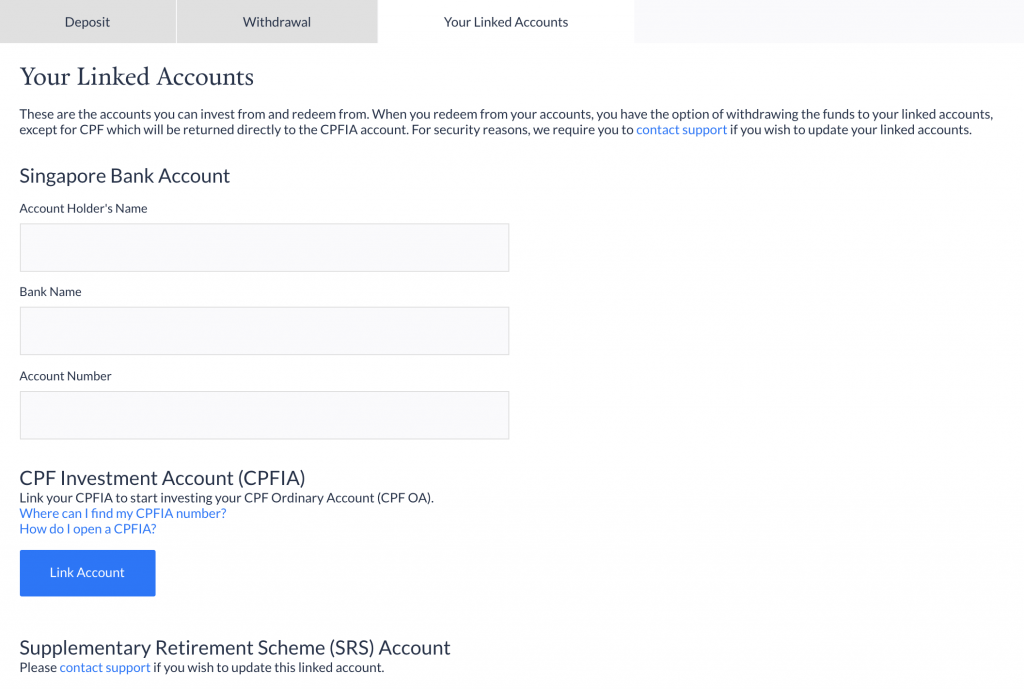

You will have to link your Cash or SRS accounts first before you can start to transfer your funds.

4. Select your portfolio and initial investment amount

The minimum amount to start getting invested is $100.

You will then be able to see the Fees and Underlying Funds,

as well as the holdings in your portfolio.

After confirming via SMS OTP, your portfolio will be created!

#2 Fund your Cash Smart Portfolio

To start investing with Cash Smart, you will need to fund your account.

If you are investing in Cash Smart using SRS, Endowus will automatically deduct the funds from your linked SRS account.

As such, don’t forget to ensure that your SRS account has enough funds!

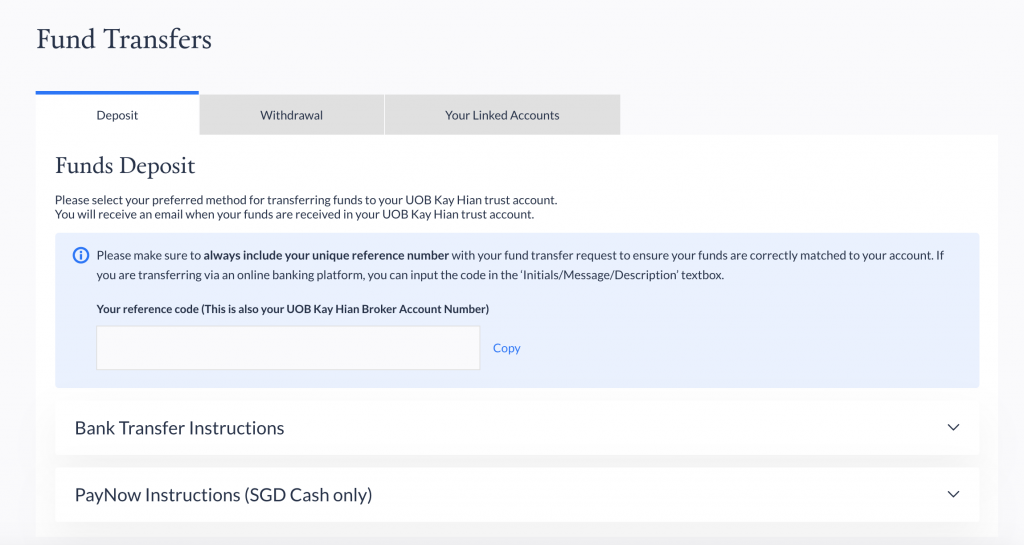

If you are using cash, you will need to go to ‘Invest | Redeem | Transfer → Deposit Cash‘ on the Endowus platform.

You will need to transfer your funds to Endowus’ bank account. Don’t forget to include your reference code!

Endowus also allows you to set up a recurring transfer. This will allow you develop a savings habit by contributing each month to your short term goal.

Once Endowus has received your funds, you will be sent emails regarding your investment progress.

It took around 2 working days for my funds to be invested.

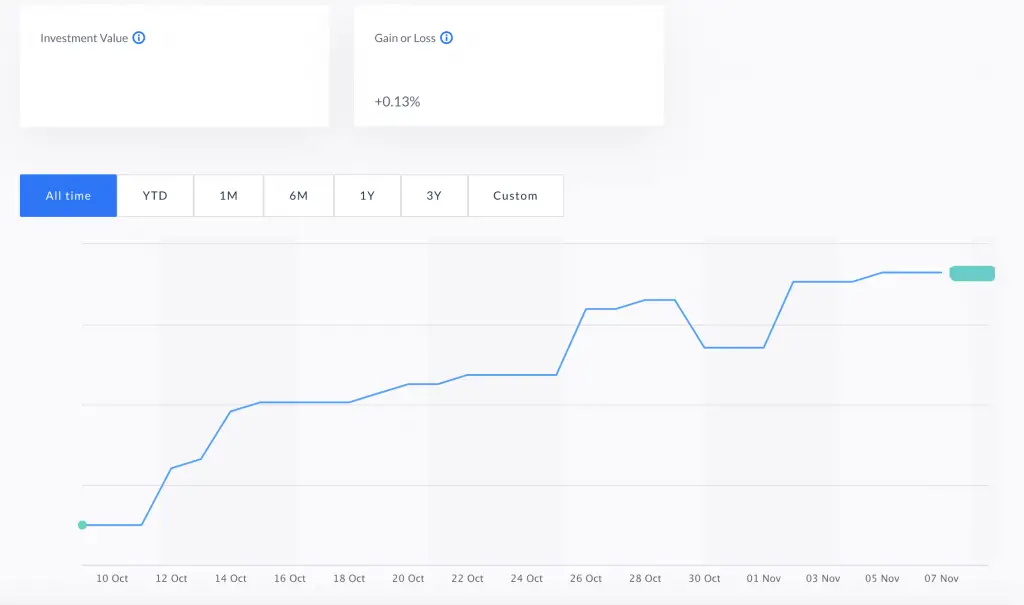

#3 View your performance

You can view how your Cash Smart portfolio is performing in the ‘Performance‘ tab. Here’s how my Enhanced Portfolio has been performing in one month.

My portfolio has been growing pretty steadily over this past month.

How do I withdraw my funds from Endowus Cash Smart?

To withdraw your funds from Endowus Cash Smart, you will need to make a redemption request on the platform. The minimum amount to withdraw is $100, and it will take between 6-10 business days before you receive your funds.

If you want to liquidate your portfolio for cash, you will need to redeem your portfolio first before withdrawing your funds. You can view my guide to find out more on how to withdraw your funds from Endowus.

The amount that you actually receive may be different from the amount you redeem.

This is because:

- Endowus will deduct the access fee from your funds before transferring you the remainder

- The price at which the units of the funds which are sold may be different from the current asset value

You should expect the funds to reach your bank account within 6 business days for cash and within 10 business days for CPF/SRS funds.

As such, do try to redeem your funds at least 2 weeks before you require them!

What are the fees to invest using Cash Smart?

For investments in Endowus (including Cash Smart), you will be paying 2 layers of fees:

- Access fee to Endowus

- Fund-level fees to the fund managers

The projected yield that you will receive is net of these 2 fees that you need to pay.

Firstly, Endowus charges an access fee of 0.05% a year for their Cash Smart portfolio. This fee is deducted from your total average daily assets with Endowus each quarter. The fee is pretty affordable and is much cheaper compared to other low cost platforms.

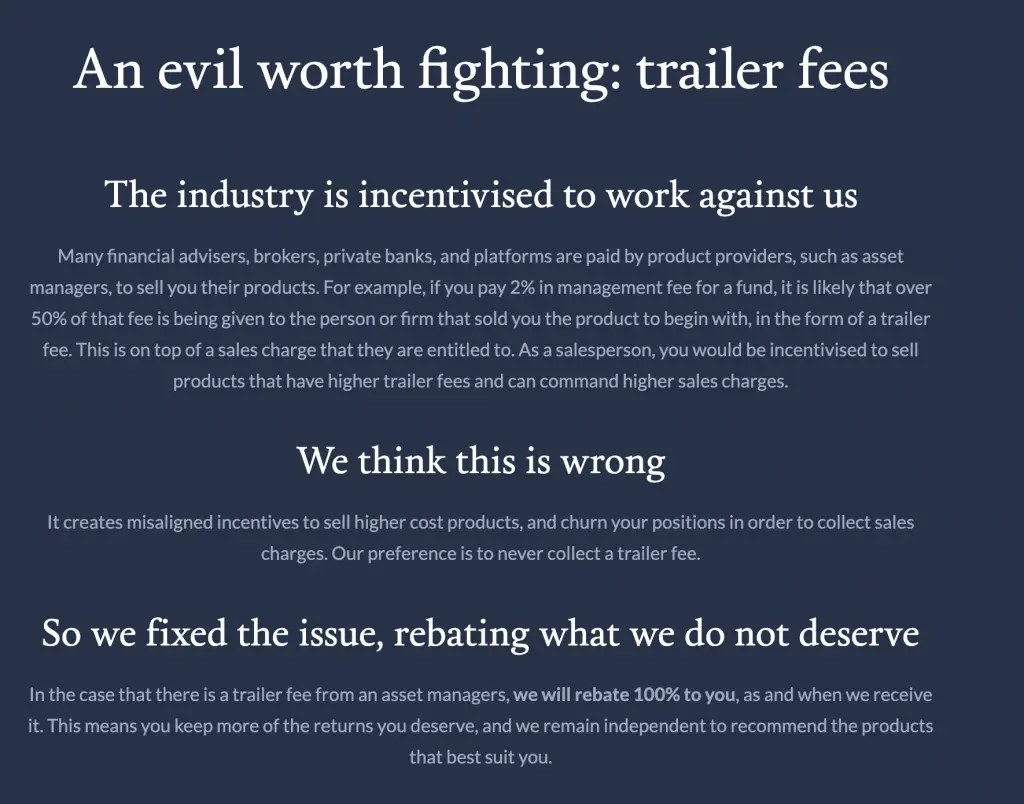

The second layer of fees are fund-level fees payable to fund managers who are managing your portfolio.

To keep fund-level fees as low as possible, Endowus rebates 100% of the trailer fees that it receives from the fund managers.

Trailer fees are fees that a fund manager pays a platform. This is similar to a commission that the platform receives for introducing the investor to the fund.

Ultimately, you will be paying institutional share-class fees for your funds!

Is Endowus Cash Smart safe?

Your funds with Endowus Cash Smart are kept in a UOB Kay Hian account that is under your own name. In the event that Endowus closes down, you will still be able to have control over your assets.

You may have heard the news about Smartly closing down. As such, you may be afraid of the risks involved with investing in a robo-advisor.

However, Endowus is possibly one of the safer robo-advisors to invest in. This is because your assets are held under your own name.

When you are signing up for Endowus, they will help you to create a UOB Kay Hian account under your own name. This is where all of your assets will be stored.

In the event that Endowus closes down, all of your assets are safely under your own name. As such, you are able to decide whether you wish to hold onto the assets or to sell them.

This is in contrast to robo-advisors that co-mingle your assets with other customers under a single custodian account.

If these firms like StashAway or Syfe close down, you may have some issues with the transferring of assets.

Is Endowus insured?

Endowus Cash Smart is not insured by the SDIC, as your money is invested into unit trusts. Nevertheless, Cash Smart consists of funds with holdings that are spread across different banks, which ensures that your risk will be spread out.

Is Endowus Cash Smart capital guaranteed?

Endowus Cash Smart is not capital guaranteed as it invests your money into a variety of low-risk funds. The value of these funds will fluctuate daily, and there may be periods where you may experience negative performances.

While Endowus Cash Smart invests in low-risk funds, this does not mean that they are capital guaranteed! It is still possible for you to lose money when you invest in these funds.

For example, here was how my portfolio dropped in value between March and May 2021. I did not add or withdraw funds during this period, so it shows how your portfolio’s value can fluctuate.

There is still a risk that your portfolio will lose its value, especially in the short term. However, the returns should normalise after staying invested for a longer period of time.

This is also why Endowus has a recommended time horizon for each portfolio that they have. If you are close to the date where you need your funds, you may want to switch to the Core portfolio instead.

Alternatively, you can look for capital guaranteed options, such as Dash PET.

What’s the difference between Endowus Cash Smart and Fund Smart?

Endowus Cash Smart offers you advised cash management portfolios, based on Endowus’ recommended allocation. However for Fund Smart, you can build your customised cash management portfolio by choosing the funds and your allocation into each fund.

Endowus Cash Smart has a fixed allocation into the different cash management funds. This is the allocation that Endowus believes is the best for you.

However, you may feel like you can beat the returns that Cash Smart is offering you. This is where Fund Smart comes in, where you can choose your own cash management portfolio.

You can choose from 8 different cash management funds, including:

- Fullerton SGD Cash Fund

- Fullerton Short Term Interest Rate Fund

- LionGlobal Short Duration Bond Fund

- UOB United SGD Fund

- UOB United SGD Money Market Fund

- LionGlobal SGD Enhanced Liquidity Fund

- LionGlobal SGD Money Market Fund

You can choose the allocation you wish to have into each of these funds too.

If you are a more savvy investor, investing via Fund Smart may be the better choice for you!

What’s the difference between Endowus Cash Smart and General Investing?

Endowus Cash Smart offers cash management portfolios that are good for short term goals. If you want to save for a long term goal, Endowus’ General Investing portfolios are more suitable, which include a mixture of stocks and bonds.

Endowus Cash Smart is suitable if you’re saving for a short term goal. This is because the money market funds are relatively stable and you should not experience a huge loss on your capital.

However if you’re saving for a long term goal, you will have a longer time horizon to deal with the volatilities. In this way, the General Investing portfolios will be more suitable for you.

The General Investing portfolios invests your money into funds containing stocks or bonds. You can choose to invest in a variety of portfolios, ranging from the Ultra Defensive to the Aggressive portfolios.

You can choose to create an ESG portfolio too!

The General Investing portfolios have higher returns compared to Cash Smart. Due to their volatility, you should only be using them for long term goals.

Verdict

Is Endowus Cash Smart something worth investing in? I think that it is a great place to keep your savings for a short-term goal.

You may be saving up to buy something in the near future, such as a car or house. By placing your savings in Cash Smart, you are able to earn a better yield compared to leaving it in your savings account.

However, here are 2 points you may want to consider first:

- The initial investment amount is $1k, which may be quite high

- It may take up to 6 (for cash) or 10 business days (for CPF/SRS) before you will receive your funds

As such, don’t forget to redeem your funds from Endowus at least 2 weeks earlier!

Which portfolio should I choose?

You may be wondering which portfolio you should be using. Here are some considerations for you:

Choose the Core Portfolio for really short term goals

If you need the cash in a few days’ or even weeks’ time, you should go for the lower risk portfolio. Although the yield is lower, you should not experience any negative performances. This ensures that you do not withdraw a lower amount compared to your initial capital!

If you are looking for higher liquidity and better yields for funds going toward your short term goals, you may want to consider the SingLife Account instead. This is a flexible insurance savings plan that provides you with a 1% return on your first $10k.

Choose the Enhanced Portfolio for a slightly longer time horizon

If you need your money in the next month, you may want to use the Enhanced portfolio instead. This helps you to receive a slightly higher yield by taking more risks compared to the Core portfolio.

You may want to take note that Syfe’s Cash+ offers a return similar to the Enhanced Portfolio. However, Cash+ offers higher liquidity and no minimum amounts to invest.

Choose the Ultra Portfolio for longer term goals

You may need the money in the next few years. As such, the Ultra Portfolio provides you with the highest yield. With a longer time horizon, this gives you enough time to compensate for any days that you have a poorer return.

You can change between goals to suit your time horizon

You can change between any of the 3 portfolios any time by selecting your goal under ‘My Goals’ → ‘Goal Settings’→ ‘Modify Goal’ on the Endowus platform.

One tactic you can use to optimise your returns is to choose the Ultra portfolio at the start.

However, once you are closer to the date of your large purchase, you can switch to the Enhanced portfolio.

When you are less than a month away from your purchase, you can switch to the Core portfolio to lower your risk even more.

Conclusion

Endowus Cash Smart is a great place to store your funds for a short term goal. With its flexibility to switch between portfolios of different risk levels and decent yield, it may be something that you can consider to earn more returns on your savings.

If you’d like to find out more about Cash Smart, you can view Endowus’ webinar on it below:

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?