Last updated on June 6th, 2021

You may have heard of the term ‘core-satellite‘ investing before.

This is just one of the many investing strategies that you can use.

So what exactly is a core-satellite portfolio and how do you go about building one in Singapore?

Here’s what you need to know.

Contents

What is a core-satellite portfolio for Singaporeans?

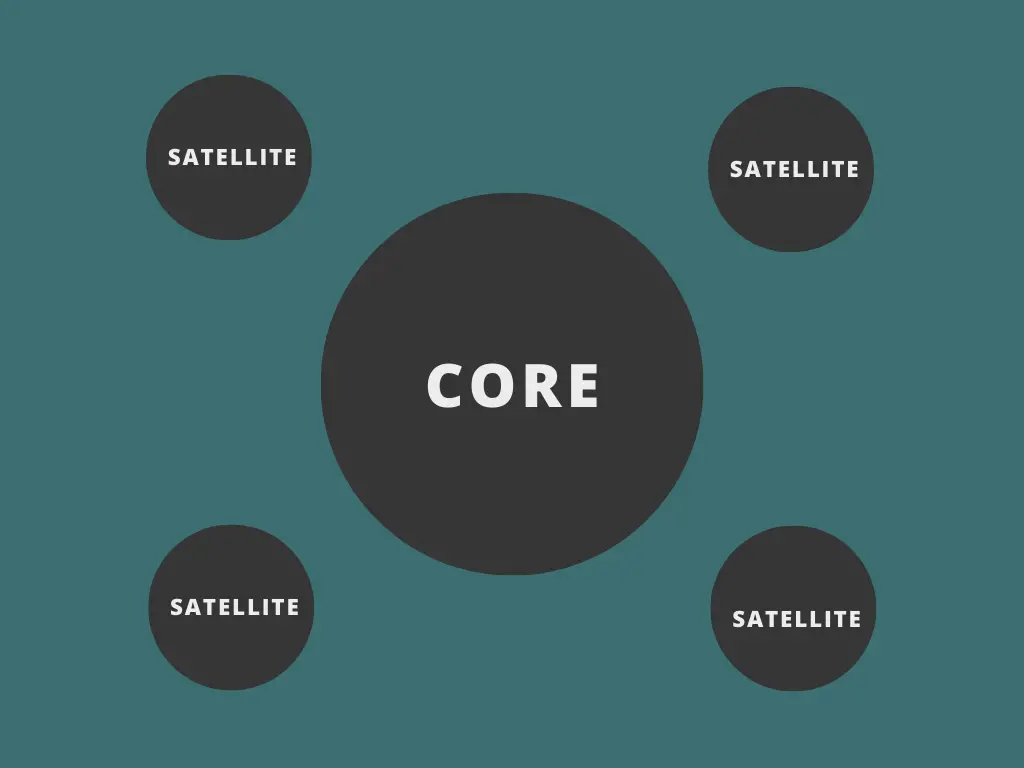

A core satellite portfolio allows you to split your investments into 2 components. The core component is usually a passive strategy, such as an index-tracking ETF. Meanwhile, the satellite component uses a more active investing strategy, where you can take more risks.

This is how your core-satellite portfolio may look like:

Your core investment forms the base of your entire portfolio.

Meanwhile, your satellite investments have a smaller allocation. However, they have the chance to outperform your core investments.

Here is an in-depth explanation about this strategy:

What is the core component of the portfolio?

The core component of the core-satellite portfolio forms the bulk of your portfolio. This component should be passive and broadly diversified, so that your risk is not too concentrated.

The most common investment that you may have in the core component may be an index tracking fund.

A fund that tracks a market index is usually one of the most broadly diversified forms of investments.

There are a few indices you can track, such as:

| Index | Coverage |

|---|---|

| Straits Times Index (STI) | Top 30 companies in Singapore |

| S&P 500 | Top 500 companies in the US |

| MSCI World Index | Large and mid cap companies from 1,586 companies |

When you buy into a fund that tracks these indices, your money will be used to buy stocks in the companies in the index.

As such, your risk is spread out across these companies.

Even if one company performs badly, there will be other companies in the index that may perform well.

If more companies perform well than those that perform badly, you will have a positive return on investment!

You can even consider the Dimensional World Equity Fund, which contains 11,540 holdings!

Robo-advisors allow you to build a core portfolio spread across different asset classes

You may be too worried about concentrating your core portfolio solely in stocks. As such, you can consider diversifying across different asset classes too.

Other asset classes include:

- Bonds

- Commodities (e.g. gold)

By diversifying across multiple asset classes, your risk is spread out even more. As such, you may still have positive returns, regardless of the economic condition.

Buying multiple funds that track different different asset classes can be quite costly. As such, you can consider using robo-advisors to help you build your portfolio instead.

Some examples include:

Here are some advantages about choosing these portfolios:

- You only need a small capital outlay (both do not have a minimum sum)

- You are not charged any transaction fees

However, you will be charged an annual management fee. Most of these robo-advisors will charge you less than 1% per year.

This may seem very little when you’re just starting to invest. However, it can be rather significant once you have a large sum with them!

After reading up and learning more about investing, you may want to consider DIY investing instead.

The core component forms the bulk of your investment portfolio

The core component is meant to be a passive strategy. This way, you can continue placing money into this fund, without worrying too much about it.

So long as you buy and hold long term, this fund should be able to give you a positive return overall.

As such, the core component should form the bulk of your portfolio. Even if your satellite investments perform badly, your core investment may still perform well!

The allocation of your portfolio into core investments really depend on your risk profile.

The more risks you’re willing to take, the lower the allocation of your portfolio towards your core investments.

Core investments are usually very safe, and you can’t go wrong holding them for the long term.

However, satellite investments are much more risky!

If you are willing to take more risks, you can consider placing a larger sum of your investments into your satellite investments.

What is the satellite component of the portfolio?

The satellite components of the core-satellite portfolio are usually investments that you actively manage. This comprises riskier investments that have potential for greater returns, however they can be much more volatile.

Usually, you would make these investments as you believe they will outperform your core investments.

There are many investments that you can consider to include in your satellite portfolio. These include:

- Individual stocks

- Actively-managed ETFs (e.g. ARKK ETF)

- Thematic portfolios of robo-advisors

- Cryptocurrency

When you are investing in any of these products, you are taking an active approach towards investing.

This is because you’ll need to study your investment well before you choose to invest in it.

Satellite investments should only form a small part of your portfolio

Satellite investments are much riskier compared to your core investment.

There is a higher chance that these investments may perform badly compared to your core investments.

As such, it is best to allocate a small amount of your entire portfolio into these investments.

If they perform badly, your entire portfolio would not be so severely affected.

However, if they perform well, then you may be missing out on extremely high returns!

As such, it really boils down to the amount of risk you’re willing to take.

There is no right or wrong answer. The best way would be to allocate your funds in a way that is comfortable for you!

My example of a core-satellite portfolio

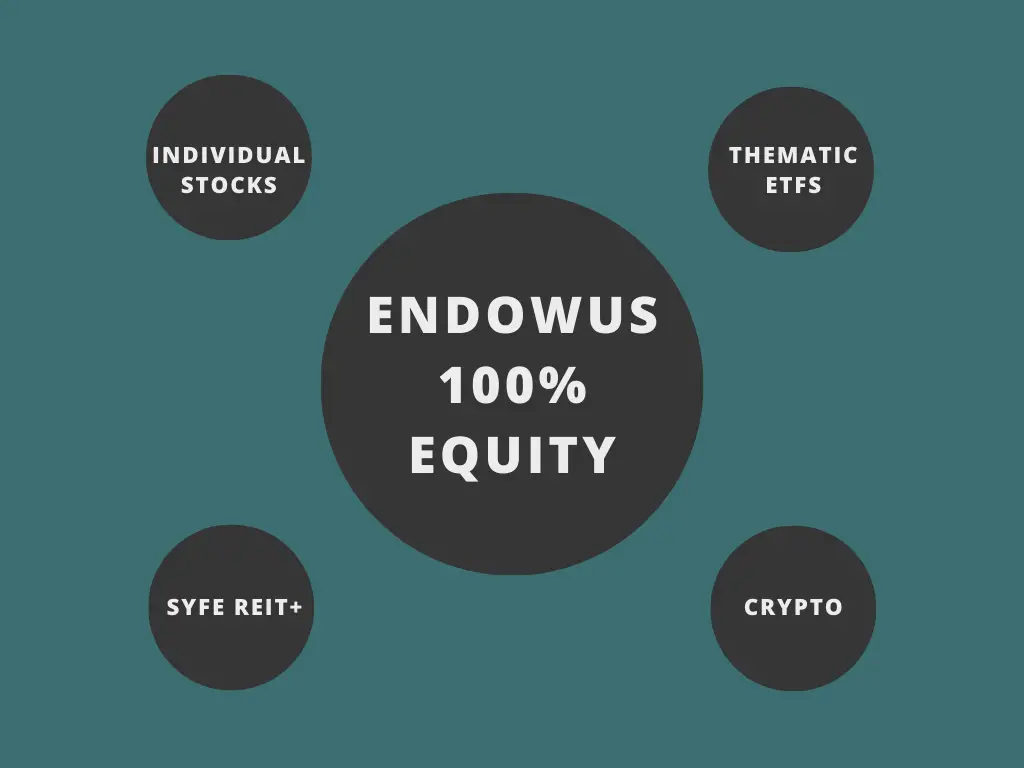

To give you an idea of how a core-satellite portfolio can be built, here is my current strategy:

| Core | Endowus 100% Equities |

| Satellite | Syfe REIT+ Stocks and ETFs Cryptocurrency |

This is just my investment strategy, which may be different from yours!

Here is the rationale for my investments:

Endowus 100% Equities

I chose this as my core portfolio as I am still young, and I have a long time horizon to ride out any volatilities in the market.

Furthermore, Endowus invests your money into 4 funds:

- Dimensional Global Core Equity Fund

- LionGlobal Infinity US 500 Stock Index Fund

- Dimensional Emerging Markets Large Cap Core Equity Fund

- Dimensional Pacific Basin Small Companies Fund

Endowus is one of 3 methods that you can use to buy Dimensional Funds in Singapore.

This provides quite a broad exposure to the entire equity market.

I’ve also chosen to use Endowus for these reasons:

| Relatively lower management fees | 0.4% for SRS and 0.6% for Cash |

| No US estate tax incurred and lower dividend withholding tax (15%) | Endowus invests in Irish- domiciled mutual funds |

| Funds are denominated in SGD | Reduces currency exchange risk |

Although the fees may be higher than US funds, I believe that it is worth it for the conveniences that it provides.

However, the costs will eventually be quite high eventually.

This is because robo-advisors charge an annual management fee. With a larger amount invested in them, the fees you pay can be quite substantial too!

Once I have enough capital to invest a larger sum each month, I intend to switch to investing in the LSE and buy the IWDA or SWRD ETF.

Syfe REIT+

I chose Syfe REIT+ as a convenient platform to invest any small amounts that I have. This includes any dividends that I’ve received.

Syfe allows you to invest with no minimum sum. You can start to use their platform even if you only have $1!

However, the drawback is that they invest in fractional shares, which you may not have full control over should Syfe close down.

Furthermore, Syfe REIT+ does not buy into an ETF. Instead, it buys into the individual REITs that are found in the iEdge S-REIT Leaders Index.

As such, you only need to pay the management fees to Syfe. You do not need to pay the expense ratio to a fund manager!

This helps you to save one layer of costs!

I personally feel that this is a great way to start building up a dividend portfolio with very little capital.

Stocks and ETFs

There are stocks that have the potential to give you high returns.

However, they may not be included in the market indices, as they may not meet certain requirements.

If you want exposure to these stocks, you may have to buy them individually. Alternatively, you can consider buying into thematic ETFs that invest in a certain theme that you see potential in.

However, actively managed funds or ETFs usually charge higher expense ratios compared to index ETFs.

You can consider using Tiger Brokers or Moomoo Trading if you intend to buy stocks from the US, HK or SG markets.

Cryptocurrency

Cryptocurrency has emerged as a new investment product that you can get exposure to.

However, any investment that you make is extremely risky! The markets are extremely volatile, and can be really unpredictable.

If you decide to purchase some currencies, you can choose to stake them or lend them out to receive higher returns on platforms like:

Investing in cryptocurrency has the potential to provide you with attractive returns. However, I would strongly suggest that you invest just a small portion of your portfolio into it.

Conclusion

When building a core-satellite portfolio, the most important thing you’ll need to decide on is the core component of your portfolio.

This is the component that you can fall back on, in case your satellite investments do not perform well!

Choosing a broadly diversified investment as your core will help you to reduce any volatilities.

So long as you continue to buy and hold the fund that you’re tracking, it should go up in the long term!

Once you have settled your core component, you are able to make your satellite investments with lesser worries.

In this way, you are able to receive some stability in your returns with your core investments. You’ll also be able to receive high returns if your satellite investments do well!

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Endowus Referral (Receive a $20 Access Fee Credit)

If you are interested in signing up for Endowus, you can use my referral link to create your account.

You will receive a $20 access fee credit, irregardless of the amount that you start investing with Endowus.

The access fee does not have any expiry date. As such, you can invest at any pace that you wish, and still get $20 off your fees!

Syfe Referral (Up to $30,000 SGD managed for free for 3 months)

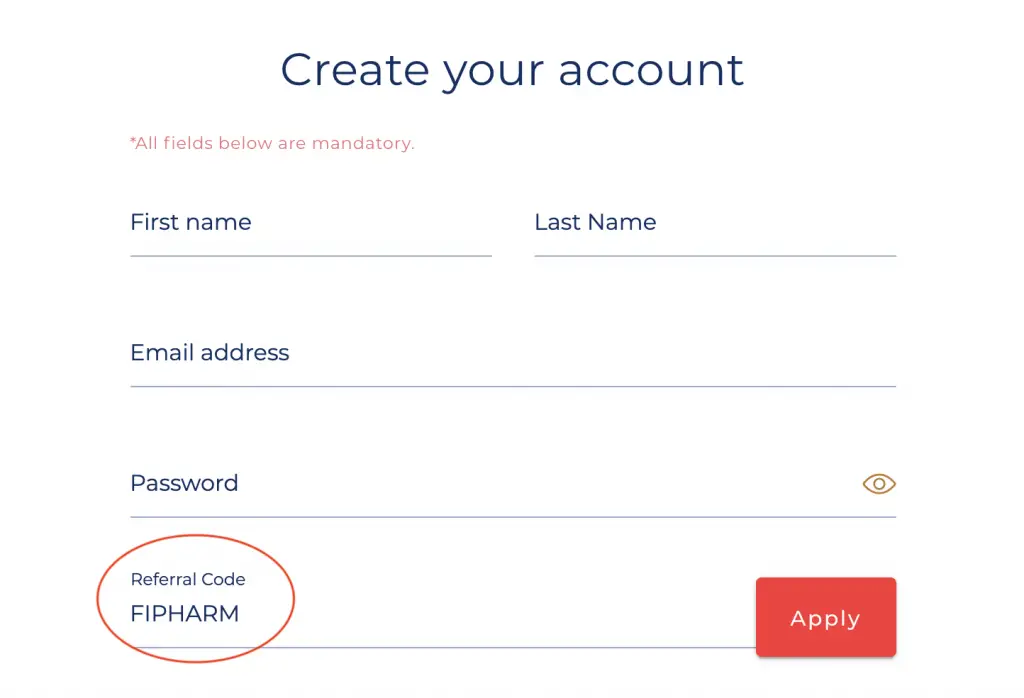

If you are interested in signing up for Syfe, you can use the referral code ‘FIPHARM‘ when you are creating your account. You will have your first $30,000 invested with Syfe managed for free for your first 6 months.

You will be able to save up to $75 worth of fees!

You can view more information about this referral program on Syfe’s website.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?