Last updated on September 5th, 2021

Endowus is one of the many robo-advisors that are available in Singapore.

They operate slightly differently from the other platforms, so you may be a bit confused about what they are offering.

Here’s what you need to know about this platform.

Contents

- 1 How is Endowus different from other robo-advisors?

- 2 Is Endowus a broker or a unit trust?

- 3 Does Endowus invest in ETFs?

- 4 How do I start investing with Endowus?

- 5 How much should I invest in Endowus?

- 6 Can I use Endowus to invest my CPF SA funds?

- 7 Can I invest my CPF OA Funds into the S&P 500?

- 8 What are some of the portfolios that Endowus offers?

- 9 How does Endowus rebalance my portfolio?

- 10 Does Endowus pay dividends?

- 11 What happens if Endowus closes down?

- 12 How does Endowus make money?

- 13 Is Endowus expensive?

- 14 How much does it cost to invest my CPF funds with Endowus?

- 15 Does Endowus have a mobile app?

- 16 Conclusion

- 17 👉🏻 Referral Deals

How is Endowus different from other robo-advisors?

Endowus invests in unit trusts, which is a different approach compared to other robo-advisors that invest in ETFs. They mainly focus on broad diversification and low cost investing, and try to lower your costs as much as possible.

Endowus are one of the very few robo-advisors that invest in unit trusts. The other platform that does so is MoneyOwl.

Is Endowus a broker or a unit trust?

Endowus is neither a broker or a unit trust. Instead, they are a platform that offers low-cost unit trusts from reputable fund managers. You are able to use their advised portfolios, or create your own with Fund Smart.

Endowus is not a unit trust by itself. However, they provide you with access to unit trusts from reputable fund managers, including:

- PIMCO

- Dimensional

- Vanguard

- Schroders

Does Endowus invest in ETFs?

Endowus does not invest your money into Exchange-Traded Funds (ETFs). Instead, it invests your money into unit trusts (or mutual funds) that are from reputable fund managers.

You may have the idea that unit trusts are:

- Very expensive

- Actively managed

However, that is not always the case!

Endowus’ focus is on funds that are:

- Low cost

- Passive in nature

- Globally diversified

As such, the funds that they have on their platform all have these characteristics.

For example, Endowus invests in the Dimensional World Equity Fund, which has an expense ratio of 0.40%.

Endowus allows you to access the institutional share classes of these funds. This means that the fees that you pay are much lower, compared to the retail share classes that you’ll buy on other platforms.

In the end, the fees that you pay for the unit trusts on Endowus may be comparable to that of ETFs with similar holdings.

The main difference between ETFs and unit trusts is that ETFs can be traded on an exchange when the market is open. Meanwhile, unit trusts only trade once a day after the market closes.

Both are still similar as they hold a basket of stocks or bonds.

How do I start investing with Endowus?

Here are 8 steps to start investing with Endowus:

- Create an Endowus account

- Take an online education module on Unit Trusts

- Go to ‘Invest | Redeem | Transfer’ and click on Invest

- Select the your investment goal

- Select your funding source

- Select your risk tolerance for your goal

- View and confirm the details of your goal

- Fund your account (for cash investments)

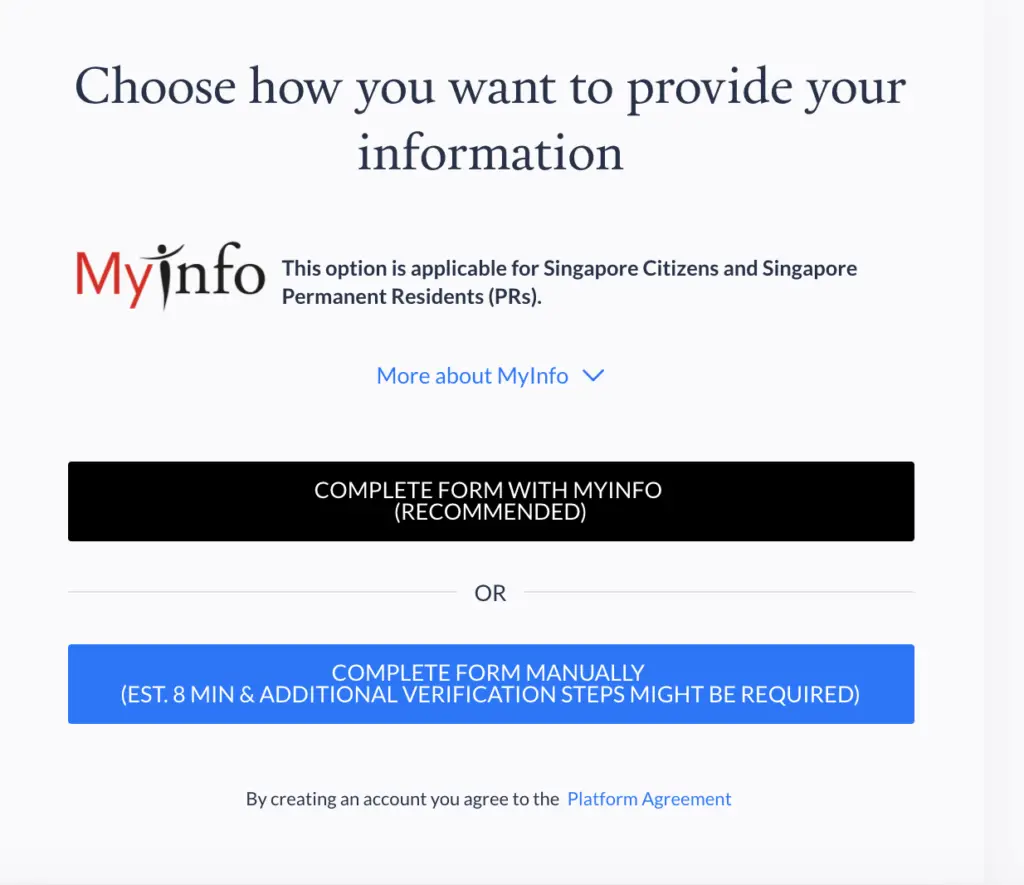

The first thing you’ll need to do is to create an Endowus account. This is quite fast as you can use MyInfo to fill in your details.

You can use my referral link when signing up to get a $20 Access Fee Credit.

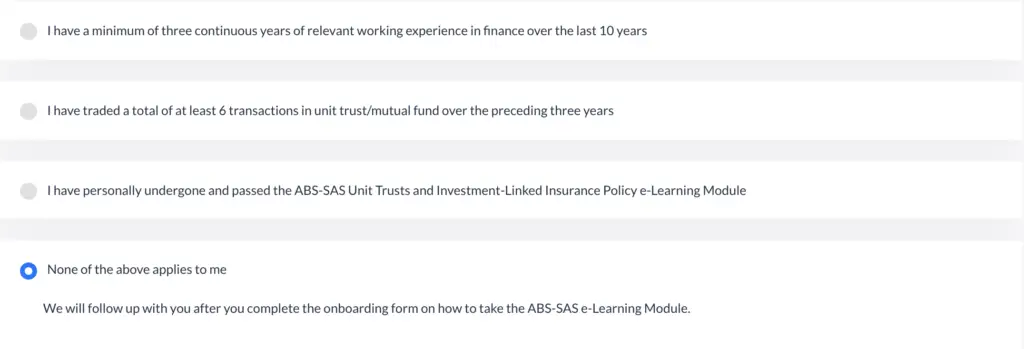

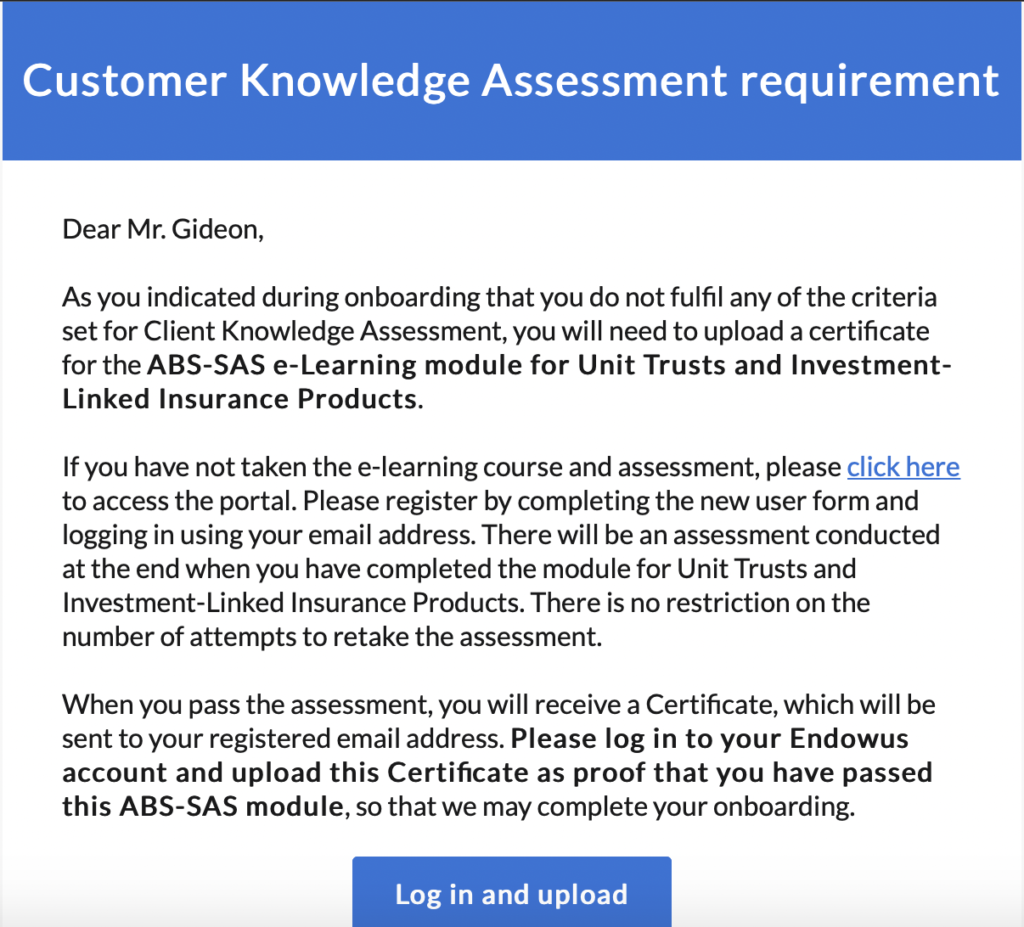

After signing up as a retail investor, you will need to take the Customer Knowledge Assessment (CKA). There are certain criteria that you need to meet.

For most of us, we would need to take the ‘Unit Trusts and Investment-linked Insurance Policies‘ module to pass the assessment.

Once your account has been created, you can start to invest your funds by going to ‘Invest | Redeem | Transfer‘.

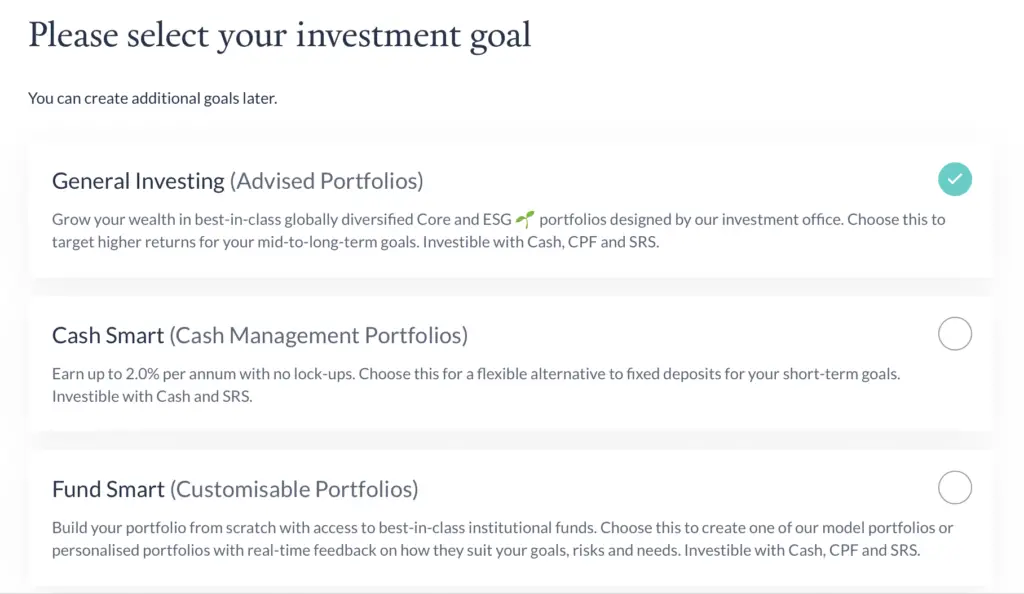

After selecting ‘Add Goal‘, you will be asked which Investment Goal you would like to create. There are 3 main types of portfolios you can create:

- General Investing (Advised Portfolios)

- Cash Smart (Cash Management Portfolios)

- Fund Smart (Customisable Portfolios)

Cash Smart would be a good place for you to store some of your emergency funds and savings for a short term goal.

If you want to create your customised portfolio with Endowus’ funds, you can do so with Fund Smart.

Otherwise, you can use General Investing to create either a Core or ESG portfolio.

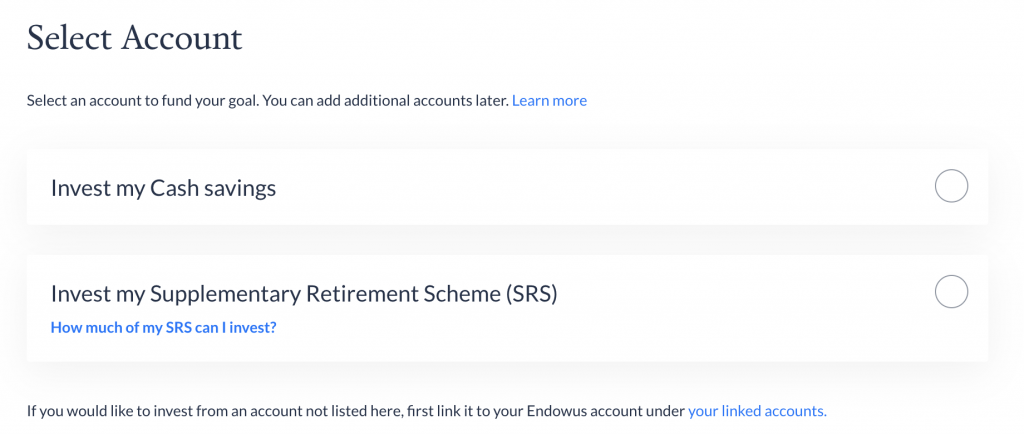

You will need to select the source of your funds, which is either Cash / SRS / CPF.

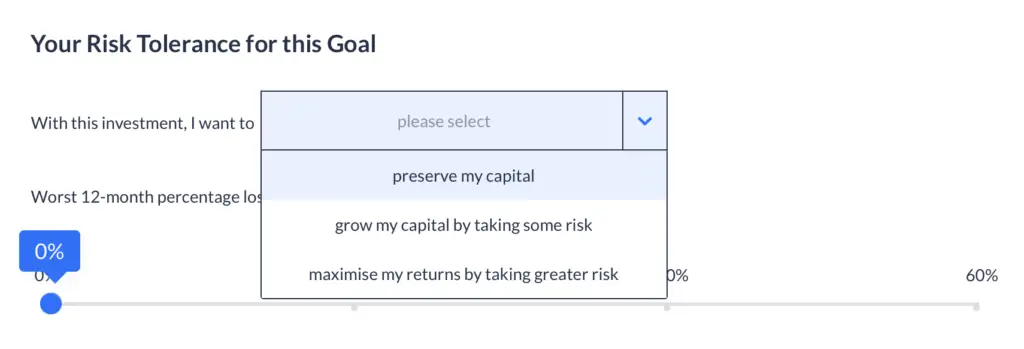

If you have selected the Advised Portfolio, you will need to choose:

- The amount you wish to invest

- Your risk tolerance for the goal

This depends on whether you want to:

- Preserve your capital

- Grow your capital by taking some risk

- Maximise your returns by taking greater risks

The higher the risk you’re willing to take, the greater the allocation towards equities (stocks).

Endowus requires you to make an initial investment of $1,000. For every subsequent investment, you will need to invest at least $100.

After selecting your goal, you will be shown some details regarding the portfolio.

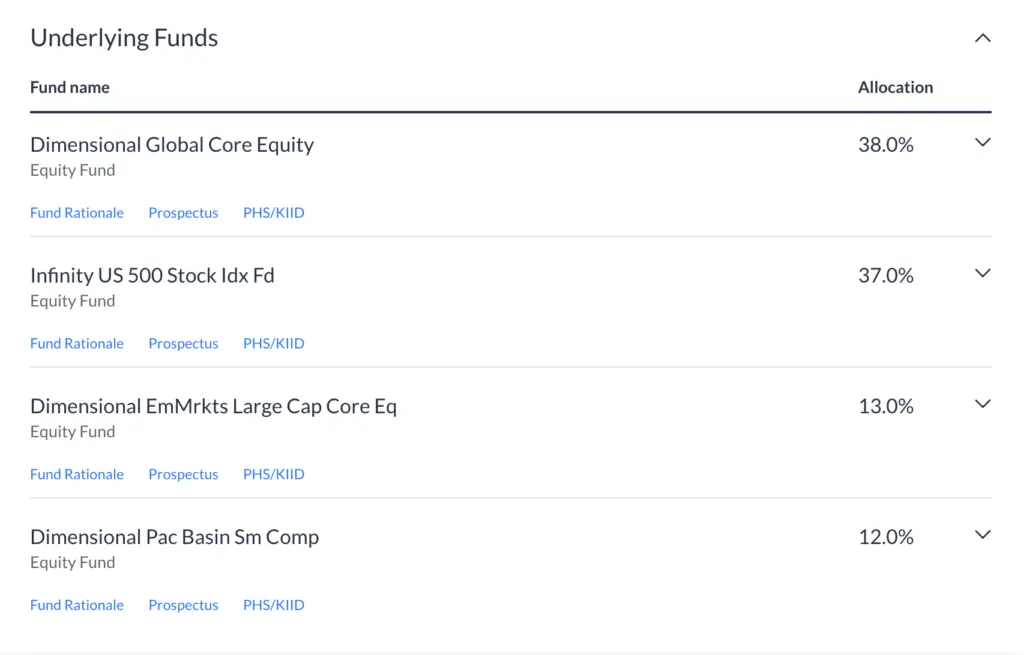

This includes the underlying funds,

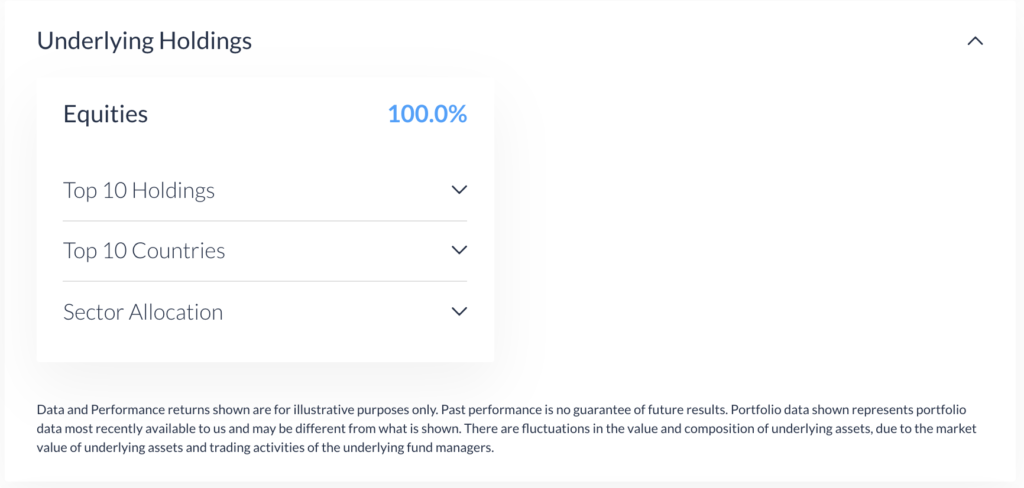

the top holdings of your portfolio,

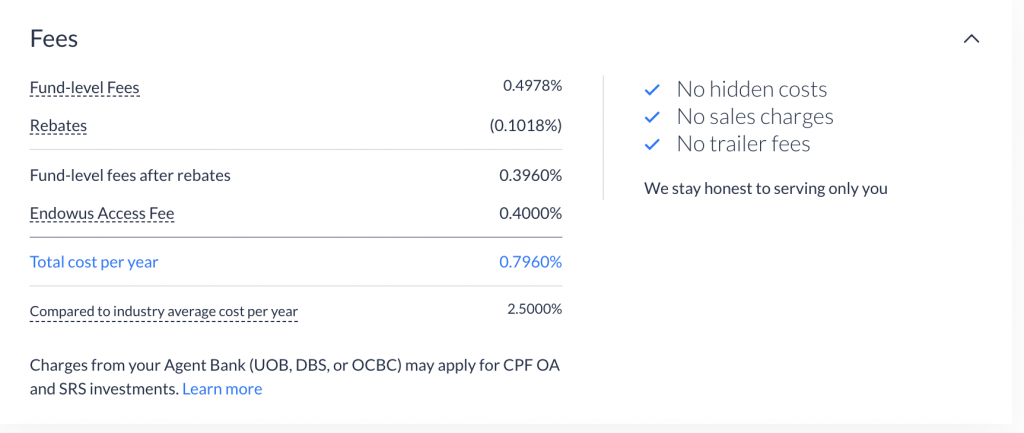

as well as the fees you’ll need to pay.

You will need to confirm the creation of your portfolio by SMS.

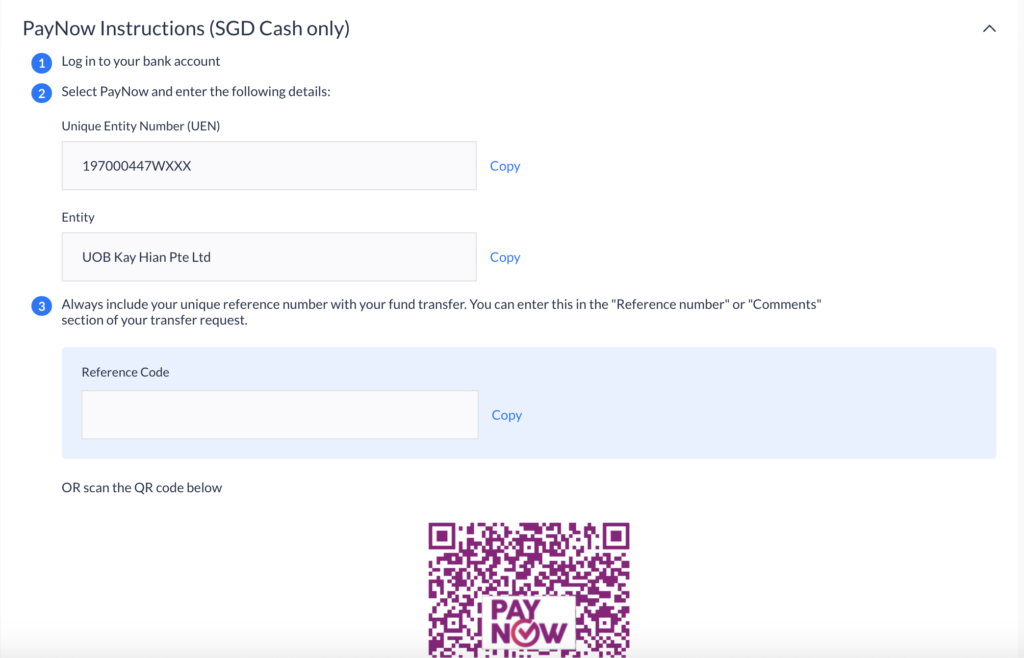

If you have created a Cash portfolio, you will need to fund your account via either of these 2 ways:

- PayNow

- Bank Transfer

Don’t forget to include the reference code in any transfer that you make!

Can I fund my Endowus account in USD?

All of the funds in Endowus’ portfolios are denominated in SGD. If you intend to fund your Endowus account using USD, you will need to contact their support at support@endowus.com.

The advantage of investing with Endowus is that your assets are all denominated in SGD. This is advantageous as you do not have to convert your SGD into USD to invest in these funds.

As such, it helps to reduce currency exchange risk, which can be found in other robo-advisors like Syfe or StashAway.

If you are thinking of funding your account in USD, it may be slightly more troublesome!

How do I invest in Endowus with my SRS funds?

Here’s what you need to do to invest your SRS funds with Endowus:

- Link your SRS account with Endowus

- Create an investment goal

- Choose SRS as your funding source

- Confirm the details of your goal

- Transfer the required amount to your SRS account

You will need to link your SRS account to Endowus. This can be done when you are registering for your Endowus account. If not, you can go to ‘Linked Accounts‘ to enter the details of your SRS account.

When you are creating your portfolio, you will need to select SRS as your funding source. For cash investments, you’ll need to transfer the cash to your Endowus account. However, Endowus will automatically deduct the SRS funds from your account.

As such, you will need to ensure that you have enough funds in your SRS account!

How much should I invest in Endowus?

Endowus allows you to invest a minimum of $1,000 for your first investment, and $100 for every subsequent investment that you make. You should invest the amount that will help you to achieve your various financial goals.

You are able to create multiple portfolios on Endowus. This makes it very easy for you to invest towards different goals.

To achieve these different goals, the best way would be to set aside an amount from your salary every month, and invest into them.

For example, you may have 2 different goals:

- Retirement (long-term)

- House (short-term)

In this way, you can choose a riskier portfolio for your retirement savings. Meanwhile, you should be choosing a more conservative one for your house savings.

What is the minimum amount I am required to invest my CPF funds with Endowus?

You are required to make an initial investment of $1,000, which can be combined from your CPF funds, as well as using cash and SRS. For every subsequent investment with your CPF funds, the minimum amount is $100 per transaction.

Can I use Endowus to invest my CPF SA funds?

Endowus only offers investment portfolios for your CPF OA funds. However, it does not allow you to invest your CPF SA funds.

Endowus believes that they will be able to help you achieve returns that are higher than the 2.5% being offered to your CPF OA funds.

However, your CPF SA funds offer you a 4% p.a. return. This is one of the best risk-free investments you can ever make!

Even if Endowus allows you to invest your CPF SA funds, you may not want to do so due to its really high returns.

Can I invest my CPF OA Funds into the S&P 500?

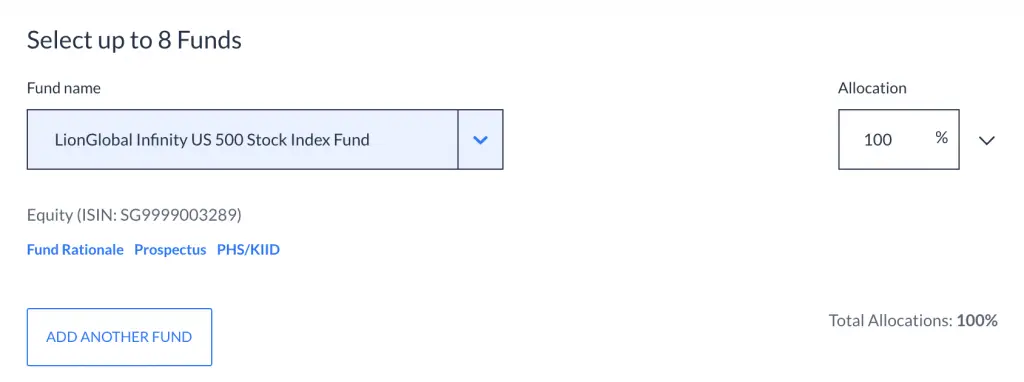

Endowus allows you to invest your CPF OA into the Infinity US 500 Stock Index Fund, which tracks the S&P 500. You are able to invest in this fund as part of their advised portfolios, or individually via Fund Smart.

Endowus is currently the only platform that allows you to invest your CPF OA funds into the Infinity US 500 Stock Index Fund. This means that you can invest your CPF OA funds into the S&P 500.

You may be able to receive higher returns than the 2.5%, especially if you hold for the long term!

You can gain access to this fund through Endowus’ advised CPF OA portfolios. Another way you can buy this fund individually on the Fund Smart portfolio as well.

What are some of the portfolios that Endowus offers?

Here are some examples of the portfolios that Endowus can offer you:

Ultra defensive portfolio

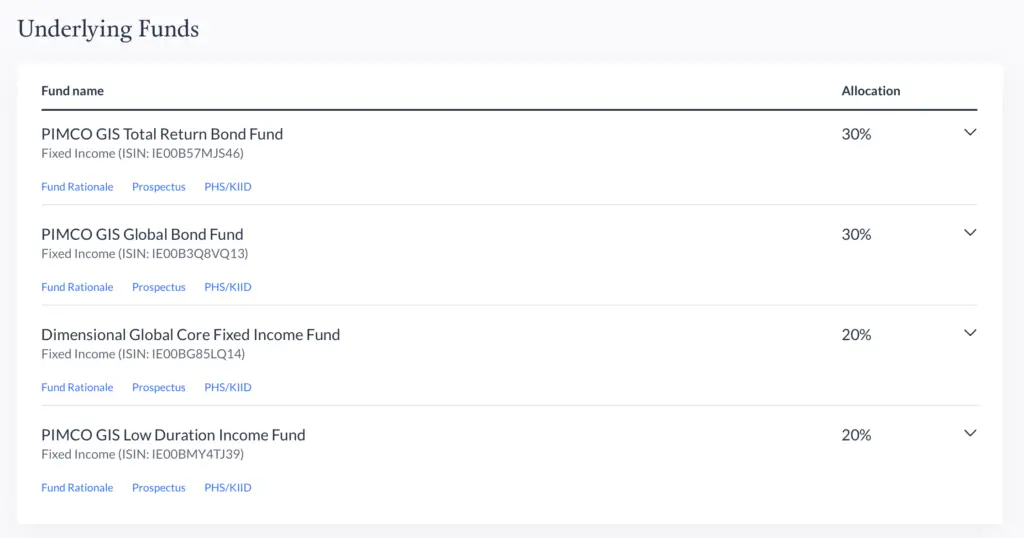

Endowus’ ultra defensive portfolio is a mixture of 4 bonds (from PIMCO and Dimensional) that you can create using Fund Smart. The aim of this portfolio is to reduce the volatility you may experience when investing in Endowus’ 100% Fixed Income advised portfolio.

While Endowus already has a 100% bond portfolio, the returns that you receive may be quite volatile.

If you are investing in this portfolio for a short-term goal, it may be rather risky as your portfolio’s value may be negative when you’re withdrawing your funds.

Endowus introduced this new portfolio that include 4 funds:

| Fund | Allocation |

|---|---|

| PIMCO Global Bond Fund | 30% |

| PIMCO Low Duration Bond Fund | 20% |

| PIMCO Total Return Bond Fund | 30% |

| Dimensional Global Fixed Core Fund | 20% |

You are able to create this portfolio using Endowus Fund Smart.

I’m personally using this portfolio to grow my savings for a house in the future.

Aggressive portfolio

Endowus’ Aggressive Portfolio invests 80% of your funds into equities (stocks), and 20% of your funds into fixed income (bonds). The aim of this portfolio is to maximise your returns by taking higher risks.

The Aggressive portfolio is considered to be ‘safer’ than the Very Aggressive portfolio. This is because the Aggressive portfolio has a 20% allocation to fixed income.

The Very Aggressive portfolio invests your funds into 100% equities. While this has the highest potential to maximise your returns, the volatility you face will be the highest.

The Aggressive portfolio allocation is available on all of Endowus’ general investing portfolios, for both Core and ESG.

However, Endowus does not have an ESG portfolio for your CPF OA funds.

The Aggressive portfolio is useful if you have a long time horizon and you want to maximise your returns.

How does Endowus rebalance my portfolio?

Endowus rebalances your funds to ensure that your portfolio’s holdings are in line with the target asset allocation of your portfolio. The rebalancing will take 5-7 business days to be processed.

For example, let’s say you have 4 funds in your portfolio, each being allocated 25%.

If one of your funds performs very well and goes up in value, its allocation may now be more than 25%.

When the allocation exceeds a certain threshold set by Endowus, they will rebalance it so that the fund’s allocation remains at 25%.

Endowus will sell a percentage of your holdings in that fund. The proceeds of the sale will be used to buy more of the other funds. This ensures that your portfolio will still be in line with the target allocation you set from the start!

Does Endowus pay dividends?

Endowus mainly invests in accumulating funds, which means that any dividends being issued will be automatically reinvested back into the fund. If your portfolio contains distributing funds, Endowus will reinvest your dividends into the funds at no extra costs.

Compared to other robo-advisors, Endowus does not give you the option to receive your dividend payouts. Instead, they will automatically help you to reinvest them into your portfolio.

The good thing is that you are not charged any transaction fees. This will help to further compound your returns in the long run!

You can read my comparison between an accumulating and distributing fund to understand the differences between them.

What happens if Endowus closes down?

In the event that Endowus closes down, your assets are held under the your own name at UOB Kay Hian as the custodian. You will be able to decide whether you want to hold onto your assets or sell them off.

If Endowus closes down, you still have full control over your assets. Furthermore, since you are buying unit trusts and not ETFs, you are able to own fractional shares.

This is in contrast to investing with other robo-advisors, like Syfe or Stashaway. They invest your funds in fractional units of ETFs, which may cause a problem if they close down.

Endowus is just a platform that provides you with access to these funds. Even if they close down, you still will be able to control the fate of your assets.

How does Endowus make money?

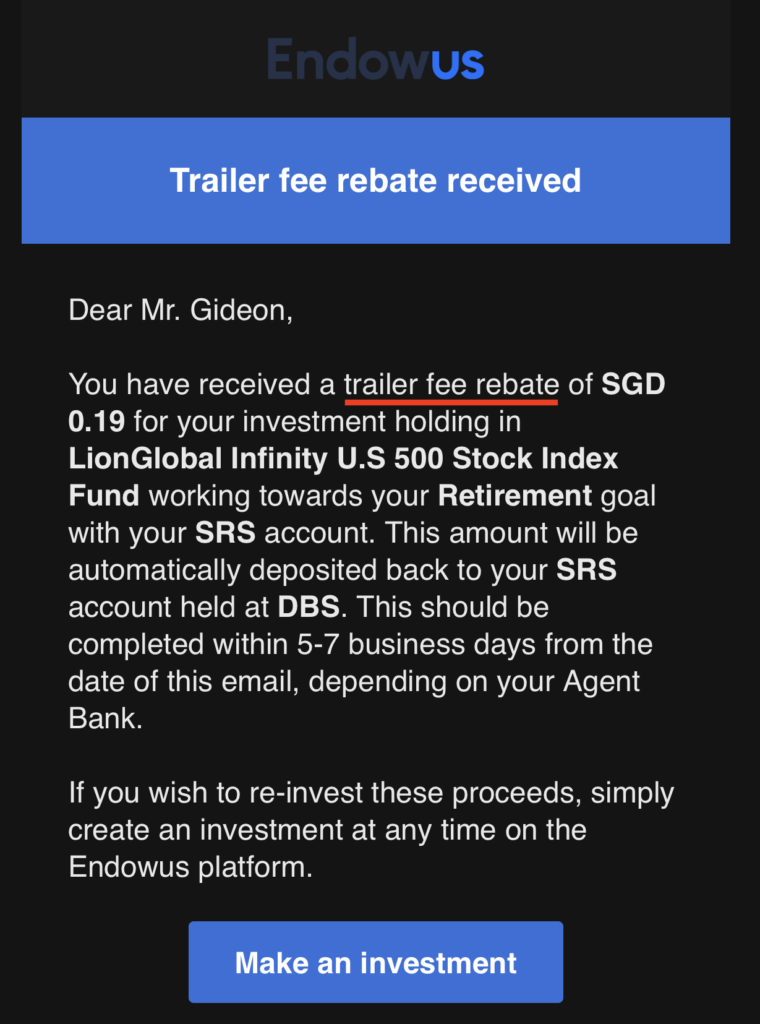

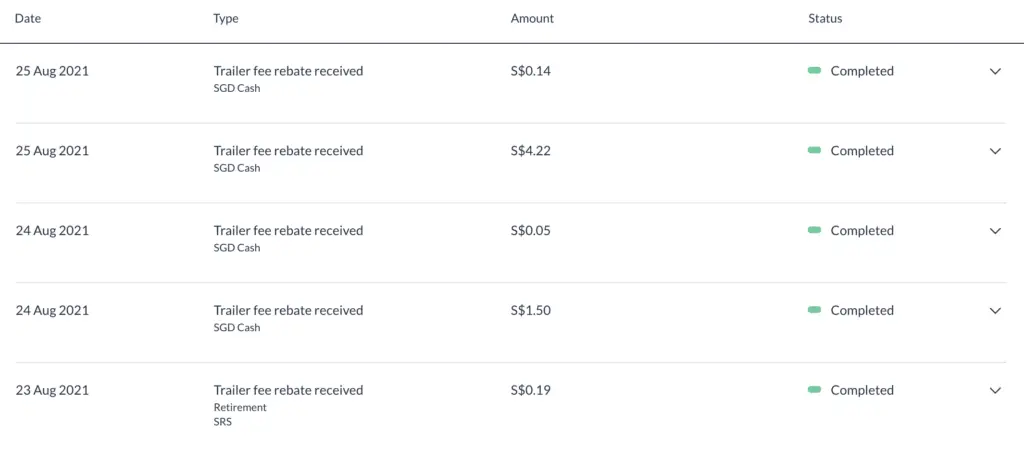

Endowus obtains its revenue mainly from the Access Fee that they charge you. This is based on the amount of assets you have under their management. Endowus will rebate any trailer fees (or commissions from the fund managers) back to you.

Some platforms may receive a commission from the fund manager when you buy a certain fund on that platform. This is known as the trailer fee, and it will be included in the fees that you pay for investing into the fund.

If the fund manager offers a trailer fee to Endowus, they will rebate the fee back to you.

You will receive an email from Endowus if you are eligible for any trailer fee rebates.

Here are some of the rebates that I have received so far.

These rebates will ultimately help to lower your costs!

Is Endowus expensive?

Endowus charges you a platform fee of between 0.30% – 0.60%, depending on the type of funds that you invest. This is relatively low compared to the fees that are charged by other robo-advisors.

Here are the fees that other robo-advisors charge you:

| Platform | Fees |

|---|---|

| Syfe | 0.4% – 0.65% |

| StashAway | Up to 0.80% |

| AutoWealth | 0.5% + USD $18 p.a. |

| DBS digiPortfolio | 0.75% |

| OCBC RoboInvest | 0.88% |

| MoneyOwl | 0.6% for amounts > $10k |

| Kristal.AI | 0.3% for amounts > $10k |

| UOB Utrade ROBO | 0.88% |

In comparison with the other platforms, Endowus charges a very competitive rate.

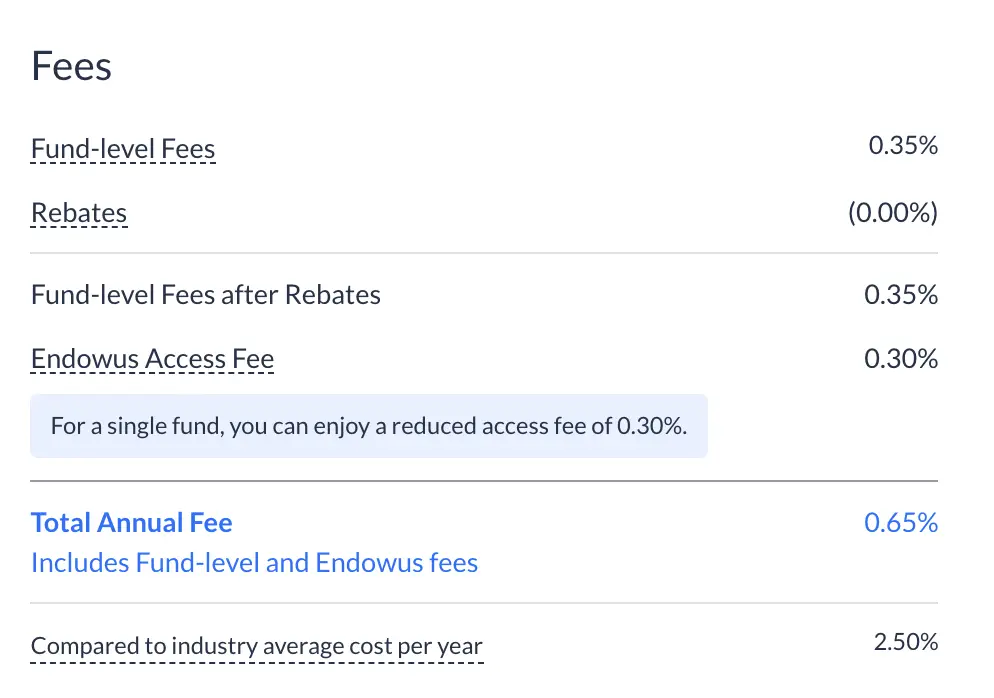

Moreover, Endowus charges 0.4% for your SRS funds, which is one of the cheapest rates!

Flat 0.3% for single fund portfolios with Fund Smart

If you have a Fund Smart portfolio that only has a single fund inside (i.e. 100% allocation), you will only be charged 0.3%. This is irregardless of whether you’re using your Cash, SRS or CPF to invest.

This makes it one of the cheapest fees that are being provided by a robo-advisor!

You can consider investing in a broadly diversified fund, such as:

- Infinity US 500 Stock Index Fund

- Dimensional World Equity Fund

You’ll need to consider the fund-level fees too

On top of the advisory fees that you pay Endowus, you’ll need to consider the fund-level fees as well.

This is similar to the expense ratio that you’ll pay to the manager of an ETF.

What I like about Endowus is that they will show you the complete breakdown of the fees that you’ll need to pay for each portfolio.

In this way, you are able to see just how much in fees you’re paying for the portfolio!

For the convenience that Endowus provides, I believe that it is worth the fees that you are paying.

How much does it cost to invest my CPF funds with Endowus?

Endowus charges a 0.4% platform fee to invest your CPF funds, irregardless of the amount that you have invested. However, you may incur additional charges through the fund-level fees and agent bank charges.

Endowus has a rather low platform fee at 0.4% for your CPF funds. However, there are 2 other fees that you’ll need to pay when you want to invest your OA funds.

The fund level fees are the same as those you’ll need to pay for the other portfolios.

However, an additional fee that you’ll incur when investing your CPF is the Agent Bank Fees:

| Fee Type | Amount |

|---|---|

| Transaction Fee (Buy / Sell) | $2 – $2.50 |

| Service Charge | $2 – $2.50 per quarter |

| Rejected Trades | $5 |

These are additional fees that you’ll need to consider when investing your CPF OA funds.

Since these fees are quite high, it would not be cost effective if you are only investing a small amount of your OA funds!

Does Endowus have a mobile app?

Endowus has a mobile app that is available on the Apple Store and the Google Play Store.

I really like the user interface of the app, as it is really clean and easy to use.

On the app, you are able to perform all of the same functions as the desktop platform.

Conclusion

Endowus is a low cost investment platform that allows you to invest your Cash, SRS and CPF.

Overall, I am happy with the experience I’ve had with this platform, and I do intend to keep my funds with Endowus for the long term.

Hopefully, this article will help to answer some of the questions that you have about Endowus!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?