Last updated on June 6th, 2021

We are certainly spoilt for choices when it comes to investing. There are so many different options that you can choose from!

If you are a beginner investor, most people will advise you to invest in either a robo-advisor or a regular savings plan (RSP).

How are these 2 different and which one should you choose? Here’s a detailed comparison between robo-advisors and regular savings plans:

Contents

Investment strategy

Robo-advisors and regular savings plans have different investment strategies:

Regular savings plans allow you to invest in an individual stock or ETF

When you are investing in a regular savings plan, you are investing in an individual stock or ETF. This means that your portfolio will be rather concentrated to a certain sector or stock.

Here is a breakdown of what the different regular savings plans offer:

| Regular Savings Plan | ETFs | Stocks |

|---|---|---|

| OCBC BCIP | ✓ | ✓ |

| Invest Saver | ✓ | ✕ |

| POEMS SBP | ✓ | ✓ |

| FSMOne | ✓ | ✕ |

| Saxo | ✓ | ✕ |

You can invest in ETFs

Most RSPs allow you to invest in ETFs. This makes your investment rather diversified.

The BCIP, Invest Saver and POEMS only allow you to invest in SG markets. However, both FSMOne and Saxo allow you to invest in ETFs from other markets too!

You can invest in stocks

Both the OCBC BCIP and POEMS SBP allow you to invest in stocks as well. This is the riskiest form of investment as you are only buying a single stock!

As such, this stock that you’re purchasing should not be your entire portfolio. If the stock decides to drop in value, you will lose a lot of money!

Robo-advisors recommend a diversified portfolio for you

In contrast, robo-advisors recommend a portfolio to you, based on your risk profile. Their portfolios are usually diversified across different asset classes.

This includes:

- Equities (stocks)

- Bonds

- Commodities (e.g. gold)

Based on your risk profile, the robo-advisor will determine the best portfolio for you.

The more risk you’re willing to take, the higher the allocation towards equities. The lower the risk, the higher your allocation will be towards bonds.

Within each asset class, the robo-advisor will invest in different ETFs or mutual funds.

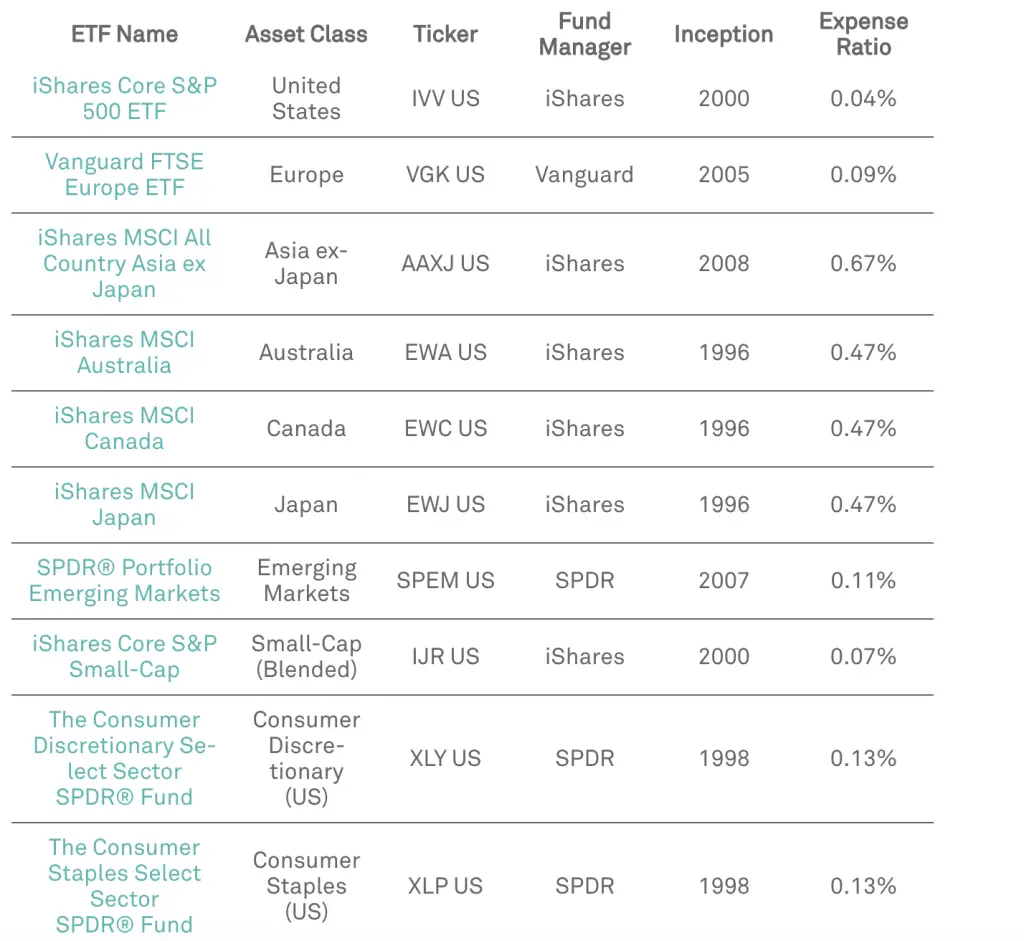

Here are some ETFs that StashAway will invest based on the different asset classes.

For example, StashAway invests in 2 different equity ETFs: EWJ and KWEB.

This helps to diversify your risk!

Robo-advisors are more diversified globally

Most robo-advisors invest in mutual funds and ETFs that are from other markets. The popular choice is the US market.

As such, your portfolio will be more diversified across companies from different countries. This is in contrast to most RSPs which are restricted to the Singapore market.

The only exceptions are Saxo and FSMOne RSPs that allow you to invest in other markets besides Singapore.

Extra risks when investing overseas

However, you may want to take note of the risks of investing in overseas markets. This includes:

Different portfolios offered by the same robo-advisor

Moreover, each robo-advisor has different portfolios that cater to your different needs.

Here are some different portfolios offered by some robo-advisors:

| Robo-Advisor | Portfolios Offered |

|---|---|

| Endowus | General Investing Cash Smart Fund Smart |

| MoneyOwl | General Investing WiseSaver |

| StashAway | General Investing Income Portfolio StashAway Simple |

| Syfe | Global ARI Equity100 REIT+ |

You are certainly spoilt for choice! However, this also means that you need to take more time to select the portfolio that best suits your needs.

Lack of customisability

Most robo-advisors recommend their portfolios based on a certain algorithm or investment strategy. This means that you are unable to choose your preferred allocation.

However, some robo-advisors do allow you to build your own strategy as well. This includes Endowus’ Fund Smart portfolio.

Minimum amount to invest

Both robo-advisors and regular savings plans have different minimum amounts to invest with them.

Regular savings plan have a monthly requirement

For regular savings plans, you will need to invest a fixed amount each month. This allows you to adopt a dollar cost averaging approach to your investing.

These regular savings plans usually have a minimum sum of $50-100 each month. You can then invest in further multiples of $50 or $100.

The minimum sum looks really attractive as you only require a small sum to invest each month. However, the transaction fees can be quite hefty if you only invest a small sum!

Robo-advisors have more flexibility in minimum sums

Robo-advisors do have slightly more flexibility when you invest with them.

Here are the minimum sums required for these robo-advisors.

| Robo-Advisor | Minimum Initial Investment |

|---|---|

| StashAway | None |

| Syfe | None |

| UOBAM Invest | None |

| Kristal.AI | $100 |

| MoneyOwl | $100 initial lump sum OR $50/month |

| FSMOne MAPS | $1,000 OR $500/month |

| DBS DigiPortfolio | $1,000 (USD / SGD) |

| AutoWealth | $3,000 |

| OCBC RoboInvest | $3,500 |

| Phillip SMART Portfolio | $5,000 |

| UOB Utrade ROBO | $5,000 |

| Endowus | $10,000 |

Some robo-advisors such as StashAway, Syfe and UOBAM Invest do not have a minimum sum to invest with them. This means that you are able to start investing with any amount that you have!

You will have much more flexibility when deciding the amount that you wish to invest.

However, these robo-advisors usually invest in fractional shares. In the unfortunate event that they close down, there may be some problems with redeeming your shares.

You can contribute a ‘regular savings plan’ into a robo-advisor

Most robo-advisors allow you to set up a recurring transfer from your bank account. This allows you to do a regular savings plan into your robo-advisor.

Instead of buying a single stock or ETF, you will be dollar cost averaging into your diversified portfolio.

Fees charged

The fee structure of robo-advisors and regular savings plans are quite different:

Regular savings plans will charge you a transaction fee

Whenever you make a buy or sell order with a RSP, you will be charged a transaction fee.

Here are the transaction fees for the different regular savings plans:

| RSP | Buy Order Fees | Sell Order Fees |

|---|---|---|

| FSMOne | 0.08%, min SGD1 / HKD5 / USD1 | 0.08%, min SGD10 / HKD50 / USD8.80 |

| OCBC BCIP | 0.88% if below 30 0.3%, min $5 | 0.88% if below 30 0.3%, min $5 |

| Invest Saver | 0.5-0.82% | 0.5-0.82% |

| POEMS | $6.42-$10.70 per month | $6.42-$10.70 per month |

| Saxo | 0.75% p.a. | 0.75% p.a. |

The only exception is Saxo that charges you a management fee, similar to robo-advisors.

FSMOne and the OCBC BCIP do offer pretty attractive rates. However, there is a minimum fee that you’ll need to pay. As such, it is not worth just investing a very small sum with either of these RSPs.

Robo-advisors charge you a management fee

Robo-advisors do not charge you whenever you make a buy or sell order. This technically means that you can make an unlimited amount of transactions!

Instead, they will charge you a management fee. The management fee is similar to how a fund charges its expense ratio.

This management fee depends on the total amount of funds that you have invested with them. The robo-advisor will deduct a percentage of your total invested amount.

Here are the management fees that some of these robo-advisors charge:

| Robo-Advisor | Fee |

|---|---|

| AutoWealth | 0.5% p.a. Advisory Fee + USD$18 Platform Fee |

| Endowus | 0.25% – 0.6% |

| Kristal.AI | 0% – 0.3% |

| MoneyOwl | 0% – 0.6% |

| StashAway | 0.2% – 0.8% |

| Syfe | 0.4% – 0.65% |

| DBS DigiPortfolio | 0.75% – 0.8% |

| OCBC RoboInvest | 0.88% |

| UOBAM Invest | 0.6% – 0.8% |

| FSMOne MAPS | 0.35% – 0.5% |

| Phillip SMART Portfolio | 0.50% |

| UOB UTrade Robo | 0.5% – 0.88% |

Most robo-advisors look cheap since their fees are less than 1%. However the larger amount of money that you have with them, the higher the amount you will need to pay!

| Amount Invested | Fees per annum (Assuming 0.6% p.a.) |

|---|---|

| $1,000 | $6 |

| $10,000 | $60 |

| $100,000 | $600 |

| $1,000,000 | $6000 |

Once your portfolio becomes really large, the fees may not be worth it anymore. You will be paying $6k a year if you have $1 million invested in this example!

This is unlike a regular savings plan that charges you a one-off transaction fee.

You will need to pay the expense ratios as well

If you are investing in ETFs or mutual funds, you will need to pay an expense ratio as well. This is usually an annual management fee which you pay to the fund manager.

For RSPs, you will be paying the expense ratio on top of your transaction fee.

For robo-advisors, most of them invest in ETFs or mutual funds. As such, you will incur 2 types of management fees:

- Management fees paid to the robo-advisor

- Expense ratios paid to the ETF / mutual fund’s manager

Here’s an example of the expense ratios of ETFs that StashAway invests in:

For StashAway, they focus on asset allocation. As such, your total expense ratio will be an aggregate of the different expense ratios of each fund.

It’s important to factor in the expense ratios when considering the cost of investing in a robo-advisor or RSP!

Returns

The types of returns when you invest in a robo-advisor or RSP may be different.

You depend on that single ETF or stock when you use a RSP

When you invest in a RSP, you are buying into a single ETF or stock. This means that your risk and returns are all concentrated on that stock or ETF.

This can be rather risky if your entire portfolio just contains that stock or ETF!

You depend on the performance of your entire portfolio when you use a robo-advisor

When you invest in a robo-advisor, your portfolio is more diversified. Most robo-advisors invest in a basket of ETFs or mutual funds.

Each ETF or mutual fund itself has a basket of stocks. As such, your assets are really diversified across different stocks.

Even if one stock performs poorly, 2 other stocks may perform well. As such, your net returns will eventually even out to a positive return.

This helps to reduce the risk as you are not dependent on the performance of a single stock or ETF.

Past performance is no guarantee of future results

It is important to note that past performance does not guarantee future results. No one is able to predict what will happen in the future!

As such, you may want to focus on reducing your risk, rather than focusing on the past returns.

Verdict

So should you invest with a robo-advisor or a regular savings plan?

Here’s a summary of the comparison above:

| Comparison | RSP | Robo-advisor |

|---|---|---|

| Investment Strategy | Individual stock / ETF | Diversified portfolio |

| Minimum Amount | $50-100/mth | Depends on robo-advisor |

| Fees Charged | Transaction fee | Management fee |

| Returns | ‘Higher’ risk | ‘Lower’ risk |

Here’s my opinion on which investment product may be better for you.

Invest in a RSP if you want to invest in the specific stock / ETF

If you are confident that a single stock or ETF will do well, then a regular savings plan may be the better option.

When you invest in the S&P 500 or the Straits Times Index, your risk is spread among those stocks in the ETF.

However, you may want to be cautious if you’re just investing in a single stock. If your entire portfolio just consists of one stock, it can be really risky!

As such, I believe that RSPs into a single stock should just be a part of your portfolio and not be your entire portfolio.

Invest in a robo-advisor if you want a diversified portfolio

Investing in a robo-advisor is much more automated. All you need to do is select your risk profile and everything will be done for you.

The robo-advisor may even offer automatic rebalancing of your portfolio for you. This ensures that your portfolio is always suited to your risk profile!

As such, you don’t need to worry much about your portfolio. You are able to let the robo-advisor manage everything for you!

Robo-advisors may be costly in the long run

However, the management fees can be really hefty. If you invest a large amount with a robo-advisor, the fees can really add up.

The management fees are good for a small starting sum as they are much cheaper than transaction fees charged by brokerages. These transaction fees usually have a minimum amount to invest. As such, they may not be ideal for small sums.

Once your portfolio grows and you have a larger amount to invest, a robo-advisor may not be so cost effective anymore.

Doing DIY Investing may be the most cost effective option

Both RSPs and robo-advisors are great when you don’t have much investment knowledge. They are very automated and passive forms of investing. This will help to reduce your tendency of checking your stocks everyday.

However as both your knowledge and amount to invest increases, you may want to consider DIY investing. When you have a larger amount to invest each time, the transaction fees would not be so costly.

You are able to use low-cost brokers such as Tiger Brokers which help to greatly reduce your fees!

Moreover, you are given the flexibility to choose what you wish to invest in.

Once you’ve gained enough investment knowledge, DIY investing may be the most ideal option!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 6 months.

You will be able to save up to $75 worth of fees!

You can view more information about this referral program on Syfe’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?